The Electronics and ICT sector: designing a new matrix

The Electronics and ICT sector: designing a new matrix

The 2020 European New Circular Economy Plan has identified the Electronics & ICT industry as one of the seven intensive-resources sectors that need to implement a Circular Economy given its environmental impact and circularity potential.

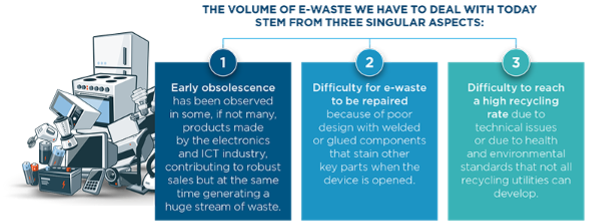

For many years, the Electronics & ICT industry has been experiencing strong growth resulting in the growth of e-waste. The sector has traditionally used early or planned obsolescence to ensure that products only perform for a certain number of years, ensuring a steady stream of robust sales but at the same time generating a huge stream of waste.

Source: Amundi Asset Management

At the same time, many products are not designed with repair or reuse in mind, with welded or glued components that stain other key parts when the device is opened, making it difficult to recover materials.

Compounding the issue is e-waste’s low recycling rate, given the existence of many hazardous compounds in electronics and the lack of health and environmental standards to develop recycling utilities. In 2019, only 17% of global e-waste was collected and properly recycled, and 44 million metric tonnes of e-waste was either placed in a landfill, burned or illegally traded and treated in a sub- standard way.

Poor treatment of waste has three major consequences: pollution of the environment, health deterioration for the people handling this waste and high CO2 emissions. Implementing a Circular Economy could help solve these three issues and improving product durability and reparability are at the heart of the Circular Economy process and remains likely the best lever the industry has at its disposal.

Board and Management need to show stronger leadership

During Amundi Asset Management's 2020 Circular Economy Engagement Campaign, the asset manager interviewed and assessed the Circular Economy practices of seven companies in the sector.

Half of the analyzed companies confirm they do discuss Circular Economy as one of the strategic issues the company needs to handle at Board meetings at least once a year. However, including for these companies, Circular Economy is often assimilated to sustainability generally rather than being addressed as a strategic topic in itself.

Companies also do not have a global approach on Circular Economy. They tend to focus only on some pillars and forget the other pillars more complicated to implement. Thus, it is difficult for investors to understand how these commitments add up and how the company’s trajectory toward a circular business model would look like from here.

Besides, very few companies have managed to make clear commitments at this juncture, and they lack relevant KPIs to evaluate progress, which does not help to make the subject concrete.

In order to switch from a linear to a circular business- model, companies are encouraged to train Board members and top managers to the potential of Circular Economy. In a second step, top management is encouraged to review its global strategy in light of the circular model. This will include taking into account every single pillar of the Circular Economy, from sustainable procurement to a higher recycling rate.

Last but not least, companies are encouraged to develop a system of metrics that can guide their decision-making when moving toward Circular Economy and help them communicate with investors on their trajectory and progress over time. For doing so, companies can rely on the Circular Transition Indicators developed by 25 companies in one of the World Business Council for Sustainable Development (WBSCD)’s work stream.

Eco-design is key for the sector

Eco-design is a fast-developing area, where product differences clearly exist. In the companies analyzed, partnerships with suppliers around eco-design initiatives could be extended further, notably to build reverse supply chains.

The recommendation to tackle the issue is two-fold: companies need to build up a well-developed closed loop system for some products. In doing so, they can promote some of the product range as being aligned with Circular Economy as waste will be minimized through parts reuse and recycling of old materials into new parts.

Another way of demonstrating a company’s actions toward Circular Economy is to calculate and publish the cycled resource percentage of one of its product range, using a methodology such as the WBCSD Circular Transition Indicators (CTI) methodology. Initial figures from companies using the methodology suggest a global average of 8% circularity for electronics products, so any figure above that average can be seen as progressive and reflect positively on the company.

Product as a Service (PaaS) is a step in the right direction

Three companies in the panel had a well-developed PaaS or leasing offer. Benefits of the PaaS leasing model are not only from a pure business perspective but also impact stakeholders: value can be maximized by relocation of equipment to another organization that has lower specification requirements, while repair, refurbishment or recycling should be ensured. It should also allow better traceability of materials, and help the establishment of closed-loop value chains.

Based on findings, companies are recommended to explore product ranges that can lend themselves to the PaaS business model. Nonetheless, bringing this model to the B2C market is likely to be a challenge in light of low barriers (costs) for product change or upgrade and the likely preference of consumers to retain ownership of their electronic device.

Conclusion

Companies are timidly starting to integrate the Circular Economy into their business processes and innovations. This integration must intensify and gain speed in order to be extended to all products. The Circular Economy must become a compass for the company in order to radically break with the economic model that is dominant today. For this, the highest management bodies - Board of Directors and Executive Management - must be trained and give a clear line.

Companies in the sector must also develop further eco-design and improve the collection and recycling rate in order to ensure a supply of raw materials while limiting the need to extract virgin materials. Companies must also develop product leasing, thus limiting the number of new products brought to market and thus the environmental footprint, while maintaining revenues through new services.

A change in business model is required for companies based on the principle of “always more, always faster”. However companies that will integrate Circular Economy into their strategy will be the winners of tomorrow's economy.

Important information