Cash-on Instalments is now more rewarding than ever! Enjoy 2% unlimited cashback when you apply with a minimum approved loan amount of S$5,000 and a tenor of 36, 48 or 60 months.

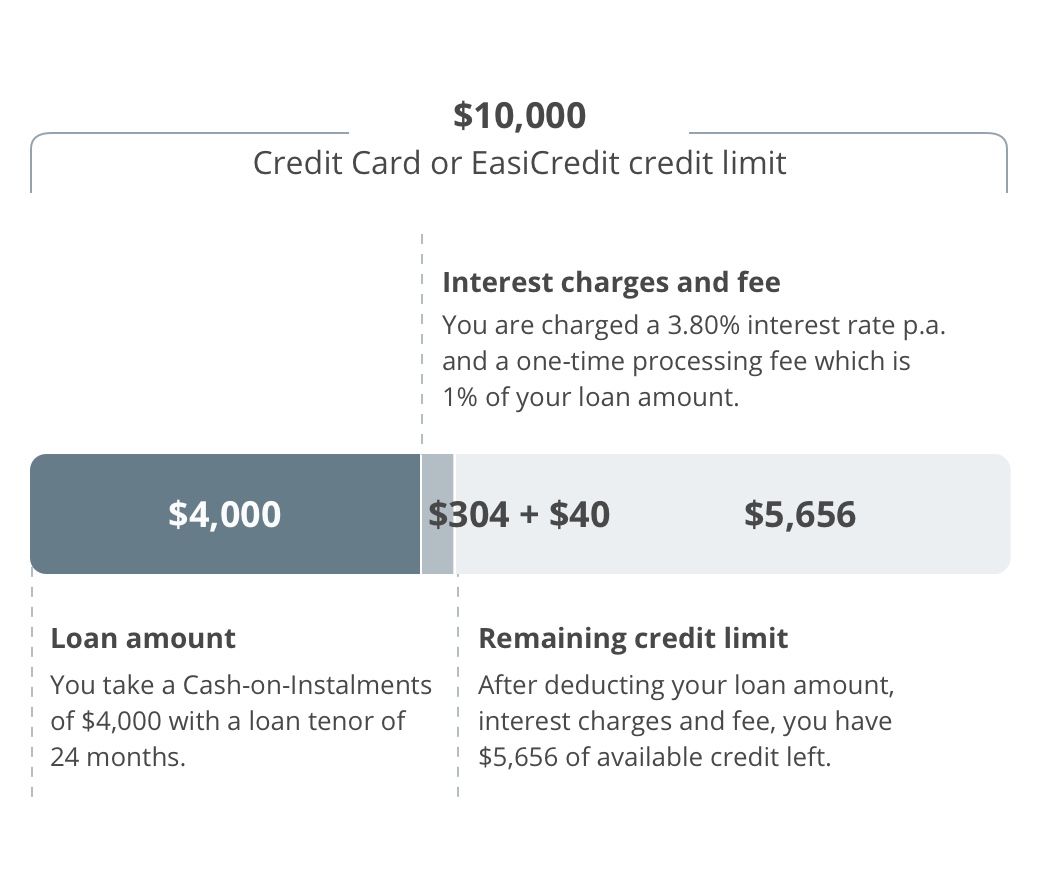

Refer to the table below for monthly instalment breakdown based on the same loan amount, with different loan tenors from 12 to 60 months, applicable interest rate and effective interest rates.

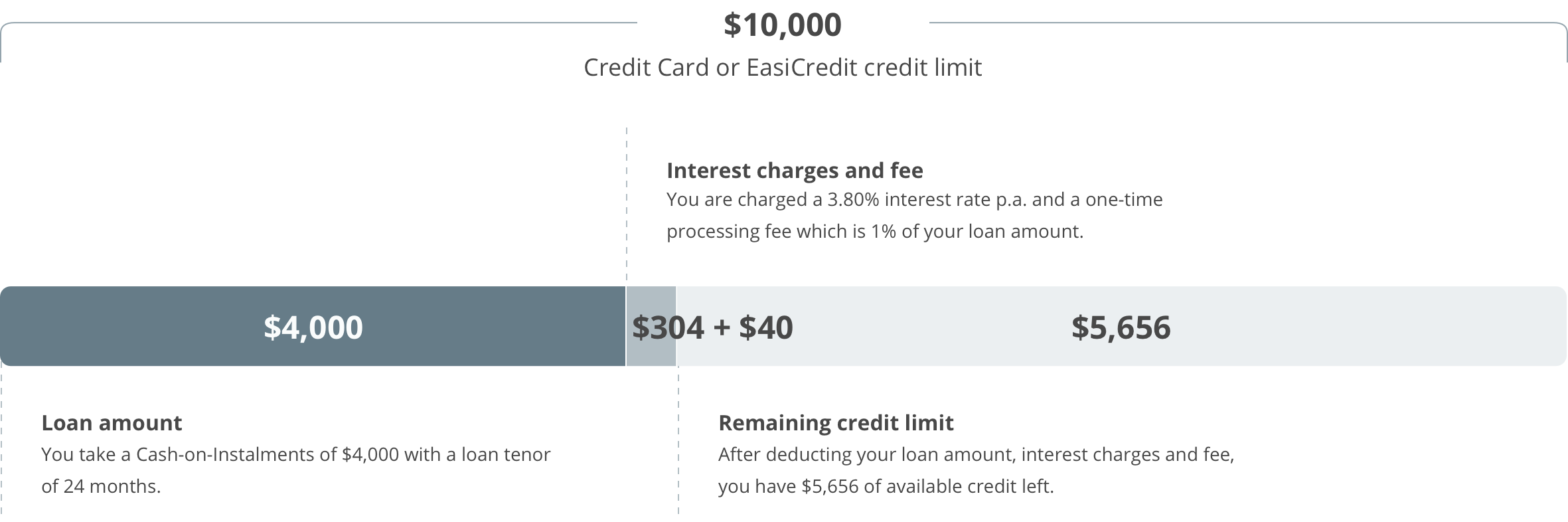

Illustration:

Approved Loan Amount: $10,000

Processing Fee: 1.00%

| Repayment Period | Interest Rate (Flat Rate)1 |

Monthly Rest Rate2 | Effective Interest Rate3 |

Monthly Instalment4 |

|---|---|---|---|---|

| 12 months | 3.80% | 6.94% | 8.82% | $865.00 |

| 24 months | 7.13% | 8.12% | $448.33 | |

| 36 months | 7.14% | 7.82% | $309.44 | |

| 48 months | 7.11% | 7.63% | $240.00 | |

| 60 months | 7.06% | 7.49% | $198.33 |

1 Interest on loan amount as quoted in the loan application form.

2 Interest on loan amount is calculated on a monthly rest method, excluding processing fee.

3 Effective interest rate is inclusive of a one-time processing fee.

4 Instalment amounts are calculated based on a fixed monthly instalment payment option and are simplified for illustration purposes.