Bringing you the latest insights and research, helmed by our team of in-house economists, strategists and analysts, with more than 100 years of combined experience.

Learn more

SME Index

Real data. Real insights.

Measuring business health and performance of SMEs in Singapore.

The OCBC SME Index is the only quantitative index in Singapore powered by real transactional data from over 100,000 SMEs and 5 million data points with comprehensive coverage across industry value chains.

Gain insights into how SMEs are navigating disruptions and opportunities in digitalisation, transforming industries and shifting towards sustainability.

100,000

SMEs

5M

Data Points

Across multiple industry value chains, each business is just 1 in over 100,000 SMEs that powers the OCBC SME Index.

Of the 700 respondents in the OCBC SME Business Outlook poll, SMEs in outward-oriented sectors exhibited stronger sentiment, with 40% reporting improved business conditions over the past quarter, compared to 33% among domestically oriented sectors. This result is in line with the OCBC SME index reading in the fourth quarter.

Chief among the concerns of SME business owners was stiff market competition, with about 36% of respondents indicating it as the biggest challenge to their business in the next 6 months. This was followed by geopolitical uncertainties, with about 20% of business owners indicating it as their biggest challenge.

Know where you stand in your industry then stand taller.

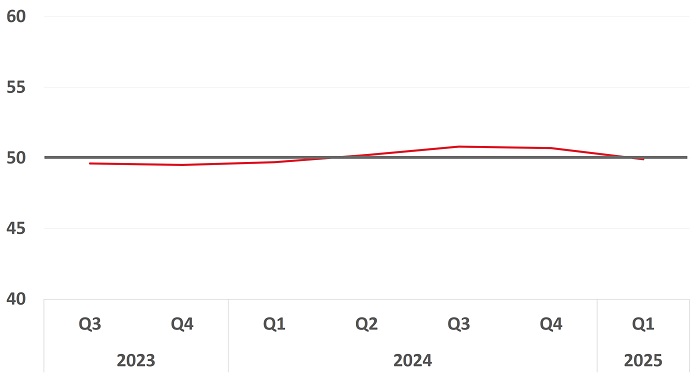

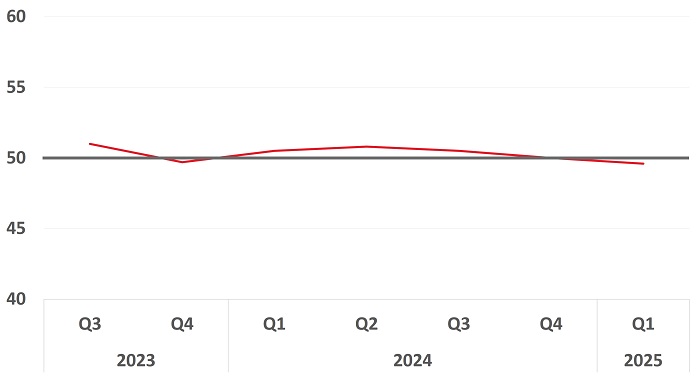

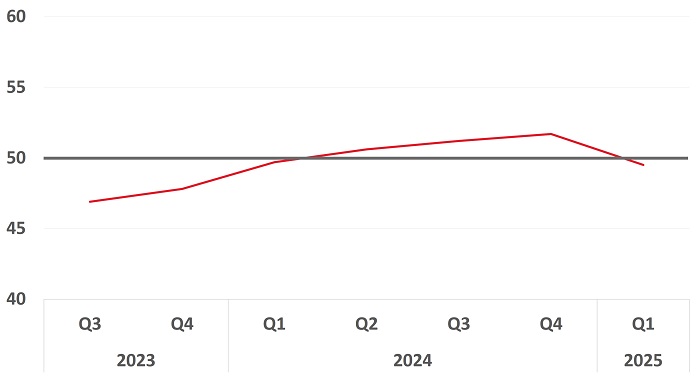

The OCBC SME Index is centred on a score of 50, which represents zero change in the inputs from a year ago. A reading above 50 indicates an improvement while a sub-50 reading indicates a deterioration relative to the same period a year ago.

The OCBC SME Index rose to 50.8 in 4Q 2025, remaining in expansionary territory for the third consecutive quarter, with outward oriented SMEs leading the expansion.

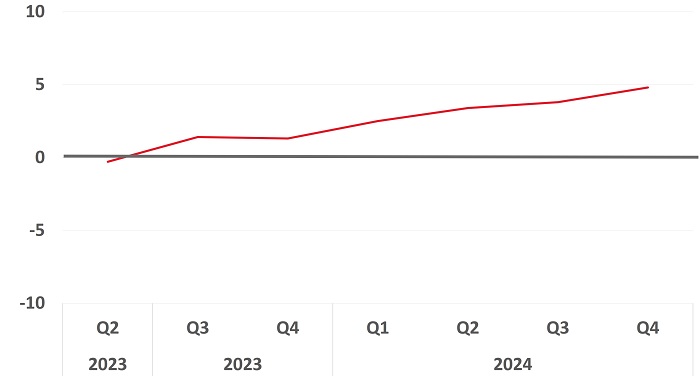

The 4Q 2025 GDP growth Nowcast based on the OCBC SME Index is around 5%, with the economy showing healthy activity in the outward oriented industries, and resilience in the domestic oriented industries despite softening consumer demand and a tougher operating environment.

Discover the 2025 Q4 edition of the SME Index. It will help you identify where you stand within your industry value chain and understand the performance of your industry. Be nimble in spotting industry changes and trends.

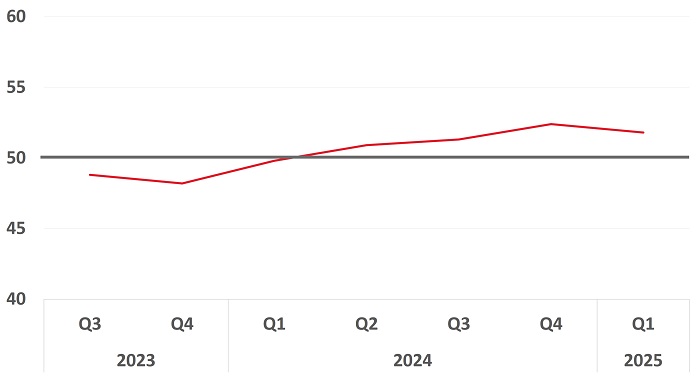

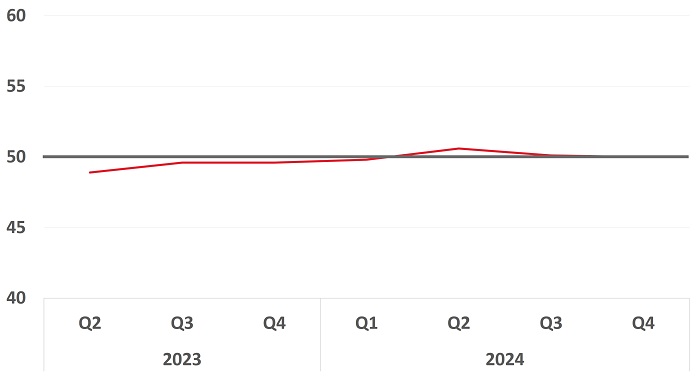

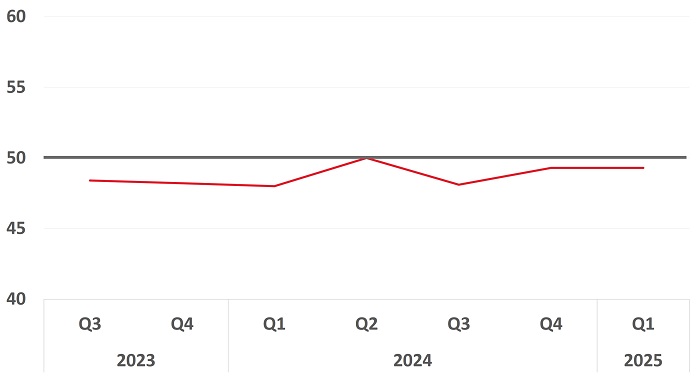

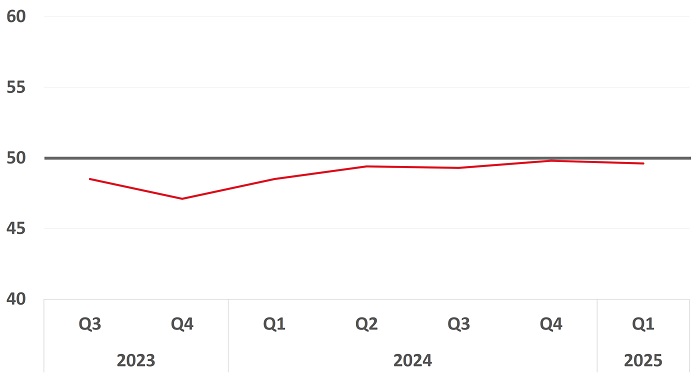

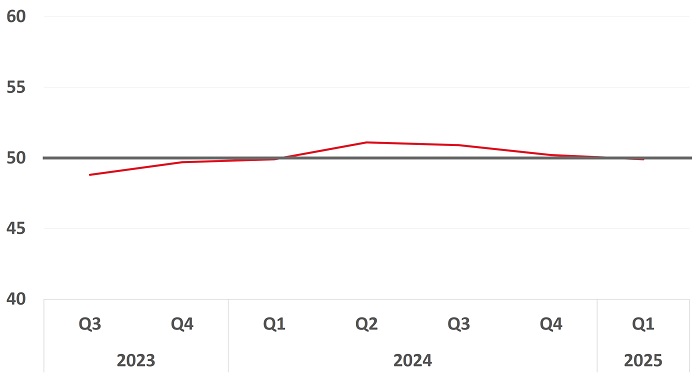

Building & Construction

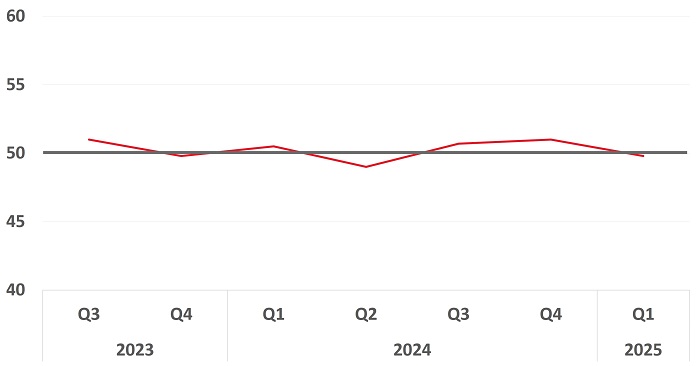

Building & Construction rose to 50.3 in 4Q25, with a healthy year-on-year increase in overall collections (18%) and payments (19%). The performance of the industry is driven largely by expansions in the Construction segment (50.3). The Building Materials segment remained in contraction (49.4) and exerted a drag on the performance of the industry. Overall, SMEs in Building & Construction should continue to benefit from the strong pipeline of public and private housing and infrastructure projects in the year ahead.

Building & Construction rose to 50.3 in 4Q25, with a healthy year-on-year increase in overall collections (18%) and payments (19%). The performance of the industry is driven largely by expansions in the Construction segment (50.3). The Building Materials segment remained in contraction (49.4) and exerted a drag on the performance of the industry. Overall, SMEs in Building & Construction should continue to benefit from the strong pipeline of public and private housing and infrastructure projects in the year ahead.

Building & Construction rose to 50.3 in 4Q25, with a healthy year-on-year increase in overall collections (18%) and payments (19%). The performance of the industry is driven largely by expansions in the Construction segment (50.3). The Building Materials segment remained in contraction (49.4) and exerted a drag on the performance of the industry. Overall, SMEs in Building & Construction should continue to benefit from the strong pipeline of public and private housing and infrastructure projects in the year ahead.

Building & Construction rose to 50.3 in 4Q25, with a healthy year-on-year increase in overall collections (18%) and payments (19%). The performance of the industry is driven largely by expansions in the Construction segment (50.3). The Building Materials segment remained in contraction (49.4) and exerted a drag on the performance of the industry. Overall, SMEs in Building & Construction should continue to benefit from the strong pipeline of public and private housing and infrastructure projects in the year ahead.

Building & Construction rose to 50.3 in 4Q25, with a healthy year-on-year increase in overall collections (18%) and payments (19%). The performance of the industry is driven largely by expansions in the Construction segment (50.3). The Building Materials segment remained in contraction (49.4) and exerted a drag on the performance of the industry. Overall, SMEs in Building & Construction should continue to benefit from the strong pipeline of public and private housing and infrastructure projects in the year ahead.

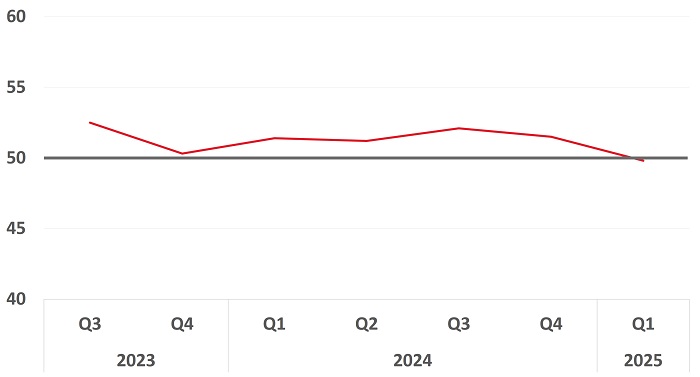

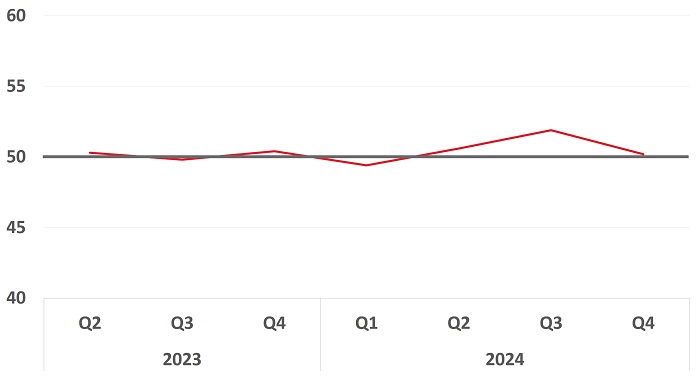

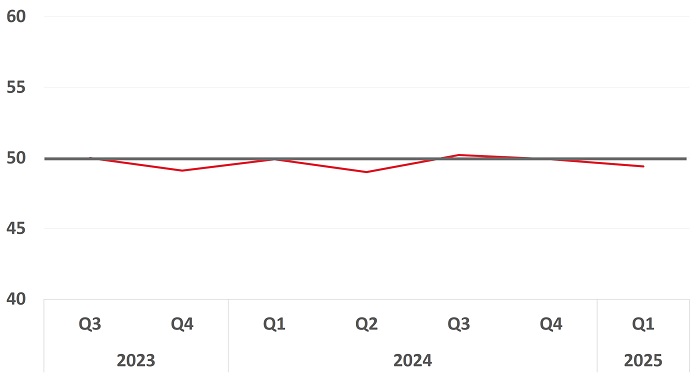

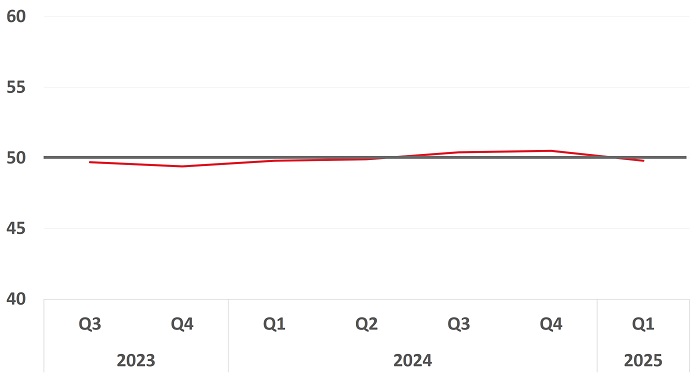

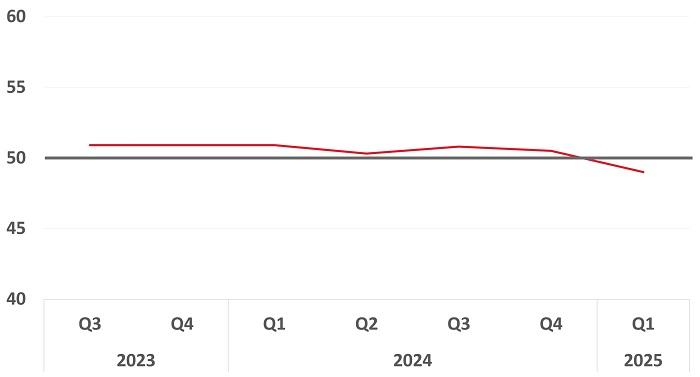

Business Services

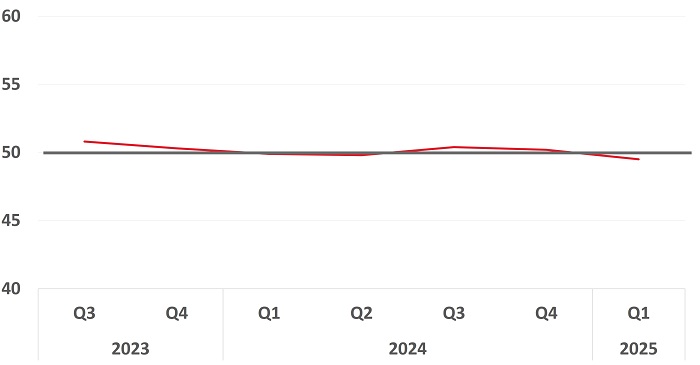

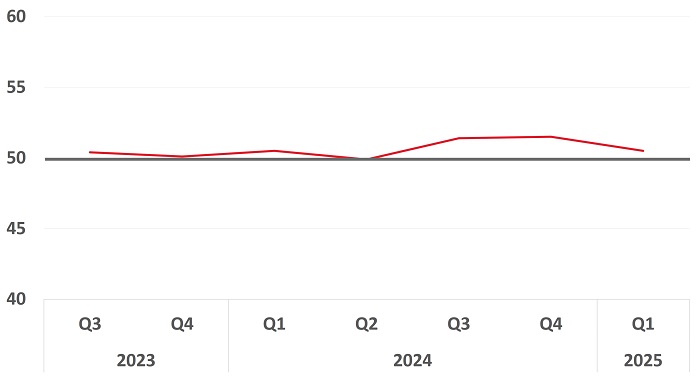

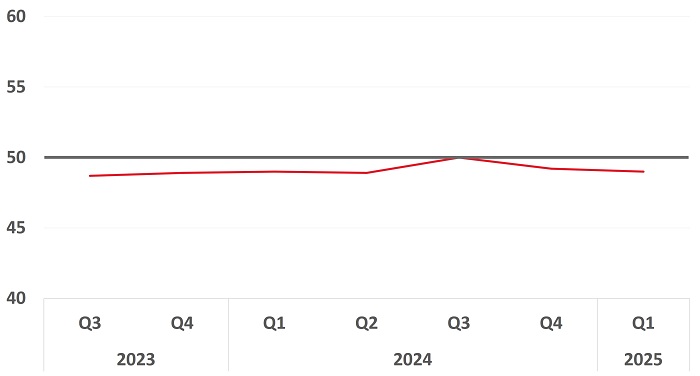

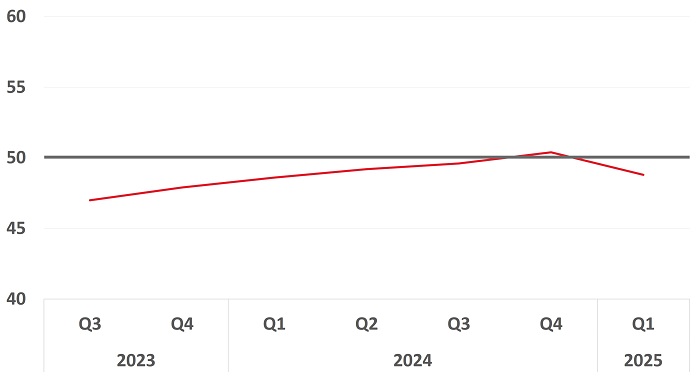

Business Services contracted marginally with a reading of 49.8 in 4Q25. The performance of the industry was predominantly weighed down by contraction in both the Business Consultancy (49.7), Advertising and Exhibition (49.2) segments.

Business Services contracted marginally with a reading of 49.8 in 4Q25. The performance of the industry was predominantly weighed down by contraction in both the Business Consultancy (49.7), Advertising and Exhibition (49.2) segments.

Business Services contracted marginally with a reading of 49.8 in 4Q25. The performance of the industry was predominantly weighed down by contraction in both the Business Consultancy (49.7), Advertising and Exhibition (49.2) segments.

Business Services contracted marginally with a reading of 49.8 in 4Q25. The performance of the industry was predominantly weighed down by contraction in both the Business Consultancy (49.7), Advertising and Exhibition (49.2) segments.

Business Services contracted marginally with a reading of 49.8 in 4Q25. The performance of the industry was predominantly weighed down by contraction in both the Business Consultancy (49.7), Advertising and Exhibition (49.2) segments.

