Take the worry out of timing the market with Dollar Cost Averaging

Take the worry out of timing the market with Dollar Cost Averaging

Buying low and selling high may sound like a simple investment strategy but it can be tough to execute in practice. Unless you are capable of accurately predicting key events like war, oil price shocks and election outcomes ahead of time, you may be better off adopting dollar-cost averaging as your investment strategy.

Time in the market matters

One of the key factors in growing one’s wealth is putting money to work consistently for you. By doing so, the focus is then on accumulating assets on a regular basis, instead of trying to figure out the best time to buy an investment.

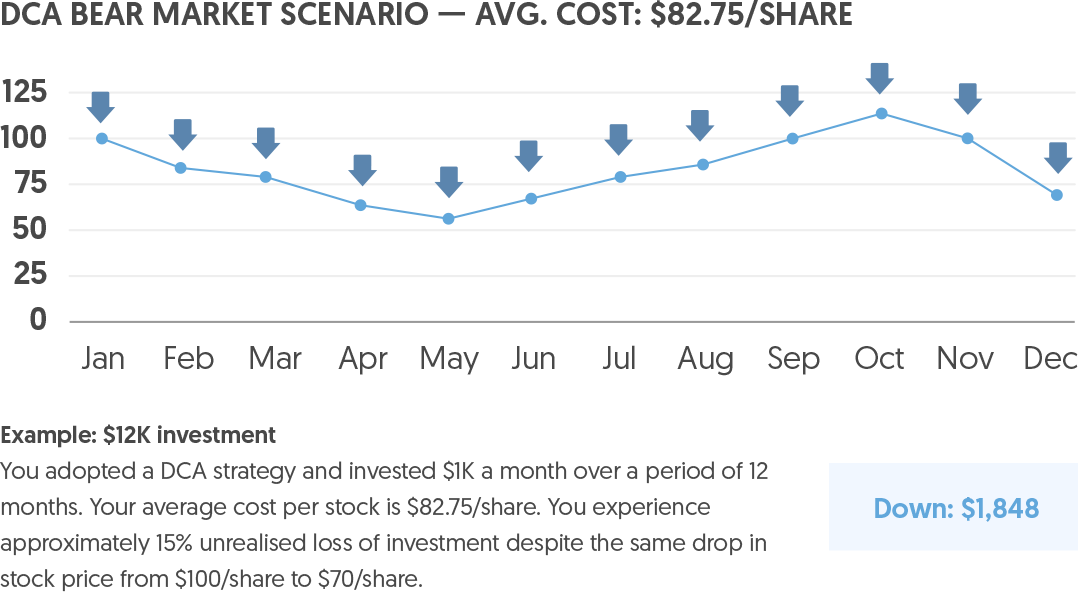

With dollar-cost averaging, you are investing a pre-determined amount every month, regardless of what the price of the underlying asset is. The idea here is that when the price drops, you buy more, and when the price increases, you buy less. In this manner, you create the potential for investment gains down the road.

As you may have accumulated more shares when prices are lower, you are potentially lowering the average purchase price over time. Should the price of that asset increase over time, you gain when you sell your accumulated shares at a higher price.

The rationale behind dollar-cost averaging

Let’s take a look at some of the reasons why it could make more sense to employ a dollar-cost averaging approach as part of one’s investment strategy:

It takes the emotion out of investing

Market dips can be intimidating but if you stop investing, you risk missing out on future growth. On the flip side, market exuberance may see risk-taking in assets that were expected to go up in value, only to be proven wrong. By making regular investments over time, you remain invested regardless of which direction the market is going.

It can be difficult to predict market swings

A gradual investment approach can be favourable in volatile markets, or when a bull market is running out of steam. You eliminate a single market entry risk by buying over a longer period at the same frequency.

It creates a disciplined investing habit

By maintaining a consistent exposure to the market, your focus is on building your investment over time rather than worrying about short-term volatility. The longer you remain invested, the more time your investment has to recover from any near-term market dips.

Dollar-cost averaging vs a lump sum investment strategy

Although you might make more money without DCA in certain bull market situations, the benefit of DCA is to take the emotion out of investing and to reduce single market entry risk.

Is dollar-cost averaging for everyone?

Overall, your outlook on markets and your risk appetite determine which strategy is a good fit for you.

If you are concerned about the potential of a downturn, market correction or prolonged period of volatility, dollar-cost averaging can be an effective way to mitigate the risks. If you expect markets to rise, you might prefer to invest a larger sum.

If you are an investor with a lower risk tolerance, dollar-cost averaging may be appealing as you get to split your investment into smaller sizes over a longer period of time, thus buffering you against price volatility.

Ready to invest?

Here are some opportunities that you may tap on:

Unit Trusts

Fidelity Global Multi Asset Income Fund

A focus on quality opportunities across multiple income streams helps this fund deliver a consistent income, even during difficult market conditions.

This fund offers exposure to countries across Asia, including China. It adopts a bottom- up selection methodology to identify companies that are attractively valued with a competitive advantage.

OCBC RoboInvest

This portfolio is systematically rebalanced to provide targeted exposure to specific themes in the Chinese market. New themes and sectors are constantly monitored for possible inclusion in the portfolio. As COVID-19 outbreaks wane, policymakers may have greater room to manoeuvre policies to support economic growth.

The Impact Investing portfolio focuses on various environmental investment themes, offering exposure to companies screened for economic, social and governance (ESG) characteristics.

Blue Chip Investment Plan (BCIP)

Lion-OCBC Securities Singapore Low Carbon ETF

The Lion-OCBC Securities Singapore Low Carbon ETF is an exchange-traded fund incorporated in Singapore. The fund seeks to track the performance of the iEdgeOCBC Singapore Low Carbon Select 50 Capped Index using a direct investment policy of investing in all, or substantially all, of the underlying Index Securities.

Lion-OCBC Securities Hang Seng Tech ETF

This is an exchange-traded fund incorporated in Singapore. The fund seeks to track the performance of the Hang Seng Stock Connect China 80 Index using a direct investment policy of investing in all, or substantially all, of the underlying Index Securities.

How to put dollar-cost averaging into practice

- Invest in OCBC RoboInvest from as low as US$100 a month.

- Invest in Unit Trusts from as low as S$100 a month.

- Invest in OCBC Blue Chip Investment Plan from as low as S$100 a month.

Disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore. Collective Investment Schemes For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units. Any indicative distribution rate may not be achieved and is not an indication, forecast, or projection of the future performance of the Fund.