China: Opportunities not clouded by regulatory headwinds

China: Opportunities not clouded by regulatory headwinds

China's latest regulatory crackdown on multiple sectors – including big tech, private education, property and food delivery – may have rattled global investors, but they should not let it cloud the overall investment landscape in what is still the world’s second largest economy.

The regulatory overhang could well continue into 2H2021, amid simmering tensions with the US.

Hence, amid a widespread reassessment of risks in markets, the regulators have given assurances that the regulatory developments are not an attack on profitable enterprises but attempts to rein in private businesses that regulators blame for exacerbating inequality, increasing financial risk and — in the case of some tech titans — challenging Beijing’s authority.

Shift toward domestic consumption

China’s spectacular V-shaped recovery from the pandemic hit a soft patch in May this year.

During the celebration of the 100th anniversary of the Chinese Communist Party in June, President Xi Jinping took a page from his arch nemesis – Donald Trump – to showboat with the following words: “The Chinese nation is marching towards a great rejuvenation at an unstoppable pace.”

The posturing may have been necessary, as the China now is not the same China that we saw in the beginning of the year, the one that had the world lifting its collective eyebrows in admiration as it emerged as the only economy in the world to have avoided a pandemic induced contraction, with its GDP expanding by 2.3% last year.

Even though the increase in exports, industrial production, fixed asset investment and retail sales were still robust in May compared to a year ago, each data release rose less than expected.

The official PMI survey showed sentiment in China’s manufacturing sector dipped from 51.0 in May, to 50.9 in June. A reading above 50.0 indicates that firms see activity expanding, while a print below 50.0 implies orders are contracting.

