Established in Singapore in 1932, OCBC is the country’s longest-standing bank and the second largest financial services group in Southeast Asia by assets. We have a strong presence across key markets like Singapore, Malaysia, Indonesia and China.

INTERNATIONAL BANKING SOLUTIONS

Expand your wealth and explore opportunities, wherever you are

Be rewarded when you start a Premier Banking relationship with us

Learn more

We provide seamless and trusted solutions for your banking needs in Singapore.

Comprehensive wealth management solutions

We offer a comprehensive suite of wealth management services – including banking, insurance and asset management – as One Group (comprising OCBC, OCBC Securities, Great Eastern and Lion Global Investors).

We offer a comprehensive suite of wealth management services – including banking, insurance and asset management – as One Group (comprising OCBC, OCBC Securities, Great Eastern and Lion Global Investors).

A brand built on innovation, care and a long-term vision

We are among the world’s most highly-rated banks, with an Aa1 by Moody’s and an AA- by both Fitch and S&P.

We are among the world’s most highly-rated banks, with an Aa1 by Moody’s and an AA- by both Fitch and S&P.

- Political and economic stability: With its flexible risk control measures and stable leadership, Singapore is an ideal hub for investment, growth and networking.

- Well-regulated market: Singapore adheres to international standards in banking, insurance, securities, and financial market infrastructures.

- Strategic location: Its UTC+8 time zone bridges London and New York trading hours.

- Taxation framework: Low progressive income tax rates, plus no capital gains and inheritance tax, are among features of the tax system that appeal to expatriates and investors. Additionally, investors do not pay stamp duties on electronic share transfers on the Singapore Stock Exchange.

Extensive wealth services to support your financial goals

Explore a range of financial services designed to help you grow, protect and manage your wealth, including:

Access exclusive features with OCBC Premier Banking

Monitor your portfolio(s) easily with real-time alerts on market movements. Gain access to an expanded suite of wealth products through the account.

Save and transact in 10 major currencies with preferential interest rates for four selected currencies.

Save, spend and keep track of transactions with monthly statements.

Enjoy an unlimited 1% rebate when you make transactions in selected spending categories.

Access exclusive features with OCBC Premier Banking

Get expert wealth advice in the comfort of welcoming, relaxing spaces catered to you – our Premier Banking Centres in Singapore.

Get personalised wellness, education and relocation support through our Regional Premier Concierge.

Seamless digital solutions to help you manage your wealth

From making investments to overseas payments, managing your finances with confidence is easier with our digital tools.

Stay on top of your investments

Manage your portfolio(s) through a single account. Plus, expand your investment opportunities with our suite of wealth products.

Manage your portfolio(s) through a single account. Plus, expand your investment opportunities with our suite of wealth products.

Transact and save in 10 major currencies

Access up to 10 major currencies and enjoy preferential rates on selected currencies with the Premier Global Savings Account.

Access up to 10 major currencies and enjoy preferential rates on selected currencies with the Premier Global Savings Account.

Send money overseas with zero fees

Make transfers in 19 currencies – no cable or commission fees needed.

Make transfers in 19 currencies – no cable or commission fees needed.

Send money to Weixin Pay and Alipay wallets

Enjoy instant peer-to-peer transfers at zero transfer fees via the OCBC app.

Enjoy instant peer-to-peer transfers at zero transfer fees via the OCBC app.

Make seamless cross-border payments

Scan and pay with the OCBC app at over 40 destinations worldwide through our cross-border payment partners - Alipay+ QR, UnionPay QR, DuitNow QR, PromptPay QR and QRIS.

Scan and pay with the OCBC app at over 40 destinations worldwide through our cross-border payment partners - Alipay+ QR, UnionPay QR, DuitNow QR, PromptPay QR and QRIS.

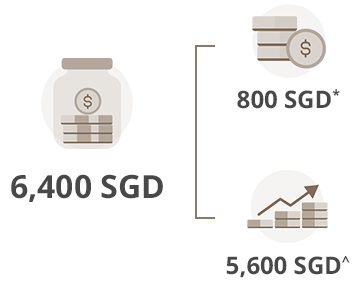

Be rewarded when you start a Premier Banking relationship with us

Earn up to 6,400 SGD* when you deposit 350,000 SGD in fresh funds. *T&Cs apply.

SGD deposits are insured up to S$100k by SDIC.

Eligibility requirements

Minimum age

21 years old

Deposit requirements

Minimum deposit or investment required to start and maintain a Premier Banking relationship with us

S$350,000

Supporting documents required*

Passport

If your passport contains a microchip, we will be able to retrieve your details once you scan it using the OCBC app. If not, you will be asked to enter the details in the app.

ID Card

You will be asked to scan both the front and back of your ID card using the OCBC app.

Proof of address

In the final stages of application, we will ask for proof of residential address.

* Additional documents or information may be required depending on the situation to complete the application process.

Banking made easy – no matter where you are

-

Terms and Conditions

Policy Owners’ Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).Terms and Conditions of OCBC Premier Banking Asia Client Referral Programme

Terms and Conditions Governing OCBC Premier Banking Asia Welcome Reward Programme

Cross-Border Marketing Disclaimers relevant for your country of residence

Welcome rewards

Welcome rewards

*Cash reward

Earn a cash reward of 800 SGD when you deposit 350,000 SGD in your Premier Dividend+ Savings Account.

^Interest earnings

Earn 1.60% interest a year when you deposit 3,000 SGD in your account a month – for 12 months – and make no withdrawals at all.

* Credited into OCBC Premier VOYAGE Card or OCBC Premier Visa Infinite Card.

^ Based on existing prevailing Premier Dividend+ Savings Account interest rate and account mechanism, which may be subject to change.

Terms and conditions apply

Tailored concierge services

Our Regional Premier Concierge1 is available 24/7 to assist you with a variety of matters – from finding suitable health and wellbeing programmes to providing guidance for your children’s education overseas and relocation logistics.

Wellness

Tap into an extensive network of healthcare practitioners and hospital facilities.

Seamless access to specialist care

Easily connect with suitable medical specialists through our trusted network of regional healthcare partners.

Comprehensive wellness solutions

Access a broad range of healthcare services in the region, including dental care, Traditional Chinese Medicine (TCM) and health screenings.

Support for international patients

Get peace of mind when you travel for medical appointments (at selected hospitals) with services like medical escort arrangements, interpreters and visa application.

Additionally, get exclusive benefits across the region – including preferential rates for specialist consultations and wards2.

Education for your children

Receive tailored support from a distinguished education consultant, who can share more about your children's overseas education options in popular study destinations.

Complimentary consultation with an education specialist3

Enjoy a complimentary one-hour consultation session that covers study destinations, school selection and admission requirements. Settling-in arrangements can also be made at an additional cost.

Preferential rates for global youth programmes

Access preferential rates on premium study tours and holiday programmes offered by selected top-tier universities around the world.

Relocation matters

Make moving to a new country easier with relocation support for you and your family.

Complimentary consultation with an immigration specialist4

Get guidance on the necessary steps for relocation and ensure a smooth relocation process.

Relocation assistance

Gain access to a relocation partner that provides tailored services like shipping and accommodation.

1 The Regional Premier Concierge services are provided by a third-party service provider (Aspire Lifestyles Singapore and China) as the Bank may designate from time to time, on an "as is", "as available" basis. The Bank shall have no liability whatsoever in connection with the Regional Premier Concierge services. The Regional Premier Concierge services are available in English, Malay and Mandarin.

For verification purposes, you may be asked to provide the first 6 digits of your OCBC Singapore or OCBC Hong Kong Premier ATM/credit/debit card number.

2 The exclusive benefits may vary depending on the healthcare providers in participating countries. Contact the Regional Premier Concierge to learn more about the participating healthcare providers.

3 Education consultancy services are provided by AUG Singapore or Crimson Education Singapore.

4 Relocation consultancy services are provided by OCSC Global Singapore or AIMS Singapore.

*The qualifying assets under management refer to deposits in the current or savings account(s) and time deposits, investments and insurance (with surrender value) products obtained through the bank.

Start your journey with us

Deposit or invest at least S$350,000 in fresh funds to enjoy Premier Banking privileges.

Begin your application via the OCBC app (for a smoother process, have your passport and ID card on hand). This will take about 20 minutes.

A Relationship Manager will be in touch to take you through the final steps of the application.

Begin your application via the OCBC app (for a smoother process, have your passport and ID card on hand). This will take about 20 minutes.

A Relationship Manager will be in touch to take you through the final steps of the application.

Apply nowGet in touch

Indicate your interest in starting an OCBC Premier Banking relationship. A Relationship Manager will be in touch to assist you.

Please apply via OCBC Internet Banking (Login > Open an account > Savings) or visit any OCBC Bank branches.

Download the appIndicate your interest in starting an OCBC Premier Banking relationship. A Relationship Manager will be in touch to assist you.

Apply now via the OCBC app

Appy for an OCBC 360 Account