Tailored financial relief programme for businesses

Supporting SMEs through COVID-19

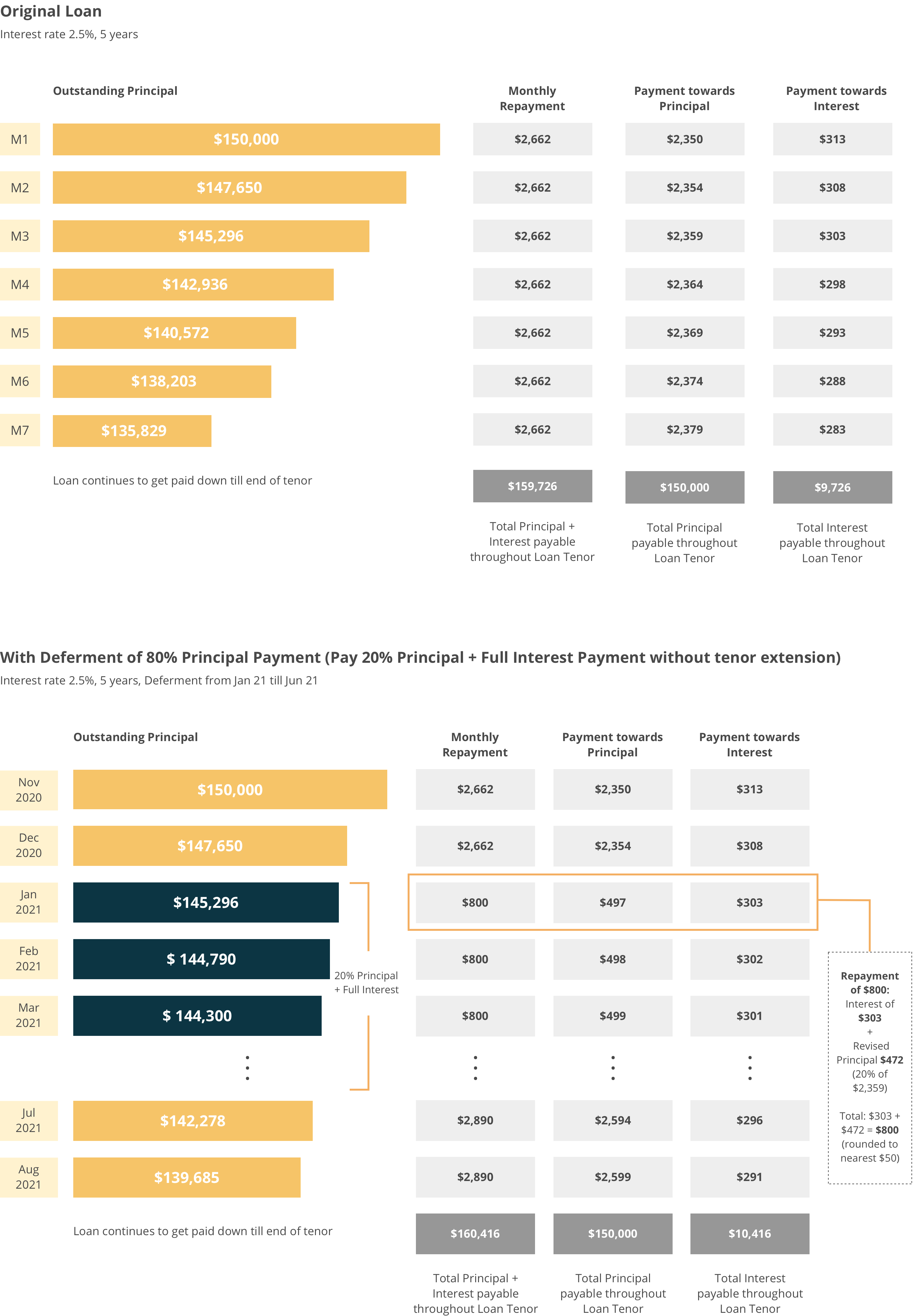

To provide your business with greater cash flow flexibility, we have various options available for you to defer your principal payments on your secured and unsecured business loans via the Extended Support Scheme – Standardised (ESS - S), Extended Support Scheme – Customised (ESS - C) and Sole Proprietor and Partnership Help Scheme.

Secured SME loan

From 2 November 2020, you can apply to defer 80% of the principal payment of your Secured SME loan(s) if you have not missed more than 1 month of instalment payment at the point of implementation.

Defer Partial Principal

Payment Deferment

During the 80% principal deferment period, continue to pay the interest on the loan account plus 20% of principal of your revised instalment on each relevant due date. Late fees and charges apply.

The effective period of the payment deferment depends on the industry tier that you are in.

Unsecured SME Loan

From 2 November 2020, you can apply to defer 80% of the principal payment of your Unsecured SME loan(s) if you have not missed more than 1 month of instalment payment at the point of implementation.

Defer Partial Principal

Payment Deferment

During the 80% principal deferment period, continue to pay the interest and 20% of principal on the loan account on each relevant due date. Late fees and charges apply.

The effective period of the payment deferment depends on the industry tier that you are in.

|

|

Please refer to Jobs Support Scheme (JSS) Notice to ascertain your industry category.

Effective Date

We will inform you of the approved deferment period via a Notification Letter.

With an 80% principal moratorium on your loan, the cash flow burden on your business during this difficult period will be greatly reduced.

|

|

*Option 1: Deferment of 80% principal payment without corresponding loan tenor extension Disclaimer You may be directed to third party websites. OCBC Bank shall not be liable for any losses suffered or incurred by any party for accessing such third party websites or in relation to any product and/or services provided by any provider under such third party websites.

Apply for the Extended Support Scheme – Standardised today.

Other Restructuring Options

Extended Support Scheme - Customised

For all SMEs with multiple creditors that do not qualify for the other restructuring programmes.

Learn MoreCredit Counselling Singapore - Sole Proprietor and Partnership Help Scheme

For sole proprietors and partnerships, with multiple creditors and unsecured debt up to S$1 million.

Learn MoreHow to Apply for the ESS-C?

1. Please check that you meet the following eligibility criteria:- - You have credit facilities with more than 2 Financial Institutions (FIs);

- - You do not qualify for the Credit Counselling Singapore’s Sole Proprietor and Partnership Scheme (SPP Scheme);

- - You do not qualify for the Simplified Insolvency Programme (SIP) (if operational); and

- - You have approached its FIs to restructure its credit facilities but the solutions provided were not sufficient/ suitable.

2. If you meet the above criteria, please complete the ESS-C Application Package and submit it to any ONE of its FIs* (“Receiving FI”).

3. The Receiving FI will performs an initial assessment to see if ESS-C is expected to be beneficial for you. If so, the Receiving FI notifies you that you have been recommended for ESS C.**

4. After being notified by the Receiving FI, you will have to inform all your other FIs and submit the ESS-C Application Package to them, and arrange for a joint call with all the lenders.

- - For SMEs with 2 FIs and total credit exposure of less than $10million, FIs will conduct a Business Viability Test. If the SME is assessed to be viable, Fis will coordinate and propose restructuring solutions beneficial to the SME.

- - For SMEs with more than 2 FIs or total credit exposure of S$10million or more, SME to appoint an ESS Assessor***, subject to agreement by the FIs. The ESS Assessor will conduct a Business Viability Test If the SME is assessed to be viable, ESS Assessor will be in charge of coordinating with FIs and SME, and propose restructuring solutions beneficial to the SME.

*The FI must be one of the Participating FIs in the ESS C scheme: Bank of China, CIMB Bank, Citibank, DBS Bank, HL Bank, Hong Leong Finance, HSBC Bank, Indian Overseas Bank, Industrial & Commercial Bank of China, Maybank, OCBC Bank, RHB Bank, Sing Investments & Finance, Singapura Finance, Standard Chartered Bank, United Overseas Bank.

**If one FI rejects the application, SME can approach any of its other FIs for assessment and recommendation into ESS C.

*** Please refer to the list of qualified ESS Assessors here.

Disclaimer

You may be directed to third party websites. OCBC Bank shall not be liable for any losses suffered or incurred by any party for accessing such third party websites or in relation to any views or opinions expressed or any products and/or services provided by any provider under such third party websites.