Understanding the financial wellness of Singaporeans

We know you are concerned now.

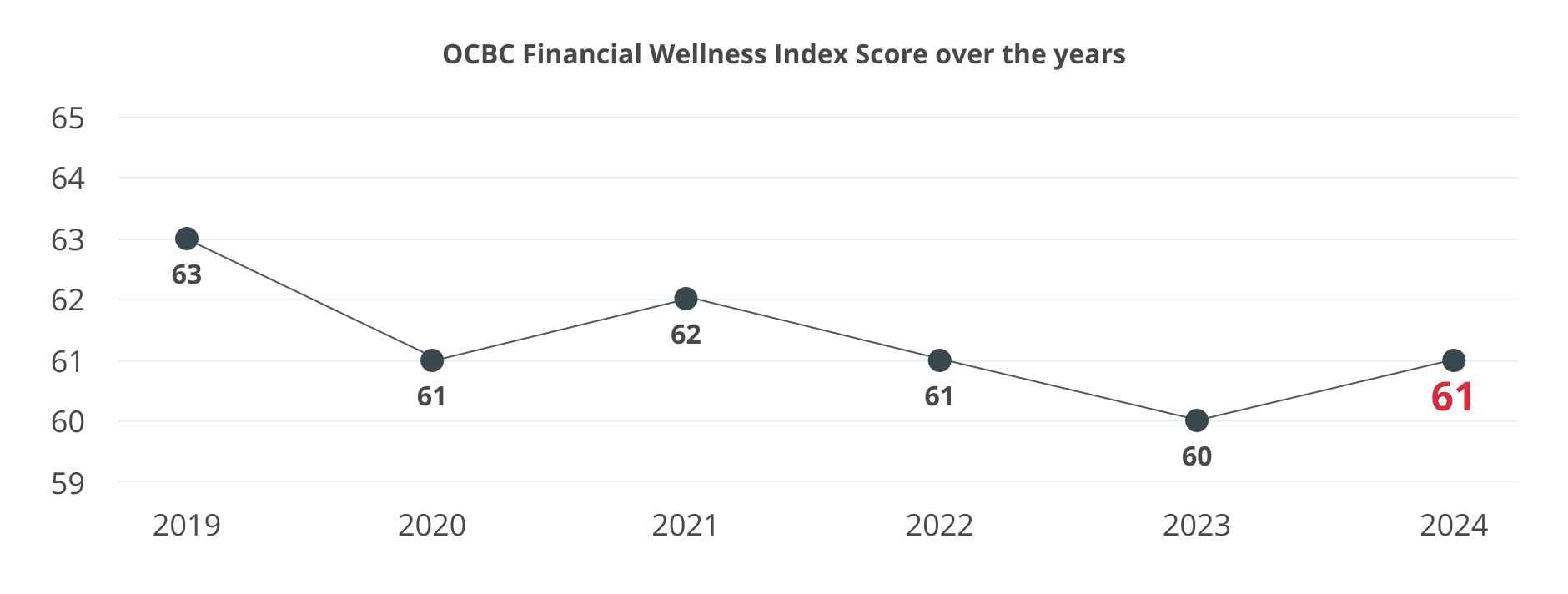

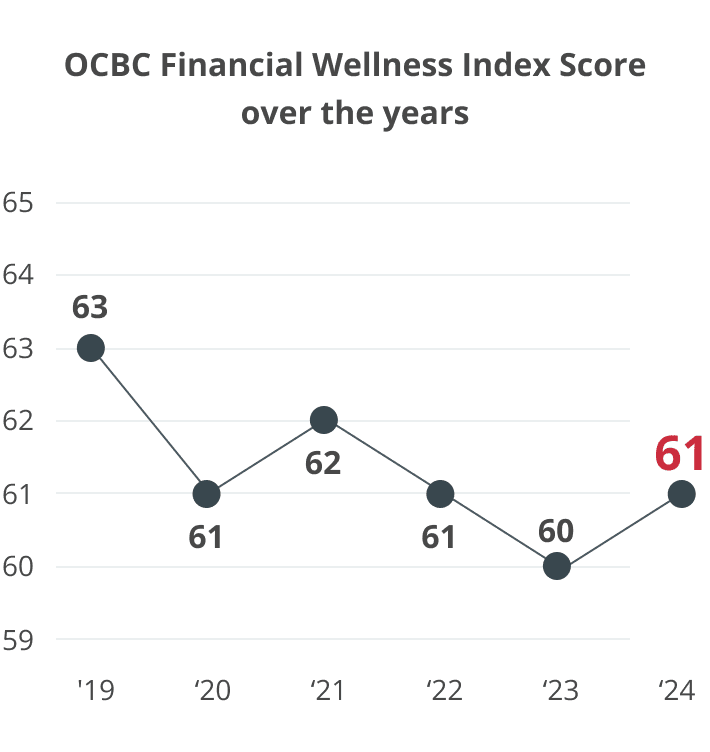

With easing inflation, Singaporeans are building their savings, managing their debt better, and investing. These are just some of the factors that have contributed to a one-point increase in the OCBC Financial Wellness Index, bringing it to 61 this year.

