Empowering edupreneurs to write your own success stories

An edupreneur is an education entrepreneur who provides a service or creates a product for the enhancement of learning.

As an edupreneur, focus on preparing today's learners for tomorrow's world while we help you start, run and grow your operations.

Education and life-long learning will continue to play a crucial role as Singapore transforms into a knowledge-based digital economy and beyond.

From early childhood, tuition and enrichment centres to skills-based courses, higher education, EdTech and more, OCBC is here no matter which segment of the education industry you are operating in. Whether you are opening your first centre or expanding your chain or franchise, our Education Specialists are here to support you with advice and business solutions at every stage.

Infant and childcare centres

If you are opening a nursery, pre-school, kindergarten, childcare centre, or promoting an integrated approach to learning through pedagogy, you can receive funding even before you start. Learn how to optimise your daily operations by leveraging our payment and collection solutions or tap our expansion loan if you are expanding your franchise or chain.

Tuition and enrichment centres

If you are teaching subjects taught in mainstream schools or conducting courses in music, dance, art, speech, drama, sports and games, score better results by capturing new opportunities with the help of our business solutions. Get insights into your customers’ profiles and data on where to open your next centre.

Commercial schools

Education providers like you are taking the business of learning to the next level. This includes government, independent, specialised and international schools that offer formal education as well as private schools that offer programmes in higher education with diplomas and certificate courses.

EdTech providers

You are transforming the learning landscape by going from classroom learning to virtual learning. Education technology (EdTech) refers to the hardware and software designed to enhance the learning experience for children and adults. As learning moves beyond the classroom and the community embraces lifelong learning, EdTech has grown to include e-learning, hybrid learning, gamification and personalised learning solutions.

Skills training

You are in the business of delivering quality training to develop a highly-skilled workforce. By mastering new knowledge and skills, people have a better chance of career advancement and earning more. This includes training programmes for adult educators, and for SkillsFuture and Workforce Skills Qualifications (WSQ).

Get fast funding and greater cash flow when you open a new education centre or expand your franchise or chain.

Optimise productivity with digital solutions that will help your business automate manual processes and facilitate learning.

Start collecting payments digitally with multiple merchant collection methods and simplify reconciliation processes so you can focus on your business. We’re here to help make it as easy as 123.

Get access to our marketing resources and knowledge bank to grow your education business.

Discover why edupreneurs like you have chosen OCBC to help them start, run and grow their businesses.

MindChamps

MindChamps has made its mark in the education space in Singapore. Now, they are taking their unique model of education to the world.

Whether you are looking to start or expand an early childhood, tuition or enrichment centre, our Education Specialists are ready to help you tackle important topics, like setting up your business, managing day-to-day operations, financing and more.

We also provide customised advisory and solutions to facilitate your centre’s specific growth objectives, minimise its risks, and adopt new EdTech and digital solutions. Let us help you shorten the learning curve so you can quickly reap the rewards from the learning economy.

Get started now >

No matter the size or stage of your business, we can support you every step of the way.

Starting a business?

If you are starting your business for the first time, join us as an OCBC Business Banking customer by opening a business account. Or contact our education specialist to help you get started on the right foot and to digitalise your business.

Open a business account

Growing your business?

Whether you are expanding your range of services or your footprint, we offer industry insights and solutions to help you grow and scale. Contact us and our Relationship Manager will be in touch.

