Back-to-Back Letter of Credit

Secure the goods with your buyer’s Letter of Credit as collateral

Mitigate payment and funds receipt risk

Assures your seller of payment by relying on our credit-worthiness and matching against funds receipt from your buyer’s Letter of Credit.

Assures your seller of payment by relying on our credit-worthiness and matching against funds receipt from your buyer’s Letter of Credit.

Facilitate complex structure

Secure goods from seller based on contract with buyer.

Secure goods from seller based on contract with buyer.

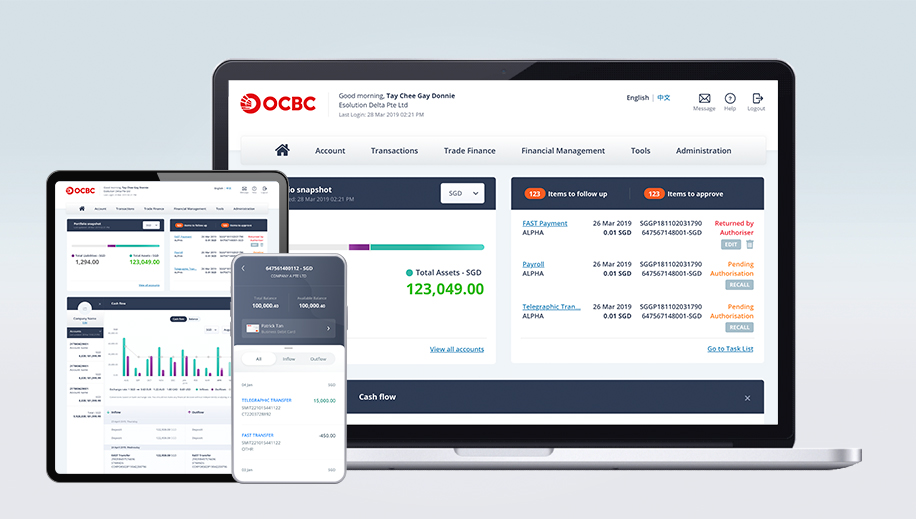

Seamless online experience

Apply and manage your trade finance transactions on desktop or mobile and get real-time status updates.

Apply and manage your trade finance transactions on desktop or mobile and get real-time status updates.