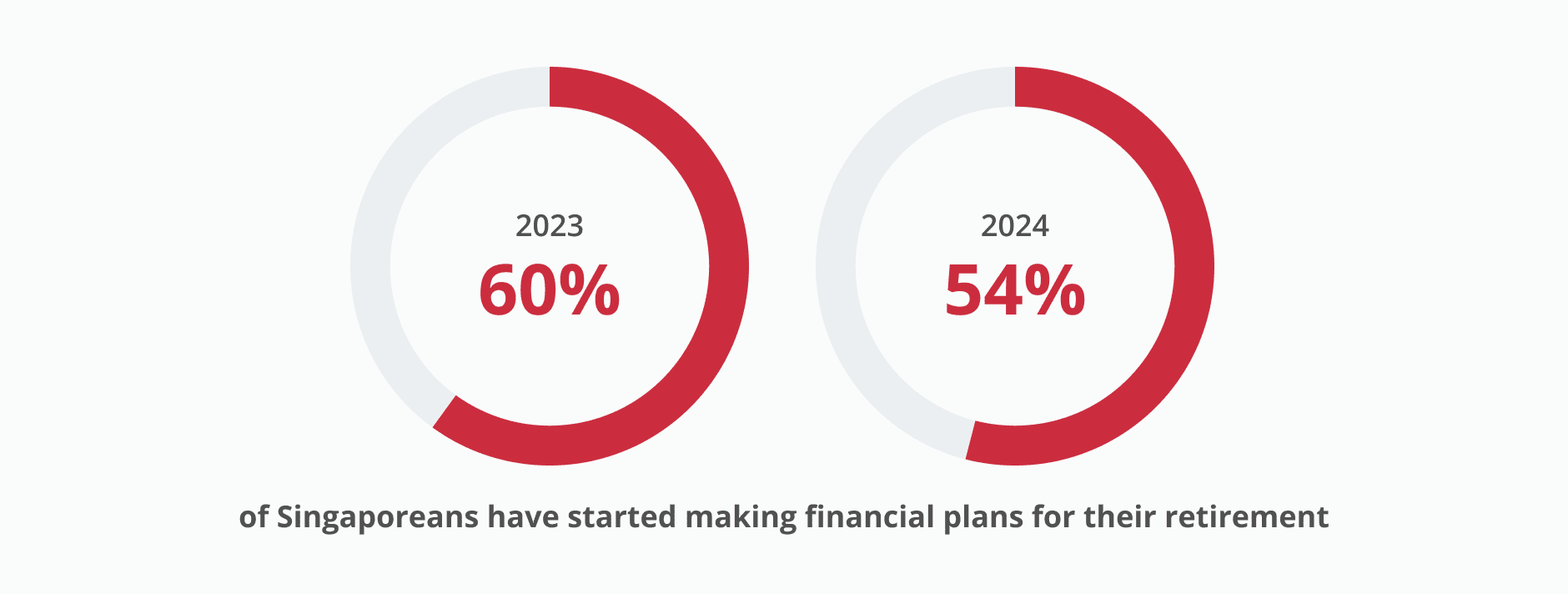

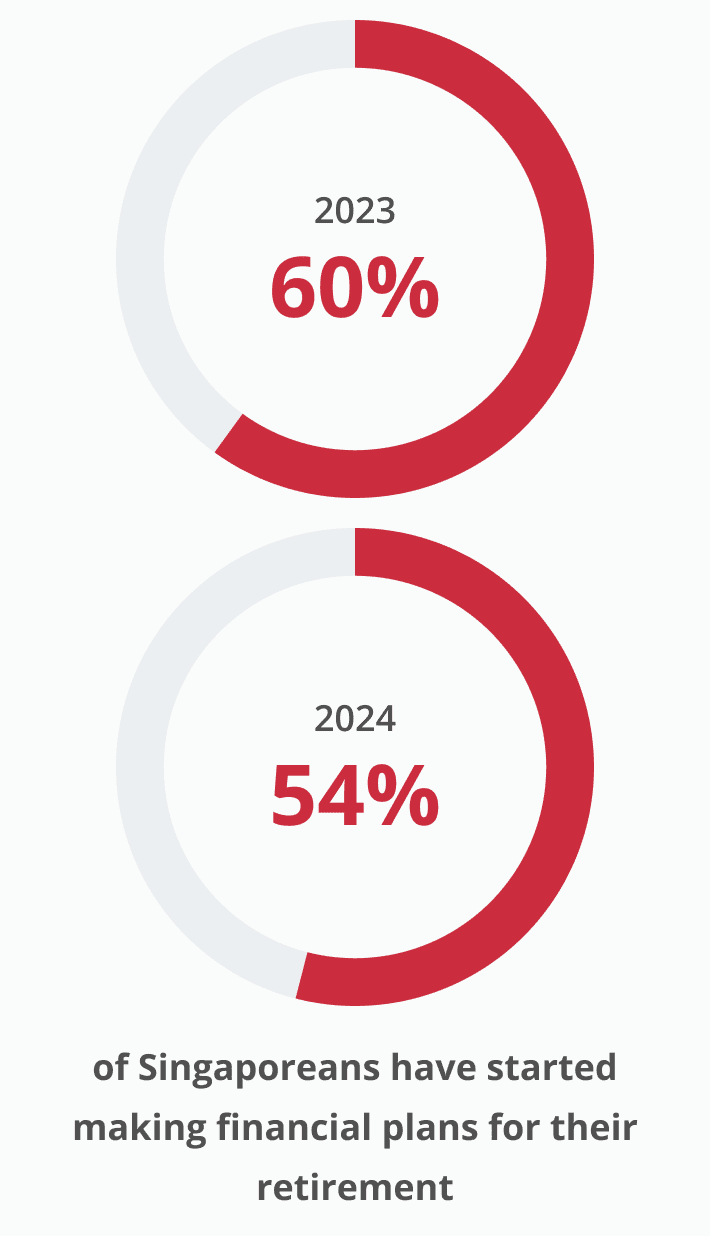

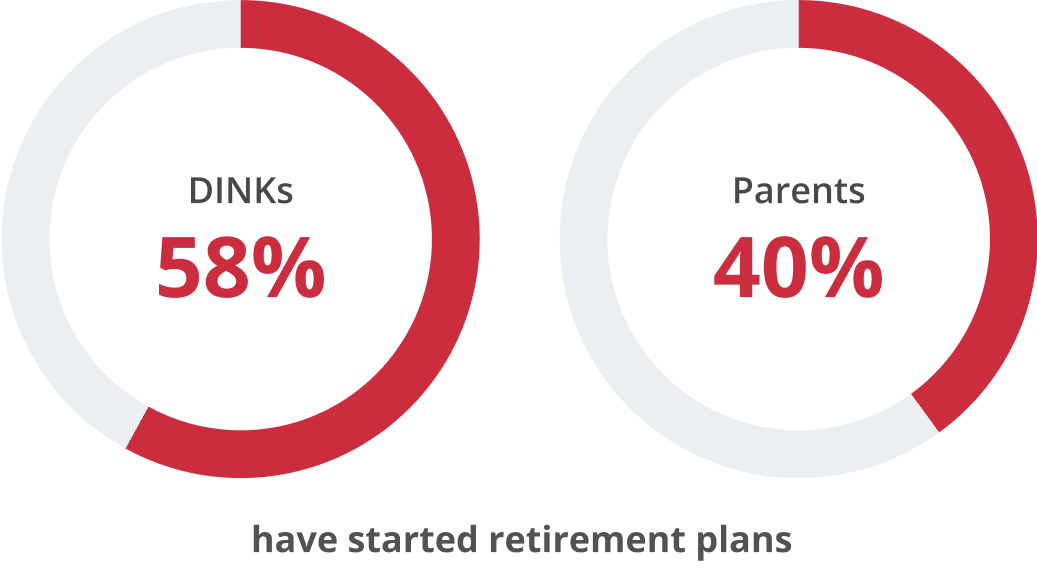

However, Singaporeans still perform poorly when it comes to retirement planning. Only 54% of Singaporeans have started making plans for retirement—a 6-percentage-point decrease compared to last year. Additionally, Singaporeans are planning for retirement later in life. In particular, those with dual incomes and no kids (DINKs) fare considerably worse than parents when it comes to retirement planning.

We developed 6 financial personas, based on a combination of the top 2 dominant financial

personality traits. Some personas had better financial wellness index scores on average than

others.

Which persona are you?

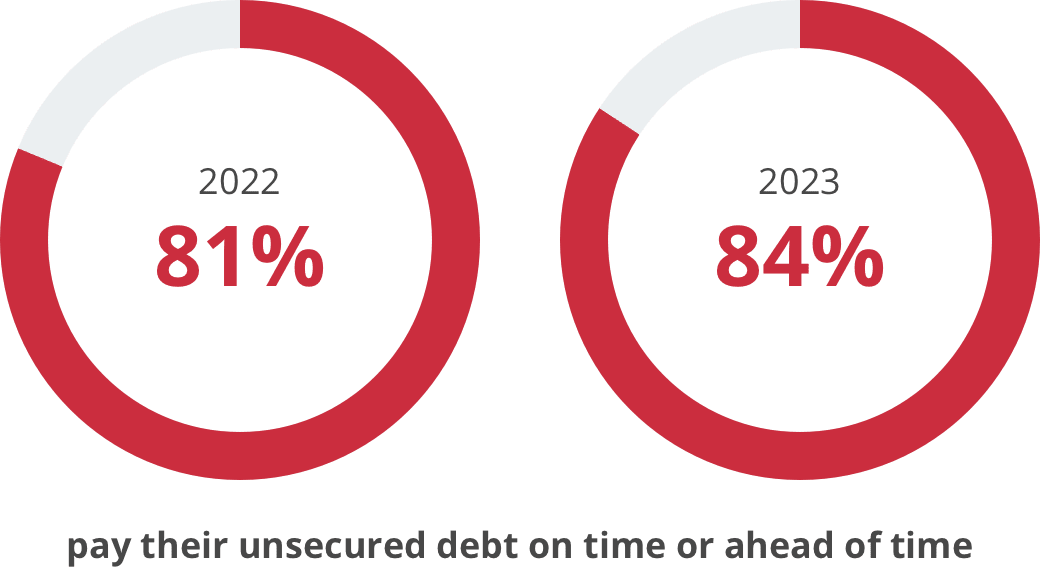

More Singaporeans are paying off their unsecured debts on time or ahead of time.

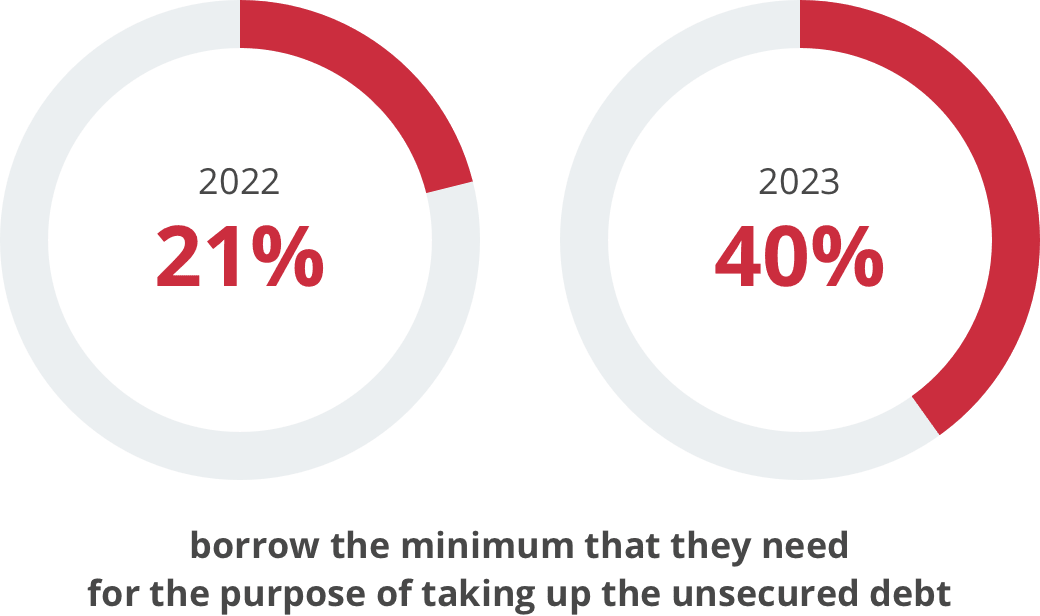

Of the Singaporeans that have unsecured debt, more of them are borrowing only the minimum that they need for the purpose of taking up the unsecured debt.

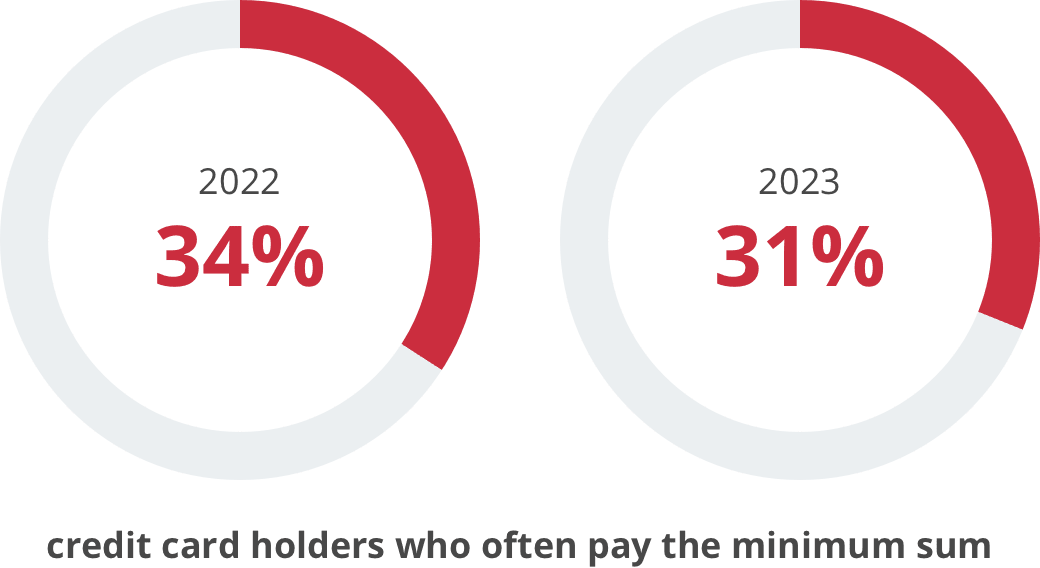

There are also fewer credit card holders who often pay the minimum sum.

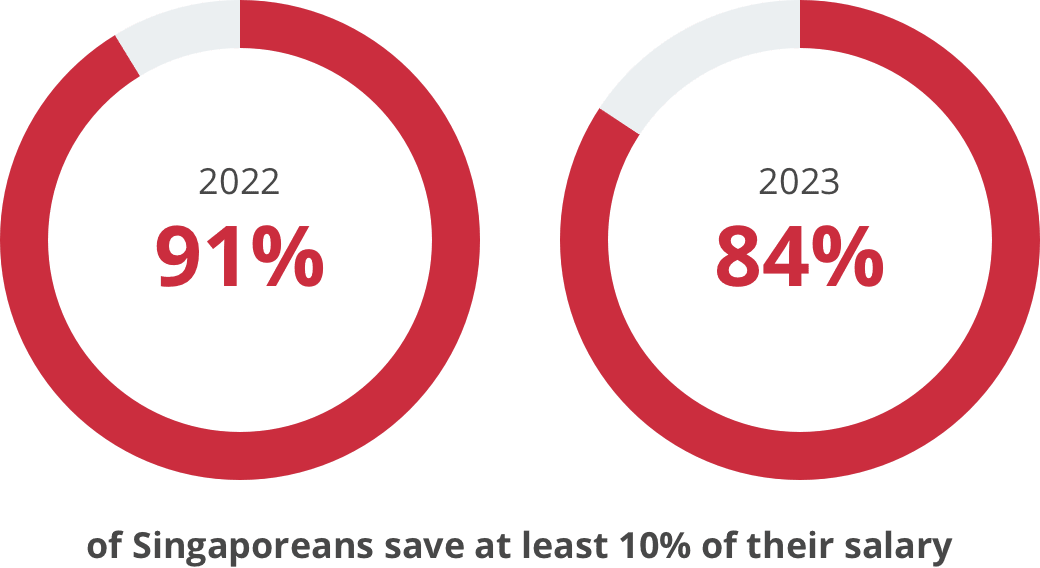

While Singaporeans continue to save well, fewer Singaporeans save at least 10% of their salary.

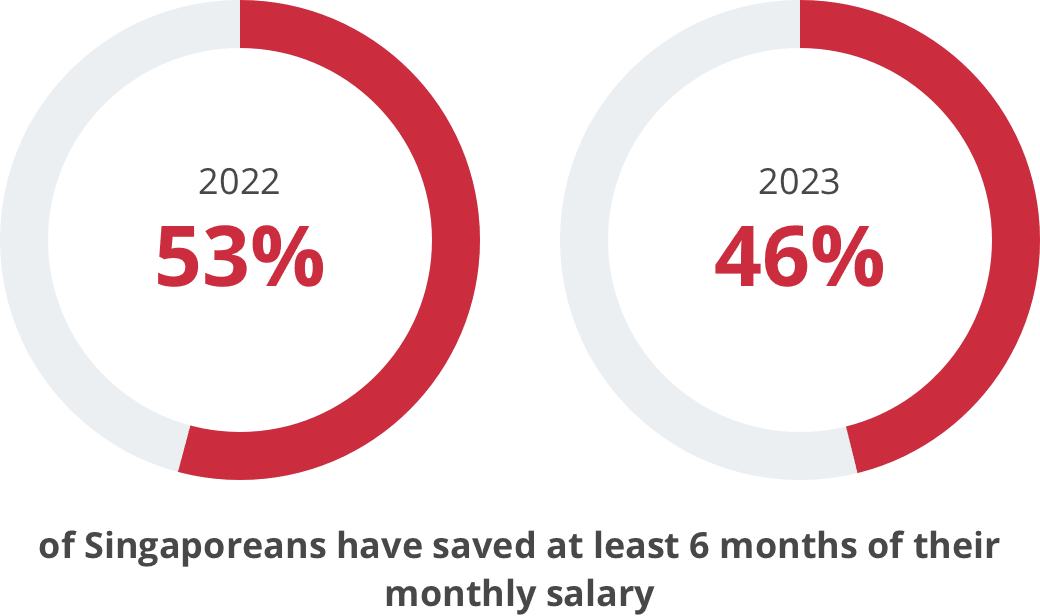

There is also a decrease in the number of Singaporeans with sufficient emergency funds.

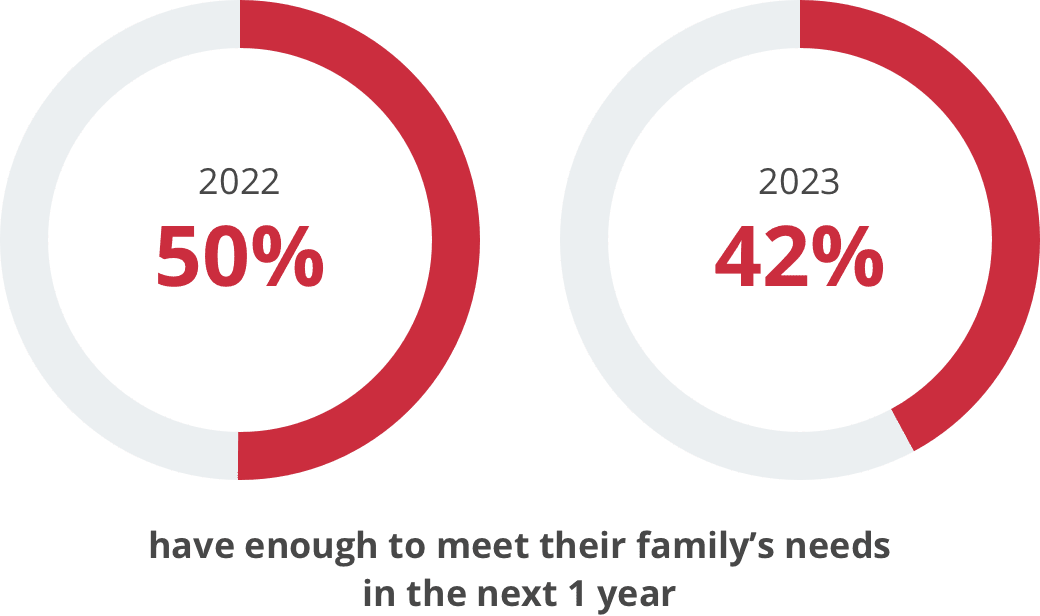

The number of Singaporeans that have enough to meet their family’s needs in the next 1 year has also dipped.

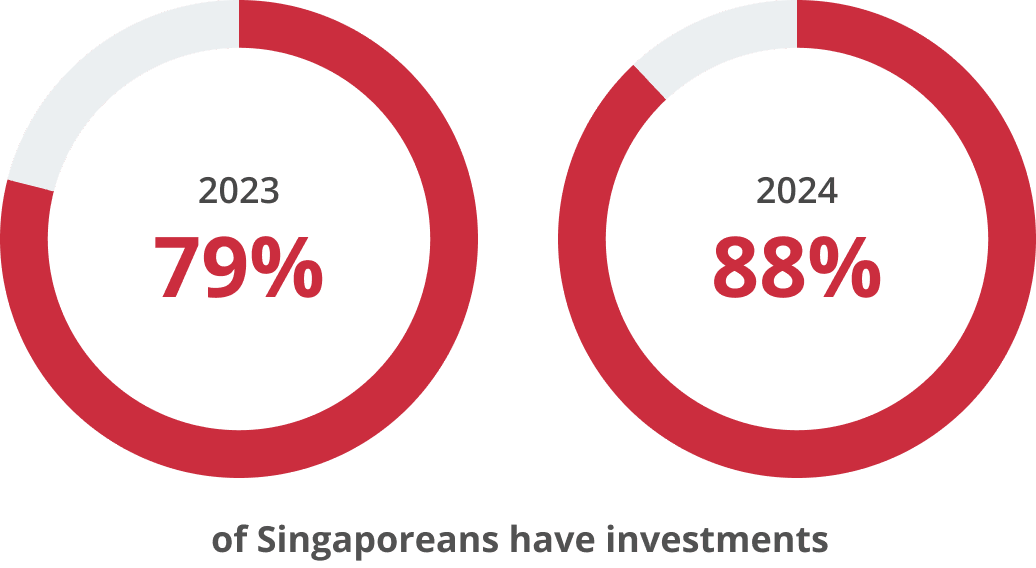

More Singaporeans are investing.

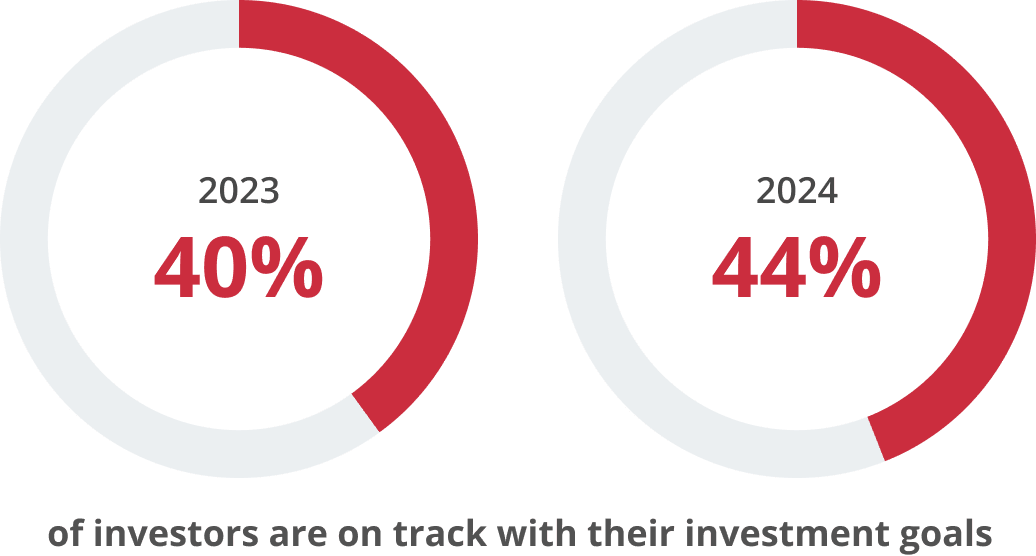

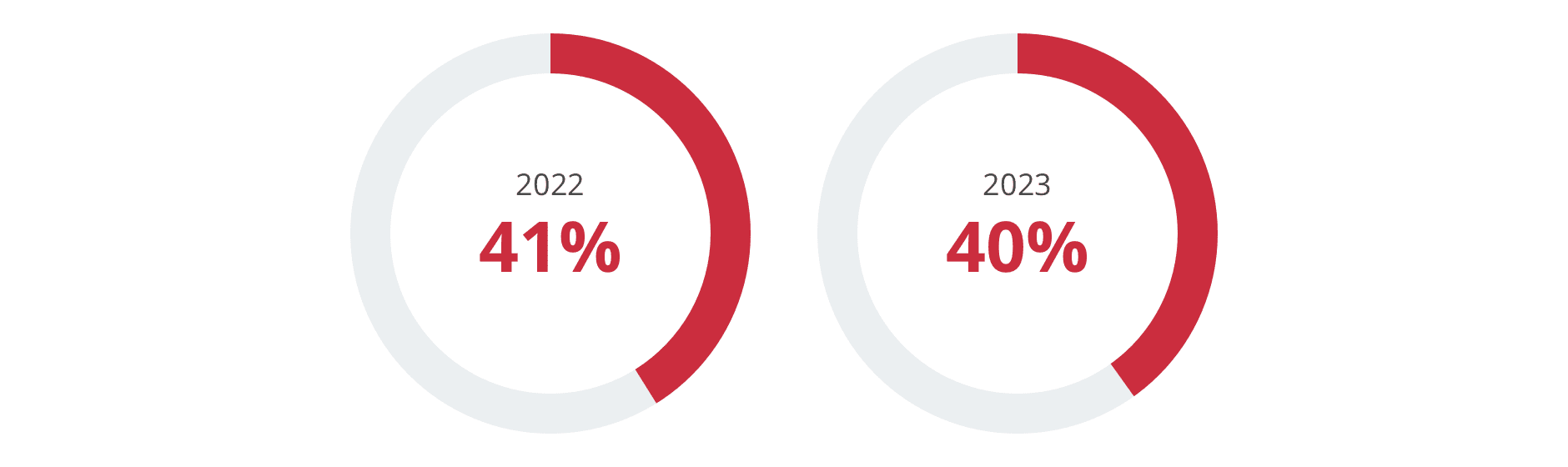

Of those with investments, more are on track with their investment goals.

