Gazing into the political crystal ball

The rising Democratic tide

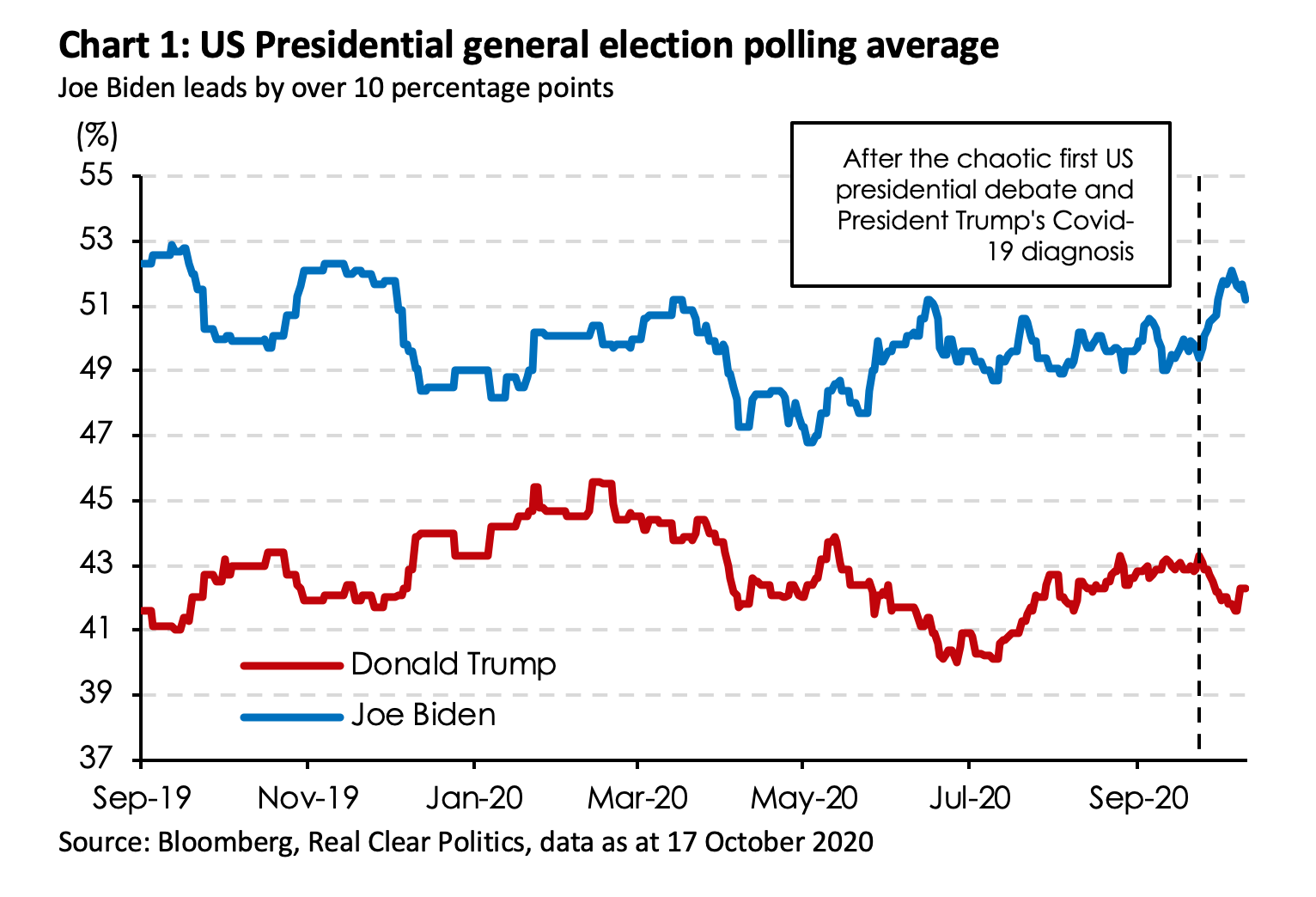

Joe Biden continues to enjoy a widening lead in the polls and prediction markets in the race for the White House against President Donald Trump. Of course, as with many things this year, we should not take this for granted, as polls may well flip and political fortunes can change just weeks before an election. After all, in 2016, James Comey’s letter informing Congress that he was reopening investigations into Democratic hopeful Hillary Clinton’s emails surfaced just a week before the fateful election. That might not be the principal reason behind her loss, but it certainly did not help.

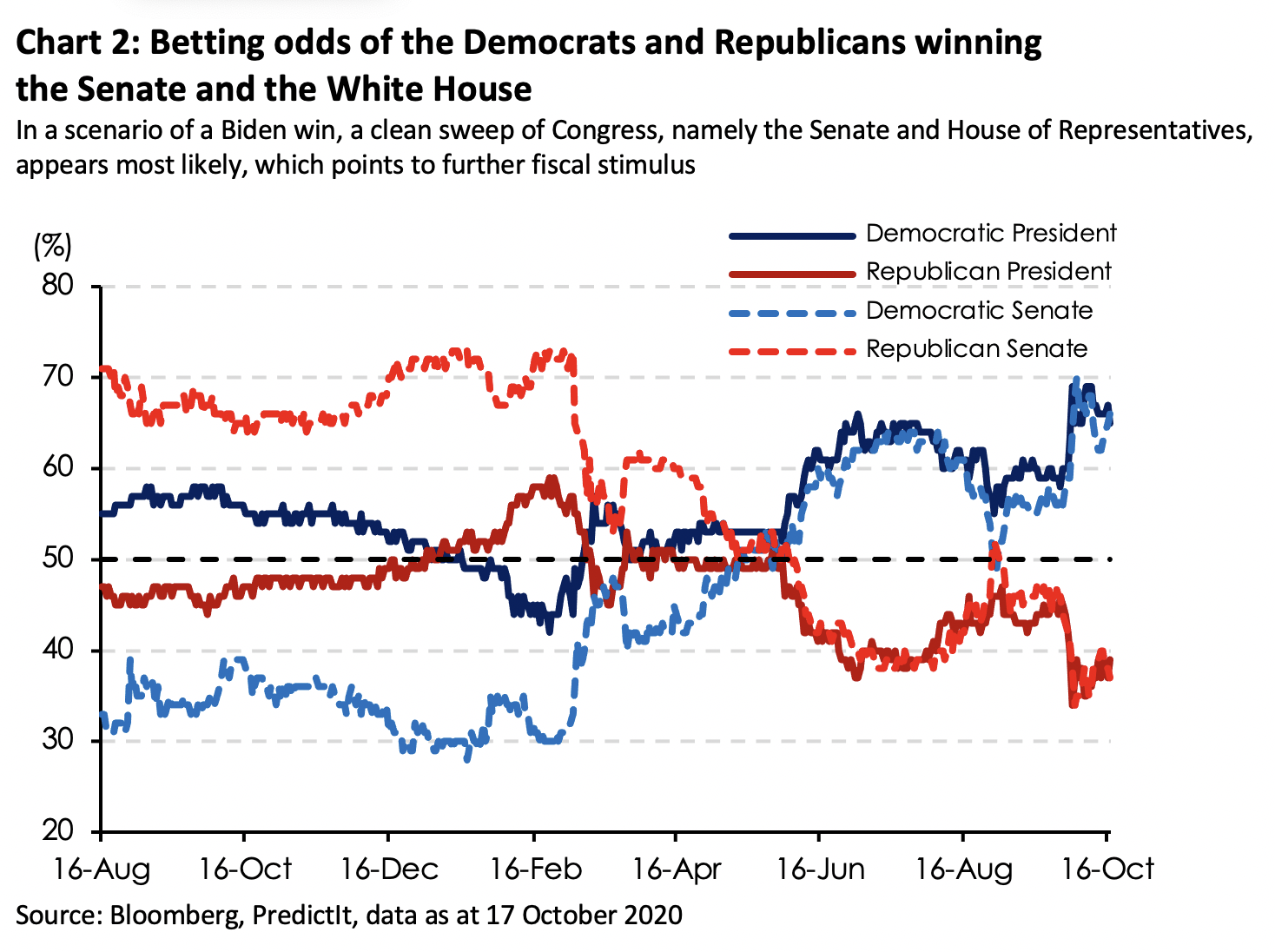

Meanwhile, betting odds predicting Democratic control of the senate have tracked the presidential race quite closely. Hence, it is quite likely that if Joe Biden wins, the Senate could flip from red to blue, red being the colour associated with the Republicans and blue being the colour associated with the Democrats. The House of Representatives is largely expected to remain firmly within Democratic control.

