How to cope with inflation and rising costs? Start planning early to achieve your life goals with OCBC Financial OneView

How to cope with inflation and rising costs? Start planning early to achieve your life goals with OCBC Financial OneView

Feeling the pinch from inflation & rising costs?

You’re definitely not alone.

If you’re looking for a handy tool to plan and track your finances, to achieve your life goals, consider OCBC Financial OneView.

Through SGFinDex, OCBC Financial OneView gives you greater clarity on your finances to help you make better financial decisions.

Even better, with the latest insurance upgrades, it consolidates your insurance policies and finances in one place (the OCBC Digital app), so you are always in control and on track to achieve your life goals.

Easy, convenient and most importantly, free for all OCBC customers!

OCBC Financial OneView helps you manage your finances, all in one place.

The award-winning app, having just bagged Best Mobile Banking Initiative at the Global Retail Banking Innovation Awards 2022, helps you to avoid the hassle of manually tracking your accounts across multiple banks and insurers through its innovative features below.

You can:

- Consolidate your finances from participating banks for greater financial clarity

- Get personalised insights to make better financial decisions

- Plan and manage your insurances

- View your investment holdings with SGX CDP

- Build your retirement nest egg by making CPF top-ups

- Pay your taxes with ease

Read on to find out more!

Note: This post is sponsored by OCBC. All views and opinions in this post are from Financial Horse.

Start planning early to achieve your life goals

With higher cost of living looming over everyone’s shoulders these days, it is a great time to relook your finances.

The best way to get on top of your finances? Tackle the problem head-on!

Being in control of your finances is a great stress reliever.

There’s nothing better than taking charge of your own finances, and financial future.

And when it comes to retirement planning, the earlier the better.

Many of us put off financial planning because it seems like an insurmountable task.

Having to manually consolidate everything across banks, CPF, taxes etc. and input everything in an Excel sheet, just seems too tiresome.

How many times have you told yourself that you’ll get to organising your finances soon?

But “soon” never materialises…

If you keep postponing planning for your financial future, your financial future will suffer.

Get clear on your finances, so that you can get a head start on your life goals.