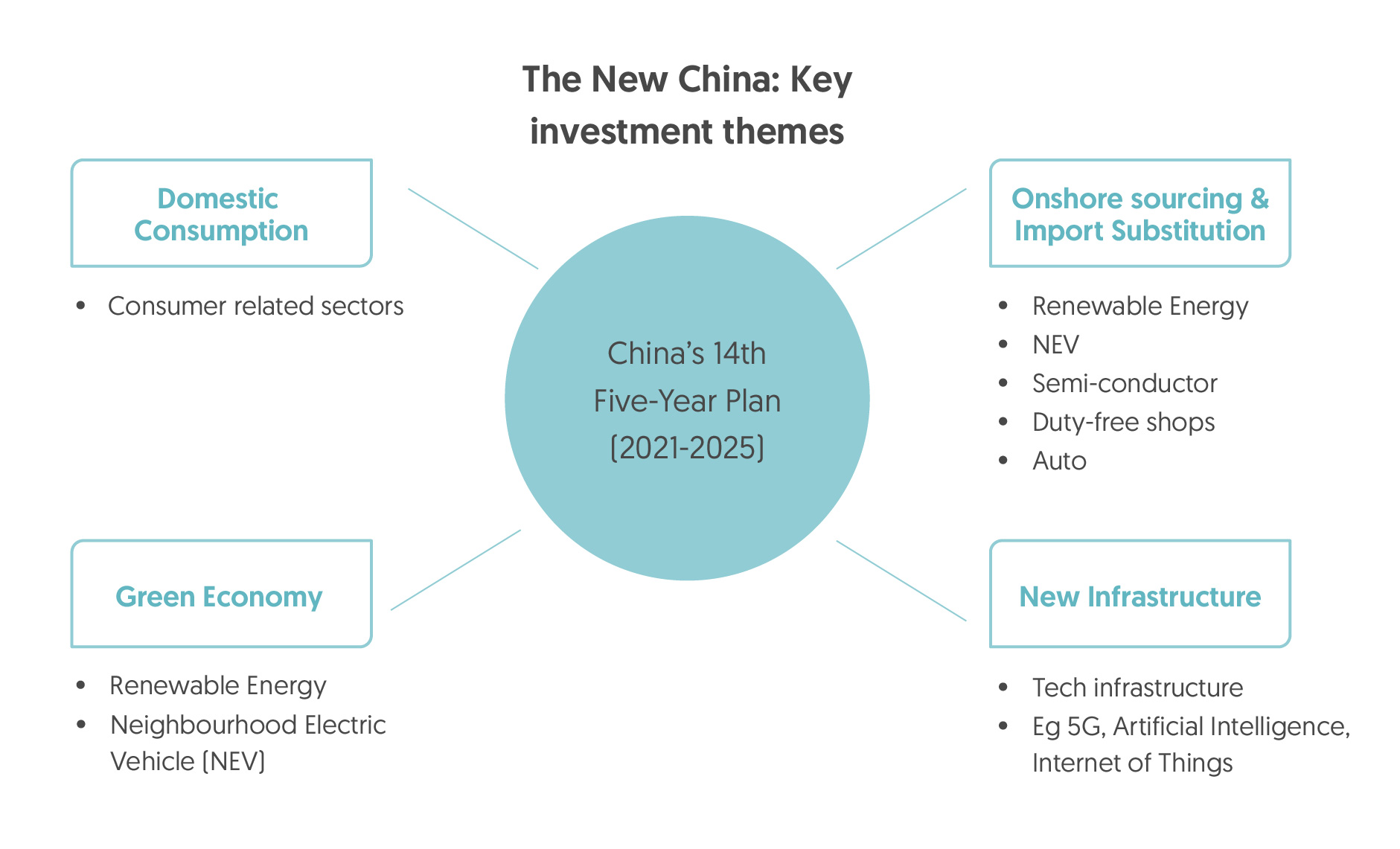

The monthly setbacks indicated that the soft patch may extend further into the summer, as consumption may take longer to return to pre-pandemic levels. The slowdown in this sector was an issue of deep concern, as domestic consumption happens to be one of the key initiatives in China’s 14th Five-Year Plan (FYP), which touts a “dual circulation” concept.

First brought up in May 2020, this new concept to economic development moves away from the export-led growth strategy that China had pursued previously, to one where domestic consumption (internal circulation) is prioritised even as China remains open to international trade and investment (external circulation).

Best of both worlds, so to speak.

But moderating growth does not mean no growth.

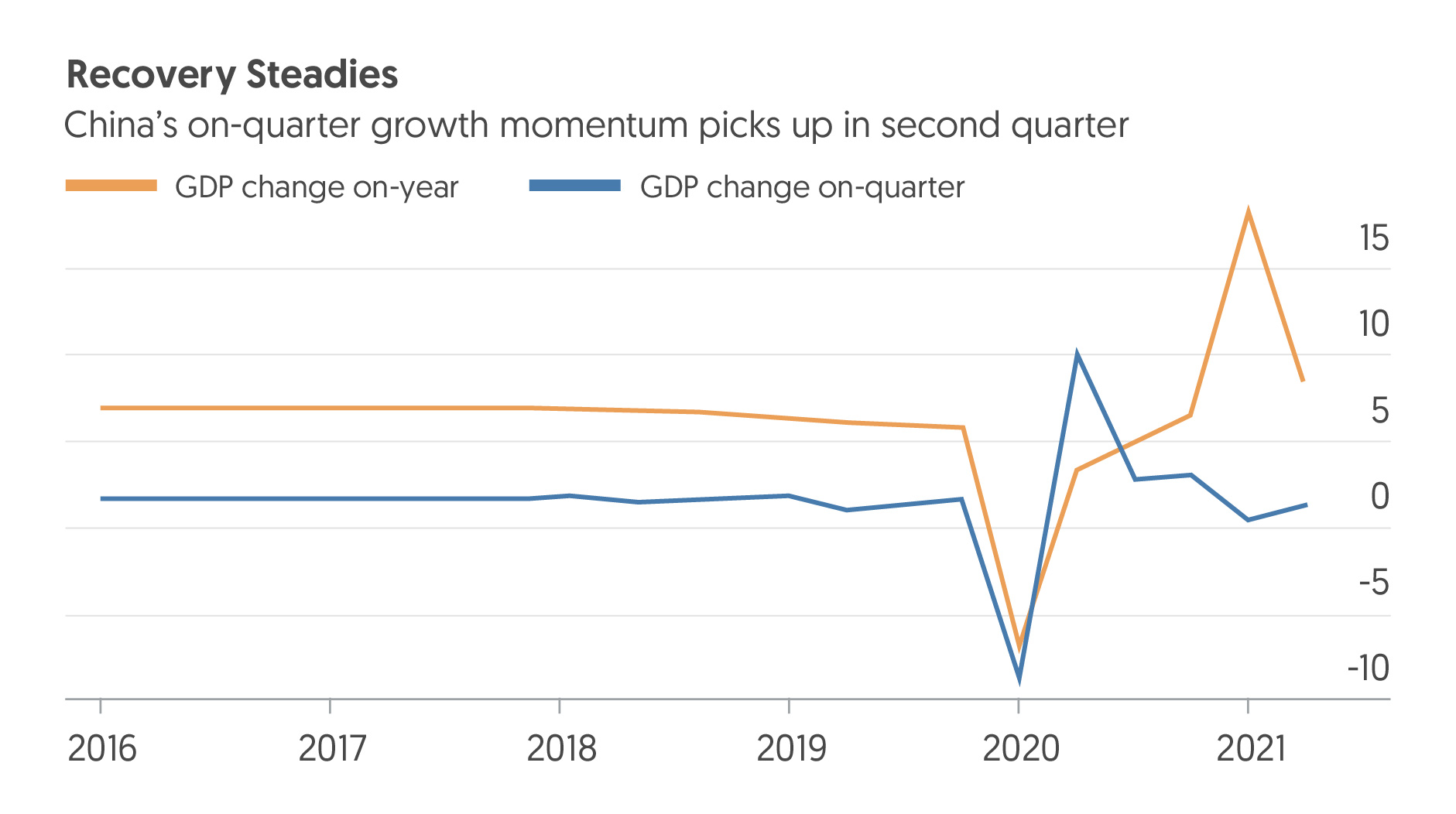

So far, data in July has allayed fears of a broader slowdown, as China’s GDP rose 7.9% from a year earlier in the second quarter of 2021, from 18.3% in the previous three months.

Source: National Bureau of Statistics/Bloomberg

On a two-year average growth basis which strips out pandemic induced base effects, the economy grew 5.5% last quarter, slightly higher than in the previous three months.

Recovery in the consumer market gained momentum in the first half of the year. Total retail sales of consumer goods in the first half of 2021 recorded US$3.27 trillion, up 23.0% year-on-year, according to data from the National Bureau of Statistics.

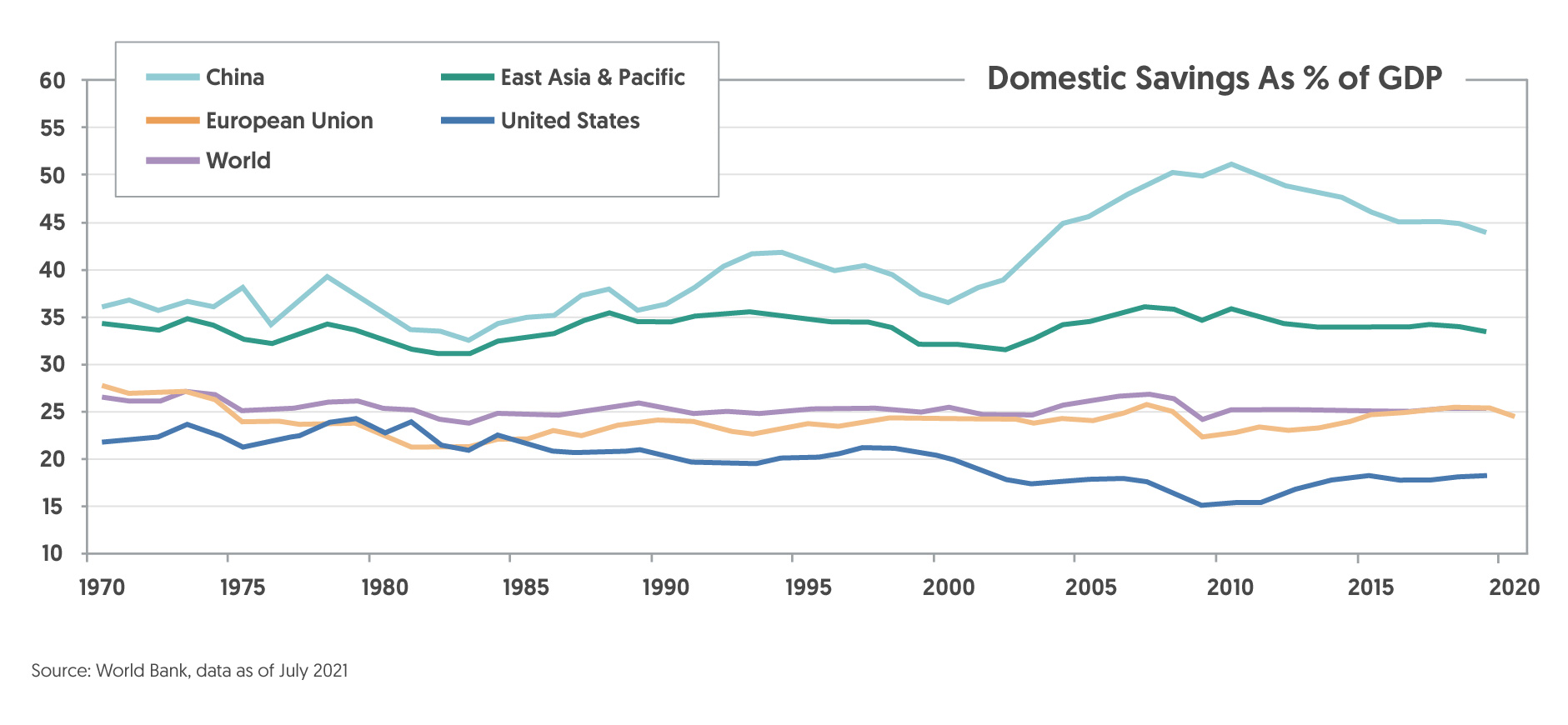

An economic update from the World Bank shows real consumption growth is projected to gradually return to its pre-Covid-19 trend, supported by the ongoing labour market recovery, improved consumer confidence, and rising household incomes (see chart below).

