Singaporeans have a penchant for property. They invest for two reasons: (1) to benefit from capital appreciation or (2) as a source of passive income when they retire. These are somewhat similar reasons for investing in the stock market. Yet, that is the less popular option.

What makes property so attractive then? It largely stems from the misconception that property is a safe and appreciating asset, when the reality might be a little more complicated.

Beware the property cycle

Conventional wisdom would have you purchase an additional property when young and sell it years down the road at a hefty profit, hence affording you a comfortable retirement. This wisdom is right if property prices only go up.

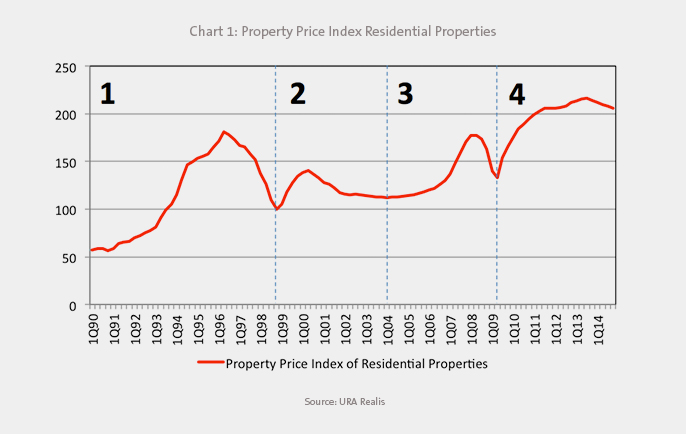

Indeed, property is much the victim of cycles as any other asset class. From Chart 1, it is clear that since 1990, the property market has gone through three different cycles and is currently in the middle of its fourth. Thus, the success of property investing seems contingent on the timing of the investment. Ideally you would want to purchase at the trough and sell at the peak. However, trends are only clear in retrospect. There is no crystal ball solution.

Investing in property at the wrong time may well be a costly decision. Suppose you were to follow the property craze and purchase a residential property when prices were high in the beginning of 1995. You would have to wait till late 2007 to make a slight profit from the sale of the property. This translates to a mere 4 per cent return for the period of twelve years. Annually, that is a meager return of 0.31 per cent on your investment.

Sure, we’d like to think that we wouldn’t make such a mistake.

However, regardless of the timing of purchase, the fact is you may retire at the most inopportune time in the property cycle. If that were your only investment for retirement, you may be forced to sell it during the downturn and stomach some loss. Otherwise, you would have to wait for the upswing in prices to sell at some profit. But as the above example illustrates, that might be a long wait, one you cannot afford at retirement.

And the rental cycle as well

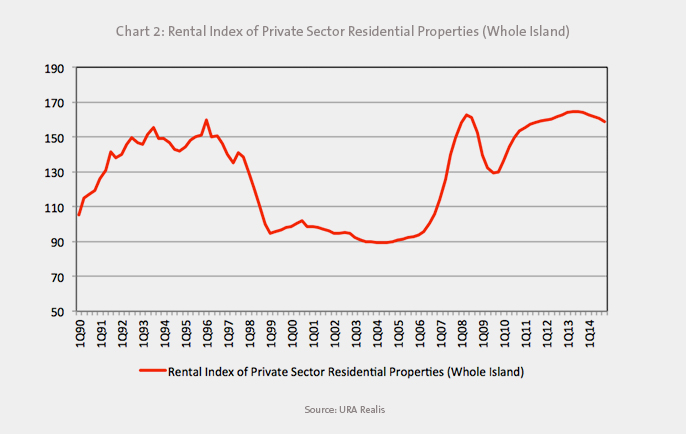

Even for those who invest in property as a source of passive income, the flow of rental income is not a surety. The rental market, like the property market, is cyclical as well (see chart 2).

That is also assuming you are able to rent out your property. Unless you are able to do so easily, you could either end up owning a property that is vacant for long periods (i.e. loss of rental income) or may have to slash rentals to secure a tenant, especially when the rental market is weak.

Regulatory Measures

Also, the case for investing in property at this juncture is less compelling owing to the government’s property cooling measures. Measures like the additional stamp duty on second property purchases serves to inflate the cost of purchasing property at this time. Other measures like the substantial increase in initial cash down-payment for a second property further hinders such investments. For the most part, these measures have worked, sending property prices down.

Admittedly, these measures are transitory. Once prices are deemed low enough, we can expect regulations to change.

They add an additional layer of uncertainty when investing in the property market. It’s not just the movement of the market that we should be concerned about. It is also when and how the government will react to such movements. Indeed, those who thought property prices would only go up in recent years were proved wrong when the government acted aggressively to cool prices.

It’s hard to predict when such discretionary measures would be taken, as hard as it is to predict when prices would trend up or down. The only thing for certain is that you have one more thing to worry about.

Over-concentration risk

Property is neither liquid nor cheap. You are not able to sell it as easily as you could other financial assets and it requires a huge financial outlay.

Hence property investing comes with concentration risk as your fortunes are tied to a single illiquid asset and the outlook of the local property market.

Also, by putting down huge sums to secure a property investment, you are essentially foregoing other potential investments that are more liquid and may be higher yielding in nature.

Not a one way street

Ultimately, investing in property for retirement is not as simple as location, location, location. It requires an understanding of the risks involved and if you are willing and able to undertake those risks both mentally and financially. It is your retirement pot we’re talking about after all.

While we should be mindful of the risks, we should never rule out property as an investment. Rather, property should not be the only investment. In the end, we need to approach retirement with a holistic mindset, and not be caught up with the trends of the time.

This means diversify, not concentrate, especially for retirement.

Disclaimers