Extreme weather: Cooling demand to heat up

Extreme weather: Cooling demand to heat up

Investment summary

Our new Extreme Weather series will provide insights into a pivotal yet underappreciated grey swan event in long-term investing.

Investors are constantly poring over historical data for patterns and lessons on what to expect next, which implicitly assumes stationarity in systems to some extent. While it works well enough in most cases, the instances when it does not could entail some of the greatest opportunities and risks. Longer term regime changes are more likely to be not yet fully incorporated in asset prices and are not easily detected with quantitative techniques. Extreme weather is predicted to occur with increasing frequency due to climate change, although their exact timing and intensity may be difficult to predict in the short term. Correspondingly, climate adaptation is an inevitable need.

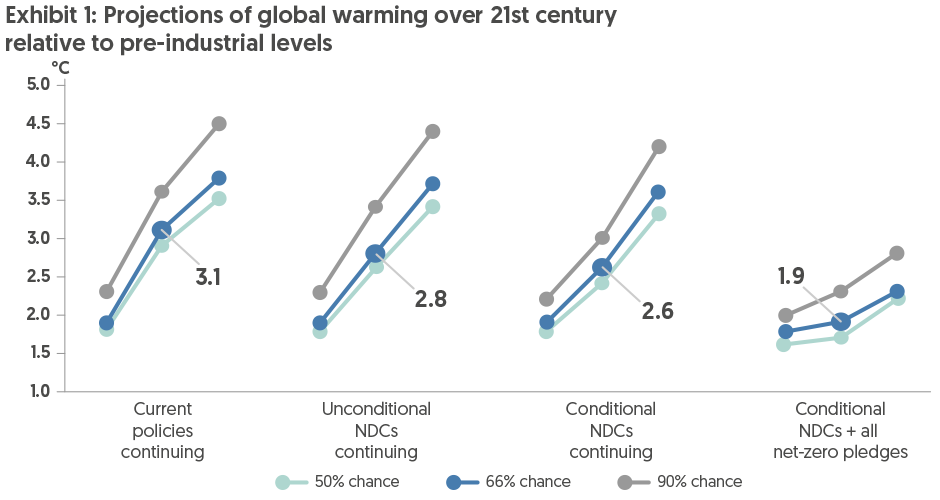

Temperatures in 2024 reached record highs in our 175-year observational record, averaging 1.5⁰C above the pre-industrial average from 1850 to 1900. The frequency and severity of extreme weather events are increasing, having caused USD4t in reported economic losses over the last five decades. According to the UN Emission Gap report, the world is on course for a global temperature increase of 2.6-3.1°C over the course of this century based on existing policies and Nationally Determined Contributions (NDCs), which are national climate action plans submitted by countries. The increase in global average temperatures would cross the 1.5°C threshold for unleashing more severe climate change impacts, including more frequent and severe droughts, heatwaves and rainfall.

The Climate Action Tracker had also assessed that none of the countries it covered had policies and targets that were "1.5°C Paris Agreement Compatible". Major emitters such as the US, China, India, and EU were assessed as "insufficient" or "highly insufficient" based on their carbon reduction pledges (as of 8 May 2025). In this first Extreme Weather report, we will be looking at the relatively direct impact of how a warmer world would lead to higher cooling demand.

Note: NDC = Nationally Determined Contributions, which are national climate action plans submitted by countries.

Source: UN Emission Gap Report 2024

Sizing up the cooling market in a hotter world

Cooling helps maintain health and productivity, minimises food waste, and enables cold chains for the transportation of goods and medicine. Human bodies are extremely sensitive to temperature changes, with labour productivity beginning to decline above 24-26°C; according to the United Nations (UN), productivity drops by 50% at 33-34°C. Cooling is especially important for Asia and emerging markets, where climate change will have a bigger effect.

The "cooling market" as discussed in this report includes the following types:

- Space cooling: Systems that provide thermal control for comfort in residential homes, commercial buildings and industrial facilities.

- Industrial process cooling: Highly customised and sophisticated systems that allow more accurate and sensitive temperature regulation for industrial equipment, processing, and products. We exclude AI-related and data centre liquid cooling for this report.

- Multi-purpose cooling: Versatile systems that are used in various applications beyond one segment.

The global cooling market is a large and growing one, with space cooling accounting for the bulk of the market.

Longer and more frequent heatwaves are to be expected, and the evolving geopolitical landscape to a multi-polar world and recent setbacks on the global decarbonisation efforts have significantly increased the risk of a 3°C global warming scenario.

