OCBC Financial Wellness Index 2020 Key Takeaways

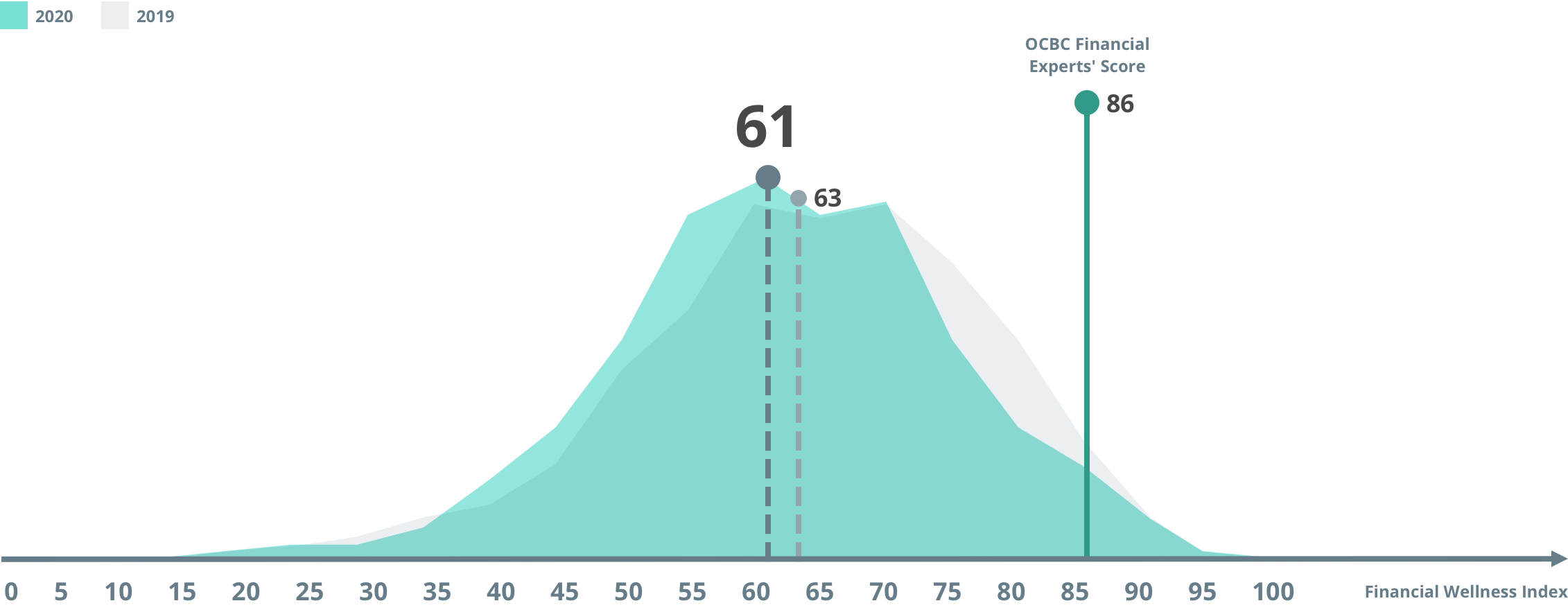

The OCBC Financial Wellness Index 2020 is 61, down 2 points from last year.

The OCBC Financial Wellness Index, launched in 2019, is a measurement of the state of Singaporeans' financial wellness. A total of 2,000 working Singaporeans aged between 21 and 65 were surveyed.

The Index is based on 10 pillars of financial wellness – Saving Habits, Protection from Financial Emergencies, Regular Investing, Retirement Planning, Regular Reviews, Gambling Habits, Excessive Speculation, Borrowing Money, Spending Beyond Means and Manageable Debt. To assess how the 2,000 respondents fare on these pillars, 24 indicators – standards and guidelines that are widely-accepted best practices in financial planning – are used. The resulting scores from all respondents are then averaged out to derive the Index.

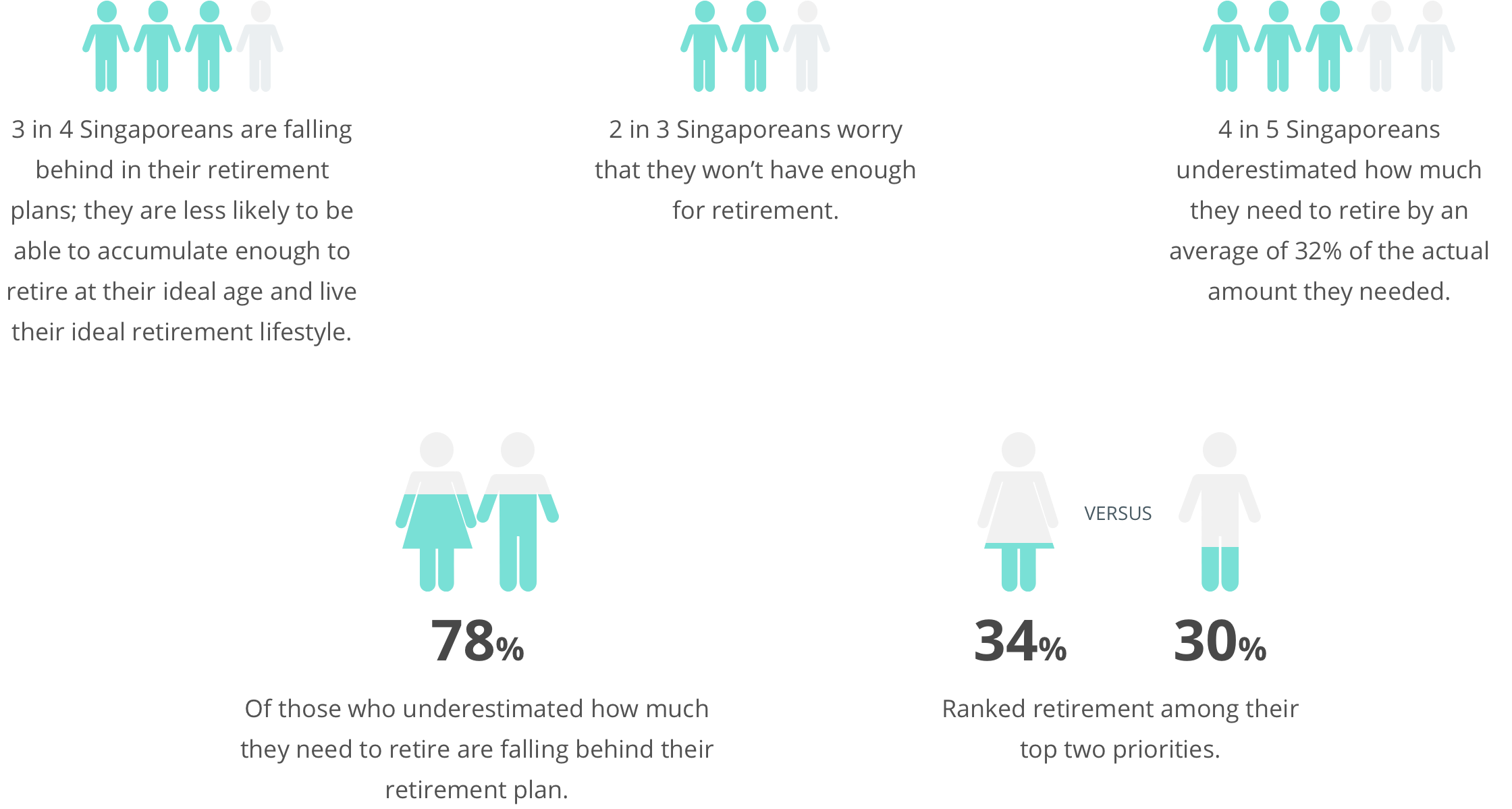

The financial strains caused by the pandemic were reflected in the Index's 2-point decline this year. Singaporeans' ability to pay off housing loans and monthly credit card bills have been hampered, and regular passive income has been adversely affected. With more pressing financial worries at hand, Singaporeans also put the longer-term financial goal of retirement on the backburner.

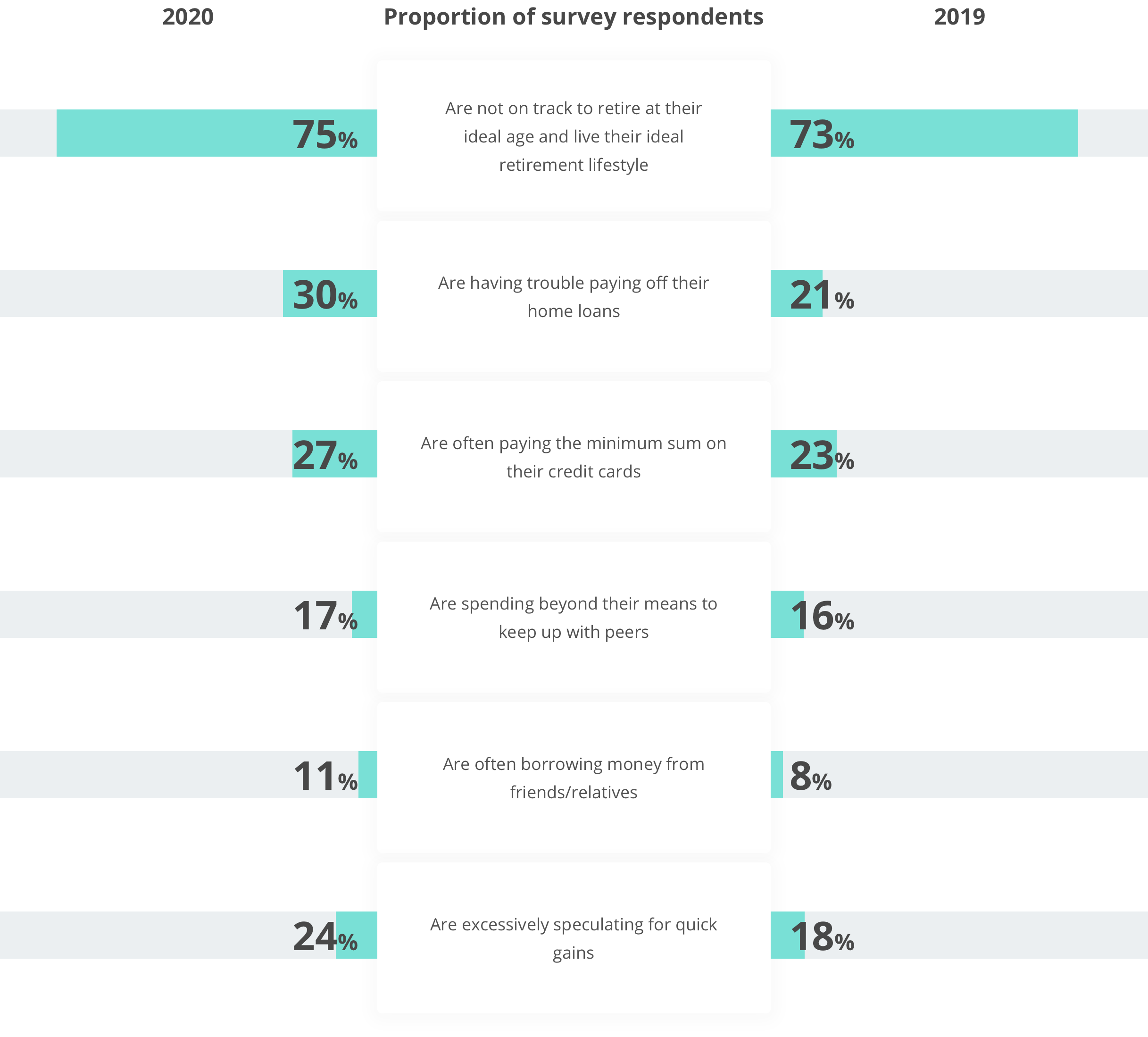

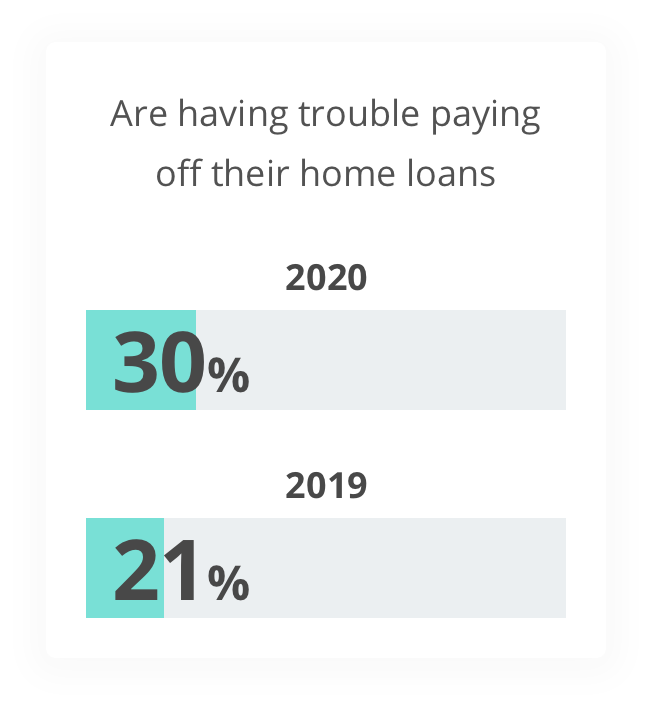

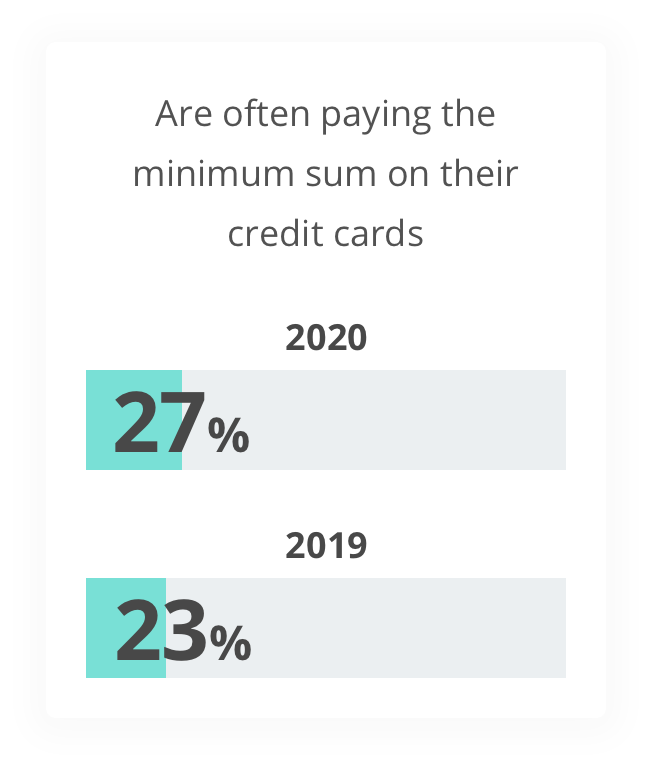

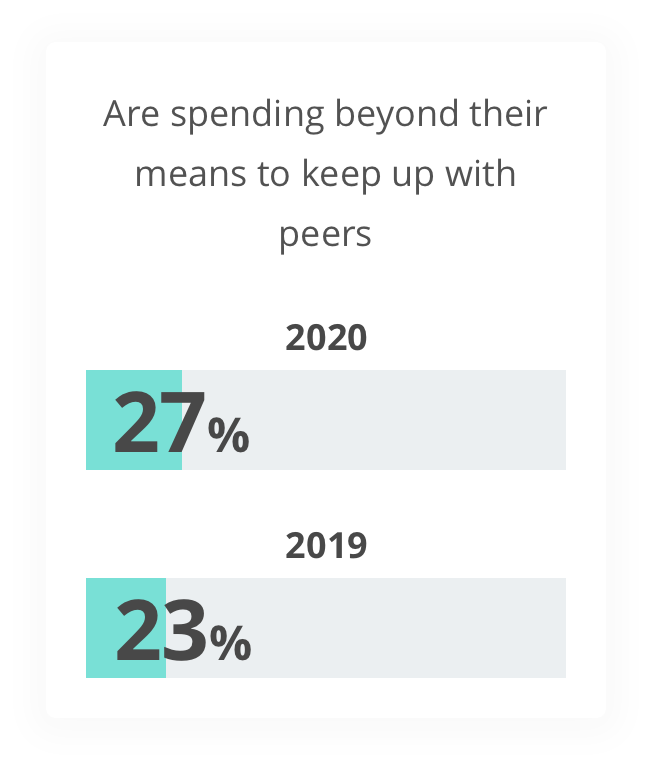

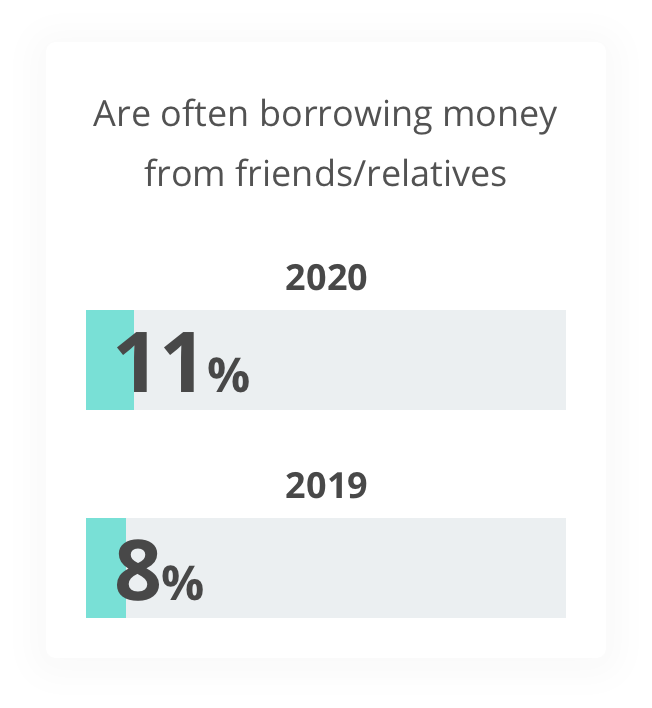

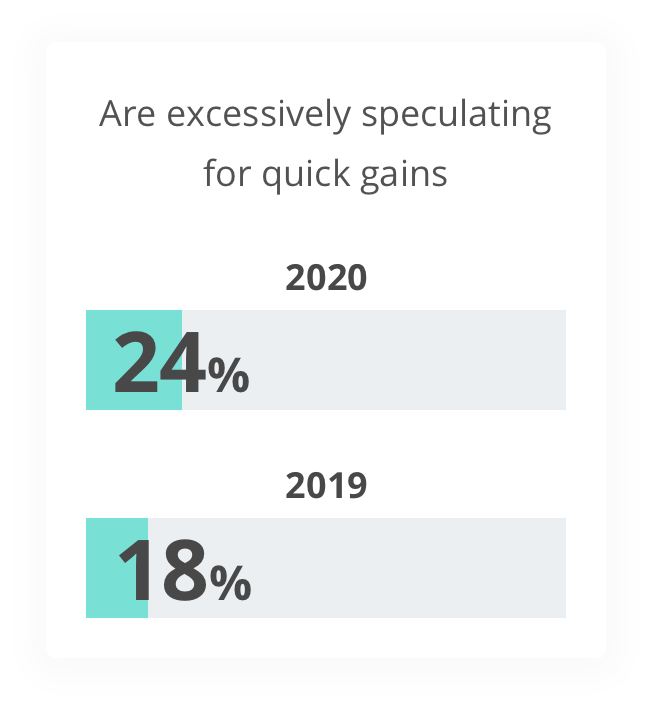

Against this backdrop, more are borrowing money from friends and family often to get by, paying only the minimum sum on their credit card bills, and excessively speculating for quick gains. Yet, more admitted to spending beyond their means to keep up with their peers when the pandemic has widened the gap between those who can and those who cannot.

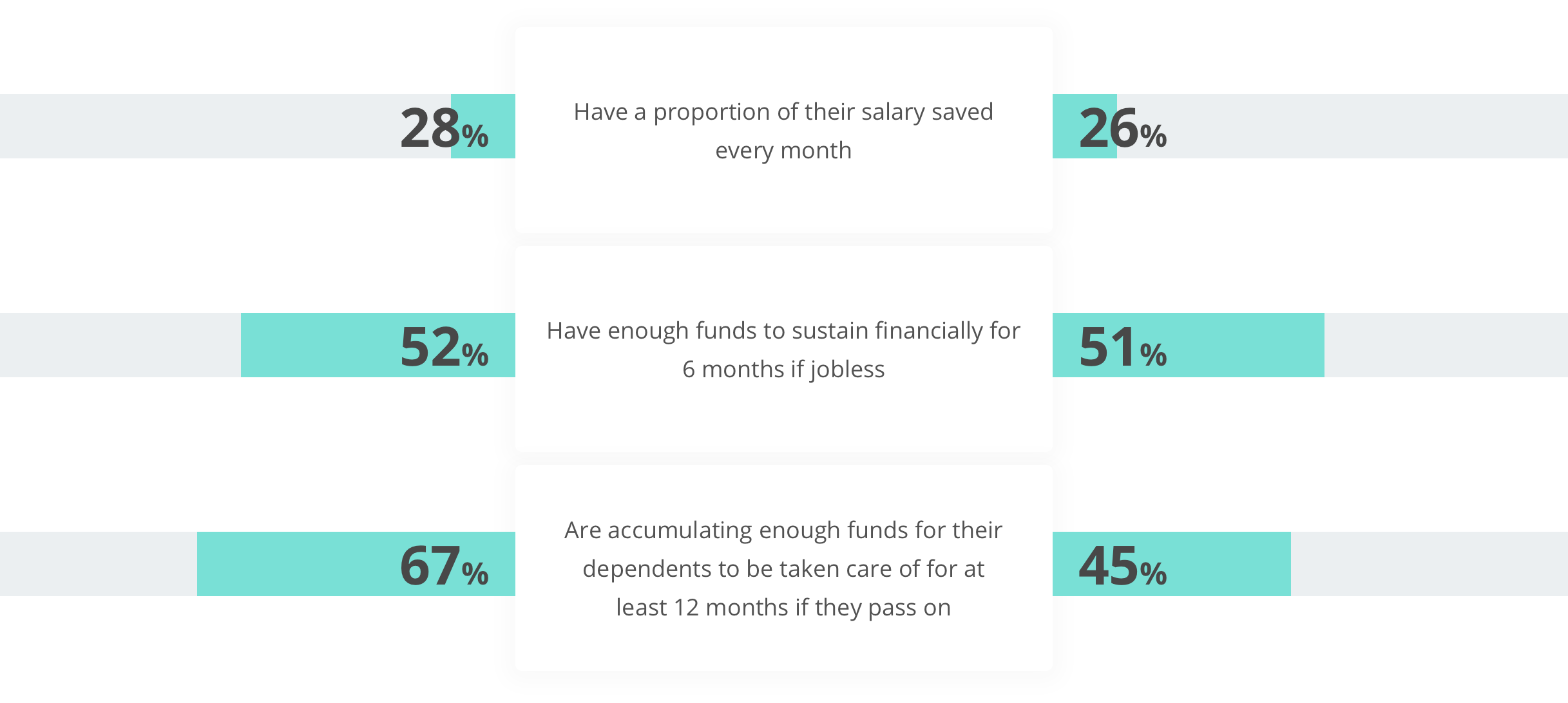

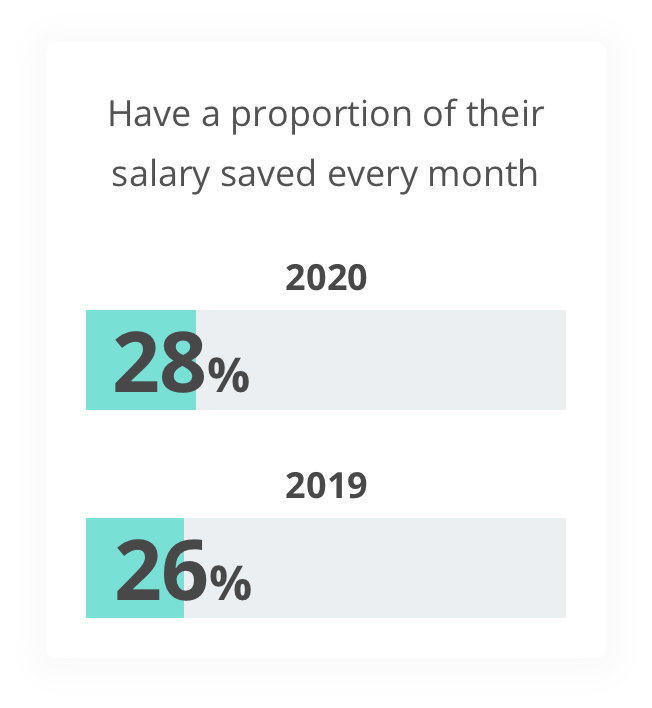

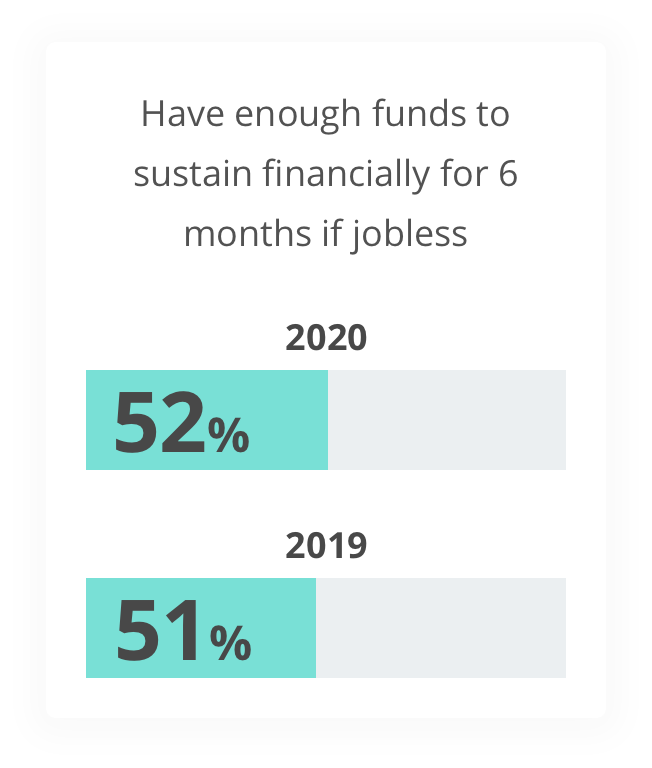

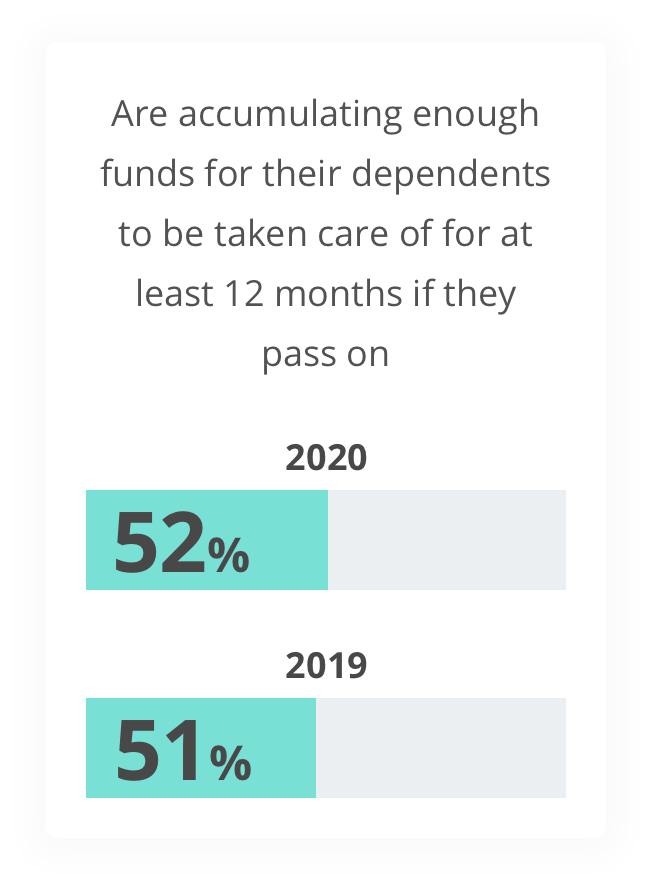

Proportion of survey respondents

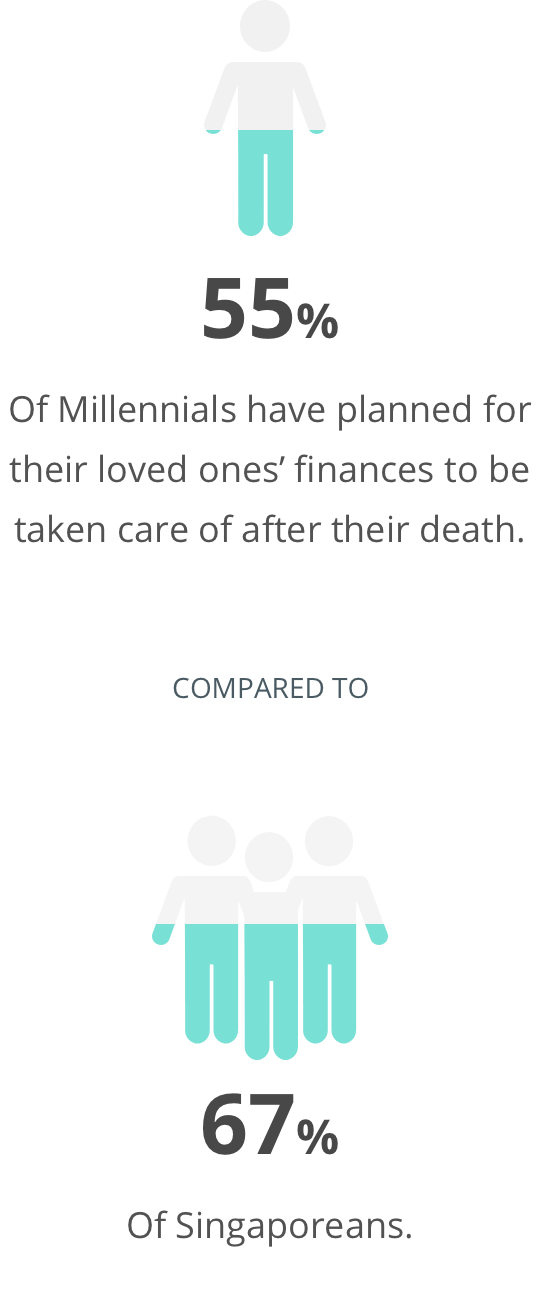

With the fear of further strain on personal finances and the uncertain future from the effects of COVID-19, Singaporeans are saving more; ensuring that they have enough emergency funds to weather any job loss; and ensuring that loved ones are well taken care of should they pass on. Improvements on these indicators buoyed the Index from slipping further.

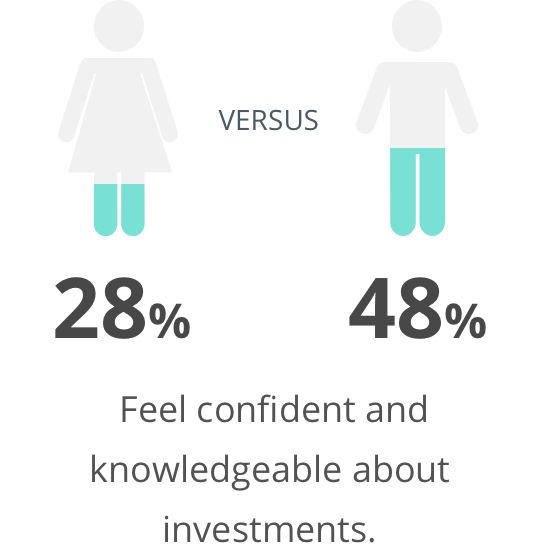

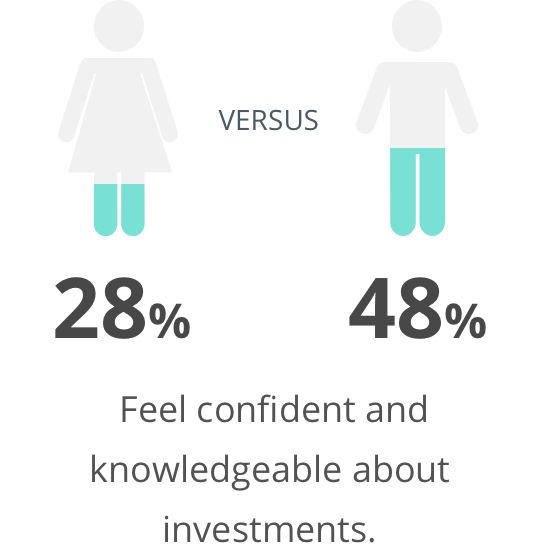

Women with financial

confidence and knowledge

Women without financial

confidence and knowledge

Millennials who are not able to spend comfortably now

Millennials who are not able to spend comfortably now

Find out more

Discover how your peers are faring.

Understand your financial situation

Men in their 20s are excellent savers

31%

save their salary every month, higher than the national average of 28%.

Men in their 20s do not have sufficient funds in case they lose their job

49%

have enough funds to tide them over the next 6 months, lower than the national average of 52%.

Men in their 20s are rolling over credit card debts

43%

pay only the minimum sum on their credit card bills, much higher than the national average of 32%.

Men in their 20s are good at keeping to a budget

75%

of men in their 20s stick closely to their budget, much higher than the national average of 69%.

Men in their 20s end up borrowing often from friends and relatives

20%

of men in their 20s often borrow from people they know, much higher than the national average of 11%.