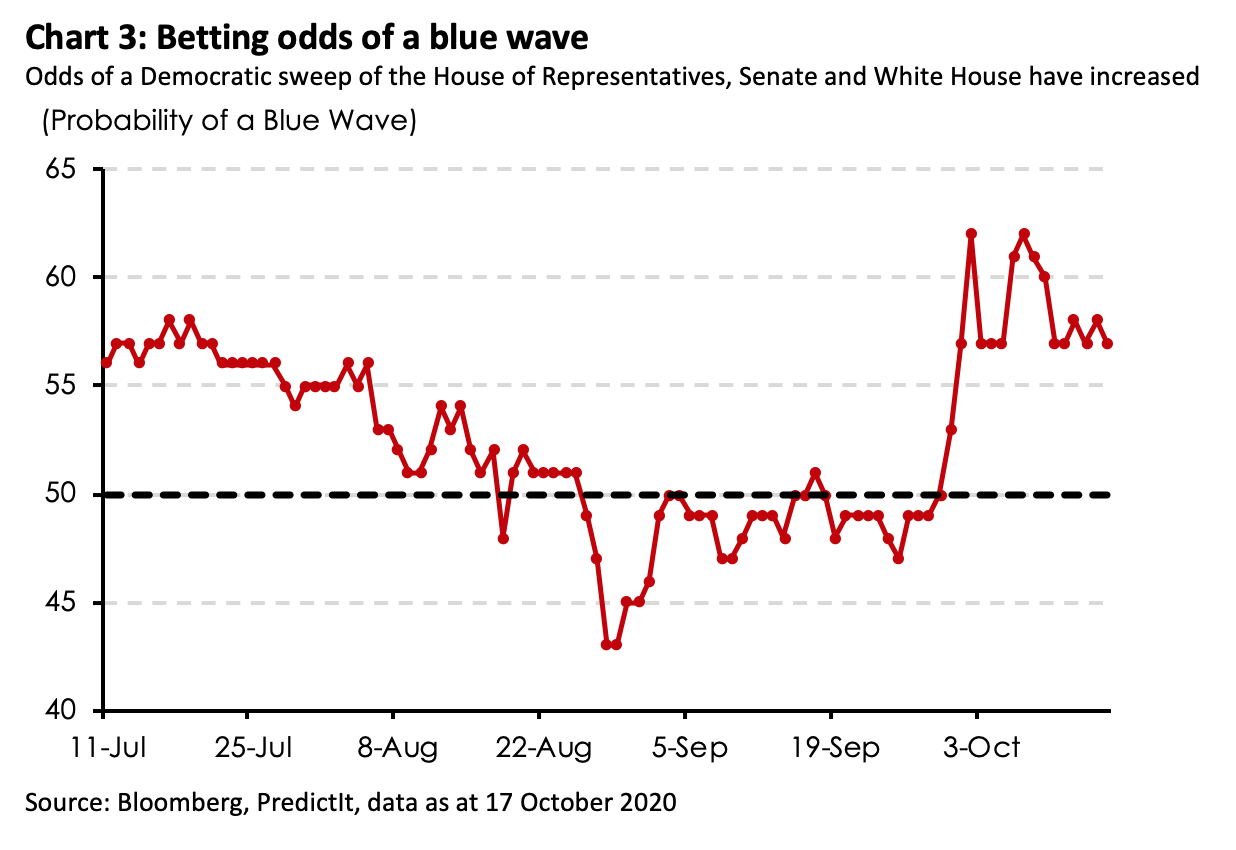

Indeed, in the event of a landslide victory for Joe Biden, we could see a wave of Democratic victories down the ballot, which would result in a clean sweep of all three levers of power: the White House, the Senate and the House of Representatives. The last time a blue wave engulfed Washington was in 2008, when a little-known senator – Barack Obama – captured the political zeitgeist and ushered in huge wins in both chambers of Congress. Coincidentally, the election outcome in 2008 happened in the throes of yet another deep recession.

As it stands, the odds of a Democratic sweep this November have increased less than a month to the election. The Democratic party’s improving odds roughly coincided with the chaotic first presidential debate and President Trump’s Covid-19 diagnosis.

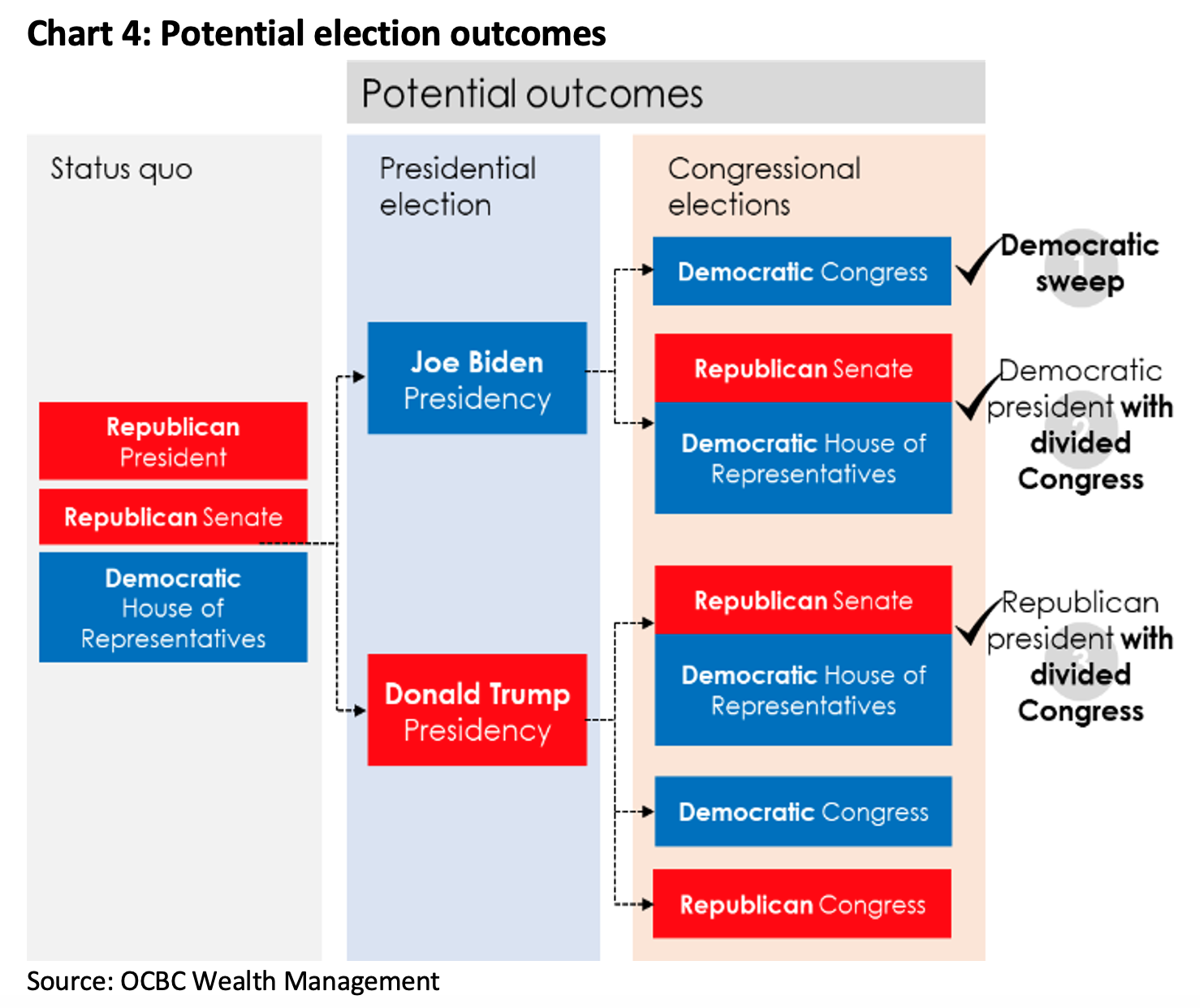

Other probable outcomes include a Biden win with a divided Congress, where Democrats retain control of the House of Representatives while the Republicans retain control of the Senate. Alternatively, if indeed President Trump wins re-election, we expect the status quo in the form of a divided Congress to be preserved. We should also not rule out the possibility of a Democratic or Republican sweep of Congress in the event of a Trump win, but we view these outcomes as less likely.

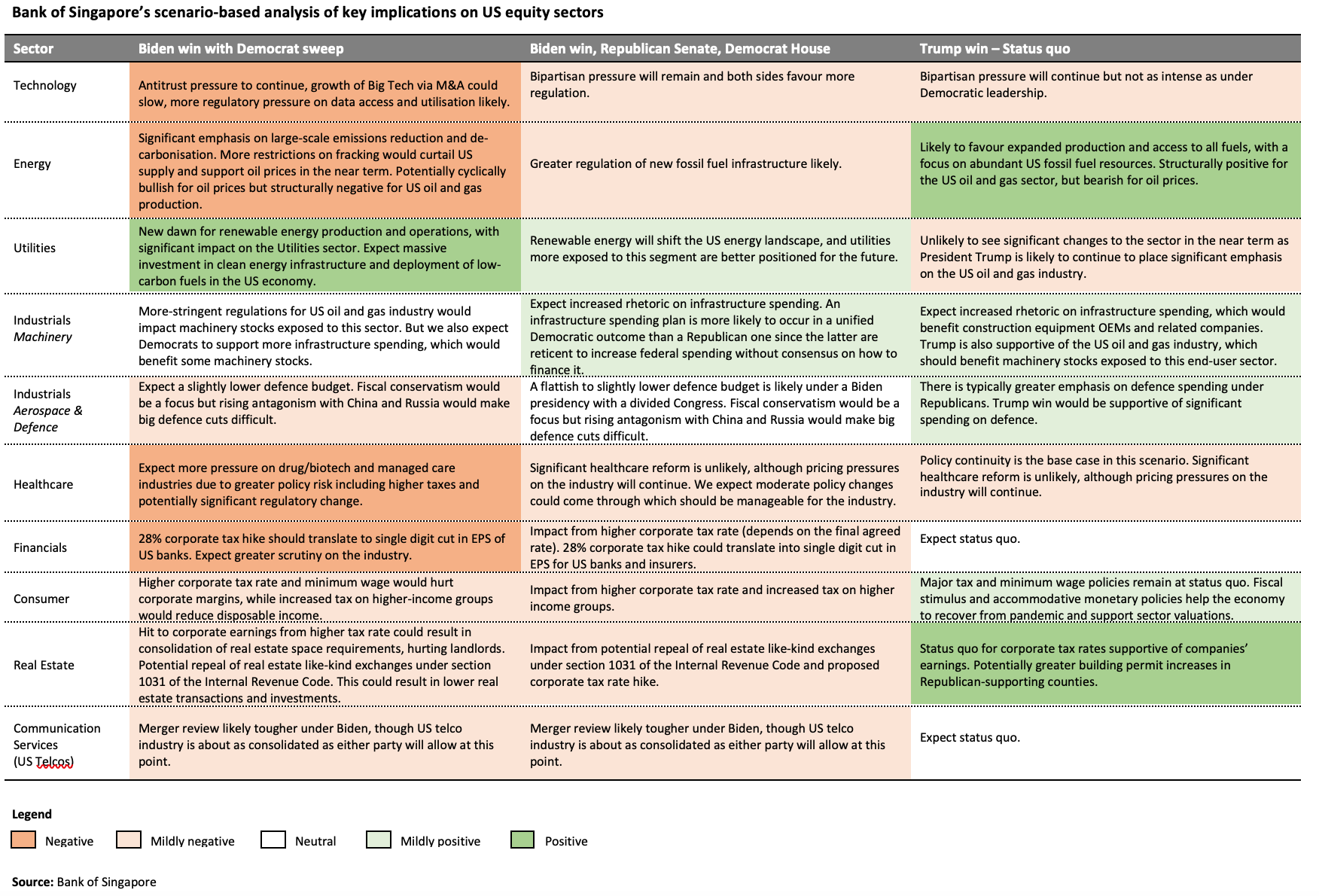

Chart 4 summarises these views. These outcomes, ranked in order of likelihood, may have material impact on financial markets. We examine the market implications of three probable scenarios: (1) A Democratic sweep, (2) a Democratic White House with a divided Congress and (3) a Republican White House with a divided Congress.

A blue wave:

White House and a Democratic Congress

Don’t get too excited. What you read is typically not what you get

A Democratic sweep of the executive (White House) and legislative (Congress) branches of government gives the president immense latitude to implement his policy agenda. With a Democratic Congress, Joe Biden will be in a good position to push through tax increases, higher minimum wage and an ambitious green infrastructure and clean energy spending plan.

Still, Congress tends to be a buffer between a president’s policy aspirations and the real economy. As long as the political centre holds, the provisions in the resulting bill would have to be moderated or move closer to the ideological centre from left-leaning extremes in order to build a “consensus” agreement and to garner support of moderate representatives. In addition, procedural rules in Congress such as the filibuster could present practical challenges in pushing through sweeping policies, hence curtailing a president’s policy ambitions. While the broad strokes of Biden’s expansionary fiscal agenda is clear, the final outcome is still uncertain.

Worried about taxes and higher minimum wage

The Biden administration’s tax plans are of particular concern to financial markets as the plans could negatively impact company earnings. Under his corporate tax plan, Biden intends to: (1) increase the corporate tax rate from 21% to 28%, which will reverse about half of Trump's cuts; (2) reduce deductions for global intangible low-taxed income (GILTI); and (3) levy a 15% minimum tax on corporates with book profits above U$100 million. All in, Bank of Singapore estimates that Biden’s tax proposals could potentially reduce S&P 500 earnings by 12% - 13%.

Hikes in the capital gains tax and the tax rates on top income earners, as well as cutting tax breaks on wealthy Americans might affect discretionary spending and hurt sectors like luxury retail, residential real estate and transport. But it is unclear if this has a meaningful adverse impact on the aggregate economy, particularly because the marginal propensity to consume for high-income segments is typically small compared to the middle- and lower-income groups. More realistically, higher taxes on their income could reduce savings and therefore reduce financial flows into equities.

Meanwhile, increasing the federal minimum wage to US$15 an hour will hurt profit margins of labour-intensive companies, although it would also increase the income of low-wage workers who typically have a higher marginal propensity to consume. The effects of higher labour costs could be offset by an increase in aggregate consumption and demand.

Taxes will be used to finance major spending plans

On balance, Joe Biden’s policy platform might not be as negative as headlines suggest. For one, the proposed tax increases will be used to largely finance an expansionary fiscal agenda. Biden’s ambitious spending proposal includes major investments in clean energy, substantial spending on repairs of America’s crumbling infrastructure and expansion of social safety nets.

