What is ESG investing?

What is ESG investing?

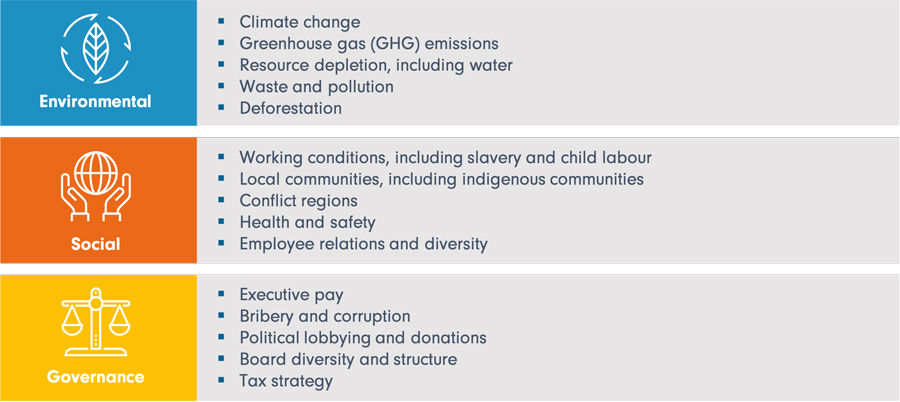

ESG investing is the consideration of environmental, social and governance (ESG) factors, alongside financial factors, in the investment decision-making process.

Different labels like sustainable investing, socially responsible investing, ethical investing and impact investing all form part of ESG investing, with ESG factors covering an extremely broad range of issues - from avoiding investing in tobacco companies to financing clean water initiatives.

Source: Fidelity International, PRI, 2018. For illustration purposes only.

Source: Fidelity International, PRI, 2018. For illustration purposes only.

The concepts underpinning ESG have evolved over time.

While a hundred years ago, responsible investing was mostly about religious beliefs influencing the choice of investments, it’s now about people’s perceptions of themselves and their role in society informing their investment framework.

ESG investing’s beginnings were largely based on exclusion - avoiding the asset classes and sectors deemed to have a negative effect on society - however in recent years it has extended to modern-day activism, where investors directly intervene to enact positive change.

Today, ESG is considered by some as an asset class and an investment approach in its own right.

Investor motivations for pursuing ESG vary widely, ranging from the already mentioned moral and religious beliefs, to regulatory and legislative requirements, public and client pressure, and economic reasons.

Why does ESG matter?

There are two broad schools of thought when it comes to why ESG matters; one starts from the role of investors in society and the other focuses on risk management.

Many investor groups including pension funds, charities and endowment funds, see their role as more than just return-seekers. They are conscious that funding our retirements, financing societal initiatives and contributing to the cost of education, can give them a function within wider society.

With this responsibility comes influence. These investor groups manage significant pools of capital; directing this capital gives them a substantial amount of authority. They decide how and where they want their funds allocated, and can choose to favour investments that aim not to have a negative effect on society, or those targeting a positive effect.

The other major philosophy behind ESG is rooted in risk management.

Investors who take this approach incorporate ESG factors into their investment process to help mitigate risk. For example, a potential investment in a company with low ESG standards could expose the portfolio to a variety of risks faced by the company in the future, such as worker strikes, litigation and negative publicity, resulting in lower future returns. For investors, monitoring the ESG credentials of an investment can lead to better risk-based judgements.

This is not a divergence from the traditional investment principle of maximising shareholder value - it’s an evolution.

In the early 2000s, there were some debates over whether the fiduciary duty of asset managers included considering non-investment related indicators such as ESG characteristics. A large body of research since has led to an overwhelming consensus that ESG factors do indeed play a part in the performance of investments. By considering ESG, investors may be able to deliver better risk-adjusted returns.

The factors driving ESG

The primary driver of the growing focus on ESG is access to information.

The proliferation of 24-hour news channels, the internet and social media mean that the public has an extraordinary amount of information available at its fingertips. It’s not only an instant news world, but it’s also a global news world - we can find out rapidly what is happening almost anywhere in the world.

Armed with this transparency, public scrutiny is at an all-time high, and people power is changing how the investment world behaves. Companies understand the value of their brand and have a heightened sensitivity to public opinion to avoid risking damage to their reputation.

This public scrutiny affects how institutional investors direct their capital, which in turn influences how asset managers deploy funds and engage with companies.

While the relationship between institutional investors, asset managers and companies isn’t one way, they often have long-term partnerships, influencing and informing each other.

So in practice, the drive towards ESG can come from institutions, asset managers and industry.

An important aspect of the increasing access to information is the availability of data. This has made it practical to incorporate ESG factors into the investment process.

Regulatory frameworks have improved, companies disclose more ESG information, ESG investment metrics and tools are proliferating, independent third-party agencies provide ESG ratings, and new ESG indices allow for portfolio benchmarking. And an increasing body of research explains how to incorporate ESG factors into decision making.

You can easily access the Sustainability Hub via your OCBC Digital app.

Important information