REITs of Passage - How to get passive income from investing

REITs of Passage - How to get passive income from investing

Investments merits of REITs

Where investing for income is concerned, attention invariably turns to investments that are able to deliver a consistent stream of dividend payments. Among the more reliable sources of investment income is real estate investment trusts, or REITs.

From the outset, REITs offer a number of advantages.

- First, this asset class offers a liquid vehicle through which to invest in income-generating real estate without having to own the actual illiquid properties.

- Second, it allows investors to diversify income streams across different asset classes and regions.

- Third, REITs are particularly well-suited for income seekers due to the recurring and regular distribution of income either quarterly or semi-annually. There is some certainty in the regularity of pay-outs as well, as REITs are required by law to redistribute at least 90% of their taxable income each year i.e., pay it out via dividends.

- Fourth, these physical assets are professionally managed, with assets held under a trustee.

- Lastly, with REITs, investors can earn from both the regular distribution of income and potential capital appreciation in the stock price. In a sense, REITs are akin to a bond trading like a stock.

Read on to find out which REITs are worth investing in amid the COVID-19 crisis.

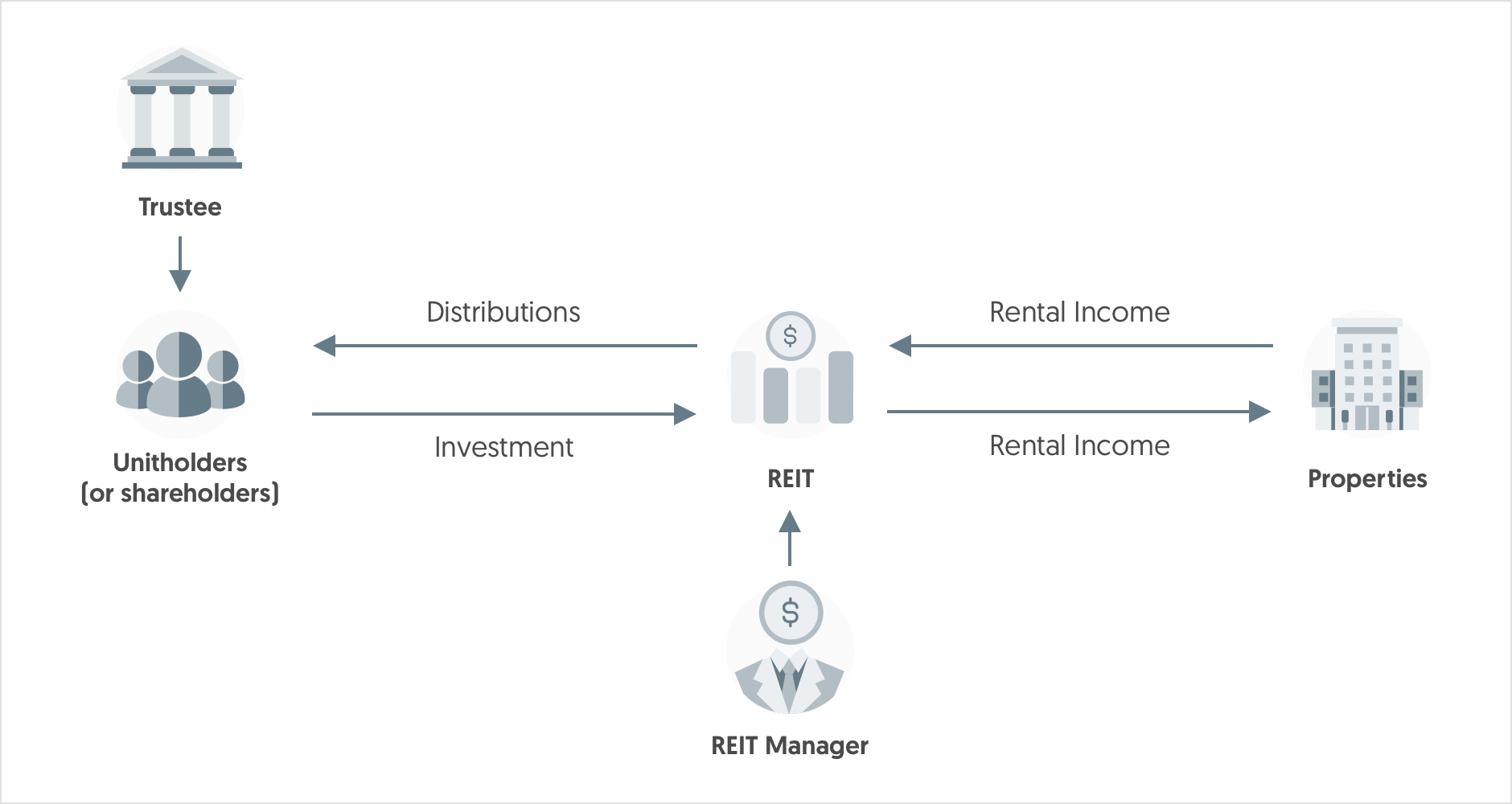

Chart 1: Structure of a REIT

Source: Bank of Singapore

Sometimes investing in property is best done indirectly

Since REITs essentially buy properties and earn rental income from the tenants of these properties, a question beckons: Why not just buy property directly and earn the rental income?

- From the outset, physical property is neither liquid nor cheap. You are not able to sell it as easily as you could other financial assets and it requires a huge financial outlay. Properties like shopping malls are just prohibitively costly to access for the average investor.

- Secondly, property investing comes with concentration risk as invariably the bulk of your portfolio will be tied to a single illiquid asset and the outlook of the local property market, which is more often than not, largely determined by government regulation which itself is unpredictable. This is before factoring the cost of maintaining the property, and other costs related to finding tenants.

- Thirdly, by putting down huge sums to secure a property investment, you are essentially foregoing other potential investments that are more liquid and may be higher yielding in nature.

