Innovating for the future of cross-border payments

Innovating for the future of cross-border payments

Problem Statement: Client expectations surrounding cross-border payments have been fundamentally altered by fintech and digital payment challengers, who have focused on elevating the speed, transparency, cost-effectiveness, and value-added services associated with these payments.

Increasingly, correspondent banks are being asked to provide experiences at an institutional level which are commensurate with the innovation clients personally consume in their day-to-day lives. Dealing with cut-off times, operating hours, fragmented banking capabilities by jurisdiction, and opaque fees are no longer acceptable. As such, it is imperative upon correspondent banks to re-think operating models, leverage new technologies, maintain adequate Anti-Money Laundering (AML) & Counterterrorist Financing (CTF) controls, and selectively partner with fintech and digital payment challengers to better integrate new innovations into mature business models.

Banks, which have become trusted institutions by shepherding the development of local and global economies, are taking action to reiterate the value of their franchises to clients and supporting underlying global corporate clients with local expertise. Between BNY Mellon and OCBC, there is a history of 330 years (and counting) of banking experience to continue to usher in the future of cross-border payments, and to potentially deliver the next generation of correspondent banking to make cross-border payments faster, smarter, and safer. This is helped in part by BNY Mellon and OCBC placing trust and resiliency at the core of their operations.

Faster. Smarter. Safer: Correspondent Banking Goes Real-Time, 24/7

To develop the next generation of correspondent banking, BNY Mellon and OCBC are focused on two key areas:

- Increasing the settlement speed and cost competitiveness of FX Payments

- Mutual 24/7 operations to support institutional clients globally

To explain why these areas are in focus, this paper will highlight the importance of each area, including details around an early proof-of-concept BNY Mellon and OCBC are currently exploring:

1. Increasing the Settlement Speed and Cost Competitiveness of FX Payments

Emerging Fintechs have made FX Payments more seamless for consumers, and these expectations are becoming the norm for finance professionals as well. While the ease of use is a value driver for these new entrants, many of these platforms also provide cost comparisons versus other providers. Correspondent banks are well positioned to combat these challenges based on their established place in the industry and direct connectivity with central banks, but need to evolve the infrastructure on which they operate and establish 24/7 operations as described later in this paper. To this end, BNY Mellon and OCBC are exploring several opportunities on the FX Payments front, including the exploration of smart contract solutions to make bank-specific blockchains more interoperable to increase speed of settlement while ensuring compliance with AML/CTF policies.

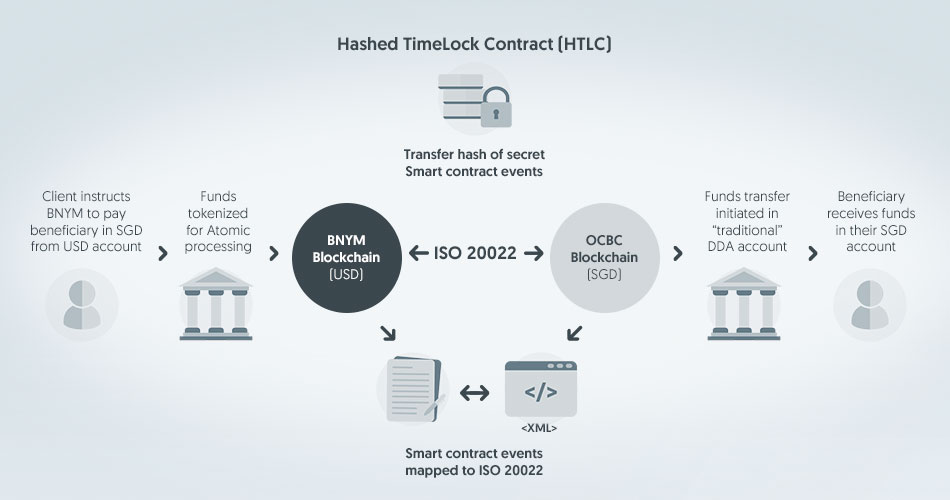

Using Hashed TimeLock Contracts (HTLCs) to Create Blockchain Interoperability:

A focus of blockchain based financial market infrastructure developments over the last 8+ years has been FX Payment versus Payment (PvP). While there has been significant operational cost reduction proven possible by the use of blockchain (some estimates are as high as 80%), most of these networks require all participants to operate on a single chain. To date, outside of SWIFT, most global banks have yet to coalesce around a single network or technology construct. As such, the BNY Mellon Technology team developed a solution for interoperability at SWIFT’s 2022 Hackathon, which leverages HTLCs to exchange information and value across two separate, private blockchains.

The interoperable and instantaneous features of HTLCs offer new options for the next evolution of nostro banking networks, where participants can maintain the freedom to design and operate their own technology stack. In this environment, real-time reconciliation of nostro accounts is greatly simplified to enable continuous funding and liquidity tracking for more efficient and transparent payment networks. As global banks with deep knowledge and engineering experience in blockchain technology, BNY Mellon and OCBC are collaborating to demonstrate the interoperable and cross-border capabilities of this technology.

HTLCs have the following primary technical features:

-

Hash function: Cryptographic hash functions are utilised to create a unique identifier for the transaction, known as a hash lock. The hash lock is generated from the recipient’s unique address and a secret phrase or set of characters known only to the sender. The secret is then securely passed from the sender to the recipient and is used to unlock the funds. In the future, it could be possible to securely pass this secret using different mechanisms such as SWIFT MT500 series messages.

-

TimeLock: A time constraint, specifying the deadline by which the recipient must input the secret and unlock the funds. If the recipient fails to do so in the prescribed time period, the funds are returned to the sender.

-

Atomic swaps: HTLCs are atomic, meaning the transaction is either successfully executed in full or is completely reversed. There is no middle ground, hence reducing the risk of partial execution and the need to manually return funds.

In addition to interoperability and reduced settlement times, HTLCs may offer additional benefits over existing correspondent banking settlement processes:

- Enhance security and reduce counterparty risk:

HTLCs can offer enhanced security by ensuring that all contractual conditions of the transaction are met before funds are transferred to another party. This can reduce the risk of fraud or non-compliance with contractual terms.

- Greater transparency:

Blockchain technology offers the ability to increase transparency for transacting parties and regulators alike when compared to existing systems. This makes it easier for clients, operations teams, and regulatory bodies to monitor and verify transactions.

- Reduce exchange rate fluctuation risk:

When combined with near-instant messaging capabilities and Straight Through Processing (STP) for exchange of the secret, atomic swaps can significantly reduce the risk of exchange rate fluctuations between the time a transaction is initiated and when it is settled. By determining and locking the exchange rate at the beginning of the transaction, greater certainty is provided for the payor and the payee.

BNY Mellon and OCBC are collaborating to put this construct into a proof-of-concept, which will demonstrate interoperability and shortened settlement cycles. This will potentially solve the challenge of lowering end-client costs, which allows the banks to be more competitive vs. FinTechs who are able to offer lower cost structures, while still providing faster and more transparent payments.

Atomic, cross-border settlement in a future with central bank digital currencies (CBDCs):

A global interoperability standard for blockchains will take some time to build. In the near term, for banks that operate 24/7 across time zones, this is a path to implementing blockchain technology to benefit end-clients, while maintaining existing correspondent banking business models. There are additional paths to shortening settlement cycles and providing higher value to clients through more traditional, modern technology stacks. Given the focus on potential blockchain interoperability between the Singapore and the U.S., this proof of concept is a natural experiment for correspondent banks to conduct and explore opportunities to build synergies with projects executed by our respective regulators, the Monetary Authority of Singapore (MAS) and the U.S. Federal Reserve, in particular Project Cedar Phase II x Ubin+ (Cedar x Ubin+).

Project Cedar examined whether wholesale CBDCs developed using blockchain could improve the efficiency and transparency of cross-border payments involving one or more vehicle currencies. By eliminating the reliance on legacy back-end cash settlement mechanisms supporting the correspondent banking network, wholesale CBDCs offer the potential for true, instantaneous cross-currency settlement. Cedar x Ubin+ was designed to simulate how commercial banks act as intermediaries throughout the payment flow, leveraging the current correspondent banking model. Building on the key learnings from Cedar x Ubin+, BNY Mellon and OCBC could achieve end-to-end on-chain atomic settlement for cross-border cross-currency payments with blockchain-enabled wholesale CBDCs.

2. Mutual 24/7 Operations to Support Corporate Client Bases

Wires remain the bedrock of global high-value payments. However, operating windows and cut-off times can vary between banks and often cause friction in payments, resulting in trapped liquidity for corporate clients, which could otherwise translate into additional working capital. While instant payment schemes have made progress globally, few jurisdictions have a high-value 24/7 payment rail (with Australia as an exception).

To remove this friction and free up trapped working capital / provide just-in-time funding capabilities for corporates, correspondent banks can establish mutual 24/7 operations for currencies they clear directly with central banks and extend this capability to one another’s client base. While not an industry-wide solution, a dedicated group of banks can effectively serve clients with the local expertise that comes from correspondent banks, while operating beyond the boundaries of cut-off times and standard market practices.

While this paper does not provide an in-depth analysis on the technical nature regarding how any of the focus areas will be executed upon, readers can be certain that there will be more coming from BNY Mellon and OCBC in the near future. Rather than building a bespoke BNY Mellon and OCBC solution, we invite our clients to speak with us about their challenges and key areas of commercial focus so our efforts can be deployed more broadly to benefit their end-clients and the broader financial market ecosystem. BNY Mellon and OCBC have grown and strengthened over time by listening to clients, and as we build the future, we look forward to doing so, collaboratively. Furthermore, given the collaboration between MAS and the U.S. Federal Reserve, our organisations are also keen to explore how we can support, harness, and cross-pollinate the strong innovation ecosystems in Singapore and the U.S.

Disclaimer

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally and may include The Bank of New York Mellon, 240 Greenwich Street, New York, New York 10286, a banking corporation organised and existing pursuant to the laws of the State of New York. BNY Mellon has various subsidiaries, affiliates, branches, and representative offices in the Asia Pacific Region which are subject to regulation by the relevant local regulator in that jurisdiction.

The information contained in this paper is for use by wholesale clients only and is not to be relied upon by retail clients. Not all products and services are offered at all locations.

This paper, which may be considered advertising, is for general information and reference purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such. Neither BNY Mellon nor Oversea-Chinese Banking Corporation Limited warrants or guarantees the accuracy or completeness of, nor undertake to update or amend the information or data contained herein. Each of BNY Mellon nor Oversea-Chinese Banking Corporation Limited disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon any of this information or data.

Trademarks and logos belong to their respective owners.

© 2023 The Bank of New York Mellon Corporation and Oversea-Chinese Banking Corporation Limited.

All rights reserved.

Discover other articles about: