Steering Towards Sustainability: Shipping's Journey to Net Zero

Steering Towards Sustainability: Shipping's Journey to Net Zero

Ships carry 90% of the world’s trade1, with global freight demand expected to triple by 20502.

The shipping sector contributes around 3% of all global greenhouse gas (GHG) emissions3, with 99% of energy demand from the sector still met by oil products today4.

This has prompted action from international standard setters and regulatory bodies alike. In March 2023, the European Union (EU) reached an agreement to cut GHG intensity of fuels used in the shipping sector by 2% in 2025, and by 80% by 20505. From 2024, shipping companies will also need to start paying for their GHG emissions.

As the pressure to go green mounts, achieving net zero emissions in shipping has emerged as an urgent goal in the transition towards a sustainable future.

The Revised IMO GHG Strategy

And What it Means to Our Customers

In 2018, the International Maritime Organization (IMO) introduced its initial GHG reduction strategy, with an aim to reduce total GHG emissions from international shipping by at least 50% by 2050. A revised strategy was released in July 2023, aiming to reduce GHG emissions levels to net zero by or around 2050, which aligns with the well-below 2°C scenario of the Paris Agreement.

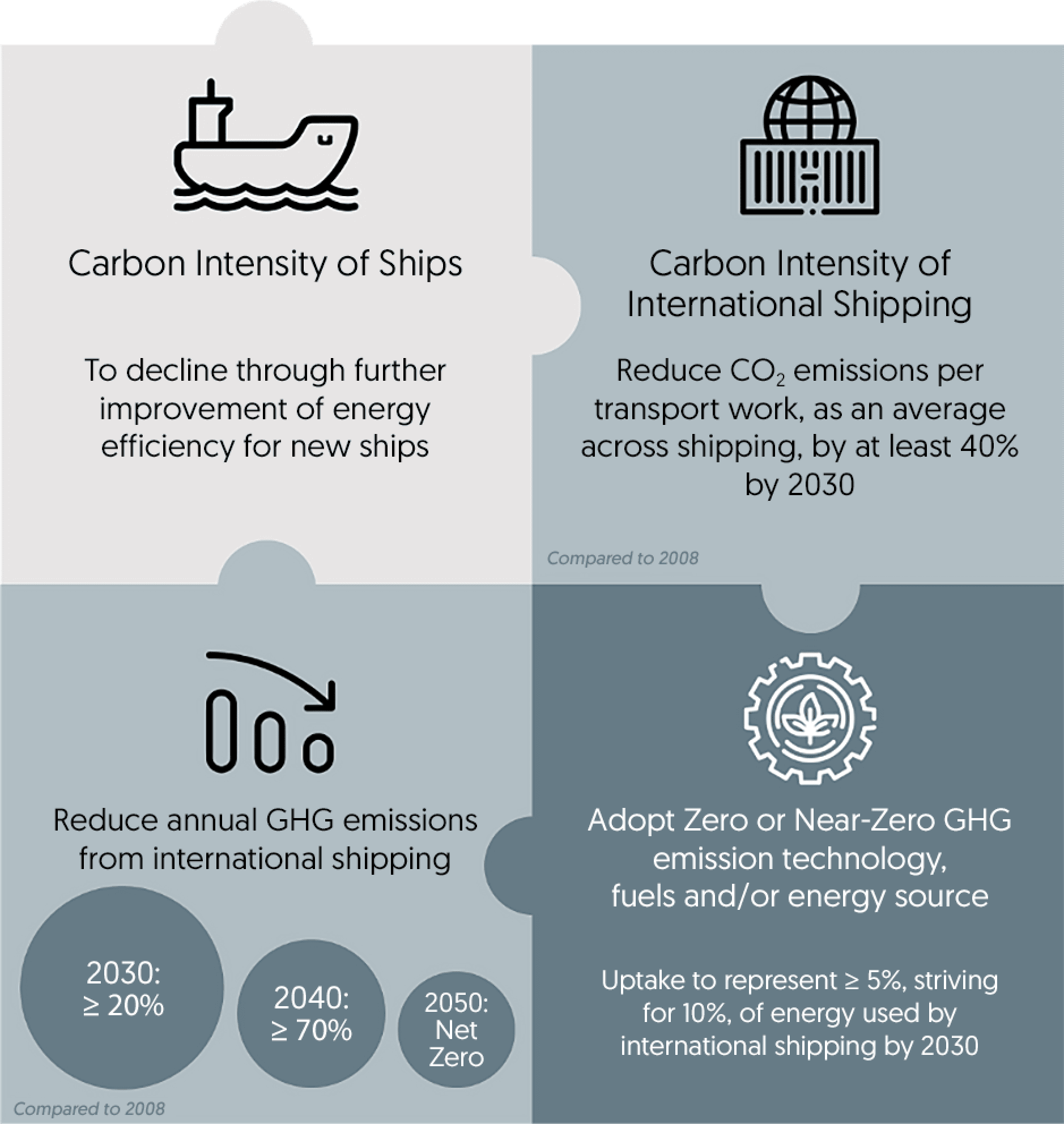

The updated strategy also expands the scope of the GHG emissions reduction target from tank-to-wake emissions, which includes the emissions that result from burning or using a fuel once its already in the tank, to well-to-wake emissions, which includes GHG emissions related to every stage in the life cycle of a fuel, from production until it is used to fuel a vessel. The strategy also introduced a new target to increase the uptake of zero or near-zero GHG emissions fuels (Figure 1).

Figure 1: Revised IMO 2023 GHG strategy

Source: 2023 IMO Strategy on Reduction of GHG Emissions from Ships

The strategy also introduced new mid-term GHG reduction measures, which have yet to be finalised. These include a marine fuel regulation on the phased reduction of marine fuel’s GHG intensity, and a maritime GHG emissions pricing mechanism, to be adopted in 2025. Shipping companies will now need to accelerate their decarbonisation efforts, including the adoption of new technologies, low-carbon fuels, and efficiency improvements, to meet these targets.

OCBC has reached out to some of our shipping clients to better understand their reception towards the revised IMO GHG Strategy as well as how they plan to meet the new requirements.

