Invest now or visit any OCBC branch during opening hours.

Why “Corporate Karma” is crucial for your investment returns

Why “Corporate Karma” is crucial for your investment returns

The symbiotic relationship between a company and its stakeholders implies a notion of “Corporate Karma” that can help a socially responsible business thrive in the long term.

Sustainability used to be a niche preoccupation but is now discussed everywhere. From the “flight shame” movement to gender pay gap, issues related to sustainability have become part of our everyday conversation.

People today are trying to do more at a personal level to live sustainable lives, such as cutting down on single-use plastic. But what about our investments?

The way we direct capital not only shapes our financial returns, but also the type of impact we have on the world.

Sustainable companies can have a positive impact on society and the environment. What’s more, companies that consider all their stakeholders can deliver higher growth and returns through innovation, higher operational efficiency and better risk management. So sustainable investing makes both investment and social sense.

What do we mean by stakeholders?

As the name implies, stakeholders are any party that has an interest in a business or project. The chart below shows the range of stakeholders of a typical company; their relative importance will vary depending on the nature of the business. Shareholders are also a type of stakeholder, but just one among many.

Source: Schroders

The concept of “shareholder primacy” is one that really took hold in the 1970s. This is a theory that talks about how maximising profits for shareholders should be the top priority for companies over and above the other stakeholders.

This way of thinking is becoming outdated. For example, maximising shareholder returns while damaging the environment is increasingly unacceptable to employees, customers and the wider public opinion. This reputational damage could deter customers and may lead to a boycott movement, resulting in a loss of revenue, which will make it harder to recruit and retain workers. Regulators may also impose stricter standards or levy fines.

This is by no means an exhaustive list of potential consequences. Clearly, all of these outcomes would impact a company’s profits – ultimately harming the shareholders as well.

Stakeholder relations in the real world

Moving beyond the hypothetical, there have been numerous examples in recent years where mistreatment of stakeholders has had wider ramifications.

UK retailer Sports Direct became infamous in 2016 after public findings of “inhumane” working conditions in its warehouses. Consumers boycotted the stores, resulting in a sharp deterioration in sales and profits, and the share price reached a low of 70% below its 2015 peak (Bloomberg: Stock peaked at 809p on 10 August 2015 and troughed at 252p on 26 July 2016.)

We can also point to companies that have borne the cost of environmental disasters – for example, BP’s Deepwater Horizon explosion and oil spill as well as the catastrophic collapse of Vale’s tailing dam in Brazil in 2019, killing 270 people.

Positive examples are harder to illustrate as they rarely hit the headlines. However, there are many examples of companies where exemplary treatment of employees has resulted in long-tenured, deeply-committed workers, boosting productivity and reducing costs associated with staff turnover.

