Transferable Letter of Credit

Secure the goods from your seller by transferring your buyer's Letter of Credit

Expand procurement network

Facilitate the buying and selling process for a middleman.

Facilitate the buying and selling process for a middleman.

Assures end seller with payment assurance

As a first Beneficiary, you will be able to provide an LC to your actual supplier without using your own credit facility

As a first Beneficiary, you will be able to provide an LC to your actual supplier without using your own credit facility

Facilitate complex structure

Secure goods from your seller with a contract from your buyer.

Secure goods from your seller with a contract from your buyer.

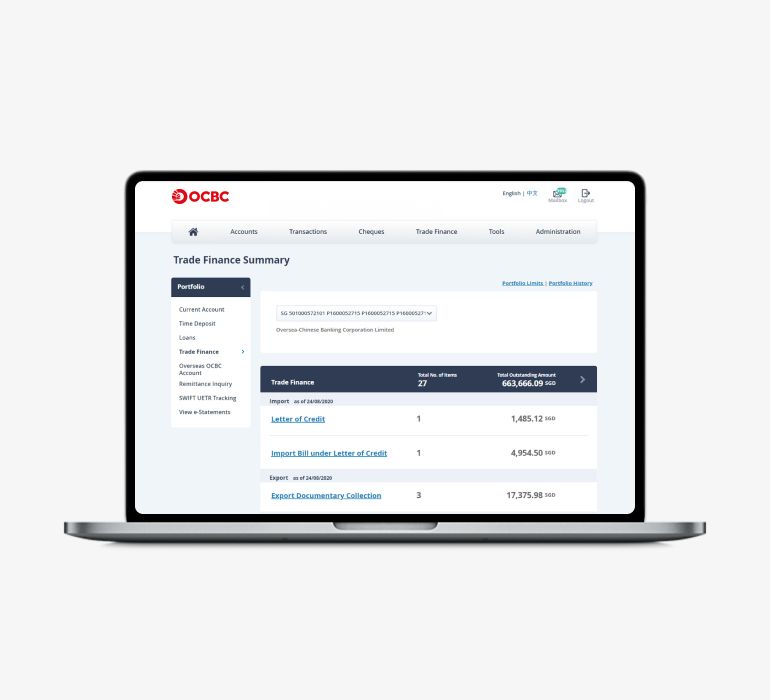

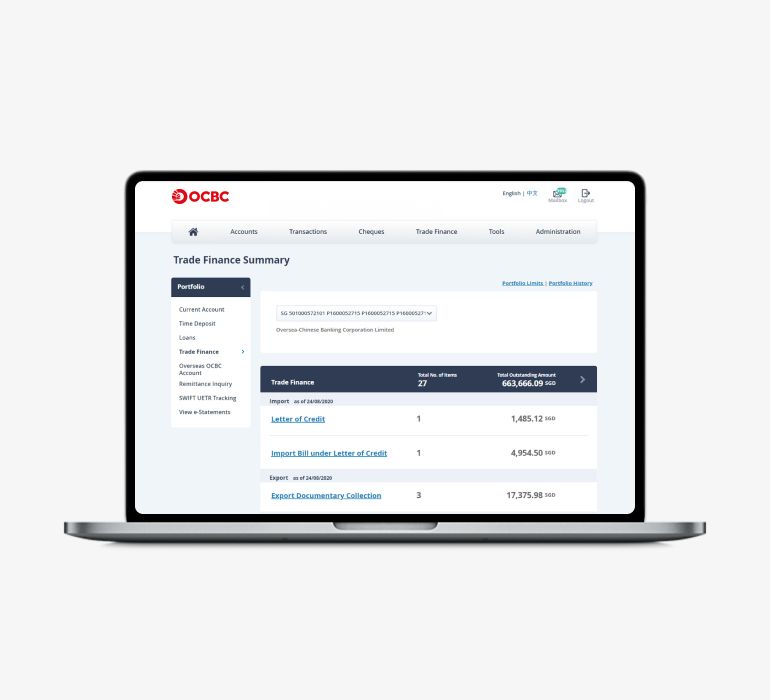

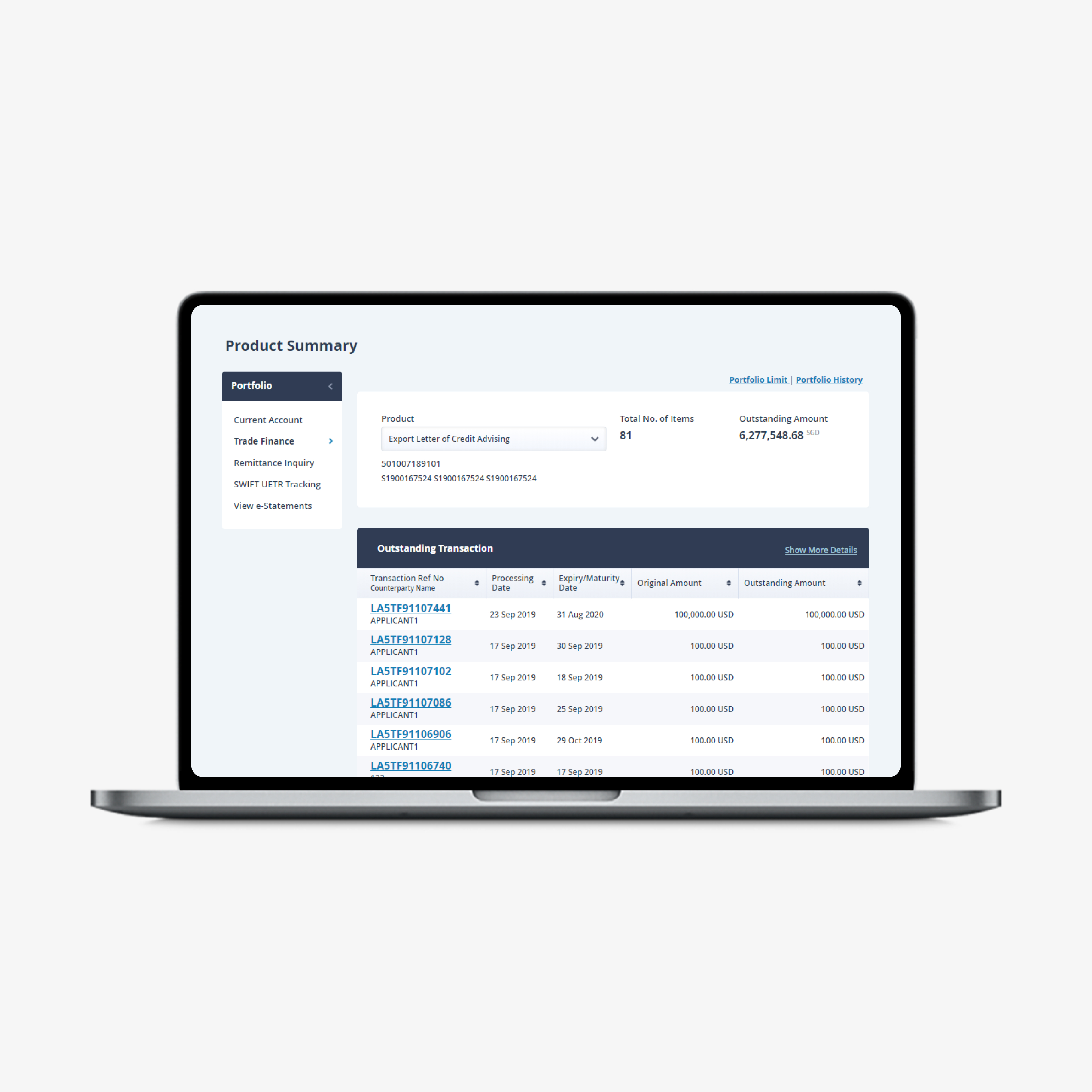

Track transactions in real time

Get an overview of your trade finance portfolio and obtain status updates of your trade finance applications submitted via OCBC Velocity.

