Keep Tabs on Your Spending with Expense Data

Keep Tabs on Your Spending with Expense Data

Economies around the world have been severely impacted by the COVID-19 pandemic. Uncertainty surrounding future revenues is high and your business must be able to adapt to the changing times.

In times like these, the first step is to get your expenses under control. Do you know how much you’re spending exactly on everything and what is chalking up extra costs?

In the past, you might have found it easier to absorb higher-than-expected monthly expense figures in your cash flow statement. However, in these trying times, you will want to know exactly where every cent is going.

But this is easier said than done. Getting down to the nitty-gritty each month can be exhausting and time-consuming — there’s just too much data! It is important that you find a way to get all your expenses under control in an easy and efficient manner, and technology can help you do just that.

Automated Expense Management Software is Here to Help

Are You Using These Platforms?

Accounting software platforms such as QuickBooks, Xero, Wave, Sage can come in handy for your business. These platforms automatically organise your data and show you your largest (and smallest) income and expenses. They can also break these down month-by-month and even day-by-day to spot trends. What’s more, these can all be accessed online and remotely, which is perfect since many of us are working from home.

You can also do this with Velocity, OCBC’s digital business banking platform. With integrated Business Financial Management capabilities, time-starved businesses can get quick access to a complete view of their accounts with automated data visualisations.

Trends in Expenses and (Hidden) Expenses Revealed

These tools also bring to light expenditure trends, and unforeseen and hidden expenses.

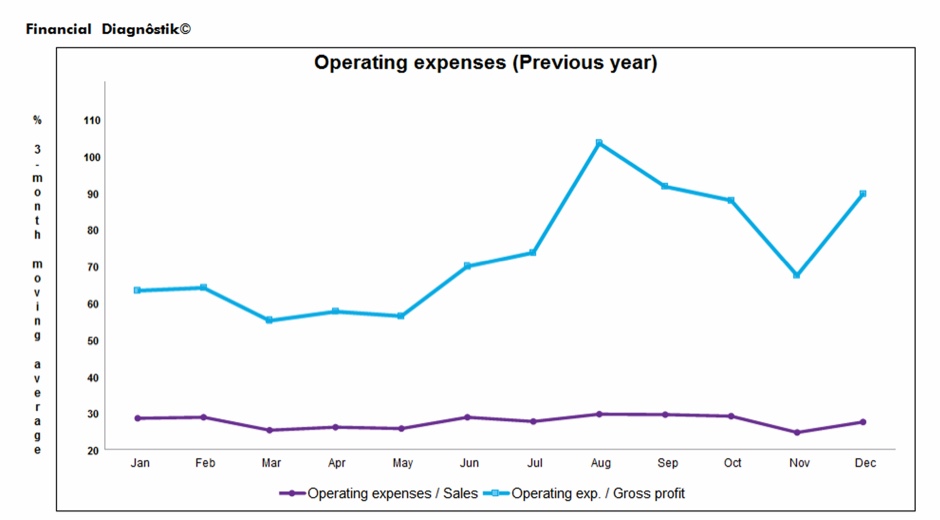

Are you aware which months of the year you’ll typically incur the most costs? As a business owner, you’ll need to be on top of your spending so you can stay prepared for any incoming bills and expenditures that may recur.

Having an overview of your expenditure trends will also help you identify the reasons why you tend to spend more than usual during a particular time of the year, and enable you to make minor adjustments to bring costs down.

Source: Financial Diagnôstik©

Do you know where your largest expenses lie? According to a study of 4,000 businesses by Soldo and YouGov, 36% of spending has to do with unnecessary financial detective work at the end of each month to determine who spent money, where they spent it and why. Why waste so much time on a monthly basis trying to figure out where the money has gone, when you can have them all logged in properly at the exact moment when it is being spent?

In addition, in a survey of over 300 small businesses, B2B research firm Clutch found that unforeseen expenses was rated as businesses top financial challenge. Remember that subscription platform you barely use that is billed annually, or that equipment repair fee your employee signed off on (and didn’t tell you)? These expenses may seem small but they can quickly add up to your business’ detriment.

Improved Accuracy in Data Records

Using software can also help to make your financial records more accurate. The Clutch survey revealed that 95% of small businesses were confident in the accuracy of their financial records, yet they still commonly faced problems such as misclassifying expenses in wrong categories, and losing receipts.

To avoid these issues, why not give yourself peace of mind with an automated system that accurately tracks your spending and expense data?

Take Control of Your expenses

It’s time to get on top of all your data and take control of your business expenses by using the new business financial management tool in OCBC Velocity, or sign up for your preferred accounting app under our Start Digital bundles today.

Disclaimer

You may be directed to third party websites. OCBC Bank shall not be liable for any loss suffered or incurred by any party for accessing such third party websites or in relation to any product and/or service provided by any provider under such third party websites.

The information provided herein is intended for general circulation and/or discussion purposes only. Before making any decision, please seek independent advice from professional advisors. No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake any obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

Discover other articles about: