Unlocking ESG opportunities: Look for winners and improvers

Unlocking ESG opportunities: Look for winners and improvers

Summary

- ESG remains an essential pillar in investment discussions. The traditional exclusion or positive screening only approaches are not sufficient anymore in a world where geopolitical risks, regulation, inflation and economic uncertainty are generating a higher dispersion in returns. This market environment requires a greater focus on stock selection.

- There are significant performance differences between different approaches depending on market cycles. In 2024, indices that adopted best-in-class approaches performed less well than their less strict ESG and climate indices.

- In this context, it is vital for investors to embrace an integrated approach that takes a forward-looking view to identify companies showing improving ESG trends that are not yet fully priced into companies’ valuations.

- To capitalise on ESG opportunities, investors should adopt an integrated approach that identifies companies with improving ESG trends not yet reflected in their valuations. This involves focusing on two types of companies:

- ESG winners: Companies with strong existing ESG ratings.

- ESG improvers: Companies on a positive trajectory regarding ESG metrics.

Last year was one of divergence for responsible investment, amid a landscape shaped by increasing geopolitical uncertainty and polarised views on sustainable investing. ESG remained an essential pillar in investment discussions, with inflows into responsible investment (RI) funds totalling €57 billion in the first three quarters of 2024, but lagging those in the broader non-RI market, which witnessed over €98 billion investment flows in Europe1.

With ESG investing becoming mainstream, we believe it is time for investors to move one step further in the search for excess returns. The traditional exclusion or positive screening only approaches are not sufficient anymore in a world where geopolitical risks, regulation, inflation and economic uncertainty are generating a higher dispersion in returns. This market environment requires a greater focus on stock selection.

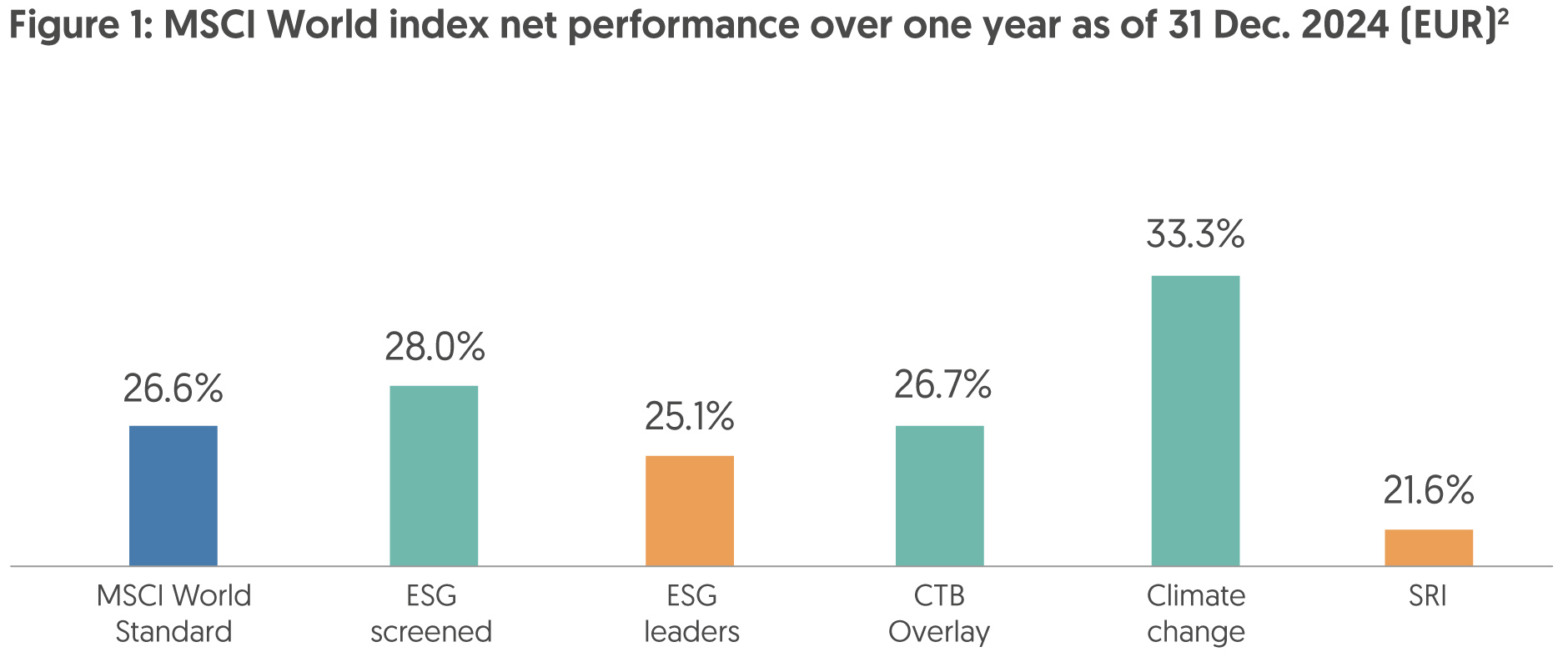

It is important to understand that the performance of responsible investment funds can be heavily influenced by the industries and sectors in which they invest (or in which they are prevented to invest), leading to significant performance difference between different approaches depending on market cycles. This variability means that investors may see returns that are as much a product of sector performance as they are of the fund’s commitment to environmental and social values, highlighting the importance of understanding each framework’s unique approach and its potential impact on long-term financial results. Overall, in 2024, indices that adopted best-in-class approach performed less well than their less strict ESG and climate indices (Figure 1).

In this context, it is vital for investors to embrace an integrated approach that takes a forward-looking view to identify companies showing improving ESG trends that are not yet fully priced into companies’ valuations.

The value of forward-looking ESG assessments

A good way to embrace an integrated ESG approach, in our view, is to use a forward-looking approach to select two types of companies: ESG winners and ESG improvers.

