What working capital means for business

What working capital means for business

Every budding entrepreneur wishes to start a business that they are not only passionate about, but also largely profitable. However, to grow such a business, business owners have to invest for the long term. In fact, business owners may be running a huge risk by not investing in new capabilities, upgrading hardware and software or modernising their operations.

For starters, you may get outpaced by competitors and ultimately be selling outdated products and/or services.

However, there’s another part of the financial statement that arguably warrants equal, if not more, of your attention. That is working capital.

What is working capital?

Working capital is defined as the difference between your current assets and current liabilities.

Working capital = Current assets − Current liabilities

Current assets refer to all assets that your business expects to convert into cash within a one-year timeframe. Among other things, your assets include any cash in the bank as well as invoices that clients have to pay and inventory that will be sold.

Current liabilities are all of the debt in your business that has to be paid off within the year. This means your working capital is used to pay for bank loans, bills from suppliers and vendors, salaries to employees and any other short-term payment obligations that you may have.

The simplest way to think of working capital is the cash that your business has on hand to fund your day-to-day operations. While businesses can also dip into the same cash pool when investing in expansion plans, it’s important to realise the difference in outcome – one is to secure your daily operations, while the other is to grow for the future.

Cash flow: The lifeblood of businesses

Even if a business is hugely profitable, if it does not have enough cash, it can become insolvent – i.e. unable to pay its debts or day-to-day operational expenses like salaries and buying inventory.

On the other extreme, even if a business is losing money in the short term, it can continue to operate if it has enough cash in the bank. This is why cash flow is commonly referred to as the lifeblood of businesses.

There are many other reasons why cash is king. Certain types of industries may also see lumpy cash flows. For example, in the construction industry, projects might require heavier upfront investments, while payments are only received after certain project milestones are hit. Similarly, retail stores may ramp up inventory and manpower in advance to capture better sales during peak seasons. Other types of businesses may not be able to foresee when they would need to undertake unexpected equipment maintenance or overhaul to continue operations.

Another advantage of a sufficient cash buffer is having the ability to deploy it on short notice to capture new contracts and negotiate better deals. You will also have the financial flexibility to offer better credit terms to certain clients, albeit for a higher profit.

Similar to a rule of thumb in managing our personal finances, an emergency fund can also be important for businesses. No one knew that COVID-19 would hit certain industries so hard and companies that did not have sufficient cash flow saw themselves having to make difficult business decisions such as reducing their headcount or closing some stores.

However, having too much cash in the bank can also mean that you may be missing out on growth opportunities for greater returns. By holding too much cash, it may be considered as hoarding rather than paying out to yourself and other investors in the business. Doing this may also incur a higher tax rate than if you had invested in your business growth or paying out to individuals (where personal income tax rates tend to be lower).

Leveraging on digital tools to keep track of cash inflow and outflow

If you haven’t already onboarded digital tools before COVID-19, then the pandemic has certainly highlighted their importance. Many businesses saw their finance teams stranded at home and unable to process even simple finance matters such as bills and invoices.

There are a variety of digital tools business owners can utilise today to help them manage their cash flow. One such tool is the OCBC Invoice Management tool, which is available for free for all OCBC business banking account holders.

Via OCBC Velocity, you can use the OCBC Invoice Management tool to manage your invoices and bills. By creating e-invoices – and sending them to your clients through email or InvoiceNow – and uploading your bills, you can easily keep track of your account receivables and account payables each time you log in to OCBC Velocity.

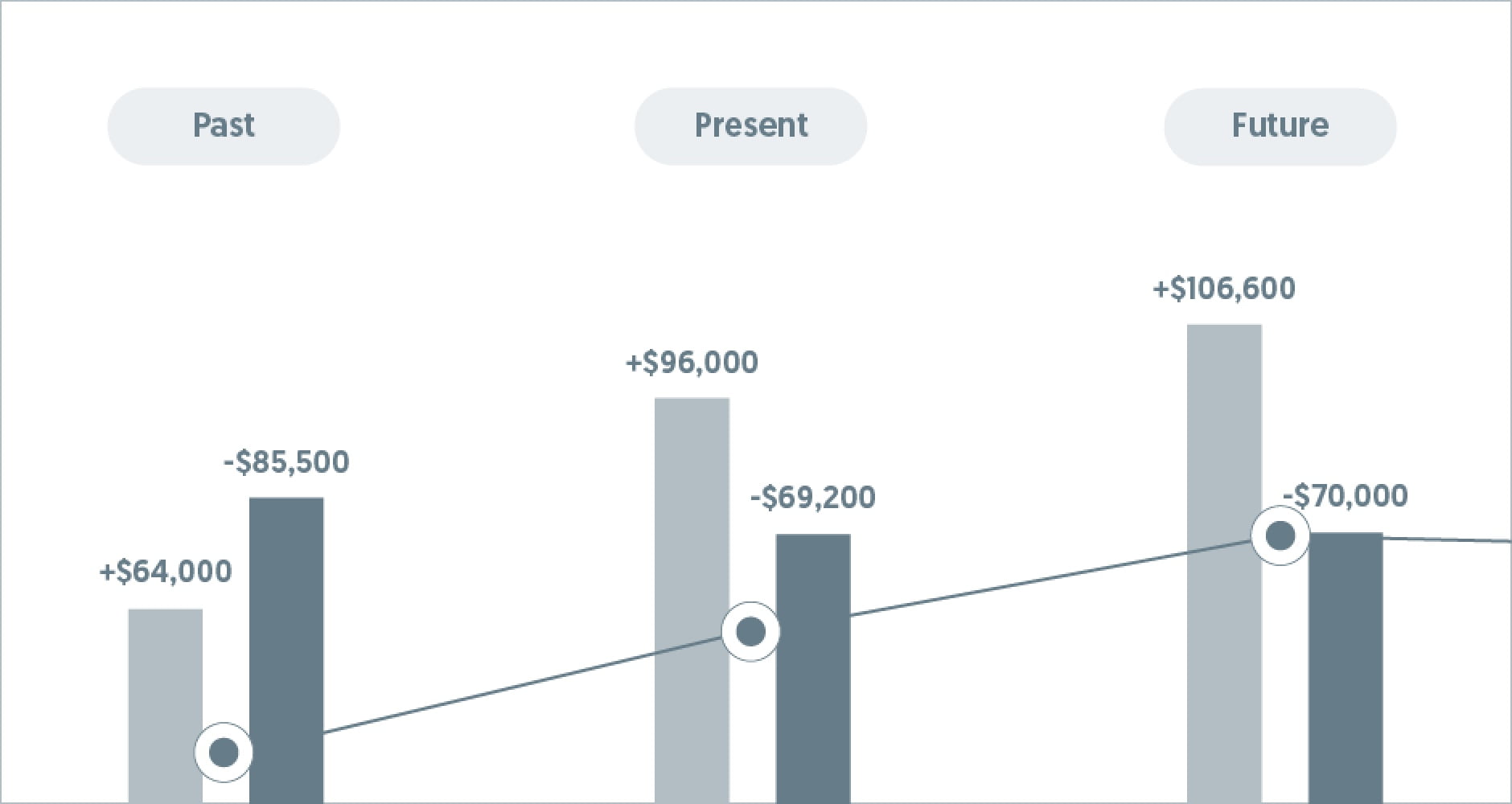

This also enables smarter cash flow forecasting for your future, where you can visualise your upcoming cash flow needs much earlier and plan for possible shortfalls.

Relying on working capital loans as another pillar of support

As alluded to, the Business Financial Management tool gives you a complete view of your business finances, so you can work out how to achieve a positive cash flow position and know when you may require more working capital in future.

Rather than hold off future expansion plans or dip into emergency business funds, you can also rely on working capital loans to give you access to cash whenever operational needs arise. For example, the Business Term Loan does not require any collateral while providing up to S$700,000 in funding, suitable for financing day-to-day operations or business expansion.

Let invoice financing bridge your cash flow requirements

Another tool in the belt for SMEs to improve their cash flow and business is to tap on invoice financing. Invoice financing gives businesses the flexibility of holding an open account to finance purchases and sales.

There are two main types of invoice financing that OCBC provides:

- Invoice Financing (Sales)

- Invoice Financing (Purchase)

When you utilise Invoice Financing (Sales), OCBC will provide an upfront payment to you based on the invoice amount issued to your customers. This not only beefs up your working capital immediately, but also allows you to build better relationships with key customers by offering them credit terms (without impacting your ability to run day-to-day operations).

Similarly, using Invoice Financing (Purchase) gives you an upfront payment on invoices that are issued to you when you purchase from your suppliers. For example, you may need to purchase significant amounts of raw materials to take on a new project or your client will only pay you once you are able to deliver your product. Invoice Financing (Purchase) helps to limit the drain on internal cash resources required in running your daily operations.

In both instances, you can free up internal cash flow for other business uses. In addition, invoice financing also lets you scale up operations in a flexible manner with an open account – without requiring hefty cash investments to purchase raw materials and allowing you to offer credit terms to your customers when required.

By understanding and tapping on the array of banking resources, such as working capital loans and invoice financing, business owners do not have to worry about running low on cash when they need it most. Having this flexibility can be especially important when you are facing high levels of stress, such as when you have to pursue business opportunities that are knocking on the door, expand to keep pace with competitors or when your business is hit by an economic downturn.

Disclaimer

You may be directed to third-party websites. OCBC Bank shall not be liable for any losses suffered or incurred by any party for accessing such third party websites or in relation to any product and/or services provided by any provider under such third-party websites.

The information provided herein is intended for general circulation and/or discussion purposes only. Before making any decision, please seek independent advice from professional advisors. No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake any obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

Discover other articles about: