Banker’s Guarantee / Standby Letter of Credit

Provides payment assurance to grow your business with your important partners

- Why you will love this

- Need to issue an eGuarantee to a Government Agency or Statutory Board?

Guarantee performance or financial payment

Providing assurance to your beneficiary, reducing the need for high security deposits.

Providing assurance to your beneficiary, reducing the need for high security deposits.

Smoothens transaction terms

Ensuring payment to your beneficiary, providing certainty

Ensuring payment to your beneficiary, providing certainty

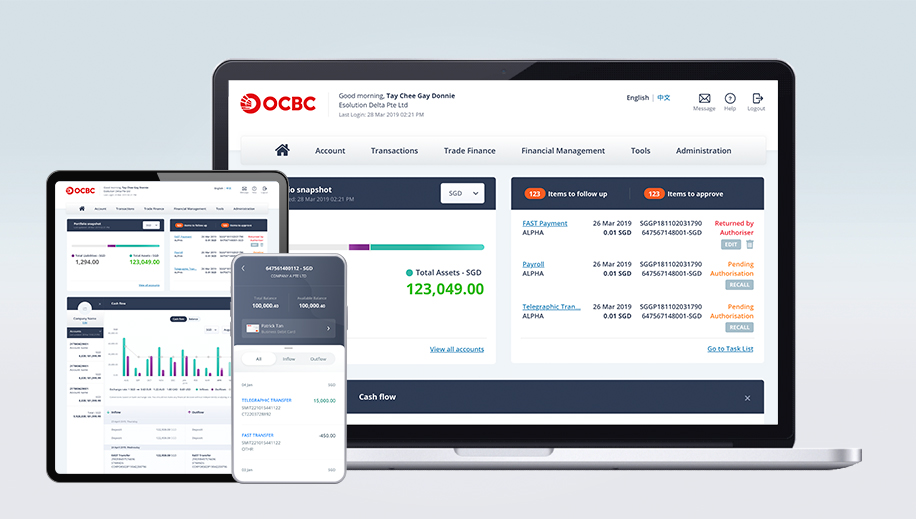

Seamless online experience

Apply and manage your trade finance transactions on desktop or mobile and get real-time status updates

Apply and manage your trade finance transactions on desktop or mobile and get real-time status updates