1. What are your thoughts on the more ambitious decarbonisation strategy by IMO?

“It was much awaited, and we were glad to see that the IMO’s current strategy is now more aligned towards limiting global warming”, says Hafnia.

BW LPG also welcomed the move. It highlighted that the truly significant push is the 70-80% reduction target by 2040 – with about one-third of that delivered by 2030. Given that most regulatory measures such as IMO’s proposed maritime GHG emissions pricing mechanism and a green fuels mandate will not be introduced until 2027, the maritime sector will need to accelerate decarbonisation efforts, including the adoption of new technologies and fuels, to meet these interim targets.

2. What do you think of the scope of reporting being expanded from ‘tank-to-wake’ to ‘well-to-wake’?

“This is absolutely the right thing to do”, says a representative from Berge Bulk. “In order to drive the right decarbonisation behaviours in the industry, the GHG emissions of a fuel should be looked at holistically: from production to transportation to combustion”. While well-to-wake carbon accounting will add a layer of complexity to accurate identification and calculation of emissions from international shipping, it is hoped that the updated scope will encourage shipping companies to accelerate their adoption of low-emissions fuels.

3. What are your views on the new target on the uptake of zero or near-zero GHG emissions technologies, fuels and/or energy sources?

“It is a tough task for the whole industry”, noted Hafnia, “serious efforts are required from all stakeholders [to meet these targets]”.

Berge Bulk notes that to fulfil the 10% by 2030 target, the shipping sector will need 30% to 40% of all produced green fuels globally, which will replace an expected demand of 17 million tons of oil equivalent. Several challenges remain in securing fuels for shipping, including insufficient volumes of feedstock based on sustainable biomass for biofuels, rigid fuels required in the production of blue fuels, and massive investments required to scale hydrogen, which is estimated to need approximately USD 7 trillion of investments in the next 30 years.

4. In light of these developments, what are some key lever(s) that your organisation is looking to employ?

- Improving efficiency is the first step

“Approximately 80 percent of decarbonisation in this decade will have to come from efficiency measures, for which we are well placed”, said BW LPG, “we continue to optimise the use of our LPG-powered Very Large Gas Carriers (VLGCs) which can reduce carbon emissions by at least 15% annually”.

