Is my retirement at risk?

Is my retirement at risk?

No matter how well thought-out your retirement plan might be, it will have to undergo some changes in the five to ten years before you actually retire.

Earlier on in your career, your portfolio was designed to grow your wealth, even if it meant taking on greater risk.

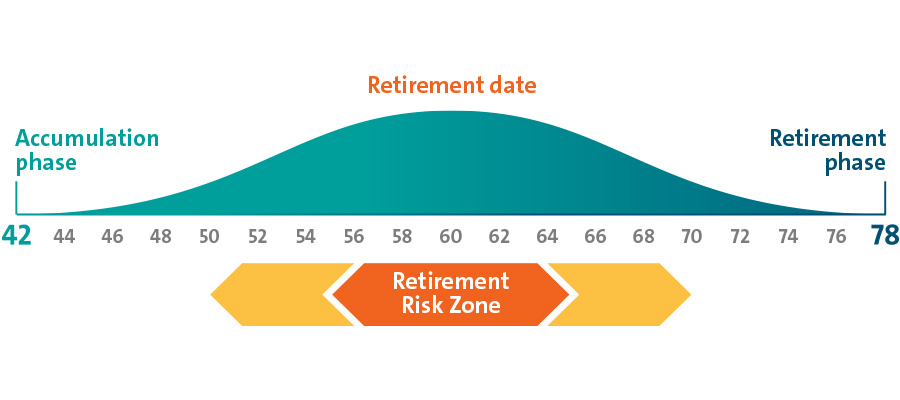

But as retirement draws closer, you enter what is known as the "Retirement Risk Zone". If you don't make appropriate changes to your portfolio, you risk jeopardising your desired retirement lifestyle.

What is the Retirement Risk Zone?

The Retirement Risk Zone is a critical period when your investment portfolio becomes particularly vulnerable.

This is typically a period spanning five years before you plan to retire and the first five years after retirement.

At this stage, any market downturns can have a direct effect on your retirement mass, since you do not have another decade or two to ride out the ups and downs.

For instance, high-risk investment vehicles like individual stocks are extremely vulnerable to market fluctuations, but nonetheless can be good long-term investments if they appreciate in value in the long-term.

Younger investors who do not need to derive an income from their investments in the near future can afford to wait for market downturns to run their course.

However, when retirement is on the horizon, you do not want to run the risk of your investments suffering from market downturns, as they can have a lasting impact on your retirement income. Reducing the risk in your portfolio is crucial at this stage.

Fear not, however. You can safeguard yourself from the heightened risk during this period. The solution is simply to shift your focus from riskier, higher-yield investments to lower-risk, income-yielding ones.

Here are three easy steps you can take to adjust your portfolio to protect your wealth and mitigate the dangers of being in the Retirement Risk Zone.

1. Decide how to allocate your wealth and investments now that you are about to enter retirement.

Ideally, you want to reduce the percentage of your wealth held in risky products such as individual stocks or single country equity funds.

At the same time, you want to increase your allocation of stable, income yielding assets such as endowment plans and diversified multi-asset funds.

These assets are less vulnerable to market fluctuations, so your retirement will not suffer great blows even if there is a market downturn just before you wish to retire.

2. Examine your portfolio and reallocate your assets according to your new plan.

Now that you have come up with a well-thought out strategy, you will need to examine your portfolio and make changes so that your asset allocation follows the plan.

You are likely to find that the proportion of your wealth in riskier investment vehicles is too high for your liking. You will thus want to shift a portion of this to lower-risk vehicles.

Some examples of low-risk investments include structured deposits, multi-asset income funds or fixed maturity bond-funds. If you find that your portfolio contains too much risk, you should focus on lowering your risk by allocating a larger proportion of your investments to such vehicles.

3. Rebalance your portfolio regularly.

Rebalancing of your portfolio should be carried out at regular intervals. That is because over time, a larger and larger proportion of your portfolio is likely to creep towards higher-risk assets.

When you rebalance your portfolio, you are restoring your asset allocation to the original proportions according to your retirement plan. In doing so, you are once again lowering your risk to comfortable levels.

So long as you are careful to ensure that you are never taking on more risk than you should, you are protecting yourself from the dangers of the Retirement Risk Zone while ensuring you have a healthy cash flow to enjoy in retirement.

With the OCBC Bank’s approach to your Silver Years, we help you make the right decisions so that you stay protected and your funds are safeguarded while you’re in the Retirement Risk Zone. We help you mitigate the risks while achieving your retirement goals, so you can enter your Silver Years with a smile.

Did you find what you were looking for?

That's great! Is there anything else you would like to share?

Did you find what you were looking for?

This is embarrassing! How can we improve your experience?

An error occurred. Please check that you have input the correct information before re-submitting.

We are unable to capture your message at the moment. Please try again shortly.

Thank you for your feedback.

This will help us serve you better.