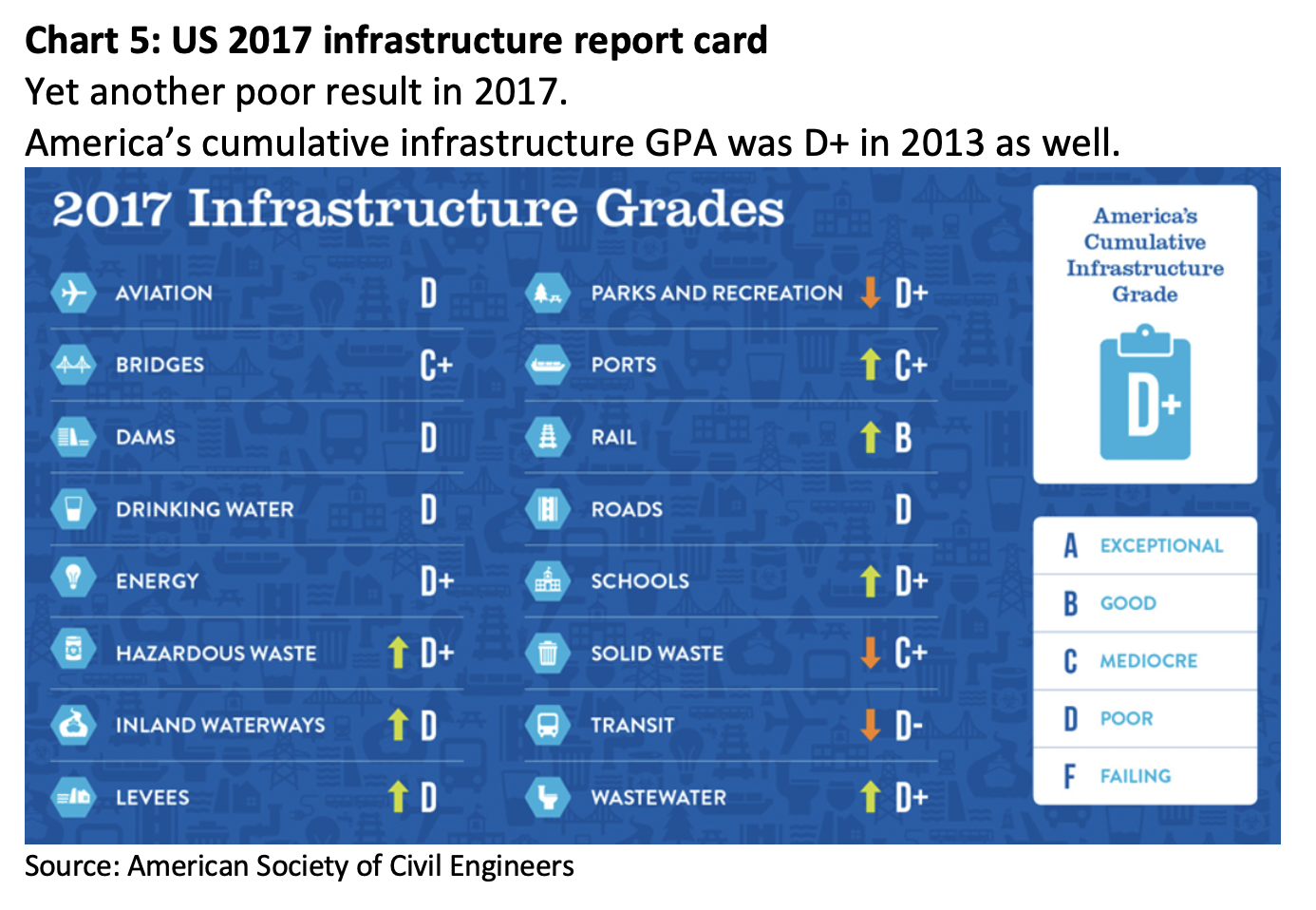

Indeed, investments in infrastructure are critical for the smooth functioning of the economy and long-term productivity growth. In 2017, the American Society of Civil Engineers (ASCE) gave domestic infrastructure an overall grade of D+ (or generally poor) and stated that an estimated US$2.0 trillion in infrastructure investment was necessary by 2025.

These public investments will lead to a net expansion of the fiscal deficit and reinvigorate various sectors in the economy and create new jobs. Such an ambitious plan is also opportune given that the Biden administration – if successful at the polls in November – will take the reins of government during a period of high unemployment and deep economic contraction. Fiscal deficit hawkery may take a back seat in view of the current economic malaise. After all, even Fed officials are endorsing more – not less – fiscal spending.

Less foreign and trade policy uncertainty

In addition, a seemingly unambiguous positive of a Biden presidency is in the realm of foreign policy, in which the White House exercises a great deal of influence. A Biden administration will mark a reversal to strategic diplomacy and multilateralism and will eliminate the capricious elements that have characterised President Trump’s approach to foreign policy.

Still, tensions between the US and China will likely remain as containment of China’s geo-political and global economic ambitions enjoy strong bipartisan support and a blue Congress might press the country further on human rights abuses. The manner of engagement, however, would likely be more strategic and less unpredictable.

Joe Biden has also shown a proclivity in compartmentalising foreign policy issues, favouring cooperation in issues of global concern, such as climate change and the pandemic, while challenging China on other fronts such as human rights abuses, corporate espionage, flouting of international trading agreements and geo-political aggression. The non-conflation of issues ensures that foreign policy response would be more predictable and less uncertain. This is a clear positive for businesses.

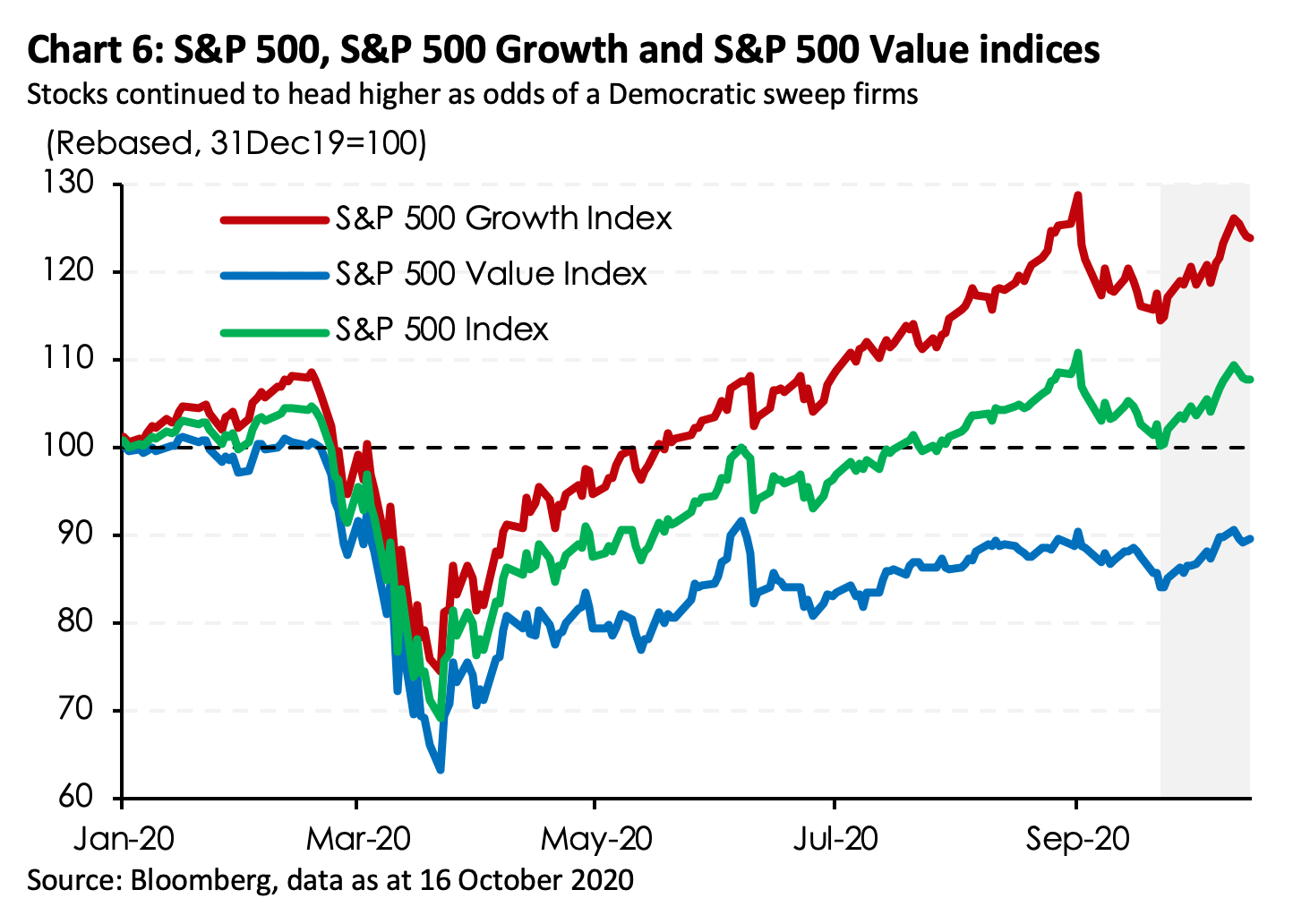

Glossing over higher taxes and tighter regulation

Traditionally, a policy agenda that includes higher taxes and tighter regulation would not be welcomed by Wall Street. In such cases, improved chances of a Democratic sweep would have made investors nervous and skittish. Yet, aside for slight bumps in risk sentiment, we have mostly observed a rising market, weeks ahead of the November election.

Perhaps the focus of the market is decidedly different in this markedly unconventional time. First, Congressional gridlock has not served the economy well. Case-in-point, the recent impasse between the Democratic House and Republican White House and Senate has delayed the passage of fresh stimulus for an economy that still requires aid. A government unified under one political party reduces such political hurdles and increases the chances for more sweeping action, especially during a crisis. In this respect, a potential Democratic sweep at the ballot box, coupled with an expansionary fiscal agenda, increases the chances of a big stimulus package that may juice economic growth.

Second, amid the current economic malaise in the time of a pandemic, a Democratic administration will likely be singularly focused on containing Covid-19 and putting the economy on a path to a sustainable recovery in their first year in office. Biden’s “Build Back Better” spending plan has all the marks of a growth-focussed and job-creating expansionary fiscal programme, overlaid with a green agenda, hence ticking many boxes at once. As prioritisations go, a Biden administration might be more focused on policies that improve existing public safety nets, create jobs and deliver strong growth in their first year in office and may well delay pushing through policies that may be less market friendly including sweeping changes to regulations.

Even so, Biden is viewed as a firm moderate and a pragmatic politician. Given his history and voting track record, Biden is certainly not opposed or hostile to a corporate-friendly agenda, unlike his more radical peers like Bernie Sanders and Elizabeth Warren. This pragmatism is expected to translate into incremental and measured changes to regulations and policies as opposed to big, radical and sweeping changes.

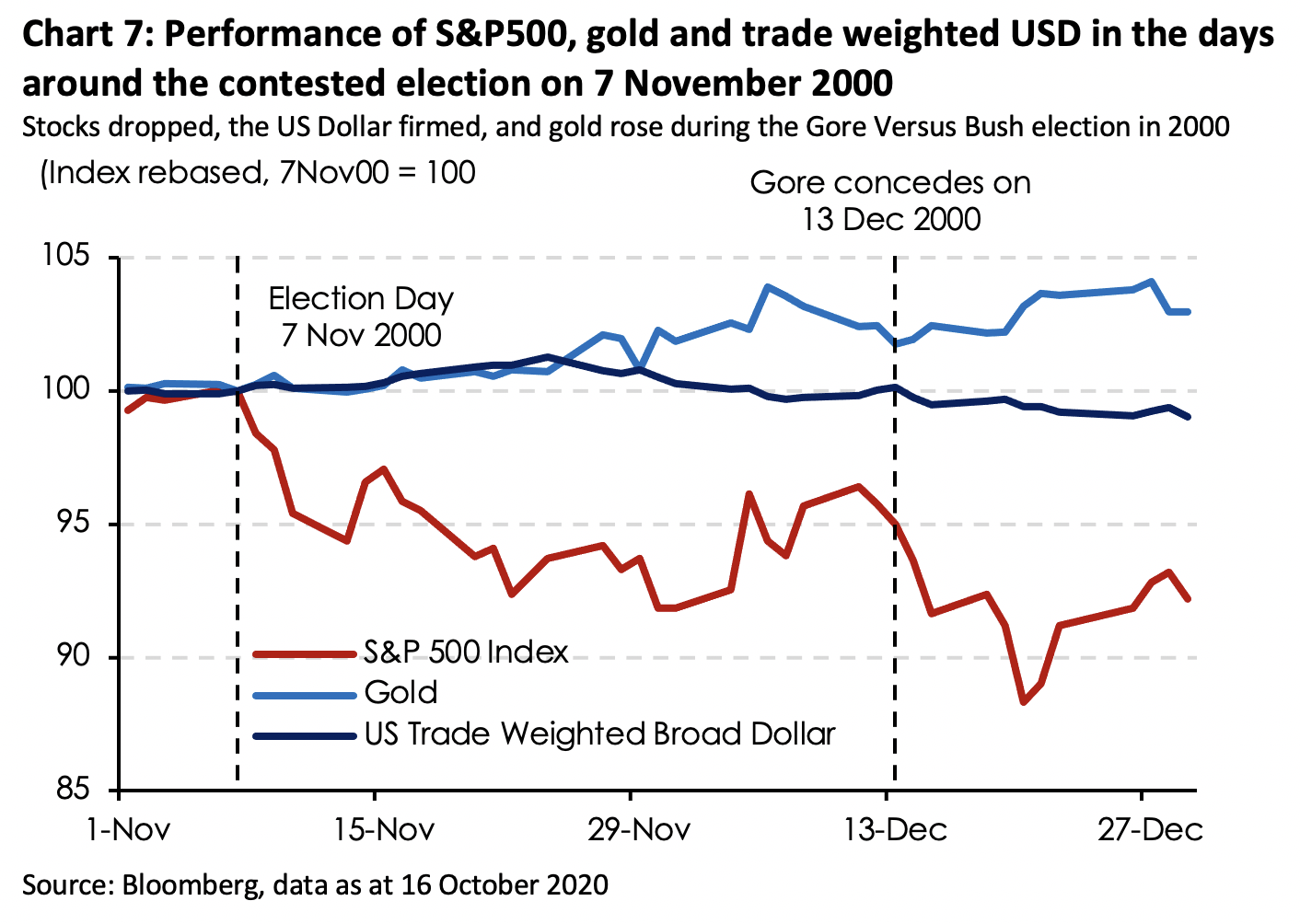

Third, widening national polls in favour of a Biden victory decreases the tail risk of a contested election, which may otherwise prolong uncertainty about the election outcome. A contested presidential election is quite rare in modern American political history. The most recent example of such an event was the Gore versus Bush election in 2000, where in an extremely close race, the winner of the electoral college was to be decided by Florida. Less than a thousand votes separated the winner from the loser in the state and this triggered many rounds of recounts. This also led to a wave of lawsuits and appeals that worked its way up to the US Supreme Court for a decision.

Weeks of uncertainty battered US stock markets and increased flows into safe haven assets such as the greenback and gold. The same could happen should the race for the White House come down to the wire. While President Trump has been unwilling to commit to a peaceful transition of power, a clear victory for Joe Biden may decrease electoral uncertainty. This may also explain why widening polls in Biden’s favour has improved market sentiment.

