Learn about our approach to sustainability, our material ESG factors and related efforts and performance for 2024.

Our approach to sustainability

One Group for a Sustainable Future

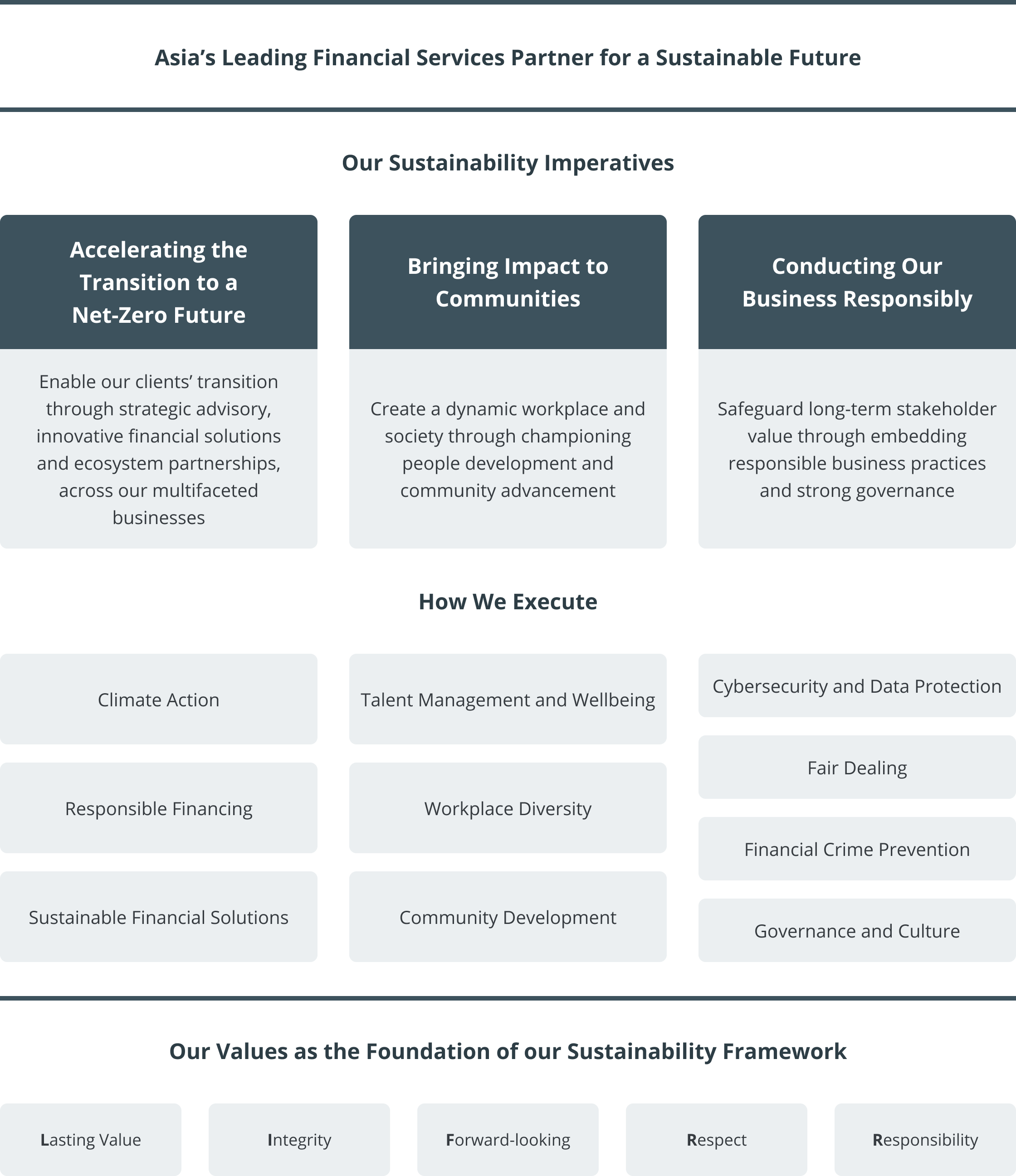

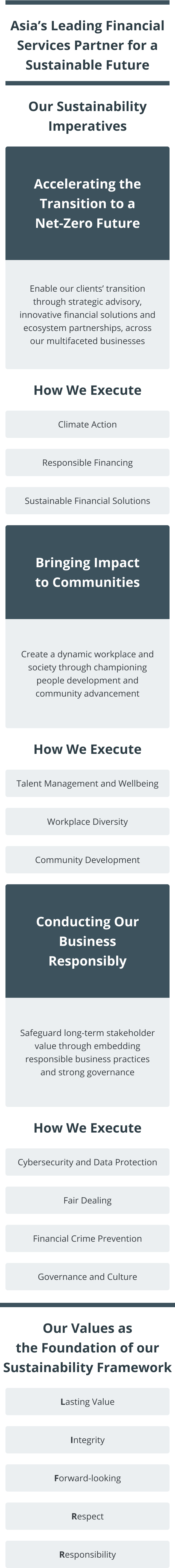

OCBC is committed to accelerating the transition to a net-zero future, while conducting our business responsibly and bringing impact to our communities.

As a financial institution, we are clear on the role we can play to make a difference and are focused on our “ABC” sustainability imperatives.

Accelerating the transition to a net-zero future

As a financial institution that is a connector of capital, we recognise the critical enabling role that we play in the journey towards a net-zero future. Our aim is to enable our clients’ transition through strategic advisory, innovative financial solutions and ecosystem partnerships, across our multifaceted businesses.

Bringing impact to communities

We believe that we can bring impact and meaningfully contribute towards the sustainable development of our communities as well as the wellbeing and flourishing of our people. Our aim is to create a dynamic workplace and society through championing people development and community advancement.

Conducting our business responsibly

Effective stewardship and corporate governance are the bedrock of our stakeholders’ trust in us and our duty as a responsible corporate citizen. Our aim is to safeguard long-term stakeholder value through embedding responsible business practices and strong governance.

OUR SUSTAINABILITY FRAMEWORK

Our framework embodies our commitment to focusing on our priorities and improving collaboration across our operations. It defines our approach to sustainability, including our key sustainability imperatives and the material ESG factors that drive long-term value and impact for us.

Our Values guide our approach to sustainability. We take a long-term view in our climate actions and community development efforts, delivering positive impact on the environment and the society in a responsible manner. Specifically, we proactively support our clients' net-zero transition and their aspirations for a low-carbon world.

Purpose

Sustainability is at the heart of OCBC’s business, anchored on our purpose to enable people and communities to realise their aspirations. We believe that our ambition to be Asia’s leading financial services partner for a sustainable future can only be achieved if it is underpinned by our focus on sustainability.

Sustainability is at the heart of OCBC’s business, anchored on our purpose to enable people and communities to realise their aspirations. We believe that our ambition to be Asia’s leading financial services partner for a sustainable future can only be achieved if it is underpinned by our focus on sustainability.

Opportunity

As we help our clients achieve their aspirations, we future-proof our business, build competitive advantage and capture opportunities for growth. We aim to excel for sustainable growth, with our drive for the transition to a sustainable low-carbon world serving as a core strategic pillar.

As we help our clients achieve their aspirations, we future-proof our business, build competitive advantage and capture opportunities for growth. We aim to excel for sustainable growth, with our drive for the transition to a sustainable low-carbon world serving as a core strategic pillar.

Risk

Adopting a robust and holistic approach in the management of ESG factors is sound risk management. From credit and operational to regulatory and reputational risks, we understand the critical role that ESG risk management plays in building a resilient organisation.

Adopting a robust and holistic approach in the management of ESG factors is sound risk management. From credit and operational to regulatory and reputational risks, we understand the critical role that ESG risk management plays in building a resilient organisation.

Responsibility

Meaningfully contributing to a sustainable future is simply the responsible thing to do. As a financial institution with a comprehensive coverage in ASEAN and Greater China, OCBC is well-positioned to be a catalyst of change, mobilising our expertise and resources and partnering our clients to address the pervasive environmental, social and developmental challenges of our time.

Meaningfully contributing to a sustainable future is simply the responsible thing to do. As a financial institution with a comprehensive coverage in ASEAN and Greater China, OCBC is well-positioned to be a catalyst of change, mobilising our expertise and resources and partnering our clients to address the pervasive environmental, social and developmental challenges of our time.

Driving progress on material ESG factors

The execution of our sustainability efforts is guided by our material ESG factors. By effectively managing these risks and opportunities, driving performance and innovation, we can deliver on our strategic sustainability imperatives and create long-term value and growth.

The execution of our sustainability efforts is guided by our material ESG factors. By effectively managing these risks and opportunities, driving performance and innovation, we can deliver on our strategic sustainability imperatives and create long-term value and growth.

Pursuing a partnership-based approach

We pursue a partnership-based approach and believe that a more sustainable world can be created as long as we are united with our clients and communities in pursuing one. Collaboration is critical in addressing global sustainability challenges while partnerships are the most efficient way to magnify the impact of our individual actions and accelerate progress.

We pursue a partnership-based approach and believe that a more sustainable world can be created as long as we are united with our clients and communities in pursuing one. Collaboration is critical in addressing global sustainability challenges while partnerships are the most efficient way to magnify the impact of our individual actions and accelerate progress.

Living our Values

The foundation of our Sustainability Framework is our Values of Lasting value, Integrity, Forward-looking, Respect and Responsibility. Serving as our compass, it guides us to embed sustainability throughout the Group and enables us to harmonise our growth ambitions with our responsibility towards stakeholders and future generations. By integrating sustainability at the core of our business, we can achieve sustainable growth, deliver enduring value to our stakeholders and play our part in building a sustainable future.

The foundation of our Sustainability Framework is our Values of Lasting value, Integrity, Forward-looking, Respect and Responsibility. Serving as our compass, it guides us to embed sustainability throughout the Group and enables us to harmonise our growth ambitions with our responsibility towards stakeholders and future generations. By integrating sustainability at the core of our business, we can achieve sustainable growth, deliver enduring value to our stakeholders and play our part in building a sustainable future.