Future growth will be driven by higher average temperatures, urbanisation, rising income levels and improved grid resilience

While AC penetration rates are already high in developed countries such as Japan and the US, improving living standards in key emerging markets, particularly China and India, will be significant drivers of global cooling demand. Both urbanisation and household incomes have a strong correlation with air conditioner (AC) ownership. Additionally, more resilient grids across emerging markets will provide the necessary infrastructure to support increased cooling penetration.

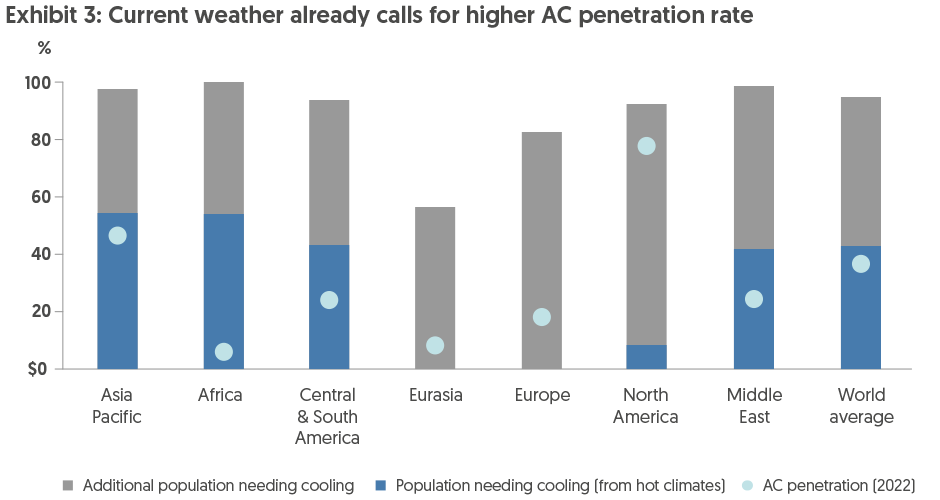

(i) Higher average temperatures

3.5b people (or 44% of the global population) lived in hot climates where building construction requires cooling-oriented design options in 2022. However, the International Energy Agency (IEA) estimated that an additional 4.1b people live in climates that also require cooling options, covering 95% of the global population. That said, household ownership of ACs remains relatively low at 37%. AC ownership rates vary substantially across developed and emerging markets; for example, virtually all households in Japan (91%) and US (90%) own AC units, while in India the rate drops to 8%. European and African regions lag with only around 19% and 6% of households being equipped with an AC for different reasons, such as general historical climates, access to electricity and affordability. The IEA projects that by 2030, the AC ownership rate will increase from 37% to more than 45% with rising incomes and a hotter climate.

Source: IEA, Bank of Singapore

An analysis of cooling degree days (CDD) is an indicator of normalised temperature exposure, and therefore, a good proxy for cooling demand (Note: CDDs are equal to the number of degrees Celsius a given day’s mean temperature is above a given reference temperature).

European and tropical countries will face adaptation challenges while countries in hot climates will have exacerbated cooling requirements. Under a 1.5°C to 3°C global warming scenario, countries and regions such as the Middle East, Latin America, and Sub-Saharan Africa that have had the most extreme heat historically will be the most challenged by any increase in absolute CDDs. Countries in cooler climates that have not traditionally needed cooling, such as parts of Europe and tropical countries that have had low seasonal temperature variations, will face large adaptation challenges given that they are likely to face the greatest relative CDD increases.

Lack of access to indoor cooling puts the global population at higher risk for heat stress, with the elderly most affected. The number of people exposed to extreme heat is growing. A study by Falchetta, G., De Cian, E., Sue Wing, I. et al. projects that, by 2050, over 23% of the global population aged 69+ will inhabit climates where the daily maximum temperature exceeds the critical threshold of 37.5°C, up from 14% in 2020, exposing an additional 177–246m older adults to dangerous and acute heat.

The workforce also needs protection from heat stress. Direct health implications of heat stress include exhaustion, cramps, worsening mental health, diabetic complications, and stroke. At work, these could lead to increased injuries and productivity losses, threatening companies' output, revenues, and reputations. The World Health Organisation (WHO) believes lost productivity will be one of the most important economic impacts from heat waves.

(ii) Rising income levels

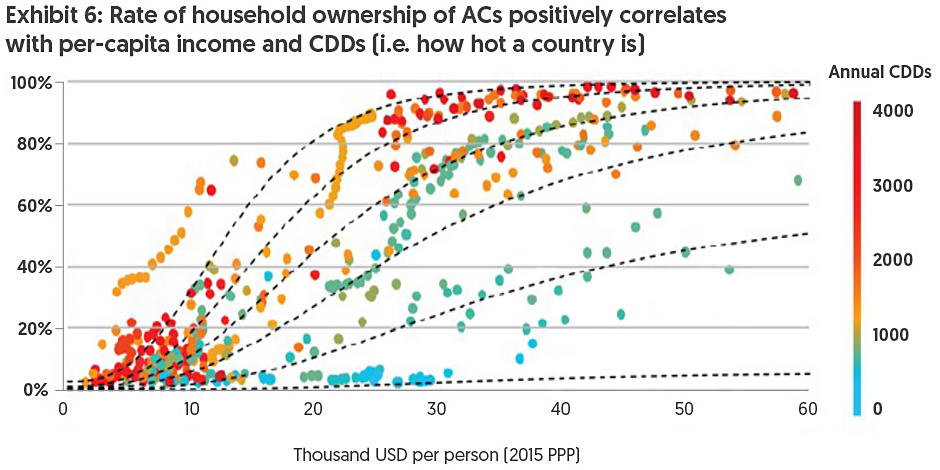

Higher incomes typically push up AC demand, especially in hotter countries. As household incomes pass a certain threshold, sales of AC units and their usage start to take off, replacing or supplementing the use of electric fans.

In hot countries, such as Brazil, Egypt, India, Thailand, Indonesia, and Venezuela (with CDDs > 3,000), where cooling is essential, ownership rises steeply with income. For the countries in between, the correlation is less strong and varies with the type of climate and humidity levels. More humid countries like Japan and the US have a stronger ownership-income correlation than generally drier Italy, Portugal and Spain. Other factors affecting the relationship include sociocultural preferences, the cost of ACs and electricity.

Note: The dotted lines shown here are illustrative pathways for a typical place or country according to CDDs adjusted for relative humidity. PPP = purchasing power parity, used to normalise per-capita income. For the purposes of this study, CDDs are measured in °C, standardised to 18°C, in all countries.

Source: IEA

(iii) Urbanisation

The heat-island effect and higher standards of living in the urban areas drive cooling demand. The global urban population is expected to grow by 2.3b between 2020 and 2050. By 2040, there will be 23 new megacities with over 10m inhabitants globally, mostly in the Global South, including emerging markets according to the UN Environment Programme. Beyond 2025, fastest-urbanising countries include China (+4ppt, 2025-2030) and India (+16ppt, 2025-2050). Meanwhile, Japan is expected to de-urbanise and see little change in the next 25 years. Overall, the global urban population ratio is on track to increase from 58% in 2025 to 60% in 2030 (+2ppt vs 2025) and 68% in 2050 (+10ppt vs 2025).

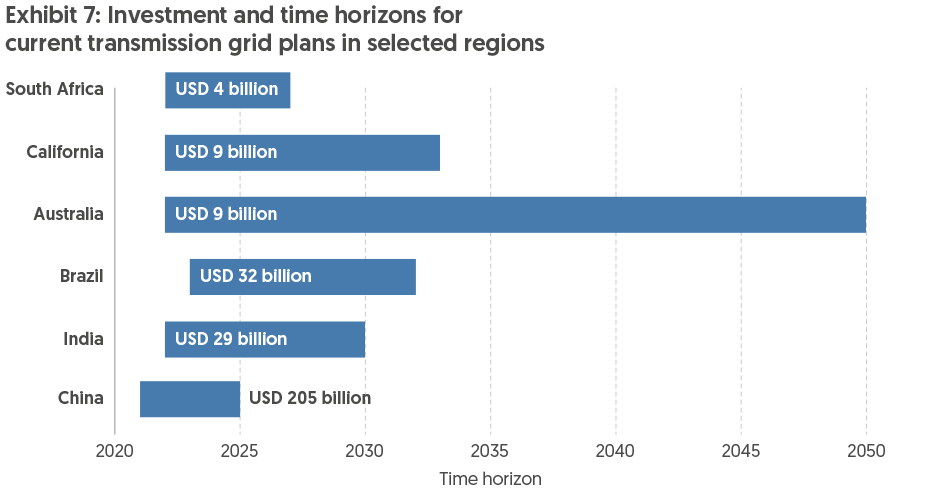

(iv) Grid stabilisation to enable higher power demand for cooling

Electricity grids are key enablers of cooling systems for residential, commercial and industrial applications. China stands out for grid investments (accounting for over 60% of APAC grid investments in 2023), with specific grid investment targets laid out. Its Action Plan to Accelerate Construction of New Power System for 2024-27 and Action Plan for High-Quality Development of Power Grid Distribution Network for 2024-27 both mentioned investments in smart dispatch systems and the enhancing reliability of renewable energy consumption. Japan’s Climate Change Adaptation Plan also provides support for the private sector to manage its climate adaptation risks, with quantitative targets pertaining to resilient infrastructure against natural disasters, sustainable energy supply, as well as climate monitoring and early warning. Japan's Green Transformation (GX) Plan also allocates investments for renewable energy (JPY20t) and electricity grid upgrading (JPY11t).

Note: Selected regions are included with specific cost estimates for the entire transmission grid, excluding distribution.

Source: IEA (2023)

Mitigating sustainability dilemma with policies

Cooling, despite being vital for heat resilience, contributes to emissions and global warming. In 2022, the greenhouse gas (GHG) emissions from global cooling equipment totalled an estimated 4.1b tons of CO2e. Of these emissions, the majority (64%) were indirect (energy-related) and 36% were direct (from refrigerant emissions). The direct emissions include emissions of hydrochlorofluorocarbons (HCFC) as well as hydrofluorocarbons (HFC). Cooling represents around 10% of global electricity demand, and it can drive an electricity demand increase of more than 50% in summer in hotter countries. Extreme summer heat would push up cooling demand and lead to higher consumption of fossil fuels. In China, coal power generation in August 2022 rose 15% year-on-year (YoY) due to increased cooling demand. Europe also saw an increase in electricity demand from space cooling because of a hotter summer in 2022.

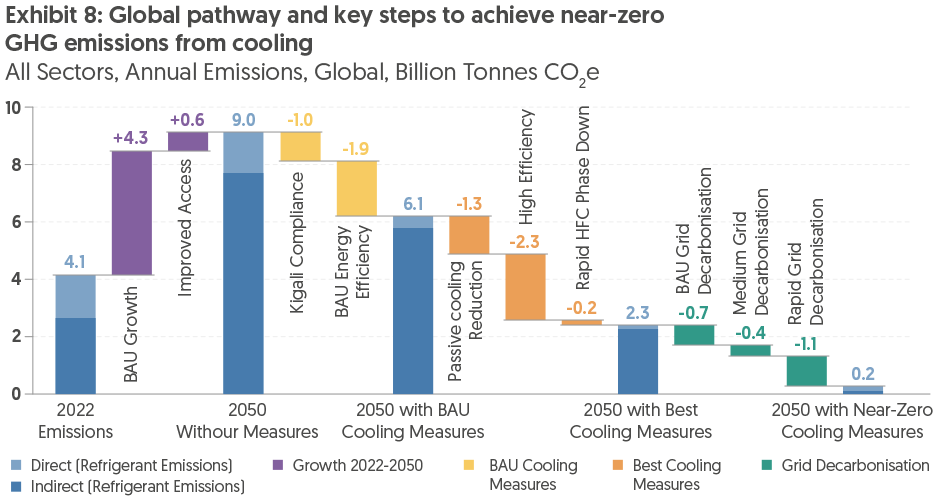

In the absence of policy interventions including the Kigali Amendment (i.e. a legally binding international agreement to gradually reduce the consumption and production of hydrofluorocarbons), improvements to energy efficiency and grid decarbonisation, the emissions from cooling are forecast to increase a substantial 120% by 2050 (9.0Bt CO2e in 2050).

Improving efficiency potentially reduces both emissions and costs. Imposing tighter minimum energy performance standards (MEPS) on AC equipment can mitigate peak load pressure, as well as generate cumulative savings of USD2.9t from 2017 to 2050 according to an OECD/IEA study in 2018.

Grid decarbonisation could also help, as coupling efficient cooling with cleaner power sources could cut CO2 emissions by 93% and air pollutants by 85% over the same period of time.

Source: UN Environment Programme

In Japan, New Energy and Industrial Technology Development Organization (NEDO) has allocated JPY36.5b to research and innovation projects in the energy saving and environmental technology areas including high efficiency coal-fired power generation, Carbon Capture, Utilization, and Storage (CCUS), 3R (reduce, reuse, recycle) in metal refinement, and fluorine countermeasure technology. In particular, the project lineup includes the development of AC and refrigeration technology that adapts low global warming potential (GWP) refrigerants to address the Kigali amendment. In FY2024 (financial year ending March 2024), JPY500m was allocated for the development and evaluation of low GWP mixed refrigerants suitable for home ACs. China also published its first national Green Cooling Action Plan in June 2019 to propel improvements in cooling efficiency and the transition to green refrigerants with new energy efficiency and market penetration targets for cooling products including ACs.

Important information

This advertisement has not been reviewed by the Monetary Authority of Singapore. Cross-Border Market Disclaimers