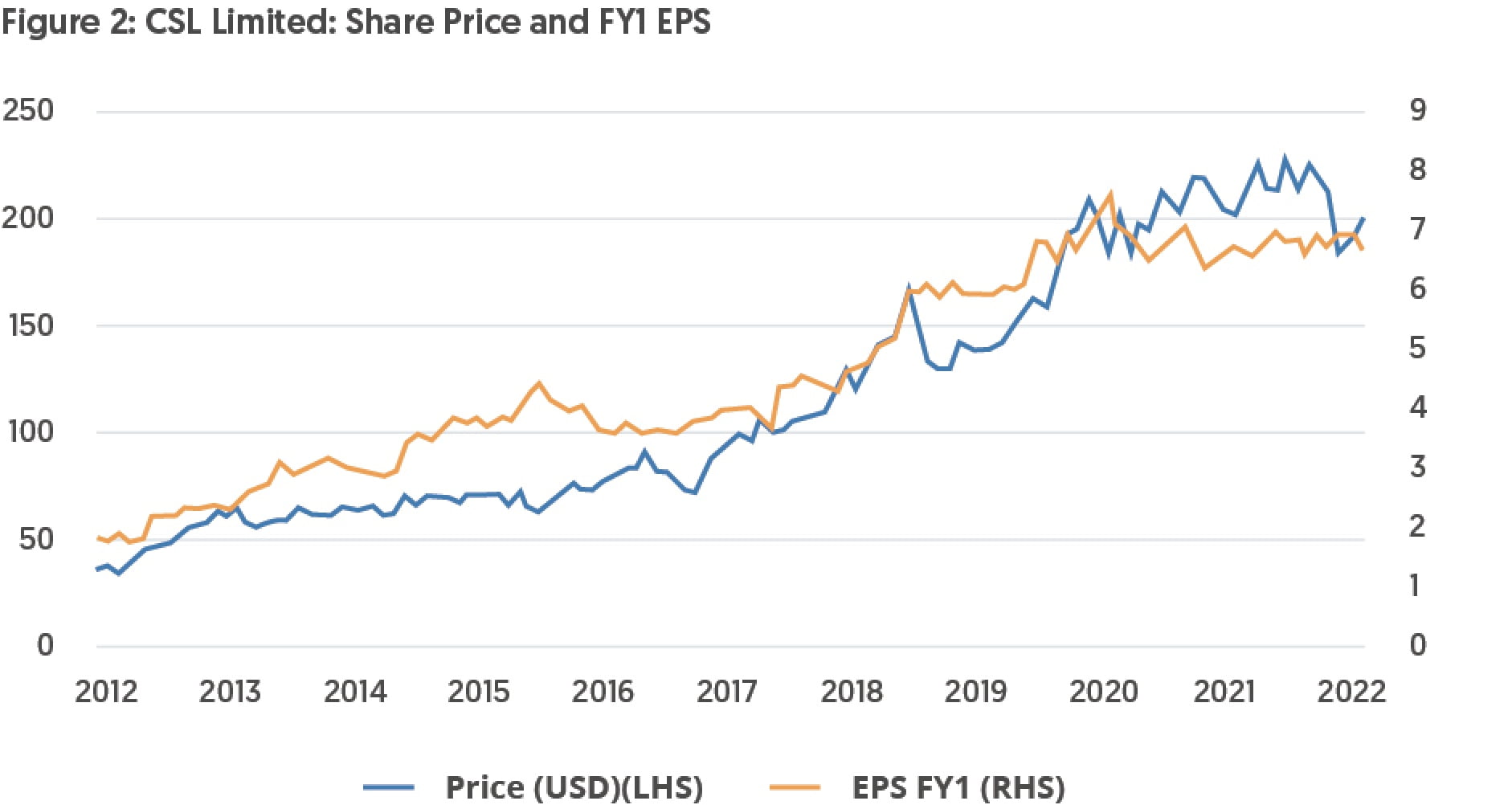

CSL Limited is a specialty biotechnology company that Schroders has invested in for several years. The company researches, develops, manufactures, and markets products to treat and prevent serious human medical conditions. Through Seqirus, CSL Limited is one of the world’s largest producers of the influenza vaccine.

The company prioritises the long-term sustainability of its business by investing consistently in R&D. This ensures that they have a steady pipe of new products that save lives and deliver on patient needs. Their historic record of accomplishments in innovation and commercial successes demonstrate their strong social responsibility such as the focus on quality, safety, and achieving regulatory audit requirements.

All this has been recognised by the market in terms of long-term financial outperformance.

Sustainable businesses can thrive in the long term

The examples above illustrate that there is a symbiotic relationship between a company and its stakeholders; a kind of “Corporate Karma”. As well as avoiding harm, there is growing recognition that taking care of stakeholders has positive business benefits.

Source: FactSet, as of 31 March 2022, monthly data for 10 years.

However, financial markets still tend to be very focused on the short term. The analysis of many companies tends to focus on their prospects for at most the next two or three years, if not just the next couple of quarters. The conventional financial analysis also struggles to capture non-financial factors, such as corporate culture and stakeholder relations.

This means that the wider market often underestimates and undervalues the resilience of growth and returns that sustainable companies can deliver. This offers an opportunity for investors to exploit mispricing in the market, and reap the benefit when those sustainable companies keep beating market expectations.

Active asset managers like Schroders have the power to help create a sustainable and more prosperous world through their role in the financial system. Not only is the firm able to allocate more capital to sustainably-run companies, they can actively engage with companies that they own to become more sustainable.

To shed light on how this works in practice, let’s look at China Pacific Insurance Company (CPIC). This is an integrated insurance player that Schroders first invested in in 2018.

Financial disclosures across listed Chinese insurers vary significantly, and this can result in valuation discrepancies between players. In May 2019, Schroders wrote to CPIC’s management to lobby for improved disclosures of key financial data and operating metrics.

As a significant shareholder, Schroders was able to encourage the company to provide information on segmental operating profits and disclosure of movements in residual margin, in line with industry best practices. They also requested more comprehensive operational data that would help investors better understand trends within the business.

In a letter signed by CPIC’s Chairman and President, the company announced its commitment to improving disclosures to investors. In the next set of results announcement post-engagement, the company provided additional line items that laid out greater transparency on operating trends1.

Incorporating a multi-asset lens to sustainable investing

While we truly believe that sustainably-run companies are best placed to deliver superior growth and stable long-term returns, just like any investment, they can experience divergence in returns over the short term.

This is why taking a diversified approach with active, dynamic asset allocation is warranted for a smoother path of returns from sustainable investing. Actively managed multi-asset funds offer the flexibility to apply tactical thinking based on short-term performance, while delivering on the objectives of diversification and long-term risk-adjusted returns against the backdrop of sustainability.

All of Schroders’ multi-asset strategies, including its flagship fund in Singapore Schroder Asian Income, are fully ESG integrated with sustainability as one of the four key pillars that underpin the investment philosophy in generating sustainable returns and mitigating risk.

Schroders and OCBC have also collaborated to launch a new W share class for Schroder Asian Income, with OCBC as the exclusive distributor. Find out more about Schroder Asian Income and the sustainably-run companies that the fund invests in.

Companies mentioned in this article are for illustrative purposes only and does not constitute to any recommendations to invest in the above-mentioned security/sector/country.

1We recognise that success factors may be subjective, and that Schroders’ influence may not have been the sole driving force for this change. However, we believe it is important to track companies’ progress and measure the outcomes of our engagement.

Invest in the Schroders Asian Income Fund

or locate a branch to learn more.

Important notes

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This is prepared by Schroders for information and general circulation only and the opinions expressed are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any Schroders fund (the ‘Fund’) and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser before purchasing units of any Fund. In the event that the investor chooses not to seek advice from a financial adviser, he should consider whether the Fund in question is suitable for him. Past performance of the Fund or the manager, and any economic and market trend or forecast, are not necessarily indicative of the future or likely performance of the Fund or the manager. The value of units in the Fund, and the income accruing to the units, if any, from the Fund, may fall as well as rise. Investment in units of the Fund involves risks, including the possible loss of the principal amount invested. Investors should read the prospectus, available from Schroder Investment Management (Singapore) Ltd or its distributors, before deciding to subscribe for or purchase units in any Fund. Funds may carry a sales charge of up to 5%.

For Bloomberg data the information contained herein: (1) is proprietary to Bloomberg and/or its content providers; (2) may not be copied or distributed; (3) may not be accurate, complete or timely; and (4) has not been checked or verified by Schroders in any way. None of Bloomberg, its content providers or Schroders shall be responsible for any damages or losses arising from any use of the information in any way.