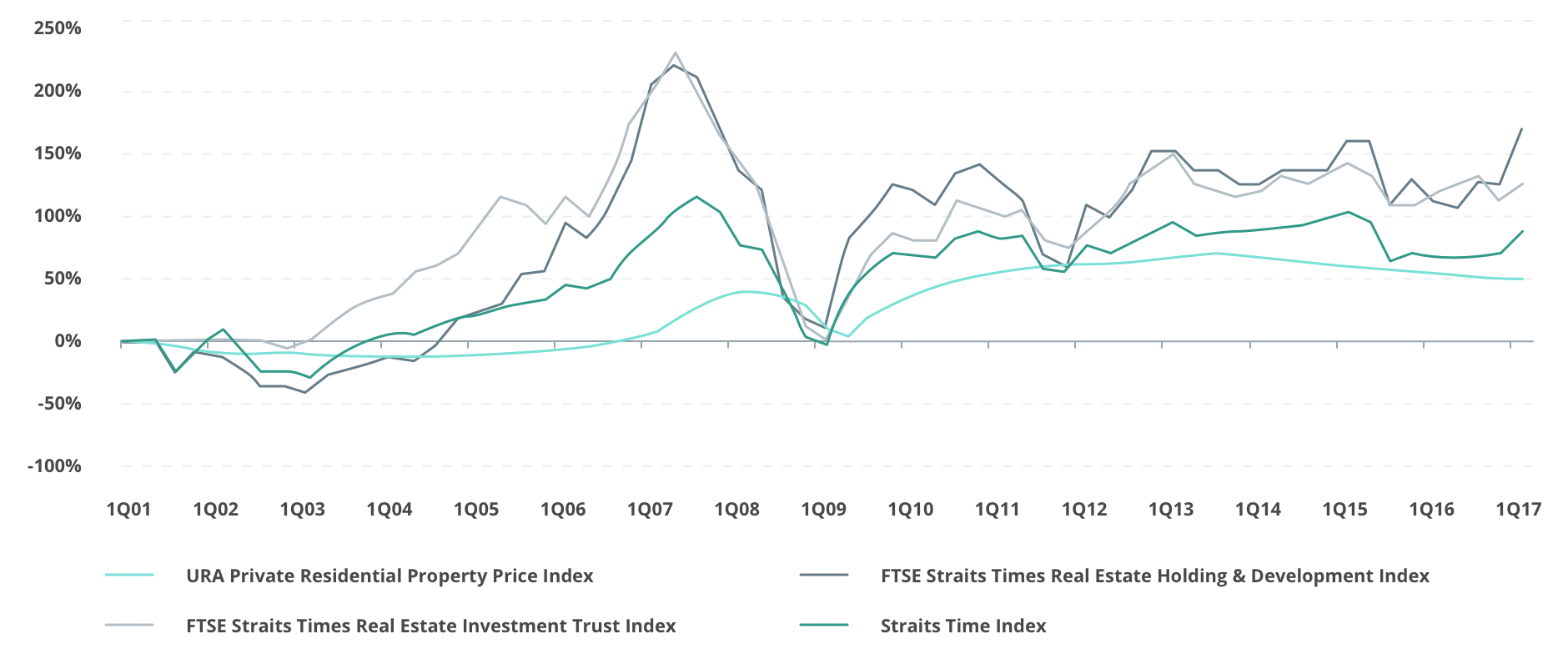

As can be gleaned from Chart 2, investing in financial assets in Singapore would have yielded better returns, albeit with more volatility, versus investing in physical property over a span of 20 years.

Chart 2: Singapore private property price appreciation versus equity indices over past 20 years

Equities generated highest capital appreciation in the long term, albeit with higher volatility.

Source: Bloomberg, data as at 22 April 2021

REITs are generally prized for their defensiveness in bad times

REITs are not just valued for the access it gives investors to illiquid properties or for the regular income it pays out. Generally, they play a useful role as defensive assets in portfolios and are typically favoured by investors when market conditions worsen and risk sentiment falter.

REITs also receive a boost when interest rate expectations are low and demand for less risky, income yielding assets is high.

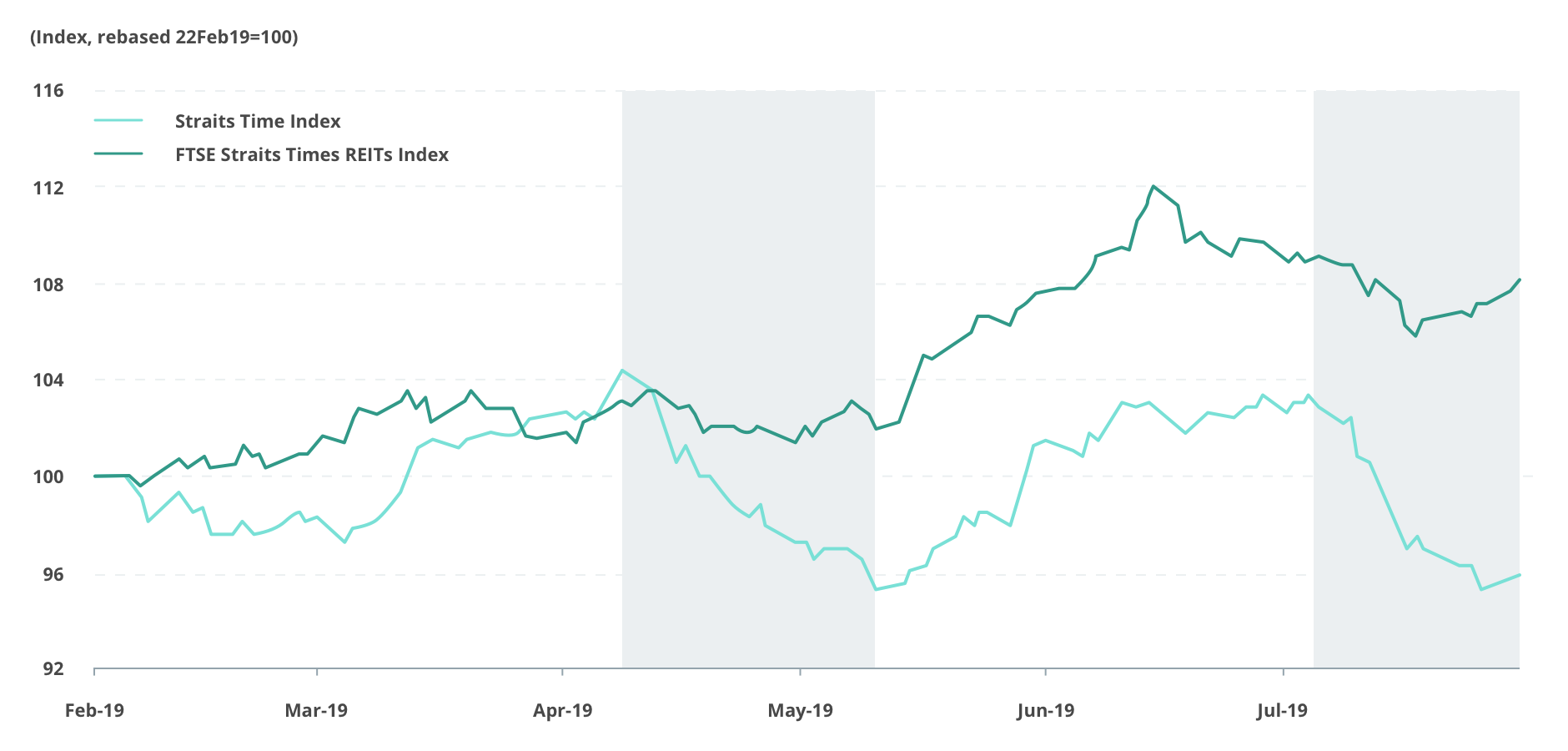

Singapore REITs (SREITs), for example, has outperformed the broader market during episodes of heightened risk aversion. We saw this play out in 2019 during the height of the US-China trade war and the recession in the US manufacturing sector.

Chart 3: FTSE Straits Times REITs Index versus the broader market

During periods of heightened risk aversion in 2019, REITs outperformed the broader market.

