Bridging the net-zero ambition gap: the robust use of market mechanisms

Bridging the net-zero ambition gap: the robust use of market mechanisms

As the global economy transitions toward a low-carbon future, businesses face increasing pressure to align their operations with net-zero commitments.

Market-based solutions, such as carbon credits and environmental attributes certificates (EACs) from renewable energy, often referred to as renewable energy certificates (RECs), are essential tools to bridge the gaps between current decarbonisation capabilities and ambitious net-zero goals.

Market mechanisms can also be used to bring a shadow carbon price onto the balance sheet, effectively realising the cost of emissions. This incentivises businesses to take bolder action in their decarbonisation efforts as there is an additional commercial cost savings that can materialise from this.

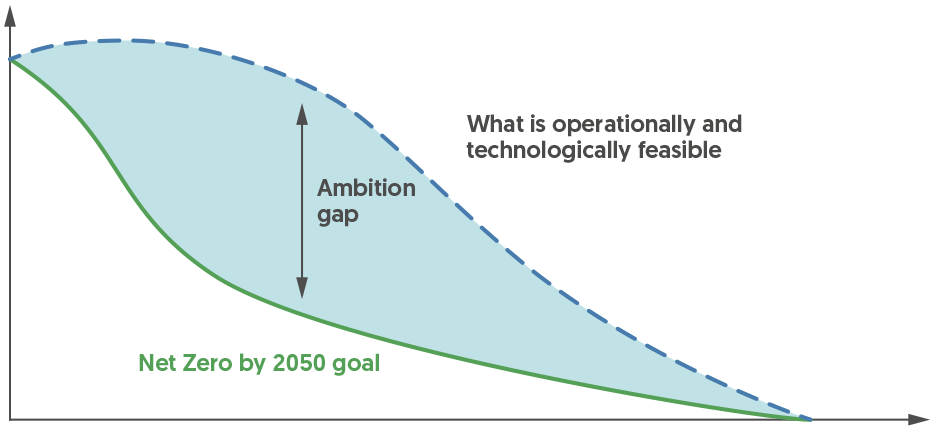

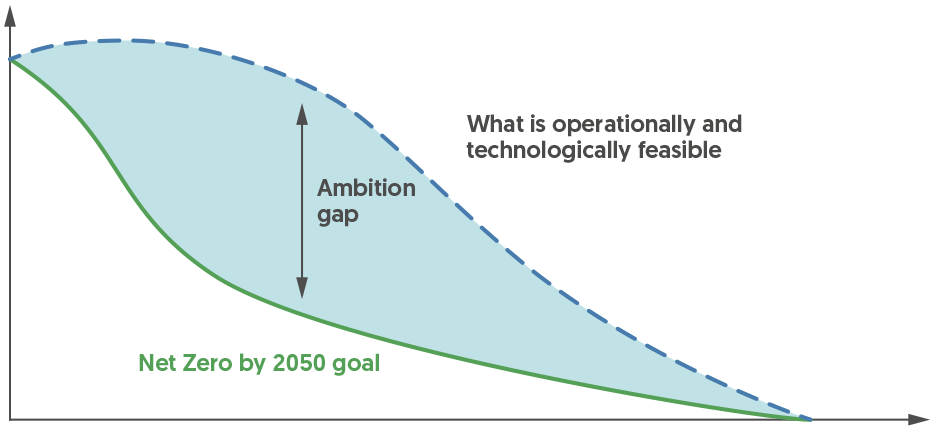

Figure 1: Market mechanisms can help bridge the gap between what is operationally and technologically feasible, and long-term net-zero ambitions

| Purpose | Source | Claim | Reporting | Unit of measure | |

|---|---|---|---|---|---|

| Renewable Energy Certificates |

Convey the use of renewable electricity |

Renewable electricity generators |

“I use “x” MWh of renewable electricity” |

Lower market-based Scope 2 emissions from purchased electricity |

Megawatt hours (MWh) |

| Carbon Credits |

Represent the reduction of Greenhouse Gas (GHG) reductions |

Projects that avoid or reduce carbon emissions |

“I have offset “x” MtCO₂ equivalent through the purchase of carbon credits” |

Offset scope 1, 2 or 3 emissions |

Metric tonnes of CO₂ or CO₂ equivalent |

Figure 2: Key differences between RECs and Carbon Credits

Understanding Renewable Energy Certificates

What is a REC?

RECs represent the generation of one megawatt hour (MWh) of renewable energy. This certificate can be monetised and sold. Who owns the certificate owns the associated decarbonisation. By purchasing and retiring RECs, companies can claim use of an equivalent amount of renewable electricity, effectively reducing their Scope 2 emissions from the purchase of electricity.

How Renewable Energy Certificates work

Figure 3: How RECs work

How can RECs be used effectively?

In regions where energy grids have not fully transitioned to renewable sources, RECs serve as an interim solution, bridging the gap between renewable energy that can be self-generated and long-term net-zero goals.

Good practice: Use RECs to help offset your Scope 2 emissions to help you align with your net zero ambition. Adhere to market standards, such as the Singapore Standard 673: Code of practice for RECs, a national standard that defines the types of renewable energy sources eligible to generate RECs. To offset your Scope 2 emissions in Singapore, select RECs in Singapore and Southeast Asia, and prioritise newer RECs.

