| Transfer Currency | Beneficiary Country | Maximum Limit (in Transfer Currency) |

|---|---|---|

| AUD | Australia | 100,000 |

| CAD | Canada | 100,000 |

| DKK | Denmark | 600,000 |

| GBP | United Kingdom | 100,000 |

| NOK | Norway | 600,000 |

| NZD | New Zealand | 100,000 |

| USD | United States | 100,000 |

INTERNATIONAL AUTOMATED CLEARING HOUSE (IACH)

Low-cost international fund transfer

Save on transaction fees for cross-border transfers in 7 major foreign currencies.

IACH stands for International Automated Clearing House. This is a cross-border transfer service that enables you to electronically transfer payments to your beneficiary in their country using the local currency.

- International Automated Clearing House

| Factors | International Automated Clearing House |

|---|---|

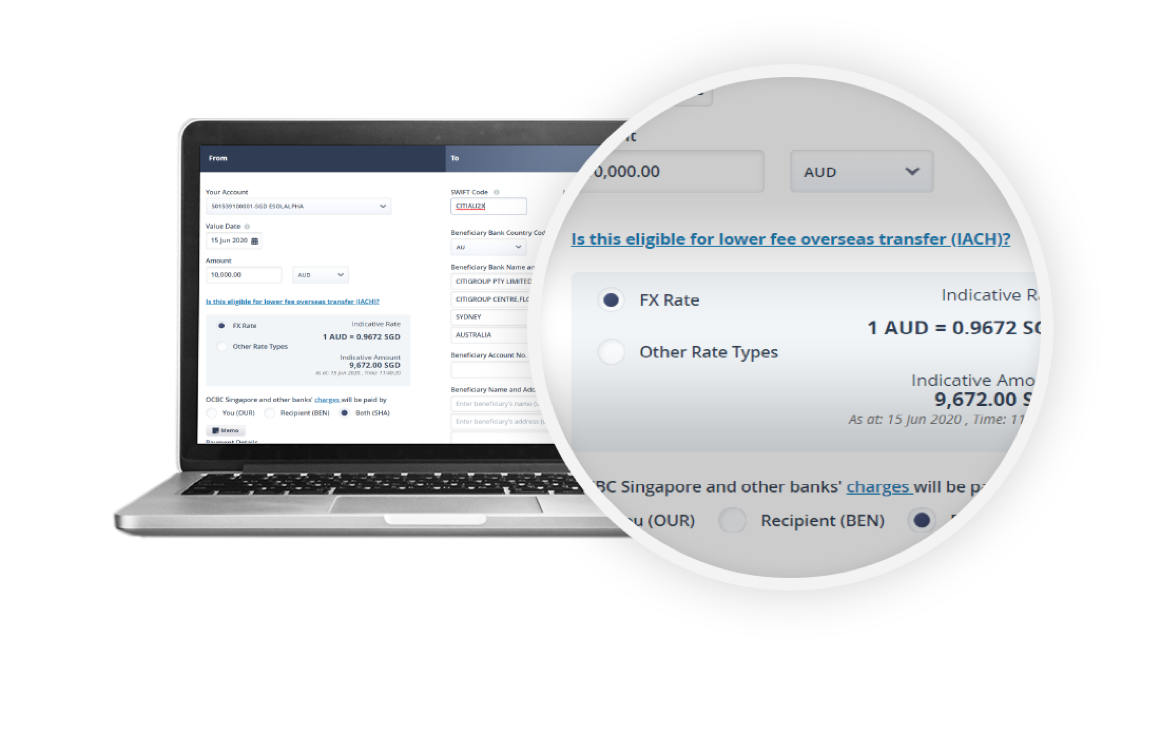

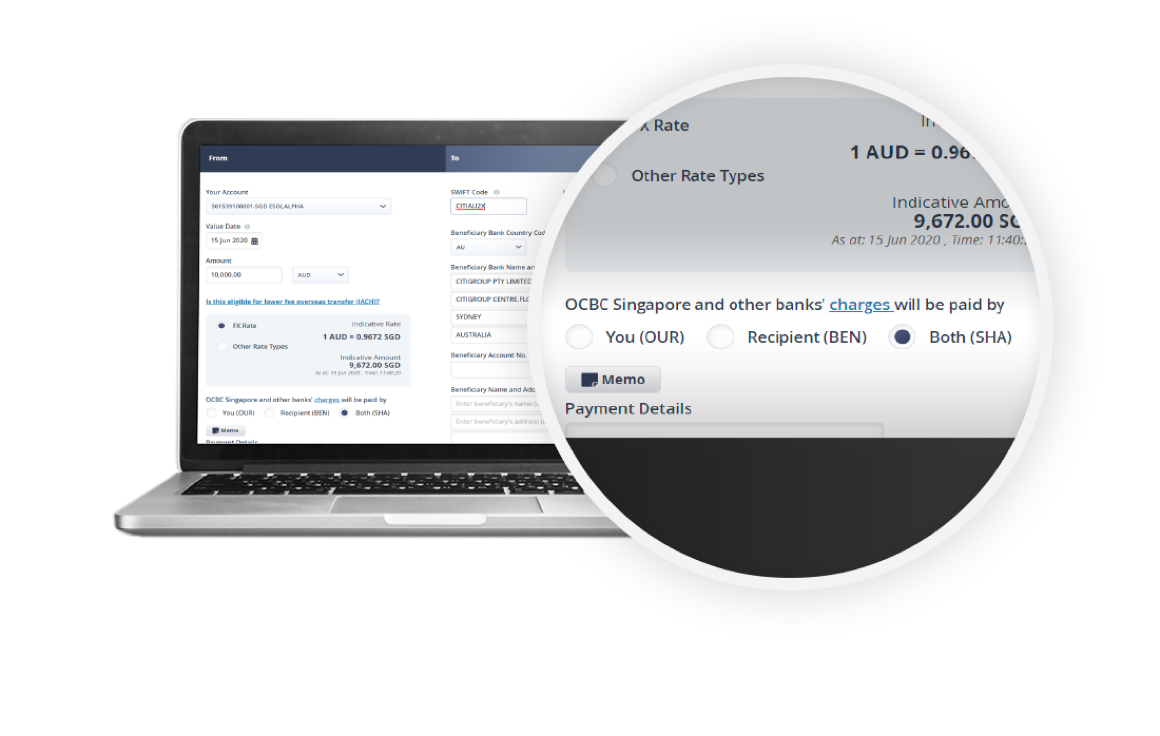

| Pricing | Flat Fee of just S$30 per transaction |

| Speed | Typically takes 2 to 3 business days |

| Payment value | Beneficiary receives full amount |

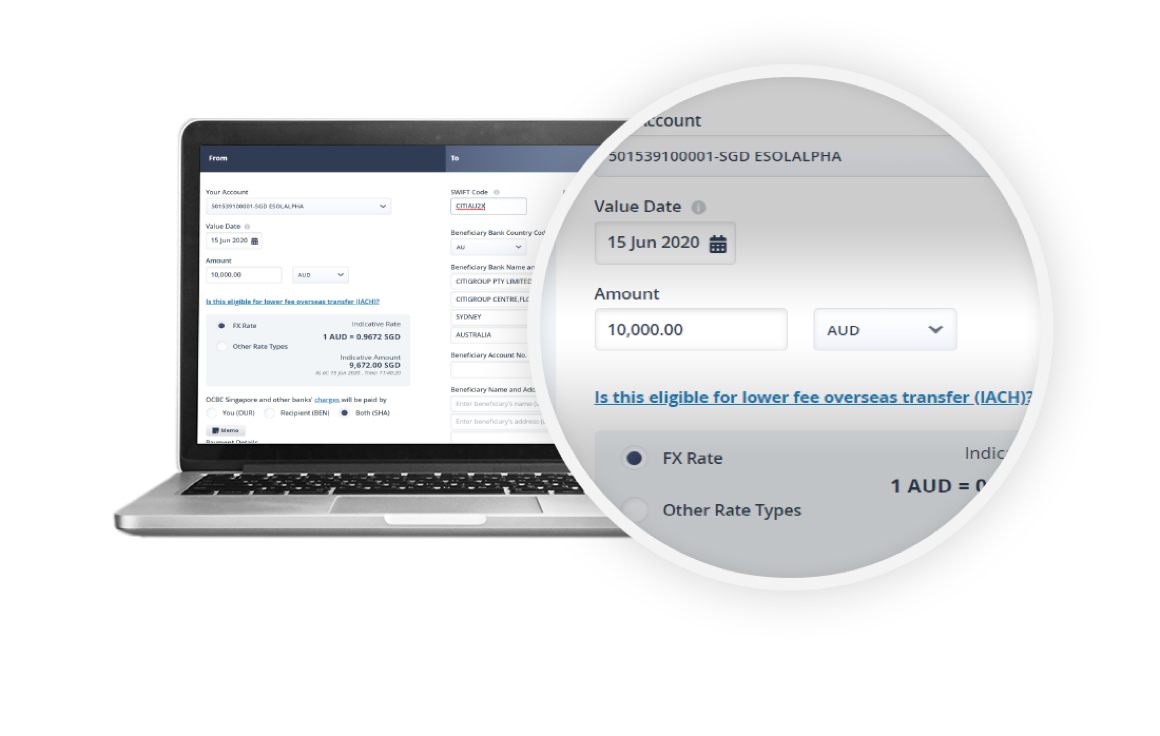

The following steps and qualifying conditions are required to enable the IACH transfer ‘option’.

After IACH option is enabled:

Eligibility requirements

Who is this service available for

Available to all business banking Velocity users* (as per T&Cs) Refer to “Making an IACH transfer” for steps.

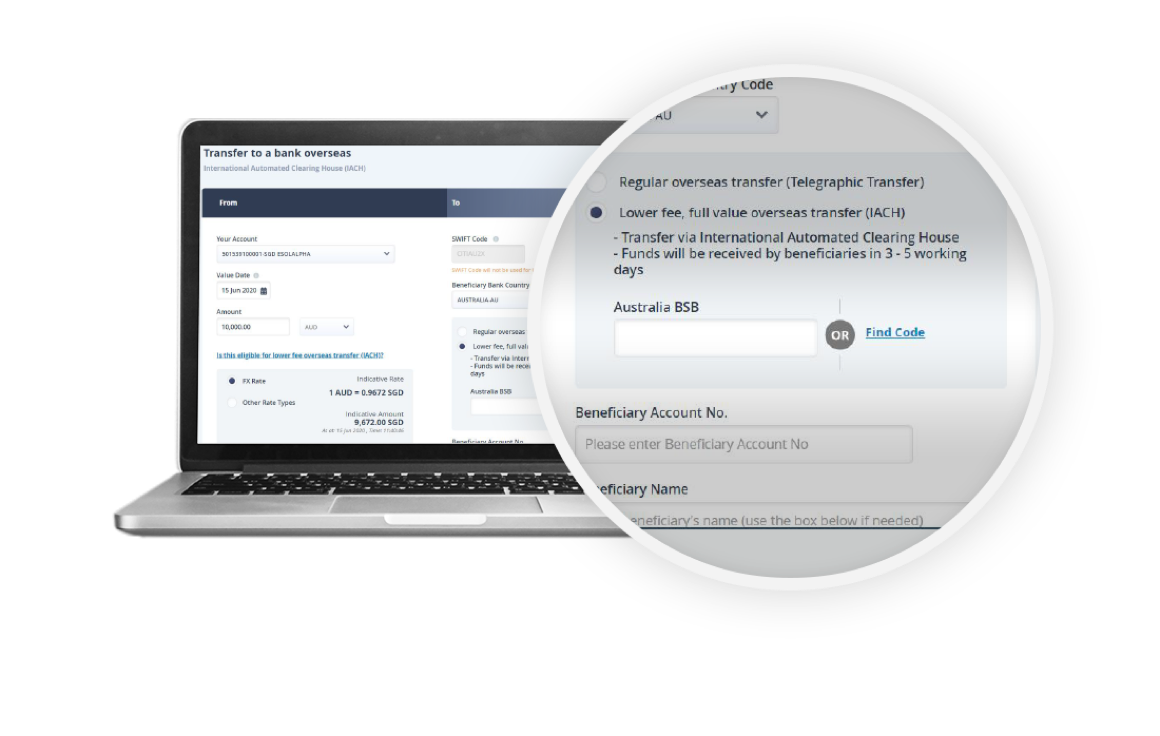

Domicile currency must be paid into domiciled originating beneficiary country (Example AUD to Australia)

Fees and charges

Transfer fee

Flat fee of S$30 per transfer

Pricing guide and notices

Terms and conditions

*Available for Standard and Classic Velocity@ocbc service packages only. For premium packages, please contact your Relationship Manager or call our Business Banking Hotline at +65 6922 3199 (Open: Monday to Friday excluding public holidays from 8am-8pm).

Not an OCBC Business Banking customer?

Open your OCBC Business Account and enjoy savings on Overseas Transfers. Account opening is instant!

Make overseas transfers with IACH now.

If you do not have OCBC Velocity, apply now.

Common questions

Some IACH payments require exact information such as local clearing code, purpose of payment, specific beneficiary account length and format. Refer below for account details requirements.

You can follow the on-screen instruction in Velocity@ocbc to find the code you require.

| CCY | Country | Clearing Code | Account Number |

|---|---|---|---|

| AUD | Australia | 6-digit Australia BSB Code | Max 9 digits |

| CAD | Canada | 9-digit Canadian Clearing Code | Max 12 digits |

| DKK | Denmark | 4-digit Clearing Code (NCC) | Max 10 digits |

| GBP | United Kingdom | 6-digit UK Domestic Sort Code | Max 11 digits |

| NOK | Norway | 4-digit Clearing Code (NOBIC) | Must be 11 digits |

| NZD | New Zealand | 4-digit Clearing Code (NCC) | Must be 10 digits |

| USD | United States of America | 9-digit ACH ABA Code | Max 17 digits |

Once the transaction is processed by OCBC, the transaction status will be updated as successful and the beneficiary is expected to receive the funds in 3 business days. In the event where the transaction is rejected by the partner or beneficiary bank, the return status will not be updated. You can expect to receive the return funds in 4 to 9 business days.

In the event of a Return Fund, the bank will generate Credit Advice, and eAlert. You will receive SMS and/or Email as per your subscription.

No. MT103 is not available as this is not a TT transaction. Customers can have the option to notify beneficiary through email or Fax at time of application.