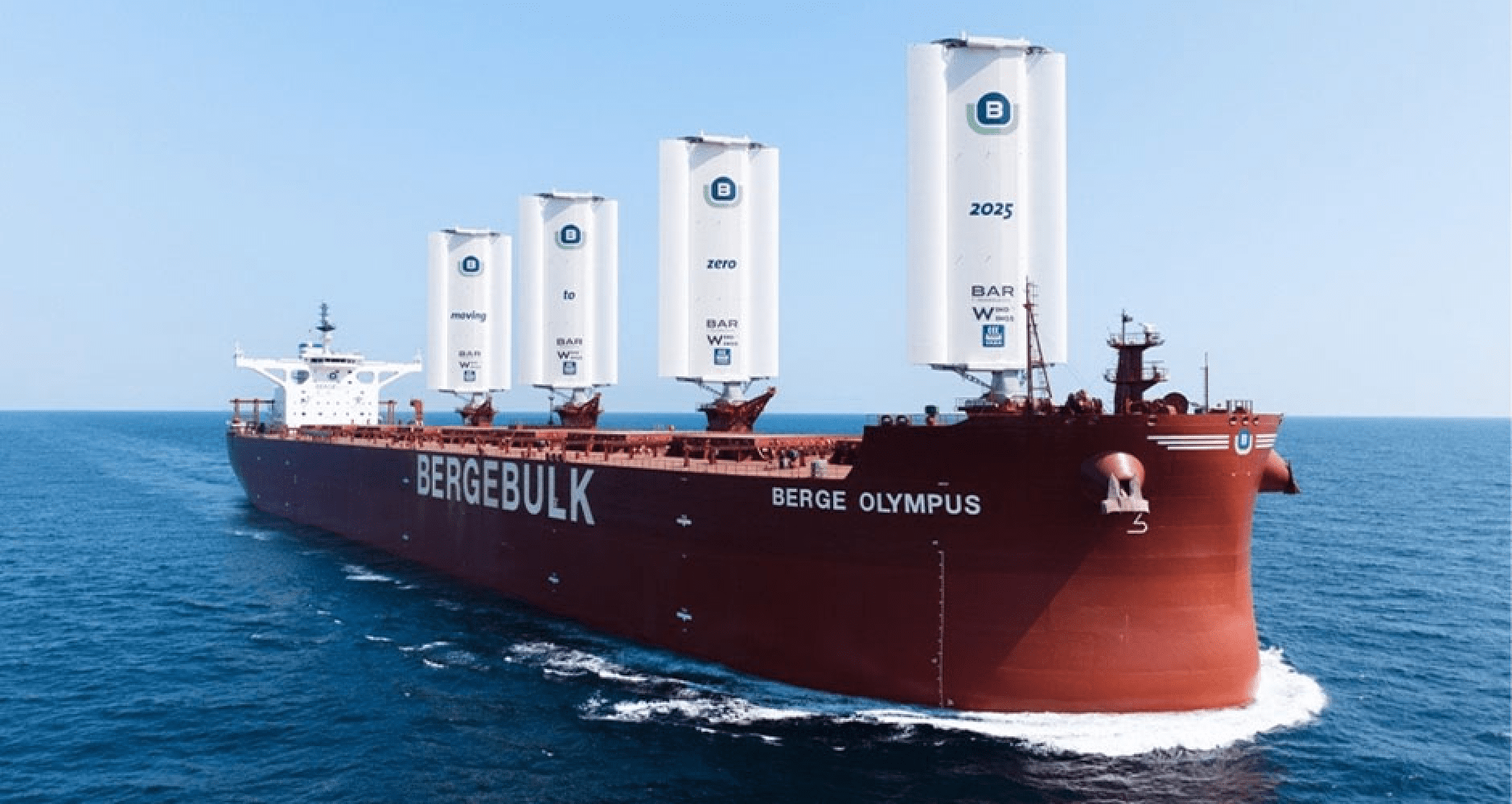

Berge Bulk has also made significant strides in improving efficiency. By the end of 2022, it has improved its carbon intensity by 46% compared to the 2008 baseline, by building newer, bigger, and more efficient ships, retrofitting vessels with energy efficiency improvement technologies, and optimising its operational efficiency. For example, Berge Bulk has launched its Newcastlemax bulker, Berge Olympus, with four retrofitted WindWings, a technology that uses wind power to reduce fuel consumption and CO2 emissions. With the installation of the WindWings, the Berge Olympus will save 6 tonnes of fuel per day on an average worldwide route and, in the process, reduce CO2 emissions by approximately 19.5 tonnes a day. Berge Bulk is also evaluating the potential of installing WindWings on more of its vessels that trade on routes with favourable wind conditions6.

Figure 2: Berge Olympus, a Newcastlemax builder, retrofitted with four WindWings. Image courtesy of Berge Bulk

- Transitioning to alternative fuels is critical

Shipping companies have also begun work in exploring cleaner energy sources for their fleet. Given that the development of alternative fuels is relatively nascent, shipping companies are actively involved in the research and development of such fuels. Berge Bulk has completed several trials with bunkering biofuel and is actively engaged with discussions on ammonia and methanol fuelled propulsion systems. Similarly, CMA CGM is exploring research and development on new alternative fuels like ammonia and other innovative technology for its ships7.

Shipping companies are also preparing their fleets to be ready for the adoption of alternative fuels. For example, CMA CGM and Hafnia have acquired dual-fuel LNG and methanol vessels7, while BW LPG is part of the Getting to Zero coalition, an industry-led platform with an ambition to commercialise zero-emissions vessels operating along deep-sea trade routes by 2030. It is also actively managing fleet renewal activities and researching next-generation VLGCs and new propulsion methods such as ammonia.

- Ecosystem players need to come together

Achieving the IMO’s 2023 GHG Strategy demands collaboration and commitment between ecosystem players in the shipping sector. “We will need strong collaboration amongst all key stakeholders so that we can balance all concerns and find the best way forward in the decarbonisation of the shipping sector”, says Hafnia. Berge Bulk added that both customers and suppliers must have sustainability as a priority for a successful and smooth transition of the shipping sector.

For example, CMA CGM has partnered up with Maersk to establish a framework of the mass production of green methane and green methanol. They will also develop and maintain standards for operation of green methanol vessels with regards to safety and bunkering while simultaneously accelerating port readiness for bunkering and supply of bio/e-methanol at key ports around the world7.

OCBC is also working with our clients in the alternative fuels value chain to facilitate the development of a sustainable fuel ecosystem. For example, we are working with Alpha Biofuels, Singapore’s first and only locally made biodiesel provider, to support the adoption of biofuels in the shipping and logistics sectors and beyond. The company manufactures sustainable International Sustainability and Carbon Certification (ISCC) certified biodiesel by recycling locally collected Used Cooking Oil (UCO) from the Food and Beverage Industry.

- Transition financing as a vital lever

Transition means shipping companies will need to invest in new technologies and research, build the necessary infrastructure for alternative fuels and retrofit existing vessels to improve efficiency and reduce emissions.

Given that new technologies will come with formidable cost barriers, support from financiers will be crucial. In addition, there is a need for more creative financing structures to support the transition. “Any transition like this comes with cost and risk”, says Berge Bulk,” that also implies a need for financiers and regulators to rethink their capital and risk modelling”.

“In the near-term, sustainability-linked loans (SLLs) and transition loans can support the achievement of sustainability ambitions”, notes BW LPG. OCBC was the Green Co-ordinator for BW LPG’s first transition loan in 2021 to finance the retrofitting of existing vessels with dual-fuel propulsion technology and helped develop BW LPG’s transition financing framework. OCBC is also part of the lending syndicate to BW LPG’s SLLs in 2021 and 2023, with the sustainability margin adjustment of the loans tied to continuous improvement in emissions related key performance indicators across its fleet.

Additionally, regulatory support to provide predictable and supportive playing fields such as grants, tax reliefs and policies can mobilise greater private sector investment in technologies and initiatives that require longer time frames to be profitable.

OCBC’s Role in Navigating towards Net Zero in Shipping

OCBC, the first and only Southeast Asian bank to adopt the Poseidon Principles in 2021, is committed to partner our clients to support the decarbonisation of the shipping sector. OCBC welcomes the Poseidon Principles’ commitment to align targets with the revised IMO GHG strategy8, and we look forward to our continued partnership with our shipping clients to achieve net zero.

In May 2023, OCBC announced decarbonisation targets for six sectors, including the shipping sector, to achieve Net Zero emissions by 2050. Our Net Zero target for the shipping sector is aligned with the IMO’s Initial Strategy on the reduction of total annual GHG emissions by at least 50% by 2050 based on 2008 levels, adjusted for our Poseidon Principles commitment.

The IMO 2023 GHG Strategy signifies a pivotal moment in the maritime industry’s journey towards sustainability. Its ambitious decarbonisation target underscores the industry’s deep commitment to addressing its environmental impact. While headwinds persist, the IMO’s vision offers hope that the seas can continue to be a pivotal global transportation route without compromising the health of the planet.

Mike Ng, OCBC’s Chief Sustainability Officer, said: “OCBC’s rich expertise in the maritime industry, coupled with our unwavering commitment to supporting our customers in their green journeys, sets us apart. We are in the midst of assessing our portfolio’s alignment with the revised IMO GHG Strategy and will look to update our Net Zero targets for the shipping sector in due course.”

“Together with our customers, we are navigating towards a sustainable horizon, where environmental responsibility and financial success converge.”

References

1 International Chamber of Shipping, “Shipping and world trade: driving prosperity”, https://www.ics-shipping.org/shipping-fact/shipping-and world-trade-driving-prosperity/

2 International Transport Forum, https://www.itf-oecd.org/transport-demand-set-triple-sector-faces-potential-disruptions

3 Poseidon Principles, “Annual Disclosure Report 2022”, December 2022, https://www.poseidonprinciples.org/finance/wp-content/uploads/2022/12/Poseidon-Principles-Annual-Disclosure-Report-2022.pdf

4 IEA, https://www.iea.org/reports/international-shipping

5 Council of the European Union, “FuelEU maritime initiative: Council adopts new law to decarbonise the maritime sector”, 25 July 2023, https://www.consilium.europa.eu/en/press/press-releases/2023/07/25/fueleu-maritime-initiative-council-adopts-new-law-to-decarbonise-the-maritime-sector/

6 Berge Bulk, “Berge Bulk Unveils The World’s Most Powerful Sailing Cargo Ship”, 17 October 2023, https://www.bergebulk.com/berge-bulk-unveils-the-worlds-most-powerful-sailing-cargo-ship/

7 CMA CGM, “CMA CGM and Maersk join forces to accelerate the decarbonization of the shipping industry”, 19 September 2023, https://www.cmacgm-group.com/en/news-media/cma-cgm-and-maersk-join-forces-accelerate-decarbonization-shipping-industry

8 Poseidon Principles, “Poseidon Principles Align Shipping Finance Reporting with Ambitious New IMO Climate Goals”, 2 October 2023, https://www.poseidonprinciples.org/finance/news/poseidon-principles-align-shipping-finance-reporting-with-ambitious-new-imo-climate-goals/

Disclaimer

This publication is solely for information purposes only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without our prior written consent. This publication should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities/instruments mentioned herein. Any forecast on the economy, stock market, bond market and economic trends of the markets provided is not necessarily indicative of the future or likely performance of the securities/instruments. Whilst the information contained herein has been compiled from sources believed to be reliable and we have taken all reasonable care to ensure that the information contained in this publication is not untrue or misleading at the time of publication, we cannot guarantee and we make no representation as to its accuracy or completeness, and you should not act on it without first independently verifying its contents. The securities/instruments mentioned in this publication may not be suitable for investment by all investors. Any opinion or estimate contained in this report is subject to change without notice. We have not given any consideration to and we have not made any investigation of the investment objectives, financial situation or particular needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any class of persons acting on such information or opinion or estimate. This publication may cover a wide range of topics and is not intended to be a comprehensive study or to provide any recommendation or advice on personal investing or financial planning. Accordingly, they should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. OCBC Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products. OCBC and/or its related and affiliated corporations may at any time make markets in the securities/instruments mentioned in this publication and together with their respective directors and officers, may have or take positions in the securities/instruments mentioned in this publication and may be engaged in purchasing or selling the same for themselves or their clients, and may also perform or seek to perform broking and other investment or securities-related services for the corporations whose securities are mentioned in this publication as well as other parties generally.

This report is intended for your sole use and information. By accepting this report, you agree that you shall not share, communicate, distribute, deliver a copy of or otherwise disclose in any way all or any part of this report or any information contained herein (such report, part thereof and information, “Relevant Materials”) to any person or entity (including, without limitation, any overseas office, affiliate, parent entity, subsidiary entity or related entity) (any such person or entity, a “Relevant Entity”) in breach of any law, rule, regulation, guidance or similar. In particular, you agree not to share, communicate, distribute, deliver or otherwise disclose any Relevant Materials to any Relevant Entity that is subject to the Markets in Financial Instruments Directive (2014/65/EU) (“MiFID”) and the EU’s Markets in Financial Instruments Regulation (600/2014) (“MiFIR”) (together referred to as “MiFID II”), or any part thereof, as implemented in any jurisdiction. No member of the OCBC Group shall be liable or responsible for the compliance by you or any Relevant Entity with any law, rule, regulation, guidance or similar (including, without limitation, MiFID II, as implemented in any jurisdiction).

Discover other articles about: