Everyday business accounts with powerful features for banking

Business Growth Account

Designed for start-ups or new businesses.

- 80 free FAST and 80 free GIRO per month

- Low initial deposit of S$1,000

- Open your account online instantly with Singpass

Business Entrepreneur Account Plus

Designed for expanding or established businesses. Enjoy zero monthly account fee.

- Min deposit: S$30,000

- Min balance: S$30,000

- Fees: No account fee

No endownment plan for this option

Try a different goal or time period.

Account opening for foreign-owned companies

100% remote and online with dedicated support in a language of your choice.

Account highlights

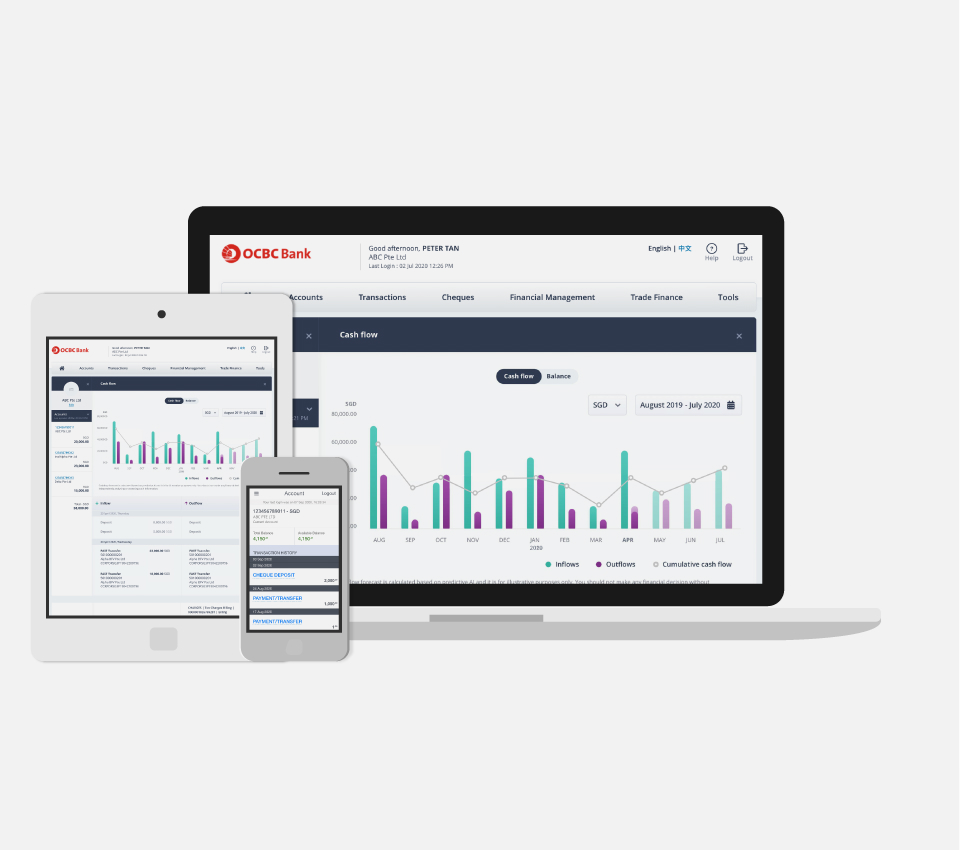

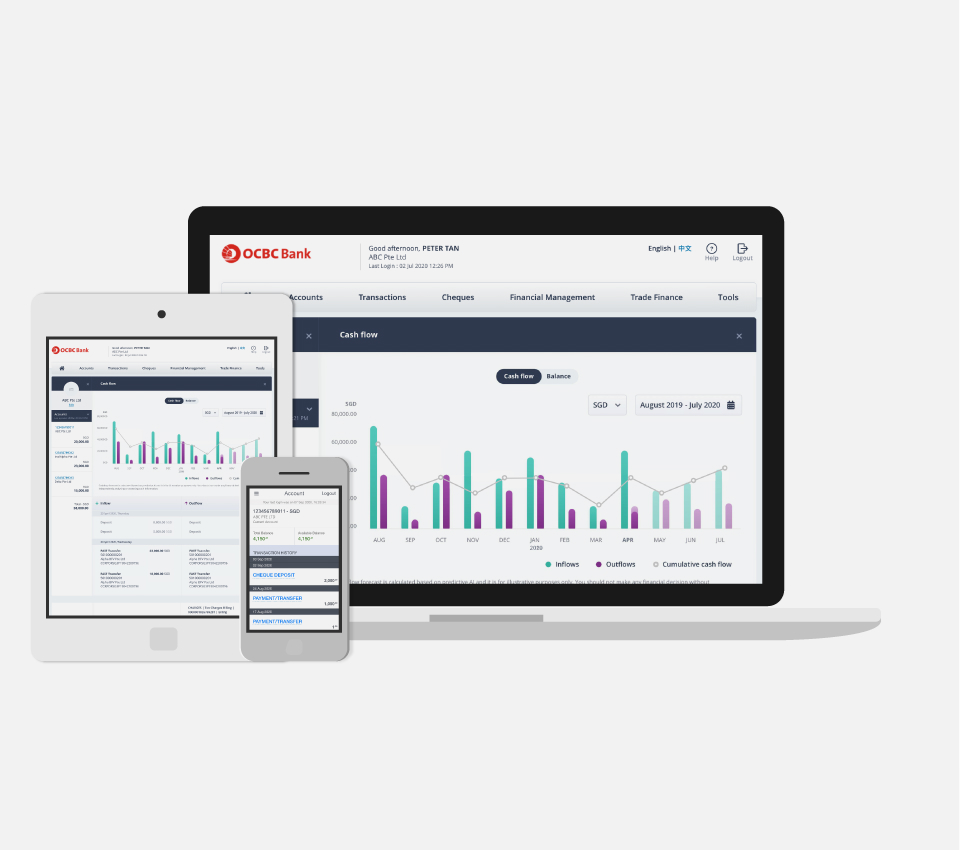

Digital Business Banking

Additional Information