GREAT LIFETIME PAYOUT 3

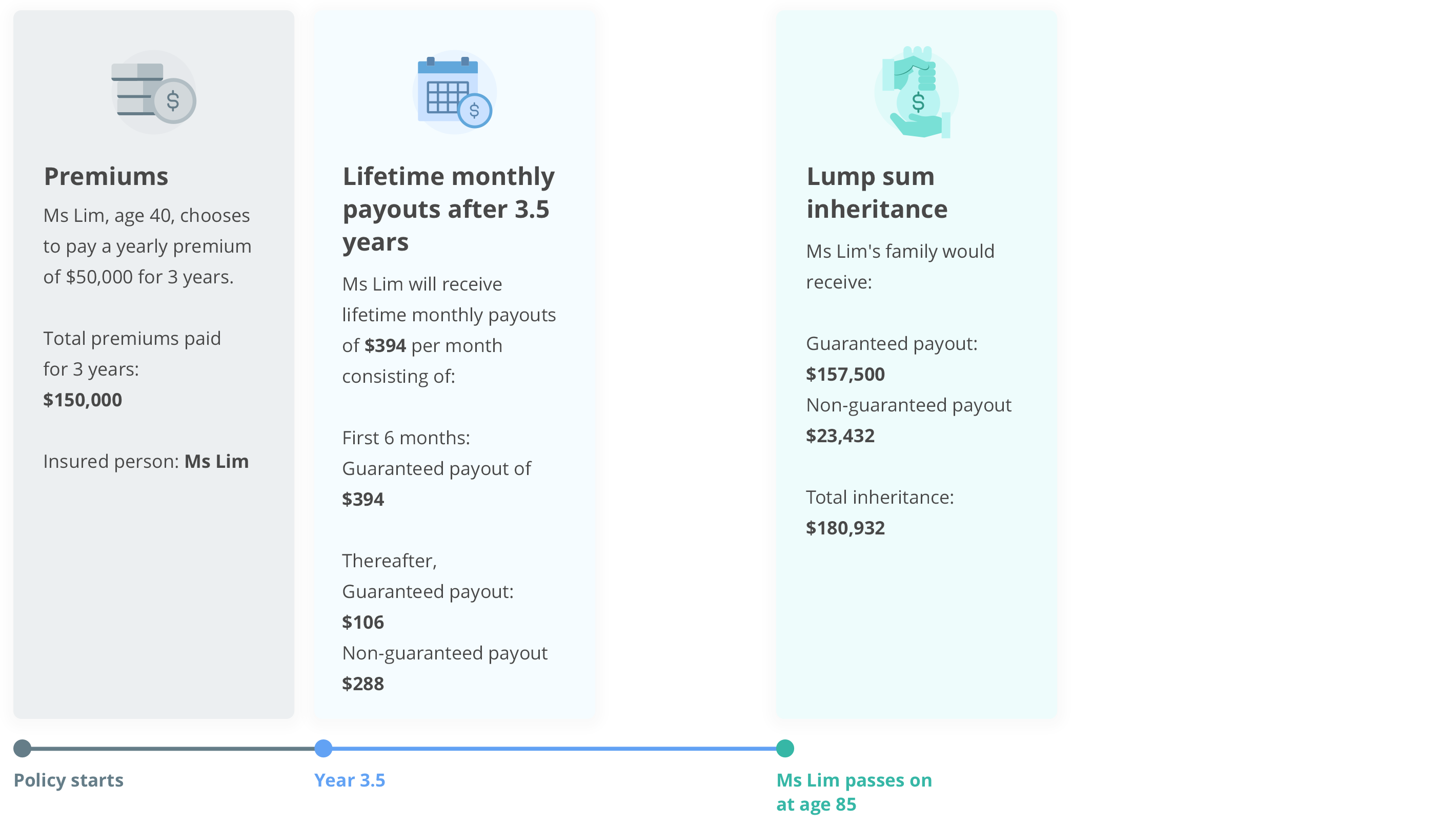

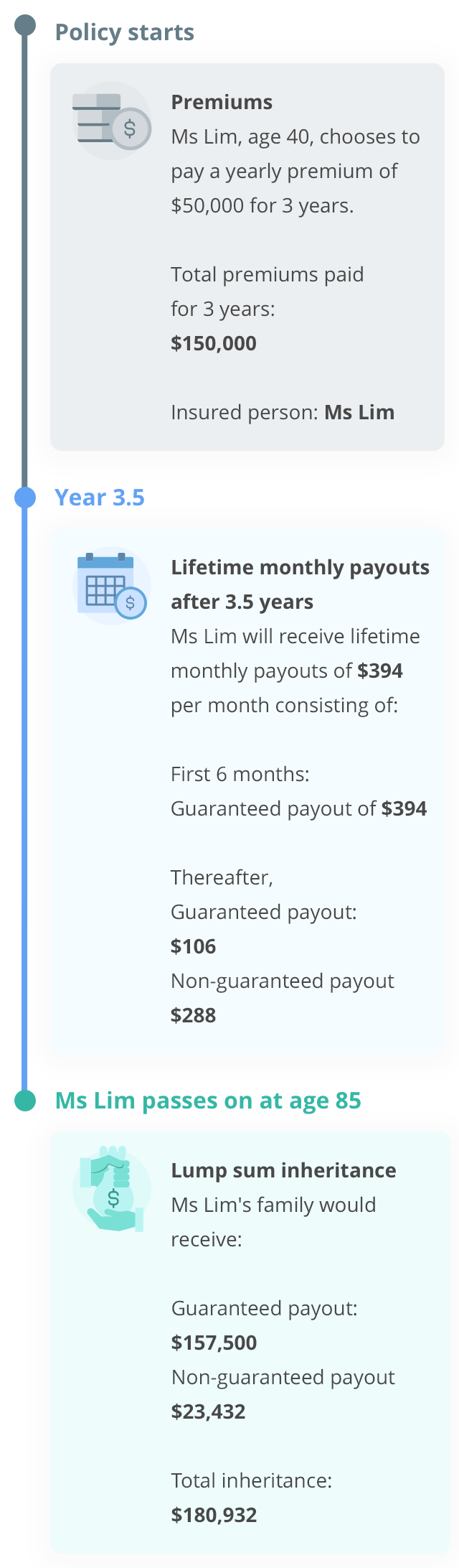

Set aside your funds for 3 years, steady income stream for life

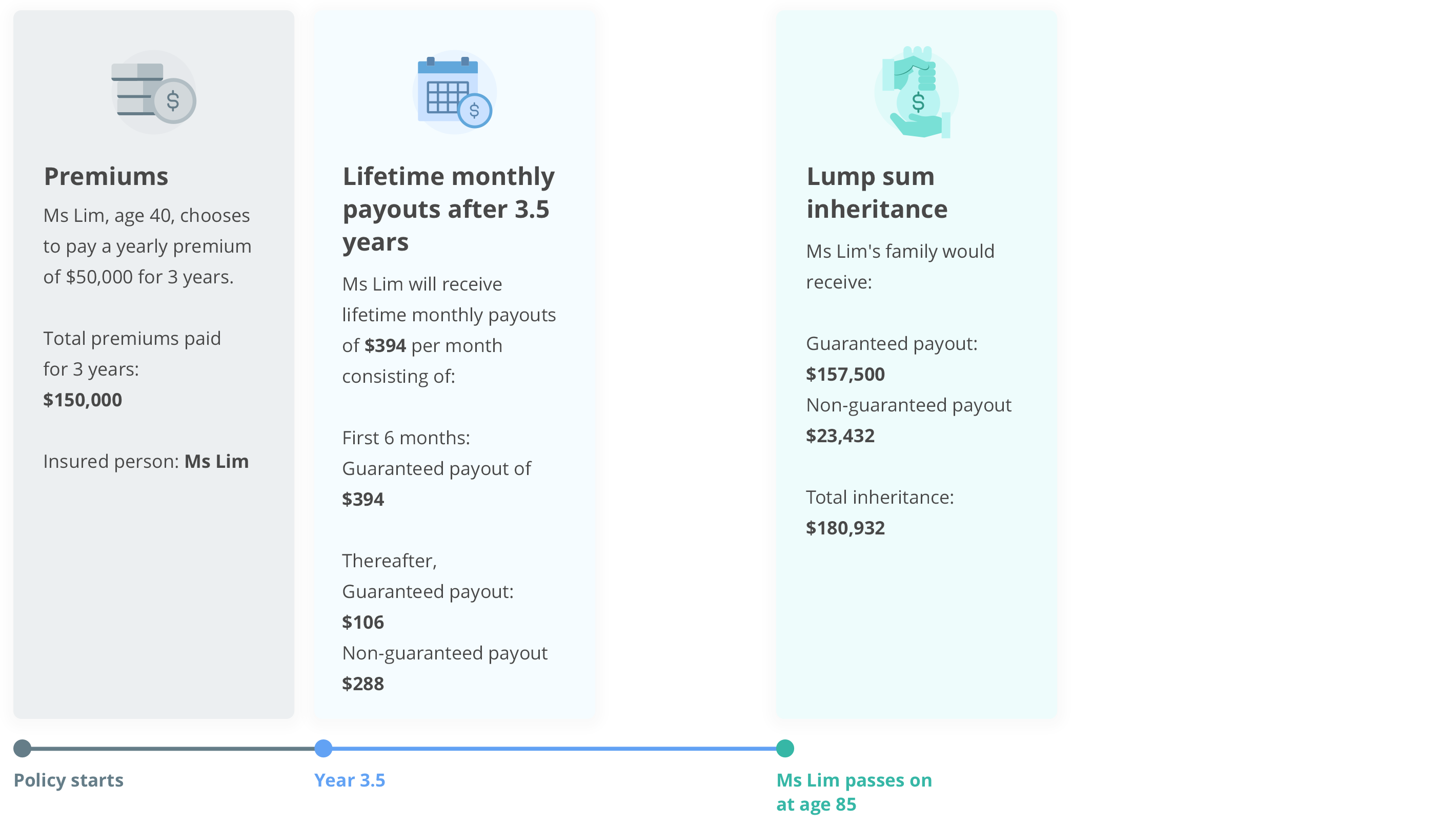

Total benefits

Monthly payouts received over the years

$196,087

Lump sum inheritance

$180,932

$377,019

All figures in the above illustration are based on illustrated investment rate of return of the participating fund at 4.25% per annum and are subject to rounding. The lump sum inheritance received by Ms Lim’s family includes total guaranteed and non-guaranteed death benefit plus remaining declared but unpaid cash bonus and non-guaranteed interest earned on unpaid monthly cash bonus. Please refer to the policy illustration for the exact values. Based on illustrated investment rate of return of 3.00% per annum, Ms. Lim’s monthly payout from the 49th policy month onwards will be $261. The monthly payouts received over the years will be $131,102, and the total inheritance will be $169,180. Interest earned on the unpaid month cash bonus is accumulated at 3.00% per annum and 1.50% per annum based on illustrated investment rate of return of 4.25% per annum and illustrated investment rate of return of 3.00% per annum respectively. This rate is not guaranteed and can be changed from time to time. The actual benefits payable may vary according to the future experience of the participating fund.

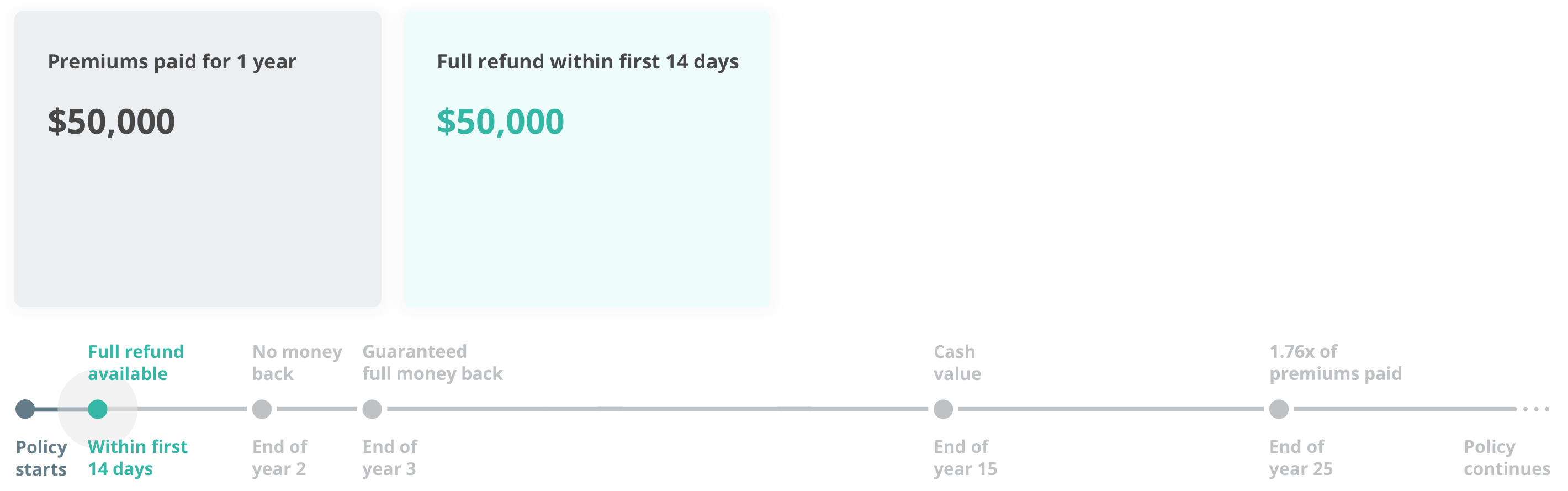

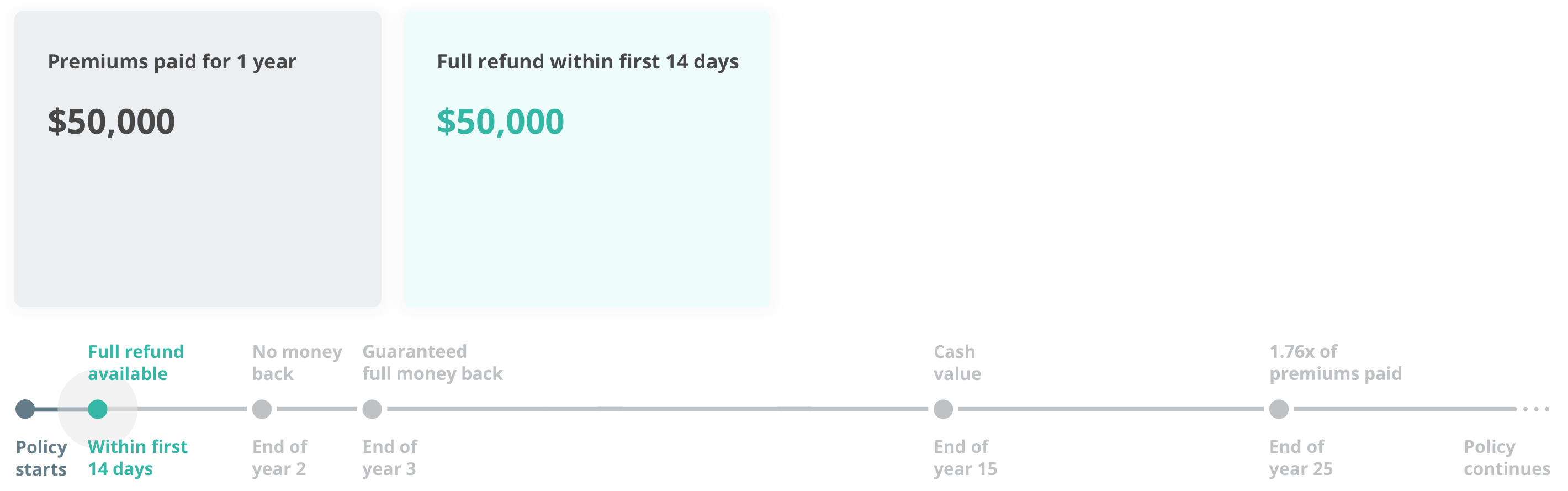

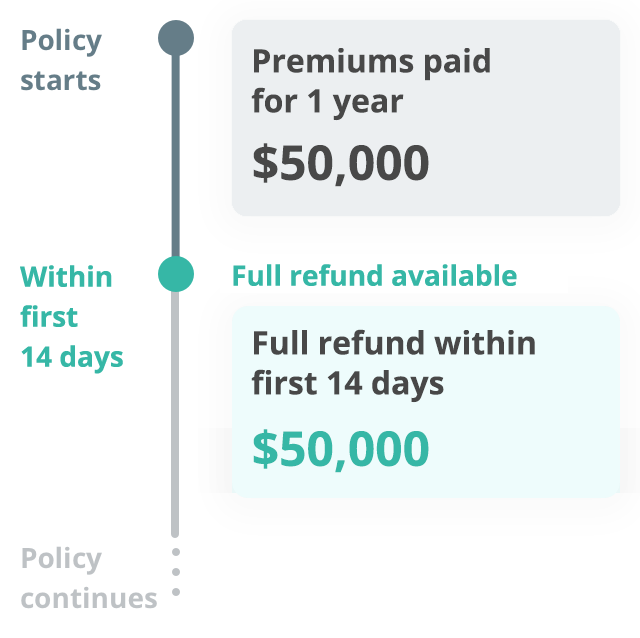

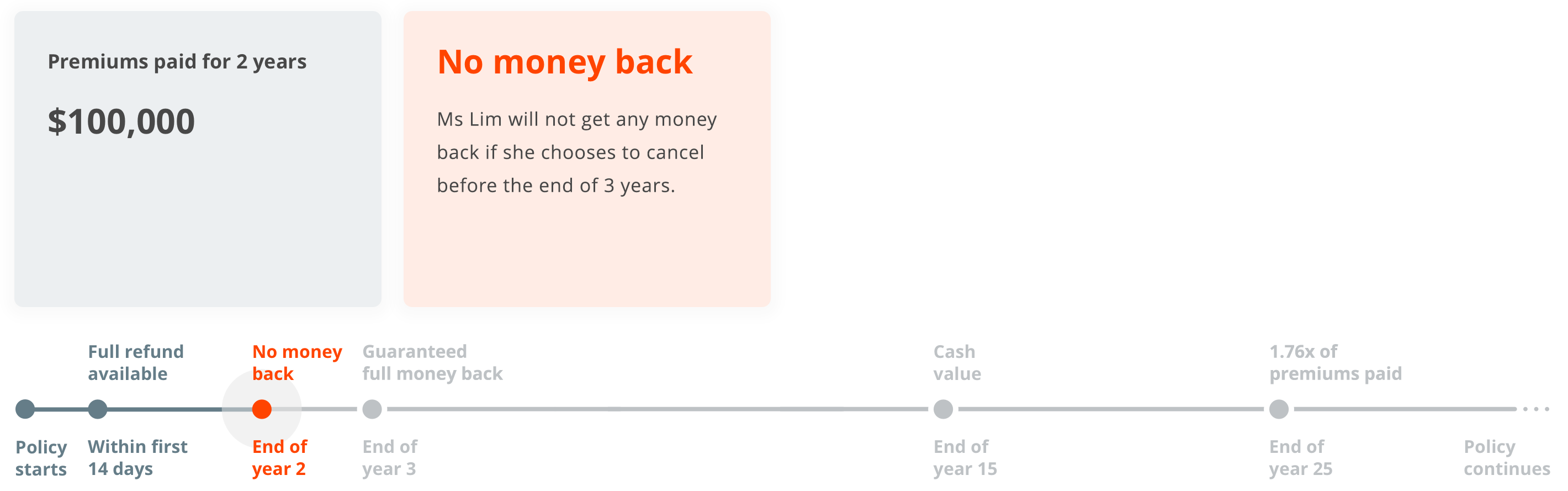

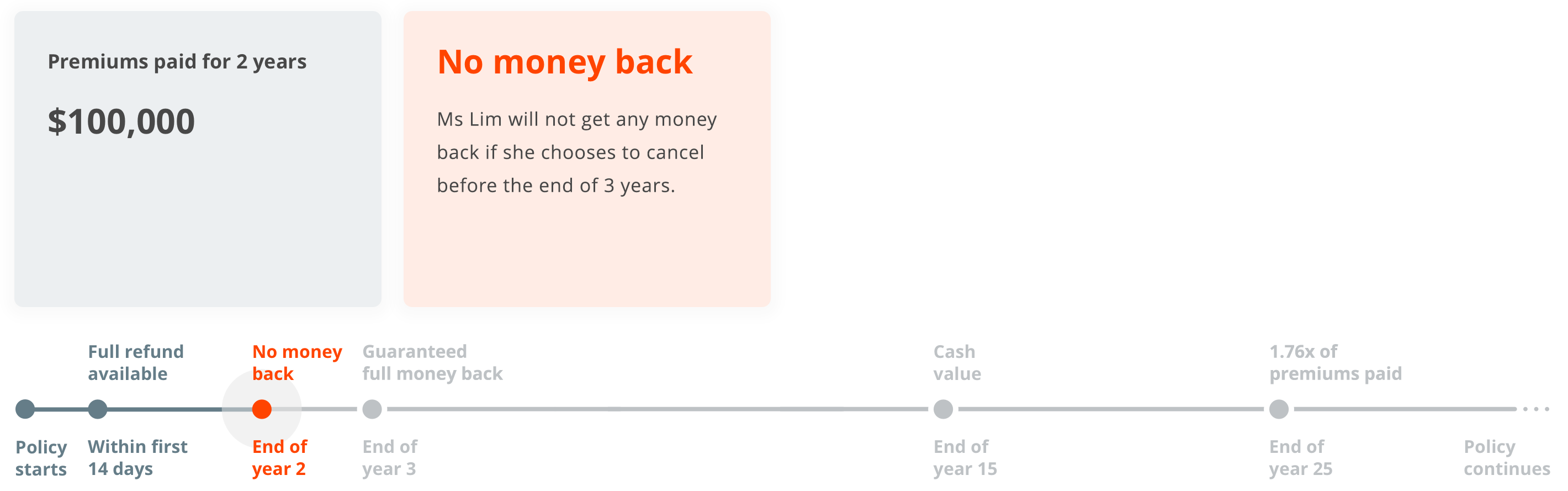

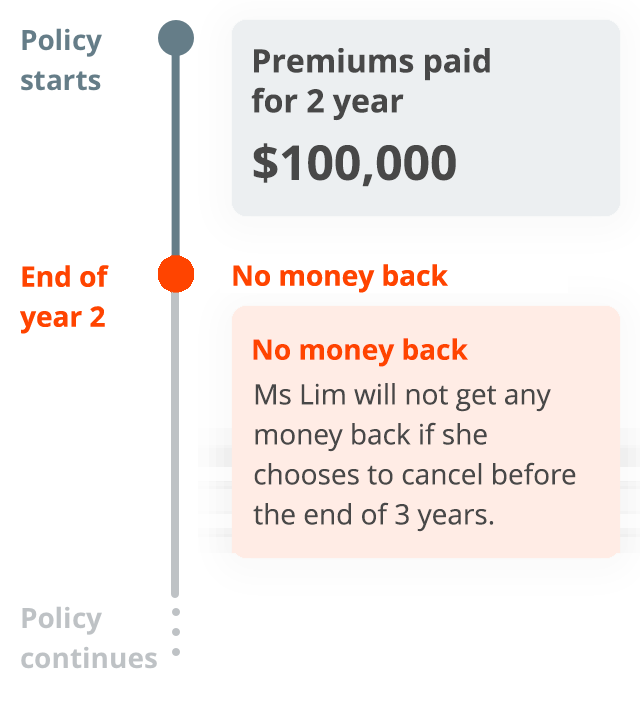

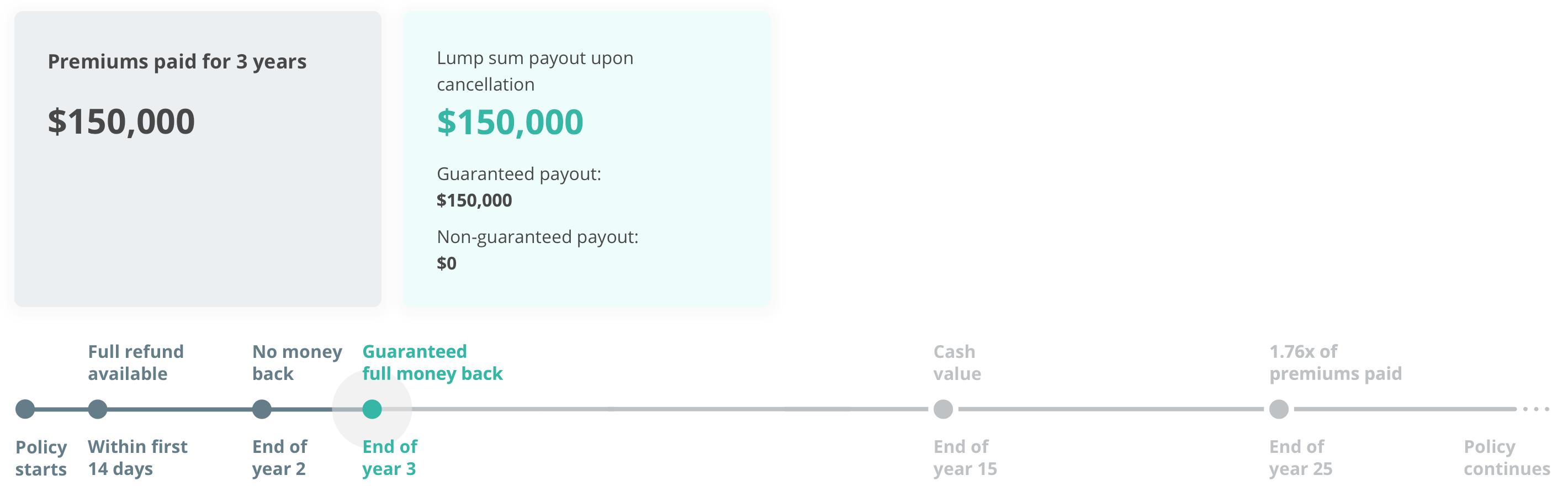

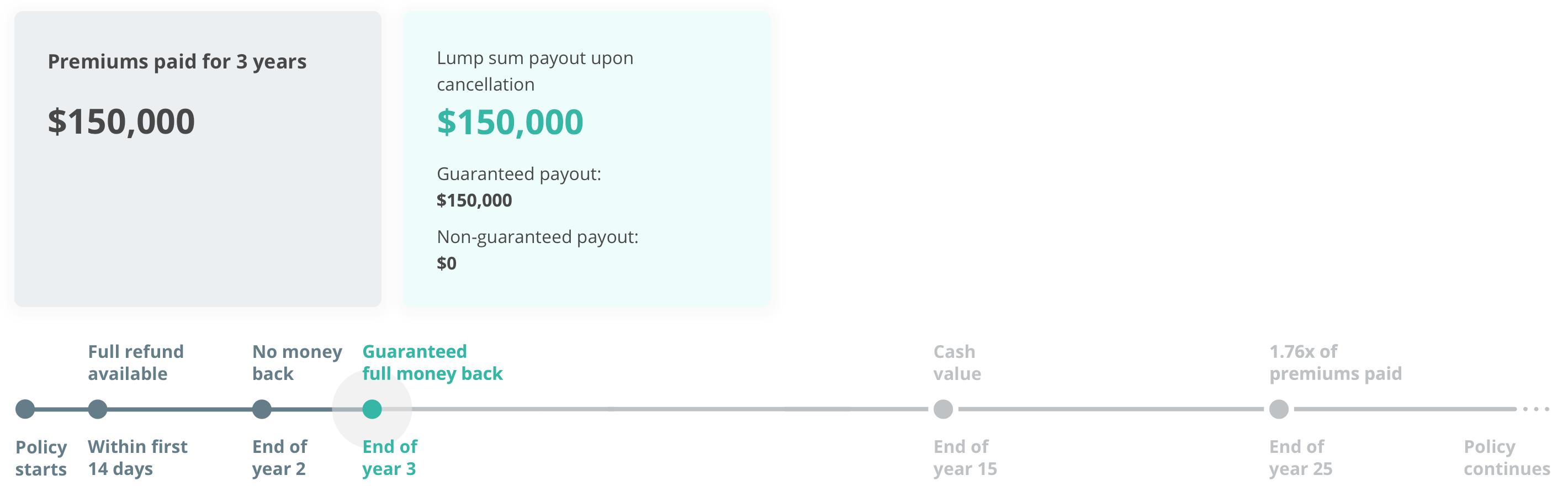

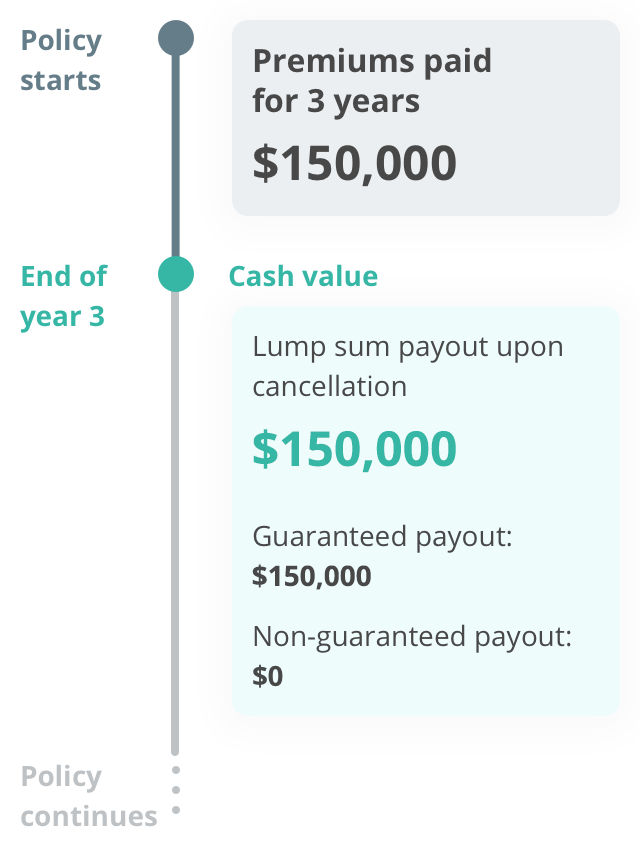

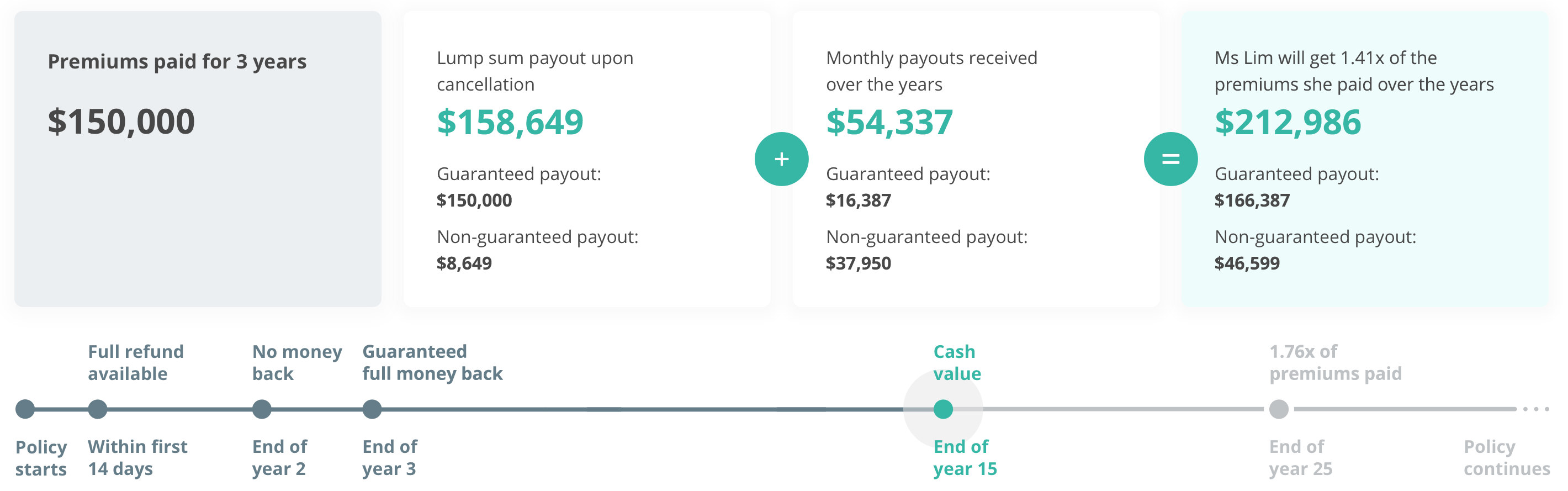

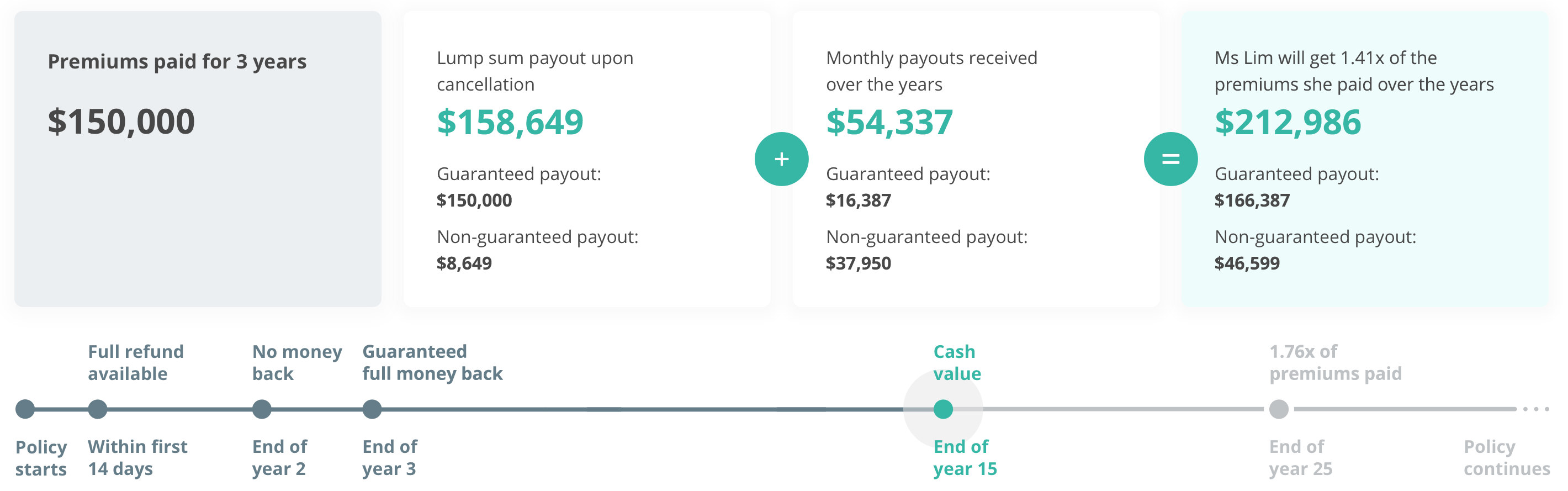

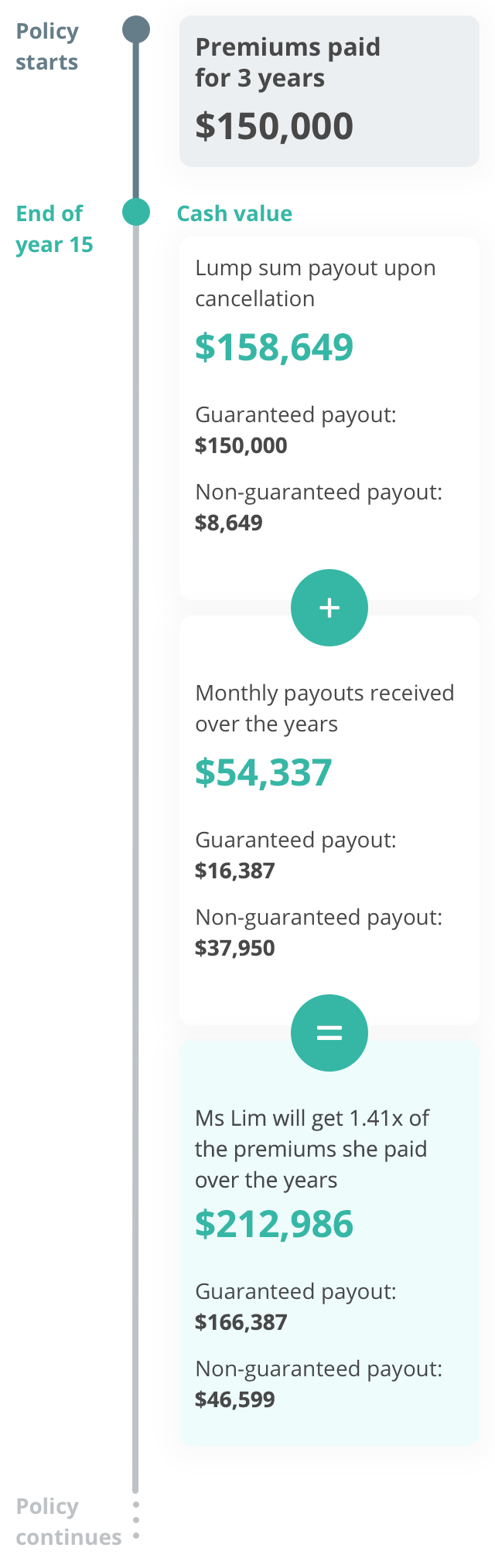

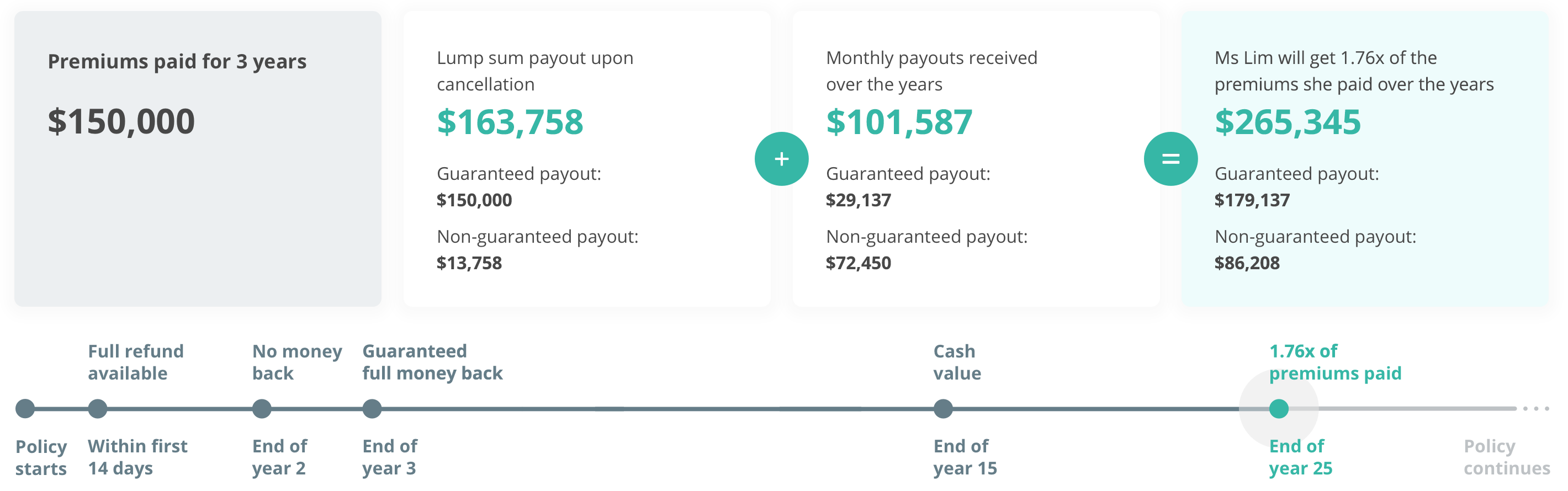

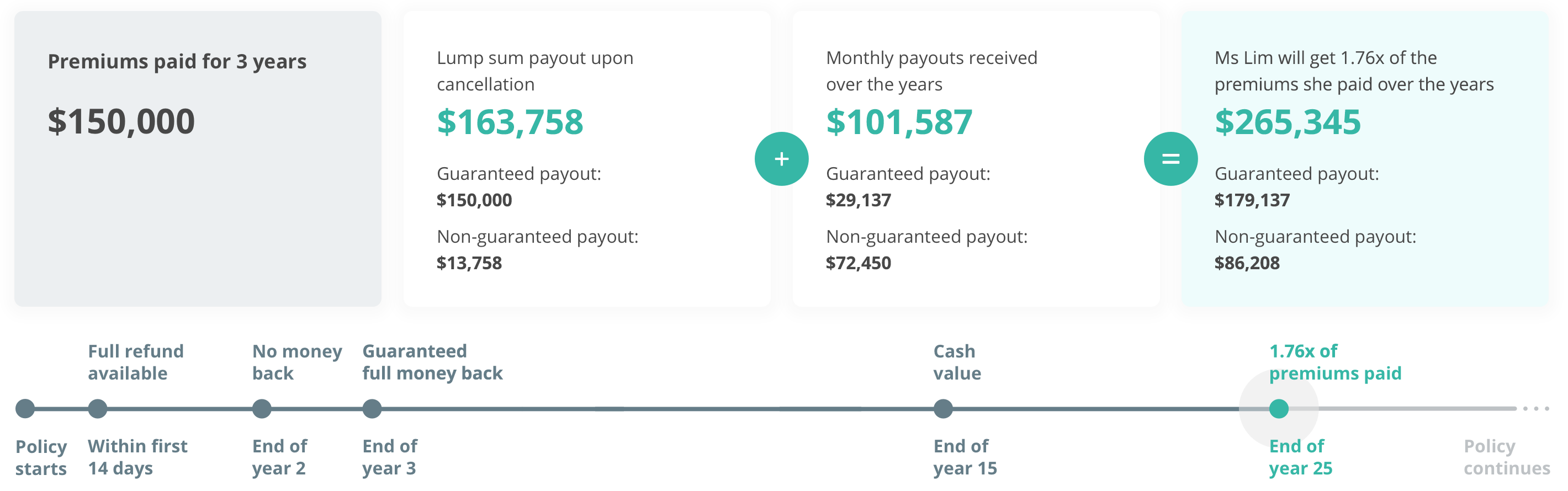

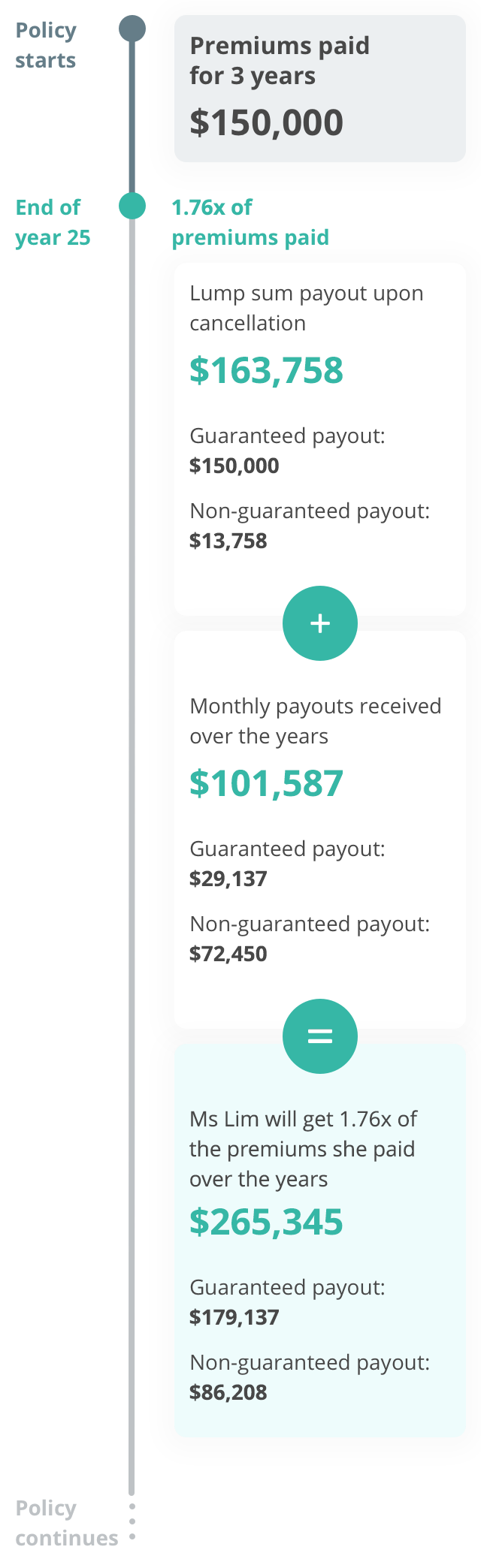

Early cancellation

What Ms Lim would get back over the years if she chooses

to cancel the plan

Ms Lim may get back less than what she paid if she cancels the policy anytime before the end of year 3.

The figures used are for illustrative purposes and are subject to rounding. Please refer to the policy illustration for the exact values.

The figures used are for illustrative purposes and are subject to rounding. Please refer to the policy illustration for the exact values.

The lump sum payout upon cancellation at the end of year 3 is $150,000 guaranteed under both illustrated investment rate of return of the participating fund at 4.25% per annum and 3.00% per annum, subject to rounding. Please refer to the policy illustration for the exact values.

The figures used are based on an illustrated investment rate of return of the participating fund at 4.25% per annum and subject to rounding. Please refer to the policy illustration for the exact values. The lump sum payout upon cancellation includes total guaranteed and non-guaranteed surrender value plus remaining declared but unpaid cash bonus and non-guaranteed interest earned on unpaid monthly cash bonus. Based on illustrated investment rate of return of 3.00% per annum, the lump sum payout upon cancellation will be $154,288, the monthly payouts received over the years will be $36,902 and the total amount received by Ms Lim will be $191,190 (1.27x of the premiums paid over the years). Interest earned on the unpaid monthly cash bonus is accumulated at 3.00% per annum and 1.50% per annum based on illustrated investment rate of return of 4.25% per annum and 3.00% per annum respectively. This rate is not guaranteed and can be changed from time to time. The actual benefits payable may vary according to the future experience of the participating fund.

The figures used are based on an illustrated investment rate of return of the participating fund at 4.25% per annum and subject to rounding. Please refer to the policy illustration for the exact values. The lump sum payout upon cancellation includes total guaranteed and non-guaranteed surrender value plus remaining declared but unpaid cash bonus and non-guaranteed interest earned on unpaid monthly cash bonus. Based on illustrated investment rate of return of 3.00% per annum, the lump sum payout upon cancellation will be $157,222, the monthly