For most pre-retirees, cash is king. This is according to a survey done by HSBC, where a whopping 69 per cent of pre-retirees categorised cash deposits among the top three assets that they have the most confidence in, as an income stream for retirement. In another survey, they found that 29% of an average retiree’s income derives from cash savings. At least for retirement, cash is royalty, pure and simple.

Indeed, cash is by far the safest asset. Nothing could go wrong with a simple deposit savings account. As conventional wisdom goes, leave the money and let compounding interest take care of the rest. It’s a fool-proof strategy, but does that necessarily mean a good retirement plan?

Face what is real, not nominal

We often hear the older generation lament the loss of the value of a dollar, time and again providing anecdotal evidence as to what a dollar could have purchased back in their day. We often disregard these stories as old people quirks. However, could they perhaps be warning us of bad times ahead rather than just recollecting the good ole’ days?

Indeed, the worth of our savings in the future is largely dependent on the prices of the goods we buy. If a dollar affords us less at tomorrow’s prices than it does at today’s prices, then certainly the value of the dollar has decreased. However, we seldom take note of this as we are too often focused on the figure in our savings account and neglect thinking about how inflation would impact the true or real value of our savings.

And it is perhaps time we pay attention, for the statistics are not in our favour.

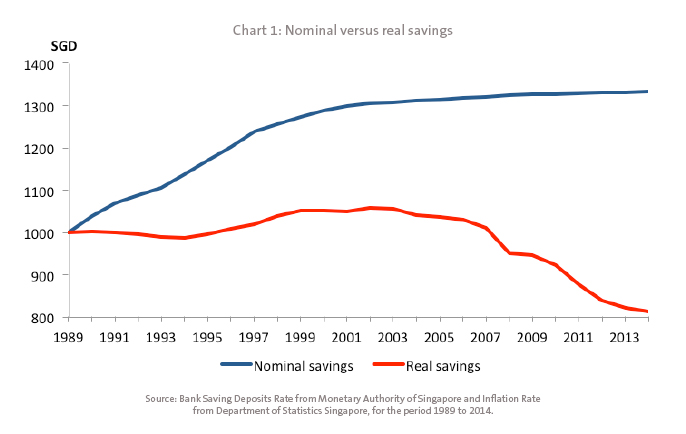

Consider an individual who leaves her money in a conventional deposits account in 1989. The blue line in Chart 1 shows the progress of her savings through the 15 years, following historical deposit interest rates and assuming that she does not spend her interest earnings. Up and up the line goes - the law of compounding seems to work.

However, to assess that is only part of the story. Nominally, the money grows. But to assess the real value of her savings, we need to factor in the effect of inflation.

The red line shows the inflation-adjusted value of the individual’s savings over the 15 year period. Quite clearly, from the middle of 2007 onwards, inflation has eroded the real value of her savings to levels below what it was worth in 1989. Hence, the bleak reality is that the amount of money you set aside today in your deposit accounts may not afford you the same level of consumption tomorrow.

The push and pull of interest and inflation

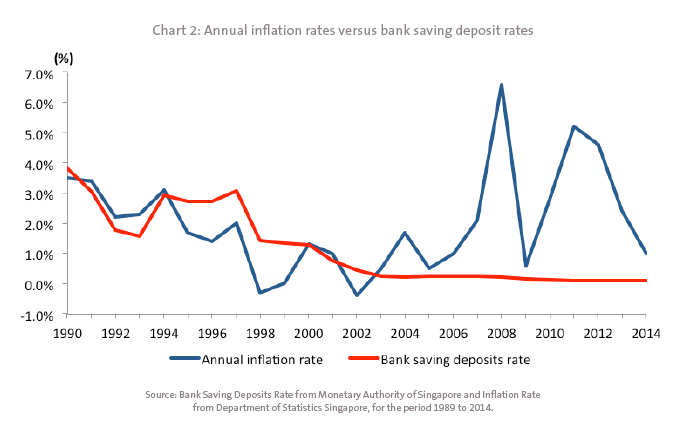

Why is this so? This is due to the effect of interest rates and inflation rates on returns to savings. While interest earnings serve to increase the dollar amount of one’s savings, inflation diminishes its purchasing power. In the past few years, since the great financial crisis of 2008, we have been living in a low interest environment as central banks across the world slashed rates to support economic activity. Inflation rates, however, has consistently remained above interest rate levels.

Consequently, this means that savings placed in deposit accounts have not kept up with inflation. Unless our savings are able to keep pace with inflation, we will undoubtedly experience a decline in purchasing power which could set us back in our retirement years.

Invest for higher returns

If the return on savings in deposit accounts is the problem, perhaps it’s time to consider other alternatives with higher rates of return.

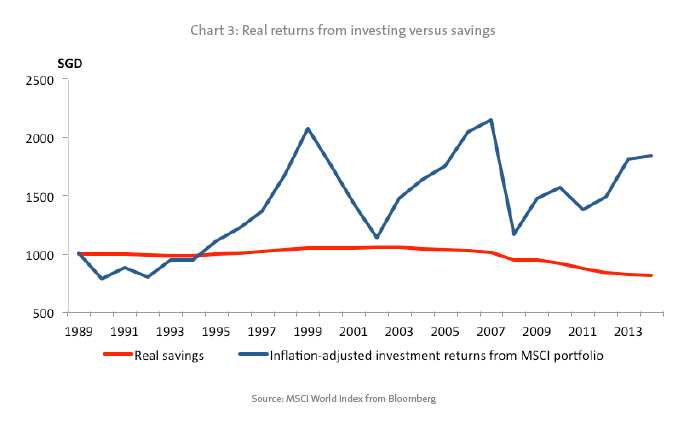

For example, consider an investment of the same $1000 in the MSCI World index, starting in 1989 for a period of 15 years. Within that period, the MSCI world index averaged about 6% annually in returns, relative to Singapore’s annual inflation rate of about 2% in the same period.

From an inflation-adjusted basis, we find that the return from the investment outperforms deposits over most of the 15 year period.

While this is merely theoretical, it makes clear that we can beat inflation by investing our savings in higher yielding financial assets as opposed to leaving them idle in a deposit account.

That doesn’t mean we disregard cash completely and wholly invest our savings. Everything in moderation, they say. That rings true for investing, especially for a long term goal like retirement. We have to first establish our own risk and return preferences before we can start developing a diversified portfolio that includes a variety of financial assets, from stocks, to bonds, to unit trusts and cash.

Where do I begin?

Admittedly, investing can seem somewhat daunting. The risks involved may be harder to swallow. Yet, accepting some risk is essential to beat inflation.

For those who want to dip their toes in investing before taking the plunge can always consider a dollar cost averaging approach through a regular investment plan. Here, instead of investing in a lump sum, you can build your investment by buying a small amount over a longer period of time.

This smoothens out the cost over years, and mitigates your investment entries against market volatility that affect asset prices.

For those who are enthusiastic about investing, it is important to do so prudently. Understand the products and the risks involved before investing. Seek the counsel of financial consultants to be better informed before making your decision. After all, it is your retirement nest we are talking about. Spare no measure to make sure the risks and rewards are appropriate for you.

Disclaimers