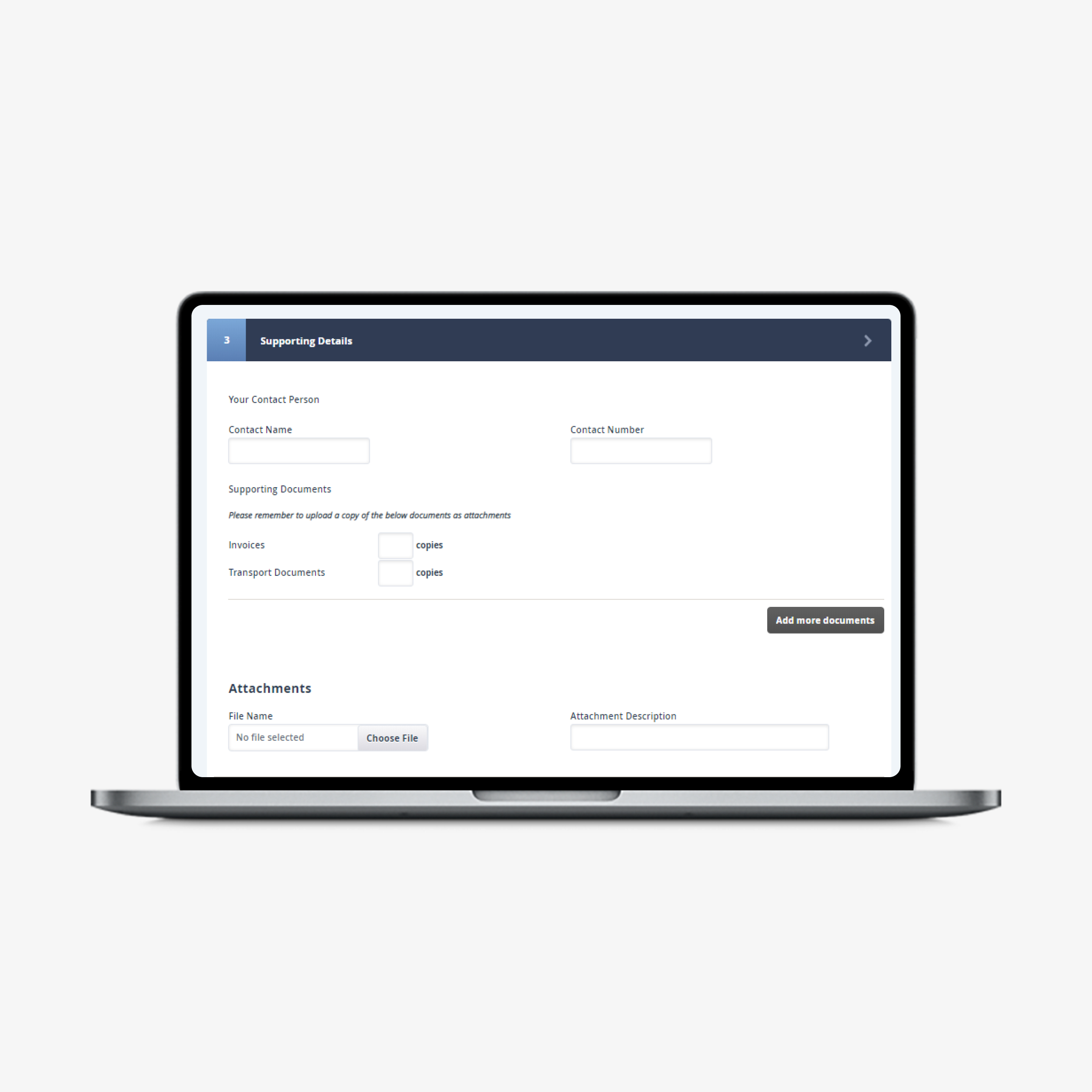

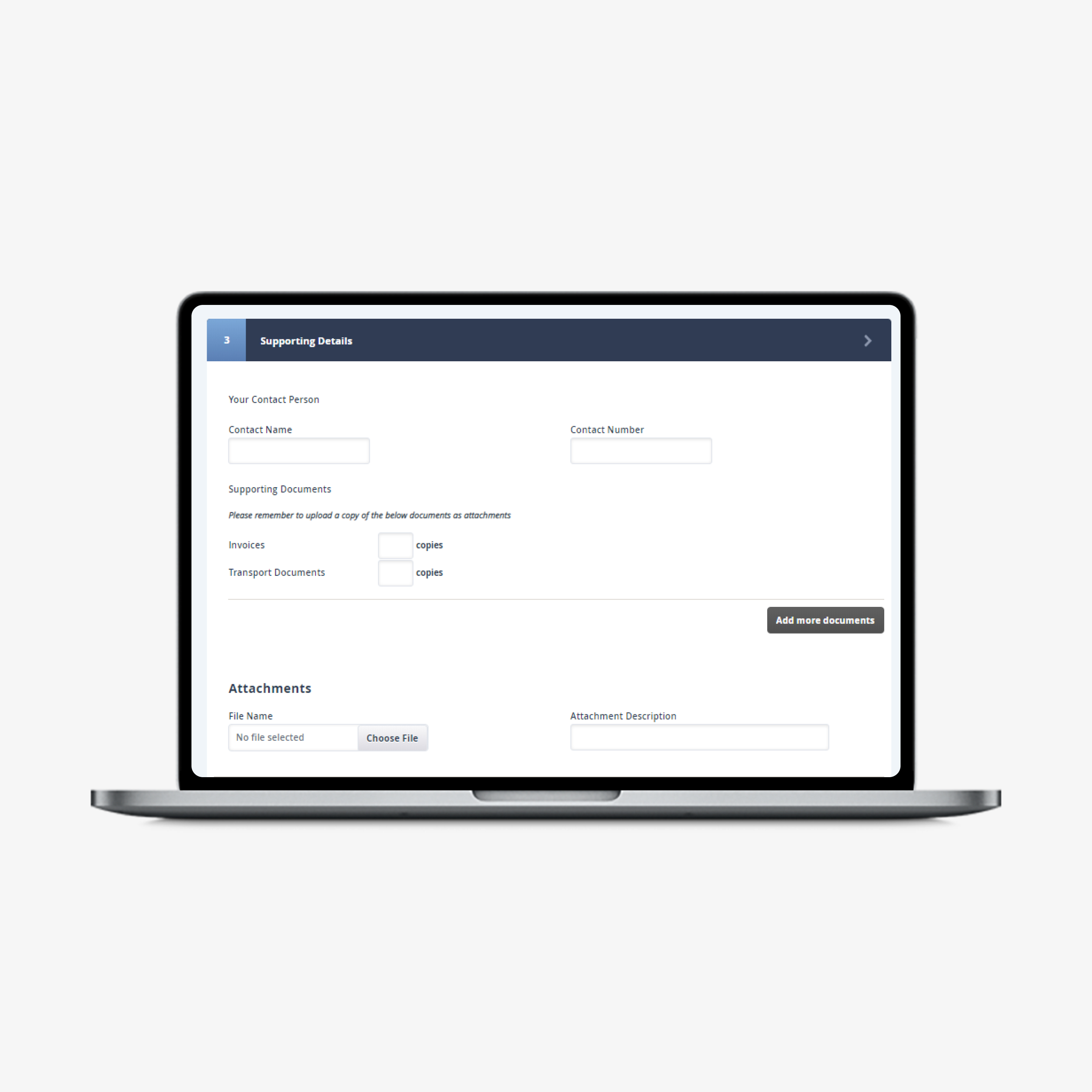

Quicker processing without hard copy

Submit your supporting documents online for quicker processing.

