Are you still waiting to invest? Read this!

Are you still waiting to invest? Read this!

What price, indecision?

Greed and fear are two commonly acknowledged emotions associated with stock markets, and are often cited as factors behind unpredictability and volatility in investment behaviour.

But while greed and fear may have their place in the overall investment scheme, there is also another emotion that may stand in the way of investors making good investment choices, and that is: Indecision.

Indecision can be a crippling adversary, as missed investment opportunities can have enormous consequences on your financial health down the line. Indecision can strike investors anytime, be it when stocks are going down (fear) or while stocks are going up (greed).

The opportunity cost of holding on to your money

For investors, the market can get intimidating when volatility comes to the forefront, as it is often associated with risks. When investors contemplate only the possible risks, it makes it difficult to anticipate possible returns with certainty.

Volatility – which measures the degree of change in the price of an asset over a period of time – is not uncommon for investments like stocks, which can experience wide price swings over a very short period of time. But volatility creates fear and uncertainty, which can lead to bad investment decisions.

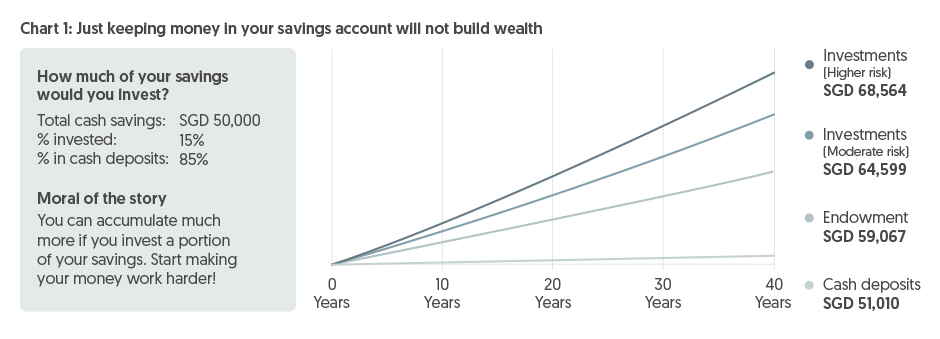

Investors may resort to inaction and choose to leave their money in a deposit account as this is seen as the safest alternative to wait out the volatility until the ‘right’ time to invest comes by.

This is often referred to as the opportunity cost of holding money.

Source: OCBC Wealth Management

Not making a choice is a choice in itself but this type of indecisiveness takes the form of missed opportunities.

Leaving cash in a deposit account may feel comforting in volatile times, but you are not giving your money a chance to grow at a much more attractive rate, and that is the opportunity cost that you have to bear. Investors tend to forget that volatility can also be an opportunity.

So, how does an investor counter indecisiveness?

When it comes to investments, the goal has always been to buy low and sell high. But can we faithfully execute such a strategy with success each time we invest?

Markets can be fluid and volatile. In the first week of October 2021, US markets were hard hit as technology stocks tanked and bond yields rose. Yet by the end of the week, markets were back in the green, recouping whatever losses they had suffered earlier despite weak payrolls data.

It is this very nature that makes it impossible to accurately and consistently determine when markets have hit their lowest or highest points.

Hence, it is not possible to buy low and sell high every single time as it is difficult to time the market.

The “perfect” time to enter investment markets probably doesn’t exist. In fact, time spent invested in the market is a bigger determinant of investment success than market timing. So long as the macro-outlook is sanguine, you should not get distracted by changing news headlines or market noise and freeze.

There are however some strategies that investors can use to help make investment decisions and ease the pain of market volatility.

