Import Letter of Credit

Assures payment when the seller’s documents meet the conditions in the Letter of Credit

Provides assurance to seller

Assures seller of payment by relying on OCBC’s credit worthiness

Assures seller of payment by relying on OCBC’s credit worthiness

Documents check

Leverage on OCBC’s expertise to check documents.

Leverage on OCBC’s expertise to check documents.

Pay only against complying documents

Stipulate documents to be presented and other terms and conditions as per sales contract.

Stipulate documents to be presented and other terms and conditions as per sales contract.

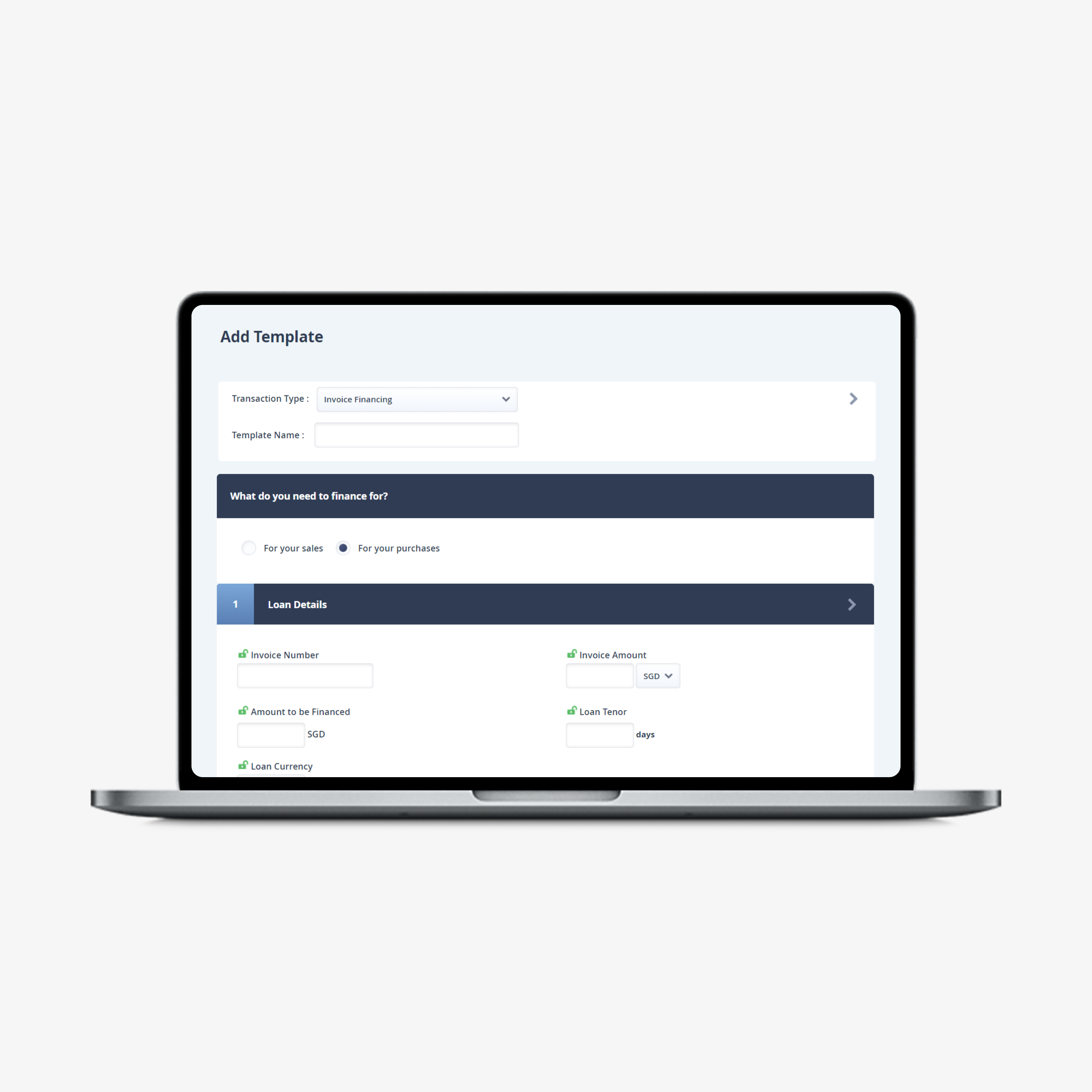

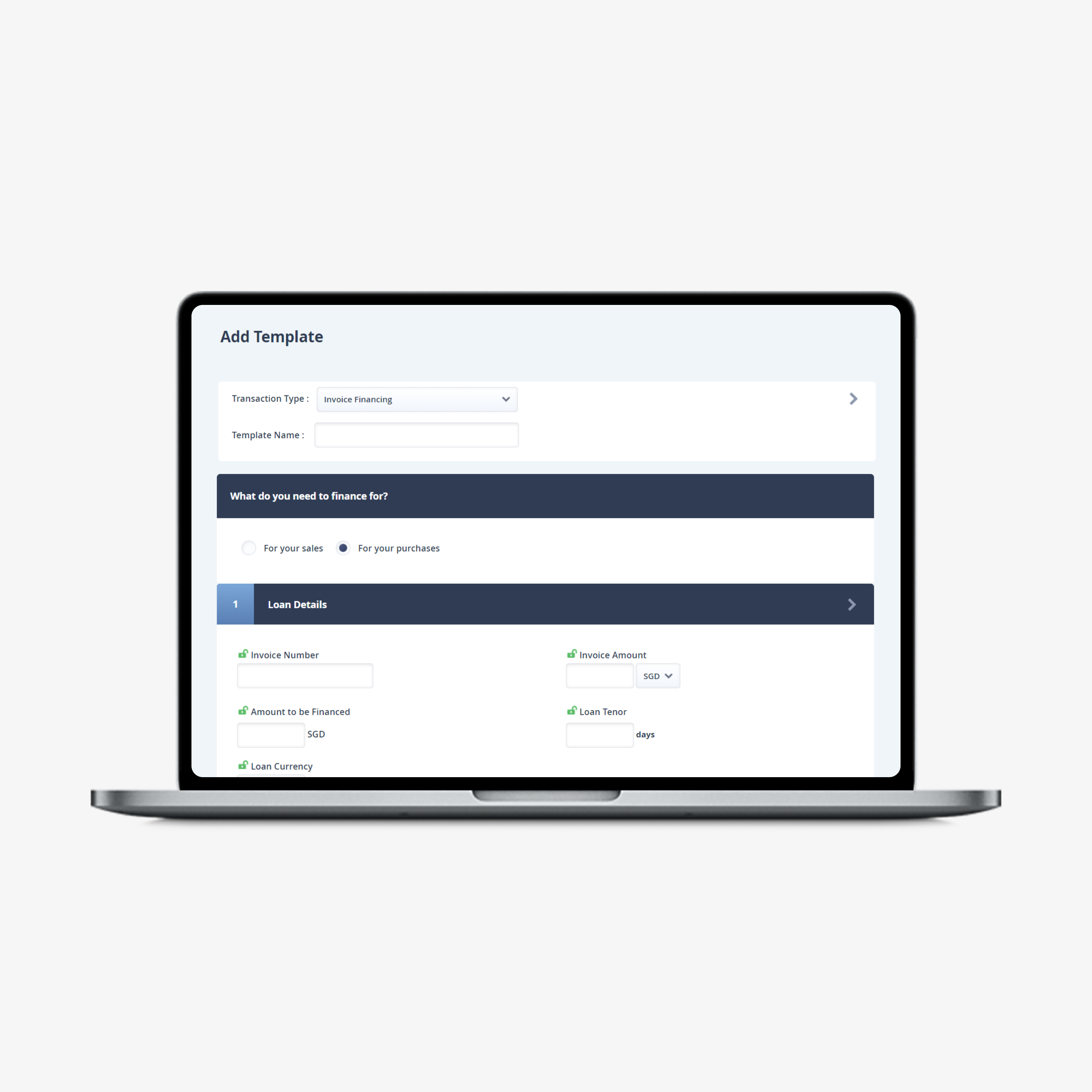

Apply for Import Letter of Credit online

Save time with customer templates. Customise transaction templates for regular transactions with your suppliers and buyers.

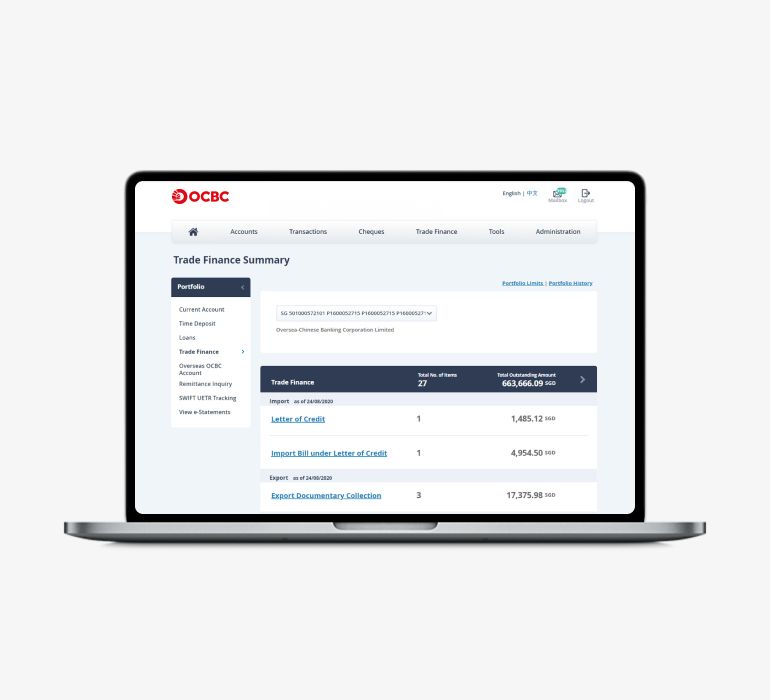

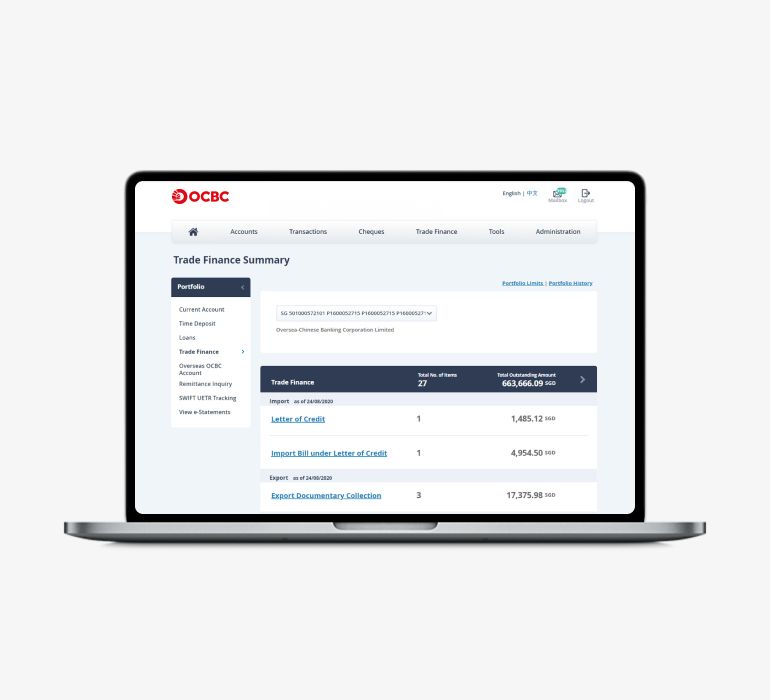

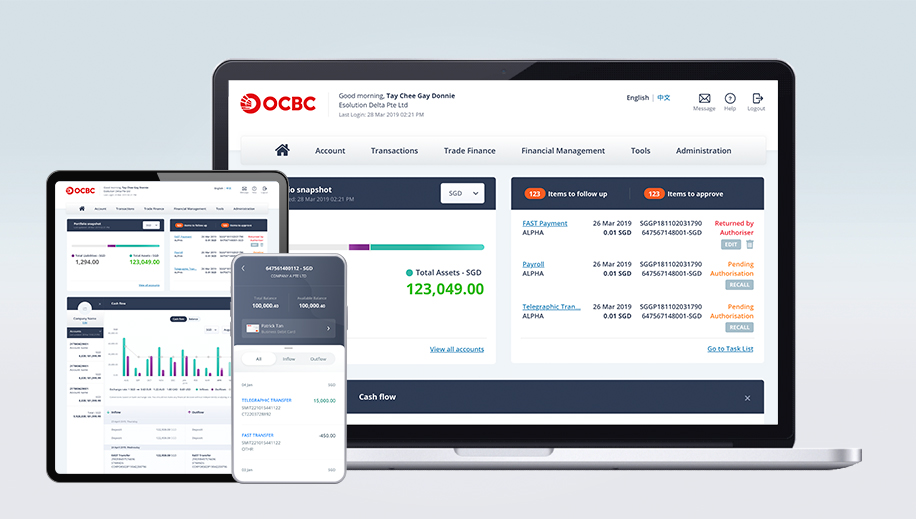

Track transactions in real time

Get an overview of your trade finance portfolio and obtain status updates of your trade finance applications submitted via OCBC Velocity.

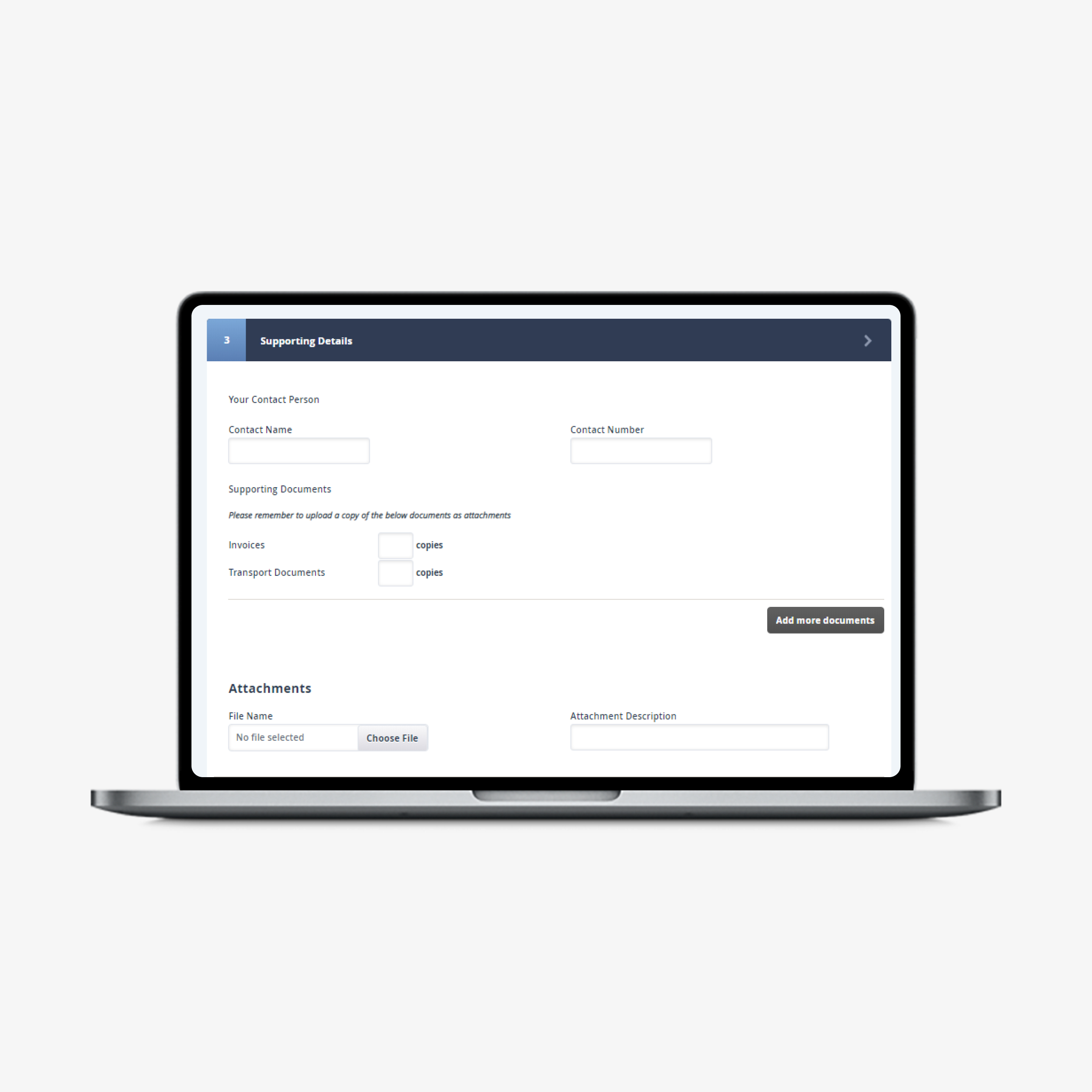

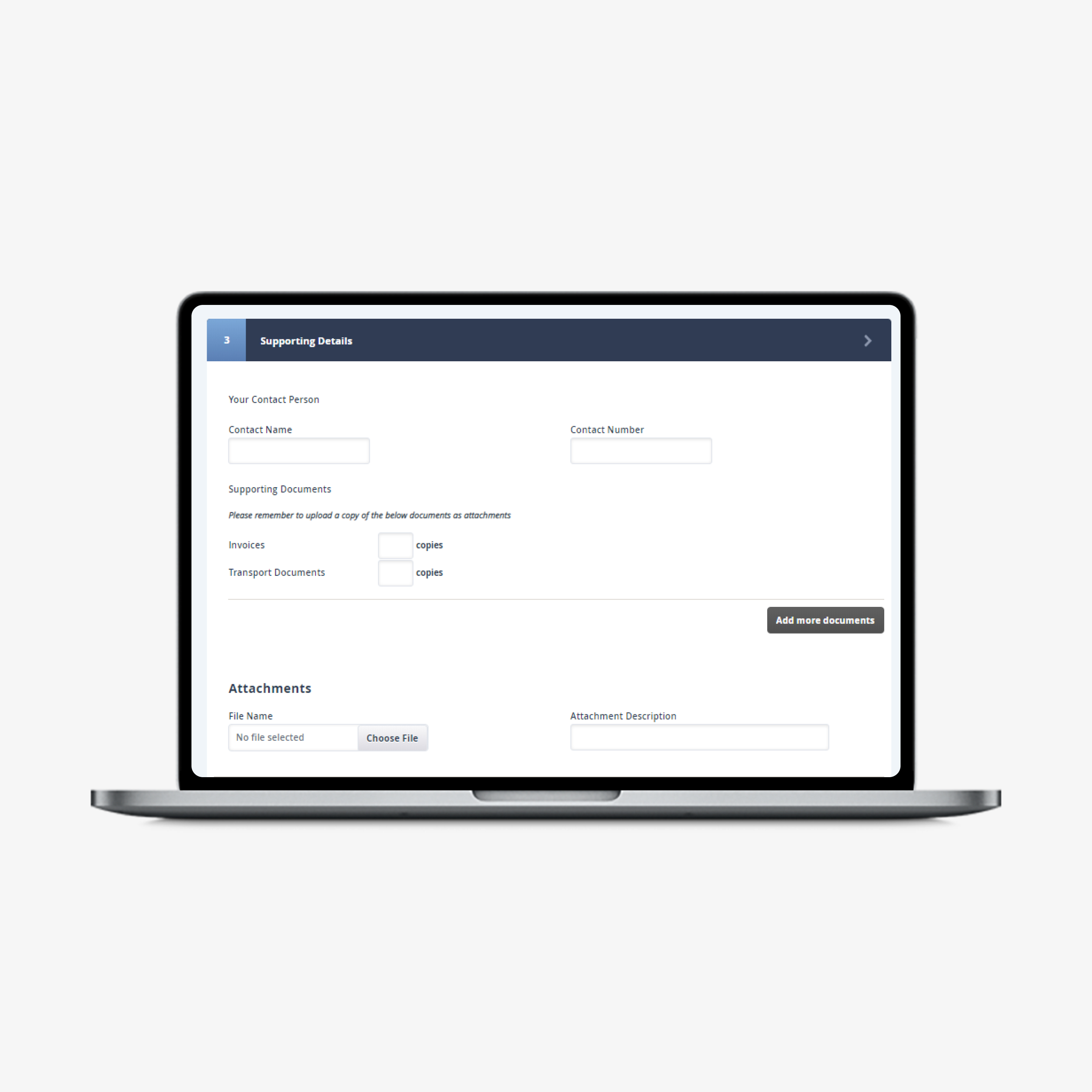

Quicker processing without hard copy

Submit your supporting documents online for quicker processing.

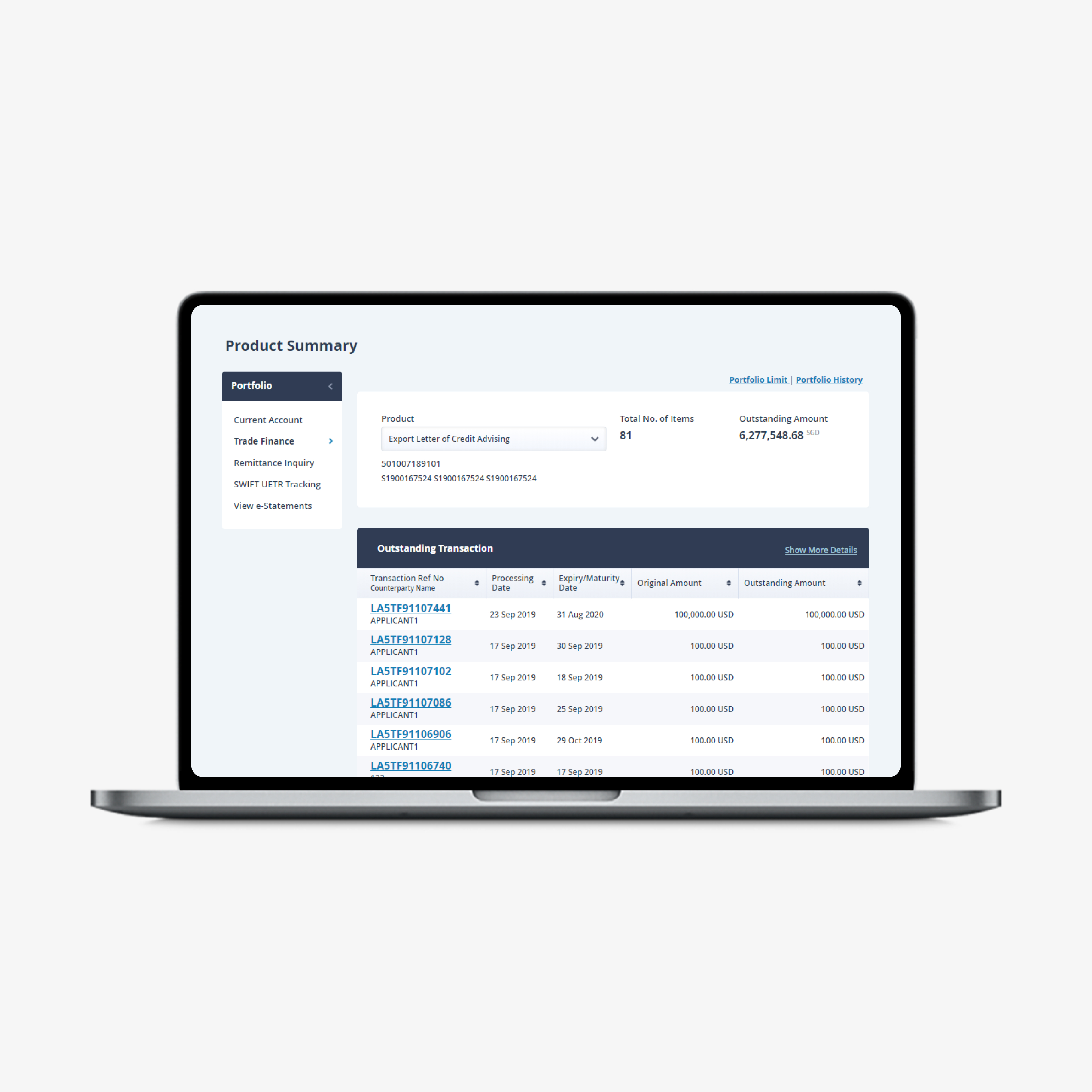

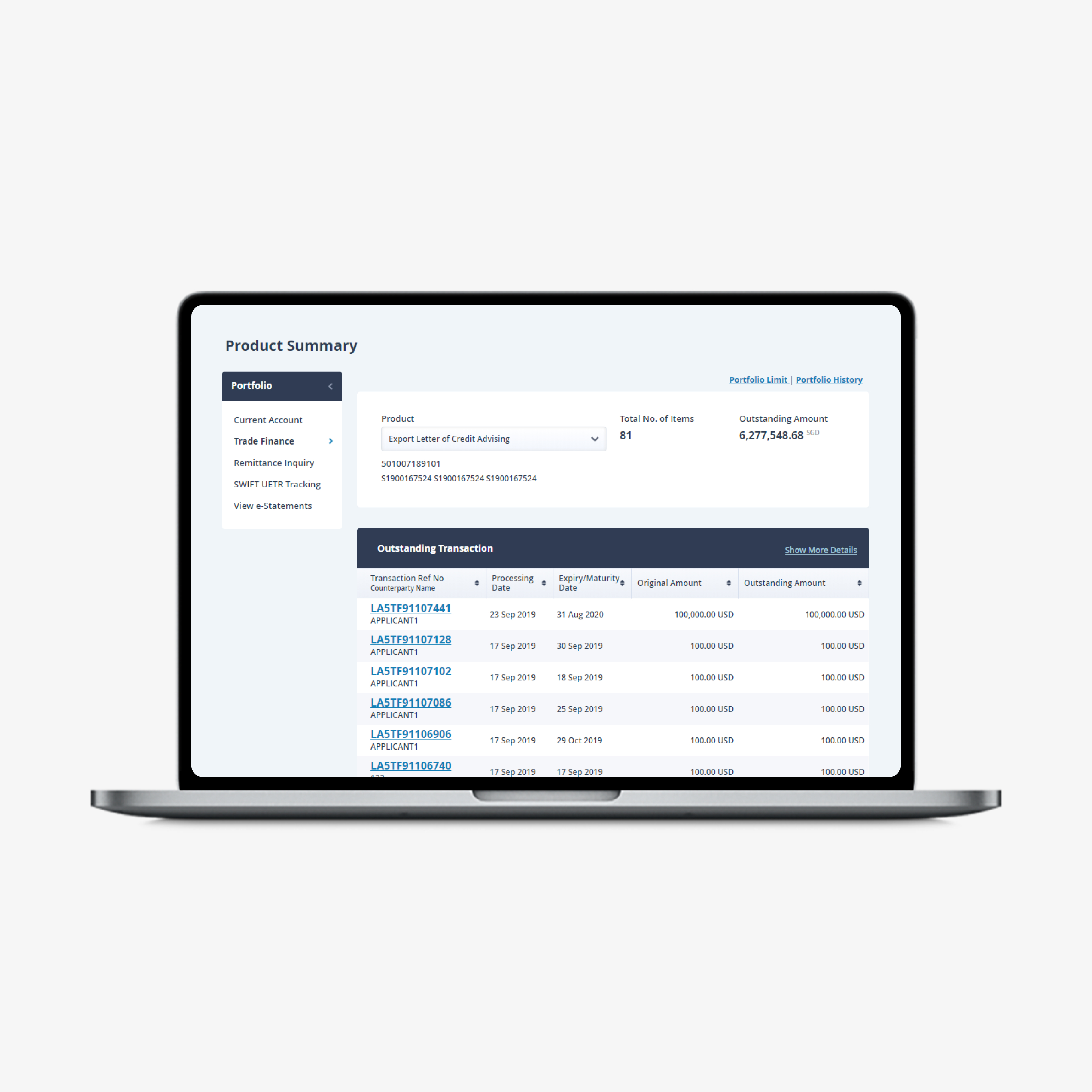

View your history instantly

Retrieve an electronic version of your advices anytime, anywhere on OCBC Velocity.

Don’t have OCBC Velocity?

Apply for OCBC Velocity to perform your first trade finance transaction and manage your trade finance portfolio on-the-go.

- Without trade credit facility with OCBC

- With trade credit facility with OCBC

| Without trade credit facility with OCBC | With trade credit facility with OCBC |

|---|

|

|

Apply for an Import Letter of Credit on OCBC Velocity today

Need help? Call us at +65 6318 7777. Mondays – Fridays, 9am to 6pm (excluding public holidays)

If you have trade credit facility with OCBC

Please log in to OCBC Velocity to apply for an

Import Letter of Credit

If you do not have trade credit facility with OCBC

Download and complete the following forms:

Letter of Credit (Application)

Letter of Credit Cash Margin Letter

Letter of Credit (Amendment)

Submit the completed form at a Trade Service Centre near you.

Shipping Guarantee / Air Waybill

Take the delivery of the goods before receipt of the Bill of Lading / Air Waybill

Trust Receipt

Free up your funds for business purposes

Invoice Financing (Purchase)

Finance your purchases for better cash flow management