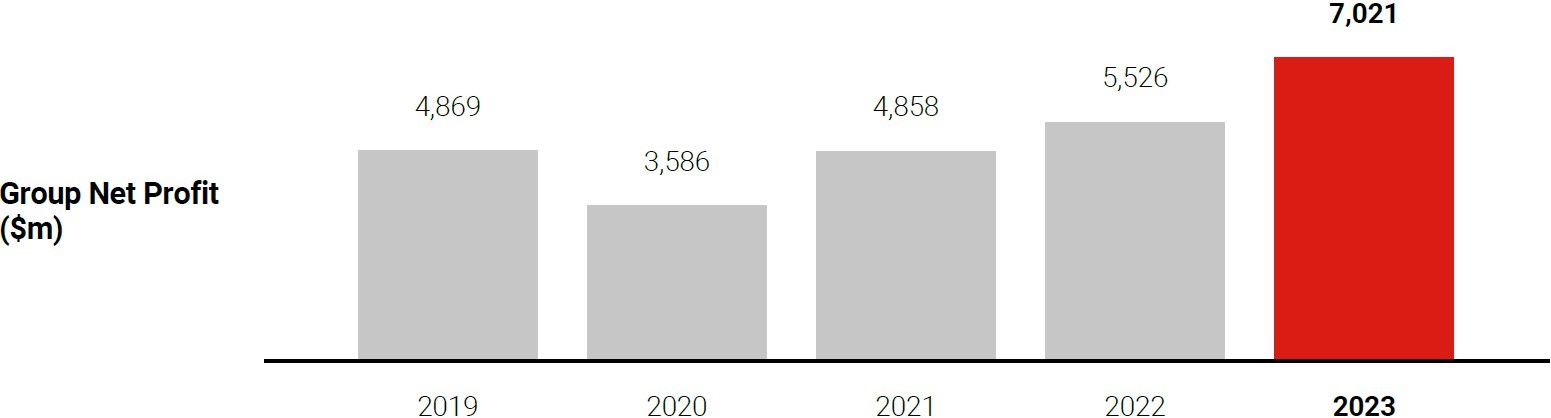

Let me highlight the key drivers of our 2023 earnings. Our total income was $13.5 billion, up 20% on the back of broad-based growth. Net interest income reached a new high, increasing by 25% to $9.65 billion, driven by 5% asset growth and a 37-basis point expansion in net interest margin to 2.28%. We have been proactively managing our balance sheet through selectively growing our loan portfolio and managing our funding base, which has positioned us well through the interest rate environment. Our non-interest income also increased by 7% to $3.86 billion, largely attributed to improved trading income and investment gains. Loan-related and credit card fees rose, but overall fee income was down as subdued investment sentiments among other reasons, continued to weigh on wealth-related fees. Nonetheless, our wealth management franchise was resilient, with our assets under management expanding 2% to $263 billion.

Our income growth far outpaced an 8% increase in expenses, which led to an improvement in cost-to-income ratio to 38.7%. Strict cost discipline will remain a priority for us, even as we continue to invest in our franchise across products, people and technology.

It is important that OCBC remains committed to enabling our customers to succeed while managing our risks prudently. Notwithstanding the challenging business landscape, our overall loans rose 2% in constant currency terms. We sustained non-trade corporate loan growth as we supported customers across our network, such as in the technology, infrastructure, logistics and electric vehicle supply chain sectors, as well as our customers’ green transition efforts. At the same time, we expanded our housing loan portfolio in Singapore. These more than offset a decline in trade loans which reflect the current operating landscape. Our asset quality remained healthy with the non-performing loan ratio dropping to 1.0% from 1.2% a year ago. Total credit costs were at 20 basis points, mainly comprising allowances for non-impaired loans as we continued to pre-emptively set aside allowances.

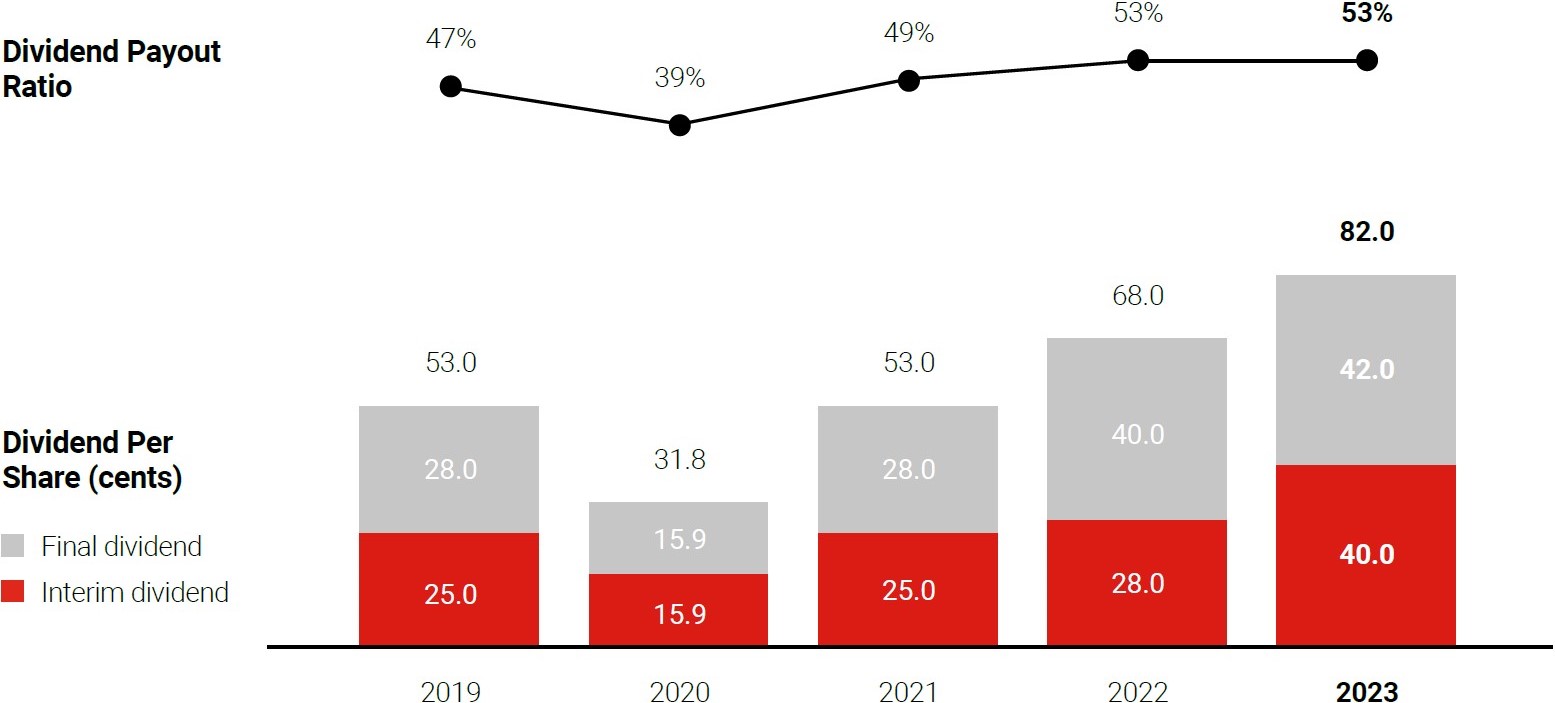

OCBC’s funding, liquidity, and capital ratios remained strong. Our Common Equity Tier 1 Capital Adequacy Ratio increased to 15.9% mainly attributable to profit accretion, RWA optimisation and positive movement in our fair value reserves. The movement in fair value reserves was supported by an $839 million net fair value gain on Fair Value through Other Comprehensive Income financial assets, as compared to $2.42 billion of losses a year ago. This reflected higher unrealised mark-to-market gains and active positioning of our debt securities portfolio against the backdrop of a volatile market environment. The Board has recommended a final dividend of 42 cents, and our total 2023 dividend is 82 cents, 21% above 2022. This is very important to us as the growth in our dividend represents the value we are creating for you, our shareholders.

Note: 2022 was restated with the adoption of SFRS(I)17. Comparatives for 2019 to 2021 were not restated.

Note: In July 2020, the MAS called on locally-incorporated banks headquartered in Singapore to cap total dividends per share for 2020 at 60% of that for 2019. In July 2021, the dividend cap was lifted for the 2021 dividend.

Strong Momentum with Our Corporate Strategy

Our corporate strategy took full flight in 2023, with a strong focus on leveraging OCBC’s strengths to capitalise on the vast opportunities in Asia. The shifting dynamics of trade, investment, and wealth flows have led to a concentration of these activities within Asia. ASEAN-Greater China flows have gained prominence, driven by geopolitical tensions and the emergence of a multipolar world. Since 2019, ASEAN has surpassed the European Union to become China’s largest trading partner, with China-ASEAN bilateral trade accounting for 15% of China’s total goods trade. This is a significant figure considering the size of the Chinese economy.

The rise of Asian wealth is expected to continue. Personal financial assets in Asia-Pacific are predicted to grow by an average of about 8% annually over the next five years, well above the 5% global average. There is also a notable wealth flow within Asia, as an increasing number of high-net-worth individuals seek to diversify their assets beyond their countries of residence. Key financial hubs like Singapore and Hong Kong are best placed to benefit from this trend.

I firmly believe that OCBC is well positioned to seize these opportunities presented by the ASEAN-Greater China region. My conviction in this belief has only grown stronger ever since I rejoined OCBC in 2020.

Inclusive of Bank of Singapore, Great Eastern Holdings and Lion Global Investors, OCBC Group has strong presence and capabilities in the top 7 ASEAN markets. Singapore, Malaysia and Indonesia are our core markets in ASEAN. We have made significant moves to shore up this position in 2023. Pending regulatory approvals, OCBC Indonesia will be acquiring PT Bank Commonwealth, with more than 1 million customers to be added to our franchise as a result. Its capabilities in wealth management and auto joint financing will broaden our product offerings and diversify our customer acquisition channels. Turning to Malaysia, Great Eastern Holdings through its subsidiaries, is set to acquire AmMetLife Insurance Berhad and AmMetLife Takaful Berhad pending regulatory approvals. Again, this will expand the Group’s customer base and breadth of product offerings.

We are strong in Greater China too, with more than 60 offices and branches in Mainland China, Hong Kong SAR and Macau SAR. The newest is our Wuhan branch which was opened in March 2023. Being the capital city of Hubei and one of China’s largest transport, industrial and manufacturing hubs, Wuhan serves as an effective gateway to Hubei province and the Central China region for OCBC.

Complementing this strong OCBC network is our associate company Bank of Ningbo, in which we have a 20% stake. Bank of Ningbo is one of the fastest growing commercial banks in China and is one of its domestic systemically important banks. This collaboration strengthens our capabilities in China and extends our reach, allowing us to support their business customers that wish to expand into ASEAN and vice versa.

Our presence in other global financial centres is also vital to what we do. OCBC has offices in London, New York, and Sydney, to support our network corporate customers in expanding and investing beyond Asia. Bank of Singapore has a presence in Dubai, London and Luxembourg as well, enabling us to serve the Middle East and Europe regions, which have the third and fourth most ultra-high-net-worth individuals respectively.

The Power of One OCBC Brand

With our extensive coverage, it is vital that we optimise our linkages to boost our network capabilities. This entails strengthening our collaboration across markets and entities. We must demonstrate our commitment to supporting our customers across all markets as one OCBC Group. It is also imperative that our colleagues feel a true sense of unity as one team. The result is a better pooling of our resources, enabling us to serve each and every customer across multiple countries, with more products, and in a concerted manner.

In line with this objective, one strategic move made in 2023 was the launch of one OCBC brand with a refreshed logo and a new tagline – For Now, and Beyond – to unify all OCBC-branded entities. The new tagline demonstrates what OCBC has always been about – enabling people and communities to realise their aspirations today, and beyond that.

I would like to thank the many colleagues across all subsidiaries, branches and offices who came together to successfully launch the refreshed logo in Singapore, Malaysia, Indonesia, Mainland China, Hong Kong SAR, Macau SAR, and overseas branches including London, Sydney, New York. The legal names in Mainland China, Hong Kong SAR and Macau SAR were also changed. In Malaysia where we have an Islamic Banking Licence, we operate with two brands – OCBC and OCBC Al Amin.

The One Group, One Brand approach we have created is powerful. Consider a Chinese company that is venturing into Indonesia to tap on its large young population and abundance of natural resources. OCBC is present in both Mainland China and Indonesia to provide seamless support. When Chinese companies go to Malaysia, for example Penang with its established ecosystem for higher-end manufacturing, OCBC is there as well. When companies set up bases in Singapore and Hong Kong SAR from which they expand, again OCBC is present in both locations. The owners of these businesses can be referred to OCBC Premier Banking or Premier Private Client or our private banking arm, Bank of Singapore. Everywhere these customers go, they can bank with OCBC. This exciting potential showcases the benefits of working as One Group. By leveraging our collective strengths, we can harness the synergies and deliver results beyond our individual capabilities.

It is with this belief that we made a big announcement in July 2023: we said that we would aim to deliver $3 billion in incremental revenue by 2025 on top of our current growth trajectory. We are firmly on track to deliver on our goal and will intensify our efforts in 2024 and 2025.

Positioning for a Sustainable Future

Our Chairman has talked about structural shifts to the operating landscape. It is therefore imperative that we position ourselves for the future. I have spoken at length about how OCBC is strategically positioned today to capture the flows between ASEAN and Greater China. This trend will last way into the future. We have also been positioning OCBC in the past several years to support efforts in dealing with climate change, and to seize the opportunities that come out of it.

One of the first things I did in OCBC was to set up a Sustainability Taskforce to drive the agenda in a more deliberate and structured manner. Naturally, one of our priorities was to look at our financed emissions. We have come a long way. In September 2023, we exceeded $50 billion in sustainable financing commitments well ahead of our 2025 target.

The first time we publicly announced our target was in 2019 – $10 billion by 2022. This came just a few months after we made a market-leading decision to stop financing new coal-fired power plants. The sustainability movement was still nascent then, so we set ourselves a target to keep the momentum going following our coal announcement. Since then, we made two more upward revisions to our target and have met them. Today, sustainability has become embedded in all that we do, as we support our customers’ green efforts via innovative products and services.

Our Group Chief Sustainability Officer was appointed to the role in 2023 and will lead the charge. A priority for him and his team will be to fulfil our commitments as a signatory of the Net-Zero Banking Alliance (NZBA). We became a signatory in 2022, and less than a year later, we announced ambitious, quantitative and science-based decarbonisation targets for six sectors – Power, Oil and Gas, Real Estate, Steel, Aviation and Shipping. These represent the most greenhouse gas emission intensive sectors that we finance. We have mapped out the key actions that we will take to meet these targets and will disclose our progress as we go along.

Building OCBC into a leading financial services partner for a sustainable future requires investments in our people and technology. While we watch our expenses closely, we do not shy away from making strategic investments. We will build up our talent pool of bankers and relationship managers in Greater China and ASEAN, and invest $30 million through 2025 to help employees progress in their careers and make them more resilient. Part of this has gone into building an artificial intelligence (AI)- enabled career marketplace which allows employees to find opportunities within the Group and recommends relevant training courses to equip them for the new role.

In 2022, we announced that we had completed Phase One of a seven-year digital core roadmap. That included a $250 million investment to accelerate digital transformation. Phase 2 is well under way, with another investment of $300 million over the period of 2023 to 2025. We are strengthening our AI architecture too, which is important given our ambitions in this space. More than 4 million decisions are made by AI daily and I expect these volumes to more than double in the next 12 to 24 months. Our experience with AI models has enabled us to move quickly in the area of generative AI. When Chat GPT took the world by storm in 2023, we became the first bank in Singapore to deploy a generative AI chatbot – OCBC GPT – to 30,000 employees globally by end 2023. Since then, I have heard so much good feedback from colleagues on productivity increases. OCBC GPT has assisted them with research, summarising of information and translation, just to name a few.

We will maintain our focus on executing our corporate strategy well. Our Ambition to be Asia’s leading financial services partner for a sustainable future is a bold one. It demonstrates our determination to surpass industry standards and establish ourselves as the benchmark in our field. While doing so, we will always be anchored on reasons for OCBC’s existence. Our Purpose, which was refined in 2023, is to enable people and communities to realise their aspirations. It means that we cannot and will not just gun for profit. Our LIFRR Values – Lasting Value, Integrity, Forward-looking, Respect and Responsibility – must always guide us. Are we advising our customers out of a sense of fair dealing? Or are we hawking an unsuitable investment product for self-serving reasons?

Are we providing the local knowledge and connections to help businesses expand into other markets? Or are we just looking to book that big loan? Our Purpose, Values and Ambition are intricately linked and are collectively referred to as our PVA. It forms the foundation of our business.

Appreciation

What we have done in 2023 would not have been possible without our people. I would like to extend my sincere appreciation to our supportive Board, my capable and committed management team, and to all colleagues across the Group for their drive, dedication and teamwork. We should take pride in the collective accomplishments we have achieved thus far.

We would not have been able to build a 91-year history without the support of customers and communities. On behalf of all of us at OCBC, I would therefore like to extend our deep appreciation to them.

And to you, our shareholders, I hope that you are as excited as we are about what lies ahead. Thank you for putting your confidence and trust in OCBC.

Helen Wong

Group CEO

February 2024