For many of us, our first taste to disciplined saving came from licking stamps onto stiff cardboards in primary school, which were then sent to the bank on our behalf.

It has instilled a good habit in us, as empirical evidence go.

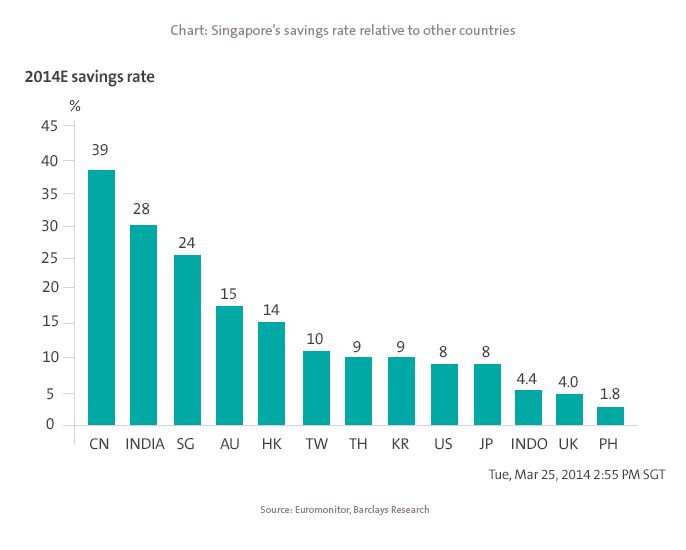

According to a report by Barclays Research (released March 2014), Singapore has one of the highest savings rates in the world at 24 per cent. In comparison, Hong Kong's savings rate is only 14 per cent.

No wonder then, the belief that Singaporeans are comfortably well-off and need only tap on their accumulated savings as a source of income in their retirement.

Those of us who have started our retirement planning know that the reverse is true. A survey done by Manulife in 2014 revealed that just 21 percent of respondents expressed confidence in the sufficiency of their Central Provident Fund (CPF) savings.

Cost of living has risen tremendously over the years. Another 2013 survey cited in the press (The Business Times, 15 December 2014) indicated that household expenditure has grown in line with lifestyle choices. Singaporeans are spending more on their hair, eating out, travel and tuition fees, compared to five years ago.

Some Singaporeans may even be spending beyond their means, as many in their 30s and 40s owe more money on their credit cards than they have in emergency savings. This is according to data from the Credit Bureau of Singapore, released in 2014.

As a result, many of us may have failed to ensure that our retirement plans remain on track.

In an era where easy credit is an everyday expression, has cash lost its royal position as a form of investment?

Low interest rates, high inflation

Household expenditure and spending habits aside, our savings could have eroded due to the low interest rate environment over the past few years. Savings placed in deposit accounts have not kept up with rising inflation. Between 1962 and 2014, the inflation rate in Singapore had risen to as high as 34 per cent. With the recovery in the U.S. economy and other developed economies, inflation rates could rise in the medium to long term, and likewise here as well.

This has implications for any retirement nest-egg, because unless investments are able to keep pace with inflation, we will experience a decline in purchasing power which could set us back in our retirement years.

Faced with such a scenario, would it ever be possible to have enough funds set aside for retirement?

Stretching the dollar

While the CPF retirement account is an important element of our retirement plan, we should consider developing a diversified portfolio that includes other financial solutions to meet our retirement needs.

There are different ways to save ‐ compulsory salary deduction scheme, annual bonuses, cash windfalls, etc ‐ but the best way is to just do it. Start small, start young. So long as you maintain the habit, and it is painless (for example, direct deposit into a savings account), you are on the right track.

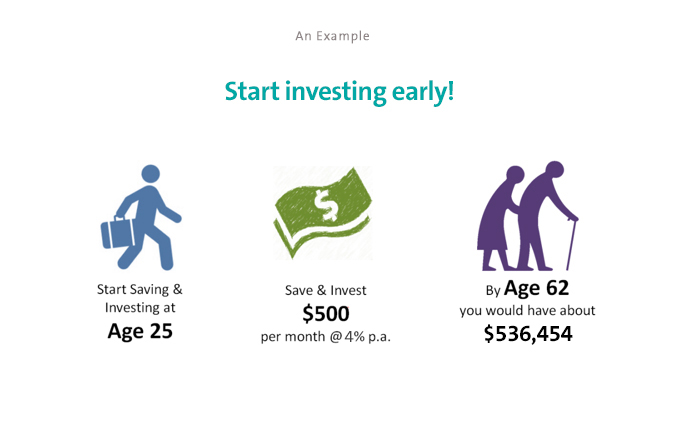

Saving now, even if it's a small amount, can reap significant rewards many years down the road. For example a person aged 25, who starts saving and investing $500 per month at 4 per cent per annum will have built up slightly more than half a million when he retires at age 62.

Once a sufficient amount of cash has been pooled, we can then turn to other options to make our money work harder for us. Based on an estimation of our retirement needs down the road, we can then gradually put in place investment and protection plans to narrow the gap and safeguard against unforeseen eventualities in our golden years.

Different approaches, one goal

Depending on the financial resources you have, there are different ways to plan your retirement nest egg.

As shown in the earlier example, dollar cost averaging through a regular investment plan is a good strategy especially for those with limited financial resources and in the earlier years. Instead of investing assets in a lump sum, you build your investment by buying a small amount over a longer period of time. This smoothens the cost out over several years, and mitigates your investment entries against markets volatility that affect asset prices.

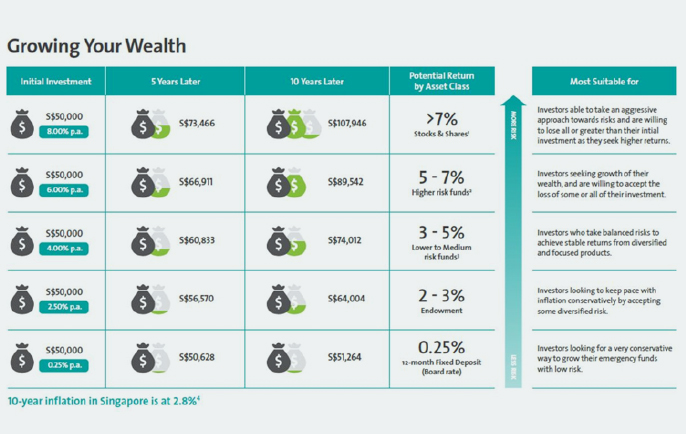

Should you prefer to do your investments by the lump sum, the below illustrative table shows how placing your funds in various instruments of varying risks and potential returns could reap you over time. Compare this to the paltry returns the deposit account gives you and the inflation hurdle you need to beat.

Cash is still king, but make it work for you

Growing life expectancy and rising cost of living means that it is even more important now to ensure that our retirement plans are not derailed due to day-to-day events.

To ensure you reach your desired financial goal, you have to do more than just save. Fortunately, it doesn't take a heroic effort to make a meaningful boost to your nest egg and enhance your retirement prospects.

If you are unsure about how much to set aside for your retirement, use our retirement calculator to find out. You can then follow up with a visit to our friendly financial planners at any conveniently located branch.

Disclaimers