payouts received over the years will be $68,302 and the total amount received by Ms Lim will be $225,524 (1.50x of the premiums paid over the years). Interest earned on the unpaid monthly cash bonus is accumulated at 3.00% per annum and 1.50% per annum based on illustrated investment rate of return of 4.25% per annum and 3.00% per annum respectively. This rate is not guaranteed and can be changed from time to time. The actual benefits payable may vary according to the future experience of the participating fund.

Eligibility requirements

Minimum age

15 days from birth or discharge from hospital, whichever is later

Maximum age

75 years old (age next birthday)

More information

or contact us at 1800 363 3333

Our hotline is available 24 hours a day.

Calling from overseas? Please contact +65 6363 3333.

Important notice

GREAT Lifetime Payout 3 is underwritten by Great Eastern Life Assurance Company Limited, a wholly owned subsidiary of Great Eastern Holdings Limited, part of the OCBC Group. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it.

This document does not take into account your particular investment and protection aims, financial situation or needs. You may want to seek advice from a financial adviser before committing to buy the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information presented as at 6 August 2025.

Policy Owners' Protection Scheme

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Your monthly payout comprises guaranteed and non-guaranteed amounts. The total payout amount depends on the annual premium of your policy, as shown in the table below:

| Based on an illustrated investment rate of return of the participating fund at 4.25% per annum |

||

| Annual premium | Guaranteed payout | Total payout |

| $30,000 and above | From 43rd to 48th policy month: 3.15% p.a. From 49th policy month onwards: 0.85% p.a. |

Up to 3.15% p.a. |

| Below $30,000 | From 43rd to 48th policy month: 3.00% p.a. From 49th policy month onwards: 0.80% p.a. |

Up to 3.00% p.a. |

Based on an illustrated investment rate of return of the participating fund at 3.00% per annum, the total payout is up to 2.09% per annum of the total annual premiums paid (for annual premium of $30,000 and above) and up to 1.99% per annum of the total annual premiums paid (for annual premium below $30,000).

This refers to 105% of the total standard annual premiums paid plus attaching bonus (if any) and less any debt.

A lump sum death benefit will be payable on the conclusive diagnosis of an illness that is expected to result in the death of the life assured within 12 months of the diagnosis.

The diagnosis has to be supported by a registered medical practitioner and when required, to be confirmed by Great Eastern’s appointed medical practitioner.

| Guaranteed payout | Non-guaranteed payout | |

| Monthly payouts received over the years | $54,637 | $141,450 |

| Lump sum inheritance | $157,500 | $23,432 |

| Total benefits | $212,137 | $164,882 |