OCBC Financial OneView: Manage your finances in one place

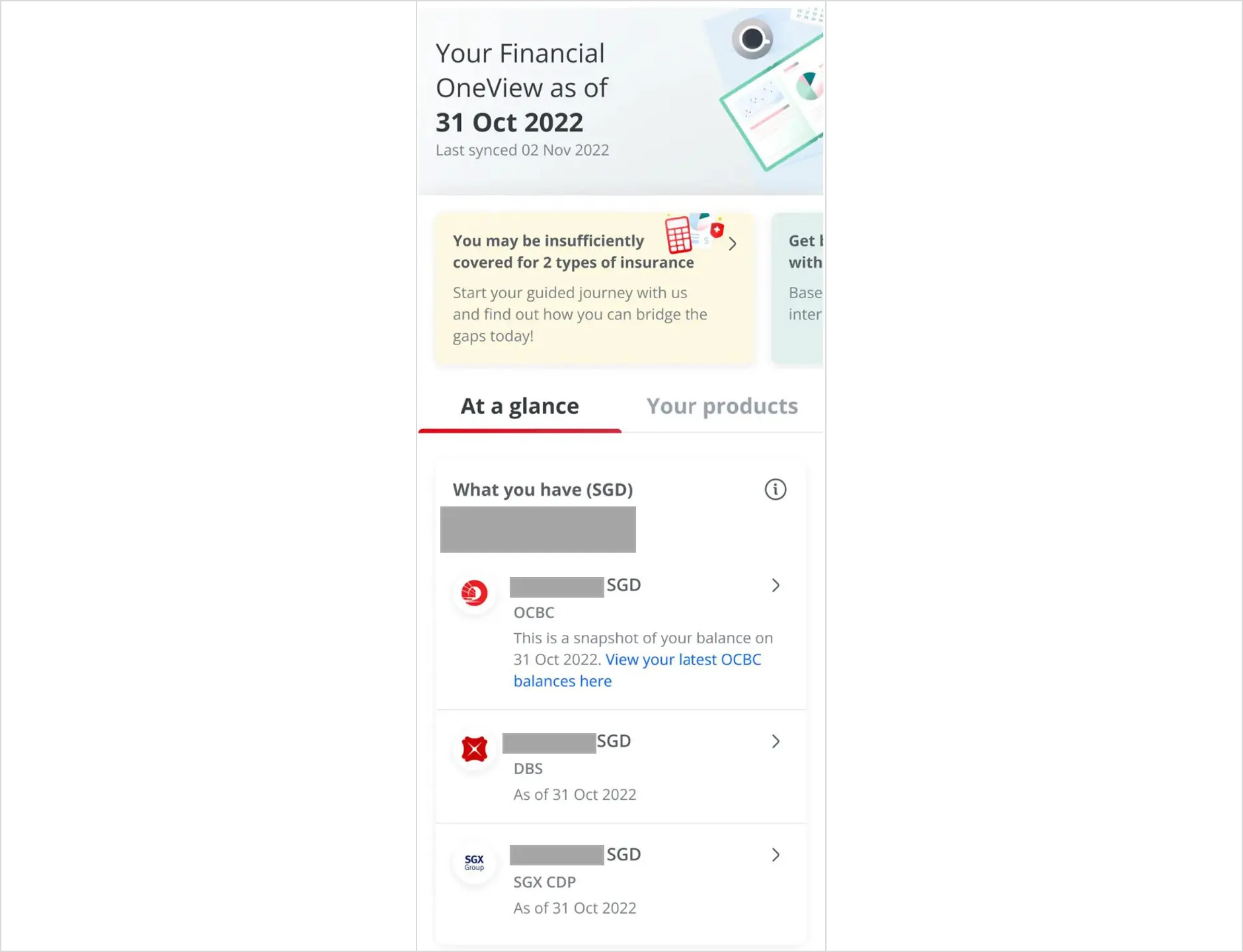

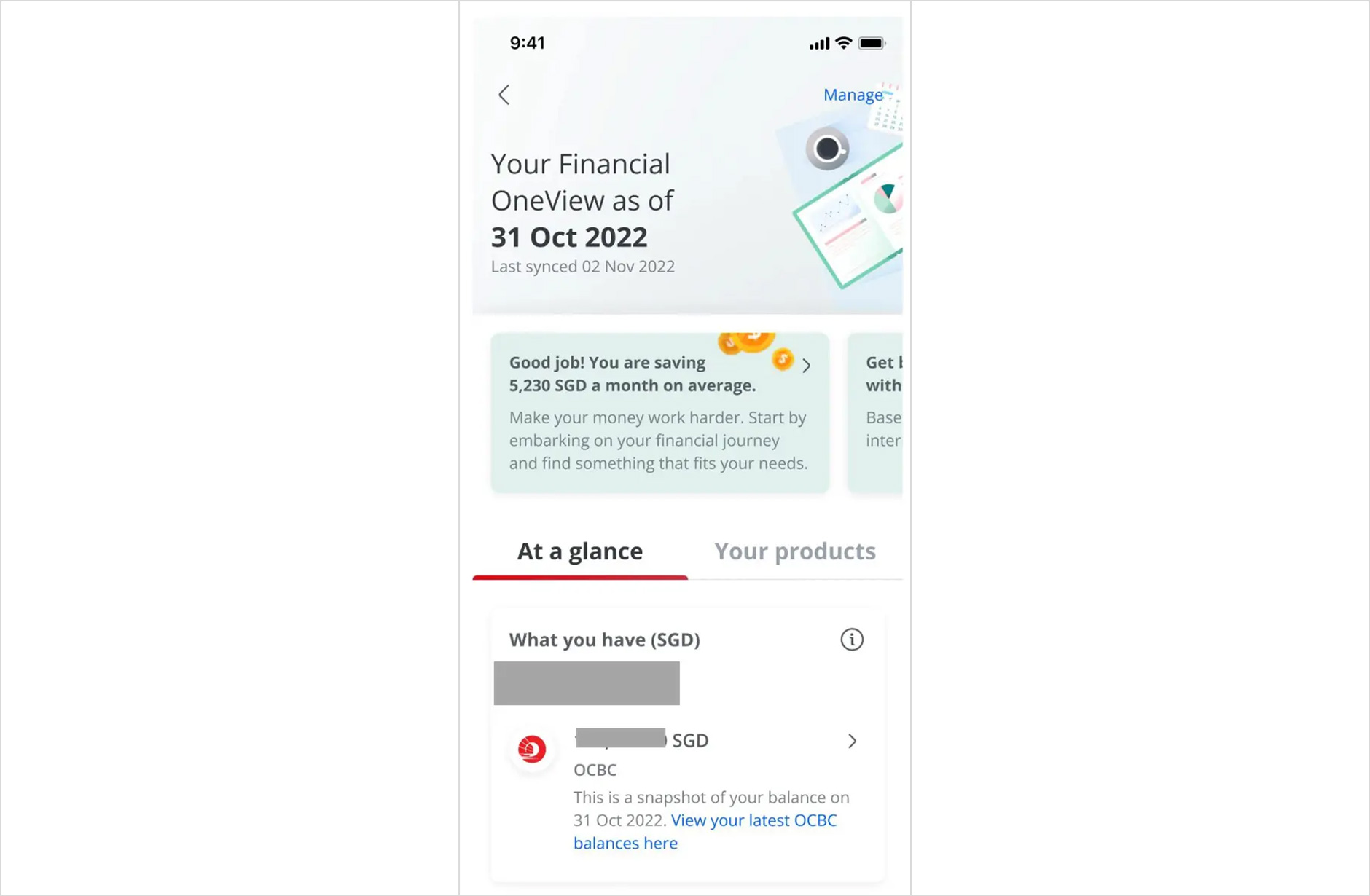

Instead of having to manually consolidate everything yourself, OCBC Financial OneView can help you conveniently aggregate all your financial data in one place.

Singapore Financial Data Exchange (SGFinDex) is a MAS-led initiative to help Singaporeans enhance financial planning across financial institutions.

OCBC Financial OneView lets you view all your accounts from participating banks, insurers, SGX CDP, CPF, HDB and IRAS on your free dashboard – enabled by SGFinDex.

This means skipping multiple app logins, no more manual tracking, and being able to see things in totality to make better informed financial decisions.

It is never too early to start planning for your future

The best time to plant a tree is yesterday. The next best time, is today.

It is never too early to start thinking about retirement.

Smart investing protects your money from being eroded away from inflation.

Investing your money allows it to grow in value over time through compounding.

Grow your wealth so that you can achieve your life goals.

Source: CPF website

Whether you choose to invest in stocks, REITs, unit trusts, robo-investments, precious metals or commodities, is your personal choice.

Investing in any or all of the above is valuable, as long as you are making the conscious effort to grow your money.

Depending on your preferences, you may choose to optimise for growth, or build passive income longer-term.

Build a portfolio that suits your needs and matches your investing time horizon and risk appetite.

A common mistake many investors make is not tracking their finances.

This doesn’t just mean tracking individual stocks/equities, and keeping tracking of gain/loss.

We’re talking about tracking the big picture.

If you’re an investor committed to growing your wealth, you should know your numbers!

Do you really know your net worth?

Break down your assets + liabilities to get a clear picture.

Know your numbers:

- Cash

- Emergency fund

- Fixed deposits / SSBs/ T-Bills

- CPF

- OA, SA, SRS

- Insurance

- Investment portfolio

- SGX CDP

- Overseas exchanges (US/HK/UK etc.)

- Commodities and precious metals

- Debt

- Mortgage (HDB/ Bank loans)

- Credit card (if any)

- Property

- Paid and outstanding mortgage / loans

- Taxes

Take the first step to organise your finances.

Know where you stand, so you can look forward to how far you can go!

Get personalised insights from your consolidated data to achieve your life goals

With consolidated data through OCBC Financial OneView, you can get personalised insights to help you achieve your life goals more effectively.

Much more than just a dashboard, use OCBC Financial OneView as a free financial planning tool to gain greater clarity on your finances, so you can achieve greater financial wellness.

OCBC Financial OneView allows you to have a bird’s eye view, of your finances across participating banks.

You can use these valuable insights to understand your saving, spending and investing patterns.

With greater clarity on your assets and liabilities, you can make better financial decisions.

Use the goals tool to keep track of your progress, and manage shortfalls or surpluses.

You can also use manual input to ensure that your financial data from across financial institutions not yet available on SGFinDex are also captured conveniently all in one place.

Along with OCBC Financial OneView‘s personalised insights, supercharge your financial planning as follows:

- Consolidate your finances from participating banks for greater financial clarity

- Plan and manage your insurances all in one place

- View your investment holdings with SGX CDP

- Build your retirement nest egg by making CPF top-ups

- Pay your taxes with ease

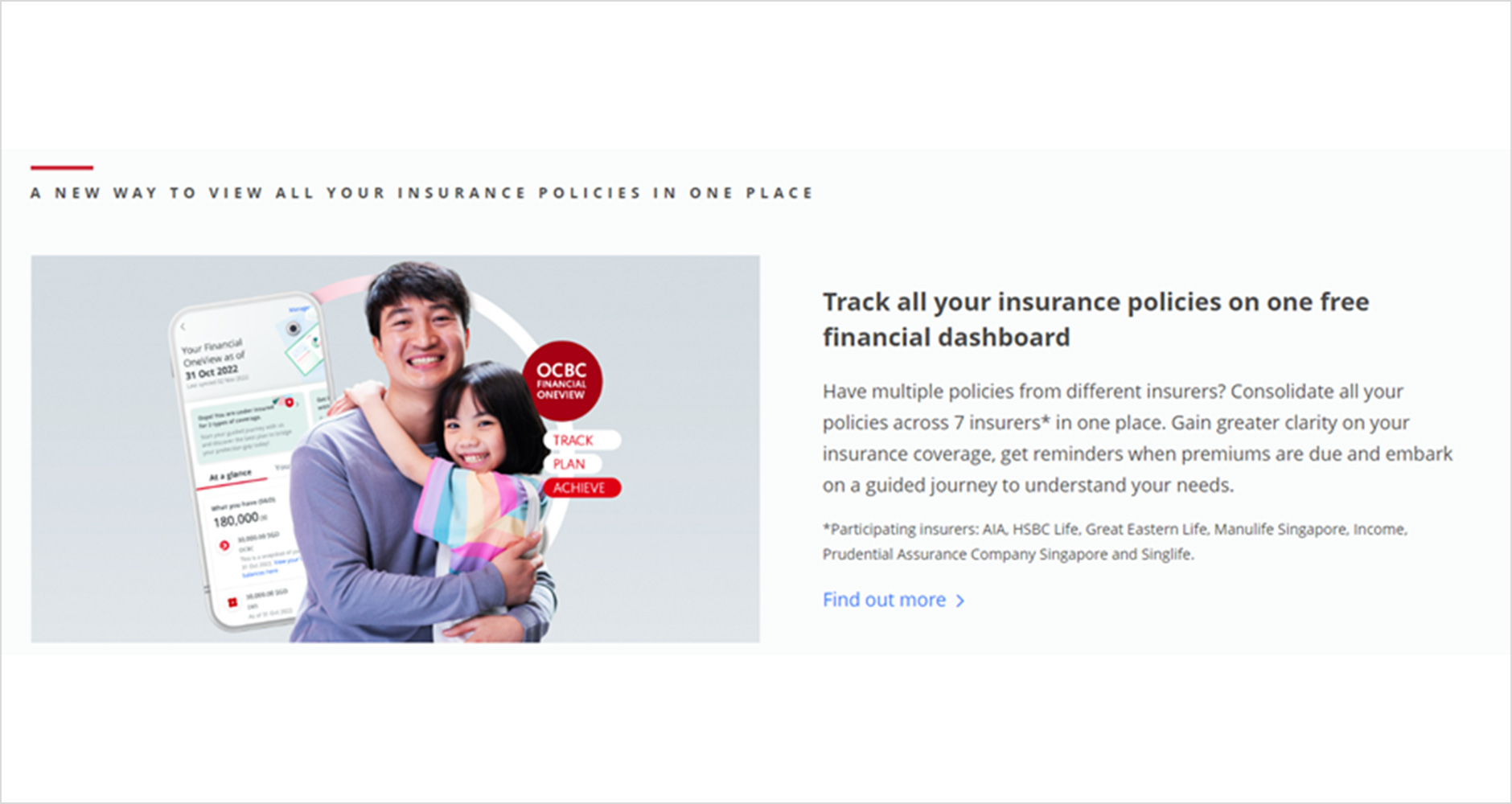

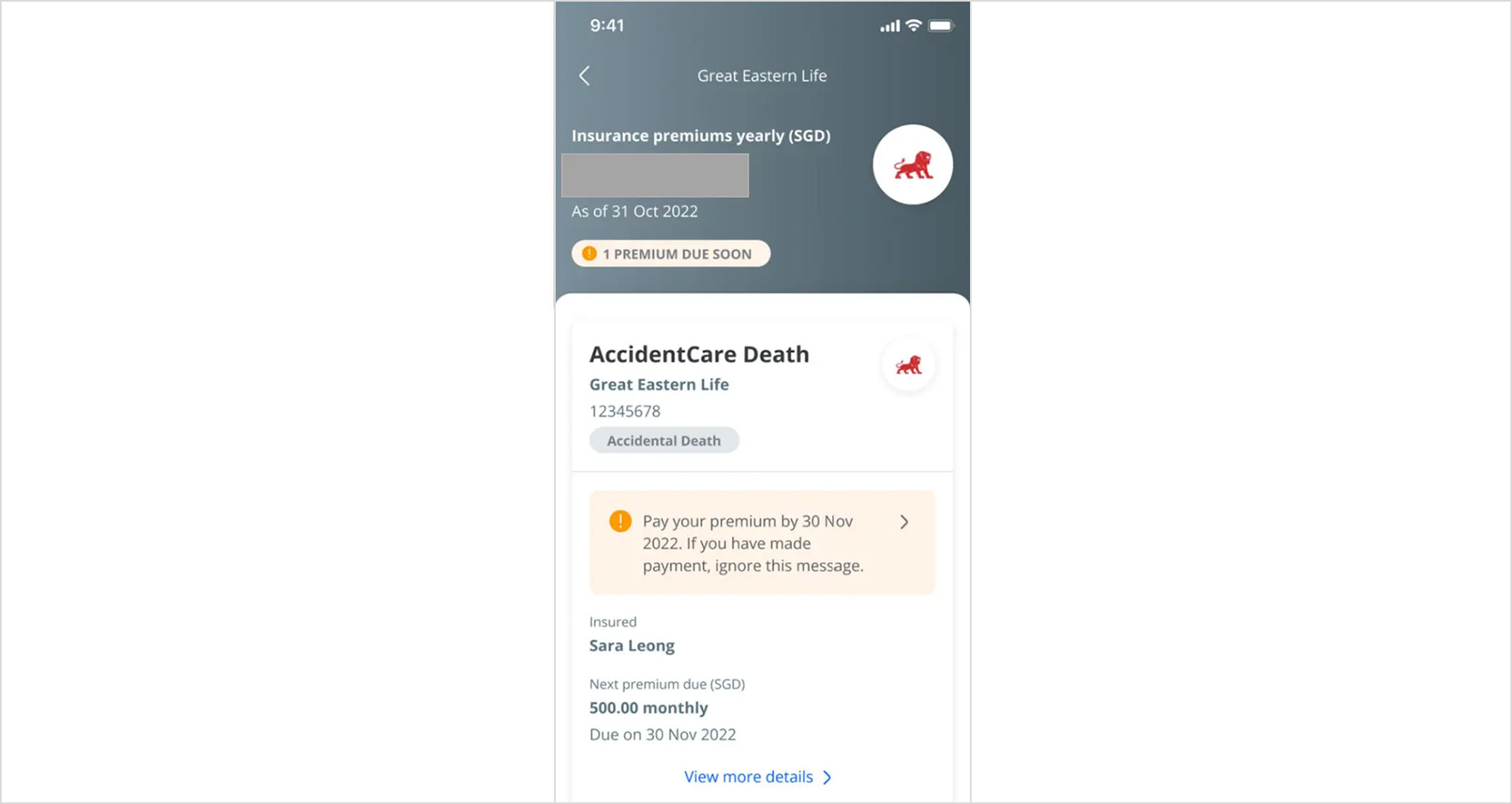

Manage your insurances *new*

From 2 November onwards, you can manage your insurance policies across 7 SGFinDex participating insurers.

This includes AIA, AXA Singapore, Great Eastern Life, Manulife Singapore, Income, Prudential Assurance Company Singapore and Singlife with Aviva.

As with all the features above, this new feature will be available on both mobile banking and internet banking.

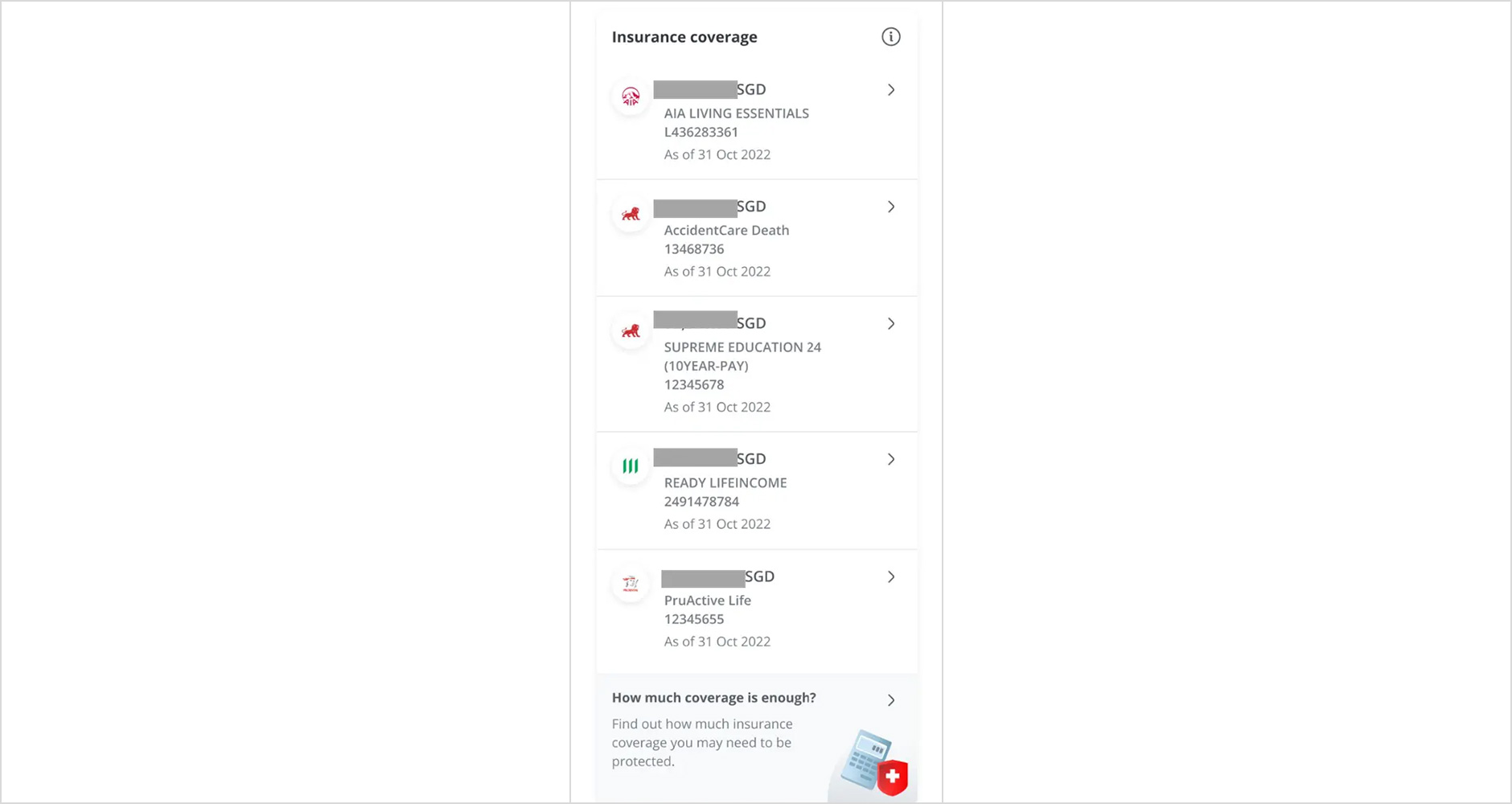

View all your insurance data securely in one place. You just need to give your consent to your insurer via SGFinDex, so that your policy information can be accessed.

Get automatic premium reminders when they are due within 30 days.

This means you no longer need to worry about remembering when to pay, or go through the hassle of asking your agent.

With all your policies in one place, it is also much easier to plan your insurance needs with your Financial Advisor or agent.

You may even discover that you have overlooked certain policies or plans, and this would be an excellent time to re-align your insurance needs to your financial situation.

If you are on GIRO, remember to ensure sufficient funds (or credit limit) in the account/ card used for the recurring payments.

For those on manual payments, the option to pay your premium will be available for selected insurers if you have an OCBC CASA.

You can also review your insurance coverage and premiums conveniently through OCBC Financial OneView.

Know what you have, so you can plan ahead to plug any protection gaps.

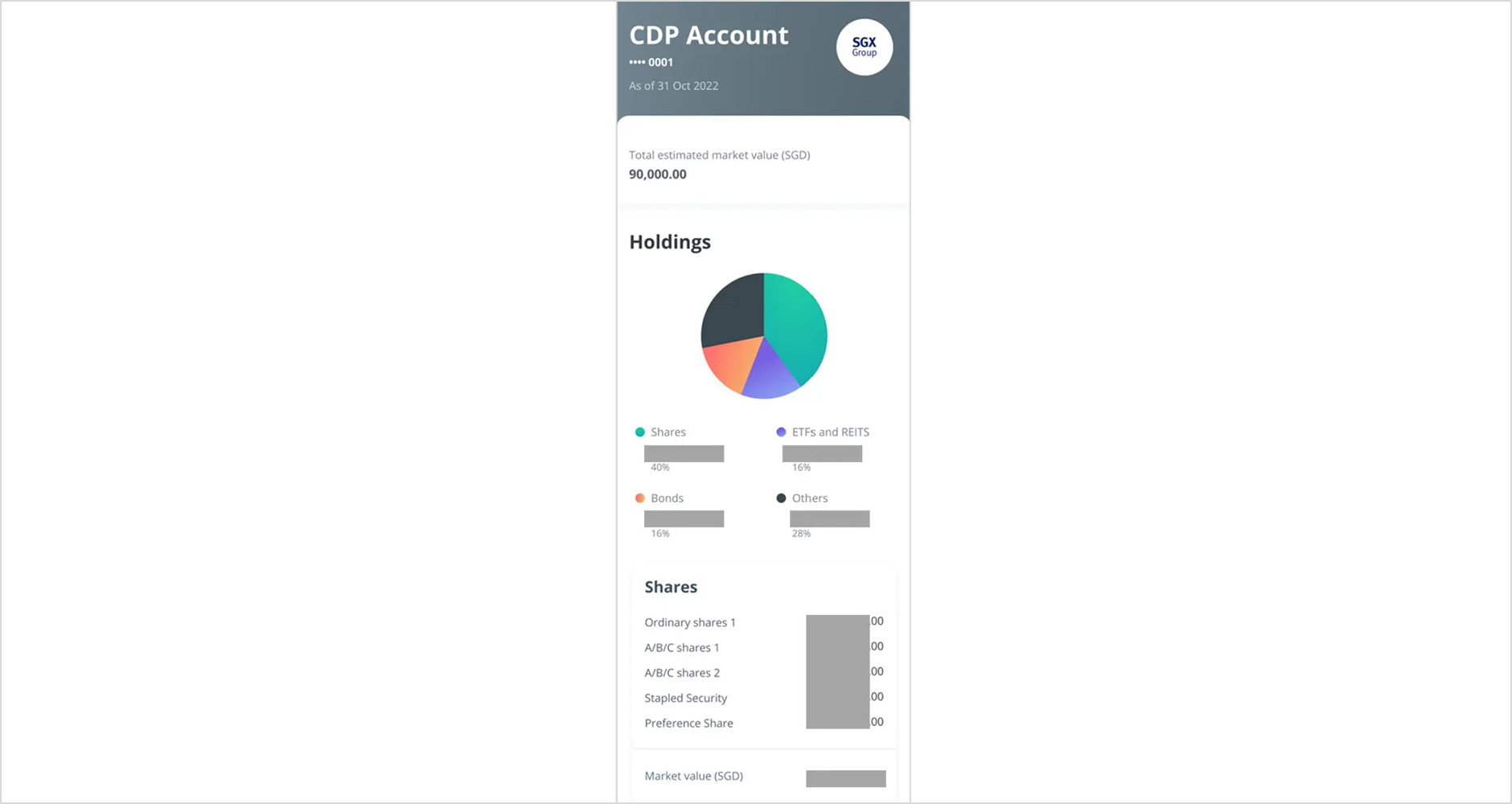

View your investment holdings with SGX CDP

Through OCBC Financial OneView, view all your SGX CDP holdings in one place.