The reflation trade gains pace

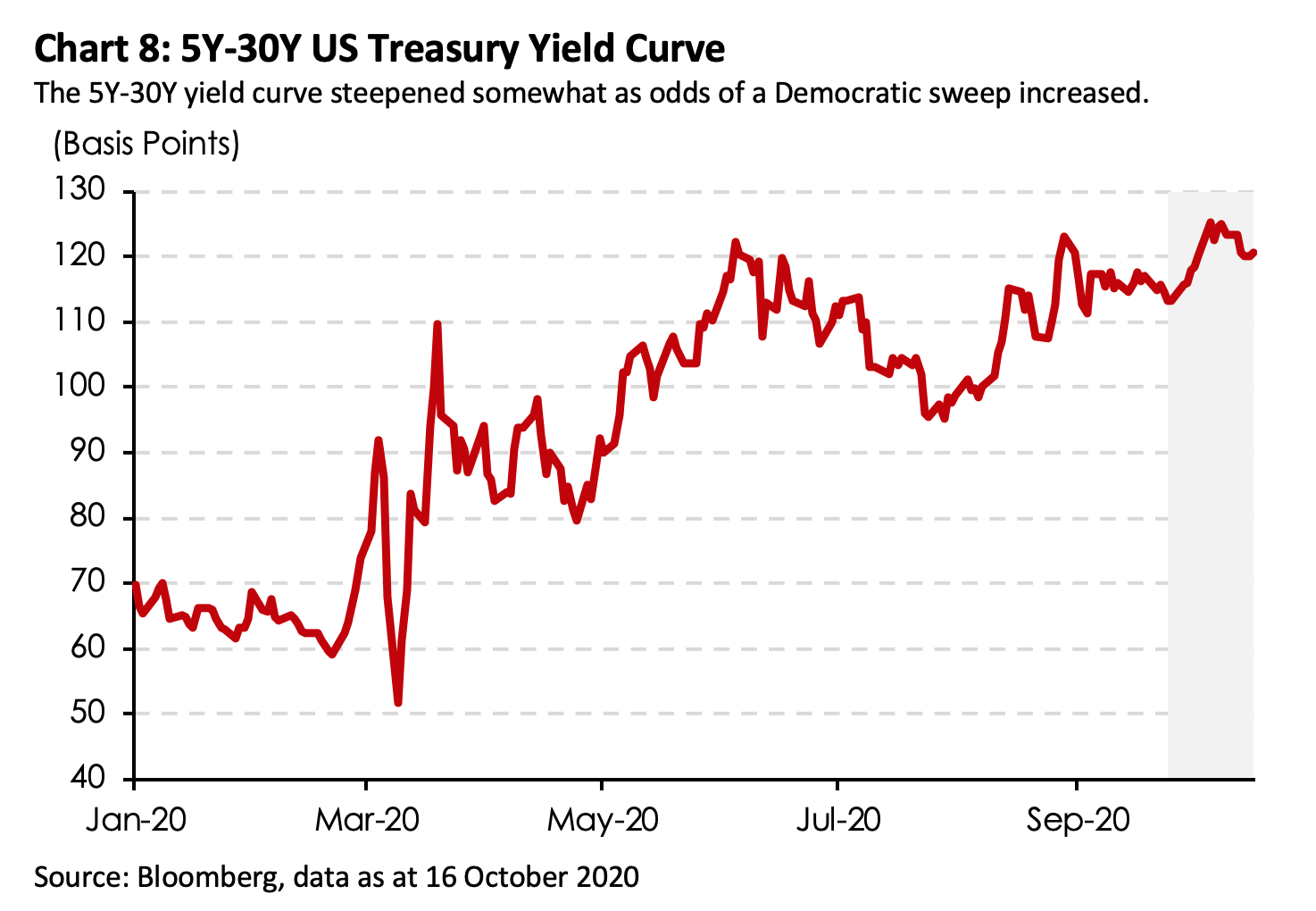

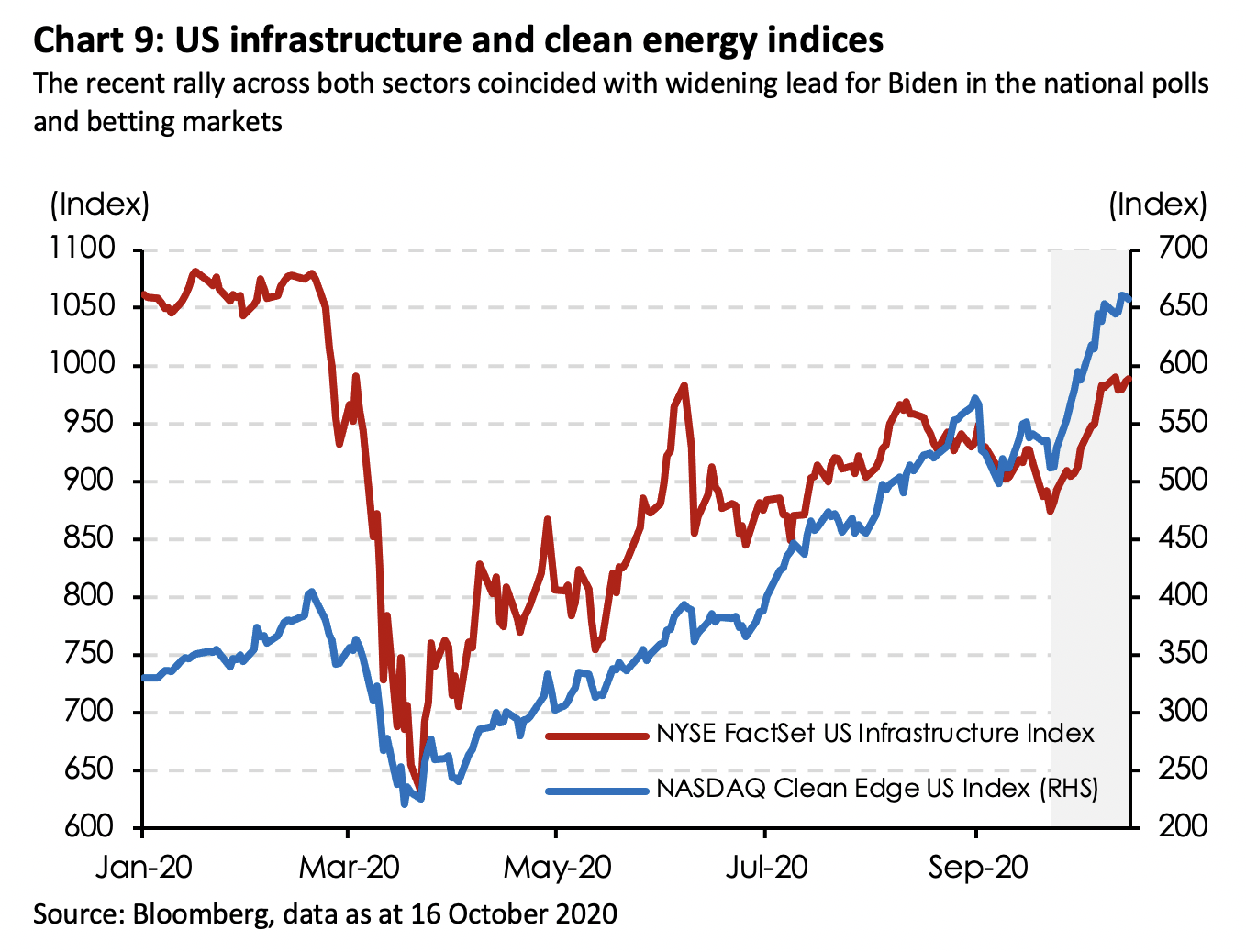

Ahead of the election, sectors that might gain from a Biden agenda have started to rally as polls increasingly point to firming prospects of a Biden victory. Infrastructure and clean energy stocks have substantially gained over the past few weeks. Meanwhile, market measures of inflation expectations have also edged higher, coinciding with Biden’s widening lead in the polls, suggesting that markets potentially expect Biden’s agenda to be reflationary for the US economy. Slight steepening of the 5-Year-30-Year US Treasury yield curve is further evidence that the market seems to be pricing a potential Biden-led reflation outcome.

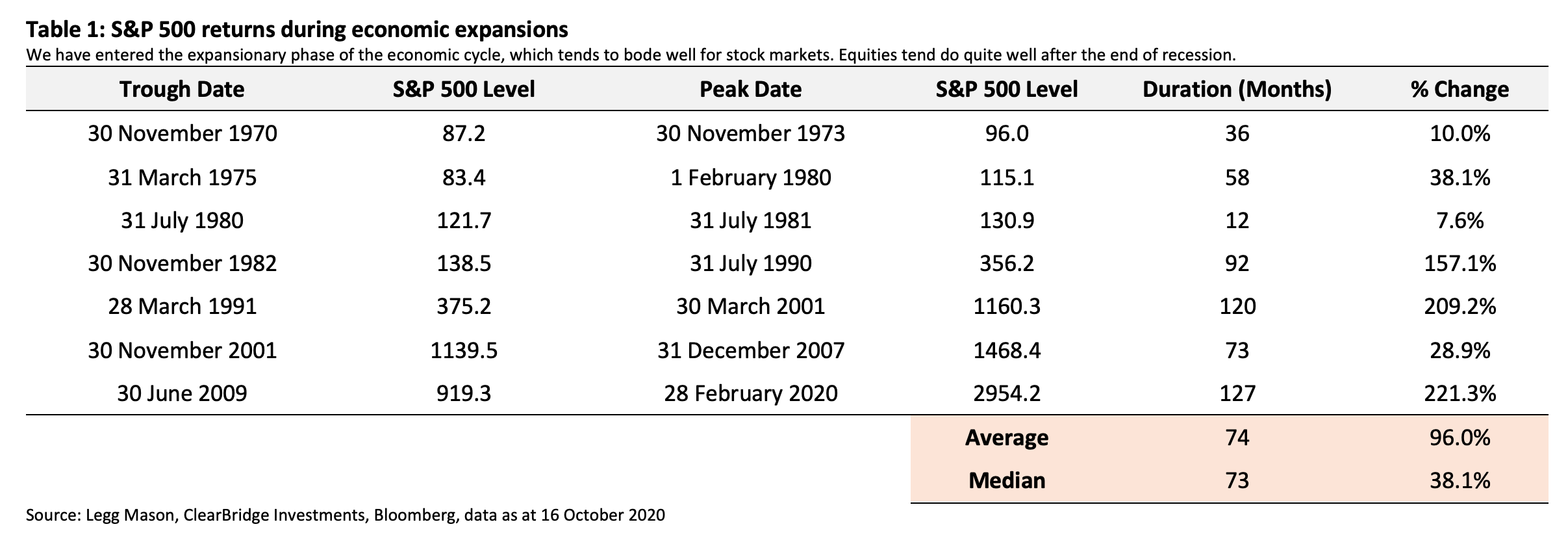

Indeed, Biden’s expansionary fiscal agenda – that is only partially offset by higher taxes – alongside more predictable trade and foreign policy will be reflationary for the US economy. It will stimulate economic activity, juice aggregate demand, support inflation and position the economy firmly in the path of recovery and expansion. A reflationary environment tends to be supportive of risk assets like equities and commodities over the long term. The data bears this out as well. Table 1 shows that equities tend to perform quite well during periods of economic expansions.

Rather fortuitously, a Biden administration will also have the support of a reactive (as opposed to proactive) Federal Reserve that is willing to stomach higher-than-target in¬flation and a hot labour market. The Fed funds rate is largely expected to remain wedged at close to zero in the near-term, at least until the core Personal Consumption Expenditure (PCE) inflation exceeds and hovers above the 2% target for some time. As a result, risk assets may benefit from the twin tailwinds of a large fiscal stimulus and continued monetary policy accommodation.

As equity sectors go, typically value stocks and cyclical sectors like materials, energy, financials and industrials benefit from a reflationary economic environment. Yet, while higher government spending – and therefore stronger growth – lifts all boats, certain sectors may still be in the firing line of tighter regulations. Cyclical sectors like financials and energy, and growth sectors like healthcare, communication services and information technology, may face the rising tide of stronger oversight and tougher regulations. This might keep investors relatively skittish in the near-term as they parse the potential for material regulatory changes. As it stands, much is still uncertain and will depend on the policies the Biden administration would prioritise in the early months of his presidency. Biden’s ambitious clean energy and infrastructure spending plan clearly enjoys top billing, but his regulatory agenda remains unclear.

Also, depending on how successful fiscal policy is in juicing aggregate demand and inflation, the Fed could potentially bring forward the first interest rate hike. The upside potential of a widely distributed vaccine, in addition to fiscal stimulus, could also hasten growth and inflation as well, increasing the risk of an earlier-than-expected interest rate hike. In the wider scheme of things, this might be less of a concern in the near-term but is certainly a risk that is worth monitoring.

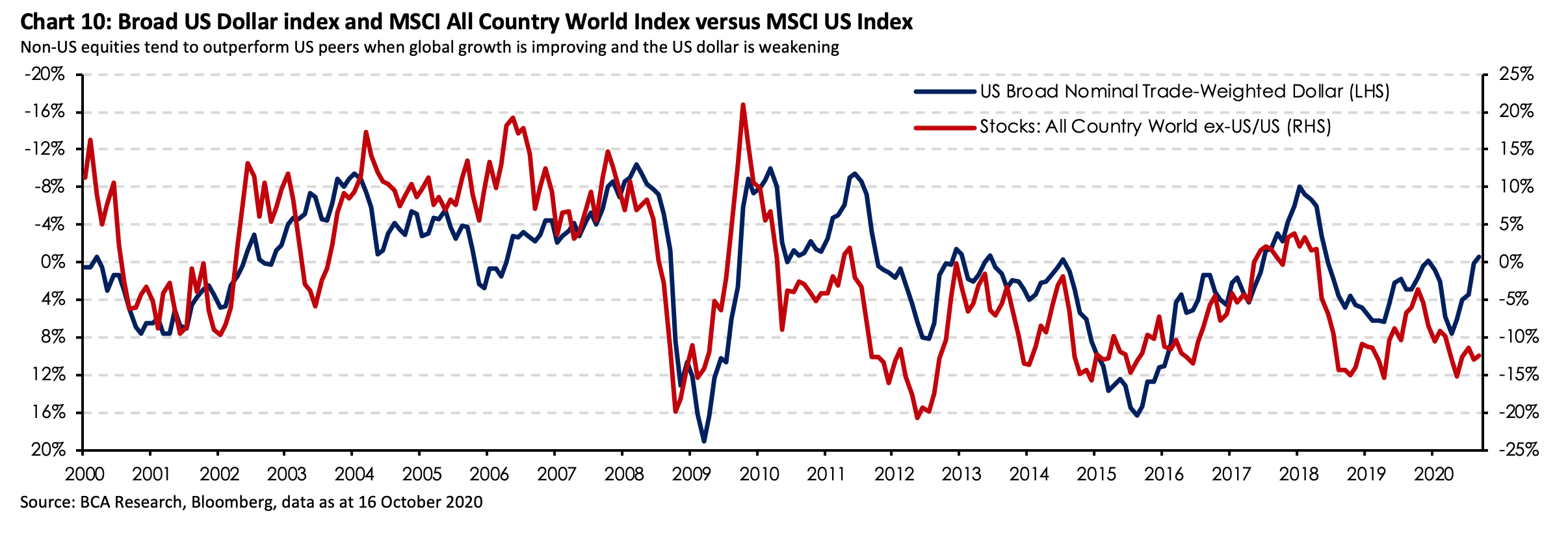

Another key implication of the reflation trade is a weaker US Dollar. As risk assets gain and risk sentiment improves, safe haven demand for the greenback will likely wane, causing the US Dollar to weaken over time, to the benefit of Emerging Market currencies. At the same time, with the Federal Reserve committed to keeping interest rates near zero for very much longer, there is admittedly little catalyst for sustained US Dollar strength.

This will no doubt be a boon for global risk assets. As Chart 10 shows, non-US equities tend to outperform US peers when global growth is improving, and the US Dollar is weakening.

- Biden White House, but divided Congress

Scaled down ambitions

The ability for a possible President Biden to fully pursue his agenda will be curtailed if Congress remains divided, in that the Democrats retain control of the House of Representatives and the Republicans the Senate. Congressional gridlock represents a major hurdle to pass important legislation as it typically takes all three branches of government to agree on a piece of legislation or budget before it is passed, endorsed and implemented.

A Republican Senate can easily block certain legislation from being debated or even considered. In addition, the Senate typically plays a key role in confirming crucial cabinet positions, nominations to the Federal Reserve board and other regulatory bodies, as well as judges to fill openings in the judiciary. Breaking through congressional gridlock to pass major bills and key personnel nominations will be an uphill task and should be a central priority for the Biden administration should he win the Presidency.

Of course, this does not mean negotiations are impossible or that a Republican Senate would necessarily be obstinate, obstreperous and vote exclusively along party lines. In view of the potential repercussions in the mid-term elections in 2022, Republican Senators in potentially difficult races may find it to their advantage to engage the new president meaningfully on his agenda.

Amid potential Congressional gridlock, the Biden administration will likely have to scale down their spending ambitions in view that a Republican Senate may block efforts to roll back President Trump’s signature tax cuts and might not be supportive of significantly higher deficit spending without cutting entitlements, although both parties support fixing America’s crumbling infrastructure.

The Biden administration may prioritise legislation on issues that share bipartisan support including broader oversight and tighter regulation on the tech sector and drug pricing. Infrastructure spending might be unifying issue, although the problem of funding is another matter. Like Presidents Obama and Trump before him, we can expect Biden to govern by executive order on issues of climate change, environmental regulations and clean energy should he not be able to push meaningful legislation through Congress due to an uncooperative Republican Senate.

In the areas of foreign and trade policy, we might see a less capricious and more strategic engagement of China. Multilateralism and alliance building are certainly not dirty words in the political vernacular of the Biden administration. This should decrease geo-political and trade policy uncertainty.

Downsizing expectations for major legislative actions

But how will risk assets react to such mixed signals? On the one hand, a divided Congress reduces the threat of higher taxes and sweeping changes to regulations, which is a firm plus for risk assets. On the other hand, Congressional gridlock also increases uncertainty about the passage of a significantly large spending bill. Much depends on Biden’s ability to break through Congressional gridlock. So far, markets have trended higher, buoyed by expectations of a stimulus and an expansionary fiscal agenda. Risk sentiment could be challenged in the near term as investors price in higher uncertainty in the political process to deliver a decisively expansionary budget.

After a possibly brief period of market consolidation, focus could easily shift to a glass half full interpretation of this outcome in that Trump’s tax cuts will not be rolled back and anti-corporate legislation would be difficult to pass through a divided Congress. Furthermore, a less unpredictable geo-political environment and waning trade policy uncertainty would be supportive of global risk assets.

This scenario could represent a benign outcome for global markets. We expect limited US Dollar strength as risk sentiment is likely to remain supported, which would be favourable for global equities.

- Trump win and divided Congress

In the event President Trump gets re-elected, we expect a broad continuation of the status quo and no major changes in policy direction during his second term. From the market’s perspective, this would be a stunning upset and could therefore lead to a near-term risk-off reaction as investors recalibrate their expectations of future policy.

If we see a Democrat sweep of Congress under a Trump victory, we could observe a lame duck presidency, much like President Obama’s second term in office. President Trump’s ability to push through significant domestic economic policy changes will be further curtailed, although his veto powers will prevent major rollbacks of his previous policies. However, Congress will not be able to check his influence on foreign and trade policy. In this case, we can expect US-China relations to deteriorate further, which will increase geo-political and trade policy uncertainty. While US-China tension is not new, it may get worse and global risk assets may enter a more volatile period.

A much less likely scenario which cannot be ruled out is a Trump win with a Republican sweep of Congress, under which the Trump administration will likely push through an extension of key TCJA provisions under a Tax 2.0 plan, representing further fiscal expansion. This would be a boon for risk assets but will be potentially offset by heightened US-China tensions.

Gridlock in perspective

Partisan politics is par for the course in the current political climate. Unless the legislative and executive branches of power are unified under one political party, it is difficult to pass major legislation, although not impossible. Typically, the economic environment can force bipartisanship. That was what we saw in March when the economy was sinking, and Congress hurriedly passed a succession of stimulus plans to the tune of US$3 trillion to stave off a Great Depression. Duty calls when the stakes are high. When it is not, partisanship tends to dominate.

Hence, the question is, are the stakes high enough for Congress to work across party lines again in the event of a divided Congress? For one, the worst is likely over for the US economy, even as the trend of new Covid-19 cases continues to rise. The fact is public health officials are no longer groping in the dark and are in a better position to contain infections without resorting to costly shutdowns. Treatment for the virus has improved which has pushed down fatality rates and pharmaceuticals continue to make steady progress towards a vaccine.

Yet, the economy is still in need of support as the economic recovery momentum is stalling. Stalling growth does not suggest that the economy is at the precipice of a second depression, although this could foreshadow adverse changes ahead. And this is perhaps the key reason for the feet dragging in Congress. The stakes are just not high enough for political agents to disregard politics and act urgently.

The reality is Congress reacts rather than anticipates. While we can make the case that growth is stalling and more must be done, incoming economic data still does not seem to spell impending doom. For instance, the headline unemployment rate continues to fall, and retail sales data continues to surprise on the upside. As long as the stakes are not as dire as it was in March, the partisan playbook is in full motion. That leads us to believe that in the absence of a government unified under one political party, amid an economic situation that is seemingly less dire than before (but is no less worrying), the probability of major legislative achievements will be low.

Perhaps, regardless the election outcome, a stimulus package may still be forthcoming given significant public demand for some assistance. But in the event of a divided Congress, the scale of the plan and the speed at which it is passed will be subject to partisan forces that insidiously claw away at various provisions and delays its passage.

What can investors do

Ahead of a deeply consequential election, investors should heed three points.

First, stay invested. Politics seldom drive financial markets over the long term and it typically takes time for political outcomes to translate into tangible economic policies that may or may not have far reaching implications for financial markets. Case-in-point, Brexit. Markets sold-off dramatically following the UK’s choice to exit the EU in 2016 but rallied to record highs some two weeks later as investors realised that it would take time for the full implications of Brexit to manifest. Four years later, the UK is still in negotiations with the EU. With President Trump’s election in 2016, the only difference was the initial risk-off reaction lasted less than a day. After which markets rallied to new highs, pricing in a Trump-flation due to his expansionary fiscal agenda. Being exposed to the market upside is just as important as managing the downside risks. The key is to construct and maintain an adequately diversified portfolio, spread across various asset classes and regional markets.

Second, making directional bets on political events is often problematic and investors should avoid doing so. The better strategy is to position for a rise in volatility, which tends to spike going into such uncertain events. This was the case during Brexit and the US elections in 2016. We continue to advocate portfolio diversification to navigate choppy markets. In a year rife with uncertainty, this has never been more important.

Within equities, a sensible strategy to hedge against election-related uncertainty is to tilt portfolios towards high-quality names with growth prospects that are not dependent on any specific political outcomes. Alternatively, investors could focus on broad sectors that may benefit from a bipartisan agenda. Infrastructure spending is a good example. It is a theme that is broadly discussed on both sides of the political aisle and could be a policy focus in most potential outcomes. In this case, cyclical sectors such as industrials stand to benefit.

While maintaining exposure to names that ride on secular growth trends is important for long-term portfolio performance, it might be opportune to rebalance portfolio weights in growth and momentum stocks – particularly in the US information technology and healthcare sectors – that have significantly outperformed into cyclical and value names with resilient balance sheets and stable business models that should benefit from the long-term economic recovery.

Lastly, do not panic sell. If you heed points 1 and 2, this point may be irrelevant. Nevertheless, when things shock us, we tend to resort to extremes, often to our detriment. It pays to remember that as with all initial risk-off phases, markets tend to overreact before finding a bottom, at which point valuations and fundamentals become extremely compelling and the market rises. It’s a cycle. The key is to remain calm, assess the risks, be a little patient and execute your next move.

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person.

Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase any investment product.

The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

Any opinions or views of third parties expressed in this material are those of the third parties identified, and not those of OCBC Group.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

OCBC Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

The information provided herein may contain projections or other forward-looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

Investors should note that there are necessarily limitations and difficulties in using any graph, chart, formula or other device to determine whether or not, or if so, when to, make an investment.

The contents hereof are considered proprietary information and may not be reproduced or disseminated in whole or in part without OCBC Bank’s written consent.

Cross-Border Marketing Disclaimers

Please click here for OCBC Bank's cross border marketing disclaimers relevant for your country of residence.