eGIRO stands for electronic GIRO. It is a nationwide initiative that digitises the GIRO application process with an aim of significantly reducing the turnaround time. This is a joint initiative by The Association of Banks in Singapore (ABS), Monetary Authority of Singapore (MAS) and Participating Banks.

OCBC eGIRO

eGIRO applications are now quick and easy

eGIRO is a nationwide service that fully digitalises the current paper-based GIRO application process.

The eGIRO service will process applications efficiently and securely within minutes, enabling consumers, businesses and billing organisations to set up their GIRO instructions in real time.

See how eGIRO works and its benefits to businesses and billing organisations.

Say goodbye to:

- Long turnaround time of up to 4 weeks

- Manually intensive process with multiple handoffs

- Human errors

- Delay in the collection of funds

- For Billing Organisations, contact OCBC Business Banking at +65 6538 1111 (Monday to Friday. Excluding public holidays from 8am - 8pm) or through our enquiry form

- For customers/business applicants of Billing Organisations, follow the steps below:

Eligibility requirements

To participate in eGIRO as a billing organisation

- Must be a OCBC corporate customer

- Must have a customer-facing website or application (eGIRO via an App interface will be supported by the industry at a later phase)

- Must have technical resources to develop their website/application and build a connectivity with the eGIRO Aggregator platform

To apply for eGIRO with a participating billing organisation

- Applicants should ensure that their billing organisation is an eGIRO participating entity

- Applicants should be an existing customer of the participating billing organisation

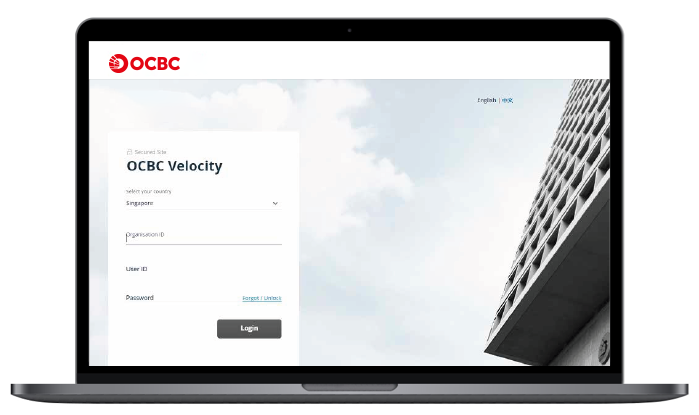

- Applicants should have an OCBC Business Account (SGD) and Velocity access

eGIRO processing time

1Time for approval

- Processing time is subject to time taken for the applicant to approve and submit the eGIRO request, and for the Billing organisation to send the eGIRO creation API to the applicant bank.

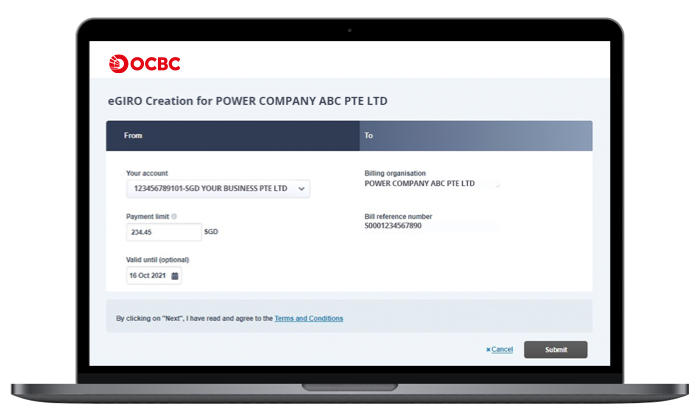

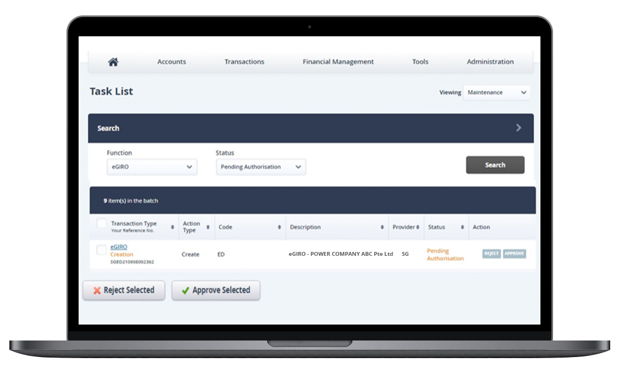

- Time taken for applicant to approve and submit the eGIRO request: Consumer applicants must submit the eGIRO application request within 10 mins. Business applicants must approve and submit the eGIRO applicant request within 48 hours. Otherwise, the request will lapse and applicant must initiate a new request via the Billing organisation’s website or application.

- Time taken for the Billing organisation to send the eGIRO creation API to the applicant bank: Some Billing organisations (such as the insurance industry) may take up to 2 weeks to assign a customer reference number and send the eGIRO creation API to the applicant bank.

Terms and conditions

Business account terms and conditions

Billing organisation and Applicants agree to the eGIRO T&Cs as listed in the business account terms and conditions

General

More questions and answersAt launch, 8 participating banks* will be taking part in eGIRO: Bank of China, DBS Bank/POSB, The Hongkong and Shanghai Banking Corporation Limited, Industrial and Commercial Bank of China, Maybank, OCBC Bank, Standard Chartered Bank and UOB.

For more information, please refer to https://www.abs.org.sg/.

*Citibank will be joining in Jan 2022

No. eGIRO is currently not replacing hardcopy GIRO forms. Hardcopy GIRO form submission will still be available to billing organisations and applicants.

No. Existing GIRO arrangements or new setups via hardcopy forms will not need to be migrated and will continue to be valid.

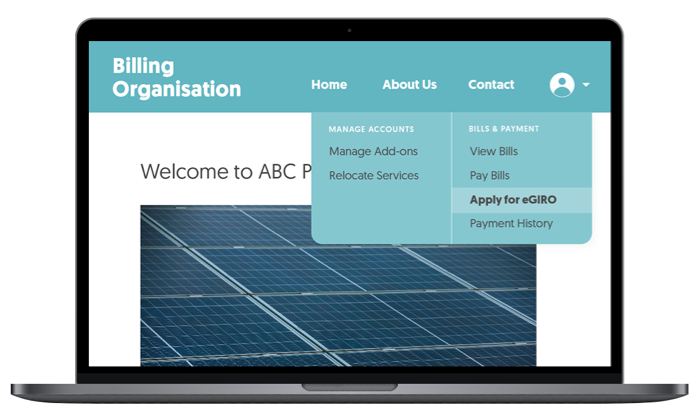

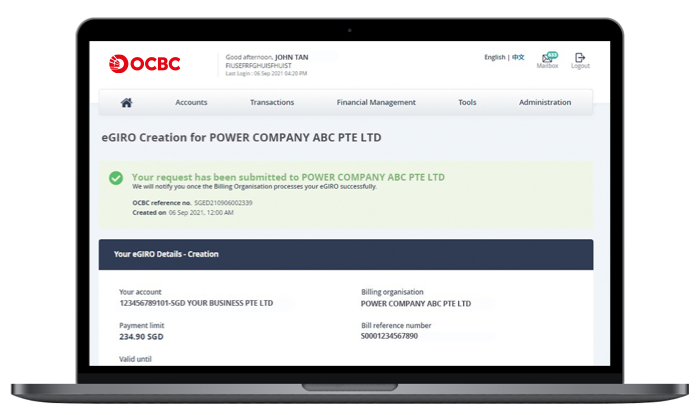

Instead of submitting hardcopy GIRO forms to billing organisations, applicants can now apply for GIRO via the billing organisation's website or application* to set up GIRO in minutes. Applicants simply specify the designated bank for the payment and are redirected to their bank’s internet banking login page. At the bank’s internet banking login page, applicants log in with their user ID and password and select their bank account for submission. Applicants will subsequently receive a confirmation that the application is successful.

*eGIRO via an App interface will be supported by the industry at a later phase

Please contact your designated OCBC Relationship Manager or OCBC Global Transaction Banking Sales Manager. Alternatively, fill up the form below.