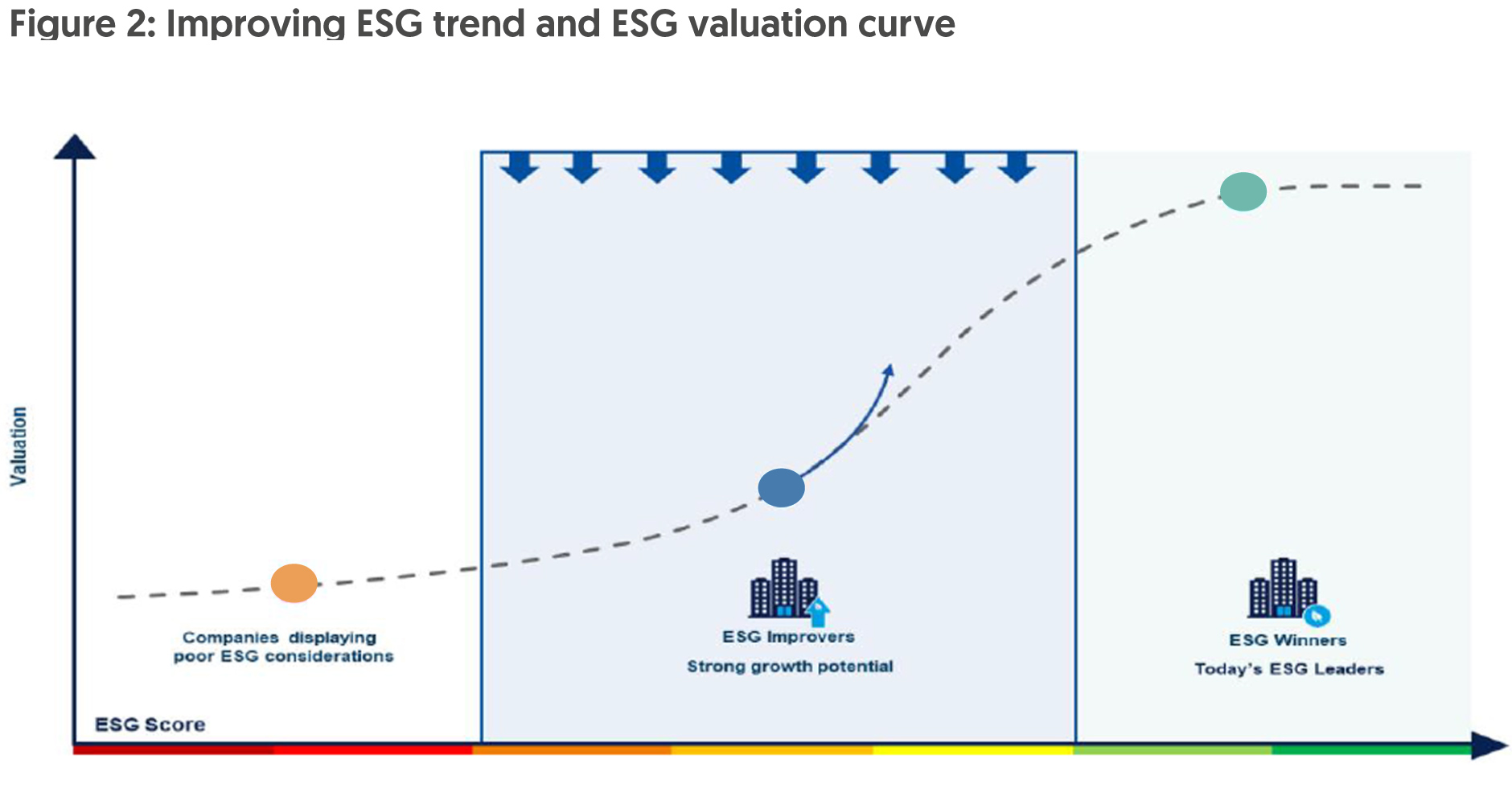

We define ESG winners as quality businesses that already have strong ESG ratings, while ESG improvers are companies with a positive ESG path with regards to the most material sector and business drivers. In this trajectory, company valuations will adjust, as shown by the MSCI and others2 (see Figure 2). Companies with improving ESG metrics benefit from a falling cost of capital, an improving operational efficiency and more stable profitability. Identifying the companies at the early stage of this ESG rating improvement will be a source of value for investors, in our view.

Such an approach offers investors the opportunity to invest today in the ESG winners of tomorrow. In selecting these companies, ESG analysis should go hand-in-hand with the qualitative fundamental research process in assessing the sustainability and profitability of each company.

To seek out ESG improvers, we believe investors cannot rely merely on the ESG standard data, as this data is backward looking and focused on risks rather than opportunities. Hence, in our view, it is not fit for purpose in seeking the value creation potential attached to an improving trend in a company’s ESG rating. A good way to identify this potential is to use a forward-looking approach based on a quantitative assessment of companies’ ESG dynamics combined with a qualitative fundamental analysis of their businesses. Such an approach would be key in forecasting potential changes ahead.

Building on the foundation of a robust ESG rating methodology, Amundi’s three-step methodology to unlocking value uses this approach:

- Identify the most material ESG drivers for each business. Materiality is measured as being the potential impact of a driver on a business’ fundamental internal rating and future value. For each investment case, we monitor between 3 and 5 material KPIs.

- Understand the financial impacts of the drivers. The material ESG drivers can affect revenue, profitability, cash flow, debt and leverage.

- Detect how the drivers will evolve in the future. We have built a database of ESG KPI scores that allows us to monitor their evolution. The portfolio managers and analysts speak with company management about the financial and ESG aspects of all investment cases.

ESG themes with strong tailwinds

Momentum shifting to clean energy investments

Clean energy added US$320 billion to the world economy in 2023, outpacing fossil fuel investments at a close to 2:1 ratio4. We expect this ratio to continue to expand, driven by a widening competitive gap. As countries work to meet their climate goals and the global consumption of energy is still growing, the demand for renewable energy sources is expected to keep rising. Global investments in renewable energy are set to increase further, fuelled by technological advancements and decreasing costs. This trend reflects a growing recognition among investors and policymakers of the importance of transitioning to sustainable energy systems.

Artificial Intelligence (AI) is set to play a significant role in the energy sector, with its share in total energy consumption currently estimated at 2-3% of global usage and projected to double by 20263. However, the opportunities presented by AI can outpace demand, as it facilitates energy efficiency, optimises grid management, and encourages big tech involvement. Recent investment by technology companies to further grow their own power generation is just one indicator of the potential impact of AI development on global electricity demand.