China’s manufacturing sector continued to recover in the first half of 2021. The share of manufacturing in China’s GDP rebounded further to 27.9% in the first half of 2021, up by 1.3% for the same period of 2020. Capacity utilisation rate increased further to 78.4% as of the end of 2Q2021, up from 77.2% in the first quarter.

The 2Q2021 GDP report and June’s activity data have helped to allay fears that China will suffer a sharp slowdown as its V-shaped rebound peaks.

As there is no evidence of a loss in growth momentum, we maintain our forecast that GDP will still rise by 8.7% for 2021.

What does this mean for investors?

Against a backdrop of economic recovery and broadening structural reform, China offers investors access to long-term growth opportunities.

In the short term, we do expect regulatory overhangs to weigh on sentiment and for volatility to dominate for now. Over the medium to long term, we maintain a constructive view on Chinese equities given its sheer growth potential and believe that it still offers good opportunities for investors.

Source: Bank of Singapore

Domestic consumption is one of the key initiatives under the FYP, and this sector will be supported by stronger social safety nets to ensure more resilient economic growth and reduced reliance on exports and foreign demand amid an uncertain political landscape.

Chinese consumer spending is set to more than double in 10 years, according to a report by Morgan Stanley published in January this year.

By 2030, China’s private consumption is set to reach US$12.7 trillion, about the same amount that American consumers currently spend, the report said. That figure is also up from Morgan Stanley’s forecast three years ago of US$9.7 trillion, and the US$5.6 trillion Chinese consumers spent in 2019.

Central to the growing global power of the Chinese consumer is a shift in spending patterns as rising living standards and household incomes see swelling numbers of Chinese shift from spending on necessities to buying ever-increasing amounts of discretionary goods and services, and increasingly, luxuries.

China will also focus on investing in ‘new infrastructure’ including 5G applications, artificial intelligence, internet networks and large data centres, and enabling infrastructure such as high-speed railways, airport clusters and renewable energy.

By investing in technology, infrastructure and renewable energy, policymakers aim to secure China’s long-term economic future while reducing exposure to potential external threats, including trade sanctions and supply chain restrictions should geopolitical tensions come into the fray again, like they did during the Trump era, and threaten to under the Biden administration.

Sectors like electric vehicle makers and clean energy producers could also benefit from President Xi Jinping’s Communist Party policies.

ETFs tracking Chinese stocks as a source of diversification

It is natural for investors reeling from the recent bouts of selloffs to express caution on China as a market.

In this case, instead of placing their hopes on a single company, investors may choose to tap opportunities in this market through a China focused exchange traded fund (ETF). Investors with a medium to longer-term investment horizon may benefit from an ETF that is well-positioned to ride on the long-term growth potential of this Asian juggernaut.

howtoinvestHow to invest

Lion-OCBC Securities China Leaders ETF

The Lion-OCBC Securities China Leaders ETF lets you tap into the exciting growth opportunity offered by China. This ETF tracks the Hang Seng Stock Connect China 80 Index’s performance, comprising the 80 largest Stock Connect-eligible chinese companies listed on Shanghai, Shenzhen and Hong Kong exchanges. To start, you can purchase the ETF via the Online Equities Account conveniently through OCBC Digital app or Internet Banking. You can also invest in the ETF from as low as S$100/month, with the OCBC Blue Chip Investment Plan.

Open an Online Equities Account now.

or Log in if you already have an account or are an OCBC Securities customer.

Disclaimers

Important Information You will need to have an account with OCBC Securities Private Limited (“OSPL”) in order to make investments, trades and/or transactions with OSPL via OCBC Digital. The Online Equities Account, and all investments, trades and/or transactions (collectively, “Transactions”) made thereunder via OCBC Digital are operated, and made available to you directly, by OSPL (notwithstanding that they may incorporate the OCBC Digital mark, logo trademarks and/or other OCBC trademarks). The access and use of the Online Equities Account and all Transactions made thereunder via OCBC Digital are made directly with OSPL, and are subject to its terms and conditions. Under no circumstances will OCBC be responsible or liable for the provision, access or use of the Online Equities Account, and/or any of the Transactions made thereunder via OCBC Digital. The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase any investment product. The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy. Any opinions or views of third parties expressed in this material are those of the third parties identified, and not those of OCBC Group. No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. OCBC Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products. The information provided herein may contain projections or other forward-looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. Investors should note that there are necessarily limitations and difficulties in using any graph, chart, formula or other device to determine whether or not, or if so, when to, make an investment. The contents hereof are considered proprietary information and may not be reproduced or disseminated in whole or in part without OCBC Bank’s written consent. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Disclaimer for Collective Investment Schemes For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units. Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance. No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.