Source: Bloomberg, data as at 22 April 2021

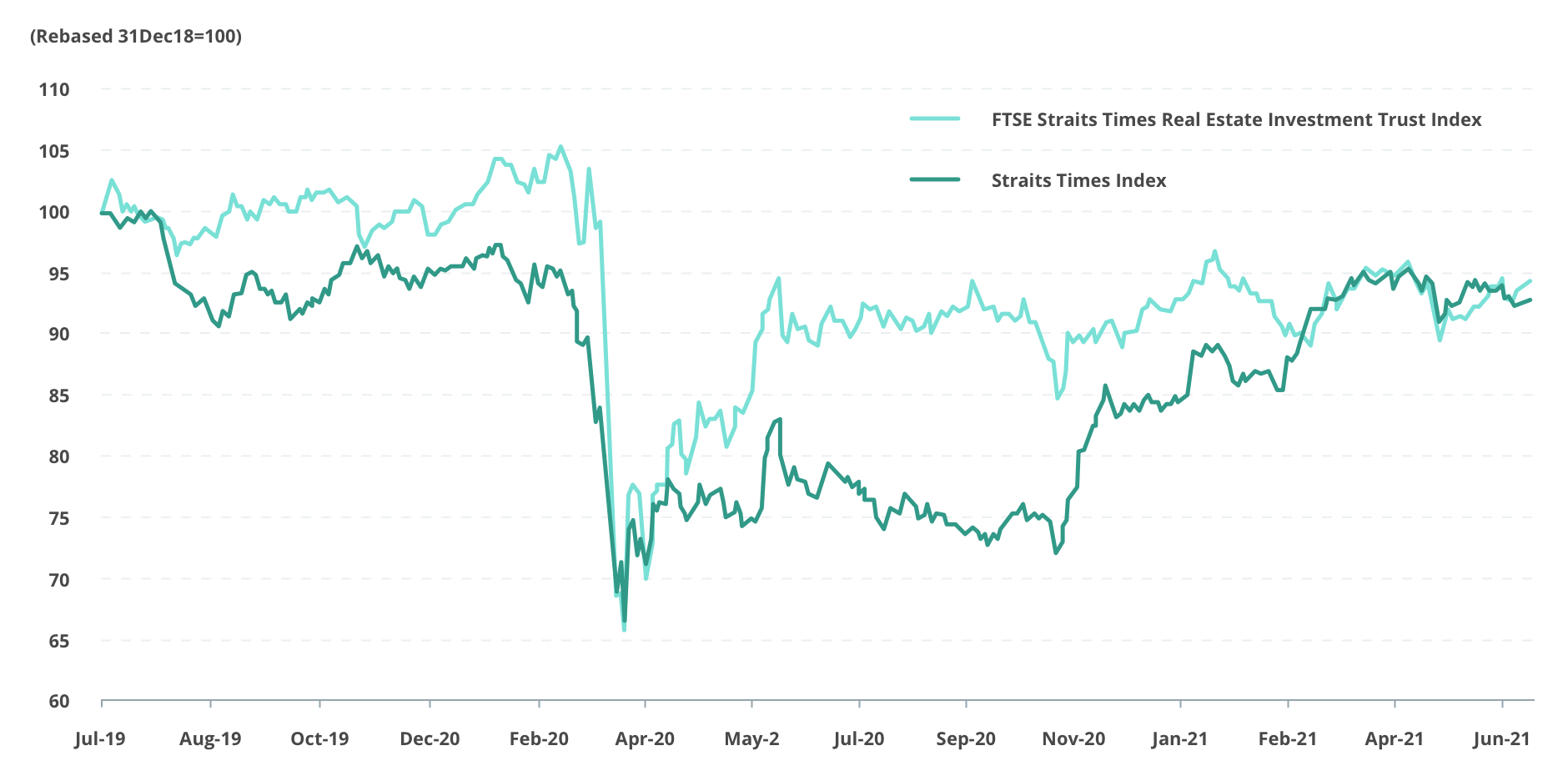

Covid-19: A unique crisis

Yet, if one looked back just a year ago, this was far from the case despite the flight to safety as risk aversion peaked. Admittedly, 2020 was unique in the sense that the pandemic-triggered recession was the result of widespread economic shutdowns that shuttered businesses, confined individuals to their homes, and turned bustling cities, once teeming with life, into vacant lots. This strongly impacted tenant sales and hurt rental income of most properties. Office space and retail malls were deserted for a period a time, affecting a key source of revenue of REITs.

To ease the uncertainty during the challenging Circuit Breaker period, the Singapore government launched a bevy of support measures to help both renters and property owners. This included rental reliefs, cash grants for small businesses and interagency support for REITs. Distributions were cut as operating income shrunk.

A year later, the outlook for SREITs had improved as normalcy slowly returned to the island city state and vaccinations became widespread.

As a consequence, the share price of REITs had recovered significantly from the lows of 2020 to near pre-pandemic levels.

Chart 4: FTSE Straits Times REITs Index versus Straits Times Index

Not back to pre-pandemic highs yet, but close

Source: Bloomberg, data as at 28 June 2021

An asset for all seasons

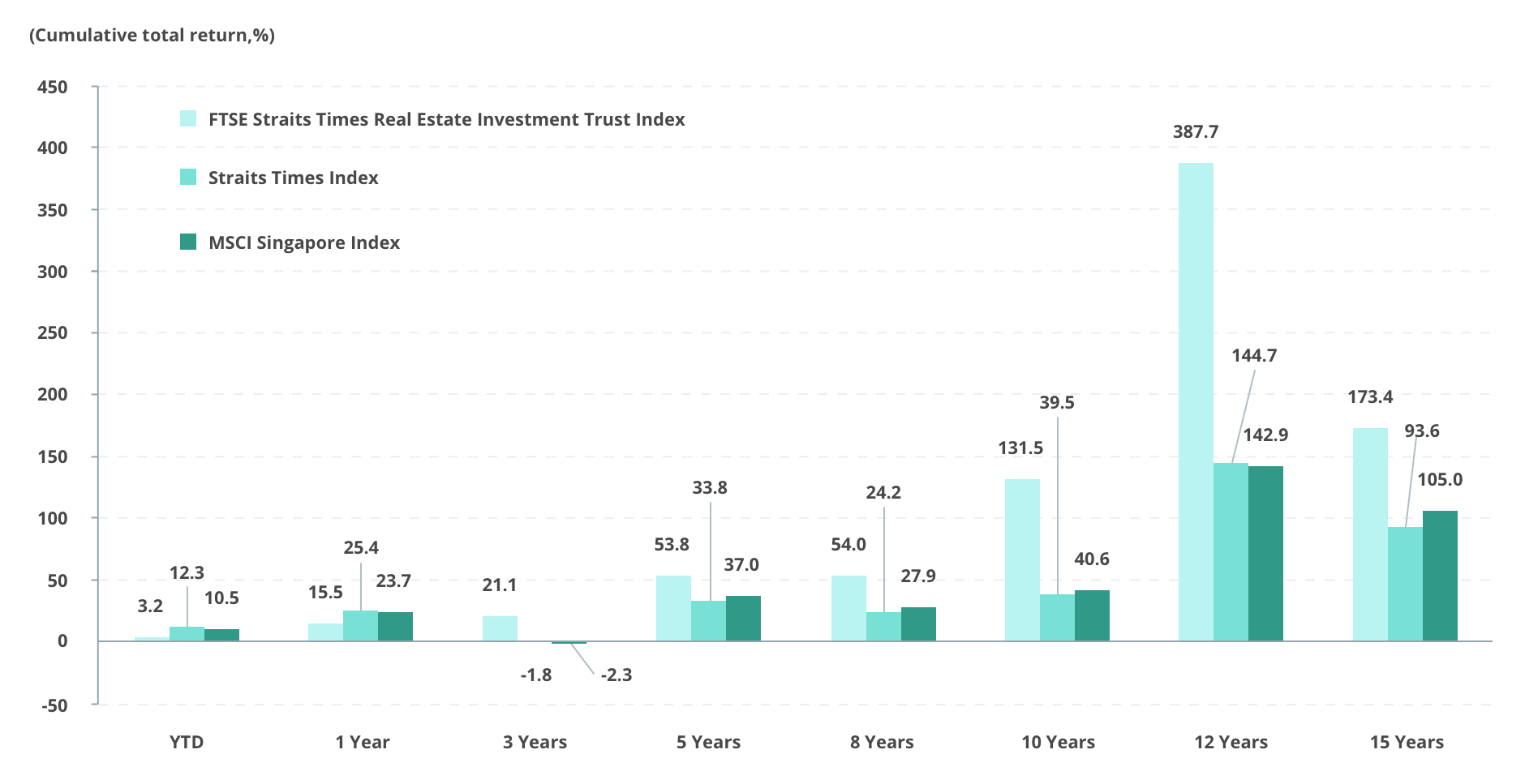

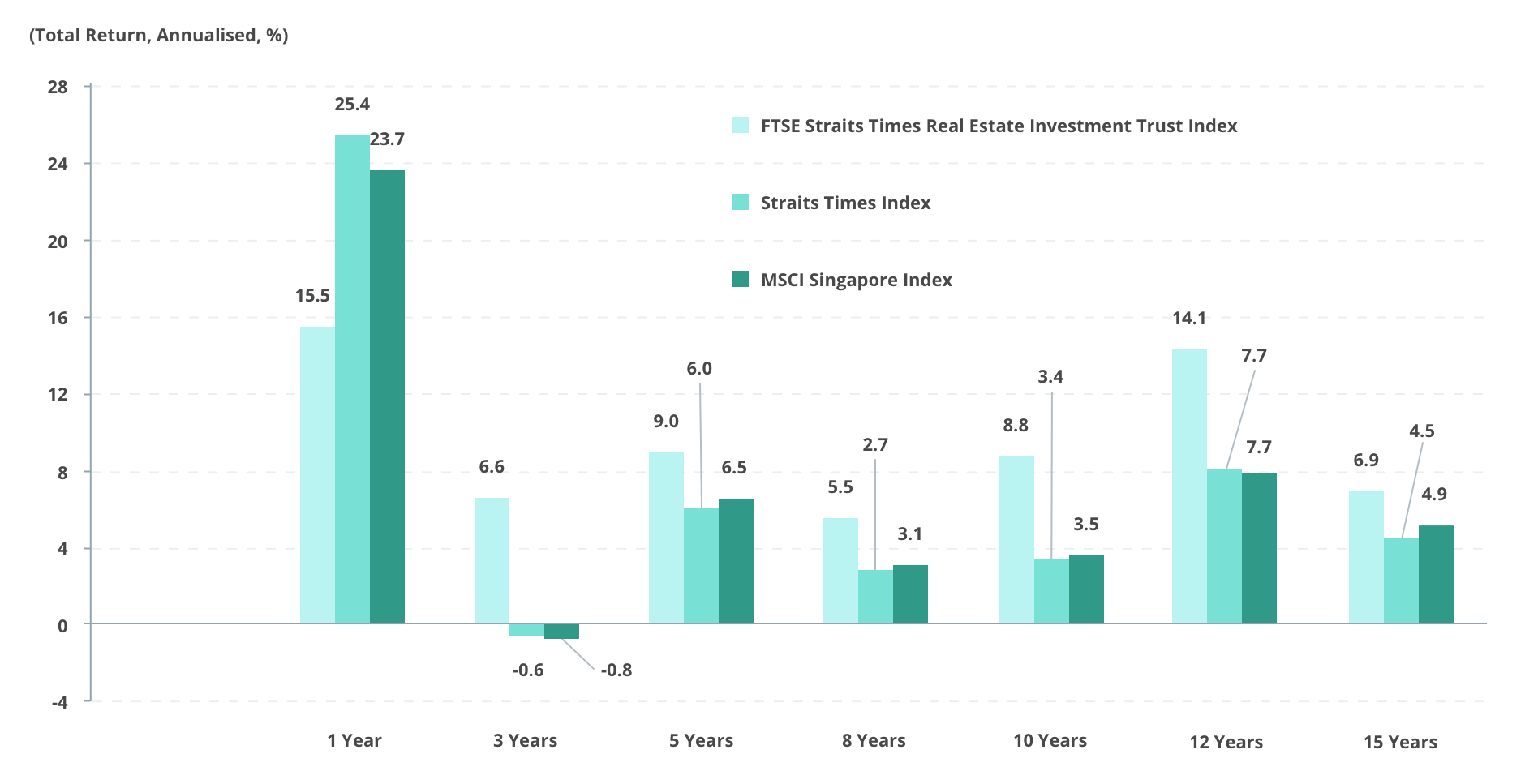

To characterise REITs as a purely defensive play -- 2020’s correction notwithstanding -- would be to miss a broader point. From a historical total return perspective, SREITs boast a rather solid performance track record, in both good times and bad. Only until recently, SREITs have consistently bested the broader market on a cumulative and annualised total return basis.

Chart 5: Cumulative and annualised total return

Overall, good performance track record in both good times and bad

Source: Bloomberg, total return calculated as at 31 March 2021

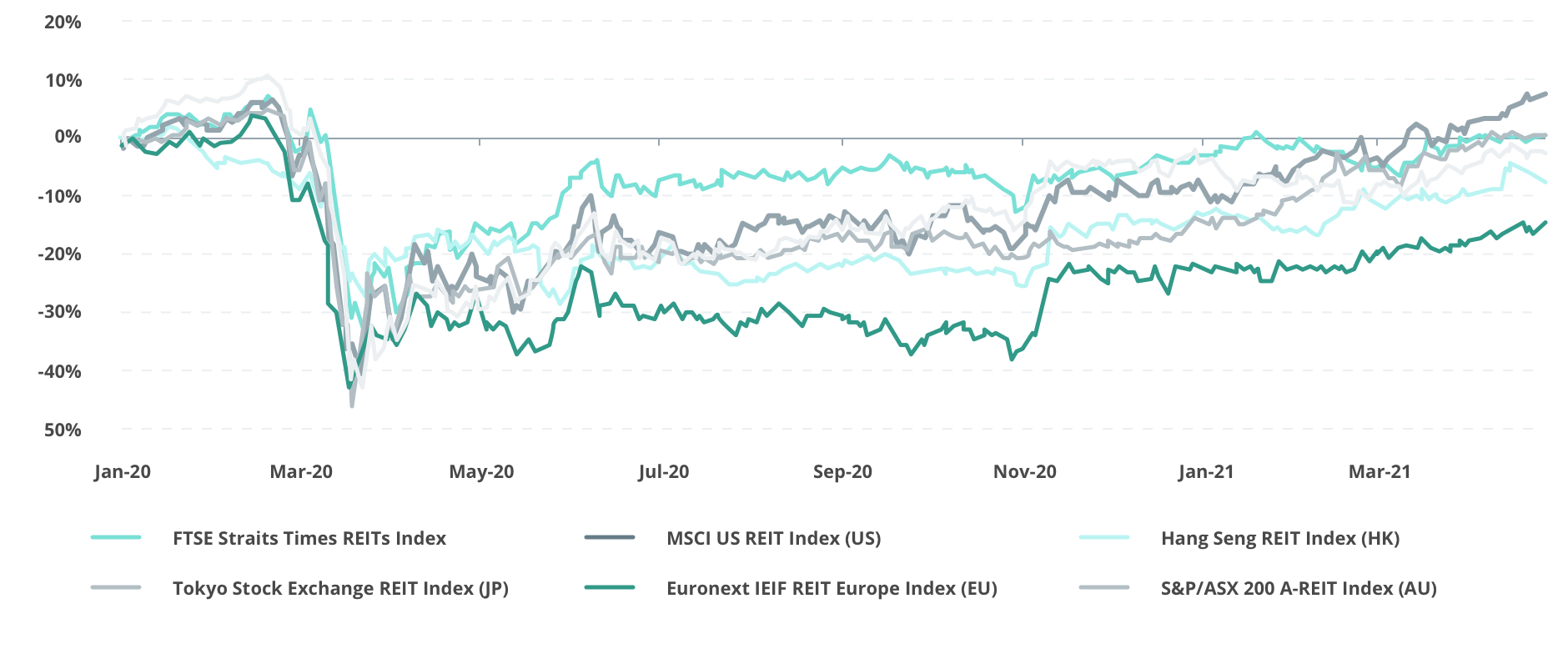

On a regional level, SREITs had also outperformed other major REIT markets around the world (in local currency terms) including the US, Australia, Japan and Europe, at the height of the Covid-19 crisis last year, as a testament to its resilience. We expect the same resilience to help the sector recover from any Phase 2 (Heightened Alert) setback.

Chart 6: Year-to-date (YTD) total returns of major REIT markets (as at 28 June 2021)

Source: Bloomberg, data as at 28 June 2021

Near-term drivers

In the near-term, two catalysts remain in place that should keep demand for REITs well-supported.

First, REITs may still get a boost from countries steadily reopening their economies for business. With the rollout of vaccination programmes globally, we expect a gradual return to normalcy from 2H2021 onwards. This will likely benefit REITs as footfall and tenant sales in shopping malls gradually recover while physical occupancies in offices increase with the gradual relaxation of social restrictions.

Following the new Covid-19 measures in Singapore, there could be downside risks to our forecasts, depending on how the situation develops.

Logistics and data centres will continue to benefit from the tailwinds of higher e-commerce penetration rates and widespread adoption of technology -- secular growth trends that have only accelerated with the pandemic. Underlying operational improvement of SREITs should help to drive a re-rating over the medium to longer term.

Second, even while US Treasury yields have risen and could continue to rise more, nominal yields remain at historically low levels and real yields are still negative. This, alongside the generally dovish interest rate environment, should continue to drive the hunt for yield, in which case REITs are poised to benefit.

For one, SREITs offer higher dividend yields relative to the broader market and even against peers in the US and Europe. Nevertheless, as 2020 showed, dividends are not sacrosanct. Hence a bottom-up stock picking strategy to evaluate the longer-term sustainability of dividend payments should be a key consideration.

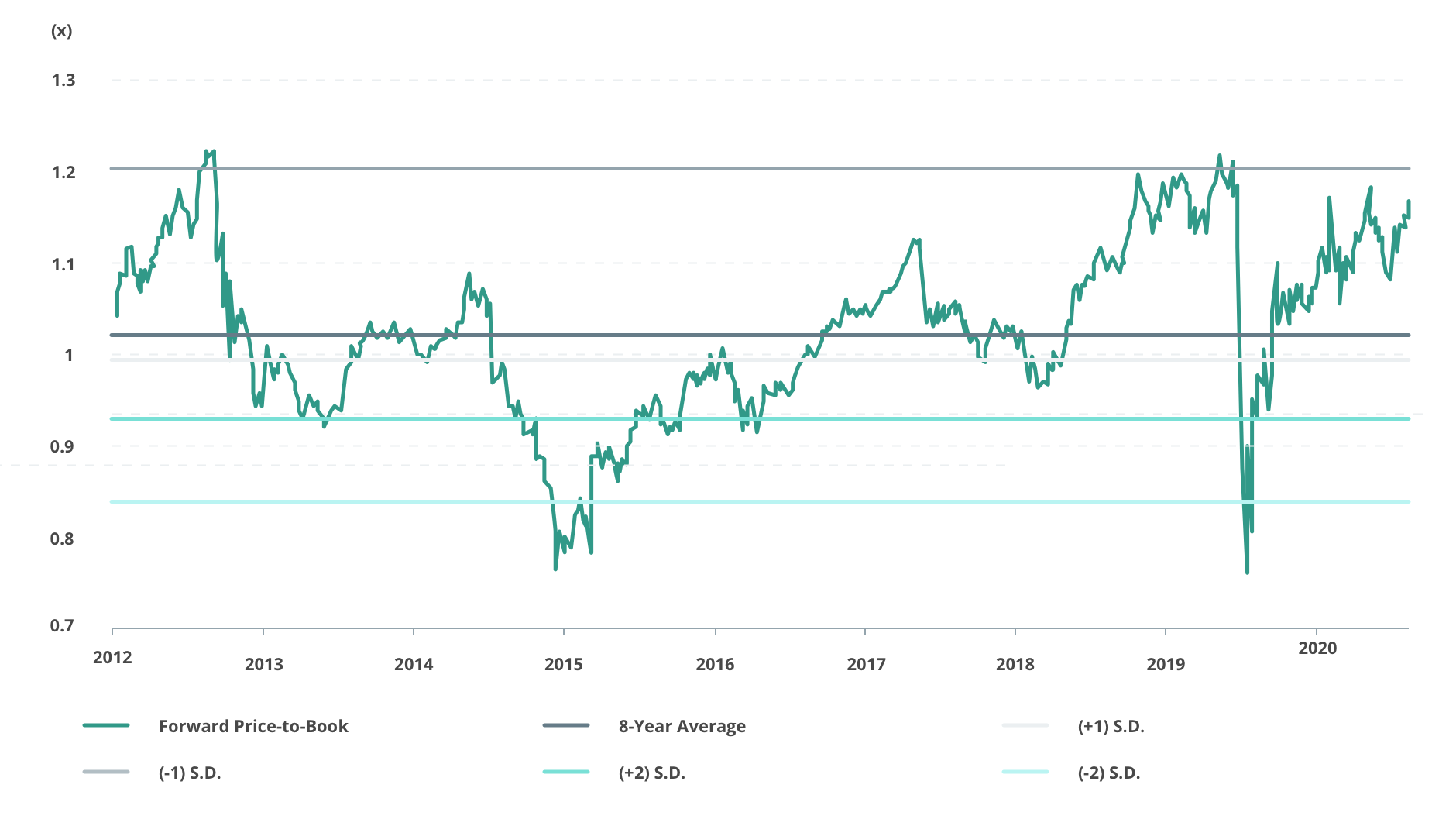

SREITs had performed reasonably well in the first quarter of this year, which translated into higher valuations. Another reason to remain slightly cautious in the near-term is due to volatility, which is likely to remain a fixture of the current trading environment.

Chart 7: 8-year forward price-to-book trend of FTSE Straits Times REITs Index

Valuations are no longer as appealing

Source: Bloomberg, data as at 28 April 2021

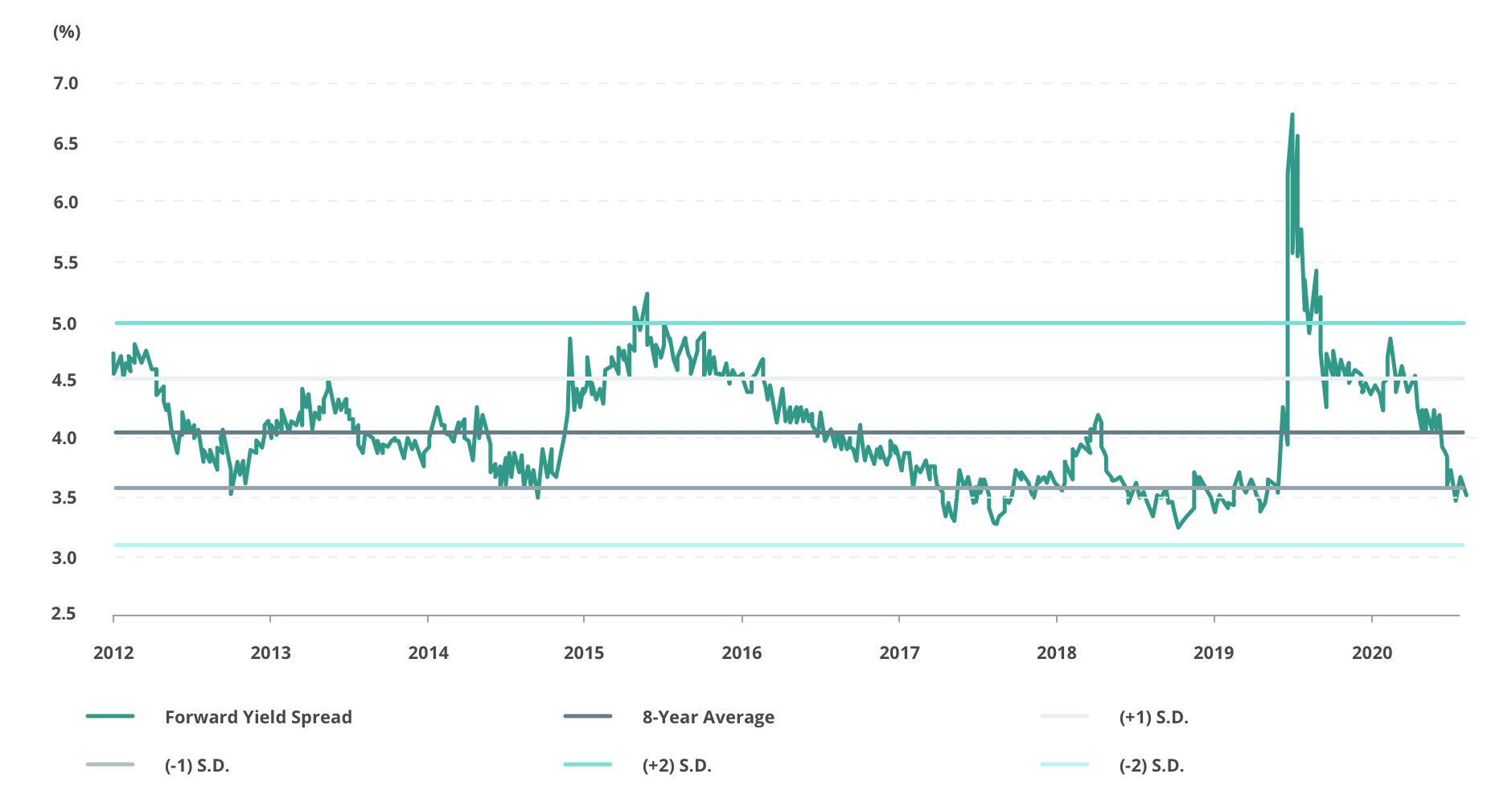

Chart 8: Yield spread between FTSE Straits Times REITs Index and Singapore government 10Y bond yield

The rise in the Singapore government 10-year bond yields have compressed spreads.

Source: Bloomberg, data as at 28 April 2021

Don’t pay too much for income. Stay selective amid higher valuations.

Given that valuation metrics are not outright cheap, selectivity matters. After all, not all SREITs are created equal. The dampening effects of the Covid-19 pandemic have created challenges for the real estate sector, some of which are structural in nature. On the other hand, opportunities have also emerged and provided tailwinds for others.

In this, investors should pay careful attention to the growth potential of the underlying properties and the sectors and segments in which they operate. This is key to gain exposure to long-term winners.

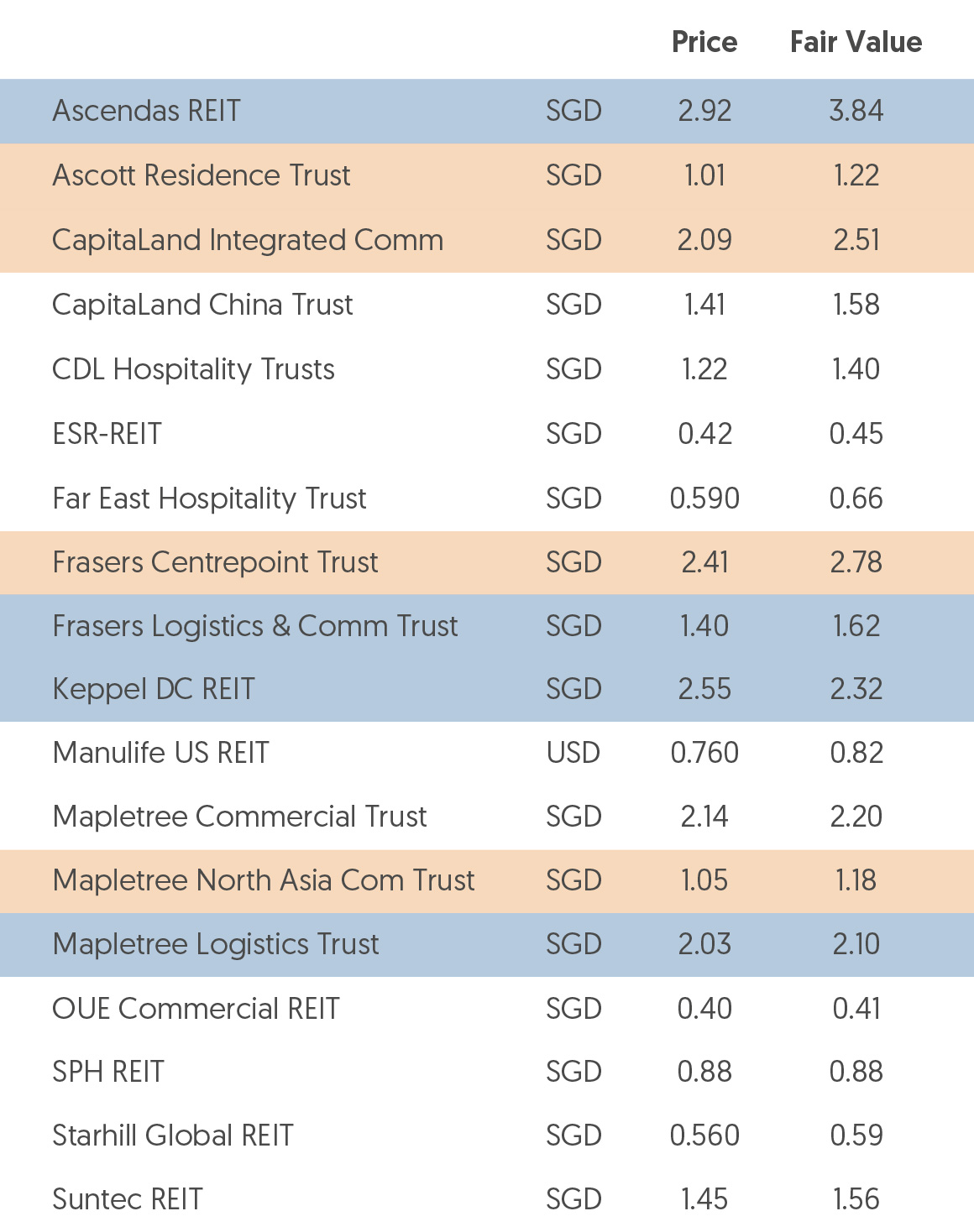

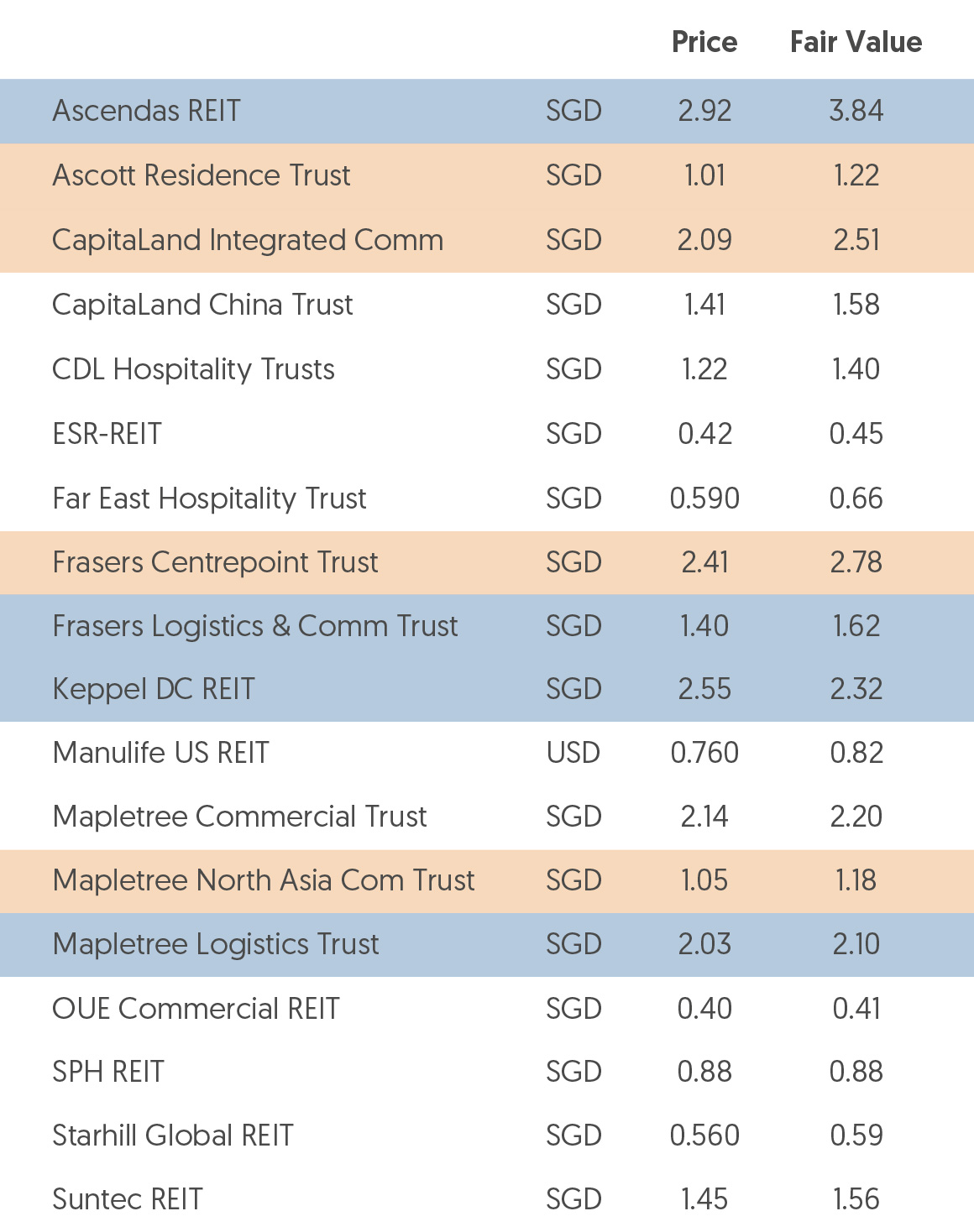

Due to the Covid-19 crisis, we think it is useful to categorise the broad SREITs space into two key camps or baskets:

- Recovery basket: This would comprise retail and hospitality REITs that are more sensitive to the economic winds and are well positioned to benefit from the rotation to value and cyclical stocks globally (highlighted in orange).

- Resilience basket: These are high-quality SREITs which are expected to be beneficiaries of secular growth trends with room for solid inorganic growth opportunities over the long-term (highlighted in blue).

Depending on where an investor’s interest and priorities lie as it pertains to their portfolios, they may look at quality picks in these two baskets.

Table 1: OCBC Investment Research (OIR) SREITs coverage

Source: Bloomberg, OCBC Investment Research estimates, extracted from the “Weekly SREITS Tracker” report dated 21 June 2021

Against this selection, we believe increased digitalisation and e-commerce penetration rates have boosted demand for data centres and modern logistics properties.

We believe this bodes well for the following SREITs as at 21 June:

|

Name |

Description |

Fair Value |

|

Keppel DC REIT |

|

S$3.32 |

|

Ascendas REIT |

|

S$3.84 |

Source: OCBC Investment Research, extracted from the latest available research notes at the time of writing, as at 21 June.

Within the logistics space, we like the following SREITs as at 21 June:

|

Name |

Description |

Fair Value |

|

Frasers Logistics & Commercial Trust |

|

S$1.62 |

|

Mapletree Logistics Trust |

|

S$2.10 |

Source: OCBC Investment Research, extracted from the latest available research notes at the time of writing, as at 21 June.

The rise in e-commerce penetration rates may have boosted demand for logistics assets, but it has also posed structural challenges for the retail sector. That said, we believe that brick and mortar retail and online retail need not be a zero-sum game, as an omnichannel strategy can enhance a customer’s shopping experience in both an offline and digital format.

The following are names which we believe are adapting to stay relevant:

|

Name |

Description |

Fair Value |

|

CapitaLand Integrated Commercial Trust |

|

S$2.51 |

|

Frasers Centrepoint Trust |

|

S$2.78 |

Source: OCBC Investment Research, extracted from the latest available research notes at the time of writing, as at 21 June.

To seize opportunities in the REITs space, open an Online Equities Account and start investing today. With access to 15 global exchanges and 24/7 wealth insights, you will never miss an investment opportunity. Now made available on OCBC Digital as well, you can easily manage both your daily banking and investment transactions – anytime, anywhere, using just one app.

Open an Online Equities Account now.

or Log in if you already have an account or are an OCBC Securities customer.

Disclaimers

You will need to have an account with OCBC Securities Private Limited (“OSPL”) in order to make investments, trades and/or transactions with OSPL via OCBC Digital. The Online Equities Account, and all investments, trades and/or transactions (collectively, “Transactions”) made thereunder via OCBC Digital are operated, and made available to you directly, by OSPL (notwithstanding that they may incorporate the OCBC Digital mark, logo trademarks and/or other OCBC trademarks). The access and use of the Online Equities Account and all Transactions made thereunder via OCBC Digital are made directly with OSPL, and are subject to its terms and conditions. Under no circumstances will OCBC be responsible or liable for the provision, access or use of the Online Equities Account, and/or any of the Transactions made thereunder via OCBC Digital. The content in this app is either written by OCBC Wealth Management or a third party commissioned by Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”), and the information herein is intended for general circulation and/or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person. Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of OCBC Bank. Some of the contents in this app are summaries of the investment ideas and recommendations set out in research reports disseminated by OCBC Bank and its respective associated and connected corporations ("OCBC Group"). For any interest that OCBC Group might have in the securities and/or issuers of the securities, you may request for a copy of the relevant report from your relationship manager. No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. The information in and contents in this app may not be reproduced or disseminated in whole or in part without OCBC Bank’s written consent. Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same. And it does not constitute a recommendation to you. If you do wish to make an investment, you should first seek advice from your OCBC Relationship Manager or Personal Financial Consultant regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs. If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product. You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your OCBC relationship manager. We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through any content in this app. Nothing in this app shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy. Where the contents have not been identified as summaries of the investment ideas and recommendations set out in research reports disseminated by the OCBC Group, the information is not intended to constitute research analysis or recommendation and should not be treated as such. Investments are subject to investment risks Do note that investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance. Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way. Conflicts of interest OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products. Foreign Currency Foreign currency investments or deposits are subject to inherent exchange rate fluctuation that may provide opportunities and risks. Consequently, exchange rate fluctuations may affect the value of your foreign currency investments or deposits. Earning on foreign currency investments or deposits may change depending on the exchange rates prevalent at the time of their maturity if you choose to convert. Exchange controls may apply to certain foreign currencies from time to time. Any pre-termination costs will be taken and deducted from your deposit directly and without notice. Collective Investment Schemes A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund. The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund. Investment involves risks. Past performance figures do not reflect future performance. Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way. For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units. By buying Dual Currency Returns, you are giving us the right to repay you at a future date in a different currency from the currency in which you made your original investment, even if you would prefer not to be paid in this currency at that time. Dual Currency Returns are affected by foreign exchange rates, which may affect how much you get back from your investment. You may receive less than you originally invested. Foreign exchange control restrictions may apply to the foreign currencies linked to your Dual Currency Returns. As a result, we may repay your investment and interest in a different currency. You may receive less than you originally invested when the amount of this different currency is converted back to the base currency (the currency you originally invested). You may be able to get information on foreign exchange control restrictions, if any, for each foreign currency offered in relation to Dual Currency Returns, from the relevant monetary, regulatory or other governmental authorities for that currency. We will not end Dual Currency Returns before the maturity date (the date they are due to end). You may, however, withdraw the amount you originally invested before the maturity date. If you do this, please remember that you will have to pay any charges that apply which are calculated based on the amount of the time remaining before maturity date, as well as current market conditions relating to strike prices, foreign exchange rates and changes in the underlying foreign exchange pair. These charges may mean that you get back much less than you originally invested. Please feel free to approach your relationship manager for details of the procedures and charges that apply if you withdraw your Dual Currency Returns investment before the maturity date. Dual Currency Returns are not insured deposits for the purposes of the Deposit Insurance and Policy Owners’ Protection Schemes Act of Singapore. Valuations All valuations are as of the valuation date indicated and represent an estimated valuation derived from market quotations or from proprietary models that take into consideration estimates about relevant present and future market conditions as well as the size and liquidity of the position and any related actual or potential hedging transactions. Although the information is derived from sources believed to be reliable, we assume no responsibility to independently verify the same. Valuations based upon other models or assumptions or calculated as of another date and time may yield significantly different results. All valuations are provided for your general information only. We expressly disclaim any responsibility for (i) the accuracy of the models, market data input into such models or estimates used in deriving the valuations, (ii) any errors or omissions in computing or disseminating the valuations and (iii) any uses to which the valuations are put. These valuations do not represent (i) the actual prices at which new transactions could be entered into, (ii) the actual prices at which the existing transaction could be liquidated or unwound or (iii) an estimate of an amount that would be payable following the early termination date of any transaction. Graphs, charts, formulae and other devices Investors should note that there are necessarily limitations and difficulties in using any graph, chart, formula or other device to determine whether or not, or if so, when to, make an investment. This advertisement has not been reviewed by the Monetary Authority of Singapore. Cross-Border Disclaimer

Dual Currency Returns