Geopolitical shifts to impact energy transition

Beneath the surface, an undercurrent of investments in clean energy continues while inflation, higher interest rates and geopolitical uncertainties influence near term performance on clean technology solutions. There is a groundswell of investments in areas such as renewable energy generation (solar, wind), electric vehicles, energy storage solutions, and smart grid technologies, stoked by regulatory policies in Asia, Europe and the United States that have helped to incentivise investments in the energy transition.

While the prospects for clean energy transitions have accelerated in recent years, they will need to progress at an even faster pace to meet climate objectives. Emissions are projected to peak soon, but a rapid decline is essential.

Emerging markets and developed economies (EMDEs) are set to lead the future of clean energy investments

Emerging markets and developed economies (EMDEs) are poised to lead the future of clean energy investments, with countries such as China, India, and Brazil at the forefront. These nations are increasingly recognising the importance of transitioning to sustainable energy sources, driven by both environmental imperatives and economic opportunities. For instance, India has set ambitious targets for solar energy, aiming to achieve 450 GW of renewable energy capacity by 2030, while Brazil continues to expand its investments in wind and hydropower, capitalizing on its vast natural resources.

As a collective group, EMDEs tend to rely more heavily on fossil fuels for domestic energy consumption compared to developed markets. In fact, they account for 95% of the increase in greenhouse gas emissions over the last decade. Their share of global emissions is expected to continue rising, as EMDEs are projected to account for 98% of global population growth in this decade. Consequently, these countries are critical to global climate change mitigation efforts. Financing their decarbonisation while ensuring energy security will necessitate massive investments across various sectors.

Despite the urgent need for action, EMDEs currently receive only about one-quarter of the financial flows required to fund climate mitigation and adaptation efforts. This shortfall can be attributed to several factors, including shallow or bank-dominated financial markets and relatively higher political or macroeconomic risks compared to developed countries. Rapid population growth, urbanisation, and economic development are creating additional power supply requirements in many EMDEs. While significant risks emerge from the rapid increase in energy needs, these trends also present unique opportunities to invest in clean energy infrastructure—such as solar, wind, hydropower, and geothermal—and to replace traditional, energy-intensive production methods with low-carbon alternatives.

In summary, the transition to clean energy in EMDEs is not just a necessity for combating climate change; it is also a significant investment opportunity. Investors are encouraged to engage with these markets, recognising the potential for substantial returns while contributing to a sustainable future. By supporting the development of clean energy infrastructure and innovative technologies, investors can play a pivotal role in shaping a greener economy.

Conclusion

The path forward for EMDEs is fraught with challenges, yet it is equally filled with opportunities for transformative change. As these countries strive to balance energy security with climate sustainability, the role of investors becomes increasingly vital. By prioritising investments in energy transition, stakeholders can help drive the necessary transition, ensuring that the regions not only meet their energy needs but also contribute to global climate goals. The time to act is now—invest in the energy transition and be part of the solution.

Source: Amundi as of 10 June 2025. Views expressed are at the time of writing and are subject to change without prior notice.

1 Amundi business intelligence analysis based on Broadridge data as of September 2024, excluding Money Market

2 MSCI, How markets price ESG: Have Changes in ESG Scores Affected Stock Prices?, November 2018. UN PRI, “Financial performance of ESG integration in U.S. investing”, 2018

3 IEA (2024), Electricity 2024, IEA, Paris

4 According to SEIA’s latest Solar Means Business report, Meta, Google, and Amazon added the most solar to their electricity portfolios through Q1 2024 and those three also have the largest pipelines of new solar procurements under contract in the U.S. Google is also the largest corporate user of battery energy storage, boasting 312 MWac of capacity. Big tech firms have signed several agreements with nuclear power companies in 2024, with Google signing an agreement to buy power from small modular nuclear reactors, Microsoft agreeing on a deal that will see the reopening of a plant in Pennsylvania, and Amazon buying a nuclear-powered data centre, Reuters report and WEF

Disclaimers by Amundi

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instrument or product or index. None of the MSCI information is intended to constitute investment advice or recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including without limitation, lost profits) or any other damages”. (www.mscibarra.com)

Important information

This advertisement has not been reviewed by the Monetary Authority of Singapore. Cross-Border Market Disclaimers