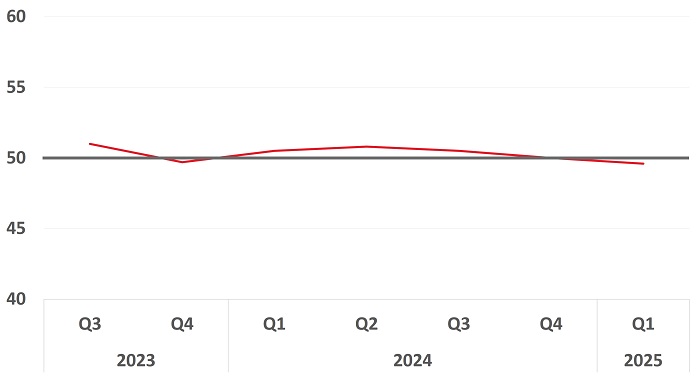

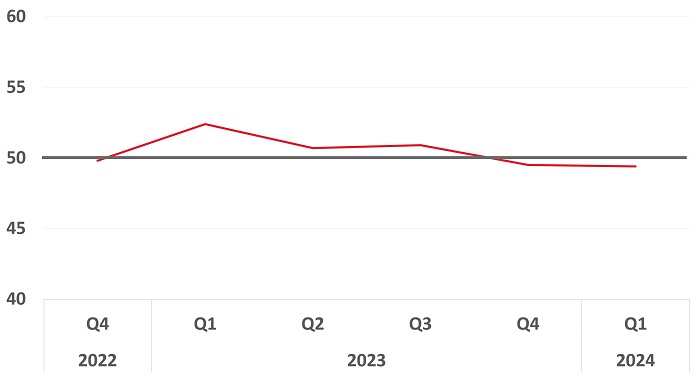

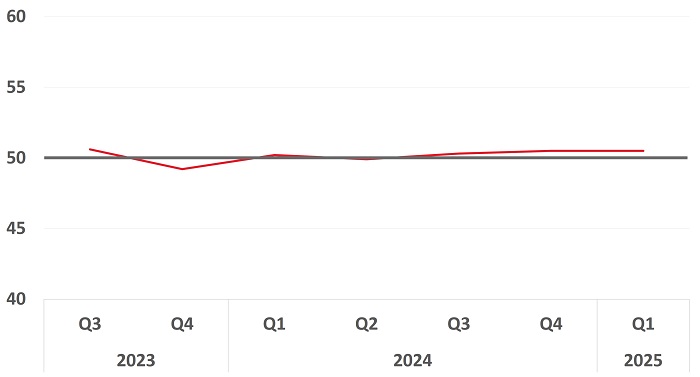

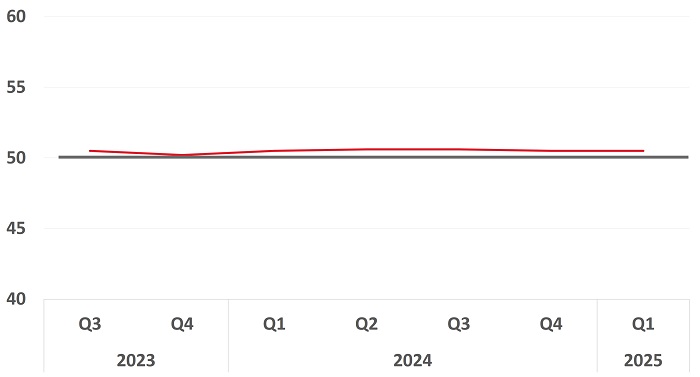

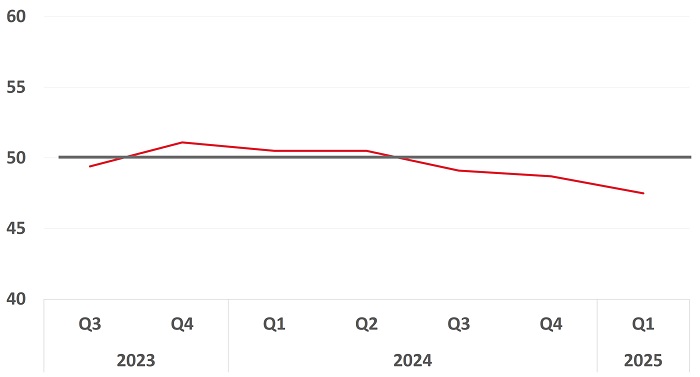

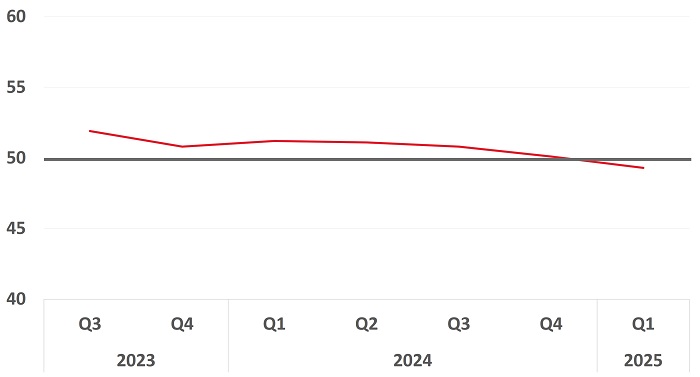

The OCBC SME Index* is a high-frequency index measuring the business health and performance of SMEs. The pick-up in readings in the second quarter of 2022 (2Q 22) for the Education sub-sectors in early childhood education and recreation classes were the result of the lifting of Covid restrictions and a higher proportion of parents returning to work at the office. Collections for recreation classes rebounded strongly with a 25% increase YoY.

Whether you are an educator or education specialist, you can count on our business solutions and Education Specialist team to provide you with a healthy dose of business insights and support.

Education

Education reversed the contraction in 1Q 22, with a reading of 50.1. The improvement in readings could be attributed to growth in both early childhood and recreation classes.

Education reversed the contraction in 1Q 22, with a reading of 50.1. The improvement in readings could be attributed to growth in both early childhood and recreation classes.

Education reversed the contraction in 1Q 22, with a reading of 50.1. The improvement in readings could be attributed to growth in both early childhood and recreation classes.

Education reversed the contraction in 1Q 22, with a reading of 50.1. The improvement in readings could be attributed to growth in both early childhood and recreation classes.

Education reversed the contraction in 1Q 22, with a reading of 50.1. The improvement in readings could be attributed to growth in both early childhood and recreation classes.

Education reversed the contraction in 1Q 22, with a reading of 50.1. The improvement in readings could be attributed to growth in both early childhood and recreation classes.

*OCBC SME Index is centered on a score of 50, which represents zero change in the inputs from a year ago. A reading above 50 indicates improved activity, while a reading below 50 indicates a deterioration relative to the same period a year ago.