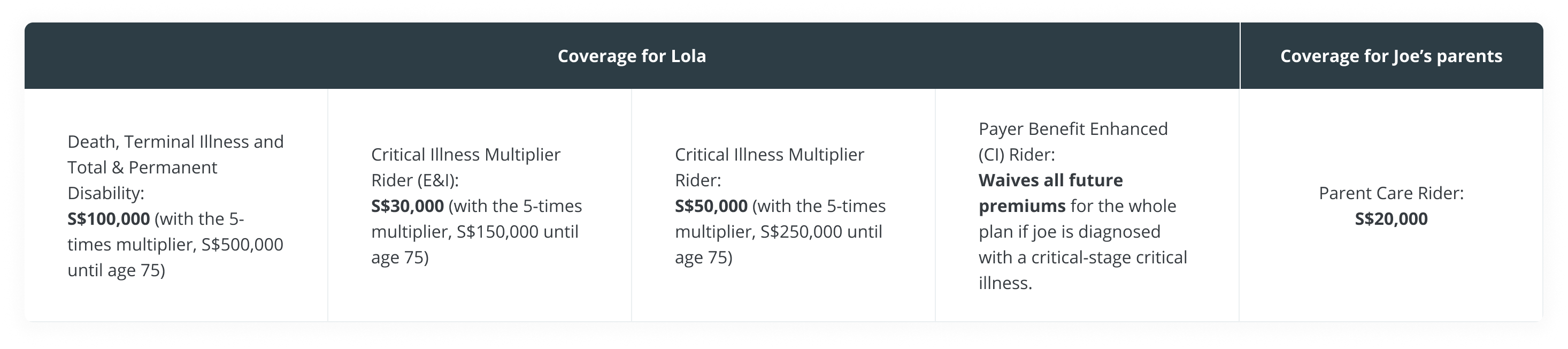

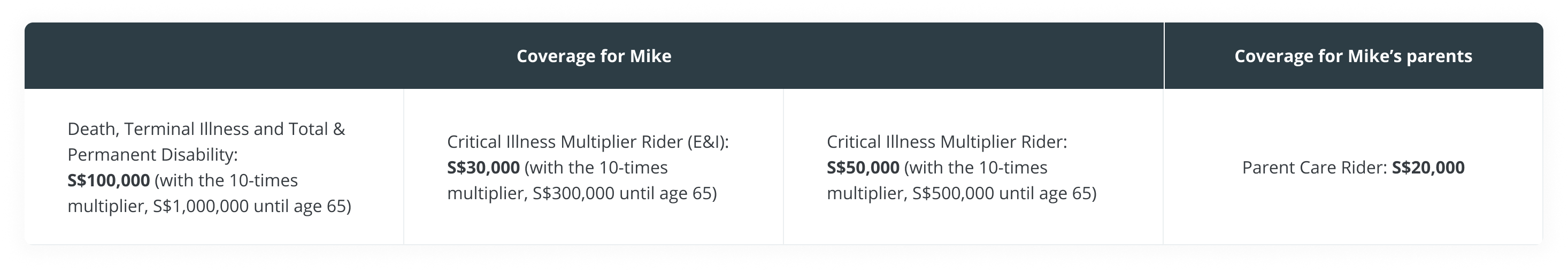

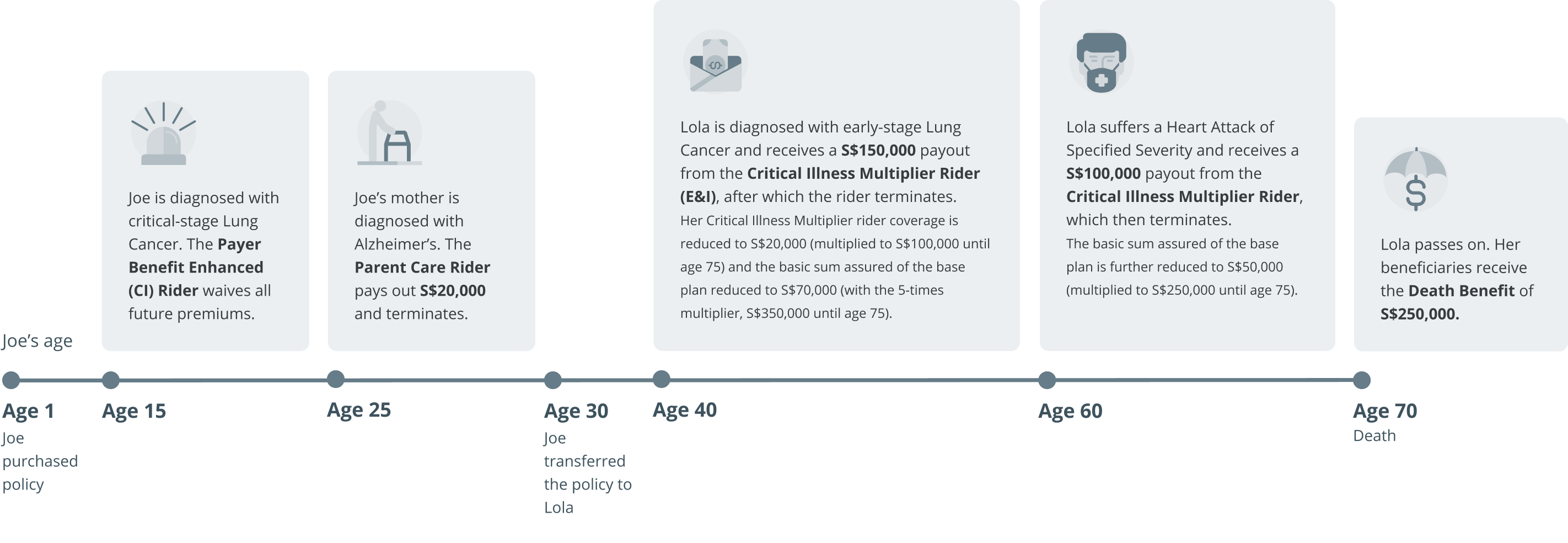

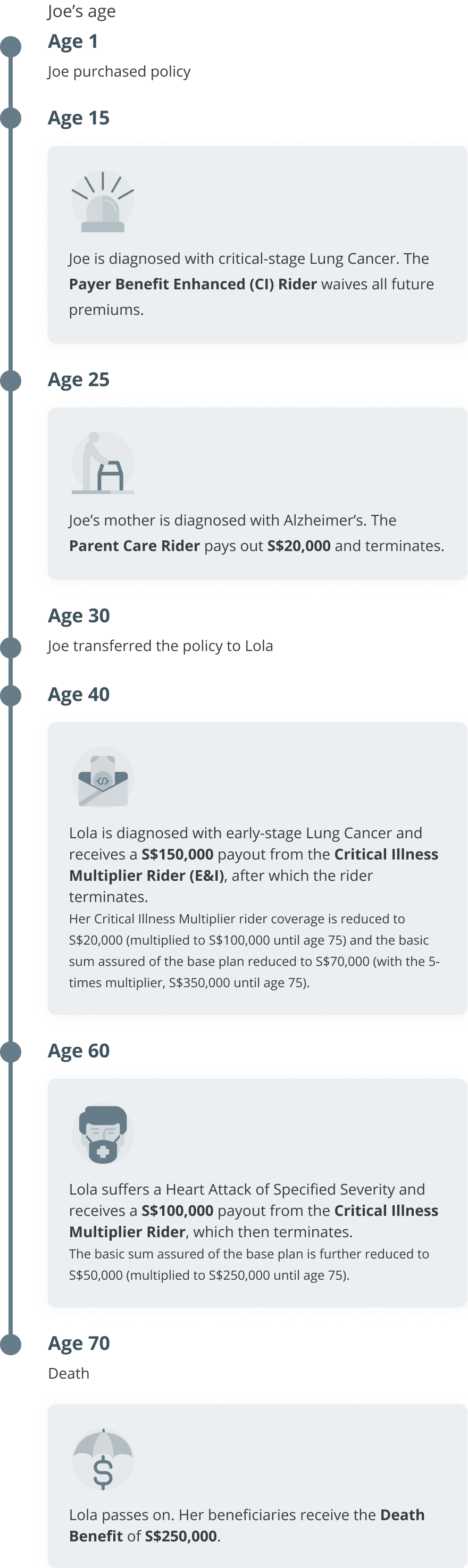

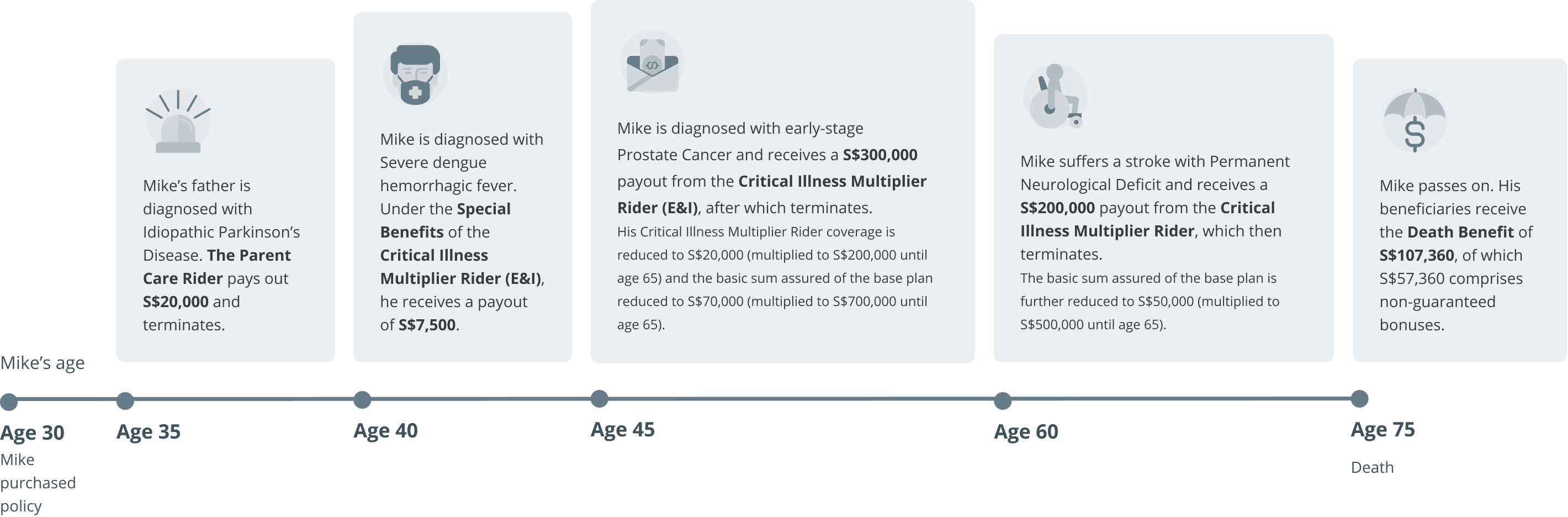

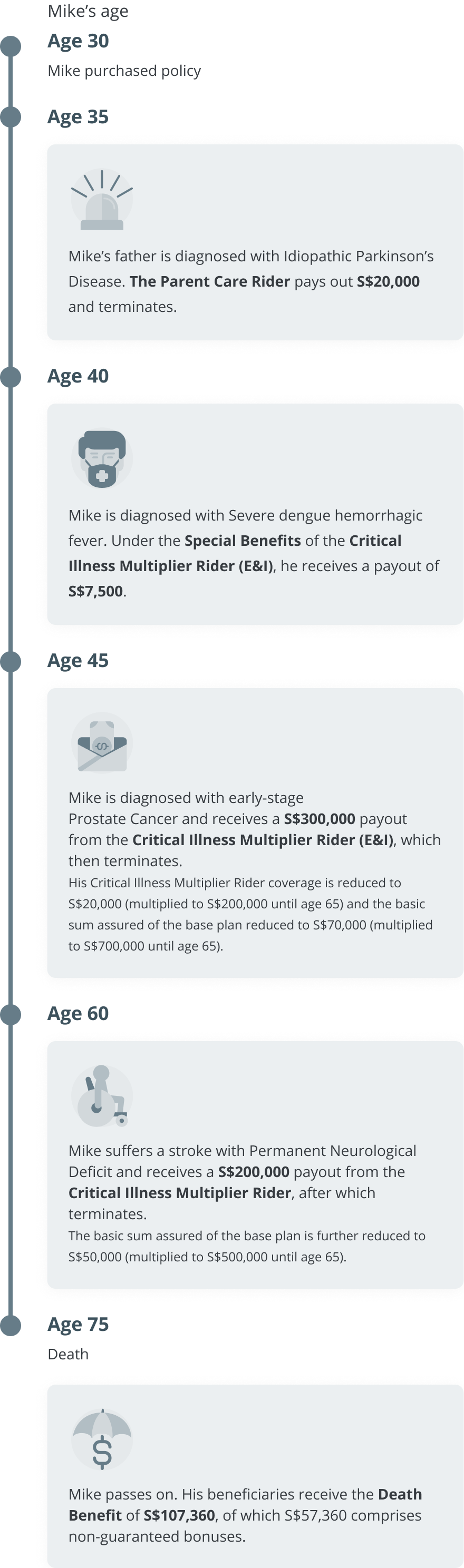

This policy covers either you or your child as the life assured. The insured person is protected for Death, Terminal Illness and Total & Permanent Disability, with the option to add Critical Illness Multiple Rider coverage. You may also add the Parent Care Rider, which covers the policyholder’s parents.

If the life insured is an adult, these are the entry ages (age next birthday) and the respective premium payment terms.

- 19 to 65 years (age next birthday): Premium payment terms of 15 years

- 19-60 years (age next birthday): Premium payment terms of 20 years

- 19-55 years (age next birthday): Premium payment terms of 25 years

- 19-50 years (age next birthday): Premium payment terms of 30 years

Note: The entry age plus premium payment term cannot exceed the Multiplier Benefit Expiry Age. For example, if your entry age is 60 (age next birthday) and your premium payment term is 20 years, you cannot choose to have the multiplier end at 85 years (age next birthday).

If the life insured is a child, he/she must be between ages 1 and 19 (age next birthday). The child must at least be 15 days from birth or have been discharged from the hospital (whichever is later).

Persons covered under the Parent Care Rider must be, at the time of the rider issue date:

- A biological or adoptive parent of the policyholder (in accordance with the laws of Singapore); and

- 80 years old (age next birthday) or younger. They will be covered up to age 100 (age next birthday); verification will be sought at the point of claim.

The Parent Care Rider will terminate once a claim is made on either parent.