OCBC Financial Wellness Index dips 2 points amidst Covid-19 pandemic; better savings habits buoy Index from a harder fall

OCBC Financial Wellness Index dips 2 points amidst Covid-19 pandemic; better savings habits buoy Index from a harder fall

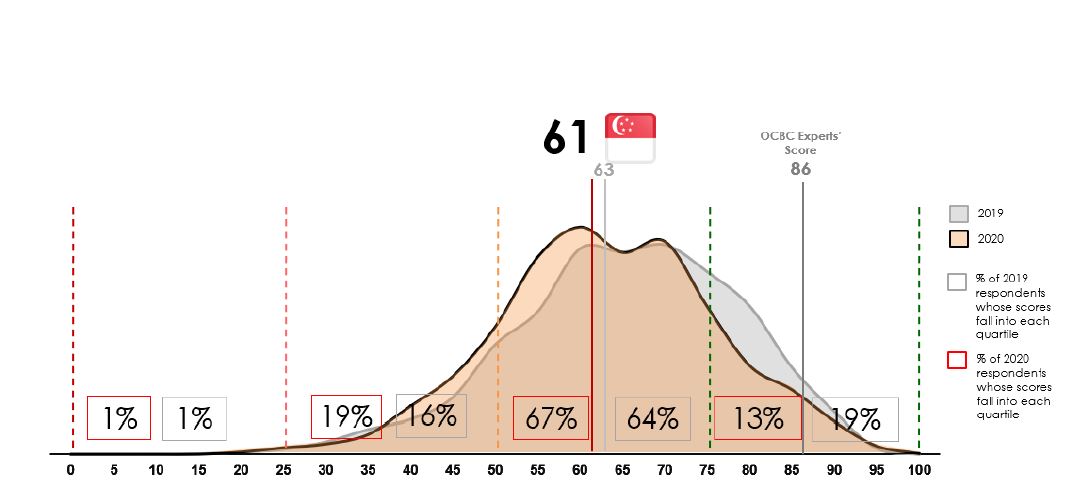

The OCBC Financial Wellness Index (“the Index”), which launched in 2019, has dipped to 61 this year, down from 63, with the unprecedented Covid-19 pandemic and resulting global economic slump causing a drag on Singaporeans’ financial wellness.

Designed and formulated by OCBC Bank, the Index is based on 10 pillars of financial wellness[1] as defined by the Bank’s wealth management experts. A total of 2,000 working adults in Singapore between the ages of 21 and 65 were surveyed online between 2 September and 3 October this year. To assess how each respondent fares on these 10 pillars, 24 indicators – standards and guidelines that are widely-accepted best practices in financial planning – are used to derive an individual score of a maximum of 100.

The resulting scores from all 2,000 respondents are then averaged out to derive the Index.

Covid-19 dragged down financial wellness, but also emphasised the importance of savings and medical coverage