You can also get an estimated market value of all your holdings in SGX CDP.

This helps you track your investment portfolio and net worth with ease.

As we discussed earlier, it is important to have a clear breakdown of your net worth and investment holdings, so you know where you stand.

You can also track your investment holdings further by industry, type, category depending on your preferences.

For instance, it would be good to know the % of your portfolio in:

- Growth vs dividend stocks

- Stocks vs index funds

- Industry/sector

- Country/region

Have you heard of the 5% investing rule? The 5% rule suggests not letting any single security or asset comprise more than 5% of a portfolio.

By tracking your investment holdings, this will allow you to have a bird eye’s view, to see if you are over or under-concentrated in any area.

This allows you to rebalance when needed, so that you maintain a diversified portfolio that works well for your investment timeframe and risk appetite.

Thinking of optimizing your portfolio for 2023? Check out how I will invest S$100,000 in 2023 as a Singapore investor!

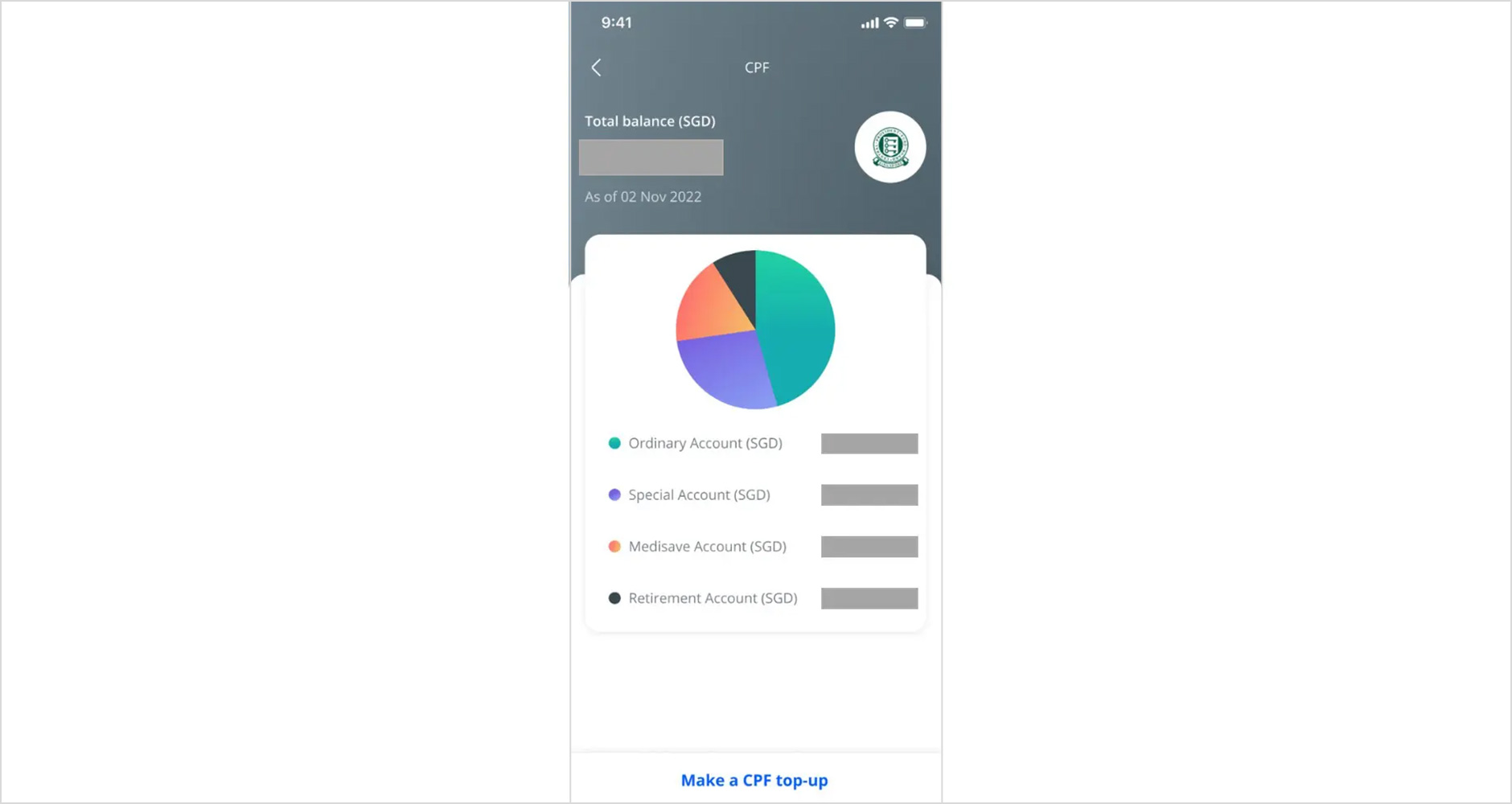

Build your retirement nest egg by making CPF top-ups

With inflation causing a dent in your finances, it is more important than ever to fortify your savings.