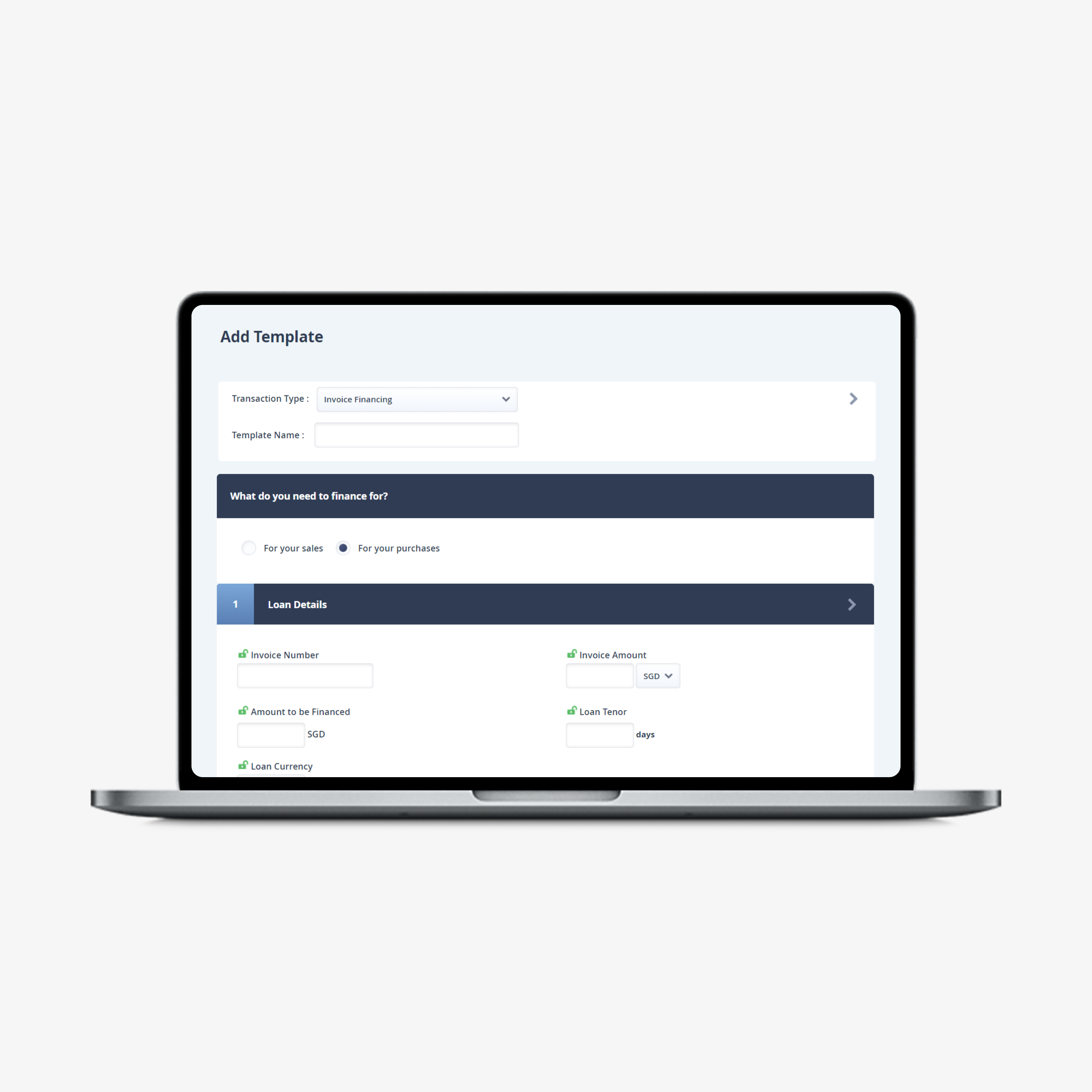

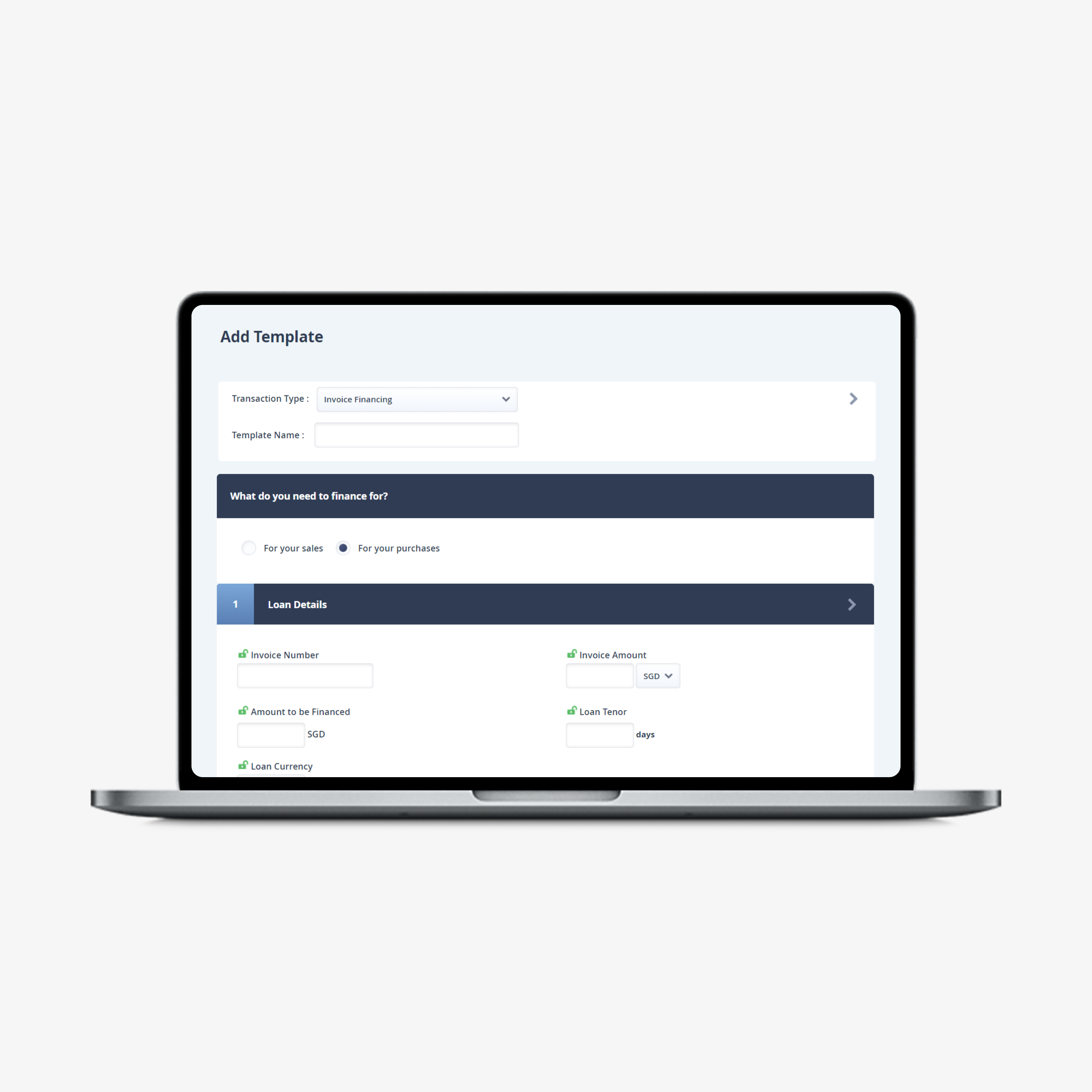

Apply for a Banker’s Guarantee online

Save time with customer templates. Customise transaction templates for regular transactions with your suppliers and buyers.

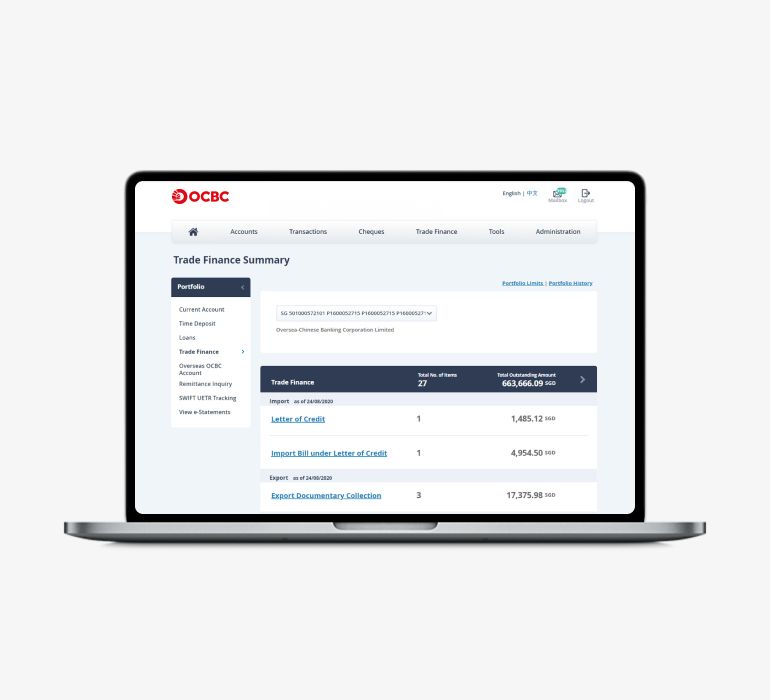

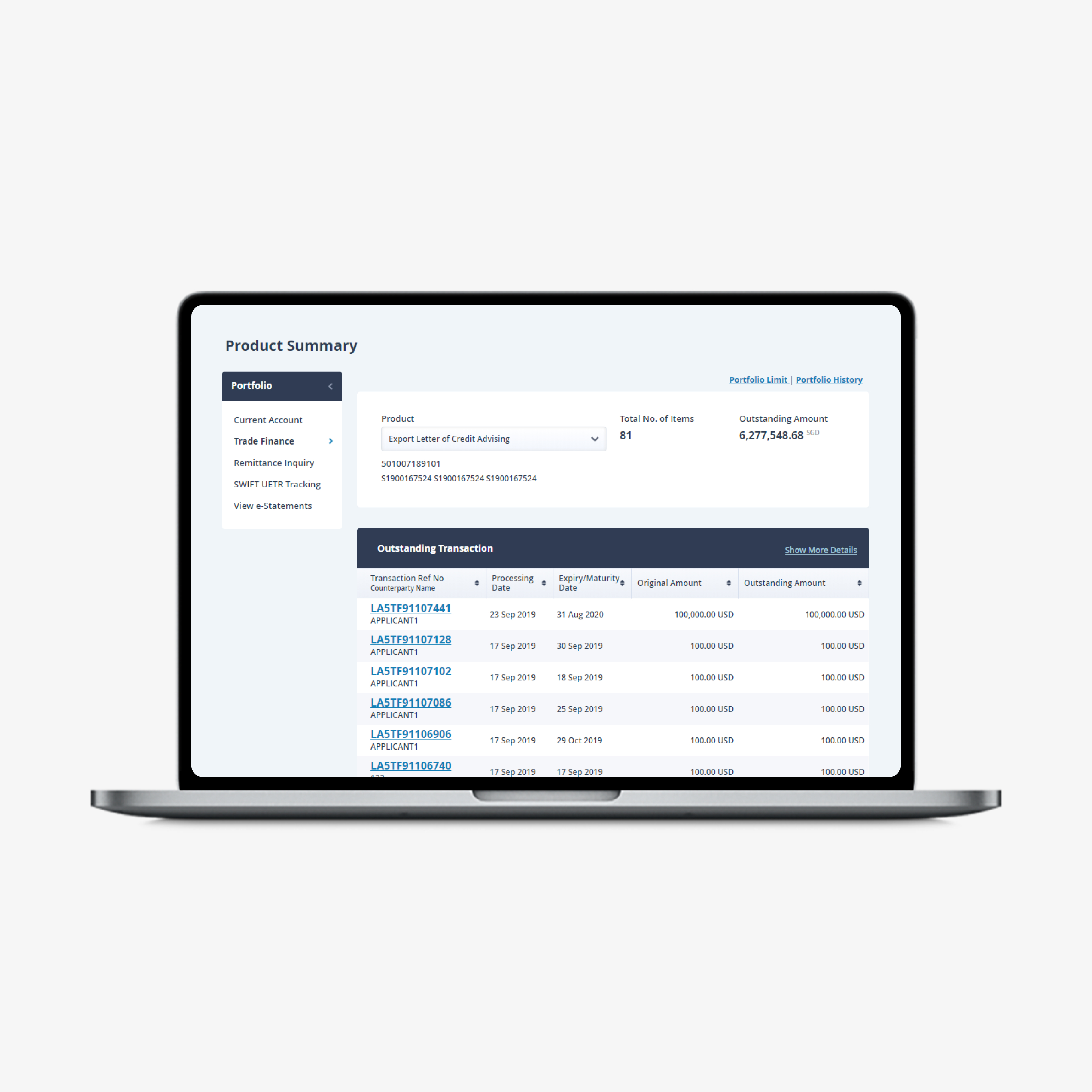

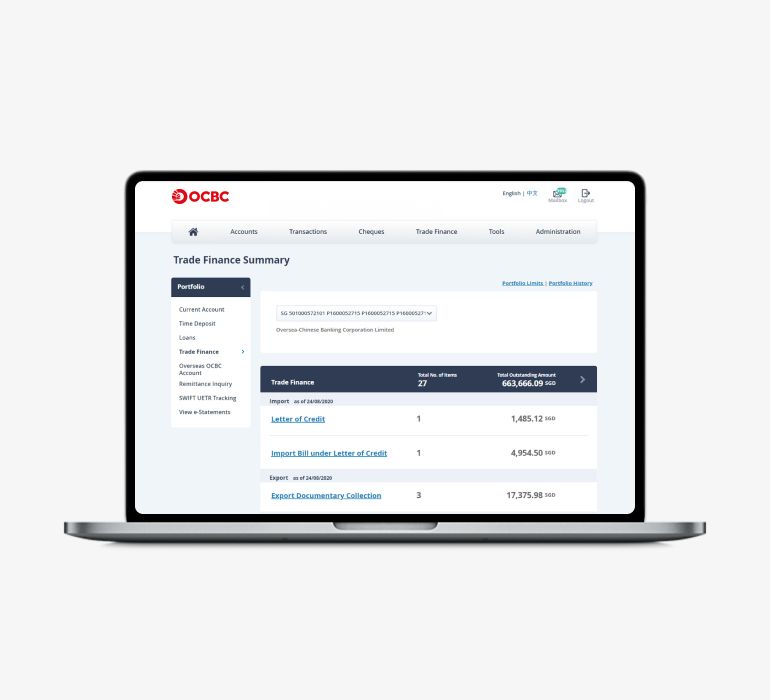

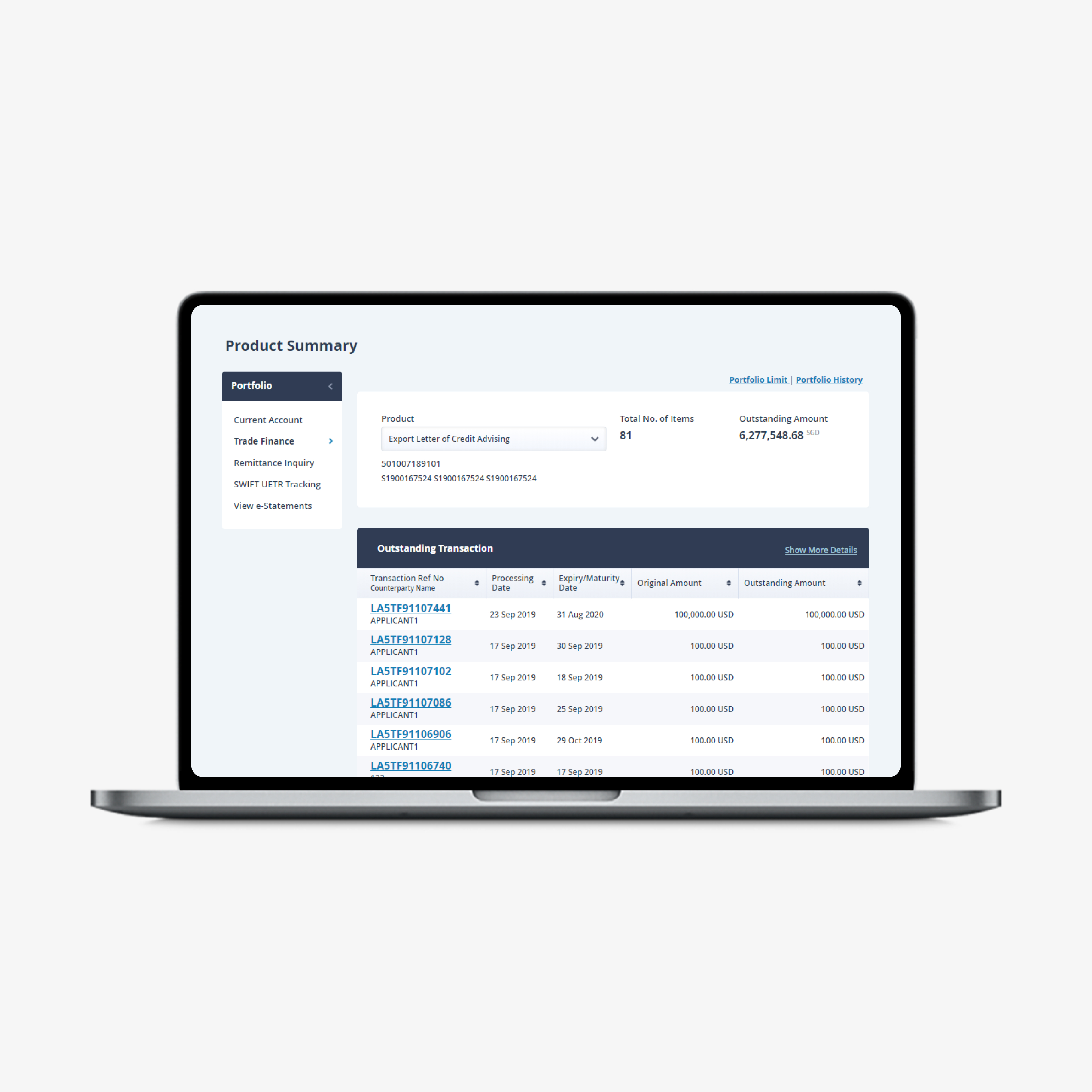

Track transactions in real time

Get an overview of your trade finance portfolio and obtain status updates of your trade finance applications submitted via OCBC Velocity.

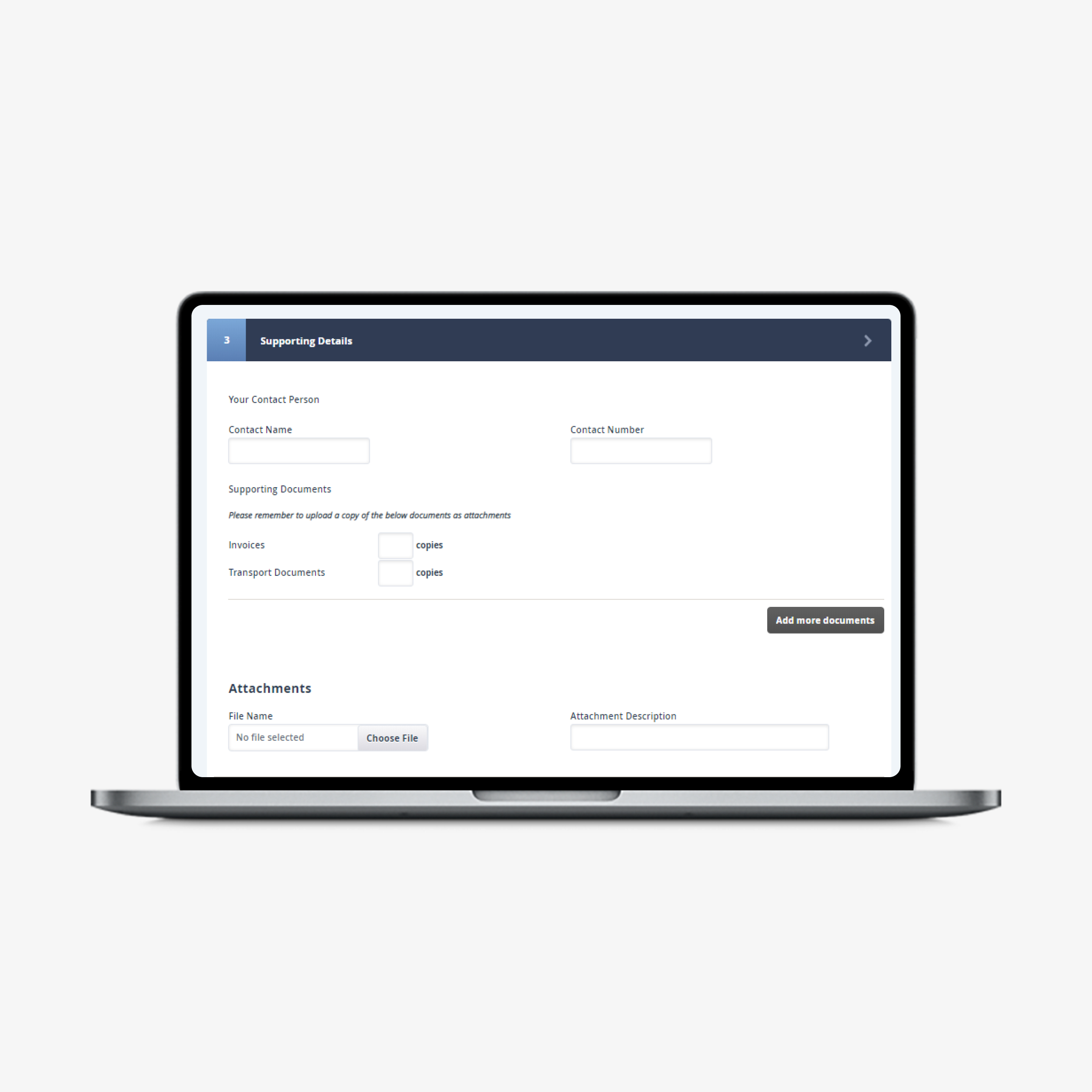

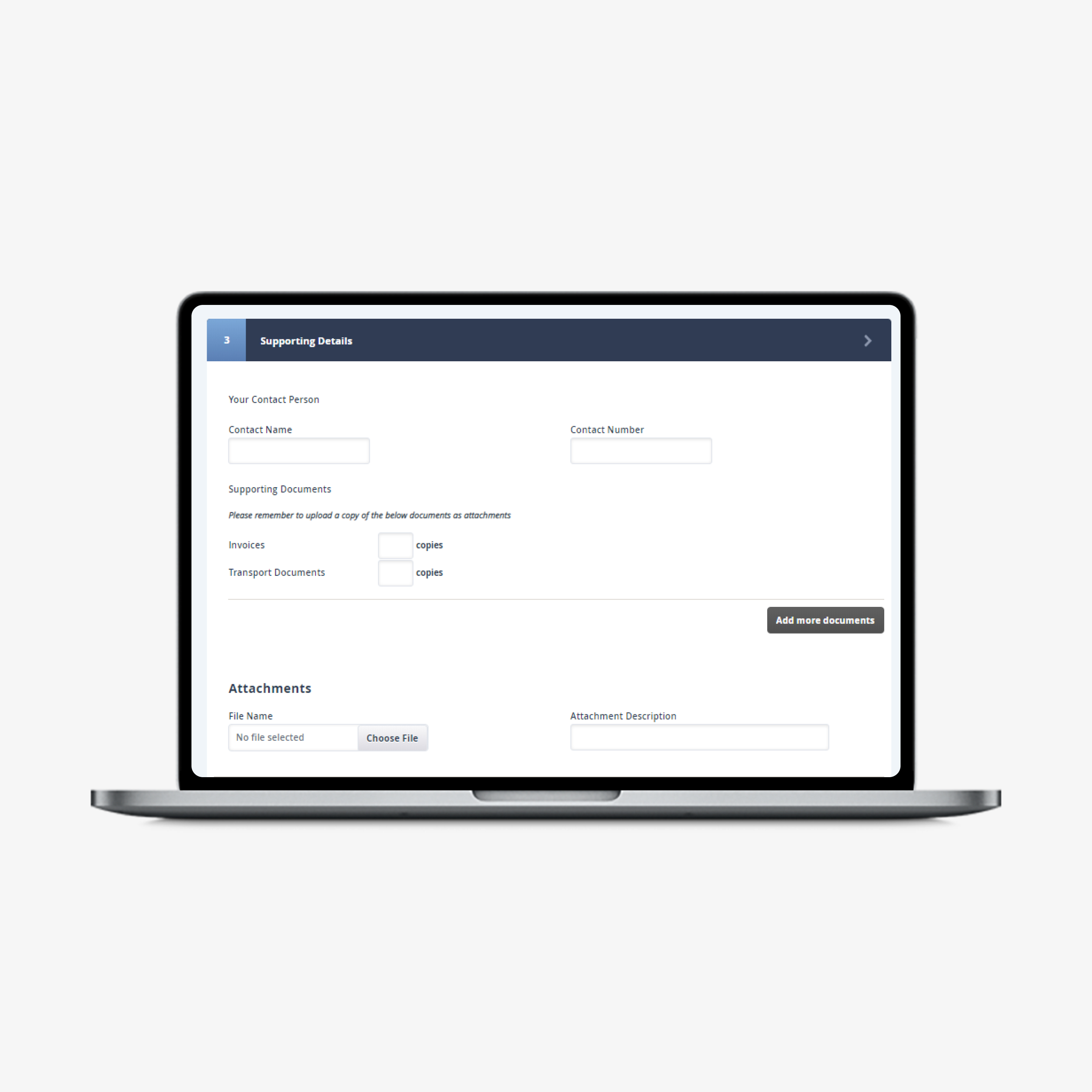

Quicker processing without hard copy

Submit your supporting documents online for quicker processing.

View your history instantly

Retrieve an electronic version of your advices anytime, anywhere on OCBC Velocity.

Don’t have OCBC Velocity?

Apply for OCBC Velocity to perform your first trade finance transaction and manage your trade finance portfolio on-the-go.

Fees and charges

Download the Banker’s Guarantee / Standby Letter of Credit pricing guide

Apply for a Banker's Guarantee or Standby Letter of Credit today

Need help? Call us at +65 6318 7777. Mondays – Fridays, 9am to 6pm (excluding public holidays)

Accounts Receivable Purchase

Unlock your working capital and make your receivables work for you

Invoice Financing (Purchase)

Finance your purchases for better cash flow management

Digital Business Banking

Take your business forward with OCBC Velocity. Maximise our powerful features and advanced tools to grow your business more effectively in this modern economy.

How to apply

Please indicate the following in the application form:

- Purpose of BG or Special Instructions: Regulatory eBG or Procurement eBG (quote Tender Ref No.)

- Delivery Instructions "Transmit electronically as required by the beneficiary"

For customers with a Banker's Guarantee facility, please log in to OCBC Velocity or you may complete the following forms.

Amendment Application form (credit facility)

For customers without a Banker's Guarantee facility, please complete the following forms and email to BusinessBG@ocbc.com.

Application form (without credit facility)You may be directed to third party websites. OCBC Bank shall not be liable for any losses suffered or incurred by any party for accessing such third party websites or in relation to any views or opinions expressed or any products and/or services provided by any provider under such third party websites.