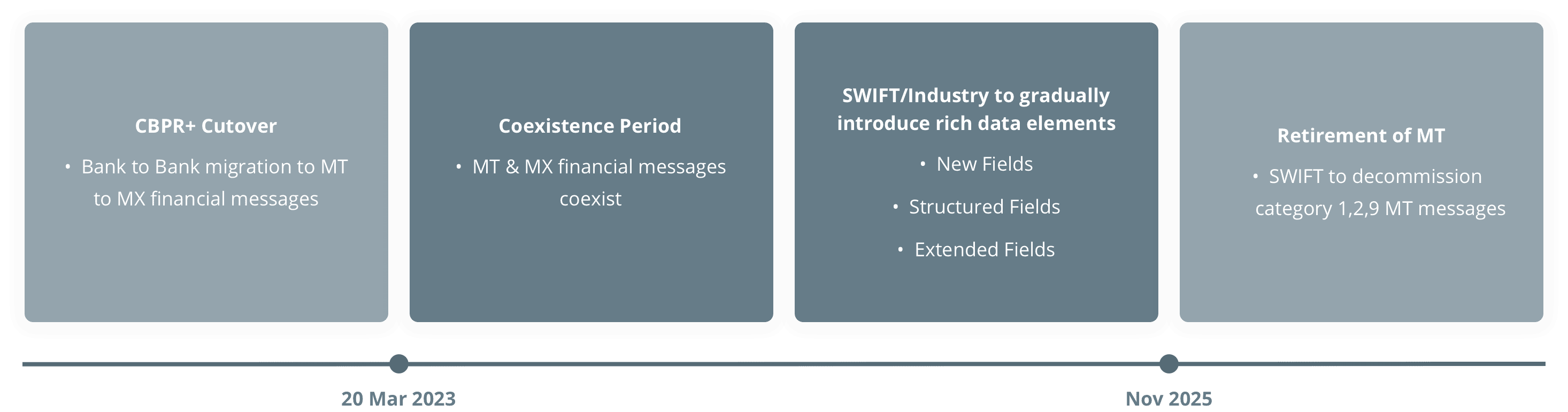

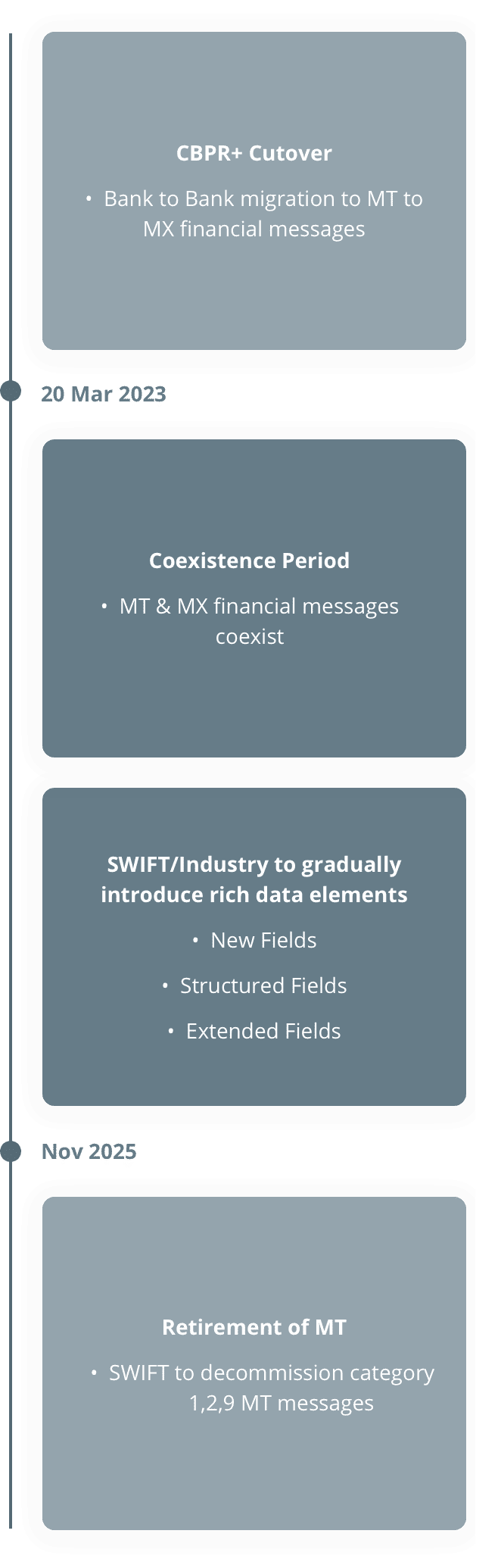

ISO 20022 CBPR+ is a SWIFT initiative to migrate payment messages towards ISO 20022 standards.

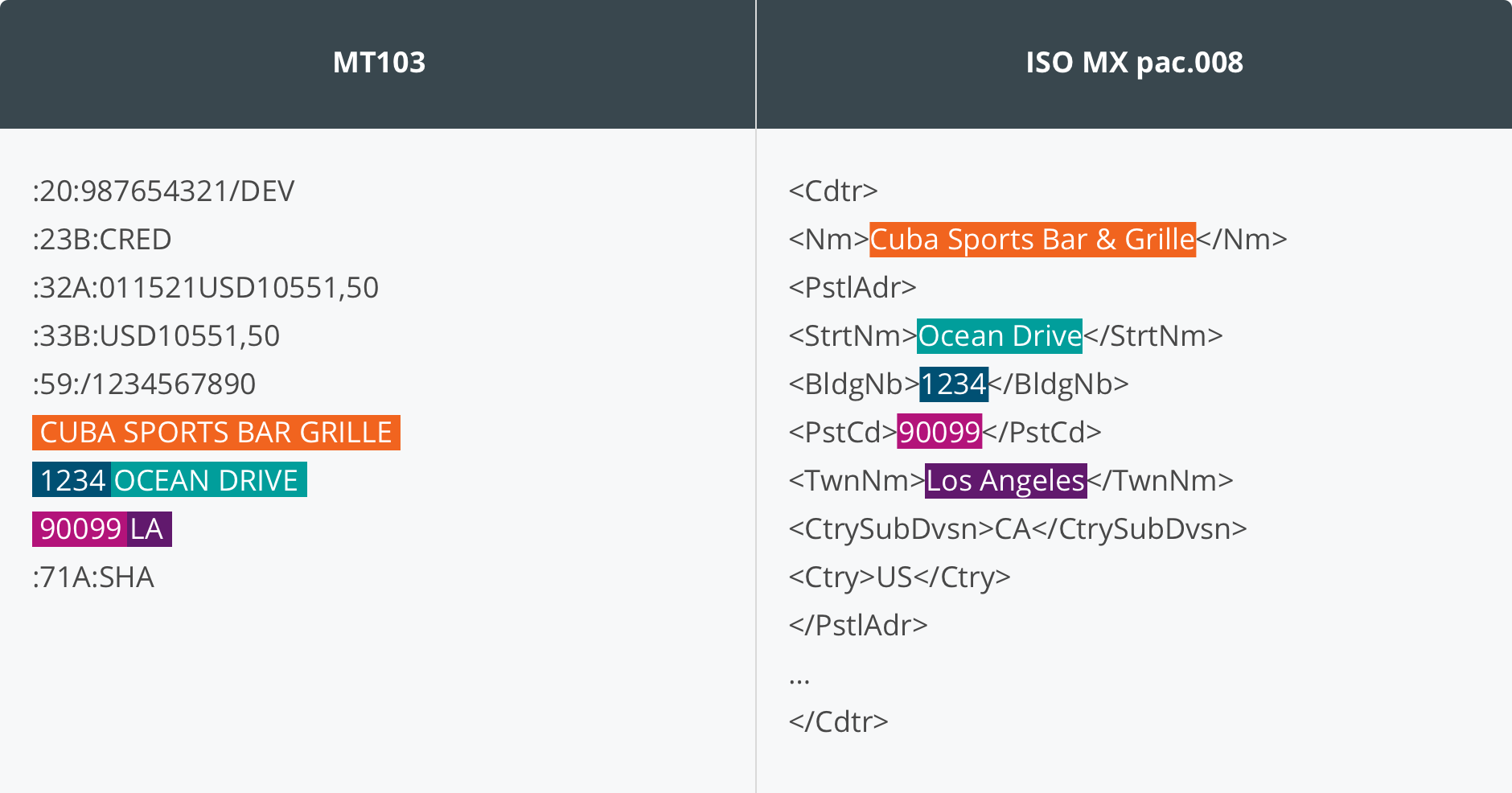

CBPR+ (Cross-border Payments and Reporting Plus) is a set of specifications for ISO 20022 cross-border financial messages. CBPR+ messages are also referred to as ISO 20022 “MX” messages.

It aims to address limitations arising from different payment formats used by institutions, such as manual processing incurred by unstructured payment data.