The Perfect Pairing for Your Financial Well-being by OCBC

The Perfect Pairing for Your Financial Well-being by OCBC

Espresso and milk are great on their own. But when combined with a sprinkle of cocoa powder, they make a satisfying cup of cappuccino. Similarly, we can get more satisfaction from banking by pairing our bank account with the right credit card to unlock more rewards.

The 360 Account rewards you for improving your financial health in line with OCBC Life Goals, using three simple steps to Manage, Safeguard and Build.

Manage your cashflow

Before you commit to longer-term plans such as insuring yourself and starting an investment plan, you need to set aside a rainy-day fund of at least six to nine months of living expenses to cover potential short-term cash needs and small emergencies.

Build up your rainy-day fund by crediting your salary to earn an effective interest rate of up to 1.50% a year. Earn additional effective interest rate of up to 0.50% a year through increasing the average balance of your 360 Account by S$500 every month.

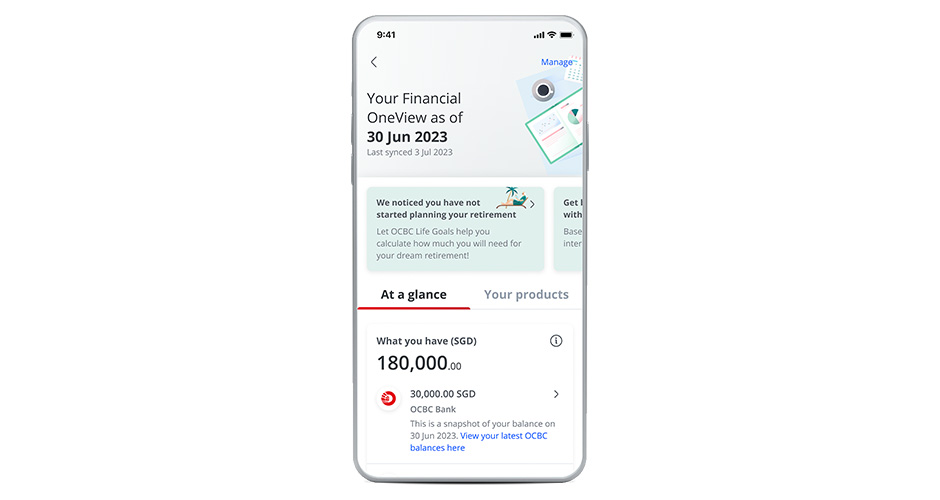

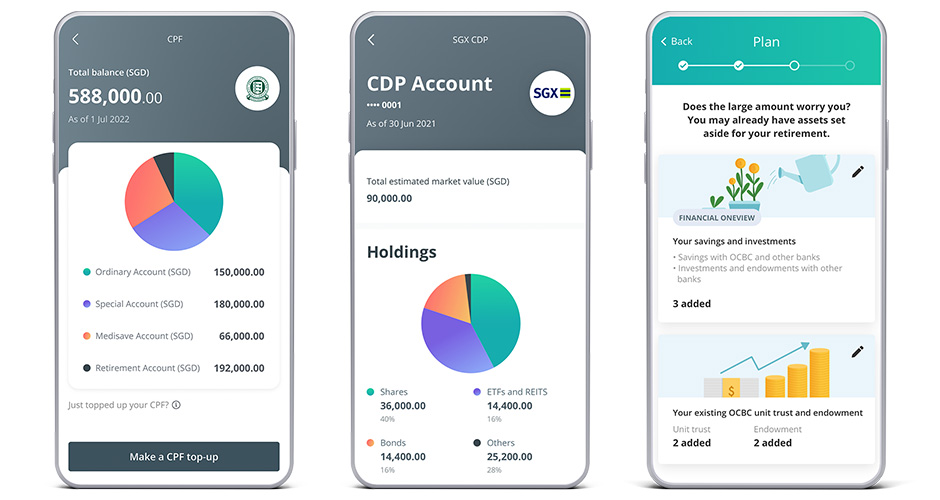

Get a complete view and manage your personal finances across your banks, SGX CDP and government agencies – CPF, IRAS and HDB – all in one place via the OCBC Financial OneView. Enabled by SGFinDex, the OCBC Financial OneView is a free one-stop financial dashboard tool that helps you stay on top of your finances and receive personalised tips to reach your financial goals.

We should always be careful with our credit card spending. But with prudence, using your credit card gives you extra benefits that you can tap on.

Reduce the effects of inflation on your daily spend by pairing the OCBC 365 Credit Card with your 360 Account. This lets you enjoy cashback on dining, groceries, petrol, transport (SimplyGo and private hire rides), utilities (telco and electricity bills), and more – with a minimum spend of just $800 per month. The OCBC 365 Credit Card is truly an everyday companion and the ideal card to do it all.

What’s more? When paired with your 360 Account, a minimum spend of $500 in a month on your OCBC 365 Credit Card lets you earn bonus interest of 0.50% a year. This is on top of the card’s usual cashback rates, magnifying your rewards for every dollar spent.

Safeguard your assets

While pursuing wealth and happiness, we should also not forget to protect ourselves, our family and assets from any unexpected risks.

Unforeseen events like illnesses and accidents may deplete any money you have painstakingly earned and saved. This potentially sets you back from achieving your financial goals like saving for a house, a wedding or a car.

By purchasing an eligible insurance plan with OCBC to protect yourself against any unexpected risks, you will unlock another bonus interest category. This allows you to earn additional up to 1.5% effective interest.

Build your wealth

The top financial goals among investors are to build a comfortable retirement nest egg and fund their children’s education. One way is to grow your assets at a faster pace than inflation. CPF is a safety net that can help you guard against inflation (Source: CPF Board). This makes them an important foundation of our retirement planning.

Apart from CPF, there are many other investment instruments you can use to reach your financial goals, such as unit trusts, structured deposits, bonds and structured products.

Investing with OCBC can unlock an additional 1.5% effective interest rate a year on your 360 Account too.

The Complete Suite – Combining powers

Used together, the 360 Account and OCBC 365 Credit Card, in conjunction with OCBC Financial OneView and OCBC Life Goals, is a complete suite that rewards you purposefully. Improve your financial health as you plan, save, spend, insure and invest towards your financial goals.

With its varied cashback categories centred around everyday spends, the OCBC 365 Credit Card is truly “the card that does it all”.

Disclaimer

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Investments are subject to investment risks, including the possible loss of the principal amount invested.

The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.