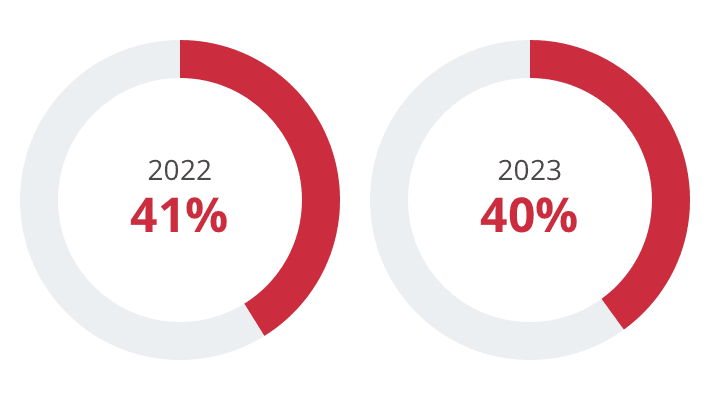

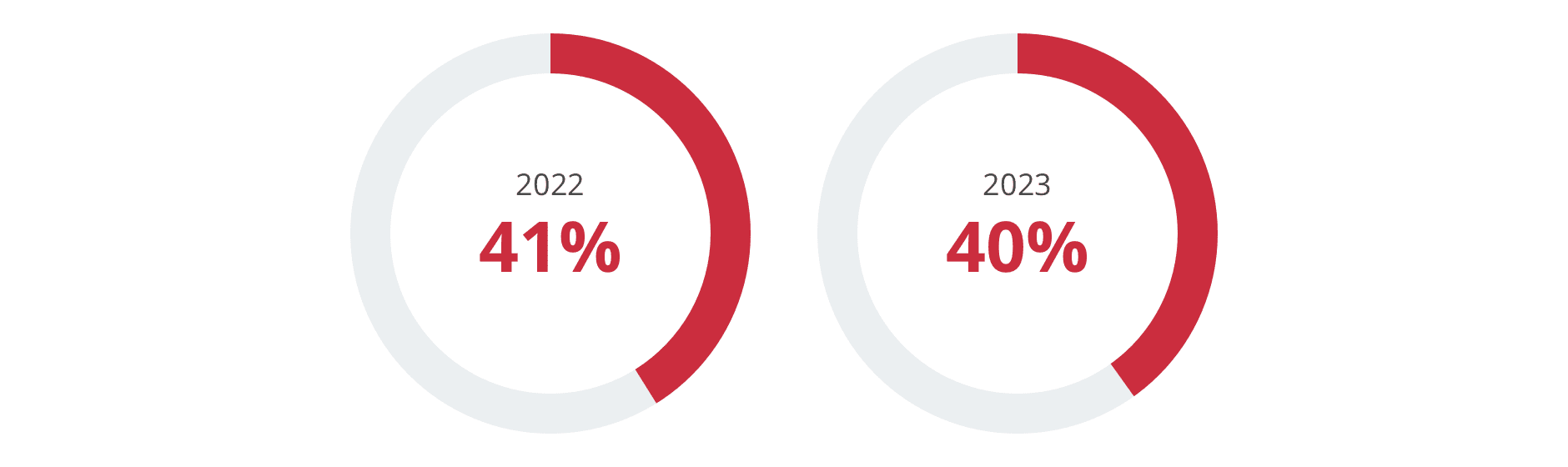

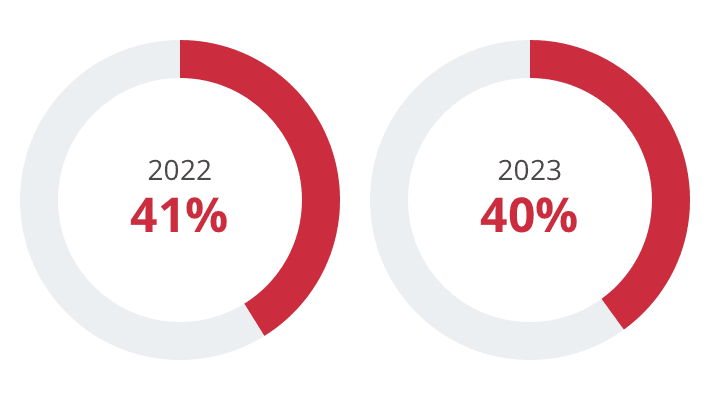

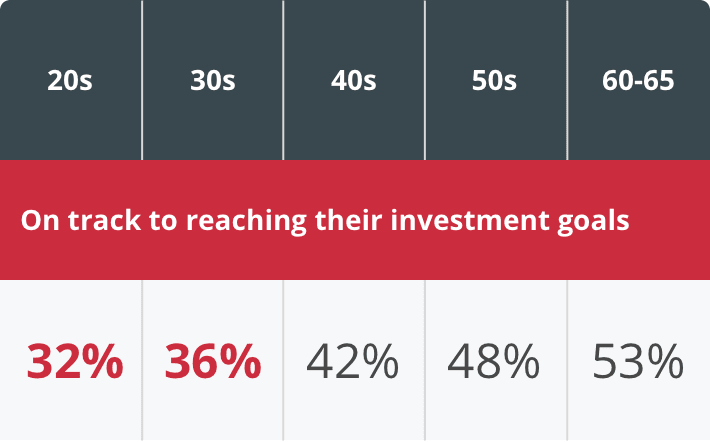

This year, fewer Singaporeans are on track to reaching their investment goals.

of investors are on track with their goals

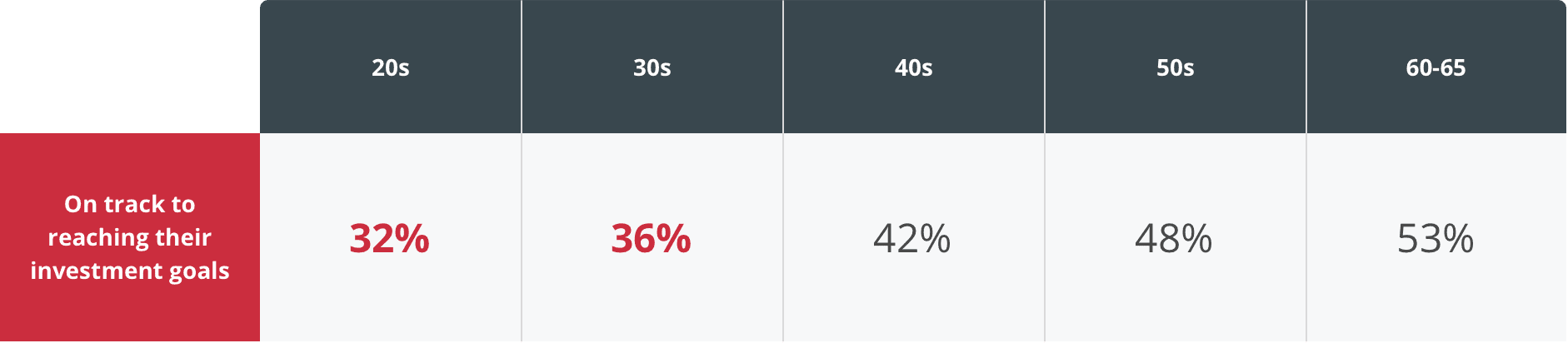

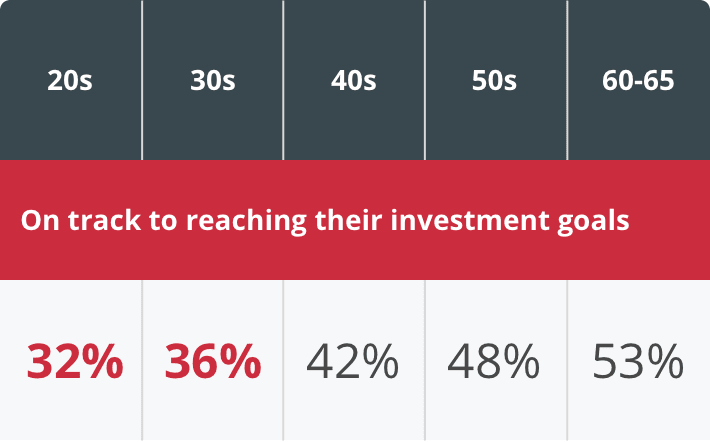

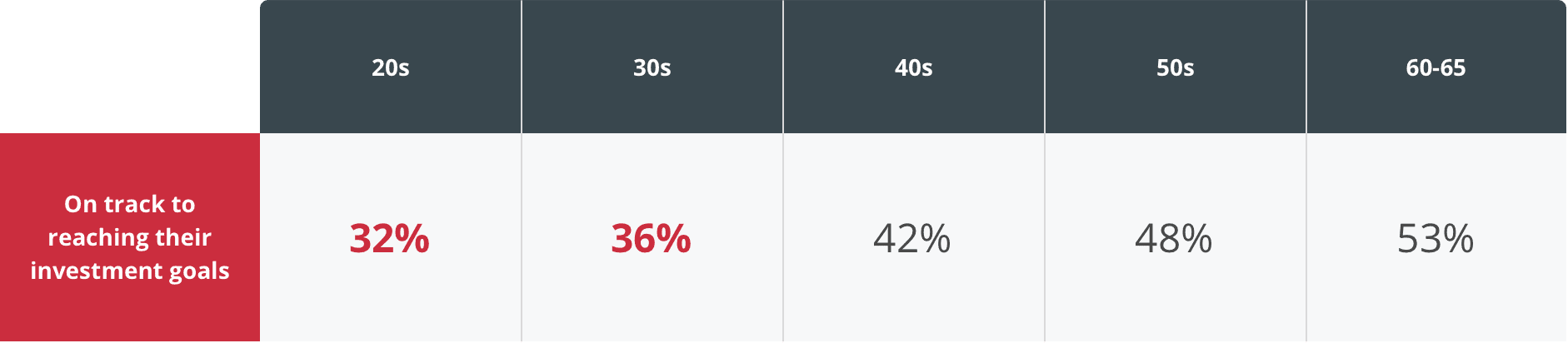

Fewer Gen Z and millennial investors are on track to reaching their investment goals compared to other age groups.

