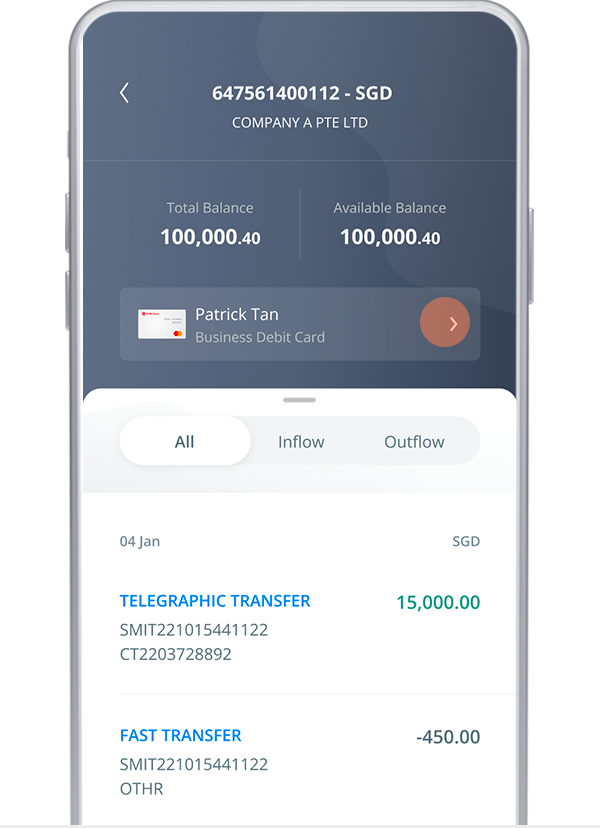

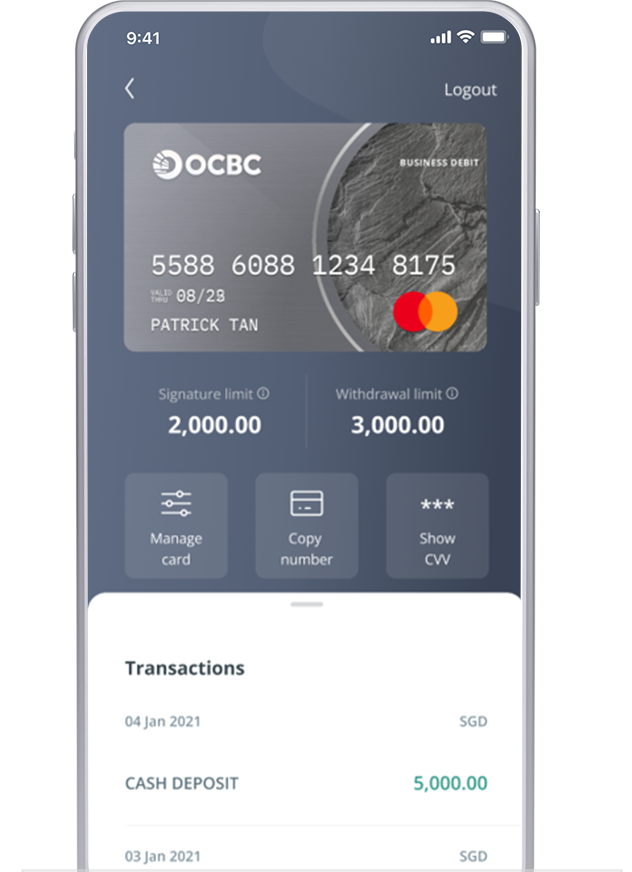

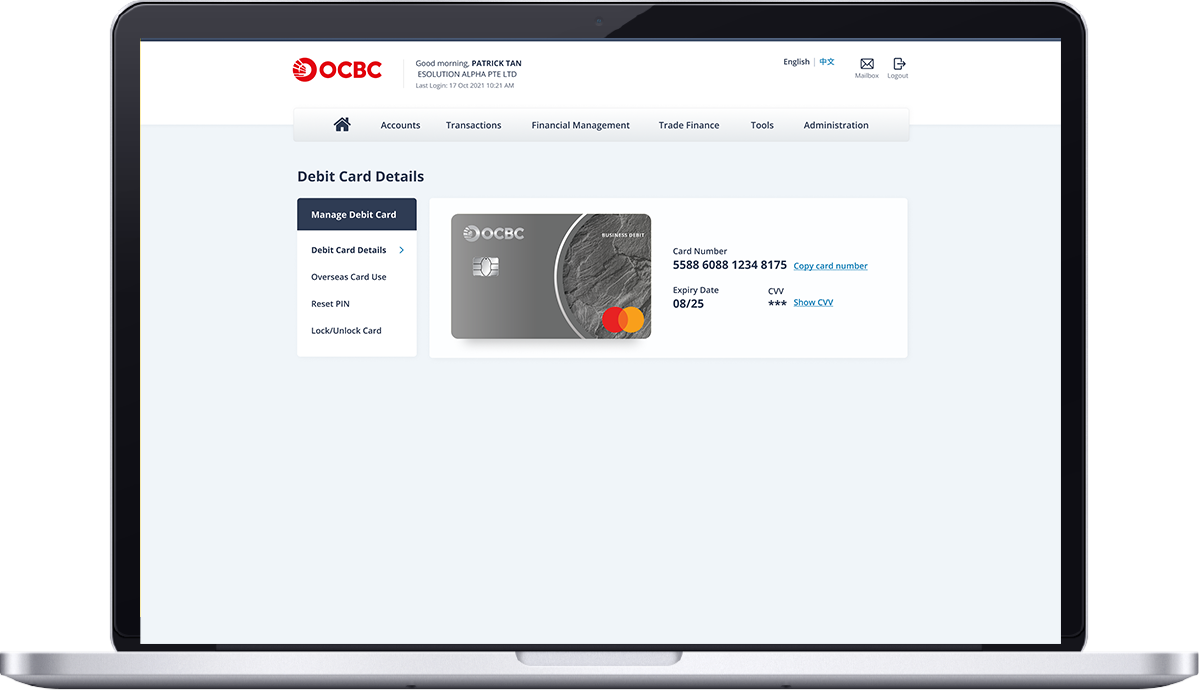

A digital card is the debit or credit card that you can easily access from the OCBC Business Banking app or OCBC Velocity after the approval of your application.

The digital card will have the same card number and expiry date as the physical card that you will receive. The only difference between the digital card and physical card is that of the CVV.