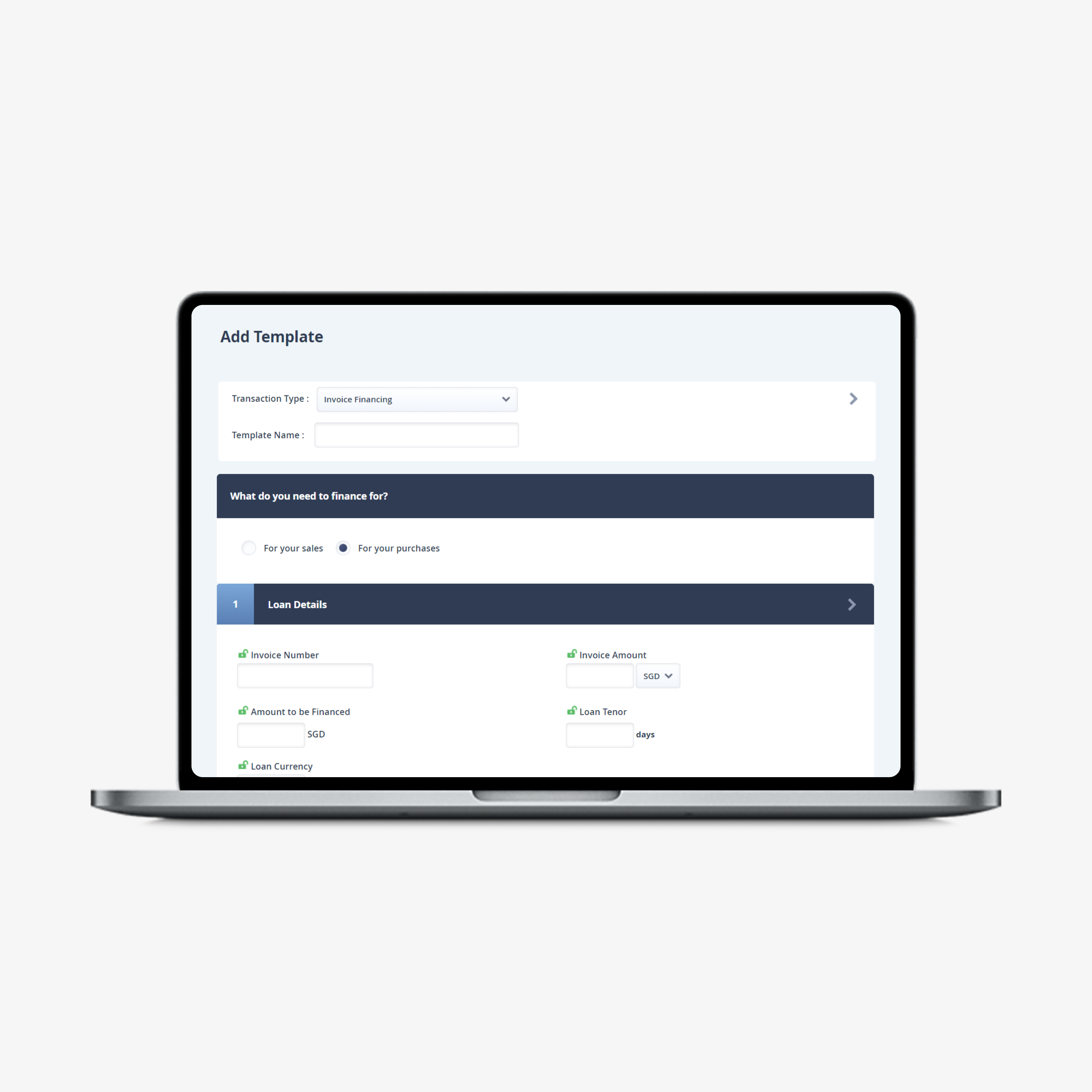

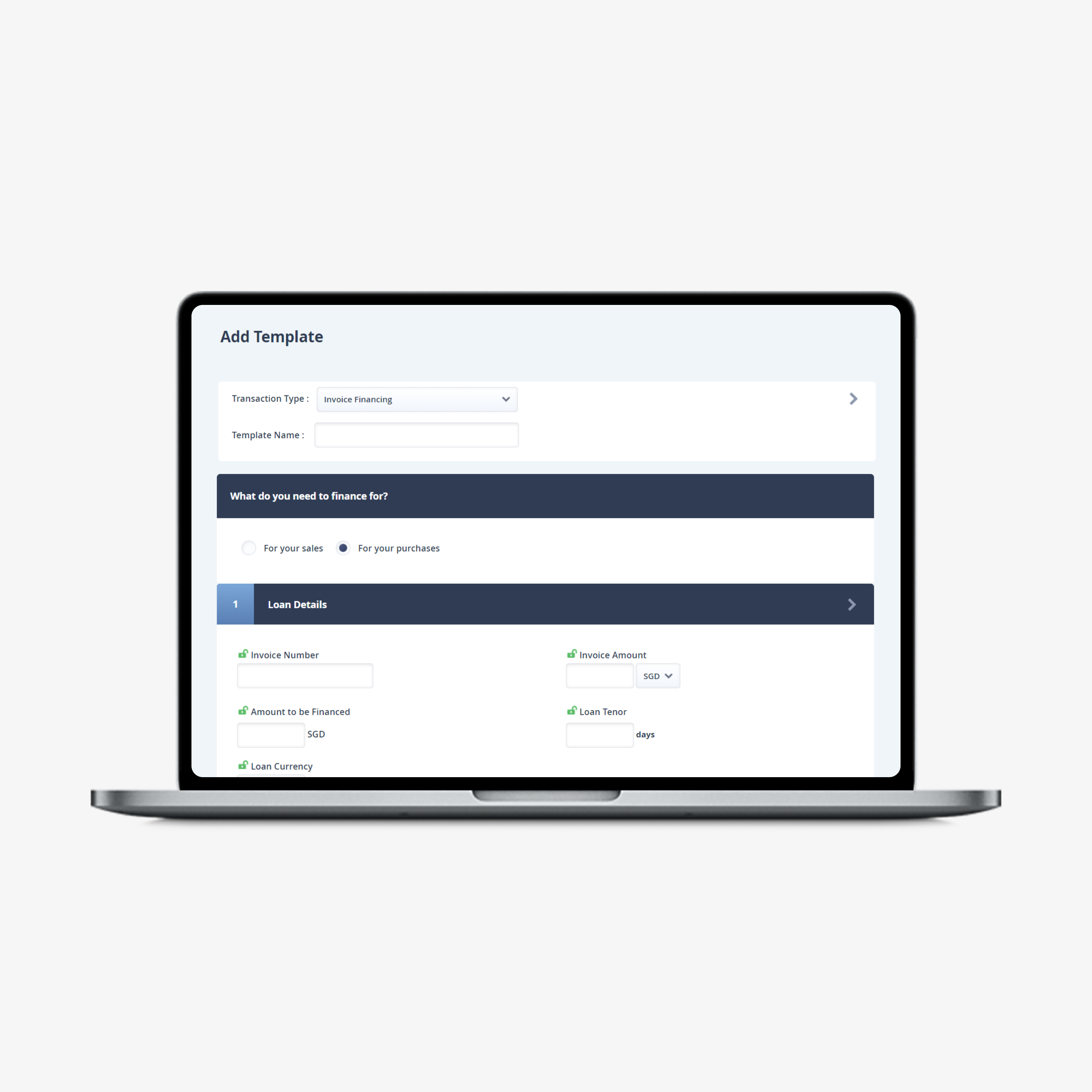

Apply for Back-to-Back Letter of Credit online

Save time with customer templates. Customise transaction templates for regular transactions with your suppliers and buyers.

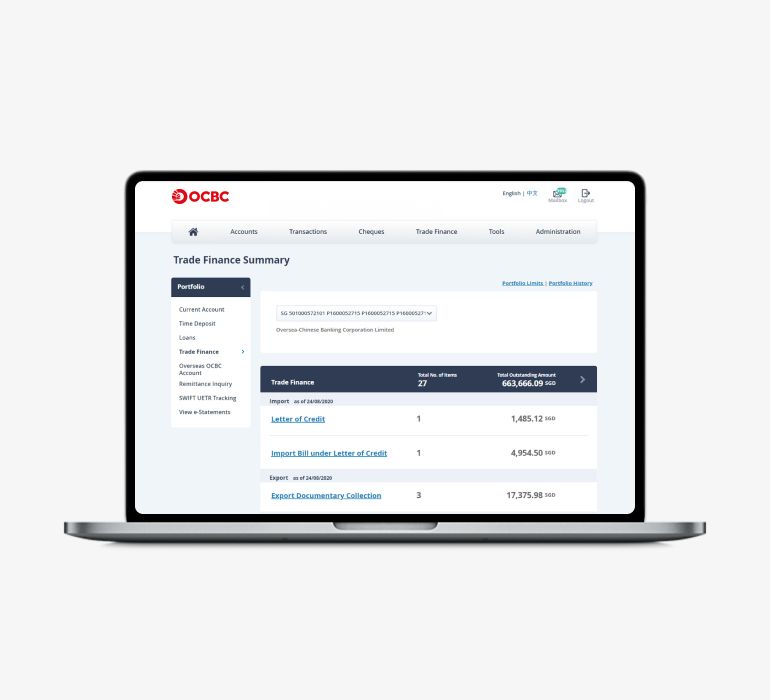

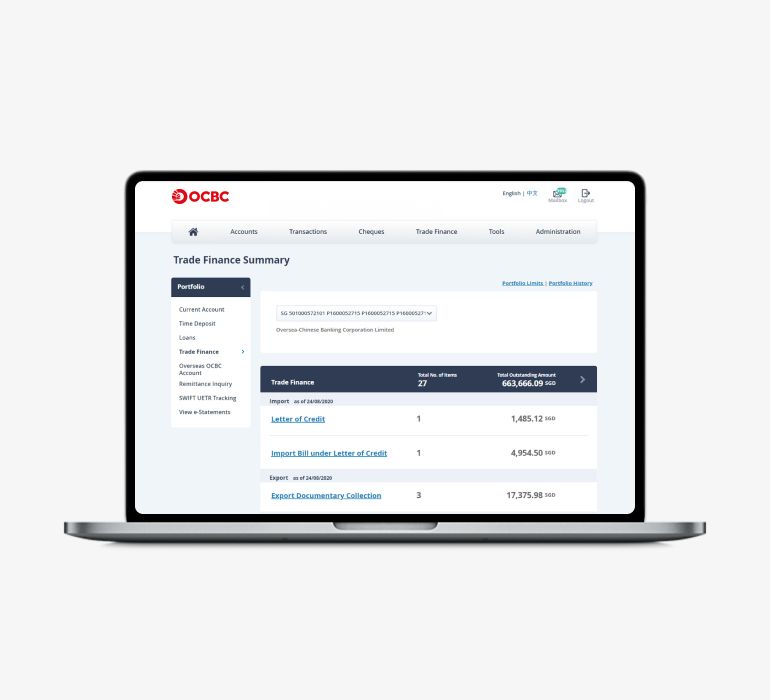

Track transactions in real time

Get an overview of your trade finance portfolio and obtain status updates of your trade finance applications submitted via OCBC Velocity.

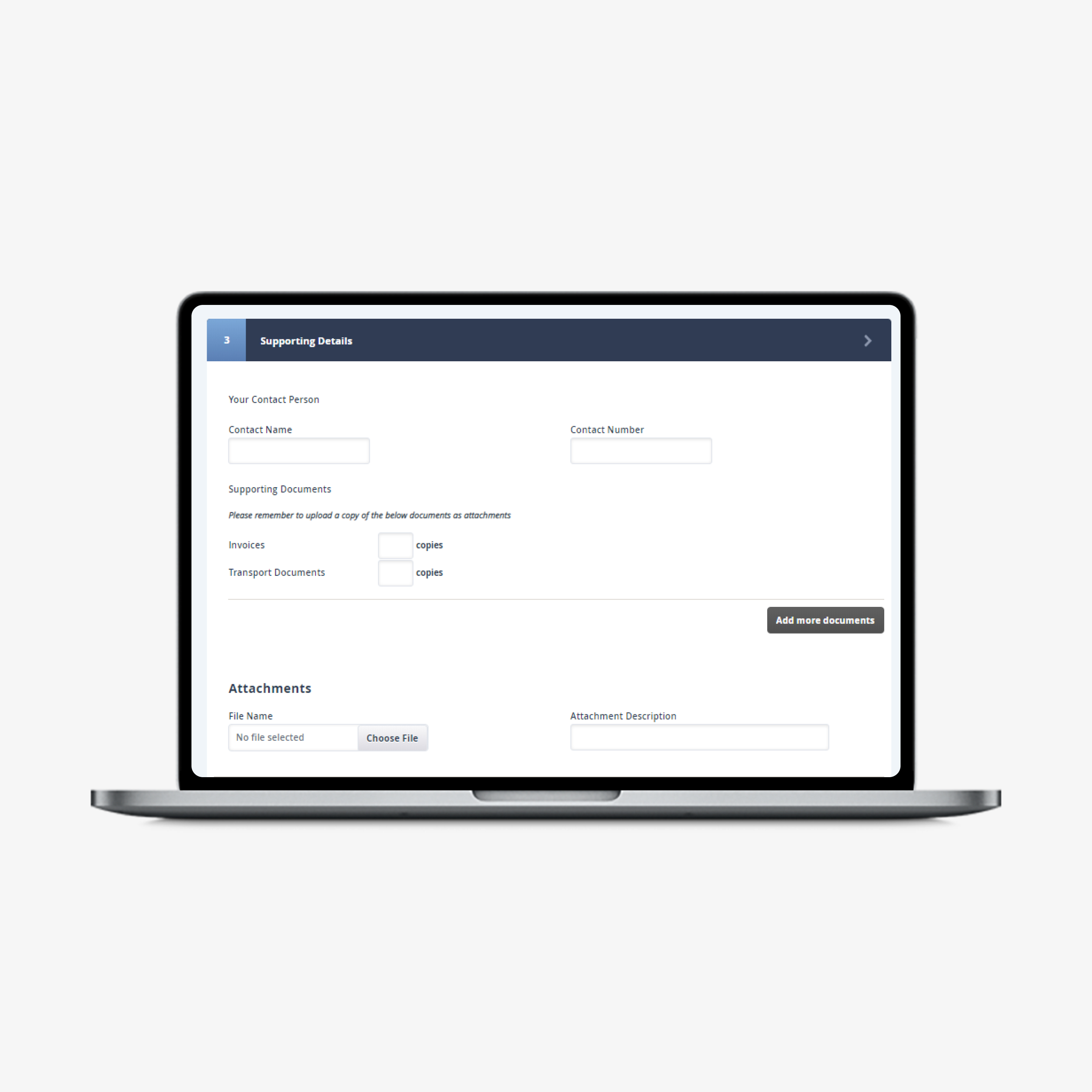

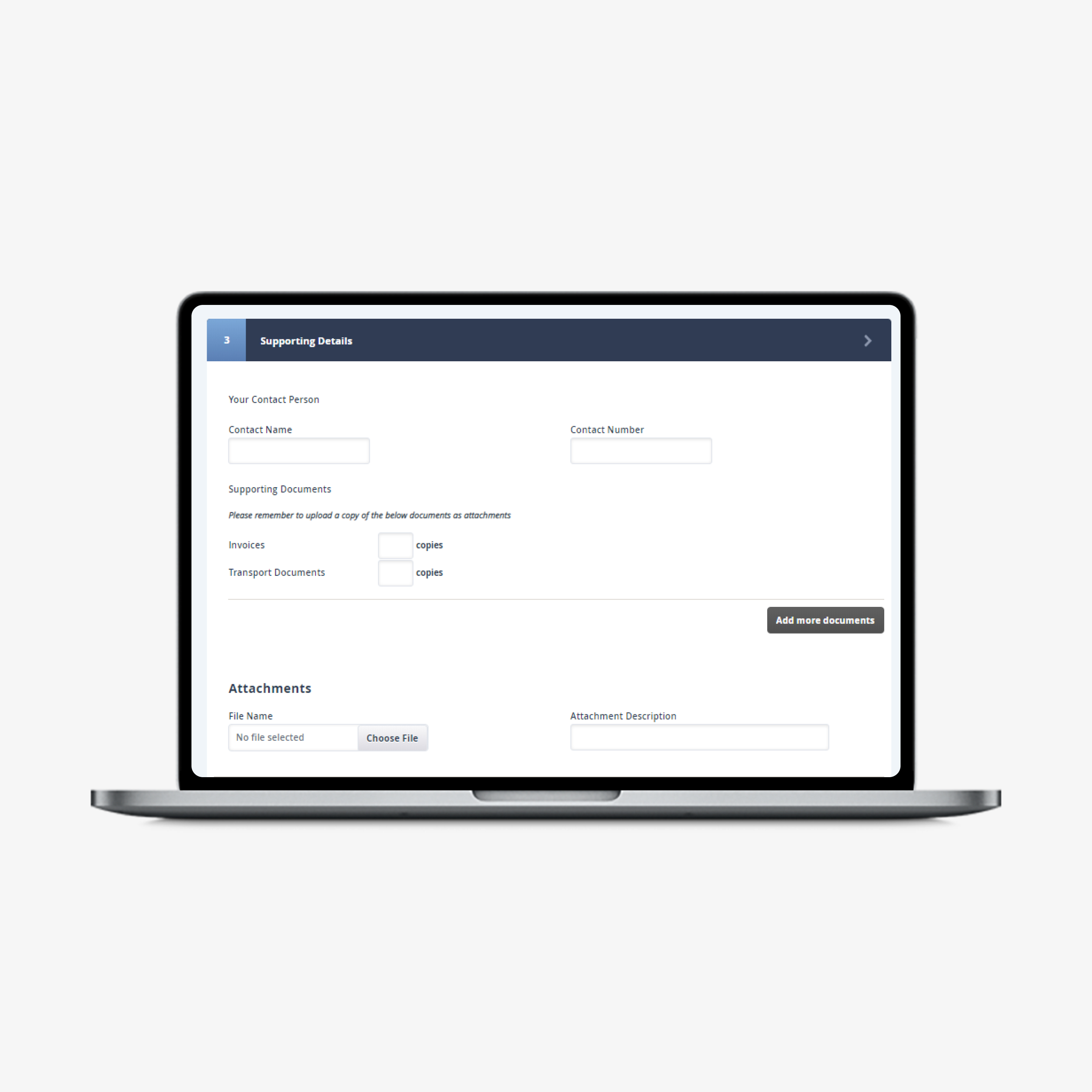

Quicker processing without hard copy

Submit your supporting documents online for quicker processing.

