GREAT Cancer Care

100% payout for all cancer stages

Includes early stage cancer coverage

Your critical illness plan may not cover early stage cancer. Enhance your protection today.

Your critical illness plan may not cover early stage cancer. Enhance your protection today.

Option to choose your coverage amount

This policy offers 3 coverage amounts (SGD):

50,000, 100,000, 150,000.

This policy offers 3 coverage amounts (SGD):

50,000, 100,000, 150,000.

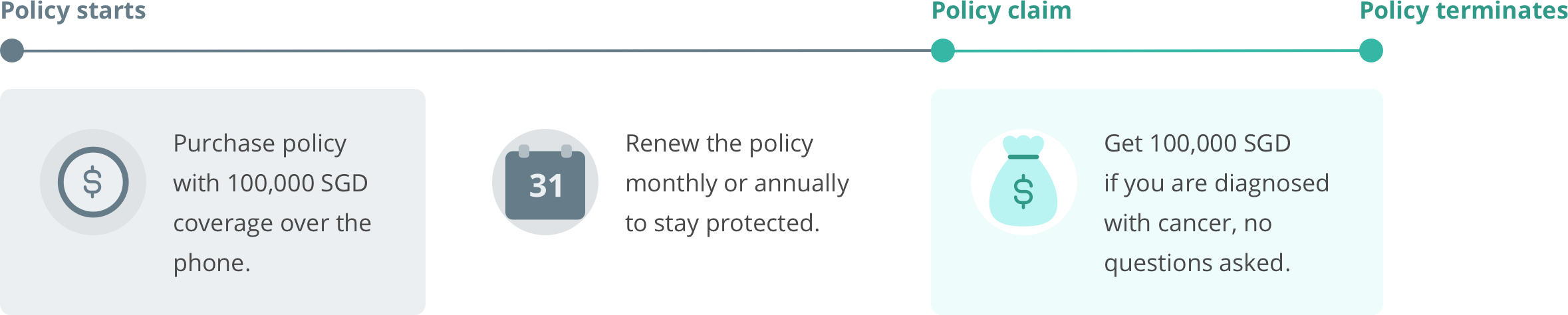

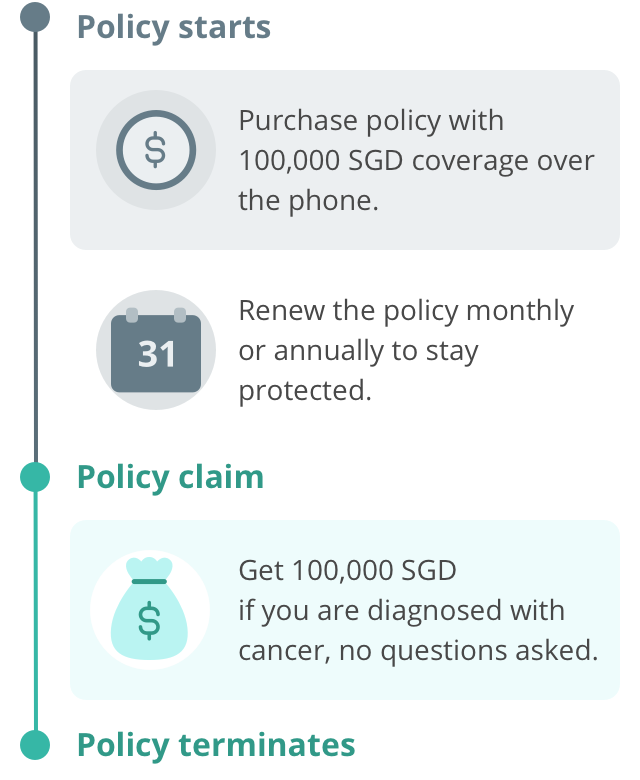

The illustration below describes the one-time payout option.

Find out how much critical illness coverage you need

Get personalised suggestions for each type of coverage on the OCBC app.

More information

Apply for GREAT Cancer Care

Important notes

Please refer to policy wording to learn more about the exclusions.

The above is for general information only. It is not a contract of insurance. It does not constitute an offer to buy an insurance product or service. It is also not intended to provide any insurance or financial advice. The precise Terms and Conditions of the plans are specified in the insurance policy contract. GREAT Cancer Care is underwritten by Great Eastern General Insurance Limited, a wholly owned subsidiary of Great Eastern Holdings Limited, part of the OCBC Group. GREAT Cancer Care is not a bank deposit or obligation of, or guaranteed by OCBC Bank.

OCBC does not provide any representation or warranty (including – but not limited to – accuracy, usefulness, adequacy, timeliness and completeness) regarding any information (including – but not limited to – any statement, figures, opinion, view or estimate) provided in this material. Such information should not be relied upon as such. OCBC does not undertake an obligation to update the information in this advertisement or publication, or correct any inaccuracies that may be apparent later. All information in this material is subject to change without notice. OCBC shall not be held responsible or liable for any loss or damage incurred – directly or indirectly – in connection with or as a result of any individual acting on the information provided in this material, or the promotion, purchase or subscription of GREAT Cancer Care by any person.

You may cancel the policy during the 14-day look-free period if you decide that it is not suitable for you. By your doing so, the insurer may recover from you any underwriting expense incurred. It is usually detrimental to replace an existing plan with a new one. A penalty may be imposed for early plan cancellation. The new plan may cost more or have fewer benefits at the same cost.

Information presented as at 6 August 2025.

Policy Owners' Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

Premiums for male, non-smoker

Premiums for female, non-smoker

- Age 25

- Age 35

- Age 45

- Age 55

| Insurance coverage amount | Annual premiums based on entry age | |||

|---|---|---|---|---|

| Age 25 | Age 35 | Age 45 | Age 55 | |

| 50,000 SGD | 181.56 SGD | 207.57 SGD | 318.78 SGD | 781.95 SGD |

| 100,000 SGD | 242.06 SGD | 294.09 SGD | 637.56 SGD | 1,563.90 SGD |

| 150,000 SGD | 302.57 SGD | 380.60 SGD | 956.35 SGD | 2,266.55 SGD |

- Age 25

- Age 35

- Age 45

- Age 55

| Insurance coverage amount | Annual premiums based on entry age | |||

|---|---|---|---|---|

| Age 25 | Age 35 | Age 45 | Age 55 | |

| 50,000 SGD | 203.67 SGD | 304.69 SGD | 531.78 SGD | 880.60 SGD |

| 100,000 SGD | 286.29 SGD | 488.32 SGD | 1,063.57 SGD | 1,761.19 SGD |

| 150,000 SGD | 368.90 SGD | 671.95 SGD | 1,595.35 SGD | 2,478.55 SGD |

All ages specified refer to age next birthday. Premiums (subjected to prevailing GST) are based on non-smoker rate including a 10% discount and are rounded up to the nearest dollar. Premium rates are not guaranteed and may be adjusted based on future experience of the plan. Adjusted rates, if any, will be advised prior to policy renewals.

The promotion is applicable to all new business policies purchased. The offer is valid from 1 June 2022 to 31 August 2022, both dates inclusive.

Great Eastern General Insurance reserves the right at its sole and absolute discretion to terminate the promotion or make changes to the promotion or any of these terms and conditions at any time without notice

The decision of Great Eastern General Insurance on all matters relating to this promotion shall be final and binding.

Try it now

Start planning via the OCBC app

Open the all new OCBC app > Login > Click on ‘Plan’ > Under ‘Insure’, click on ‘Calculate your needs’ .

If you are still on the previous version of the app, then click on ‘Insure and stay protected’ after logging in.