Men in their 20s spend to keep up with friends

20%

of men in their 20s spend beyond their means to keep up with their peers, higher than the national average of 17%.

Ensure that you are adequately insured

Men in their 20s are not prepared for health emergencies

39%

of men in their 20s have enough to defray medical costs, much lower than the national average of 47%.

Start planning for your future

Men in their 20s have not started to plan for retirement

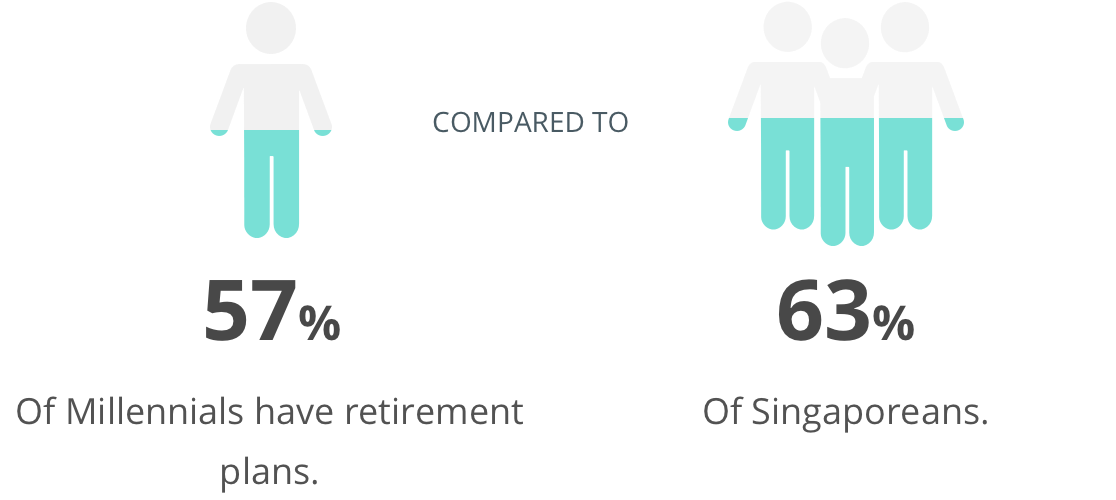

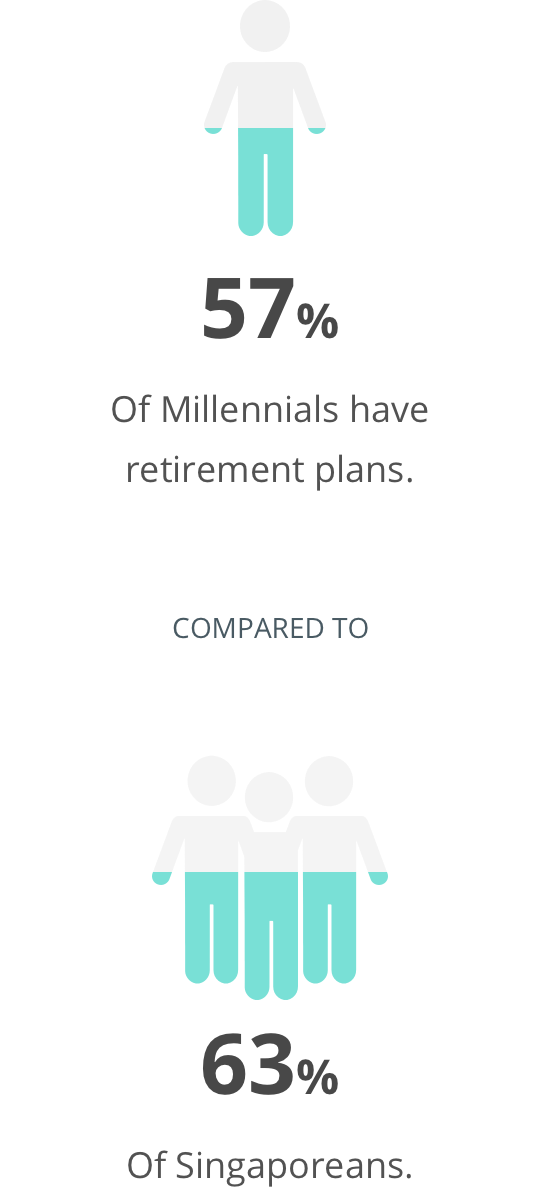

61%

of men in their 20s have retirement plans, slightly lower than the national average of 63%.

Men in their 20s have passive income

57%

of men in their 20s have passive income, much higher than the national average of 52%.

Find investment opportunities

Men in their 20s take unnecessary financial risks

35%

of men in their 20s who invest speculate excessively in the hope of making a quick buck, similar to the national average of 35%.

Men in their 20s have started investing

70%

of men in their 20s invest, slightly higher than the national average of 69%.

Review your finances periodically

Men in their 20s get a financial health check-up

58%

of men in their 20s do this regular check-up, much higher than the national average of 51%. Singaporeans who review their finances annually with an expert have returns that are 6x higher than those who don't.