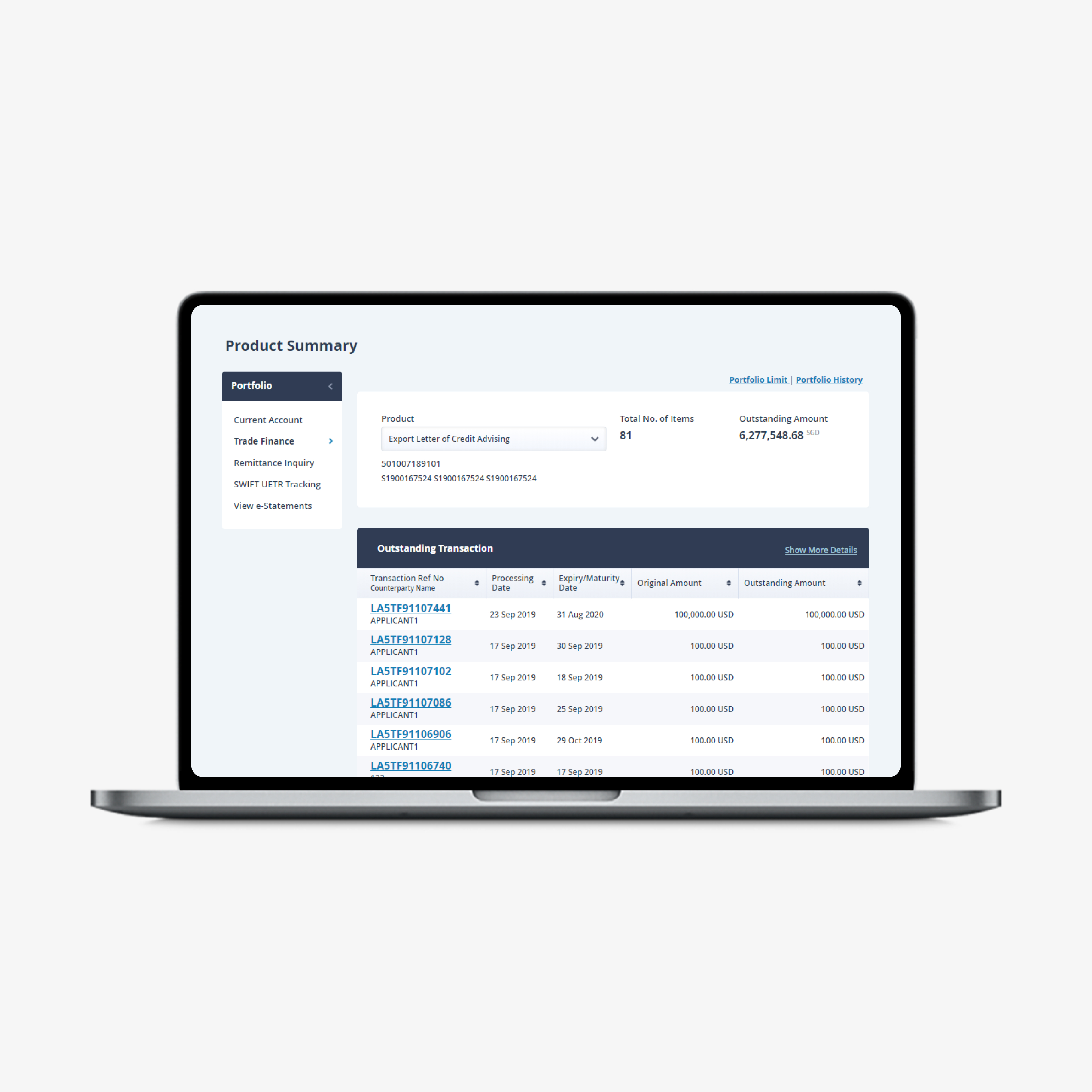

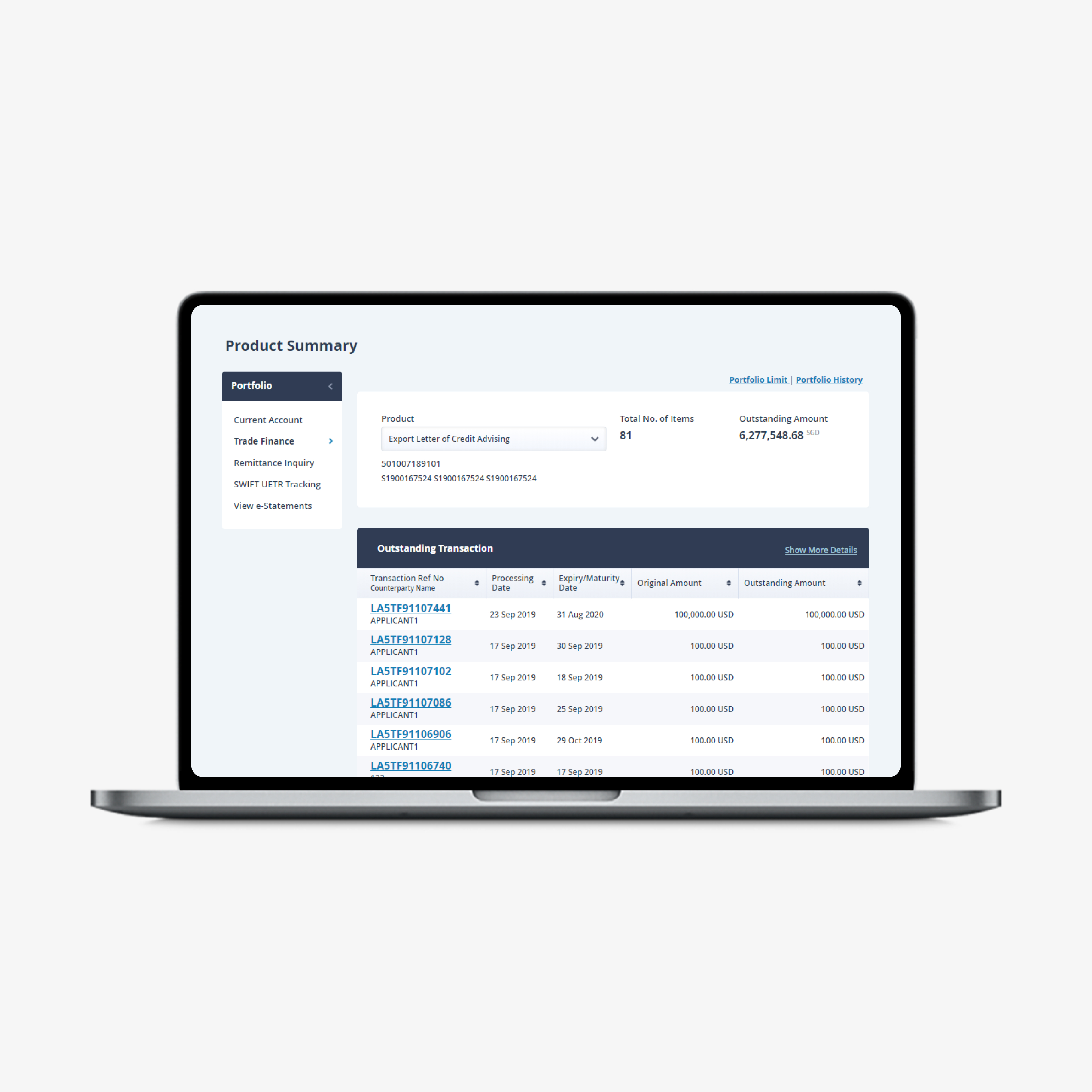

View your history instantly

Retrieve an electronic version of your advices anytime, anywhere on OCBC Velocity.

Don’t have OCBC Velocity?

Apply for OCBC Velocity to perform your first trade finance transaction and manage your trade finance portfolio on-the-go.

Fees and charges

Export Letter of Credit bill processing

Take your business to the next level with us

Our trade finance specialists are here to understand your business requirements.

Speak to us today and apply.

Mondays – Fridays, 9am to 6pm (excluding public holidays)

Transferable Letter of Credit

Secure the goods from your seller by transferring your buyer's Letter of Credit

Import Letter of Credit

Assures payment when the seller’s documents meet the conditions in the Letter of Credit

Digital Business Banking

Take your business forward with OCBC Velocity. Maximise our powerful features and advanced tools to grow your business more effectively in this modern economy.