“The move away from the multi-year policy of quantitative easing among most global central banks, will take away one of the long-standing pillars underpinning fixed income performance.”

– Vasu Menon, Senior Investment Strategist, Wealth Management Singapore, OCBC Bank

Policy interest rates are slowly heading up and the previously abundant supply of liquidity is starting to taper off. This is likely to be a challenging environment, especially with investment grade bonds. However, a gradual, well-orchestrated and well-telegraphed move upward in rates should not prove too deleterious for fixed income performance. Nevertheless with rich valuations and U.S. Treasury yields poised to move higher, expect modest returns over the next few years.

United States

U.S. 10-year Treasury yields are near the top of the narrow range seen for most of this year, as prospects for continued Fed tightening have forced a reversal from the early September lows. However, even if the Fed gives increasingly clear signals that it will hike rates again in December (as we believe), recent history suggests markets will remain unconvinced about the pace of tightening in 2018 (when we expect three more hikes). As a result, bond yields are likely to grind higher, rather than step up suddenly.

Eurozone

The European Central Bank (ECB) announced plans to reduce its asset purchases in 2018, scaling back from €60bn per month to €30bn until next September, with the possibility of an extension.

The length of the planned purchases is more important than the size, because the ECB has said that it will not raise interest rates until after its quantitative easing (QE) programme is over. Markets were buoyed, the Euro hurt by the implication that the first rate hike will not be until 1H 2019, and perhaps even later.

Unlike the Fed, there is clearly a substantial (German-centred) group inside the ECB that is uncomfortable with current policy settings. The economy is reviving and inflation is starting to rebound and ECB President Draghi will face constant pressure to move more rapidly than markets expect.

Elsewhere

Central banks in other developed markets are starting to join the Fed in raising rates. Canada has already moved twice, with more to come, while the U.K. could follow. Australia and Sweden are perhaps six months away while Japan only tightens at some distant point in the future.

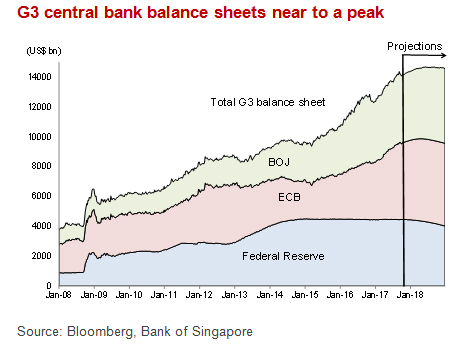

With the Fed and the ECB announcing plans to cut back on asset purchases in 2018, G3 central bank balance sheets are likely to peak by 3Q 2018. The progressive deterioration of the supply-demand balance is another argument for an upwards drift in bond yields. U.S. tax cuts – if they happen – could also contribute to the supply of bonds, as well as pressing the Fed to raise short-term interest rates more quickly.

Important Information

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person.

Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you.

The Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. The Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such.

This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

Any opinions or views of third parties expressed in this material are those of the third parties identified, and not those of OCBC Group.

OCBC Group does not guarantee the accuracy of the information provided herein at any time. All of the information provided herein may change any time without notice. You should not make any decisions without verifying its content. OCBC Group shall not be responsible for any loss or damage whatsoever arising directly or indirectly howsoever as a result of any person acting on any information provided herein.

The information provided herein may contain projections or other forward looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance.

The contents hereof are considered proprietary information and may not be reproduced or disseminated in whole or in part without OCBC Bank’s written consent.

Cross-Border Marketing Disclaimer

1. Hong Kong SAR: Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) is an Authorized Institution as defined in the Banking Ordinance of Hong Kong (Cap 155), regulated by the Hong Kong Monetary Authority in Hong Kong. This document is for information only and is not intended for anyone other than the recipient. It has not been reviewed by any regulatory authority in Hong Kong. It is not an offer or a solicitation to deal in any of the financial products referred to herein or to enter into any legal relations, nor an advice or a recommendation with respect to such financial products. It does not have regard to the specific investment objectives, financial situation and the particular needs of any recipient or Investor. This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates to any registration, licensing or other requirements within such jurisdiction.

2. Indonesia: The offering of the investment product in reliance of this document is not registered under the Indonesian Capital Market Law and its implementing regulations, and is not intended to constitute a public offering of securities under the Indonesian Capital Market Law and its implementing regulations. According, this investment product may not be offered or sold, directly or indirectly, within Indonesia or to citizens (wherever they are domiciled or located), entities or residents, in any manner which constitutes a public offering of securities under the Indonesian Capital Market Law and its implementing regulations.

3. Japan: The information contained in this document is for general reference purposes only. It does not have regard to your specific investment objectives, financial situation, risk tolerance and particular needs. Nothing in this document constitutes an offer to buy or sell or an invitation to offer to buy or sell or a recommendation or a solicitation to buy or sell any securities or investment. We do not have any intention of conducting regulated business in Japan. You acknowledge that nothing in this document constitutes investment or financial advice or any advice of any nature.