Invest small amounts over time

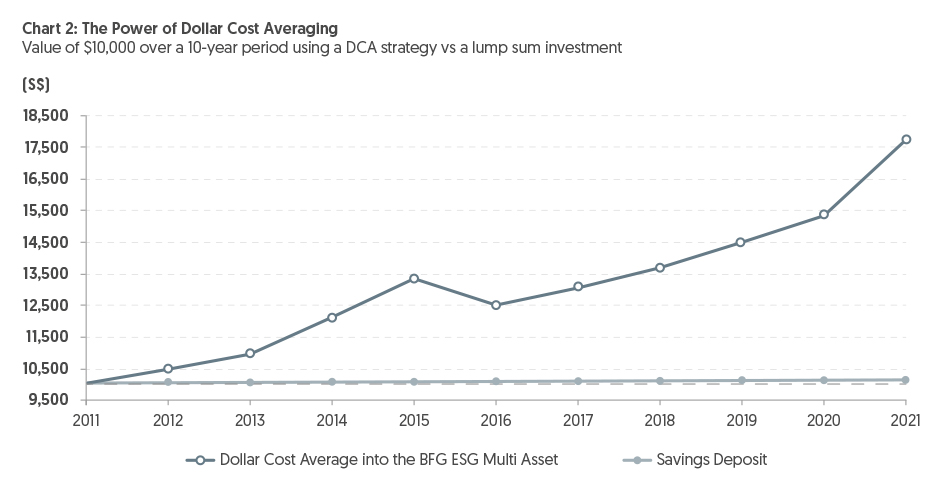

Investors can start small by adopting a dollar cost averaging strategy, where a fixed but more manageable amount of money is placed into a particular investment at regular intervals (e.g. monthly).

The key advantage of dollar cost averaging is that it reduces the effects of market timing. Investors also need not fear the risk of making counter-productive decisions out of greed or fear, such as buying more when prices are rising or panic-selling when prices decline. Instead, this strategy forces investors to remain invested in the markets despite any background noise that may be going on.

Dollar cost averaging offers an affordable, sustainable and comfortable way for new investors to ease into the stock market without incurring the anxiety that comes from having too much invested in a short period of time. It is thus the more practical choice among new investors, and investors who may not have the time to actively monitor the performance of the stock market.

Investing early and regularly, no matter how small, can deliver good returns over the long term.

For unit trusts, this can even take the form of reinvesting dividends over time.

Source: Bloomberg, data from end July 2011 to end July 2021. Deposit returns abased on Bank Saving Deposits Rate from the Monetary Authority of Singapore. BFG ESG Multi Asset equities total return based on the BlackRock ESG - Multi Asset Fund with net dividends reinvested.

You can start a regular savings plan with just a monthly commitment of S$100 and enjoy the flexibility of adjusting this recurring investment at your will.

Sometimes, it’s even easier if a robot does it for you

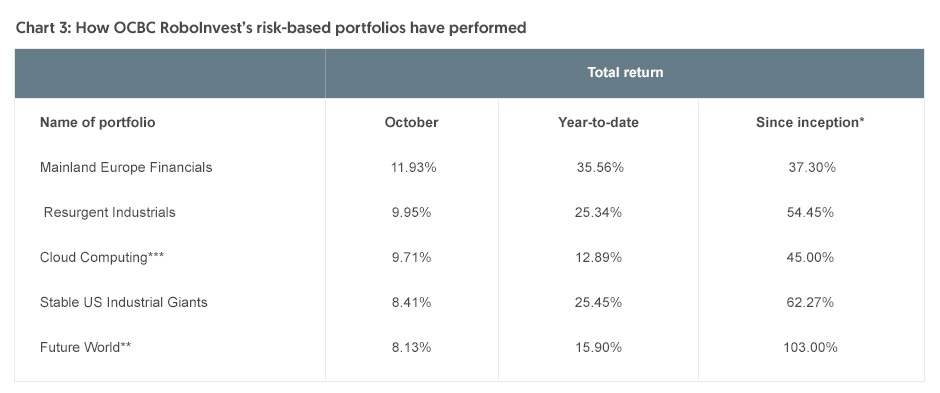

Robo-advisors are digital platforms that utilise automated solutions and algorithms to help invest and manage money for you. They offer a disciplined approach to investing that runs on autopilot as opposed to actively-managed unit trusts that tend to depend on the decisions of a fund manager in the context of the fund’s investment mandate.

