Decisive steps taken for every life stage

Decisive steps taken for every life stage

Key takeaways

- Life insurance policies can be a valuable tool to protect loved ones from devastating financial impact.

- Adequate insurance coverage can provide financial support and safeguard the livelihood and lifestyle of loved ones in the face of unexpected events.

- It is important to evaluate protection needs at each life stage and adjust the protection coverage accordingly.

Life stages are the distinct periods that everyone goes through during their lifetime, and as they move through each stage, their needs, priorities and goals tend to shift. Young adults who have just started in the workforce may be focused on establishing their career, finding a life partner and then starting a family. They may prioritise building their wealth, be it for buying a car, a house or other financial goals appropriate at this life stage. As they start their own family and have children, their priorities may shift towards financial stability, saving for their children’s education and eventually planning for retirement.

Therefore, engaging in proper financial planning at each stage is crucial. This will help to ensure that you are prepared for any change or curveball that life may throw at you. It will also help you make informed decisions so that you can achieve your goals and provide a stable future for yourself and your loved ones.

Protection needs

But first, let us start with us. As an individual, but more so as a main breadwinner, ensuring sufficient protection coverage plays an important role in serving as a safety net and offering financial support to safeguard the livelihood and lifestyle of family members in the event of terminal illness (TI), total and permanent disability (TPD) or death. Protection coverage alleviates some of the financial pressures of such unforeseen events, allowing the family to concentrate on your recovery and move forward.

How should one determine the appropriate coverage amount? It should account for expenses, outstanding debts and maintaining a reasonable standard of living for a specified period.

According to the Protection Gap Study (PGS) 2017 conducted by the Life Insurance of Association Singapore (LIA), an economically active adult in Singapore should have an average coverage of S$739,000 or nine times their annual income to sufficiently address their family's protection needs1.

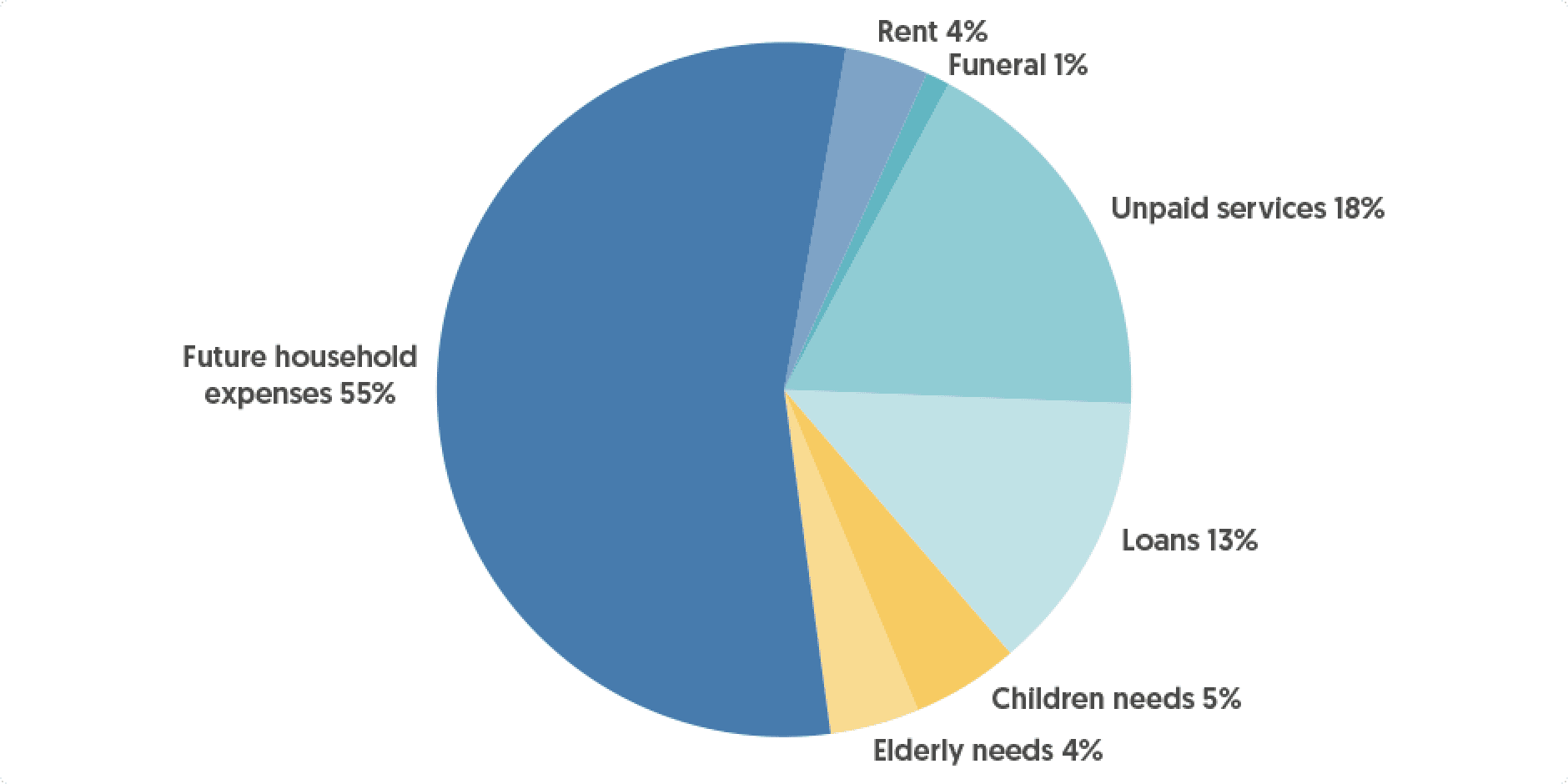

Singaporeans' protection needs rose 25%2 between 2012 and 2017 and this increase was due to meeting lifestyle requirements and needs, with the most significant portion1 (55%) going towards future household expenses and ongoing expenses for elderly family members and children.

Figure 1: Household expenses take up a significant portion of an individual’s overall expenses since these are the basic necessities required for maintaining a reasonable standard of living.

Source: 2017 Protection Gap Study, 26 April 2018 – Singapore, Life Insurance Association Singapore.

Figure 2: It is crucial to take necessary steps to safeguard the well-being of our significant ones.

- Projected cost

| Protection needs | Projected cost3 | |

|---|---|---|

| Protection needs | Projected cost3 | |

| Additional expenses | Funeral expenses | S$10,000 |

| Present value of unpaid services based on the cost of engaging a part-time helper | S$285,922 | |

| Personal and housing loans | Outstanding debts such as housing loans, personal loans and car loans | S$207,630 |

| Ongoing expenses | Present value of children’s needs | S$79,098 |

| Present value of elderly parents’ needs | S$61,678 | |

| Present value of housing needs based on the cost of renting a house | S$53,590 | |

| Present value of future household expenses | S$854,755 | |

Source: 2017 protection gap study, 26 April 2018 – Singapore, Life Insurance Association Singapore.

Term insurance

Life insurance policies should form the bedrock of one’s protection needs because such policies offer a lump sum payment to the beneficiaries in the event of TI, TPD or death.

Figure 3: Term insurance is often more affordable than other types of life insurance policies.

- Scope of coverage

- Cash value

- Premium level and charges

- Duration

| Main objective of term insurance |

|

| Scope of coverage |

|

| Cash value |

|

| Premium level and charges |

|

| Duration |

|

| Main objective of term insurance |

| Scope of coverage |

| Cash value |

| Premium level and charges |

| Duration |

Source: Understanding term insurance, MoneySense (retrieved on 18 March 2023).

Term insurance provides affordable protection, making it suitable for anyone who needs additional protection for a specific period or has excess funds to invest wisely, such as building a retirement nest or funding their children’s education.

It is crucial to note that the level of importance of protection can vary based on individual circumstances and unique needs. Using life stages as a guide can emphasise the importance of sufficient coverage and provide a foundation for a sound financial plan.

Protection needs vary with life stages

Figure 4: As individuals move through different stages of life, their protection needs may change. It is wise to recognise this and begin planning as soon as possible.

- Working adults with ageing parents and children

- Pre-retirees

| Young adults | Working adults with ageing parents and children | Pre-retirees |

|---|

|

|

Young adults

By and large, looking into life coverage is not the utmost priority for young adults who are just starting their careers. But it should still be a critical aspect of financial planning. At this life stage, individuals typically enjoy good health and have fewer pre-existing medical conditions, making it an opportune time to consider obtaining life insurance coverage that can offer peace of mind and financial security for the future.

In the unfortunate event of an unexpected illness or accident, the payout can cover expenses such as student loans, credit card debts and other financial obligations, easing the financial burden on family members. Since young adults may have limited savings, term life insurance provides a cost-effective way to protect themselves without putting undue strain on their finances.

Working adults with ageing parents and children

The responsibilities and financial challenges can be overwhelming as individuals enter the life stage of caring for ageing parents and children. They may have more liabilities such as housing loans, car loans, in addition to dependents, including ageing parents and children, who rely on their financial support.

In this sandwiched generation, adequate coverage is paramount to safeguard their loved ones. Failing to have a suitable amount of coverage could result in a significant economic impact on their dependents if something were to happen to them.

Term life insurance can be a cost-effective way to protect their dependents, using excess funds which can work as a long-term investment for their children's education and retirement planning.

Pre-retirees

As individuals enter retirement, their protection needs may reduce due to their children becoming more self-sufficient, or they may have saved enough to cover their living expenses without any outstanding debt. And although life insurance coverage may not be as crucial, it can still be a valuable investment for retirees who can afford it as the payout can be passed on as a legacy to their loved ones.

Conclusion

It is important to note that these stages are not rigid and individuals may experience them differently depending on their circumstances. Additionally, goals and priorities may shift within a life stage based on life events and experiences.

Life insurance can serve different purposes throughout various life stages, such as using the proceeds to pay off any outstanding debts, providing protection for a family, and leaving a legacy to loved ones later in life. It aims to provide emotional security and financial stability, helping families to weather unexpected events and providing a sense of reassurance for the future.

GREAT Term Guard is an award-winning3 and Singapore’s only online term life insurance that refunds you your premiums if you do not make any claim during your policy term.

This makes it a great addition to your overall protection portfolio, covering you for 53 critical illnesses, terminal illness, death and total and permanent disability till age 65 (next birthday), and returns you all your premiums if no claims are made by then.

Choose from 2 coverage amounts of S$100,000 or S$200,000, and check your premiums via OCBC app today.

Alternatively, speak to an OCBC Personal Financial Consultant today to help you plan your journey.

Discover more articles about financial planning for all ages.

Apply for GREAT Term Guard today and get up to a $500 one-time cash reward

Alternatively, you can get us to contact you.

Do not have the app?

Download on Apple app store

Download on Google Play

Download on AppGallery

General Disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

Information presented as at 1 January 2024.

References

- 2017 Protection Gap Study – Singapore, 26 April 2018, Life Insurance Association Singapore.

- Bridging the Protection Gap in Singapore, 26 April 2018, Life Insurance Association Singapore.

- GREAT Term Guard has been recognised as the Best Life Insurance Product in 2023 by The Asian Banker.

Sources

- 2017 Protection Gap Study – Singapore, 26 April 2018, Life Insurance Association Singapore.

- Understanding term insurance, MoneySense (retrieved on 18 March 2023).

- Methodology adopted for Protection Gap Study 2017 for Protection Needs. The key assumptions that were made in the 2017 PGS include the following:

- Singaporeans and Permanent Residents between age 20 and 69, who are Economically Active (EA) and have at least one dependent.

- Retirement age is assumed to be 65 years.

- Elderly parents are assumed to be age 65 and above or 25 years older than the economically active adult, used in the calculation of elderly needs and rent.

- The life expectancy is assumed to be 87.4 years for all the individuals, in line with the life expectancy of a female in Singapore as of 31 December 2016.

- Funeral costs are the cost of holding a funeral, including all after funeral costs (e.g. purchasing a niche to store the ashes).

- Each individual in the household provides a certain amount of manpower in maintaining the living standards of a household, including carrying out household chores and accompanying children or dependents. These unpaid services are based on the cost of a part-time helper and until the end of the life expectancy of the dependents. The annual cost of a part-time helper is based on the average cost per hour of S$20 for 9 hours of work per week. For single EA, unpaid services are projected until the life expectancy of elderly parents, while for married EA, this is projected for the entire lifetime of the surviving spouse.

- Personal and housing loans are the liabilities to be repaid by the family members following the death of the EA. The data is extracted from the Household Sector Balance Sheet (End of Period), 2016, Department of Statistics, Singapore.

- Needs of children is the ongoing expenses of children, including school fees and all other types of expenses such as tuition/enrichment classes, food and clothing. The needs of children were estimated by comparing the difference in expenses between households with and without children based on the General Household Survey 2015 and Household Expenditure Survey 2015.

- Future housing costs relating to rent expense are estimated by projecting actual rent expense by tenants.

- Future household expenses have been derived based on the average household expenditure plus inflation. Future household expenses are projected until the life expectancy of the spouse for the married EA and until the life expectancy of elderly parents for singles.

- Future income and expenses are inflated using prospective rates (table below) and future income and expenses are discounted at a rate that is based on the yield of the 15-year Singapore Government Bond of 2.74%.

- Rate

- Source

- Application

| Assumption | Rate | Source | Application |

|---|---|---|---|

| Wage inflation | 3.80% | Annualised change in average gross monthly income from work from 2011 to 2016 based on the Department of Statistics report titled “Household income from work time series” | S$10,000 |

| General expense inflation rate | 2.40% | 10-year CAGR of CPI from 2006 to 2016 based on the Department of Statistics report titled “Consumer Price Index (CPI)” | S$285,922 |

| Housing inflation rate | 3.04% | 10-year CAGR of Housing and Utilities index from 2013 to 2016 based on the Department of Statistics report titled “Consumer Price Index (CPI)” | S$207,630 |

| Discount rate | 2.74% | 15-year Singapore government risk-free yields as of 30 December 2016 | S$79,098 |

Sources

- 2017 Protection Gap Study – Singapore, 26 April 2018, Life Insurance Association Singapore.

- Understanding term insurance, MoneySense (retrieved on 18 March 2023).

- Methodology adopted for Protection Gap Study 2017 for Protection Needs. The key assumptions that were made in the 2017 PGS include the following:

- Singaporeans and Permanent Residents between age 20 and 69, who are Economically Active (EA) and have at least one dependent.

- Retirement age is assumed to be 65 years.

- Elderly parents are assumed to be age 65 and above or 25 years older than the economically active adult, used in the calculation of elderly needs and rent.

- The life expectancy is assumed to be 87.4 years for all the individuals, in line with the life expectancy of a female in Singapore as of 31 December 2016.

- Funeral costs are the cost of holding a funeral, including all after funeral costs (e.g. purchasing a niche to store the ashes).

- Each individual in the household provides a certain amount of manpower in maintaining the living standards of a household, including carrying out household chores and accompanying children or dependents. These unpaid services are based on the cost of a part-time helper and until the end of the life expectancy of the dependents. The annual cost of a part-time helper is based on the average cost per hour of S$20 for 9 hours of work per week. For single EA, unpaid services are projected until the life expectancy of elderly parents, while for married EA, this is projected for the entire lifetime of the surviving spouse.

- Personal and housing loans are the liabilities to be repaid by the family members following the death of the EA. The data is extracted from the Household Sector Balance Sheet (End of Period), 2016, Department of Statistics, Singapore.

- Needs of children is the ongoing expenses of children, including school fees and all other types of expenses such as tuition/enrichment classes, food and clothing. The needs of children were estimated by comparing the difference in expenses between households with and without children based on the General Household Survey 2015 and Household Expenditure Survey 2015.

- Future housing costs relating to rent expense are estimated by projecting actual rent expense by tenants.

- Future household expenses have been derived based on the average household expenditure plus inflation. Future household expenses are projected until the life expectancy of the spouse for the married EA and until the life expectancy of elderly parents for singles.

- Future income and expenses are inflated using prospective rates (table below) and future income and expenses are discounted at a rate that is based on the yield of the 15-year Singapore Government Bond of 2.74%.

- Rate

- Source

- Application

| Assumption | Rate | Source | Application |

|---|---|---|---|

| Wage inflation | 3.80% | Annualised change in average gross monthly income from work from 2011 to 2016 based on the Department of Statistics report titled “Household income from work time series” | S$10,000 |

| General expense inflation rate | 2.40% | 10-year CAGR of CPI from 2006 to 2016 based on the Department of Statistics report titled “Consumer Price Index (CPI)” | S$285,922 |

| Housing inflation rate | 3.04% | 10-year CAGR of Housing and Utilities index from 2013 to 2016 based on the Department of Statistics report titled “Consumer Price Index (CPI)” | S$207,630 |

| Discount rate | 2.74% | 15-year Singapore government risk-free yields as of 30 December 2016 | S$79,098 |

Policy Owner’s Protection Scheme

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Important notes for GREAT Term Guard

GREAT Term Guard is provided by The Great Eastern Life Assurance Company Limited, a wholly owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it.

This document does not take into account your particular investment and protection aims, financial situation or needs. You may want to seek advice from a financial adviser before committing to buy the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

We do not guarantee, represent or warrant that any of the information provided in this document is accurate and you should not rely on it as such. We do not undertake to update the information or to correct any inaccuracies.

All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information presented as at 23 February 2022.

Insurance Disclaimers

This advertisement has not been reviewed by the Monetary Authority of Singapore.

- This is for general information and does not take into account your particular investment and protection aims, financial situation or needs. You should seek advice from a financial adviser before committing to a purchase. Otherwise, you should consider the suitability of the product.

- Insurance policies are underwritten by the relevant entity in Great Eastern and are not bank deposits or obligations of, or guaranteed by OCBC Bank. Protected up to specified limits by SDIC.

- As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

- This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

- We do not guarantee, represent or warrant that any of the information provided in this document is accurate and you should not rely on it as such. We do not undertake to update the information or to correct any inaccuracies. All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document.

Scan to start application:

Apply via the OCBC app

Open the all new OCBC app > Login > Click on ‘More’ > Under ‘Apply’, click on ‘Insurance’ > Click on ‘GREAT Term Guard’.

If you are still on the previous version of the app, then click on ‘Insure and stay protected’ after logging in.

Policy Owners' Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).