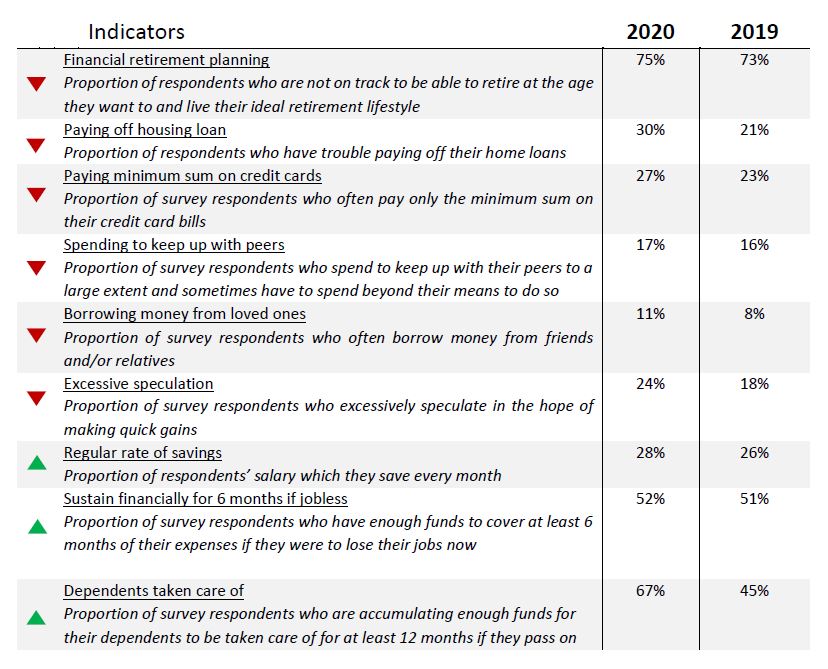

The financial strains caused by the pandemic were reflected in several of the Index’s indicators. The loss of jobs and cut in salaries have hit Singaporeans hard, hampering their ability to pay off housing loans and monthly credit card bills. Regular passive income was adversely affected too with the weakening economy putting stress on Singaporeans’ top sources of passive income – share dividends, interest income and rental income. Unsurprisingly, fewer Singaporeans said that they can spend comfortably.

With more pressing immediate financial worries at hand, Singaporeans had to put the longer-term financial goal of retirement on the backburner.

It is against this backdrop that a larger proportion of respondents admitted to often borrowing money from friends and family to get by. And with the volatile stock market this year, more people entered the market and have been excessively speculating for quick gains.

Yet, the tough economic conditions did little to deter Singaporeans from trying to keep up with the Joneses. More admitted to spending beyond their means to keep up with their peers when the pandemic has widened the gap between those who can and those who cannot.

With the fear of further strain on personal finances and the uncertain future from the effects of Covid-19, Singaporeans are saving more; ensuring that they have enough emergency funds to weather any job loss; strengthening their ability to defray medical expenses; and ensuring that loved ones are well taken care of should they pass on. Improvements on these indicators buoyed the Index from slipping further.

Click here for more findings on the OCBC Financial Wellness Index 2020.

OCBC Bank’s Head of Group Brand and Communications, Ms Koh Ching Ching, said: “Increasing affluence and the availability of more financial planning tools and products to investors do not necessarily translate to financial wellness. As a financial institution with a strong wealth management franchise, we hope that by creating a comprehensive Index, we can better understand where Singaporeans stand.

“We had hoped that the Index would improve from 2019 or remain the same, but the financial impact of Covid-19 on Singaporeans was undoubtedly reflected in the drop in the Index. In the face of the pandemic, Singaporeans are however also being prudent and saving regularly, while also putting aside adequate emergency funds that they can fall back on should they lose their jobs. If these habits stick and lessons are learned from the crisis, as Singapore and the region recovers from the pandemic, we expect to see a rise in the Index next year – perhaps even surpassing 2019’s result.”

Millennials are driven to start investing earlier because of their desire to achieve more faster

The younger generation of Singaporeans are the most worried about their finances. Compared to generations before them, Millennials have already started investing because of their strong desire to grow their wealth fast, even though many may not have proper expert knowledge on investing.

Millennials’ top priority is to grow their wealth, yet 42% of them don’t know the best way to do so. Instead, many turn to online sources to research about investments and also rely on friends and relatives for information. About 4 in 10 Millennials who invest admitted that they speculated excessively in the hope of making a quick buck. Interestingly, Millennials were also the group which were most reluctant to seek professional advice on investments – only 26% of them do so compared to 33% of Gen X and 37% of Baby Boomers.

With their current situation still not stable, many Millennials are also not able to plan for their financial future. Only 57% of them have retirement plans compared to the national average of 63% and only 55% of them have planned for their loved ones’ finances to be taken care of after their death, compared to 67% of Singaporeans.

Click here for more details on Millennials.

Women see investing as gambling but those with confidence and knowledge invest better than men

Women are less likely than men to invest – 40% of women do not have any investments, compared to only 25% of men.

This could be down to the fact that 38% of women think that investing is gambling, compared to 30% of men. Women also lack confidence in their financial knowledge and investing. But when women have the confidence, do proper research and seek advice from experts, their investments actually earn a slightly higher rate of return than men (4.5% a year compared to 4.3% for men).

With more women entering the workforce and still continuing to shoulder the bulk of household and caregiving responsibilities, it is not surprising to find more husbands (52% of married couples with investments) taking the sole active role in investments versus wives (31% of married couples with investments). Only 17% of couples have both parties making investment decisions together. When this happens though, the investment returns were almost double that of couples with a single decision maker.

Click here for more details on Women's financial habits.

Singaporeans underestimate the real amount needed for retirement by at least 30%

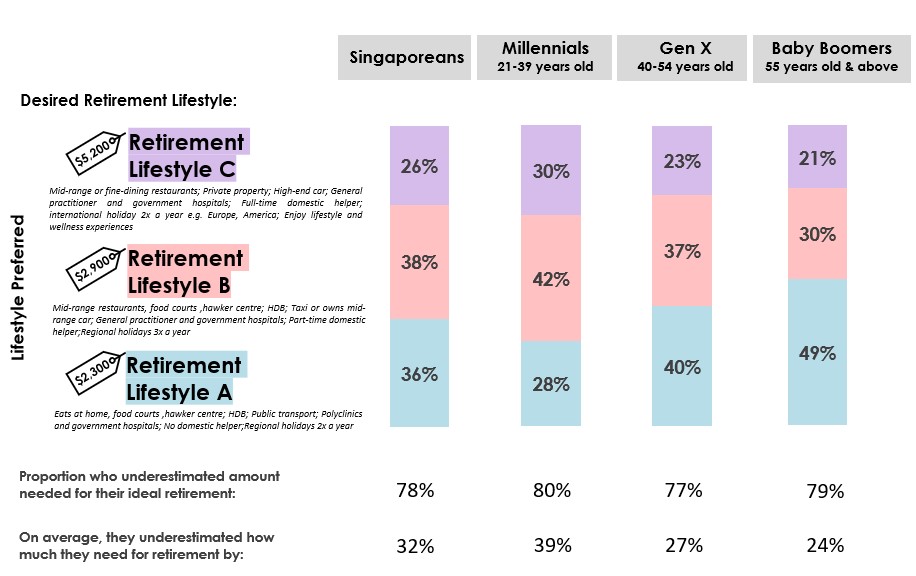

When asked how much they would need for retirement, based on their desired retirement age and lifestyle, the amount Singaporeans had in mind was insufficient – 4 in 5 underestimated how much they need by an average of 32% of the actual amount they needed.

They did not know that a more basic retirement lifestyle would still require about $2,300 a month for an individual while the higher-end of lifestyle choices requires $5,200 a month in today’s value.

That is why, as many as 3 in 4 Singaporeans are falling behind in their retirement plans.

Knowing how much is needed is crucial for retirement planning. Of those who underestimated this amount, 78% are falling behind in their retirement plans.

Click here for more details on retirement planning.

Helping Singaporeans plan better

Recognising that many Singaporeans lack clarity and knowledge in how to plan for the future, OCBC Bank enhanced OCBC Life Goals . The portal is a step-by-step guide which helps Singaporeans project what they will need for longer-terms goals like retirement and sending their children to university by factoring in their current income and expenses.

OCBC Bank’s Head of Wealth Management Singapore, Ms Tan Siew Lee, said: “From the OCBC Financial Wellness Index 2019 and 2020, the message was clear – Singaporeans don’t have a good understanding of their overall financial situation and of their projected financial needs when they retire. This is especially difficult when there are multiple goals in life, competing for one’s financial attention. We thus decided to enhance OCBC Life goals to provide a more comprehensive and holistic take on financial planning. This resulted in a five-step process to plan for their long-term financial goals. We hope customers gain from the simple tips and short take-aways we provide in each of these steps.

“Another key insight of this year’s Index is that women are not confident about investing because they think investing is gambling. One’s first investment experience is typically the most important. A good experience is a form of validation and encouragement to do more. I hope that through the OCBC MasterClass for women conducted by me, Singapore women can learn important yet simple tips to get started. This is an important first step towards building women’s confidence in investing.”

[1] These 10 pillars are – Saving Habits, Protection from Financial Emergencies, Regular Investing, Retirement Planning, Regular Reviews, Gambling Habits, Excessive Speculation, Borrowing Money, Spending Beyond Means and Manageable Debt.