View your Ordinary Account, Special Account, MediSave Account and Retirement Account balances all in one place through OCBC Financial OneView.

Make top-ups to your Special and Retirement Accounts directly online via the OCBC Digital app. This saves you the hassle of needing to access multiple apps.

Top up your Special Account or Retirement Account to get up to S$16,000 tax relief, including top-ups for your loved ones, and build greater financial security for your future.

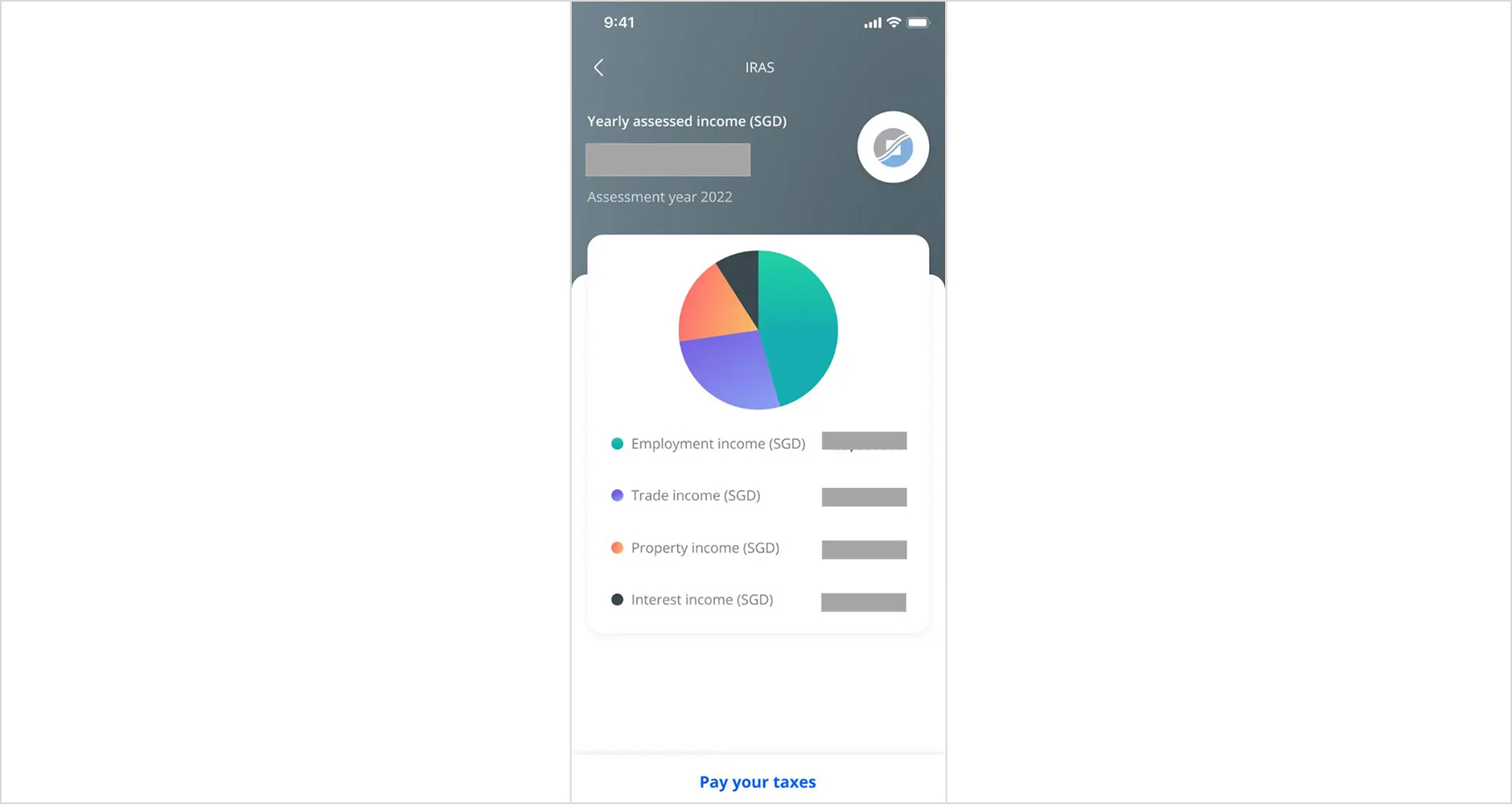

Pay your taxes with ease

In partnership with IRAS, you can pay your taxes with ease through OCBC Financial OneView.

View your latest assessable income and tax balances in one place.

With everything organised nicely for you, never miss tax season, so you avoid painful late payment penalties.

Property tax season is coming to an end! Access property tax details by using the property address or property tax reference number, and conveniently pay your outstanding taxes using your OCBC bank account.

Financial planning is crucial to achieving a worry-free future. Confidently enjoy the present by making sure your finances are in check and well looked after.

With all these convenient features, get a head start on your financial future by giving OCBC Financial OneView a try.

Start planning early, and achieve your life goals!

Note: This post is sponsored by OCBC. All views and opinions in this post are from Financial Horse.