Best practice: Offset all your Scope 2 emissions with RECs. Align the use of RECs with the RE100, a global corporate renewable energy initiative committed to using 100% renewable electricity. Source RECs connected to the same national or local grid that your asset/company is drawing electricity from, and match the year of REC production to the year of electricity consumption you are offsetting.

Good Practice vs Best Practice in REC adoption

| When to use RECs | Standards | Grid connection | Vintage | |

|---|---|---|---|---|

| Good practice |

To reduce your Scope 2 emissions to align with the 1.5°c pathway |

Adhere to market standards – the Singapore Standard 673: Code of Practice for RECs |

For renewable energy claims in Singapore using RECs, the REC should be produced in Singapore or Southeast Asia |

Prioritise newer RECs |

| Best practice |

To account for all electricity used by the asset/company, effectively reducing Scope 2 emissions to zero |

Align claims with RE100 standard |

Ensure renewable energy is connected to the same national or local grid that the asset is drawing electricity from |

Match the year the REC was produced to the year of electricity consumption |

Figure 4: Good Practice vs best practice in REC adoption

Understanding Carbon Credits

What is a carbon credit?

A carbon credit represents the reduction or removal of one metric tonne of carbon dioxide equivalent emissions, and can be generated through projects that avoid, reduce or sequester emissions. Companies can purchase and retire carbon credits voluntarily, or as part of mandatory schemes, such as the European Union (EU) Emissions Trading System (ETS).

How can carbon credits be used effectively?

High-quality carbon credits can complement domestic emissions reduction efforts and provide a pathway for companies to address hard-to-abate emissions. While the role of carbon credits in achieving companies’ net zero ambitions has been widely debated, this view must be balanced with the realities of current decarbonisation capabilities.

Good Practice: Prioritise quality carbon credits to offset residual emissions. Governments, alongside industry bodies, are developing guidelines that provide much-needed guidance for companies seeking to integrate high-quality carbon credits into their decarbonisation strategies. For example, Singapore’s International Carbon Credit (ICC) Framework has allowed carbon tax-liable companies in Singapore to use eligible ICCs to offset up to 5% of their taxable emissions since 2024. The ICC Framework is aligned with Article 6 of the Paris Agreement and enables Singapore to cooperate with other countries to support their respective decarbonisation targets. ICCs must adhere to the Eligibility Criteria and Eligibility List, underpinned by seven internationally recognised principles to demonstrate high environmental integrity, before carbon tax-liable companies can use the ICCs to offset their taxable emissions.

In addition, ensure transparent disclosure on the voluntary use of carbon credits as part of their climate commitments, aligned with best practice such as the Voluntary Carbon Markets Integrity Initiative (VCMI) Claims Code of Practice.

Seven Principles under Singapore’s Eligibility Criteria

To comply with Article 6 of the Paris Agreement, the certified emissions reductions or removals must have occurred between 1 January 2021 and 31 December 2030.

-

Not double-counted

-

Additional

The certified emissions reductions or removals must exceed any emissions reduction or removals required by any law or regulatory requirement of the host country, and that would otherwise have occurred in a conservative, business-as-usual scenario.

-

Real

The certified emissions reductions or removals must have been quantified base on a realistic, defensible and conservative estimate of the amount of emissions that would have occurred in a business-as-usual scenario, assuming the project or programme that generated the certified emission reductions or removals had not been carried out.

-

Quantified and verified

The certified emissions reductions or removals must have been calculated in a manner that is conservative and transparent, and must have been measured and verified by an accredited and independent third-party verification entity before the ICC was issued.

-

Permanent

The certified emissions reductions or removals must not be reversible, or if there is a risk that the certified emissions reductions or removals may be reversible, there must be measures in place to monitor, mitigate and compensate any material reversal of the certified emissions reductions or removals.

-

No net harm

The project or programme that generated the certified emissions reductions or removals must not violate any applicable laws, regulatory requirements, or internal obligations of the host country.

-

No leakage

The project or programme that generated the certified emissions reductions or removals must not result in a material increase in emissions elsewhere, or if there is a risk of material increase in emissions elsewhere, there must be measures in place to monitor, mitigate and compensate any such material increase in emissions.

Figure 5: Seven Principles under Singapore’s Eligibility Criteria in the Singapore’s ICC Framework

Best Practice: Commit to achieving net-zero by 2050 and demonstrate progress towards meeting these targets. Choose high-quality carbon credits that have undergone robust monitoring, reporting and verification (MRV) processes and ensure permanent emissions reduction or removal. Newer projects also tend to produce carbon credits of higher quality because of more stringent MRV methodologies in recent years. Obtain third party assurance over disclosures around carbon credits you have purchased/ retired and communicate how they fit into your broader climate goals.

Good Practice vs Best Practice in Carbon Credit adoption

| When to use carbon credits | Standards | Disclosures | |

|---|---|---|---|

| Good practice |

Prioritise emissions reductions. Use carbon credits to offset only residual emissions. |

Select high quality carbon credits aligned with market standards (e.g. Singapore’s ICC Framework) |

Report credits separately from gross emissions inventories. Disclose key information on retired credits (e.g. number of credits purchased and retired, project type, host country, methodology, vintage etc.). |

| Best practice |

Commit to achieving net-zero by 2050, and disclose validated, science-based near-term targets to reduce emission, and demonstrate progress achieved. |

Prioritise carbon removal projects (e.g. nature-based solutions, direct air capture) over carbon reduction (e.g. projects to improve fuel-efficiency). |

Obtain third-party assurance over the reported information. |

Figure 6: Good Practice vs Best Practice in Carbon Credit adoption

Conclusion

While market mechanisms can be a part of companies’ net zero strategies, carbon credits should only be used to offset residual emissions that cannot be prevented, reduced, or substituted with lower-carbon alternatives. RECs should be used to substitute residual emissions that cannot be prevented or reduced. Companies must use carbon credits and RECs to complement, not replace, direct emissions reduction efforts such as energy efficiency upgrades, renewable energy investments, and supply chain optimisation.

The path to net-zero is not without challenges. However, with the right tools and partners, you can turn your ambition into action and lead the charge towards a net-zero future.

How OCBC can support you

1. Acquire carbon credits and RECs

OCBC’s dedicated Emissions Trading Desk can help you select the right carbon credits and RECs for your needs. With our spot and forward solutions, you will be able to seamlessly purchase and retire voluntary and compliance carbon credits as well as RECs to offset or reduce your residual carbon emissions.

2. Co-create a tailored transition plan

The adoption and impact of carbon credits and RECs on your transition plans can be complex. OCBC’s dedicated team of sustainability experts stand as a trusted partner to guide you in your net-zero transition. We can advise customers on how best to use market mechanisms in their long-term net-zero strategy, supporting you to articulate your plans in a transition finance framework that will enable you to tap into sustainable and transition financing solutions to bring capital to your transition efforts.

3. Offer credible sustainable financing solutions

Since 2018, OCBC has been offering both large corporates and SME clients across markets with credible sustainable financing solutions. Recognised as the Best Bank for Sustainable Finance across the region and the top Mandated Lead Arranger for Sustainable Loans in APAC ex-Japan , OCBC is well positioned to support you in your sustainable financing efforts, whether you are looking to install solar panels at your rooftops, or purchasing carbon credits to offset your residual emissions.

OCBC has a dedicated Solar Financing Programme to support your renewable energy adoption. We can connect you with our ecosystem of solar providers to help you assess how feasible it is to install a solar panel system on your business’ roof space, while accessing financing from OCBC to support your efforts.

Building a greener future with Kimly Construction and Energetix

Powered by OCBC’s green financing solutions and advisory, Kimly Construction and Energetix are embracing clean energy technologies to reduce costs and minimise their environmental impact. Watch how they integrate solar power and sustainable building practices into their projects, driving meaningful change in Singapore’s construction industry.

Our carbon offset loan and carbon credit solutions support our clients as they offset their residual emissions with the purchase of high-quality carbon credits.

Singapore’s first green financing solution comprising green loan and carbon credits

Singapore’s first green financing solution comprising green loan and carbon credits

OCBC partnered with Frasers Centrepoint Trust (FCT) on Singapore’s first green financing solution that comprises a green loan and carbon credit.

Proceeds from the $419 million green loan will be used for the refinancing of a maturing facility, asset enhancement initiatives, decarbonisation projects such as procurement of energy efficient technology for Tampines 1 and other general corporate purposes.

The carbon credits, sourced through OCBC’s Emissions Trading Desk, will go towards investing in Verra or Gold Standard certified carbon reduction nature-based projects. The amount of carbon reduced will be equivalent to the financed emissions associated with the green loan. FCT will further purchase additional carbon credits to account for the residual and unavoidable Scopes 1 and 2 as well as energy-related Scope 3 emissions of the mall’s carbon footprint.

OUE REIT executes interest rate swap with carbon credits in S$75m transaction

OUE REIT executes interest rate swap with carbon credits in S$75m transaction

OUE REIT has completed an interest rate swap with a set of voluntary carbon credits, through a transaction with OCBC.

The S$75 million structured derivative transaction enables the REIT to hedge against interest rate risk. As part of the transaction, OUE REIT received a fixed amount of voluntary carbon credits sourced by OCBC’s emissions trading desk. It is the first transaction of its kind completed by OUE REIT.

These voluntary carbon credits will be used to invest in a carbon reduction nature-based project in South-east Asia, said the manager. The project has been certified by Verified Carbon Standard Programme, a greenhouse gas crediting programme administered by non-profit organisation Verra, which manages standards for sustainable development, climate action and responsible business practices.

OUE REIT Management said the carbon credits will be used to offset OUE REIT’s residual emissions.

References

“Principles for Carbon Credit Use”, South Pole, 2022

“Position Paper on Carbon Credits”, CDP, 2023

“Claims Code of Practice: Building Integrity in Voluntary Carbon Markets V2.1.” Voluntary Carbon Markets Integrity Initiative, 2024

Discover other articles about: