A car is often a necessity in places where public transport networks may be lacking. Most urban districts or areas with well-connected public transport networks may diminish the need for a car as the costs for getting around comfortably may be reasonably low. Such is the case for cities like New York, Hong Kong, London and even Singapore.

Yet, there is often a sense of joy and comfort attached to the ability to chauffeur oneself anywhere and everywhere. It is a freedom that many crave despite the costs and is well understood. After all, for some, just the ability to drive has become a crucial life skill, much like swimming or riding a bicycle. For some it may well be a want, for others a need. It's not uncommon to hear of people who require access to private transportation just to get to work in less connected areas. For families, just the thought of managing unruly children on public transport might be reason enough to get a car.

As is with many things in life, such private spending decisions tend to boil down to two fundamental factors: (1) Need and (2) Affordability.

While we can't speak to the first factor, affordability is certainly something we could discuss at length.

For a lack of a better analogy, conventionally men often regard their automobile as the proverbial second wife. Perhaps there's some flicker of truth in this statement. First, like marriage, it takes a great deal of savings and investments to afford that hunk of rubber and metal. Second, much like marriage, it takes time and money to keep a car well-serviced so as to ensure its unfailing durability. Essentially, owning a car takes money, and in Singapore, lots of it.

The upfront costs

So what are the upfront charges when you choose to buy that sweet ride?

- First, you have the open market value (OMV) of the car. You can treat this as the cost of buying the physical good, inclusive of its purchase price and other charges incidental to the sale and delivery of the car to Singapore.

- On top of that, you will have to add the Goods & Services Tax (GST) and Excise Duty. The total charge payable includes an excise duty of 20 per cent of the OMV plus a further 7 per cent GST.

- To that, you will have to add the Additional Registration Fee (ARF) charges, which follows a tiered structure according to the OMV of the car. Here's a current example of the current tiered fee structure for cars registered after 1 September 1998:

To encourage consumers to shift to more fuel efficient and low carbon emitting car models, the government offers rebates on cars with low carbon emissions which can be offset against the car's payable ARF. Conversely, the government taxes fuel inefficient cars.

- And, finally, we've reached the crescendo, the pinnacle of all costs – the infamous Certificate of Entitlement (COE), the very paper that legitimises your ownership of the hunk of metal and permits the use of Singapore's very limited road space for 10 years. As land space in Singapore is dreadfully scarce, we will have to pay our fair share for what limited resources we have. While not entirely perfect, the COE helps to segregate the wants from the needs using price signals administered through a competitive bidding system. The logic goes that those who really need a car would likely be willing to pay a lot more for the right to have it. COEs are bid through an open bidding system where you would submit your reservation price for the right to own a vehicle. The winning, lowest bid for the month will be the official COE amount necessary to buy that right.

- Aside from all the costs above, you have a registration fee of S$140, which pales in comparison to the other costs specified above.

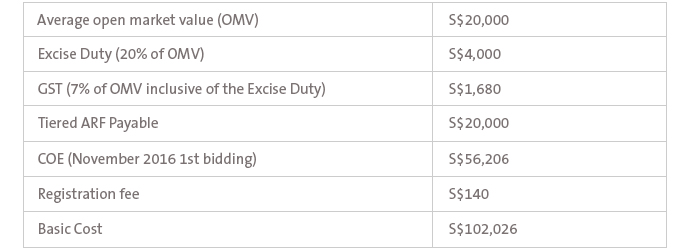

- Here's a sample calculation of the basic cost of a sweet ride ignoring the rebates one could be entitled to depending the fuel efficiency of the car:

And so we get a loan

Let's assume that a benevolent car dealer sells the vehicle to you at cost with no mark-up. Based on current Monetary Authority of Singapore (MAS) rulings, the individual will have to make a minimum down payment of 30 per cent of the price tag of the car. This is applicable for vehicles with OMV less than or equal to S$20,000.

Simple arithmetic tells us that the relevant down payment for the car in question is S$30,607.80. It follows that the individual will be able to take up a car loan with a maximum tenure of 7 years on the outstanding S$71,418.2. Suppose then an interest rate of 2.78 per cent per annum is charged on the loan. This translates to the following calculated figures:

- Total interest payable = S$13,897.98

- Monthly instalment = (S$71,418.2 + S$13,897.98)/(7*12) = S$1,015.67

- Total cost of the car = Basic cost of the car + total interest payable = S$115,923.98

From the outset, the monthly loan payment incurred from buying the car constitutes a little less than a third of an individual's median income. And this is before accounting for the variable costs incurred from the day to day use of the vehicle, an area we explore next.

The maintenance costs

Indeed, in marriage, putting an expensive ring on it is just the beginning. The work begins later. Similarly, buying a car is just one step in the process of ownership. There are other maintenance costs to bear as well.

These include:

- Road Tax - Such costs would vary according to the age of the car, engine capacity and so on.

- Car Insurance - Like any major asset, protection from any unexpected incidents is utterly essential, and that would mean allocating some cash for premium payments be it monthly or yearly.

- Vehicle Maintenance - Vehicle maintenance is another cost one should factor in to ensure that one’s vehicle is certified roadworthy. With time, some parts can become damaged and would require fixing.

- Parking fees - Your car will have to rest somewhere and that comes at a price, whether it is HDB or office season parking and other parking fees such as those at malls.

- Electronic Road Pricing (ERP) - A tool to manage road congestion, the dreaded ERP gantry deducts a certain amount of money automatically from one's cash card when they drive on certain roads during peak hours. It varies for different roads and time periods depending on local traffic conditions. At the end of the day, it still is a cost and one that we should factor in when choosing to own a vehicle.

- Price of fuel - Over the past couple of years, we've seen prices come off as the market seems to be drowning in crude. But what goes down will have to go up.

Yes, some variable costs such as servicing and ERP costs may be reduced but others like road tax and parking fees are usually fixed and a certainty. Ultimately, car ownership is expensive, not to mention that it depreciates in value consistently.

A matter of planning

That's not to say you should abandon your dream of car ownership. Rather, it's all a matter of priorities and financial planning.

Yes, buying a car and all that entails is arguably a substantial financial undertaking. But, one can still ensure a smooth financial ride ahead with sound planning. It's not about buying a car on a whim, but planning and working towards it, be it through a short-term savings goal or investment plan.

So, start by asking the question: Do I really need a car?