A beginner's guide to bonds

A beginner's guide to bonds

Here's a fun fact: The bond market is by far the largest securities market in the world – much larger than the stock market in terms of the total value of securities traded. Heard of the sub-prime mortgage crisis? Yes, bonds were the investment instrument behind the housing bubble collapse that eventually led to the 2008 Global Financial Crisis.

What is a bond

A bond is a fixed-income instrument that works as a loan from an investor to a borrower. Put simply, when you buy a bond, you (the investor) are lending money to the bond issuer (the borrower) with the promise that they will pay you back the full amount with interest at a predetermined rate and schedule. Bonds can be issued by companies (corporate bonds), government entities (treasury bonds) or municipals (municipal bonds) to raise money to do all sorts of things.

Bond maturity date

The date on which the bond issuer agrees to return the principal amount (also known as the "face value" or "par value") back to the investor is known as the bond's maturity. Bonds are often referred to as being short-, medium-, or long-term, which generally represents a maturity of 5, 10 and 30 years respectively.

Bond coupon

The interest paid by the bond issuer to the investor in exchange for the debt is known as a coupon. Although coupons are typically paid on a semi-annual basis, they can also be paid quarterly or annually. The coupon is tied to and quoted as a percentage of the bond's face value.

More bond-related terms

Besides maturity and coupon, the following are some common terms related to bonds that you might find helpful in your understanding:

How to read a bond

A bond is typically written like this: ASPSP 5.250% 28Aug2020 Corp (SGD). Let's break it down:

Where to buy a bond

Like equities, bonds are sold on both primary and secondary capital markets.

- Primary market: This is where securities are created and sold for the first time, usually via an Initial Public Offering (IPO). Investment bankers are involved in pitching a new bond deal to institutional investors (such as corporates and fund houses) during a roadshow, with the agenda to raise as much volume as possible.

- Secondary market: This is the market where securities exchange hands and are freely traded by market participants. Retail investors usually purchase and invest in the secondary market via their broker or Relationship Managers in return for a small fee (commonly called "taking a spread").

Types of bonds

The beauty of financial instruments is their versatility. While the fundamentals are usually the same, the creativity to layer on additional features is what makes them different.

- Plain vanilla bonds

- As the name suggests, these types of bonds are simple and straightforward. They are your regular coupon-paying bonds that return your principal at maturity.

- Zero coupon bonds

- Intuitively, these bonds don't pay coupons at all. So why invest in such bonds and lend money to someone who won't pay you interest? Well, a zero-coupon bond is often issued at a deep discount from its face value (e.g. 5%). You might pay $95,000 to purchase a 30-year zero coupon bond with a face value of $100,000. After 30 years, the bond issuer pays you $100,000.

- Perpetual bonds

- More commonly dubbed as "Perps", these are bonds with no maturity date. While they aren't redeemable, they pay a steady stream of interest indefinitely.

- Callable bonds

- These types of bonds can be redeemed by the issuer prior to maturity. Callable bonds generally offer investors a higher yield than bonds without call provisions. This higher yield on the bond entices investors to accept the callable feature (risk where issuer chooses to call back the bond prior to maturity). During a falling interest rate environment, most callable bond issuers would recall the bond as it's "cheaper" for them to pay investors back and re-issue a new set of bonds at a lower yield.

- Convertible bonds

- These types of bonds allow the holder to convert the bond into a specified number of common stock shares of the issuing company or cash of equal value.

- Contingent convertible bonds (CoCos)

- Unlike regular convertible bonds that allow the bonds to be converted into shares at the discretion of the bondholder, CoCos get converted into shares upon the occurrence of a trigger event – usually when the company is under capital distress as CoCos are designed to be loss-absorbing instruments. They are primarily issued by banks as such institutions have to fulfil mandatory regulatory capital requirements. Notably, these bonds do not have a maturity and are therefore perpetual by nature. In other words, all CoCos are perpetual bonds, but not all perpetual bonds are CoCos.

Bond pricing – the inverse interest rates relationship

In the market, bond prices are quoted as a percentage of the bond's face value. The easiest way to understand bond prices is to add a zero to the price quoted in the market. For example, if a bond is quoted at 99, the price is $990 for every $1,000 of face value and the bond is said to be trading at a discount. If the bond is trading at 101, the price is $1,010 for every $1,000 of face value and the bond is said to be trading at a premium. If the bond is trading at 100, it costs $1,000 for every $1,000 of face value and is said to be trading at par.

Most bonds are issued slightly below par and can then trade in the secondary market above or below par, depending on interest rates, credit ratings and/or other factors. Just remember this: bond prices have an inverse relationship with interest rates:

- When interest rates rise, bond prices fall.

- When interest rates fall, bond prices rise.

In a rising interest rate environment (i.e. the cost of borrowing money increases), newly issued bonds will pay investors higher interest rates (yield) than older bonds, so these older bonds tend to drop in price to attract demand.

In a falling interest rate environment (i.e. the cost of borrowing money decreases), the yield of older bonds would suddenly look very attractive and demand for these bonds would push its price up, meaning that they tend to sell at a premium.

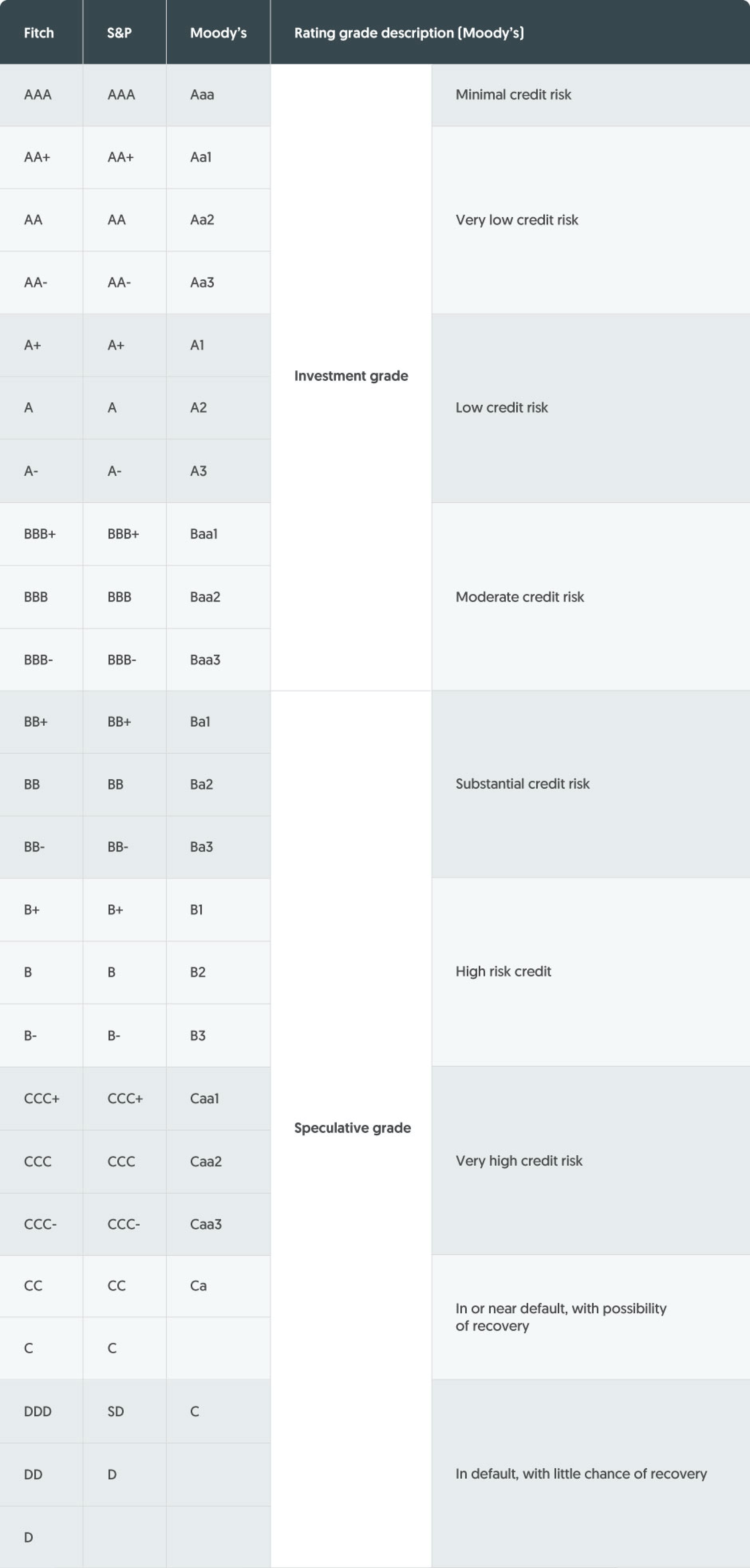

Bond ratings – investment grade vs high yield bonds

Credit ratings reflect the quality of a bond and give an indication of the bond's risk level. Ratings are given by external agencies like Moody's, Standard & Poor's (S&P) and Fitch. Bonds can be classified into Investment Grade (IG) and Non-Investment Grade (also known as High Yield (HY)).

Types of bond strategies

To be fair, this is stretching a little beyond bond basics. But learning about bond strategies might help in understanding the reasons why retail investors prefer investing into bond funds instead of executing a bond strategy themselves.

- Bullet strategy: A bullet bond strategy is a strategy in which an investor buys bonds at different times with the same maturity (the bonds mature at the same time). This is a defensive strategy as it attempts to hedge inflation risk by purchasing bonds at different intervals. Let's put this into an example: you are planning to fund your child's tuition fees in 2035 so between now and then, you want to invest your money to earn some returns. Instead of investing into a single bond that expires in 2035, you can construct a bullet strategy that includes 6 investments across 6 different years: 2022, 2024, 2026, 2028, 2030 and 2032. In each of these years, the bonds all share the same maturity date of 2035, where the returned principals can be used to pay for your child's tuition. As we know by now, interest rates are always changing so by using a bullet strategy, you are bettering your chances of optimising your returns (earning higher coupons) while minimising your risks.

- Barbell strategy: A bond barbell strategy divides a portfolio into two sections: a low-risk side and a high-risk side. The conservative side of the portfolio is filled with short-term bonds while the risker side of the portfolio is filled with long-term, higher-risk bonds. The risks are higher for longer-term bonds as they are more susceptible to rising inflation. Unlike a physical barbell, the bond barbell strategy doesn't necessarily need to be equally weighted on both sides – the weights are assigned based on an investor's outlook and yield requirements. To construct a barbell bond portfolio, an investor could split their investments into a 90/10 split, where 90% of their investments are short-term, and 10% are long-term. Compared to a bullet bond strategy, this is an active strategy as it requires frequent monitoring and action since the shorter-term bonds will need to be rolled into new issues on a frequent basis. As such, a bond barbell strategy generally offers greater diversification, higher liquidity and higher yield – but at a higher volatility risk in holding a long-term bond.

- Ladder strategy: A bond ladder is a strategy to invest in a portfolio made up of individual bonds that mature on different dates, essentially investing in multiple bonds with different maturities. This strategy is designed to provide consistent current income while minimising exposure to interest rate fluctuations. Instead of buying bonds that are scheduled to mature during the same year (like a bullet bond strategy), spreading out maturity dates can help prevent investors from trying to time the market and ride out interest rate fluctuations by reinvesting the proceeds from maturing bonds.

Why invest in bond (and bond funds)

While direct investment into a bond has its perks, it does have its own set of constraints such as minimum investment size and liquidity concerns. For most retail investors, purchasing a bond from a bank requires at least $250,000 and a Relationship Manager to help facilitate the transaction. And while bonds are traded on secondary markets, they are generally not as liquid as compared to funds and equities. Self-execution of bond strategies also requires more time and effort. In consideration of this, bond funds offer investors a great alternative to direct investment into a bond.

Here are 3 key reasons why bonds (as well as bond funds) make a sound investment:

- Income: Earn periodic coupon interest payments that are higher than your fixed deposits rates and where the yield generally beats inflation. For those that are not in need of a consistent income stream, you can choose to earn more income by reinvesting these periodic coupons.

- Capital appreciation: Capital gain (or loss) when the bond matures is recalled or sold off.

- Diversification: Bonds are great for diversification. Bond funds especially, allow an investor to be diversified across regions, issuers, strategies and bond types. A bond fund generally invests in over 100 different bonds and has a low barrier to entry, providing investors immediate access to broader diversification without the need to be capital intensive.

Fixed income fund ideas

Important notices

Grow your wealth with OCBC today

General disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

- There are links or hyperlinks which link you to websites of other third parties (the “Third Parties”). OCBC Bank hereby disclaims liability for any information, materials, products or services posted or offered on the website of the Third Parties.

Collective Investment Schemes

- A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund.

- The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

- Investment involves risks. Past performance figures do not reflect future performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units.