Timing of investments and portfolio rebalancing are done in specific intervals and/or follow specific programmed rules, hence removing human biases in the process. But of course, the algorithms and the investment methodology are monitored by a team of professionals and may be tweaked from time to time to deliver optimal performance.

The ingredients for portfolio construction are typically ETFs, ensuring that investors are not taking concentrated exposure in any specific security. That being said, OCBCRoboInvest carries a number of portfolios that are constructed using single equities as key building blocks.

Robo-advisors tend to be low-cost, passively-managed, diversified and convenient. They offer a rules-based type investment process that is relevant to individuals who would benefit from a strictly hands-off approach due to the salience of behavioural biases in their investment decisions.

When seen across a spectrum, robo-advisors lie comfortably between investing in an actively-managed unit trust and passively tracking a market benchmark via an ETF.

Plus, they offer the option of dollar cost averaging.

*Data as of 1 September 2018

**Data as of 27 April 2020

***Data as of 17 August 2020

Source: WeInvest, data as of 31 October 2021

Needless to say, the best way to counter indecision is to stop striving for perfection; the greatest decisions are made when you don’t overthink… leave it to the robots!

About OCBC RoboInvest

OCBC RoboInvest is an all-in-one digital platform that helps you invest easily at your own convenience. Smart portfolio rebalancing updates also mean you can save time on performance tracking and get alerted on rebalancing opportunities as the market changes, which is especially useful in navigating rocky markets.

Cross-Border Marketing Disclaimer

- General: The document provided by Oversea-Chinese Banking Corporation Limited, Singapore (“OCBC Singapore”) is for general information only and is not intended for anyone other than the recipient. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person, and does not constitute an offer or solicitation by OCBC Singapore to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy nor an advice or a recommendation with respect to such financial products. This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without OCBC Singapore’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction, where such distribution, publication or use would be contrary to applicable law or would subject OCBC Singapore and its related corporations, connected persons, associated persons and/or affiliates to any registration, licensing or other requirements within such jurisdiction.

- Brunei: This document has not been delivered to, licensed or permitted by the Autoriti Monetari Brunei Darussalam, the authority as designated under the Brunei Darussalam Securities Markets Order, 2013 and the Banking Order, 2006; nor has it been registered with the Registrar of Companies, Registrar of International Business Companies or the Brunei Darussalam Ministry of Finance. The products are not registered, licensed or permitted by the Autoriti Monetari Brunei Darussalam or by any other government agency or under any law in Brunei Darussalam. Any offers, acceptances, sales and allotments of the products shall be made outside Brunei Darussalam.

- Indonesia: The offering of the investment product in reliance of this document is not registered under the Indonesian Capital Market Law and its implementing regulations, and is not intended to constitute a public offering of securities under the Indonesian Capital Market Law and its implementing regulations. According, this investment product may not be offered or sold, directly or indirectly, within Indonesia or to citizens (wherever they are domiciled or located), entities or residents, in any manner which constitutes a public offering of securities under the Indonesian Capital Market Law and its implementing regulations.

- Japan: OCBC Singapore does not have any intention of conducting regulated business in Japan. You acknowledge that nothing in this document constitutes investment or financial advice or any advice of any nature.

- Malaysia: OCBC Singapore does not hold any licence, registration or approval to carry on any regulated business in Malaysia (including but not limited to any businesses regulated under the Capital Markets & Services Act 2007 of Malaysia), nor does it hold itself out as carrying on or purport to carry on any such business in Malaysia. Any services provided by OCBC Singapore to residents of Malaysia are provided solely on an offshore basis from outside Malaysia, either as a result of “reverse enquiry” on the part of the Malaysian residents or where OCBC Singapore has been retained outside Malaysia to provide such services. As an integral part of the provision of such services from outside Malaysia, OCBC Singapore may from time to time make available to such residents documents and information making reference to capital markets products (for example, in connection with the provision of fund management or investment advisory services outside of Malaysia). Nothing in such documents or information is intended to be construed as or constitute the making available of, or an offer or invitation to subscribe for or purchase any such capital markets product.

- Myanmar: OCBC Singapore is not licensed or registered under the Financial Institutions Law (Law No. 20/2016) or other Myanmar legislation to carry on, nor do they purport to carry on, any regulated activity in Myanmar. The provision of any products and services by OCBC Singapore shall be solely on an offshore basis. You shall ensure that you have and will continue to be fully compliant with all applicable laws in Myanmar when entering into discussion or contracts with OCBC Singapore.

- Oman: This document does not constitute a public offer of investment, securities or financial services in the Sultanate of Oman, as contemplated by the Commercial Companies Law of Oman (Royal Decree No. 184/2019), Banking Law of Oman (Royal Decree No. 114/2000) or the Capital Market Law of Oman (Royal Decree No. 80/1998) and the Executive Regulations of the Capital Market Law (Ministerial Decision No. 1/2009) or an offer to sell or the solicitation of any offer to buy non-Omani investment products, securities or financial services and products in the Sultanate of Oman. It is being provided to a limited number of sophisticated investors solely to enable them to decide whether or not to make an offer to invest in financial products mentioned in this document, outside of the Sultanate of Oman, upon the terms and subject to the restrictions set out herein and may not be reproduced or used for any other purpose or provided to any person other than the original recipient. Additionally, this document is not intended to lead to the making of any contract within the territory or under the laws of the Sultanate of Oman. The Capital Market Authority of Oman and the Central Bank of Oman take no responsibility for the accuracy of the statements and information contained in this document or for the performance of the financial products mentioned in this document nor shall they have any liability to any person for damage or loss resulting from reliance on any statement or information contained herein.

- Russia: The investment products mentioned in this document have not been registered with or approved by the local regulator of any country and are not publicly distributed in Singapore or elsewhere. This document does not constitute or form part of an offer or invitation to the public in any country to subscribe for the products referred to herein.

- Taiwan: The provision of the information and the offer of the service concerned herewith have not been and will not be registered with the Financial Supervisory Commission of Taiwan pursuant to relevant laws and regulations of Taiwan and may not be provided or offered in Taiwan or in circumstances which requires a prior registration or approval of the Financial Supervisory Commission of Taiwan. No person or entity in Taiwan has been authorised to provide the information and to offer the service in Taiwan.

- Thailand: Please note that none of the material and information contained, or the relevant securities or products specified herein is approved or registered in Thailand. Interests in the relevant securities or products may not be offered or sold within Thailand. The attached information has been provided at your request for informational purposes only and shall not be copied or redistributed to any other person without the prior consent of OCBC Singapore or its relevant entities and in no way constitutes an offer, solicitation, advertisement or advice of, or in relation to, the relevant securities or products by OCBC Singapore or any other entities in OCBC Singapore’s group in Thailand.

- The Philippines: The information contained in this document is not intended to constitute a public offering of securities under the Securities Regulation Code of the Philippines.

- Dubai International Financial Centre (DIFC): OCBC Singapore is not a financial institution licensed in the Dubai International Financial Centre ("DIFC") or the United Arab Emirates outside of the DIFC and does not undertake banking or financial activities in the DIFC or the United Arab Emirates nor is it licensed to do so.

- United Kingdom: In the United Kingdom, this document is being made available only to the person or the entity to whom it is directed being persons to whom it may lawfully be directed under applicable laws and regulations of the United Kingdom (such persons are hereinafter referred to as ‘relevant persons’). Accordingly, this document is communicated only to relevant persons. Persons who are not relevant persons must not act on or rely on this document or any of its contents.

- United Arab Emirates (UAE): The offering of certain products in this document has not been and will not be registered with the Central Bank of United Arab Emirates or Securities & Commodities Authority in the United Arab Emirates. Any products in this document that are being offered or sold do not constitute a public offering or distribution of securities under the applicable laws and regulations of the United Arab Emirates. This document is not intended for circulation or distribution in or into the UAE, other than to persons in the UAE to whom such circulation or distribution is permitted by, or is exempt from the requirements of, the applicable laws and regulations of the United Arab Emirates. The distribution of the information contained herein by the recipient is prohibited. Where applicable, this document relates to securities which are listed outside of the Abu Dhabi Securities Exchange and the Dubai Financial Market. OCBC Singapore is not authorized to provide investment research regarding securities listed on the exchanges of the United Arab Emirates.

- United States of America: This product may not be sold or offered within the United States or to US persons.

Did you find what you were looking for?

That's great! Is there anything else you would like to share?

Did you find what you were looking for?

This is embarrassing! How can we improve your experience?

An error occurred. Please check that you have input the correct information before re-submitting.

We are unable to capture your message at the moment. Please try again shortly.

Thank you for your feedback.

This will help us serve you better.

General disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore.

1. Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

2. This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

3. Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

4. If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

5. We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

6. No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

7. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

8. Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

9. Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

10. The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

11. OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

12. You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

13. Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

14. There are links or hyperlinks which link you to websites of other third parties (the “Third Parties”). OCBC Bank hereby disclaims liability for any information, materials, products or services posted or offered on the website of the Third Parties.

Collective Investment Schemes

1. A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund.

2. The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

3. Investment involves risks. Past performance figures do not reflect future performance.

4. Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units.

Global Equities disclaimer

- Dividend growth is not guaranteed, nor are companies in which you invest obliged to pay dividends;

- Companies may go bankrupt rendering the original investment valueless;

- Equity markets may decline in value;

- Corporate earnings and financial markets may be volatile;

- If there is no recognised market for equities, then these may be difficult to sell and accurate information about their value may be hard to obtain;

- Smaller company investments may be difficult to sell if there is little liquidity in the market for such equities and there may be substantial differences between the buying price and the selling price;

- Equities on overseas markets may involve different risks to equities issued in Singapore;

- With regards to investments in overseas companies, foreign exchange rates may move in an unfavourable direction affecting adversely the valuation of investments in base currency terms.

Dual Currency Returns

- By buying Dual Currency Returns, you are giving us the right to repay you at a future date in a different currency from the currency in which you made your original investment, even if you would prefer not to be paid in this currency at that time. Dual Currency Returns are affected by foreign exchange rates, which may affect how much you get back from your investment. You may receive less than you originally invested.

- Foreign exchange control restrictions may apply to the foreign currencies linked to your Dual Currency Returns. As a result, we may repay your investment and interest in a different currency. You may receive less than you originally invested when the amount of this different currency is converted back to the base currency (the currency you originally invested). You may be able to get information on foreign exchange control restrictions, if any, for each foreign currency offered in relation to Dual Currency Returns, from the relevant monetary, regulatory or other governmental authorities for that currency.

- We will not end Dual Currency Returns before the maturity date (the date they are due to end). You may, however, withdraw the amount you originally invested before the maturity date. If you do this, please remember that you will have to pay any charges that apply which are calculated based on the amount of the time remaining before maturity date, as well as current market conditions relating to strike prices, foreign exchange rates and changes in the underlying foreign exchange pair. These charges may mean that you get back much less than you originally invested. Please feel free to approach your relationship manager for details of the procedures and charges that apply if you withdraw your Dual Currency Returns investment before the maturity date.

- Dual Currency Returns are not insured deposits for the purposes of the Deposit Insurance and Policy Owners’ Protection Schemes Act of Singapore.

Foreign Currency

- Foreign currency investments or deposits are subject to inherent exchange rate fluctuation that may provide opportunities and risks. Consequently, exchange rate fluctuations may affect the value of your foreign currency investments or deposits.

- Earning on foreign currency investments or deposits may change depending on the exchange rates prevalent at the time of their at maturity if you choose to convert.

- Exchange controls may apply to certain foreign currencies from time to time.

- Any pre-termination costs will be taken and deducted from your deposit directly and without notice.