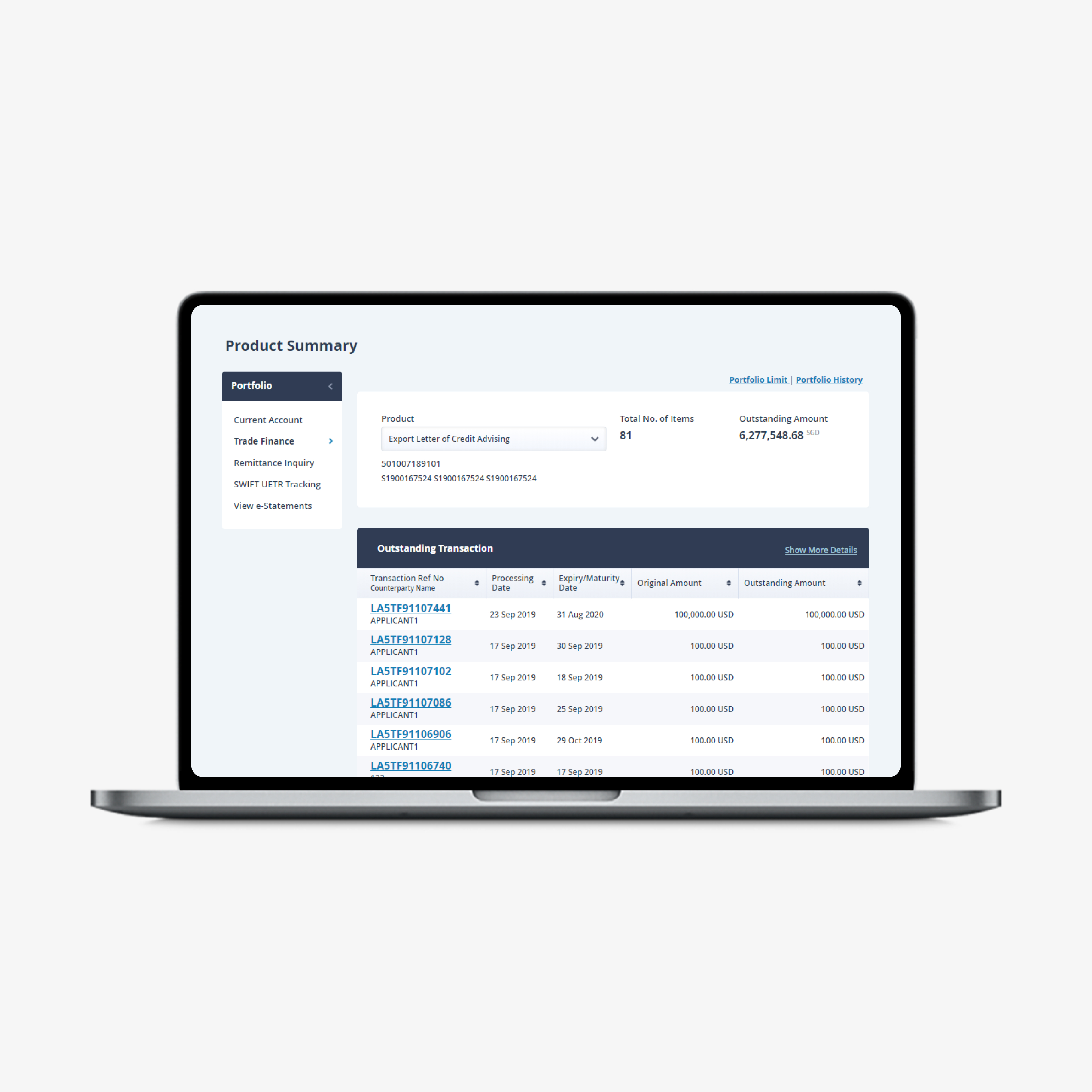

View your history instantly

Retrieve an electronic version of your advices anytime, anywhere on OCBC Velocity.

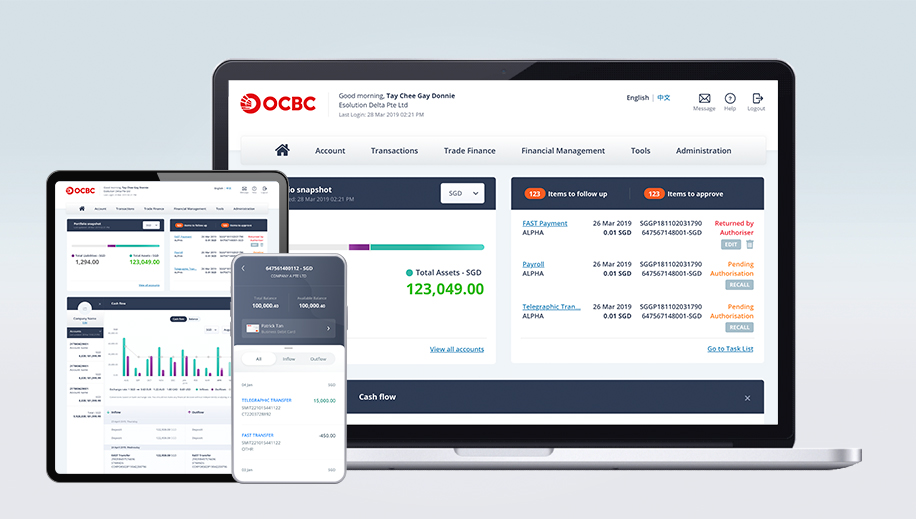

Don’t have OCBC Velocity?

Apply for OCBC Velocity and manage your trade finance portfolio on the go.

Fees and charges

Take your business to the next level with us

Our trade finance specialists are here to understand your business requirements.

Speak to us today and apply.

Mondays – Fridays, 9am to 6pm (excluding public holidays)

Common questions

A Transferable Letter of Credit allows the middleman to provide a Letter of Credit to the supplier. This is done by transferring the Letter of Credit that he receives from the buyer. You do not need a credit facility to apply for a Transferable Letter of Credit.

You can apply even if you do not have a credit facility with us.

Invoice Financing (Sales)

Finance your invoices for better cash flow management

Export Documentary Collection

Intermediary services that facilitate

trade settlement between

buyer & seller

Digital Business Banking

Take your business forward with OCBC Velocity. Maximise our powerful features and advanced tools to grow your business more effectively in this modern economy.