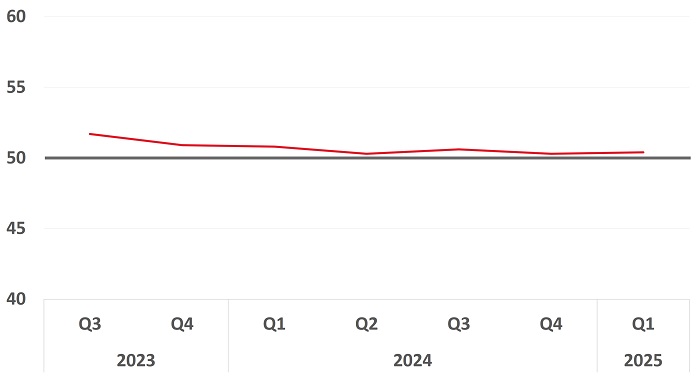

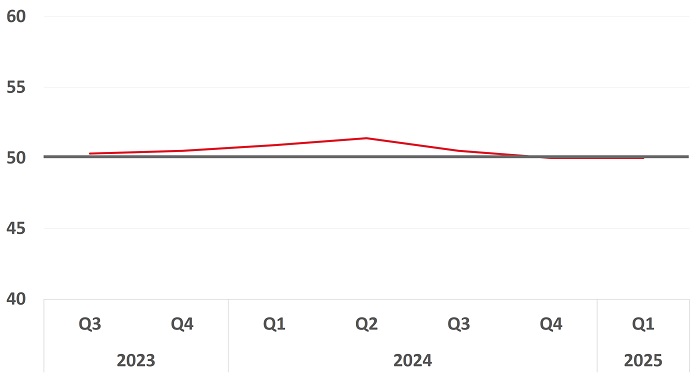

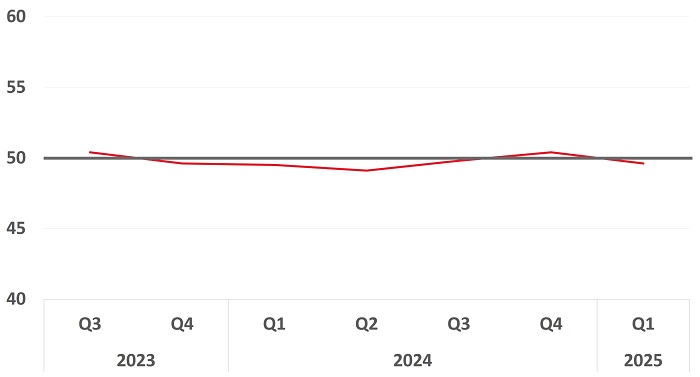

Education

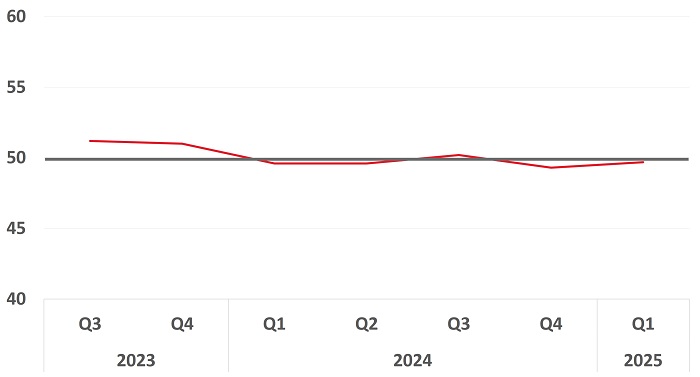

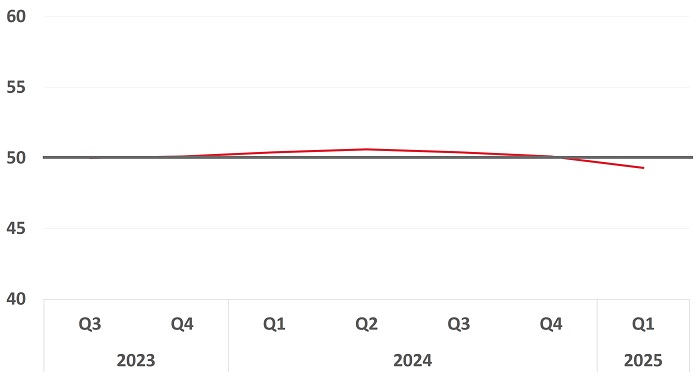

Education improved to 50.3 in 4Q25, with a 4% increase in collections and 1% increase in payments. Performance of the industry primarily attributed to expansions in Early Childhood Education (50.6). Business activities within Training Centers (50.8) also increased.

Find out more about how the education industry performed in the OCBC SME Index each quarter.

Education improved to 50.3 in 4Q25, with a 4% increase in collections and 1% increase in payments. Performance of the industry primarily attributed to expansions in Early Childhood Education (50.6). Business activities within Training Centers (50.8) also increased.

Find out more about how the education industry performed in the OCBC SME Index each quarter.

Education improved to 50.3 in 4Q25, with a 4% increase in collections and 1% increase in payments. Performance of the industry primarily attributed to expansions in Early Childhood Education (50.6). Business activities within Training Centers (50.8) also increased.

Find out more about how the education industry performed in the OCBC SME Index each quarter.

Education improved to 50.3 in 4Q25, with a 4% increase in collections and 1% increase in payments. Performance of the industry primarily attributed to expansions in Early Childhood Education (50.6). Business activities within Training Centers (50.8) also increased.

Find out more about how the education industry performed in the OCBC SME Index each quarter.

Education improved to 50.3 in 4Q25, with a 4% increase in collections and 1% increase in payments. Performance of the industry primarily attributed to expansions in Early Childhood Education (50.6). Business activities within Training Centers (50.8) also increased.

Education improved to 50.3 in 4Q25, with a 4% increase in collections and 1% increase in payments. Performance of the industry primarily attributed to expansions in Early Childhood Education (50.6). Business activities within Training Centers (50.8) also increased.

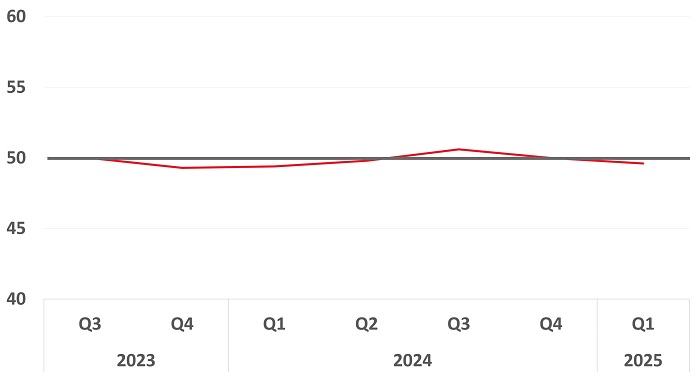

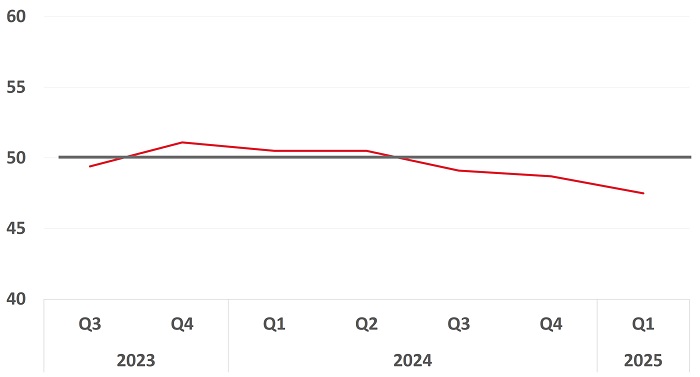

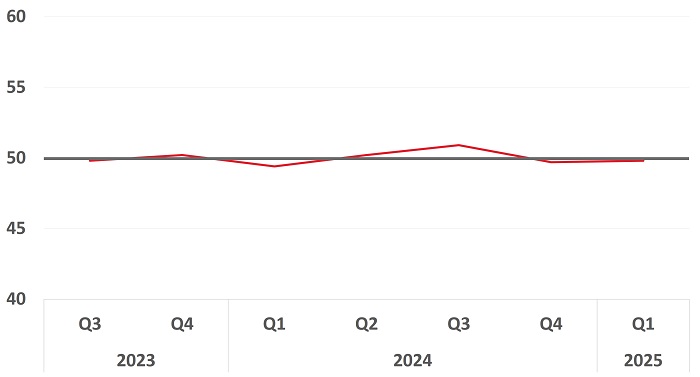

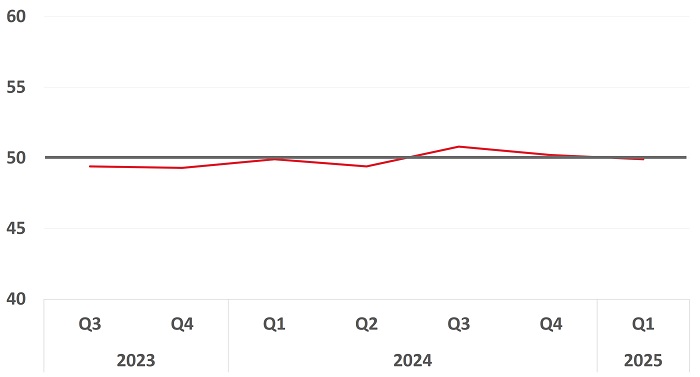

Food & Beverages (F&B) was neutral with a reading of 50.0. While SMEs in the Food Farming and Food Manufacturing segments provided some lift to overall performance, growth was muted due to weaker activity in downstream value chain. F&B Wholesale Trade and F&B Retail trade saw a slowdown, with a reading of 49.8 and 49.2 respectively.

Find out more about how the F&B industry performed in the OCBC SME Index each quarter.

Food & Beverages (F&B) was neutral with a reading of 50.0. While SMEs in the Food Farming and Food Manufacturing segments provided some lift to overall performance, growth was muted due to weaker activity in downstream value chain. F&B Wholesale Trade and F&B Retail trade saw a slowdown, with a reading of 49.8 and 49.2 respectively.

Find out more about how the F&B industry performed in the OCBC SME Index each quarter.

Food & Beverages (F&B) was neutral with a reading of 50.0. While SMEs in the Food Farming and Food Manufacturing segments provided some lift to overall performance, growth was muted due to weaker activity in downstream value chain. F&B Wholesale Trade and F&B Retail trade saw a slowdown, with a reading of 49.8 and 49.2 respectively.

Find out more about how the F&B industry performed in the OCBC SME Index each quarter.

Food & Beverages (F&B) was neutral with a reading of 50.0. While SMEs in the Food Farming and Food Manufacturing segments provided some lift to overall performance, growth was muted due to weaker activity in downstream value chain. F&B Wholesale Trade and F&B Retail trade saw a slowdown, with a reading of 49.8 and 49.2 respectively.

Find out more about how the F&B industry performed in the OCBC SME Index each quarter.

Food & Beverages (F&B) was neutral with a reading of 50.0. While SMEs in the Food Farming and Food Manufacturing segments provided some lift to overall performance, growth was muted due to weaker activity in downstream value chain. F&B Wholesale Trade and F&B Retail trade saw a slowdown, with a reading of 49.8 and 49.2 respectively.

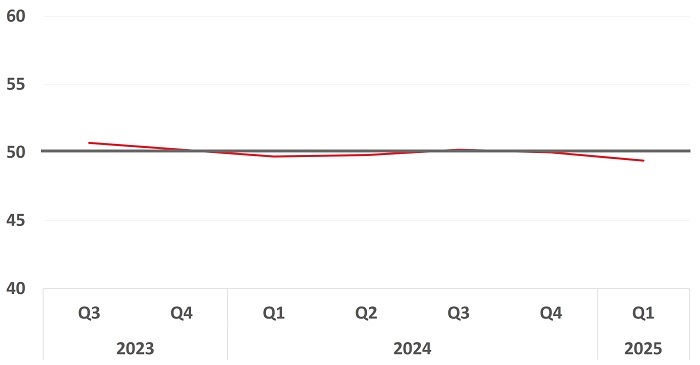

Healthcare registered a contraction at 49.7 this quarter. The lacklustre performance of the industry can be attributed primarily to contractions in the Healthcare Distributor (49.7) and Healthcare Provider (49.8) segments, year-on-year.

Find out more about how the healthcare industry performed in the OCBC SME Index each quarter.

Healthcare registered a contraction at 49.7 this quarter. The lacklustre performance of the industry can be attributed primarily to contractions in the Healthcare Distributor (49.7) and Healthcare Provider (49.8) segments, year-on-year.

Find out more about how the healthcare industry performed in the OCBC SME Index each quarter.

Healthcare registered a contraction at 49.7 this quarter. The lacklustre performance of the industry can be attributed primarily to contractions in the Healthcare Distributor (49.7) and Healthcare Provider (49.8) segments, year-on-year.

Find out more about how the healthcare industry performed in the OCBC SME Index each quarter.

Healthcare registered a contraction at 49.7 this quarter. The lacklustre performance of the industry can be attributed primarily to contractions in the Healthcare Distributor (49.7) and Healthcare Provider (49.8) segments, year-on-year.

ICT

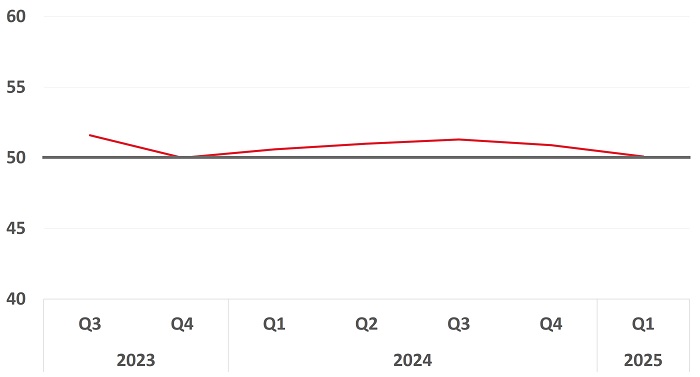

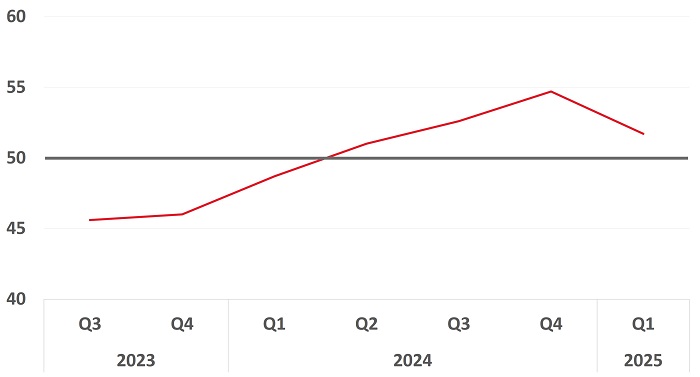

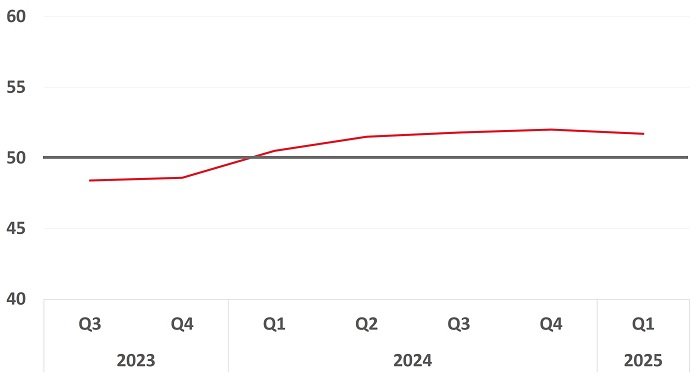

ICT continues to register a consecutive healthy expansion at 51.1 in 4Q 2025. The performance of the industry is driven primarily by the Data Processing and Software Development (50.9), and ICT Manufacturing and Sales (50.5) segment. The IT Consultancy (49.6) segment weighed down on the performance of the industry.

ICT continues to register a consecutive healthy expansion at 51.1 in 4Q 2025. The performance of the industry is driven primarily by the Data Processing and Software Development (50.9), and ICT Manufacturing and Sales (50.5) segment. The IT Consultancy (49.6) segment weighed down on the performance of the industry.

ICT continues to register a consecutive healthy expansion at 51.1 in 4Q 2025. The performance of the industry is driven primarily by the Data Processing and Software Development (50.9), and ICT Manufacturing and Sales (50.5) segment. The IT Consultancy (49.6) segment weighed down on the performance of the industry.

ICT continues to register a consecutive healthy expansion at 51.1 in 4Q 2025. The performance of the industry is driven primarily by the Data Processing and Software Development (50.9), and ICT Manufacturing and Sales (50.5) segment. The IT Consultancy (49.6) segment weighed down on the performance of the industry.

ICT continues to register a consecutive healthy expansion at 51.1 in 4Q 2025. The performance of the industry is driven primarily by the Data Processing and Software Development (50.9), and ICT Manufacturing and Sales (50.5) segment. The IT Consultancy (49.6) segment weighed down on the performance of the industry.

ICT continues to register a consecutive healthy expansion at 51.1 in 4Q 2025. The performance of the industry is driven primarily by the Data Processing and Software Development (50.9), and ICT Manufacturing and Sales (50.5) segment. The IT Consultancy (49.6) segment weighed down on the performance of the industry.

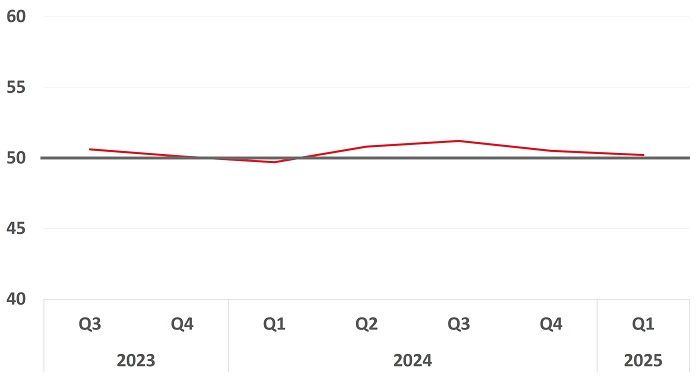

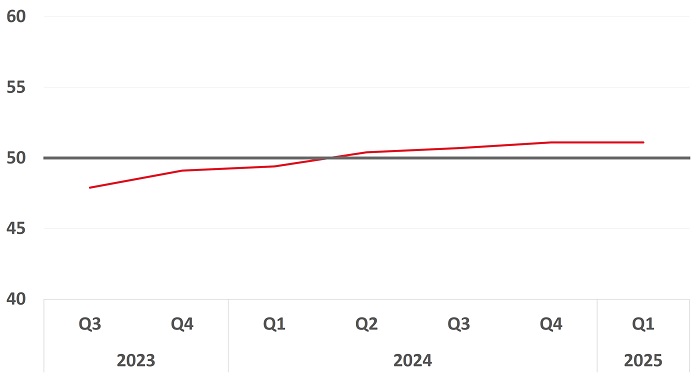

Manufacturing

Manufacturing remains on an upward growth trajectory, with an expansionary reading of 51.0 this quarter. Collections and Payments saw a year-on-year increase of 2% and 3%, respectively, indicating that SMEs continue to benefit from stable business activity in the industry. The strong result is driven by expansions across all segments, driven primarily by Precision Engineering (50.9) and Consumer Products manufacturing (50.8).

Manufacturing remains on an upward growth trajectory, with an expansionary reading of 51.0 this quarter. Collections and Payments saw a year-on-year increase of 2% and 3%, respectively, indicating that SMEs continue to benefit from stable business activity in the industry. The strong result is driven by expansions across all segments, driven primarily by Precision Engineering (50.9) and Consumer Products manufacturing (50.8).

Manufacturing remains on an upward growth trajectory, with an expansionary reading of 51.0 this quarter. Collections and Payments saw a year-on-year increase of 2% and 3%, respectively, indicating that SMEs continue to benefit from stable business activity in the industry. The strong result is driven by expansions across all segments, driven primarily by Precision Engineering (50.9) and Consumer Products manufacturing (50.8).

Manufacturing remains on an upward growth trajectory, with an expansionary reading of 51.0 this quarter. Collections and Payments saw a year-on-year increase of 2% and 3%, respectively, indicating that SMEs continue to benefit from stable business activity in the industry. The strong result is driven by expansions across all segments, driven primarily by Precision Engineering (50.9) and Consumer Products manufacturing (50.8).

Manufacturing remains on an upward growth trajectory, with an expansionary reading of 51.0 this quarter. Collections and Payments saw a year-on-year increase of 2% and 3%, respectively, indicating that SMEs continue to benefit from stable business activity in the industry. The strong result is driven by expansions across all segments, driven primarily by Precision Engineering (50.9) and Consumer Products manufacturing (50.8).

Transport & Logistics

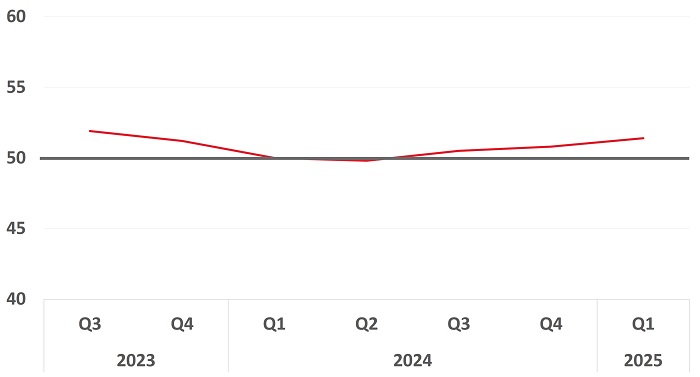

Coming off from a high base in 4Q 2024, Transport & Logistics registered an expansion at 50.1. This was accompanied by an increase in overall collections and payments of 8% on-year and 10% on-year respectively. Growth in the industry was driven by the Land Transport segment (50.6). The Sea Transport (49.8) and Logistics (48.6) segments continue to remain in contraction, exerting a drag on the performance of the industry.

Find out more about how the Transport & Logistics industry performed in the OCBC SME Index each quarter.

Coming off from a high base in 4Q 2024, Transport & Logistics registered an expansion at 50.1. This was accompanied by an increase in overall collections and payments of 8% on-year and 10% on-year respectively. Growth in the industry was driven by the Land Transport segment (50.6). The Sea Transport (49.8) and Logistics (48.6) segments continue to remain in contraction, exerting a drag on the performance of the industry.

Find out more about how the Transport & Logistics industry performed in the OCBC SME Index each quarter.

Coming off from a high base in 4Q 2024, Transport & Logistics registered an expansion at 50.1. This was accompanied by an increase in overall collections and payments of 8% on-year and 10% on-year respectively. Growth in the industry was driven by the Land Transport segment (50.6). The Sea Transport (49.8) and Logistics (48.6) segments continue to remain in contraction, exerting a drag on the performance of the industry.

Find out more about how the Transport & Logistics industry performed in the OCBC SME Index each quarter.

Coming off from a high base in 4Q 2024, Transport & Logistics registered an expansion at 50.1. This was accompanied by an increase in overall collections and payments of 8% on-year and 10% on-year respectively. Growth in the industry was driven by the Land Transport segment (50.6). The Sea Transport (49.8) and Logistics (48.6) segments continue to remain in contraction, exerting a drag on the performance of the industry. Transport & Logistics contracted marginally in 3Q 2025 with a reading of 49.9, a 0.1 improvement from the last quarter. Softer global maritime trade seemed to have weighed down on the Transport & Logistics industry for the third consecutive quarter.

Find out more about how the Transport & Logistics industry performed in the OCBC SME Index each quarter.

Coming off from a high base in 4Q 2024, Transport & Logistics registered an expansion at 50.1. This was accompanied by an increase in overall collections and payments of 8% on-year and 10% on-year respectively. Growth in the industry was driven by the Land Transport segment (50.6). The Sea Transport (49.8) and Logistics (48.6) segments continue to remain in contraction, exerting a drag on the performance of the industry. Transport & Logistics contracted marginally in 3Q 2025 with a reading of 49.9, a 0.1 improvement from the last quarter. Softer global maritime trade seemed to have weighed down on the Transport & Logistics industry for the third consecutive quarter.

Wholesale Trade

Wholesale Trade continues it's expansionary run and registered at 50.9, the second consecutive quarter where the growth has been easing slowly. This is accompanied with a 14% year-on-year increase in payments and a 18% year-on-year increase in collections.

Retail

Retail registered a reading of 50.9, extending it's expansionary results from the last quarter.

Resources

Resources continue to expand steadily, growing by 0.1 from last quarter to register 50.2 in 3Q 2025.

Or WhatsApp / SMS us at +65 8138 1964

F&B

1Q 21

The F&B industry turned expansionary at 51.1 in 1Q 21, having dipped to a low of 42.0 in 2Q 20 during the Circuit Breaker.

2Q 21

The F&B industry remains one of the most vulnerable industries despite seeing expansion since the last quarter. The Index rose to 54.7 in 2Q 21 due to 2Q 20's lower base.

3Q 21

The F&B Industry turned contractionary at 48.9 mainly due to the impact of Heightened Alert restrictions. Increased online sales and deliveries offered some support for the industry with a significant growth in collections from digital platforms since 2019.

4Q 21

F&B contracted for a 2nd consecutive quarter in 4Q 21 at 47.9 due mainly to the impact of heightened restrictions.

1Q 22

F&B contracted for a 3rd consecutive quarter at 47.7 as restrictions persisted and firms faced higher costs.

2Q 22

F&B rebounded sharply over the quarter to 51.5 as dine-in restrictions were lifted.

3Q 22

F&B rebounded strongly, extending its gains into 3Q 22 with a jump in reading from 51.5 in 2Q 22 to 52.5 in 3Q 22.

4Q 22

F&B expanded steadily at 51.4, primarily supported by growth in the F&B Services segment.

1Q 23

F&B extended its gains into 1Q 2023, growing at a healthy pace of 51.4 this quarter. Growth was primarily supported by the F&B Services segment.

2Q 23

F&B expanded marginally at 50.1 in 2Q 23, lower than the 51.4 registered in the previous quarter. More SMEs in the sector have also reported that their business have worsened compared to 3 months ago.

3Q 23

F&B extended its gains into 3Q 2023, growing at a healthy pace of 51.1 this quarter. Growth was supported by the F&B Services and F&B Retail segments.

4Q 23

F&B tipped into contractionary territority after six consecutive quarters of healthy growth, as its reading fell from 51.1 in 3Q to 49.6 in 4Q.

1Q 24

F&B expanded slightly at 50.2 in 1Q 2024, improving from the 49.6 registered last quarter.

2Q 24

F&B grew to 50.6 this quarter and recorded a rise in reading from the 50.2 registered last quarter.

3Q 24

F&B expanded to 51.2 in 3Q 2024, recording a rise in reading from the 50.6 registered last quarter.

4Q 24

F&B continues to be expansionary at 51.1 this quarter. Collections and payments for the industry increased by 7.6% and 7.2% respectively on a year-on-year basis.

1Q 25

Food & Beverage softened to 49.6 this quarter, a sizeable decline from the 51.1 registered in 4Q 2024.

2Q 25

F&B expanded to 50.6 in 2Q 2025, marking a rise in reading from the 49.6 recorded last quarter. Collections grew by 4.2% on-year, while payments grew by 5.0% on-year.

3Q 25

F&B moderated to 49.4 this quarter, reversing last quarter's expansionary results. Collections grew by 3.5% on-year, while payments improved slightly by 0.6% on-year.

4Q 25

Food & Beverages (F&B) was neutral with a reading of 50.0, improving slightly from the last quarter.

F&B Services

1Q 21

F&B Services, which includes restaurants, cafes, fast food, pubs and cooked food stalls, rose to 50.8 in 1Q 21, breaking 50 for the first time since the pandemic started.

2Q 21

F&B Services registered an expansion of 59.3, showing that the impact of the dine-in restrictions during Phase 2 Heightened Alert was significantly less severe compared to the Circuit Breaker period of the previous year.

3Q 21

F&B Services saw the sharpest drop in its Index to 48.9, as collections dropped YoY in line with lower customer traffic, resulting in deteriorating cash coverage positions.

4Q 21

F&B Services contracted for a 2nd consecutive quarter at 48.0 as collections dropped YoY from tighter restrictions during the Stabilisation Phase.

1Q 22

F&B Services saw collections drop YoY due to a lower 5-pax restriction compared to 8-pax last year, while cash coverage remained worse compared to a year ago.

2Q 22

The F&B Services sub-sector benefitted significantly from the removal of safe distancing measures for dining in as restaurants were met with the pent-up demand from larger dining events as well as stronger visitor traffic.

3Q 22

F&B Services continued on its growth trajectory in 3Q 22, penciling in an expansion of 56.3 as SMEs in the segment benefitted from the rise in tourism arrivals. This also came on the back of a low base one year ago with the suspension of dining-in services during P2HA.

4Q 22

F&B Services continues to see a strong growth momentum in 4Q 22, expanding at 54.6 as it benefitted from the rebound in international visitor arrivals and sustained demand from the domestic market.

1Q 23

F&B Services registered another quarter of robust growth, benefitting from the resumption of large scale corporate functions and international travel.

2Q 23

F&B Services eased to 51.8 but remained expansionary in 2Q 23. SMEs within the segment has provided strong growth support towards the overall F&B sector over the past quarters.

3Q 23

F&B Services expanded steadily at 52.0, an uptick from the 51.8 registered in the previous quarter.

4Q 23

F&B Services was marginally expansionary at 50.0, as domestic spending in the segment could have been moderated by an increase in outbound travel and higher prices.

1Q 24

F&B Services expanded for the eighth consecutive quarter, with businesses likely benefitting from higher domestic consumption during the CNY festive season.

2Q 24

F&B Services eased from 50.5 to 50.0, suggesting that SMEs within the segment could be facing slower demand with increased travel and also as consumers become increasingly budget conscious.

3Q 24

F&B Services ticked higher to 50.7 this quarter, with a 8.0% rise in collections and 7.4% rise in payments on a year-on-year basis.

4Q 24

F&B Services eased slightly to 50.6 this quarter, with a 5.1% rise in collections and 6.7% rise in payments on a year-on-year basis.

1Q 25

F&B Services fell into contraction at 48.3 this quarter. Collections and payments fell by 1.7% on-year and 0.9% on-year respectively.

2Q 25

F&B Services turned expansionary this quarter, registering a reading of 50.3. This was accompanied by a 3.4% on-year increase in collections and 2.6% on-year increase in payments.

3Q 25

F&B Services reversed it's expansionary results from last quarter to register a contraction at 49.0. Collections declined by 2.0% on-year and payments dropped by 3.6% on-year.

4Q 25

F&B Services saw improvement in performance but remained in contraction for another quarter and registered at 49.9.

F&B Wholesale Trade

1Q 21

F&B Wholesale Trade remained buoyant at 52.2, especially in the import & export of food.

2Q 21

F&B Wholesale Trade remained resilient as it expanded at 53.5, being able to tap on export demand.

3Q 21

F&B Wholesale Trade registered a slowdown in 3Q 21 but remained expansionary at 50.1.

4Q 21

F&B Wholesale Trade contracted for the first time since 4Q 20 at 48.6.

1Q 22

F&B Wholesale Trade remained in contractionary territory at 48.7, weighed down by rising costs.

2Q 22

F&B Wholesale Trade improved to 50, as trades improved with border reopening but continued to be weighed down by rising food prices and supply chain disruptions.

3Q 22

F&B Wholesale dipped slightly as rising food prices and supply chain disruptions posed a drag on the segment.

4Q 22

F&B Wholesale dipped slightly to 49.4, as SMEs are adversely impacted by food supply shortages and price increases.

1Q 23

F&B Wholesale contracted further to 48.2, as SMEs within the segment are faced with higher import prices.

2Q 23

F&B Wholesale extended another quarter of contraction and dipped further to 46.5 in 2Q. Weaknesses in the segment has weighed down on overall growth in the sector.

3Q 23

F&B Wholesale Trade contracted at 48.8, led by a sizeable decline in collections and payments.

4Q 23

F&B Wholesale Trade contracted at 48.2, as collections and payments dropped by 21.3% on-year and 19.7% on-year respectively.

1Q 24

F&B Wholesale Trade contracted at 49.8, led by a sizeable decline in collections and payments.

2Q 24

F&B Wholesale Trade turned expansionary in 2Q 2024 for the first time since 3Q 2021, registering a reading of 50.9.

3Q 24

F&B Wholesale Trade continues on an upward trajectory over the quarter, with an improvement in reading from 50.9 last quarter to 51.3 in 3Q 2024.

4Q 24

F&B Wholesale Trade continues on an upward trajectory over the quarter, with an improvement in reading from 51.3 last quarter to 52.4 in 4Q 2024. Collections and payments grew at 15.7% and 11.2% on-year respectively.

1Q 25

F&B Wholesale Trade grew at a healthy pace with a reading of 51.8 this quarter. This expansion is accompanied by a 17.4% increase in collections and a 17.6% increase in payments year-on-year.

2Q 25

F&B Wholesale Trade grew at a healthy pace with a reading of 51.7 this quarter, with SMEs in the segment driving overall growth in the F&B industry.

3Q 25

F&B Wholesale Trade moderated but remained in expansion and registered a reading of 50.7 this quarter. The segment saw a 6.4% on-year growth in collections and a 7.2% on-year growth in payments.

4Q 25

F&B Wholesale Trade Trade moved into the contraction territory at 49.8, a drop from last quarter's reading of 50.7.

F&B Retail

1Q 21

F&B Retail remained resilient at 49.8 especially in supermarkets and sundry stores.

2Q 21

F&B Retail remained resilient as it expanded at 51.0.

3Q 21

F&B Retail registered a slowdown in 3Q 21, contracting slightly at 48.5.

4Q 21

F&B Retail recorded its second consecutive quarter of contraction at 47.8.

1Q 22

F&B Retail remained in contractionary territory for a 3rd consecutive quarter at 48.0, weighed down by rising costs.

2Q 22

F&B Retail remained contractionary at 48.7, due to rising food prices and supply chain disruptions.

3Q 22

F&B Retail remained in the contractionary territory at 49.2 in the third quarter.

4Q 22

F&B Retail turned expansionary at 50.5 after five consecutive quarters of contraction.

1Q 23

F&B Retail continued on an upward trajectory and ticked higher to 50.7 in the first quarter of 2023.

2Q 23

F&B Retail continued on an upward trajectory and ticked higher to 51.3 in 2Q.

3Q 23

F&B Retail continued on an upward trajectory and edged higher to 52.5 in 3Q.

4Q 23

F&B Retail slipped to 50.3, but remained in expansion in 4Q.

1Q 24

In line with the modest expansion in the overall Retail sector, the F&B Retail segment also saw healthy growth.

2Q 24

In line with the expansion in the overall Retail sector, the F&B Retail segment was also expansionary at 51.2 this quarter.

3Q 24

F&B Retail registered a robust expansion of 52.1 this quarter led by a 9.8% on-year increase in collections and 7.6% on-year increase in payments.

4Q 24

F&B Retail moderated slightly to 51.5 this quarter, with a 3.5% on-year increase in collections and 5.6% on-year increase in payments.

1Q 25

F&B Retail contracted at 49.8 this quarter. Collections and payments fell by 2.2% and 0.8% respectively on an on-year basis.

2Q 25

F&B Retail flat lined at 49.9 this quarter, improving marginally by 0.1 from the previous quarter.

3Q 25

F&B Retail moved further into contraction at 48.4 this quarter. This is the segment's third consecutive month of contraction.

4Q 25

F&B Retail remained in contraction this quarter with a reading of 49.2. This is the segment's fourth consecutive month of contraction.

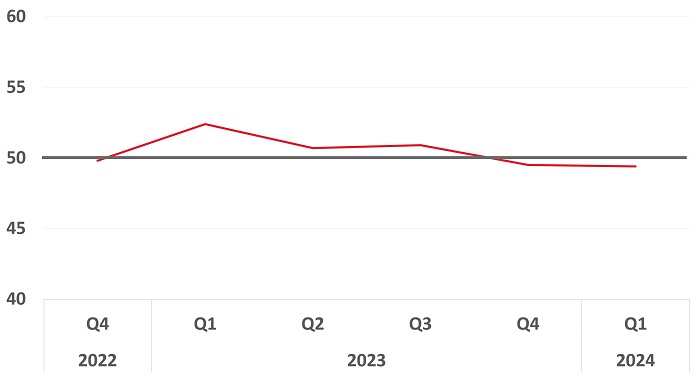

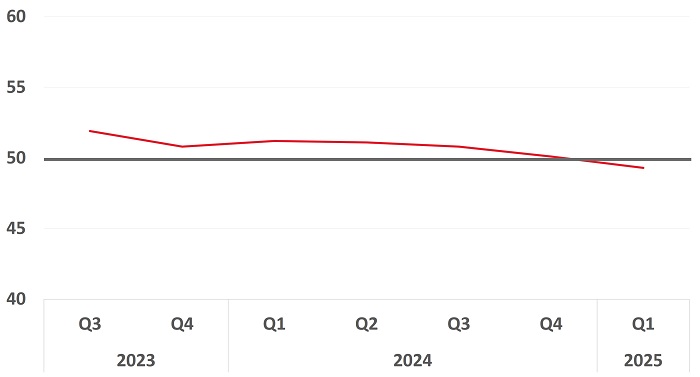

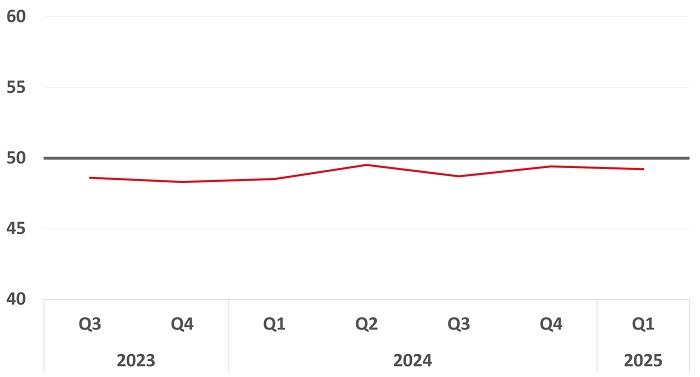

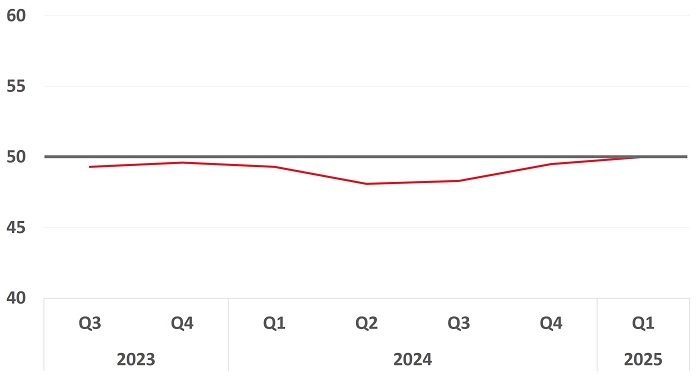

Healthcare

1Q 21

Green shoots in the industry remained intact. The Healthcare industry registered a reading of 51.3 in 1Q 21 having turned expansionary since 3Q 20, 2 quarters earlier than most industries.

2Q 21

The Healthcare industry remained expansionary at 55.0 in 2Q 21, it's 4th consecutive quarter of expansion.

3Q 21

Healthcare remained one of the most resilient industries and registered its 5th consecutive quarter of expansion at 51.2 in 3Q 21.

4Q 21

Healthcare slowed in 4Q 21 compared to the previous quarter, with a flat reading of 50.0. The industry is likely to remain resilient, supported by increased healthcare spending driven by secular trends such as Singapore's ageing population and the growth in HealthTech.

1Q 22

Healthcare remained flat compared to the previous quarter, with a reading of 50.1.

2Q 22

Healthcare continued flat lining at 50.4, caused primarily by weaker performance of the distributors.

3Q 22

Healthcare saw a slight uptick in reading at 50.7 in 3Q 22, supported by growth in the Healthcare Provider segment.

4Q 22

Healthcare continued flat lining at 50.5 in 4Q 22, as collections slipped by 0.3% on-quarter.

1Q 23

Healthcare edged higher to 50.7 in 1Q 2023, a slight improvement in performance compared to the previous quarter.

2Q 23

Healthcare saw a marginal contraction of 49.9 in 2Q 2023, a decline from the 50.7 registered last quarter.

3Q 23

Healthcare contracted at 49.8 in 3Q 2023, a marginal decline from the 49.9 registered last quarter.

4Q 23

Healthcare edged higher to 50.2 in 4Q after two quarters in contraction. This was accompanied by a 9.2% increase in collections and 3.7% increase in payments.

1Q 24

Healthcare saw a contraction of 49.4 in 1Q 2024, a decline from the 50.2 registered last quarter.

2Q 24

Growth in the Healthcare industry was supported by the modest performance in both the Healthcare Distributor (50.6) and Healthcare Provider (50.6) segments.

3Q 24

Healthcare grew to 50.9 in 3Q 2024, with growth supported primarily by the Healthcare Provider (51.9) segment. Collections and payments grew modestly at 2.9% and 5.3% on a year-on-year basis.

4Q 24

Healthcare contracted at 49.7 in Q4 2024, down from the 50.9 registered last quarter. Both the Healthcare Distributor and Healthcare Provider segments experienced a drop in their readings. Collections and payments in the industry grew minimally at 0.5% and 0.6% on-year respectively.

1Q 25

Healthcare flat lined at 49.8 this quarter and stayed in contraction, even as collections and payments rose by 3.8% and 4.0% on-year respectively.

2Q 25

Healthcare grew to 50.3 in 2Q 2025 after two consecutive quarters in contraction, with overall growth supported by the Healthcare Providers segment.

3Q 25

Healthcare eased to 50.1 this quarter, maintaining the industry's expansionary results for the second consecutive quarter this year.

4Q 25

Healthcare registered a contraction at 49.7 this quarter, a drop from last quarter's reading of 50.1.

Healthcare Distributor

1Q 21

Healthcare Distributors remained expansionary throughout the pandemic thus far. Healthcare Distributors has stayed expansionary on the back of strong demand for healthcare supplies. The segment remained robust at 52.2 in 1Q 21.

2Q 21

Healthcare Distributors continued seeing strong demand for healthcare supplies, its index saw an uptick to 52.8 in 3Q 21.

3Q 21

Healthcare Distributors remained expansionary but slowed compared to the previous quarter at 50.3 as demand for healthcare supplies saw signs of softening.

4Q 21

Healthcare Distributors turned contractionary for the first time since 1Q 19 at 48.9 as demand for healthcare supplies slowed.

1Q 22

Healthcare Distributors saw an accelerated pace of decline to 47.9 as demand for healthcare supplies continued to drop.

2Q 22

Healthcare Distributors continued its decline at 48.1 as its collections dropped 18% from the high in 2021 led by Covid-related supplies.

3Q 22

Healthcare Distributors contracted for the fourth consecutive quarter with a reading of 48.9 and weighed down on growth in the overall sector. Collections for the segment have also slipped by 16.5% on a QoQ basis.

4Q 22

Healthcare Distributors contracted at 49.1, as wholesale and retail sales of medical and pharmaceutical supplies slumped. Collections fell by 4.4% in 4Q 22 as compared to the previous quarter.

1Q 23

Healthcare Distributors contracted at 49.7, as the gradual reduction in demand for medical supplies led to a fall in sales collections.

2Q 23

Healthcare Distributors led the decline at 48.9, with a 8.7% drop in collections on a year-on-year basis.

3Q 23

Healthcare Distributors saw an improvement in reading from 48.9 in 2Q 2023 to 49.6 this quarter, despite being in contraction.

4Q 23

Healthcare Distributors registered another quarter of contraction as its reading flat lined at 49.6.

1Q 24

Healthcare Distributors registered another quarter of contraction as its reading flat lined at 49.8.

2Q 24

Healthcare Distributors turned expansionary for the first time after being in contraction since 4Q 2021.

3Q 24

Healthcare Distributors edged lower to 50.1 this quarter, down from the 50.6 registered in 2Q 2024.

4Q 24

Healthcare Distributors edged lower to 50.0 this quarter, down from the 50.1 registered in 3Q 2024.

1Q 25

Healthcare Distributors contracted at 48.9 this quarter, with SMEs in the segment registering a 5.8% decline in collections.

2Q 25

Healthcare Distributors contracted for the third consecutive quarter at 49.1, with SMEs in the segment registering a 0.7% on-year decline in collections and 12.8% on-year decline in payments.

3Q 25

Healthcare Distributors reversed it's contractionary results of the last quarter and registered an expansion at 50.2. Collections grew by 7.8% on-year and payments grew by 9.6% on-year.

4Q 25

The Healthcare Distributor segment registered at 49.7 and moved into the contraction territory this quarter.

Healthcare Provider

1Q 21

Healthcare Providers such as clinics were heavily impacted during Circuit Breaker. From a low of 43.8 in 2Q 20, Healthcare Providers turned positive in 4Q 20 and remained expansionary in 1Q 21 at 51.4.

2Q 21

Healthcare Providers saw a strong reading of 58.0, partially driven by 2Q 20's lower base but also a recovery in demand for healthcare services.

3Q 21

Healthcare Providers remained expansionary at 52.1 with collections rising 13% QoQ.

4Q 21

Healthcare Providers saw sustained expansionary activity, registering a 5th consecutive quarter of expansion at 51.7 with collections rising 18% YoY.

1Q 22

Healthcare Providers saw sustained expansionary activity from the Omicron surge, registering an expansionary reading of 51.1 with collections rising 18% YoY.

2Q 22

Healthcare Providers (e.g., Clinics) continued seeing expansionary activity, as Omicron cases remained relatively high, registering an expansionary reading of 51.6 with collections rising 19% YoY.

3Q 22

Healthcare Providers stayed resilient and continue to edge higher in 3Q 22, registering a reading of 51.9.

4Q 22

Healthcare Providers remained resilient, having been in expansionary territory since 4Q 20.

1Q 23

Healthcare Providers registered another quarter of expansion with a reading of 51.3 and a 15.2% on-year increase in collections.

2Q 23

Healthcare Providers registered another quarter of expansion but saw a moderation in growth from 51.3 last quarter to 50.3 in 2Q 2023.

3Q 23

Healthcare Providers registered the first quarter of contraction in 3Q 2023, with a reading of 49.8.

4Q 23

The reading of Healthcare Providers improved from 49.8 to 50.4 in 4Q, being the main driver of growth within the sector.

1Q 24

Healthcare Providers underperformed this quarter with a drop in reading from 50.4 in 4Q 2023 to 49.4 in 1Q 2024.

2Q 24

The reading of Healthcare Providers improved from 49.4 to 50.6 in 2Q, and this is accompanied by a 7.4% on-year increase in collections and 6.3% on-year increase in payments.

3Q 24

Reading of Healthcare Providers improved from 50.6 in 2Q to 51.9 in 3Q, as SMEs in the segment saw a 10.0% increase in collections and 15.4% increase in payments.

4Q 24

Reading of Healthcare Providers dropped from 51.9 in 3Q to 50.2 in 4Q, as SMEs in the segment saw a 8.6% increase in collections and 4.5% increase in payments.

1Q 25

Healthcare Providers remained in expansion at 50.5, improving marginally from the 50.2 registered last quarter. Collections and payments recorded an increase of 3.9% and 5.8% respectively, on a year-on-year basis.

2Q 25

Healthcare Providers remained in expansion for the fifth consecutive quarter at 50.9, improving from the 50.5 registered last quarter.

3Q 25

Healthcare Providers moved into contraction at 49.6 in 3Q 2025, ending the segments expansionary run over the last 5 quarters.

4Q 25

The Healthcare Provider segment remained in contraction for another quarter at 49.8.

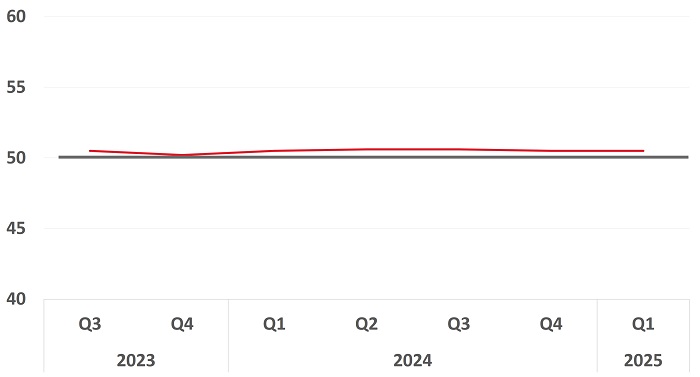

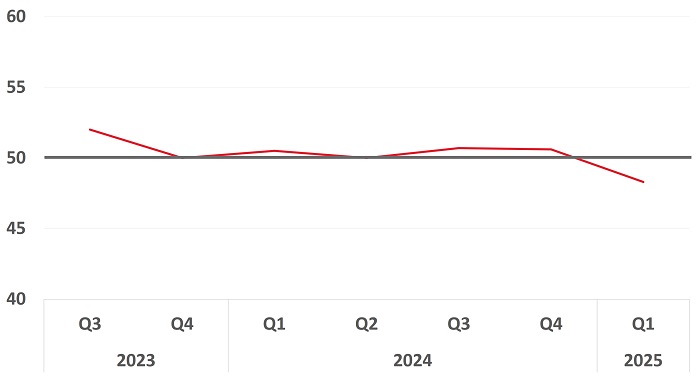

Transport & Logistics

1Q 21

Green shoots have emerged in the Transport & Logistics industry since 4Q 20 as the industry turned expansionary. The industry remained expansionary in 1Q 21 at 51.9.

2Q 21

The Transport & Logistics industry continued its strong growth as the Index increased to 58.8, partly driven by 2Q 20's lower base.

3Q 21

The Transport & Logistics industry saw its 4th consecutive quarter of expansion at 54.6 in 3Q 21, led by a 57% YoY increase in collections.

4Q 21

Transport & Logistics had its 5th consecutive quarter of expansion at 54.3 in 4Q 21, led by a 53% YoY increase in collections.

1Q 22

Transport & Logistics continued its expansion at 51.4 for a 6th consecutive quarter as collections rose 33% YoY.

2Q 22

Transport & Logistics continued a run of 6 quarters of expansion at 52 as borders opened in 2Q 22.

3Q 22

Growth in the Transport & Logistics slowed down after 6 consecutive quarters of robust performance.

4Q 22

Transport & Logistics contracted with a reading of 46.9 in 4Q 22. On a QoQ basis, collections and payments declined by 12.5% and 11.7% respectively.

1Q 23

Transport & Logistics deteriorated further, continuing a straight-line declining trend since the start of 2021. On a year-on-year basis, collections and payments declined by 26.7% and 24.7% respectively.

2Q 23

Transport & Logistics sunk deeper into contraction in 2Q 2023 with a deterioration in reading from 46.6 in the previous quarter to 45.6.

3Q 23

Transport & Logistics slowed to 46.9 in 3Q 2023, an improvement from the 45.6 registered last quarter despite being in contraction.

4Q 23

Transport & Logistics grew to 47.8 in 4Q 2023, an improvement from the 46.9 registered last quarter despite being in contraction.

1Q 24

Transport & Logistics grew to 49.7 in 1Q 2024, a healthy improvement from the 47.8 registered last quarter despite being in contraction.

2Q 24

Transport & Logistics turned expansionary in 2Q 2024 after 6 consecutive quarters in contraction, and continues on a recovery trajectory.

3Q 24

Transport & Logistics continues on an upward trajectory and rose to 51.2 this quarter. Growth was mainly supported by robust performance in the Logistics segment (52.6).

4Q 24

Transport & Logistics continues on an upward trajectory and rose to 51.7, up from the 51.2 registered last quarter. All key segments showed growth this quarter, with the Logistics segment coming in strongly at 54.7.

1Q 25

Transport & Logistics deteriorated to 49.5 in 1Q 2025, down from the 51.7 registered last quarter. This was accompanied by a 0.9% on-year increase in collections and 0.8% on-year drop in payments.

2Q 25

Transport & Logistics edged higher to 49.8 in 2Q 2025, with growth mainly supported by healthy performance in the Logistics segment.

3Q 25

Transport & Logistics remained in contraction but improved marginally to 49.9. Collections grew by 6.7% on-year, while payments grew by 1.9% on-year.

4Q 25

Transport & Logistics registered an expansion at 50.1. This was accompanied by an increase in overall collections and payments of 8% on-year and 10% on-year, respectively.

Sea Transport

1Q 21

Sea Transport expanded for a 2nd consecutive quarter at 51.8, supported by strong cross-border trade.

2Q 21

The Sea Transport segment extended its expansion, registering a reading of 57.0.

3Q 21

Sea Transport moderated slightly at 54.8 due to 2Q 20's lower base but remained expansionary.

4Q 21

Sea Transport continued its strong performance at 54.5, lifted by growth in trade and e-commerce.

1Q 22

Sea Transport slowed significantly to 51.0 but remained expansionary as supply chains remained under stress from labour shortages and the Russian-Ukraine conflict.

2Q 22

Sea Transport grew at 51.5 as cross border trades strengthened.

3Q 22

Sea Transport saw a drop in reading from 51.5 in 2Q 22 to 50.1 in 3Q 22.

4Q 22

Sea Transport slumped to 46.9 and is likely to experience stronger headwinds in the near term.

1Q 23

Performance in the Sea Transport segment remains weak, despite an increase in reading from 46.9 in 4Q 22 to 47.5 this quarter.

2Q 23

Sea Transport slumped to 46.2 in 2Q 2023, attributed to falling sea freight rates and weak demand for containers and vessels.

3Q 23

Sea Transport contracted at 47.0 in 3Q 2023, attributed to the slump in global shipping market.

4Q 23

Sea Transport contracted at 47.9, with a 12.5% on-year decline in collections and 4.4% on-year decline in payments.

1Q 24

Sea Transport contracted at 48.6, accompanied by a 12.8% on-year decline in collections and 8.8% on-year decline in payments.

2Q 24

The contraction in Sea Transport narrowed to 49.2, as the segment saw an improvement in reading from the 48.6 recorded last quarter.

3Q 24

Contraction in Sea Transport narrowed to 49.6, with SMEs in the segment registering a 14.2% drop in collections and 17.5% drop in payments.

4Q 24

The Sea Transport segment expanded at 50.4 in 4Q, an increase from the 49.6 registered last quarter. Collections and payments however, declined at 8.9% and 17.1% on-year respectively.

1Q 25

Sea Transport fell into contraction at 48.8 this quarter. This reversal from expansion is accompanied by a 15.1% on-year drop and a 16.8% on-year decline in Collections and Payments respectively.

2Q 25

The contraction in Sea Transport narrowed to 49.7, as SMEs in the segment saw an improvement in reading from the 48.8 recorded last quarter.

3Q 25

Sea Transport remained in contraction and registered at 49.9, a slight improvement from last quarter's results.

4Q 25

Sea Transport registered a reading of 49.8, remaining in contraction for the fourth consecutive quarter.

Land Transport

1Q 21

Land Transport continued its expansion at 51.4, having dropped to a trough of 42.2 in 2Q 20.

2Q 21

Land Transport expanded strongly at 57.9 due to 2Q 20's lower, Circuit Breaker-affected base.

3Q 21

Land Transport remained expansionary in 3Q 21 at 51.1 despite the impact on demand from the shift to increased work from home during the quarter.

4Q 21

Land Transport remained flat at 50.0 with tighter restrictions for most of 4Q 21.

1Q 22

Land Transport slipped into contractionary territory at 49.2 but is expected to improve as restrictions eased in end-March.

2Q 22

Land Transport improved to 50.3 as land borders opened.

3Q 22

Land Transport fell to 50.0 in the third quarter as performance in the segment remains weak.

4Q 22

Land Transport contracted slightly at 49.3, with a 4.6% drop in collections on-quarter.

1Q 23

Land Transport was slightly contractionary in 1Q 2023, as performance in the segment remains weak.

2Q 23

Land Transport contracted slightly at 49.5, as performance in the segment remains weak.

3Q 23

Land Transport stay flat at 50.0 this quarter, with as collections slipped by 0.5% on-year.

4Q 23

Land Transport stayed flat at 50.1 this quarter.

1Q 24

Land Transport improved to 50.4 this quarter and continues on a slight upward trend.

2Q 24

Land Transport improved to 50.6 this quarter, and extends on a gentle upward trend.

3Q 24

Land Transport eased slightly to 50.4 this quarter.

4Q 24

Land Transport eased slightly to 50.1 this quarter. Collections and payments increased at 3.6% and 2.2% on-year respectively.

1Q 25

Land Transport contracted at 49.3 this quarter. Down from the 50.1 registered in 4Q 2024.

2Q 25

Land Transport improved to 49.7 this quarter, but remained in contractionary territory.

3Q 25

Land Transport remained in contraction and registered at 49.9.

4Q 25

Land Transport reversed from the contraction territory and expanded at 50.6 this quarter. This is accompanied with a 9% year-on-year increase in payments, and a 10% year-on-year increase in payments.

Logistics

1Q 21

Logistics remained the most resilient segment in the industry, expanding at at 52.1 in 1Q 21.

2Q 21

The Logistics segment continued its strong expansionary performance, recording a reading of 55.2.

3Q 21

Growth in the Logistics remained robust as the segment expanded at 55.0.

4Q 21

Logistics saw accelerating expansion at 56.8, lifted by growth in trade and e-commerce as collections rose significantly by 97% YoY.

1Q 22

Logistics registered a strong reading of 54.1 as collections rose by 67% significantly YoY.

2Q 22

Logistics continued to register a strong growth of 54.2, as collections continued to rise significantly by 53% YoY.

3Q 22

Expansion in the Logistics segment moderated from 54.2 in 2Q 22 to 51.9 in 3Q 22, as elevated oil prices could have dampened demand.

4Q 22

Logistics registered a sharp slowdown from 51.9 in 3Q 22 to 46.9 in 4Q 22, against the backdrop of higher energy prices.

1Q 23

The Logistics segment saw a steeper contraction this quarter, as a reduction in global trade flows weighed down on performance of the segment.

2Q 23

Logistics registered a sharp drop collections and payments, and saw a steep decline in performance of SMEs this quarter.

3Q 23

Logistics contracted at 45.6 in 3Q 2023, as SMEs within the segment saw sharp declines in collections and payments .

4Q 23

Logistics shrunk for another quarter and registered a sizeable decline in collections and payments this quarter at 30.9% and 30.6% respectively.

1Q 24

Logistics edged higher to 48.7 this quarter with its reading continuing on a upward trend over the past quarters.

2Q 24

Logistics expanded at 51.0 this quarter, benefitting from the pick-up in external demand.

3Q 24

Logistics expanded at 52.6 this quarter, benefitting from the pick up in manufacturing activity.

4Q 24

Logistics expanded at 54.7 this quarter, benefitting from strong external demand and robust construction and manufacturing activity over the quarter. Collections and payments increased substantially at 42.8% and 33.6% on-year respectively.

1Q 25

Logistics moderated but remained in expansion at 51.7 this quarter. This strong performance is led by a healthy 20.8% growth in Collections and a 16.8% growth in Payments on an on-year basis.

2Q 25

Reading in the Logistics segment moderated to 50.8, down from the 51.7 last quarter. SMEs in the segment remained in expansion as collections and payments grew by 9.3% and 12.6% year-on-year respectively.

3Q 25

Logistics fell into contraction at 49.4 this quarter, down from last quarter's expansionary results.

4Q 25

The Logistics segment registered a reading of 48.6, a drop from last quarters reading of 49.4. This is the segment's second consecutive quarter of contraction.

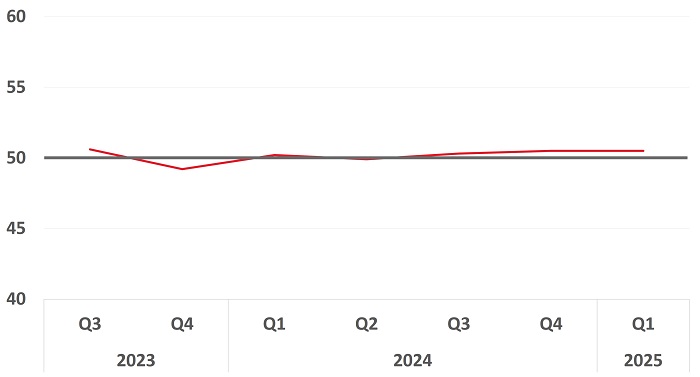

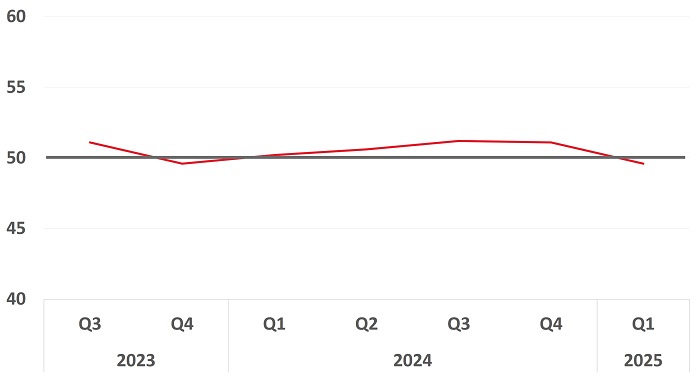

Education

1Q 21

Education turned expansionary at 51.2 in 1Q 21, recovering from a trough of 42.0 in 2Q 20.

2Q 21

Education extended its expansion from the previous quarter at 58.1 in 2Q 21.

3Q 21

Education remained expansionary for a 3rd consecutive quarter at 51.5 in 3Q 21, driven by a 21% increase in collections.

4Q 21

Education moderated in 4Q 21 compared to the previous quarter, with a flat reading of 50.0.

1Q 22

Education fell into contractionary territory with a reading of 49.0.

2Q 22

Education reversed the contraction in 1Q 22, with a reading of 50.1.

3Q 22

Education remained buoyant at 51.2 in 3Q 22, up from 50.1 in the previous quarter.

4Q 22

Education moderated to 50.5 in 4Q 22, down from the 51.2 registered in the previous quarter.

1Q 23

Education grew to 50.9 in 1Q 2023, higher than the 50.5 recorded in the previous quarter.

2Q 23

Education edged lower to 50.8 but remained expansionary in 2Q 23. Growth was relatively well-distributed across the various segments.

3Q 23

Education grew to 51.0 in 3Q 2023, slightly higher than the 50.8 recorded in the previous quarter.

4Q 23

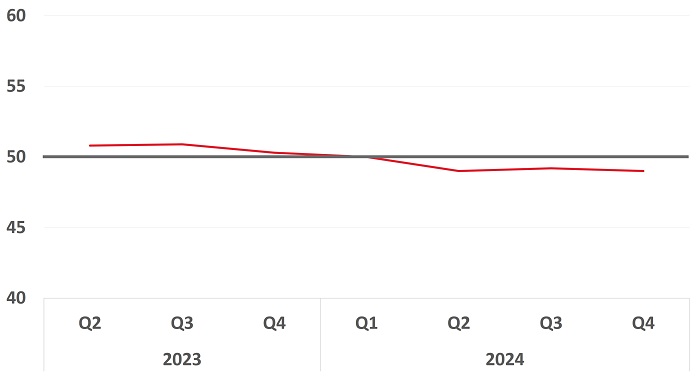

Education contracted slightly at 49.7 this quarter, a decline from the 51.0 recorded in 3Q 2023.

1Q 24

Education grew to 50.5 in 1Q 2024, as the sector saw an 8.2% increase in collections and 16.0% increase in payments.

2Q 24

Education was slightly expansionary at 50.8 in 2Q 2024, as the industry saw a 16.0% increase in collections and 11.9% increase in payments.

3Q 24

Expansion in the Education industry eased to 50.5 in 3Q 2024, accompanied by a 7.7% increase in collections and 8.2% increase in payments.

4Q 24

Expansion in the Education industry moderated to 50.0 in 4Q 2024. Collections and payments grew by 7.4% and 9.9% on-year respectively.

1Q 25

Education dipped to 49.6 in 1Q 2025 and fell into the contraction territory. This was led by a 3.0% increase in collections and 2.0% fall in payments.

2Q 25

Education remained in contraction for the second consecutive quarter at 49.7. This was led by a 1.1% on-year drop in collections and 1.8% on-year drop in payments.

3Q 25

Education remained in contraction for the third consecutive quarter at 49.9. This was led by a 1.1% on-year drop in payments, and a marginal 2.3% on-year increase in collections.

4Q 25

Education improved to 50.3 in 4Q25, entering the expansion territory with a 4% year-on-year increase in collections and a 1% year-on-year increase in payments.

Education - Early Childhood Education

1Q 21

Early Childhood Education remained slightly below the 50 reading at 49.9, being more vulnerable to restrictions with virtual learning being less feasible compared to other segments.

2Q 21

Early Childhood Education turned expansionary at 55.5 due to 2Q 20's lower base; the segment faced tightened safe management measures due to increased Covid-19 cases linked to care centres.

3Q 21

Early Childhood Education remained expansionary at 50.4. The segment is seeing cautious recovery from tightened measures, in place in Q2 and Q3, caused by increased cases linked to care centers in May and June.

4Q 21

Early Childhood Education remained expansionary at 51.4 with collections growing 26% YoY.

1Q 22

Early Childhood Education remained relatively flat with a reading of 50.1.

2Q 22

Early Childhood Education grew to 51.8 as a higher proportion of parents returned to work at the office.

3Q 22

Early Childhood Education saw the largest expansion within the sector, supported by sustained demand for childcare services.

4Q 22

Early Childhood Education contracted marginally at 49.8, weighing down on the overall performance.

1Q 23

Early Childhood Education saw the largest growth across the various segments within the Education sector, registering a reading of 52.4.

2Q 23

Early Childhood Education eased from 52.4 last quarter to 50.7 in 2Q.

3Q 23

Early Childhood Education edged higher to 50.9, supported by sustained demand for childcare services.

4Q 23

Early Childhood Education fell into contraction after three quarters of healthy expansion.

1Q 24

Early Childhood Education extended another quarter in contraction, as its reading edged lower to 49.4 in 1Q 2024.

2Q 24

Early Childhood Education saw a modest expansion of 50.6 after 2 consecutive quarters in contraction, as the segment registered healthy growth in collections and payments.

3Q 24

Early Childhood Education moderated to 50.0 down from the 50.6 registered last quarter, even as the segment saw healthy collections and payment growth.

4Q 24

Early Childhood Education fell into contraction at 49.4, down from the 50.0 registered in 3Q 2024. This contraction comes even as the segment saw healthy collections and payments growth at 10.8% on-year and 9.1% on-year respectively.

1Q 25

Early Chilldhood Education saw a modest expansion of 50.2, up from the 49.4 registered last quarter. Collections and payments saw health growth at 15.5% and 14.3% on-year respectively.

2Q 25

Early Childhood Education fell to 49.3 in 2Q 2025, down from the 50.2 registered last quarter.

3Q 25

Early Childhood Education maintained at 49.3 in 3Q 2025. Collections maintained a 2.3% on-year growth, while payments registered a 5.5% on-year decline this quarter.

4Q 25

Early Childhood Education expanded to 50.6, an improvement from the 49.3 registered last quarter.

Education - Training Centres

1Q 21

Training Centres (which includes Training Courses and Academic Tuition) turned expansionary at 50.7 for the first time since the pandemic started.

2Q 21

Training Centres extended its expansion since the previous quarter at 55.9, bouyed by increased uptake of training.

3Q 21

Training Centres continued its growth in 3Q 21 at 52.2 as the pandemic saw a push for up-skilling/re-skilling by the government and increased uptake by workers. For example, Singaporeans utilising SkillsFuture increased by 21% YoY to 188,000 in 2020. The scheme was extended to 80,00 micro-learning courses in September 21.

4Q 21

Training Centres remained expansionary at 50.9 with collections growing 21% YoY.

1Q 22

Training Centres (which includes Training Courses and Academic Tuition) continues to see a slowdown in growth since 3Q 21 as demand slowed.

2Q 22

Training Centres remained neutral at 50.1 as demand had yet to pick up.

3Q 22

Training Centres experienced broad gains, and reading for the segment increased from 50.1 in 2Q 22 to 50.9 in 3Q 22.

4Q 22

Training Centres remained slightly expansionary at 50.5 in 4Q 22, with collections growing 12.1% on a year on year basis.

1Q 23

Training Centres stayed flat at 50.2 in 1Q 2023, similar to the previous quarter.

2Q 23

Training Centres experienced slight gains, and reading for the segment increased from 50.2 to 50.6 this quarter.

3Q 23

Training Centres remained expansionary at 50.6, similar to the previous quarter.

4Q 23

Training Centres contracted at 49.2, led by a 5.9% decline in collections and 7.8% decline in payments on a year-on-year basis.

1Q 24

SME performance in the Training Centres segment improved, as its reading rose from 49.2 to 50.2 this quarter.

2Q 24

Training Centres was marginally contractionary at 49.9 this quarter.

3Q 24

Training Centres improved to 50.3 this quarter, as collections and payments rose by 3.6% on-year and 3.8% on-year respectively.

4Q 24

Training Centres improved to 50.5 this quarter, as collections and payments rose by 12.0% on-year and 11.1% on-year respectively.

1Q 25

Training Centres maintained at 50.5, registering another quarter of expansion.

2Q 25

Training Centres maintained at 50.6, registering another quarter of expansion.

3Q 25

Training Centres improved to 50.9 this quarter, registering another quarter of expansion.

4Q 25

Training Centres eased marginally and remains in expansion at 50.8. Business activity is likely driven by individuals utilising their Skills Future credits ahead of the end-2025 expiry.

Education - Recreation Classes

1Q 21

Recreation Classes was non-contractionary at 50.0 for the first time since the pandemic started, expanding from the trough of 41.0 in 2Q 20.

2Q 21

Recreation Classes expanded for the first time since the pandemic started at 55.0. The higher reading was mainly due to 2Q 20's lower base. The segment faced tightened safe management measures.

3Q 21

Recreation Classes remained flat at 50.1, as restrictions tightened under Heightened Alert measures.

4Q 21

Recreation Classes saw a steep decline and contracted at 48.0, partly affected by the restriction of group sizes during the Stabilisation Phase.

1Q 22

Recreation Classes remained contractionary at 48.5 but has seen a slight uptick as restrictions eased in late November. Things should improve further with the lifting of class size limits.

2Q 22

Recreation classes benefitted from the lifting of restrictions, moving up to 51.5 with a 25% increase in collections YoY.

3Q 22

Recreation classes saw a slight moderation, from 51.5 in 2Q 22 to 51.0 in 3Q 22.

4Q 22

Recreation classes ticked higher to 51.4 in 4Q 22, up from the 51.0 recorded in 3Q 22.

1Q 23

Recreation classes eased slightly from 51.4 to 51.1 in 1Q 2023 with a 22.0% on-year increase in collections.

2Q 23

Recreation classes saw a slight moderation, with a dip from 51.1 in 1Q 23 to 50.7 in 2Q 23.

3Q 23

Recreation classes saw a slight moderation, with a dip from 50.7 in 2Q 2023 to 50.5 in 3Q 2023.

4Q 23

Recreation classes saw a slight moderation, with a dip in reading from 50.5 in 3Q to 50.2 in 4Q.

1Q 24

Recreation classes extended its gains into 1Q 2024 as the segment grew to 50.5 this quarter.

2Q 24

Recreation classes extended its gains into 2Q 2024 as the segment grew to 50.6 this quarter.

3Q 24

Recreation classes extended its gains into 3Q 2024 as the segment grew to 50.6 this quarter.

4Q 24

Recreation classes moderated in growth, with a dip in reading to 50.5 this quarter.

1Q 25

Recreation Classes maintained at 50.5, registering another quarter of expansion. Collections and Payments increased by 8.3% and 3.8% on-year respectively.

2Q 25

Recreation Classes recorded another quarter of modest expansion with a reading of 50.8. Collections and Payments increased by 11.3% and 5.2% on-year respectively.

3Q 25

Recreation Classes recorded another quarter of expansion, bringing the reading to 50.5.

4Q 25

Recreation Classes recorded another quarter of expansion at 50.1, easing marginally from last quarter's reading of 50.5.