It isn't, according to a 2014 retirement survey by Manulife Financial Corp. Only a measly 20 per cent of respondents were confident that the CPF scheme could adequately meet their retirement needs.

Is CPF really adequate? Consider first what CPF affords us at retirement.

Is S$1200 a month for retirement enough? Think Hard

CPF members who turn 55 in 2014 and are able to meet the minimum sum of $155,000 in cash, that is without pledging their property, can expect a monthly nominal payout of $1,200 for life beginning 10 years later at the age of 65.

The key word here is "nominal". The monthly payout figure does not discount the effects of inflation. Hence, what may seem substantial today may not be so in the future depending on the inflation environment.

Also, think hard. Is $1,200 really adequate for you to sustain your present-day lifestyle in retirement, (assuming that CPF LIFE were your only source of retirement income)? Consider this: for median income earners, $1200 makes up only about a third of their current gross income. Sure, ideally you would have no liabilities by the time you retire and $1200 would seem somewhat adequate. But, retirement also means that time is finally a luxury you can afford. And for some, enjoying time in retirement may mean more than just $1200.

Perhaps for some, $1200 is sufficient. But getting this monthly figure is contingent on meeting your minimum sum in cash. Any lower than the minimum sum, you probably would be staring at a much smaller figure, and consequently settling for much more modest lifestyle.

The elusive minimum sum

It is the two words that spark the ire of many Singaporeans. It is, afterall, the benchmark for retirement. And what's worse, it keeps increasing.

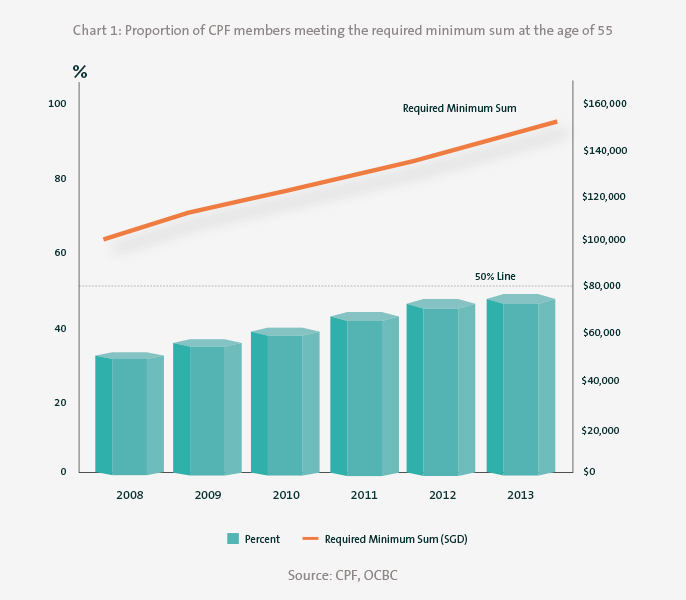

Indeed, the consistent annual increase in the minimum sum from $80,000 in July 2003 to $155,000 in July 2014 has almost always courted negative publicity, largely due to concerns by CPF members who increasingly doubt that they would ever be able to reach the minimum sum, and for good reason.

In 2013, less than half of active CPF members who turned 55 were able to reach their minimum sum. At the time, the target sum was set at $148,000. Alarmingly, this has been a consistent trend looking back at figures for the past 6 years, and even beyond.

Notably, these dismal figures include those who pledged their property to make up half of their minimum sum, meaning that only half of it is held in cash. This inevitably translates to lower CPF LIFE payouts in the future.

Thus, where the minimum sum and subsequent CPF LIFE payouts are concerned, these statistics are clearly not in our favour. Lower CPF LIFE payouts are the grim reality owing to the fact that many may not meet the minimum sum and even for those who do, it may not be wholly in cash.

Asset rich, cash poor

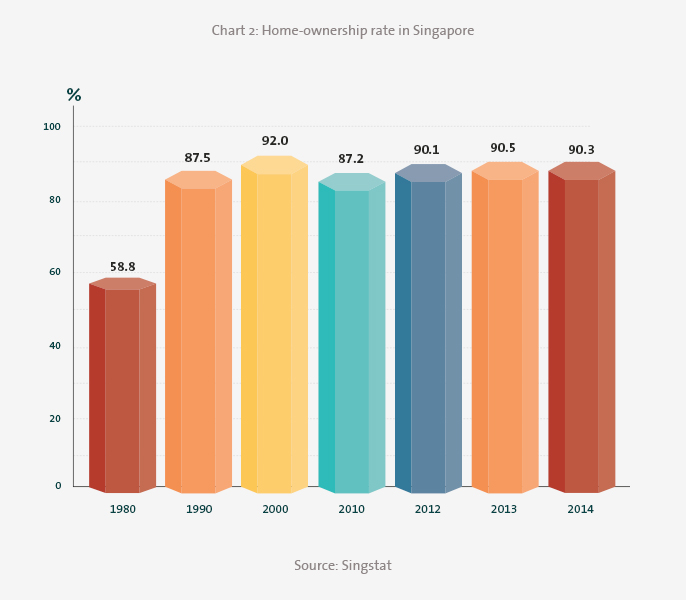

Reaching the minimum sum seems elusive largely because CPF is not just used as a retirement savings account, but is also used to finance home ownership and healthcare among other things.

By all accounts, the scheme has been successful in supporting Singaporeans' property ownership aspirations as evidenced by the consistently high home ownership rates through the years.

Unfortunately, this may have come at the expense of retirement adequacy.

Indeed, most CPF members have committed a large proportion of their retirement savings to housing, especially with the escalating housing prices in recent years. According to a study done in 2008, 44 per cent of cumulative CPF savings are invested in property. A more recent study by Manulife Asset Management in 2013, further validates that Singaporeans are certainly asset rich but cash poor.

Are we then relegated to a future with well-furnished homes but little spending money? Not so, if we are prepared to do something about it.

Do something about it.

CPF is what it is for better or worse. It is not perfect, yes. But we take what's given and make it work.

Fortunately, there are ways to do that. Instead of allowing your savings to idle away in your CPF account, take advantage of the CPF investment scheme (CPFIS) that allows members to invest excess funds into higher yielding unit trusts and other financial assets. This way you will be able to potentially reap better returns on your savings and grow it at a faster rate so that you will have a bigger pool of CPF savings at retirement.

Don't stop there. CPF should not be the be all and end all of your retirement plan. It should supplement your retirement pot, not be the pot. Hence, start laying the foundations of your retirement early through saving and investing so that you have several streams of income to keep you going in your golden years.

Ultimately, to attain the retirement lifestyle we desire, it takes effort and it should start now.

Disclaimers