Start an OCBC Premier Banking relationship with a minimum of S$350,000 (or its equivalent in foreign currency) in qualifying assets under management*.

- For customers residing in Singapore

Find out more - For customers residing outside of Singapore

Find out more

Browse our latest products and services that cater to your evolving needs.

Join the Regional Premier Banking programme to enjoy banking and lifestyle benefits catered to your regional needs.

Be rewarded when you start a Premier Banking relationship with us

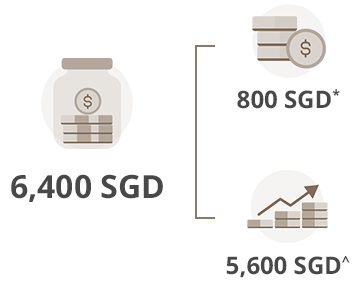

Earn up to 6,400 SGD* when you deposit 350,000 SGD in fresh funds. *T&Cs apply.

SGD deposits are insured up to S$100k by SDIC.

OCBC Premier Private Client

To be eligible for OCBC Premier Private Client, deposit or invest 1.5 million SGD in fresh funds and qualify as an Accredited Investor.

Introducing Online Call on OCBC app

This feature allows you to connect with our contact centre at no IDD cost when you travel (over the internet using mobile data or Wi-Fi), providing you a seamless and secure communication experience.

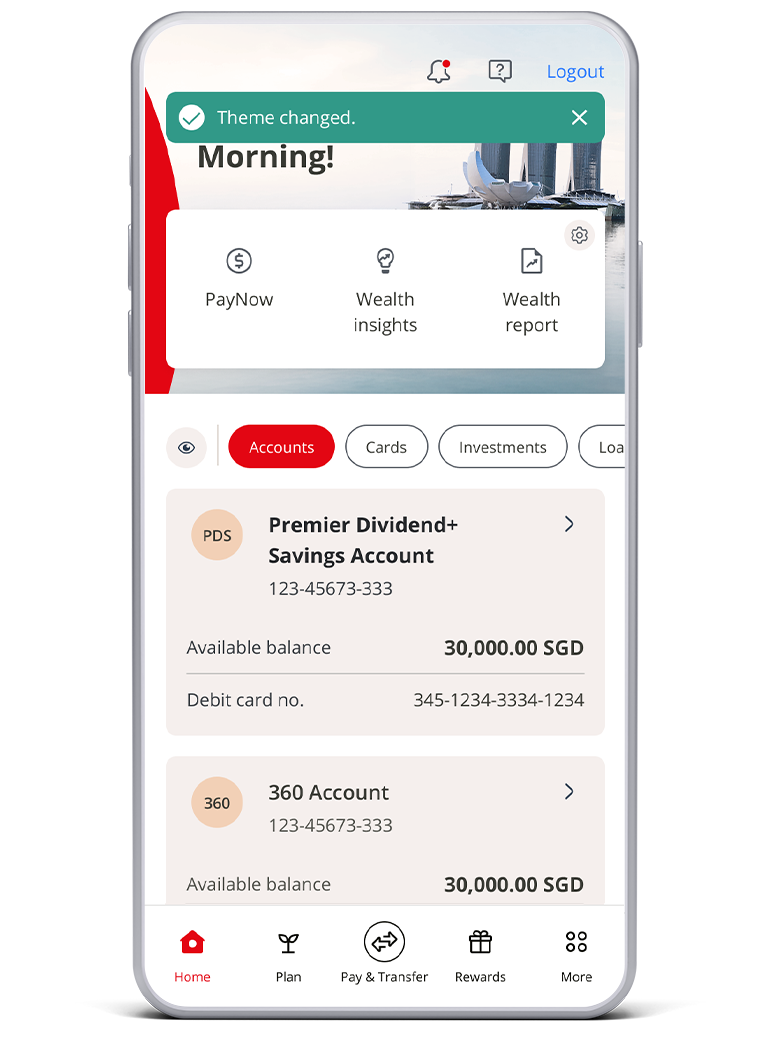

View your Relationship Manager's details and more

You can now conveniently access your dedicated Relationship Manager's contact details within the OCBC app, and enjoy a new colour theme that offers a fresh, elegant look designed to reflect your Premier Banking status.

Discover what's new on your OCBC app

Revision to OCBC Premier Banking and OCBC Premier Private Client Terms and Conditions

Effective 1 May 2026, the ‘Over-the-counter (OTC) Transactions’ section of the OCBC Premier Banking and OCBC Premier Private Client Terms and Conditions will be updated. These updates address the handling of unsuccessful settlement for structured product transactions funded by assets.

OCBC Premier Banking and OCBC Premier Private Client Terms and Conditions (with effect from 1 May 2026)

Certain overseas cheque clearing to be discontinued

From 15 March 2026, we will no longer accept Euro (EUR), British Pounds (GBP) and Japanese Yen (JPY) currency cheques presented for overseas clearing.

Please advise those who make payments to you to use alternative payment methods, such as Telegraphic Transfers.

Revision to interest rates for OCBC Premier Dividend+ Savings Account on 1 November 2025

We will revise interest rates for the OCBC Premier Dividend+ Savings Account on 1 November 2025. For more information, visit ocbc.com/notices.

Revision of Fees and Charges guides from 1 October 2025

The following fees will be revised or introduced -

Safe Deposit Box (SDB)

- Key Deposit (For new SDB opened from 1 October 2025) : S$330

- Charge for loss of 1 key: S$220 (before GST)

- Charge for loss of 2 keys: S$330 (before GST)

- Force opening charges: S$130 (before GST)

- Appointment cancellation fee: S$130 (before GST)

Our pricing guides will be revised to reflect these changes -

Revision to interest rates for OCBC Premier Dividend+ Savings Account on 1 August 2025

In line with prevailing market conditions, we will revise interest rates for the OCBC Premier Dividend+ Savings Account on 1 August 2025. For more information, visit ocbc.com/notices.

Get trusted advice from our experts for every stage of your wealth journey

or visit us at our Premier Banking Centre(s)

Terms and Conditions

Terms and Conditions of OCBC Premier Banking Client Referral Programme

OCBC Premier Banking and OCBC Premier Private Client Terms and Conditions

Terms and Conditions Governing OCBC Premier Banking Welcome Reward Programme

Terms and Conditions Governing OCBC Investment Products and Services

Terms and Conditions Governing OCBC Premier Dividend+ Savings Account Interest Rates

Important notices

Cessation of Teller Services at Parkway Parade Premier Banking Centre

Parkway Parade Premier Banking Centre will cease its teller services at 6pm on 30 September 2025.

Foreign Currency Deposits

- Foreign currency investments or deposits are subject to inherent exchange rate fluctuation that may provide opportunities and risks. Consequently, exchange rate fluctuations may affect the value of your foreign currency investments or deposits.

- Earning on foreign currency investments or deposits may change depending on the exchange rates prevalent at the time of their maturity if you choose to convert.

- Exchange controls may apply to certain foreign currencies from time to time.

- Any pre-termination costs will be taken and deducted from your deposit directly and without notice.

- Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Welcome rewards

Welcome rewards

*Cash reward

Earn a cash reward of 800 SGD when you deposit 350,000 SGD in your Premier Dividend+ Savings Account.

^Interest earnings

Earn 1.60% interest a year when you deposit S$3,000 in your account a month – for 12 months – and make no withdrawals at all.

* Credited into OCBC Premier VOYAGE Card or OCBC Premier Visa Infinite Card.

^ Based on existing prevailing Premier Dividend+ Savings Account interest rate and account mechanism, which may be subject to change.

Terms and conditions apply

Online Call: Frequently Asked Questions

- What is Online Call?

Online Call, available 24/7 via the OCBC app, is a feature that allows you to call us from outside Singapore at no cost. You will not incur any roaming charges – just connect to the Internet using mobile data or Wi-Fi.

- How do I access Online Call?

Online Call is available via the OCBC app. You may access it using one of the following methods:

Method 1: Before logging in

- Open the OCBC app

- Tap ‘More’

- Tap ‘Online Call’

- Log in to the app

- Select the topic most relevant to your query and tap ‘Speak to us’

Method 2: After logging in

- Log in to the OCBC app

- Tap ‘More’ at the bottom navigation bar

- Tap the headset icon at top right or scroll to the bottom of the page and tap ‘Online Call (via Wi-Fi/data)’

- Select the topic most relevant to your query and tap ‘Speak to us’

Note: For the best experience, please make sure your device has been updated to the latest version of its operating system and is connected to a stable Wi-Fi or mobile data network.

- What type of enquiries can be handled through Online Call?

If you are overseas and need urgent assistance with matters related to your card, you may reach us via Online Call. For example, you might call to ask why a card payment at an overseas retail store could not be made.

- What should I do if my call gets disconnected or the call quality is poor?

Please check your Internet connection to ensure that you are connected to a stable Wi-Fi or mobile data network. Then, try calling us again.

- I do not see any way to access Online Call via the OCBC app on my device. Why?

To seamlessly integrate the Online Call feature into the OCBC app, we will be progressively making it available to users from November 2025.

In the meantime, please check that:

- You have downloaded the latest version of the OCBC app from App Store, Google Play Store or Huawei App Gallery; and

- Your device has been updated to the latest version of its operating system.

*The qualifying assets under management refer to deposits in the current or savings account(s) and time deposits, investments and insurance (with surrender value) products obtained through the bank.