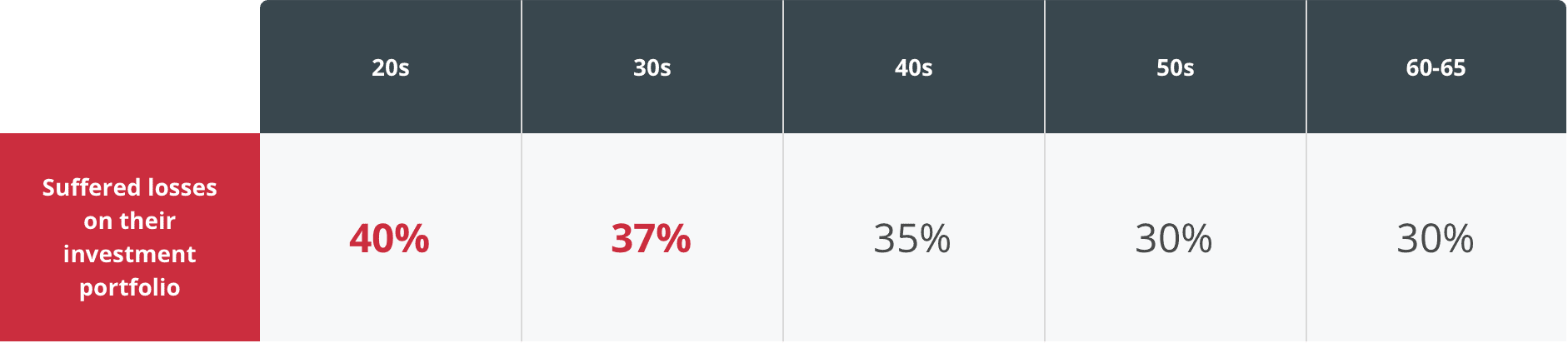

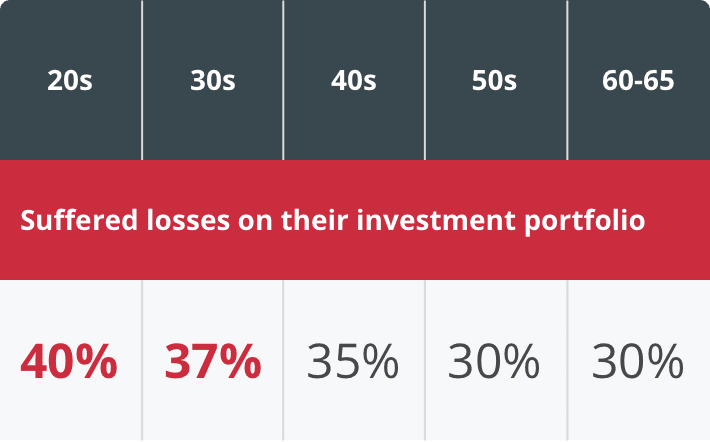

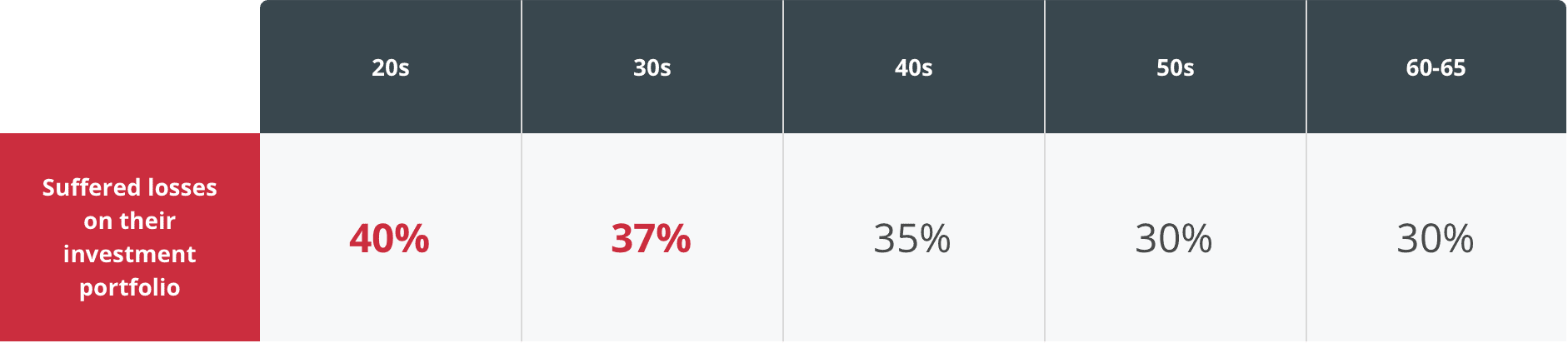

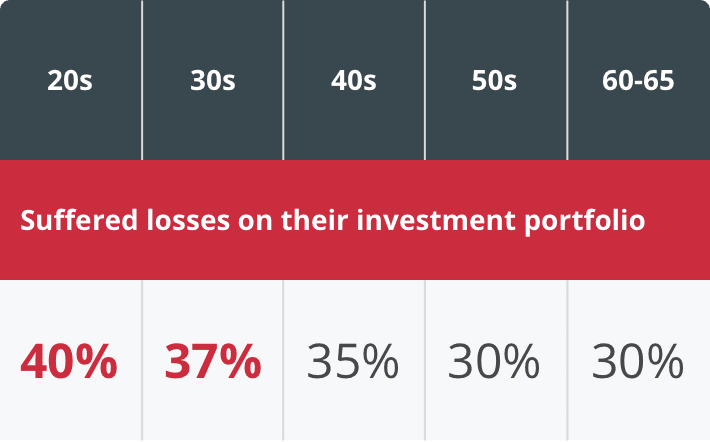

More Gen Z and millennial investors also suffered losses on their investment portfolio compared to other age groups.

Fewer Singaporeans have started making financial plans for retirement

They are also planning for retirement later in life. 1 in 4 Singaporeans (24%) intend to start or only started on retirement planning in their 50s or later.

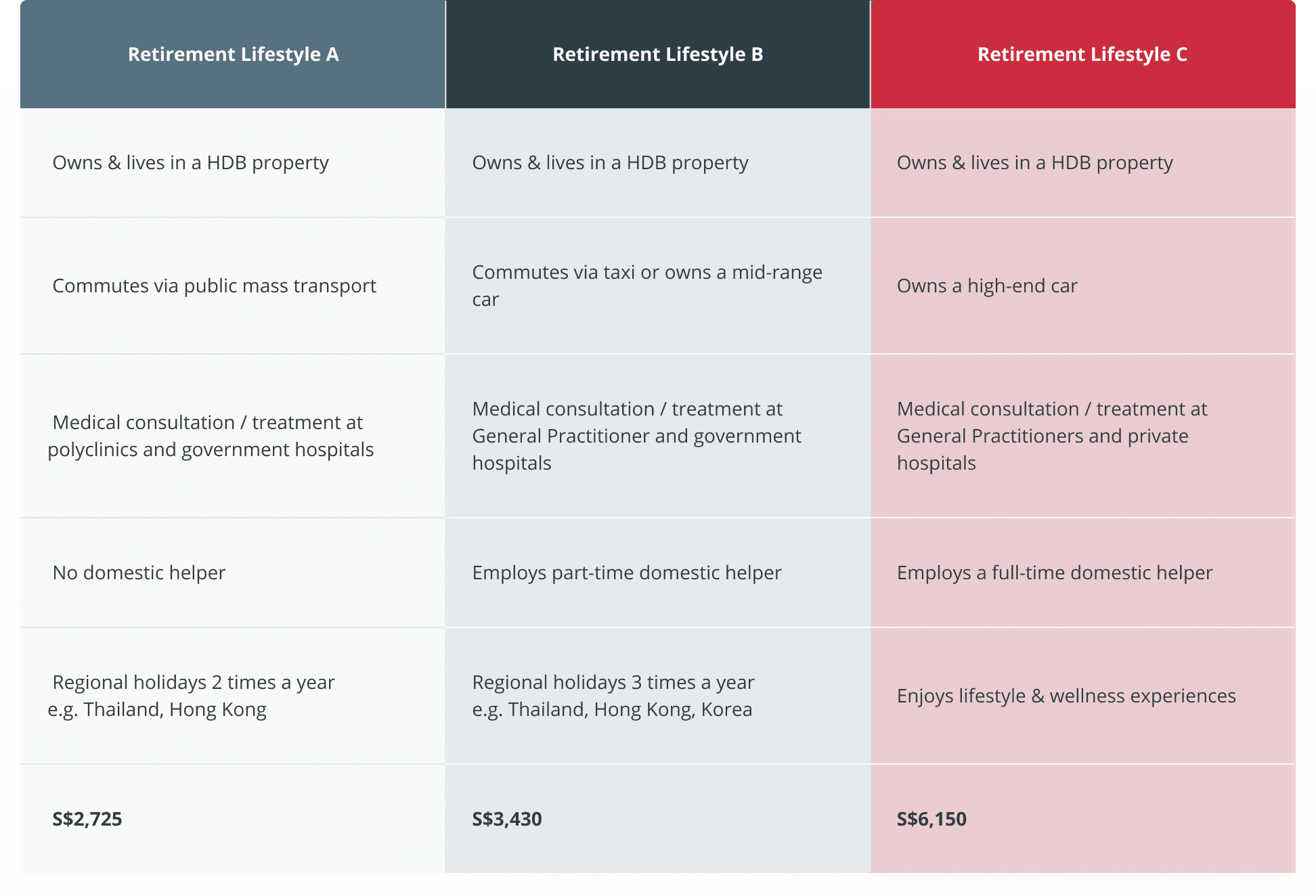

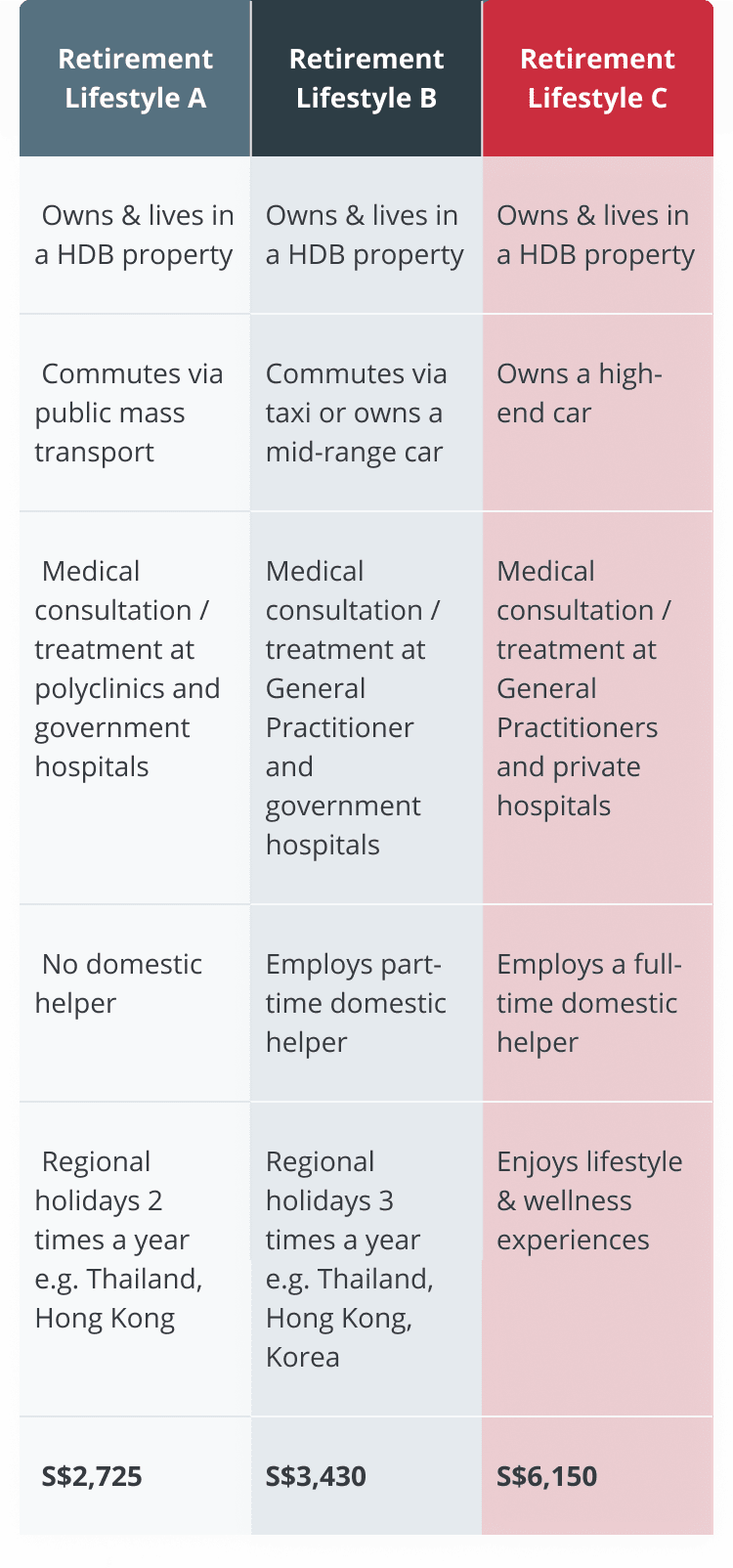

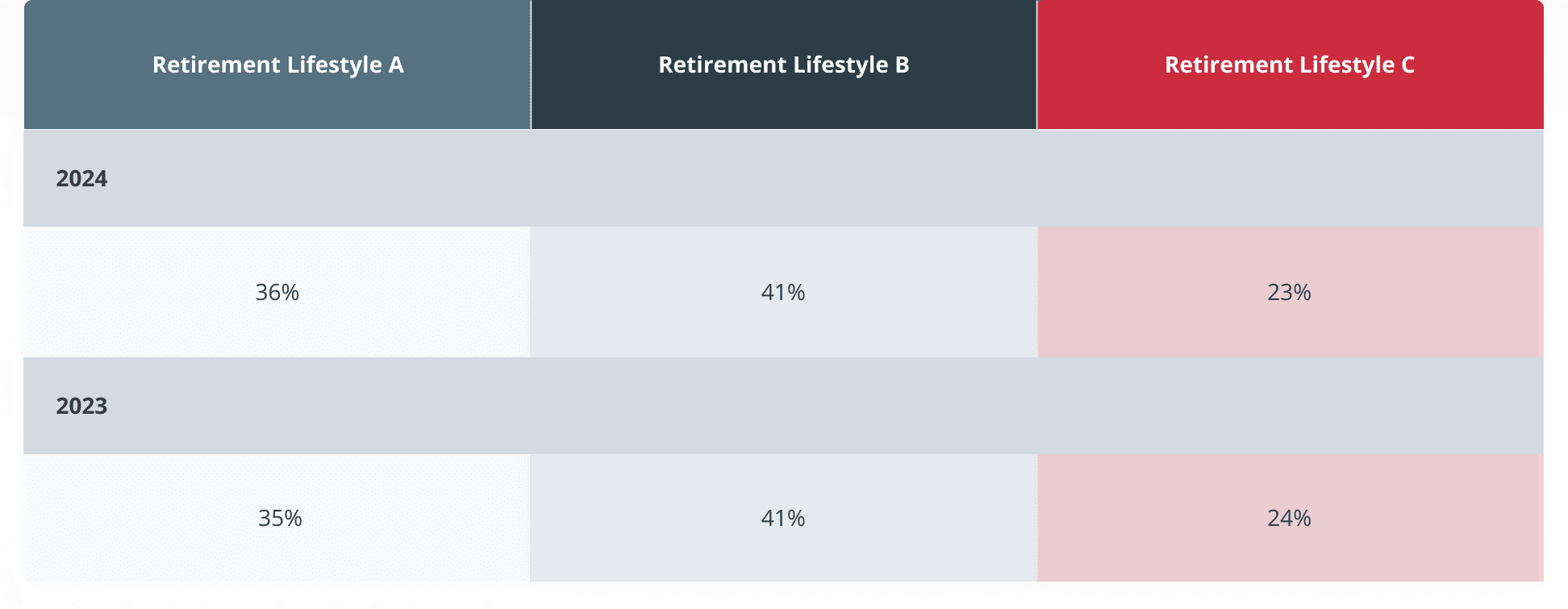

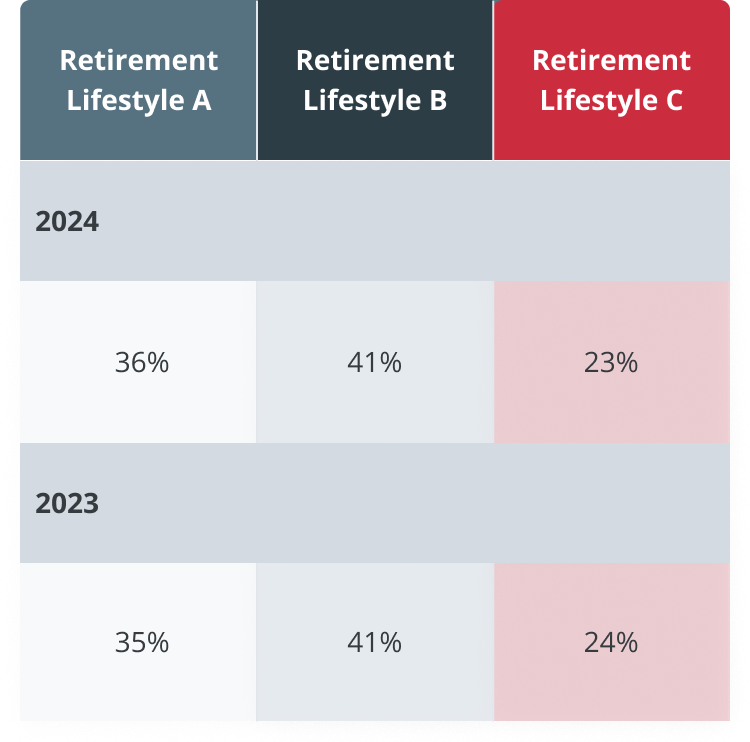

As such, more Singaporeans are choosing the most basic retirement lifestyle A.

This trend is particularly pronounced among seniors in their 60s with 63% of them choosing this lifestyle – a sizeable 21-percentage point increase compared to last year.

This could be because seniors, being closer to retirement, have a better grasp of which lifestyle is actually attainable given their personal circumstances.

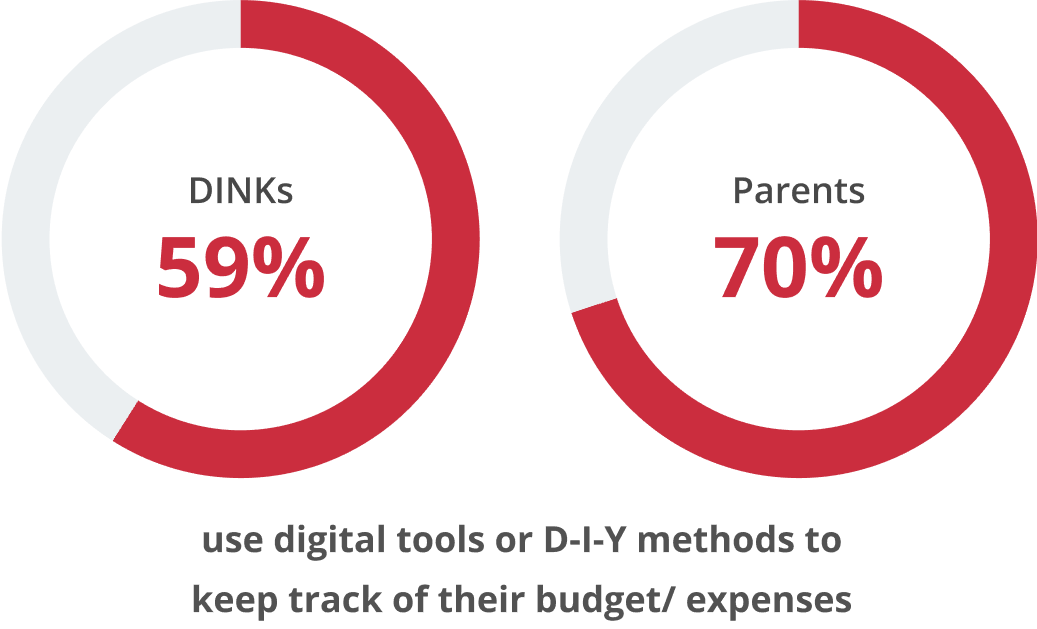

This year, we delved into an emerging segment of couples with dual income, no kids (DINKs).

Fewer DINKs have started retirement planning compared to parents

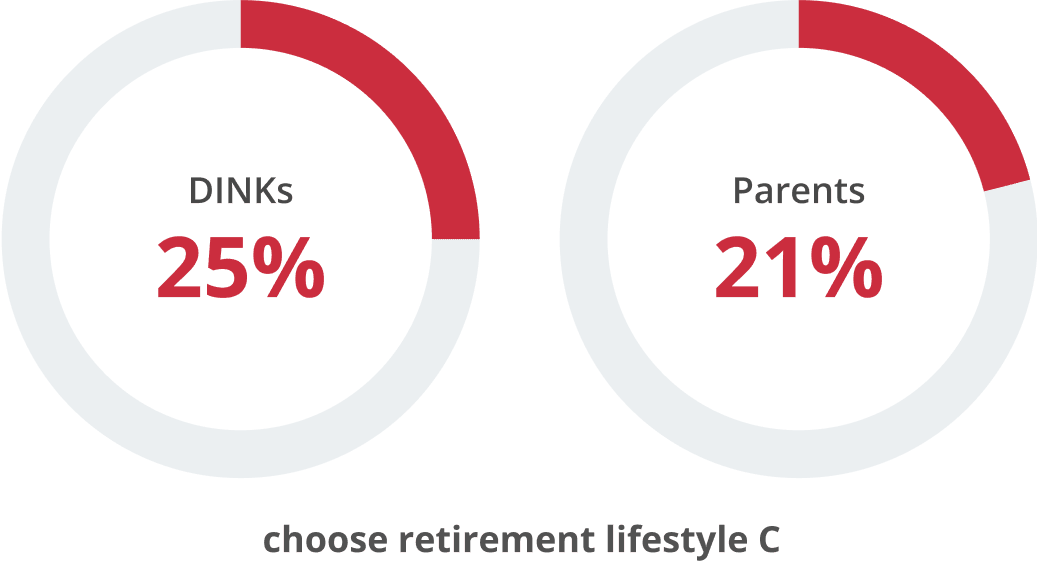

Yet DINKs without a retirement plan, are more likely than parents to choose the most expensive retirement lifestyle C

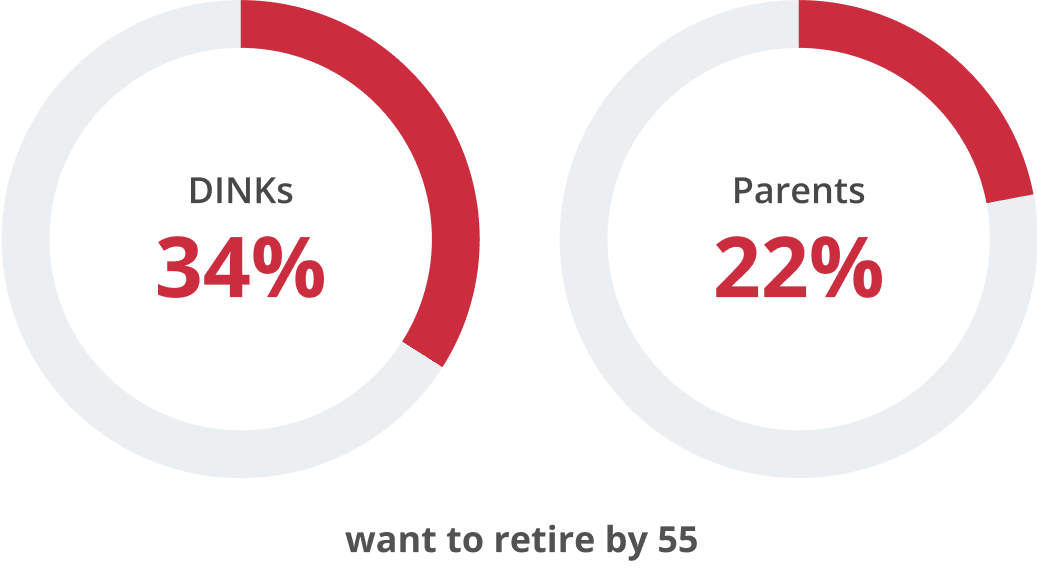

A higher proportion of DINKs without a retirement plan than a parents without a retirement plan want to retire by 55

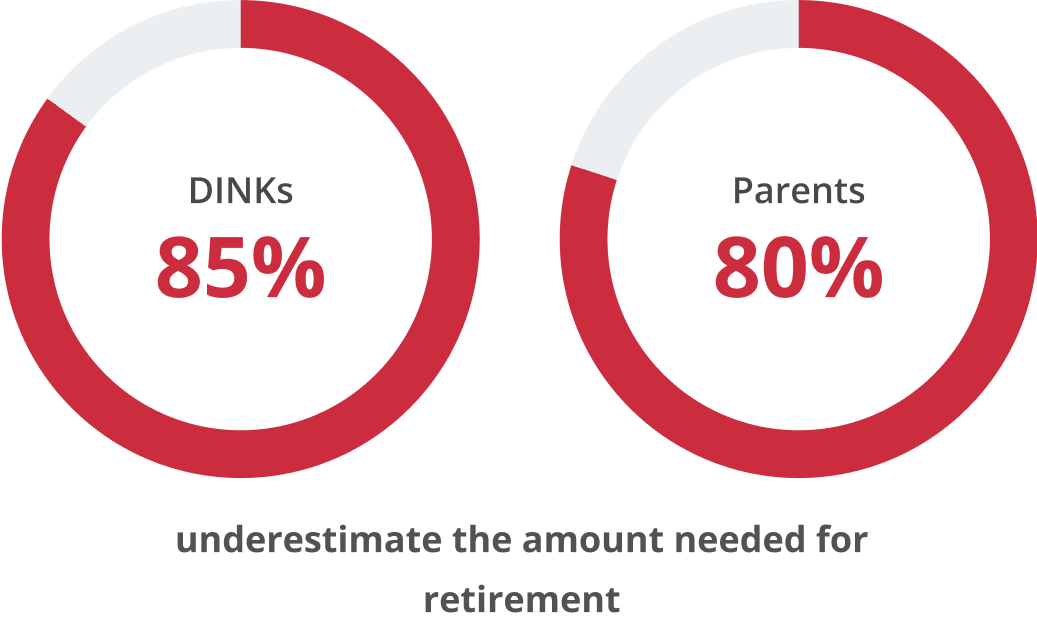

As such a higher proportion of DINKs without a retirement plan tend to underestimate the amount they need for retirement

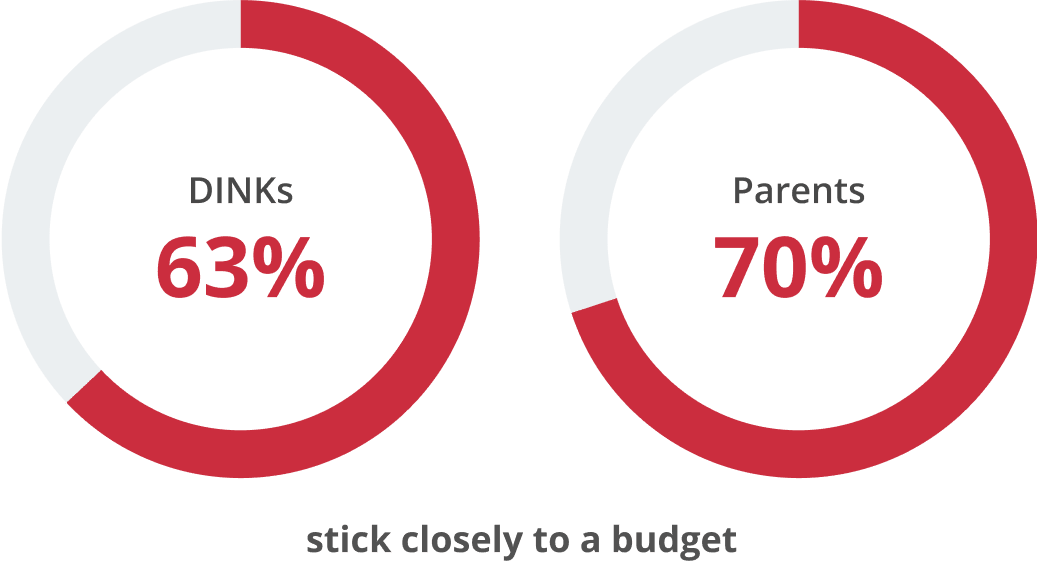

A smaller proportion of DINKs stick closely to a budget or set one

They are also less likely to use digital tools or D-I-Y methods to keep track of their budget or expenses

This year, fewer Singaporeans are on track to reaching their investment goals.

of investors are on track with their goals

Fewer Gen Z and millennial investors are on track to reaching their investment goals compared to other age groups.

More Gen Z and millennial investors also suffered losses on their investment portfolio compared to other age groups.

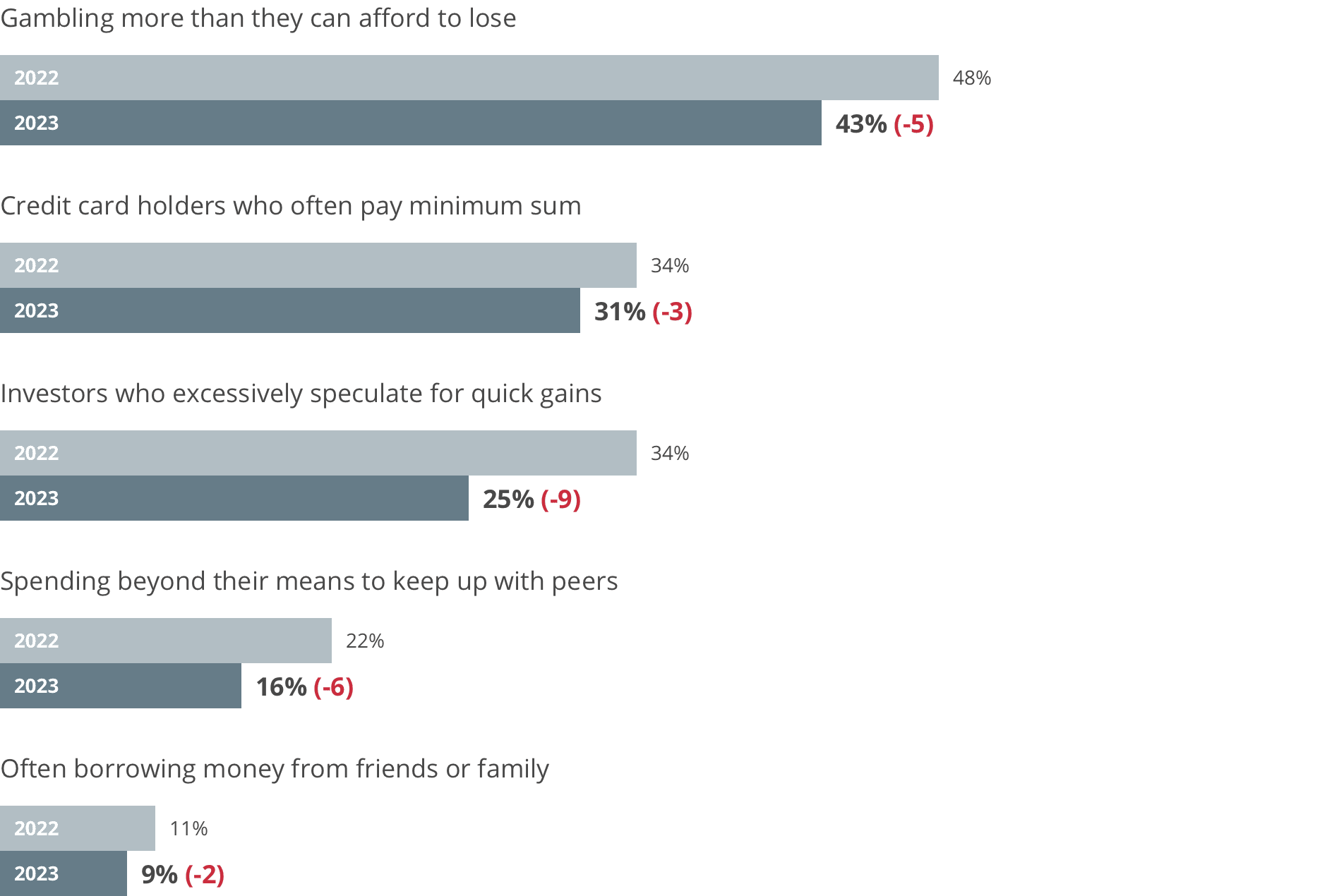

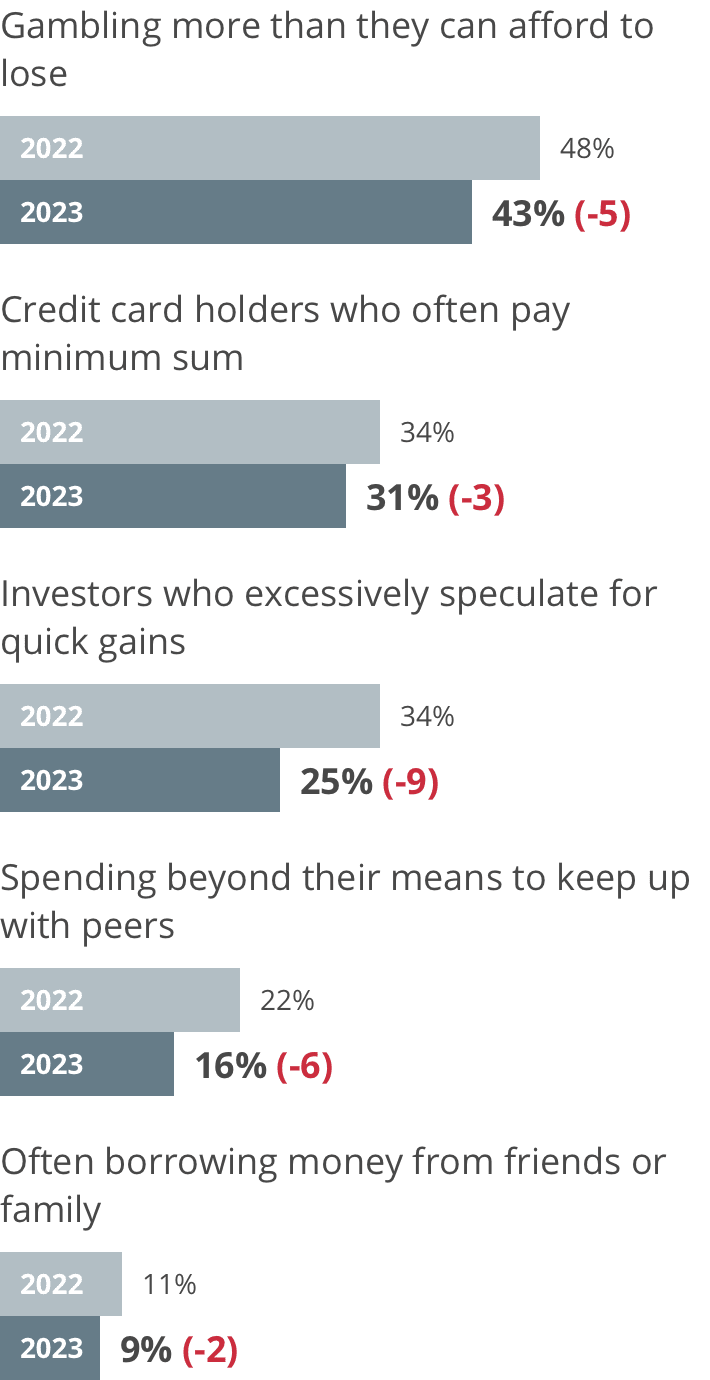

Fewer Singaporeans practised undesirable financial habits.

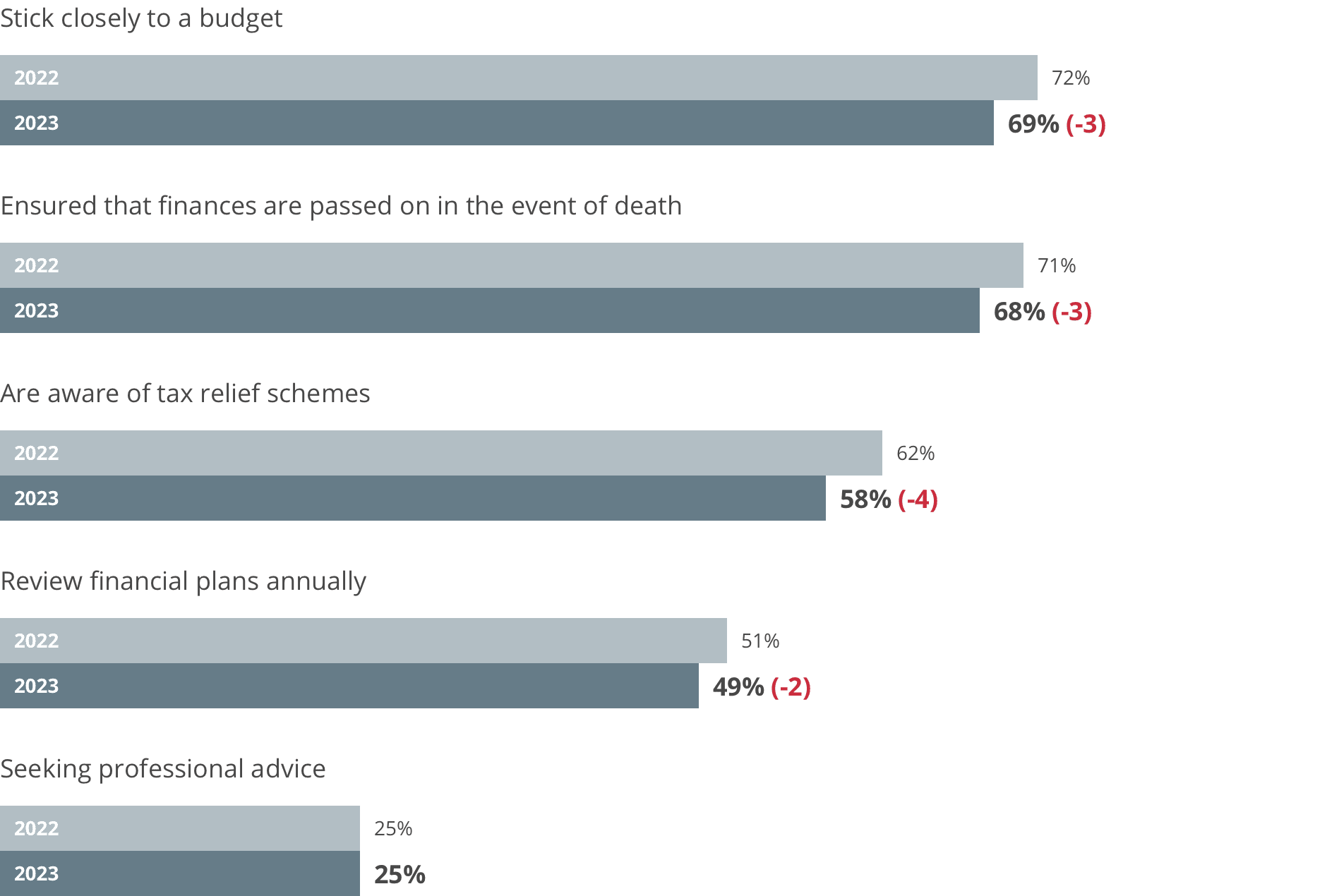

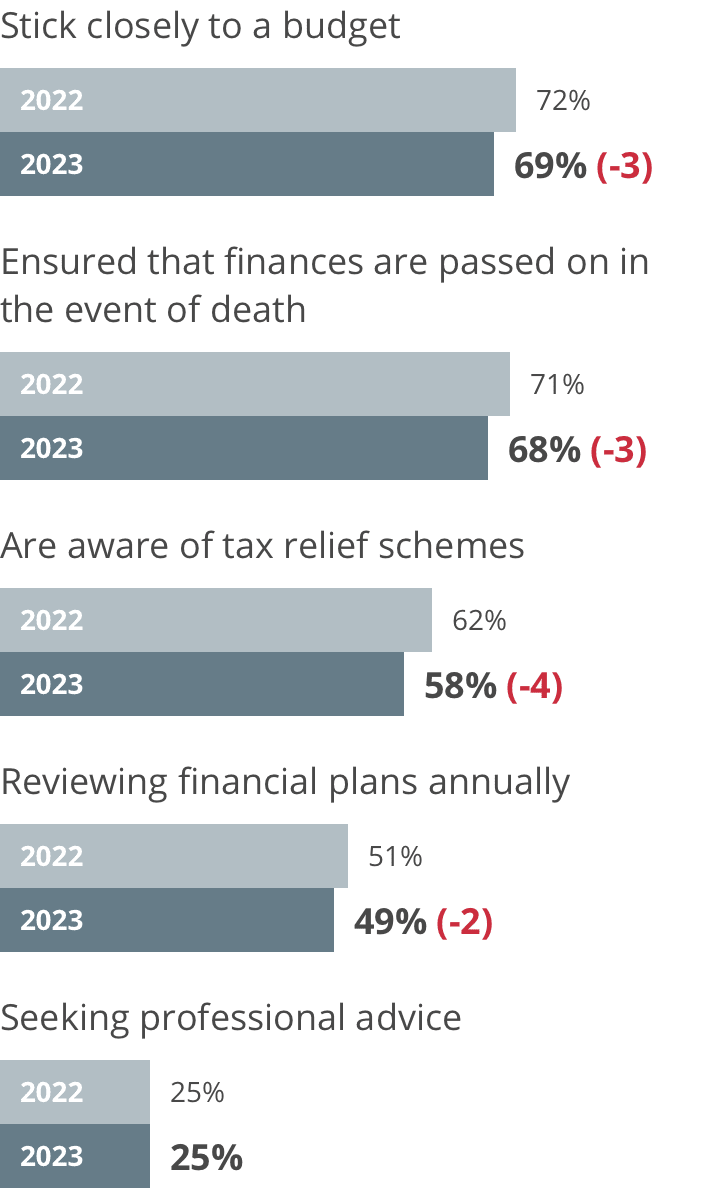

Fewer Singaporeans practised good financial virtues.