4. Malaysia: OCBC Bank does not hold any licence, registration or approval to carry on any regulated business in Malaysia (including but not limited to any businesses regulated under the Capital Markets & Services Act 2007 of Malaysia), nor does it hold itself out as carrying on or purport to carry on any such business in Malaysia. Any services provided by OCBC Bank to residents of Malaysia are provided solely on an offshore basis from outside Malaysia, either as a result of “reverse enquiry” on the part of the Malaysian residents or where OCBC Bank has been retained outside Malaysia to provide such services. As an integral part of the provision of such services from outside Malaysia, OCBC Bank may from time to time make available to such residents documents and information making reference to capital markets products (for example, in connection with the provision of fund management or investment advisory services outside of Malaysia). Nothing in such documents or information is intended to be construed as or constitute the making available of, or an offer or invitation to subscribe for or purchase any such capital markets product.

5. Myanmar: The relevant Bank entities do not hold any licence or registration under the FIML or other Myanmar legislation to carry on, nor do they purport to carry on, any regulated activity in Myanmar. All activities relating to the client are conducted strictly on an offshore basis. The customers shall ensure that it is their responsibility to comply with all applicable local laws before entering into discussion or contracts with the Bank.

6. Oman: This document does not constitute a public offer of investment, securities or financial services in the Sultanate of Oman, as contemplated by the Commercial Companies Law of Oman (Royal Decree No. 4/1974), Banking Law of Oman (Royal Decree No. 114/2000) or the Capital Market Law of Oman (Royal Decree No. 80/1998) and the Executive Regulations of the Capital Market Law (Ministerial Decision No. 1/2009) or an offer to sell or the solicitation of any offer to buy non-Omani investment products, securities or financial services and products in the Sultanate of Oman. This document is strictly private and confidential. It is being provided to a limited number of sophisticated investors solely to enable them to decide whether or not to make an offer to invest in financial products mentioned in this document, outside of the Sultanate of Oman, upon the terms and subject to the restrictions set out herein and may not be reproduced or used for any other purpose or provided to any person other than the original recipient. Additionally, this document is not intended to lead to the making of any contract within the territory or under the laws of the Sultanate of Oman. The Capital Market Authority of Oman and the Central Bank of Oman take no responsibility for the accuracy of the statements and information contained in this document or for the performance of the financial products mentioned in this document nor shall they have any liability to any person for damage or loss resulting from reliance on any statement or information contained herein.

7. South Korea: The document does not constitute an offer, solicitation or investment advertisement to trade in the investment product referred to in the document.

8. Taiwan: The provision of the information and the offer of the service concerned herewith have not been and will not be registered with the Financial Supervisory Commission of Taiwan pursuant to relevant laws and regulations of Taiwan and may not be provided or offered in Taiwan or in circumstances which requires a prior registration or approval of the Financial Supervisory Commission of Taiwan. No person or entity in Taiwan has been authorised to provide the information and to offer the service in Taiwan.

9. Thailand: Please note that neither OCBC Bank nor any other entities in the OCBC Bank’s group maintains any licences, authorisations or registrations in Thailand nor is any of the material and information contained, or the relevant securities or products specified herein approved or registered in Thailand. Interests in the relevant securities or products may not be offered or sold within Thailand. The attached information has been provided at your request for informational purposes only and shall not be copied or redistributed to any other person without the prior consent of OCBC Bank or its relevant entities and in no way constitutes an offer, solicitation, advertisement or advice of, or in relation to, the relevant securities or products by OCBC Bank or any other entities in OCBC Bank’s group in Thailand.

10. The Philippines: The information contained in this document is not intended to constitute a public offering of securities under the Securities Regulation Code of the Philippines.

11. Dubai/U.A.E: This material is communicated by OCBC Bank. OCBC Bank is not a financial institution licensed in the United Arab Emirates and does not undertake banking or financial activities in the United Arab Emirates nor is it licensed to do so. This material is provided for information purposes only and is not financial advice or a financial promotion, nor is it intended to influence an investor's decision to invest. It is not to be construed as an offer to buy or sell or solicitation of an offer to buy or sell any financial instruments or to participate in any particular trading strategy in any jurisdiction. The material is only intended for persons who fulfil the criteria to be classified as "deemed Professional Clients" as defined under the DFSA rules.

12. United Kingdom: The OCBC Bank is authorised and regulated in Singapore by the Monetary Authority of Singapore. The OCBC Bank is not authorised in the United Kingdom by the Financial Conduct Authority for the conduct of investment business. The services provided by the OCBC Bank are not covered by the UK’s Financial Services Compensation Scheme and neither the Prudential Regulation Authority nor the Financial Conduct Authority supervises or regulates the products or services provided by the OCBC Bank to UK residents.

13. United States of America: This product may not be sold or offered within the United States or to U.S. persons.

© Copyright 2017 - OCBC Bank | All Rights Reserved. Co. Reg. No.: 193200032W