GREAT Hospital Care

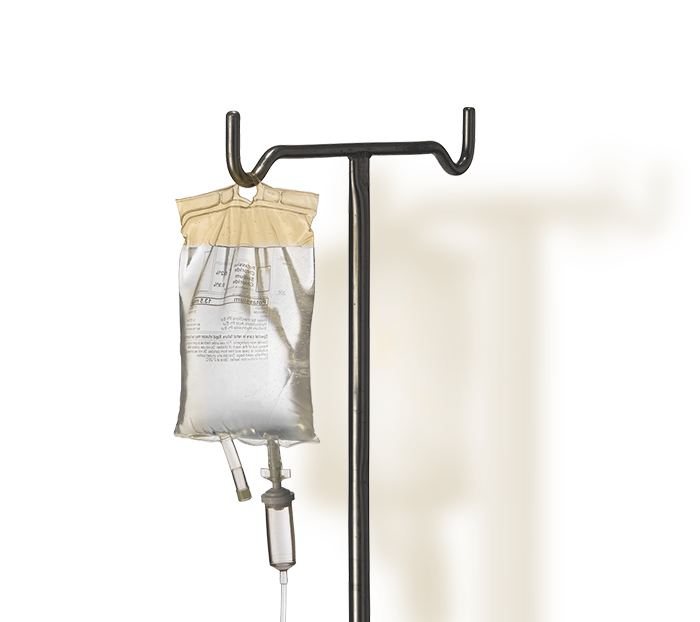

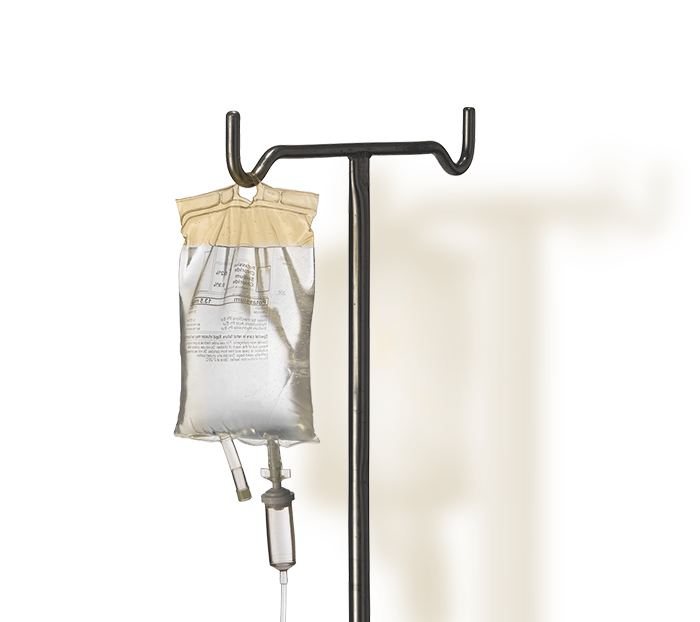

Have complete peace of mind during hospitalisation

GREAT Hospital Care covers you with daily cash benefits and reimburses your hospital expenses, allowing you to focus on your health if you are hospitalised.

Hassle-free application

No medical examination is required during the application process.

No medical examination is required during the application process.

Worldwide coverage, 24/7

Receive a Daily Cash Benefit – paid up to 180 days for accidents and up to 7 days for illnesses – even if you are hospitalised overseas.

Receive a Daily Cash Benefit – paid up to 180 days for accidents and up to 7 days for illnesses – even if you are hospitalised overseas.

Coverage can be extended to family

Easily extend your coverage to include your spouse and children.

Easily extend your coverage to include your spouse and children.

Get these benefits with GREAT Hospital Care coverage.

- Starter

- Essential

| Benefits |

|

|

Child | ||||

|---|---|---|---|---|---|---|---|

| Annual Policy Limit | S$150,000 | S$225,000 | S$75,000 | ||||

| Daily Cash Benefit | S$200 | S$300 | S$100 | ||||

| Daily Cash Benefit (ICU) | S$400 | S$600 | S$200 | ||||

| Day Surgery Benefit (for each claim) | S$200 | S$300 | S$100 | ||||

| Hospital Expenses (for each policy year) | S$1,000 | S$1,500 | S$500 | ||||

| Transport/Ambulance Fee (for each claim) | S$150 | S$150 | S$150 | ||||

| Post-hospitalisation Daily Cash Benefit | S$100 | S$150 | S$50 | ||||

| Get Well Benefit (for each policy year) | S$200 | S$200 | S$200 |

Daily Cash Benefit, Daily Cash Benefit (ICU) and Day Surgery Benefit cannot be claimed at the same time.

Find out how much hospitalisation coverage you need

Get personalised suggestions for each type of coverage on the OCBC app.

1

2

3

Attention: Claims Department

Great Eastern General Insurance Limited

1 Pickering Street, #01-01

Great Eastern Centre,

Singapore 048659

Keep all the original receipts and documents you submitted for the next 6 months – we may need to review them.

Eligibility requirements

Adult

18 to 60 years old (renewable up to age 65)

Child

1 to 17 years old or full-time students below 26 years old

More information

Important notes

The above is for general information only. It is not a contract of insurance. It does not constitute an offer to buy an insurance product or service. It is also not intended to provide any insurance or financial advice. This document does not take into account your particular investment and protection aims, financial situation or needs. Please ask a financial adviser for advice about whether the insurance product is suitable for you before you commit to buying the product. If you choose not to get advice from a financial adviser, you should consider whether the product is suitable for you. If you decide that the policy is not suitable after purchasing it, you may terminate the policy in accordance with the free look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy. The precise terms and conditions of the plans are specified in the insurance policy contract. It is usually detrimental to replace an existing accident and health plan with a new one. A penalty may be imposed for early plan termination and the new plan may cost more, or have less benefits at the same cost. GREAT Hospital Care is underwritten by Great Eastern General Insurance Limited, a wholly owned subsidiary of Great Eastern Holdings Limited, part of the OCBC Group. GREAT Hospital Care is not a bank deposit or obligation of, or guaranteed by OCBC Bank.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary (available from us) before deciding whether to buy this product.

Information presented as at 6 August 2025.

Terms and conditions governing HospitalWise promotion

- Discount will apply for all New Business policies purchased. Offer ends 31 December 2021.

- This promotion cannot be used in conjunction with other campaign codes, discounts or promotions.

- OCBC Bank reserves the right at its sole and absolute discretion to terminate the promotion or make changes to the promotion or any of these terms and conditions at any time without notice.

- The decision of OCBC Bank on all matters relating to this promotion shall be final and binding.

Policy Owners’ Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

You are leaving the OCBC Bank's website to access Great Eastern's website.

By clicking on "Proceed", you acknowledge the following:

- You have chosen not to seek advice on the suitability of this product. You should consider if this product is suitable for your financial circumstances or needs.

Try it now

Start planning via the OCBC app

Open the all new OCBC app > Login > Click on ‘Plan’ > Under ‘Insure’, click on ‘Calculate your needs’ .

If you are still on the previous version of the app, then click on ‘Insure and stay protected’ after logging in.